In the previously published first and second parts of “Sifting for Gold: Identifying Long-Term Investment Targets Through Market Cycles (2025 Edition)” we analyzed and introduced projects in the lending sector—Aave, Morpho, Kamino, and MakerDao—alongside staking sector projects like Lido and Jito, and trading sector projects including Cow Protocol, Uniswap, and Jupiter. As the final part of this series, this article will continue to spotlight projects with solid fundamentals and long-term potential for attention.

PS: This article reflects the stage-specific thoughts of the two authors at the time of publication. Their views may evolve over time, are highly subjective, and may contain factual, data-related, or logical errors.

None of the opinions expressed herein constitute investment advice. We welcome critiques and further discussions from industry peers and readers.

Contents

4. Crypto Asset Services: Metaplex

Current Business Status

Business Scope

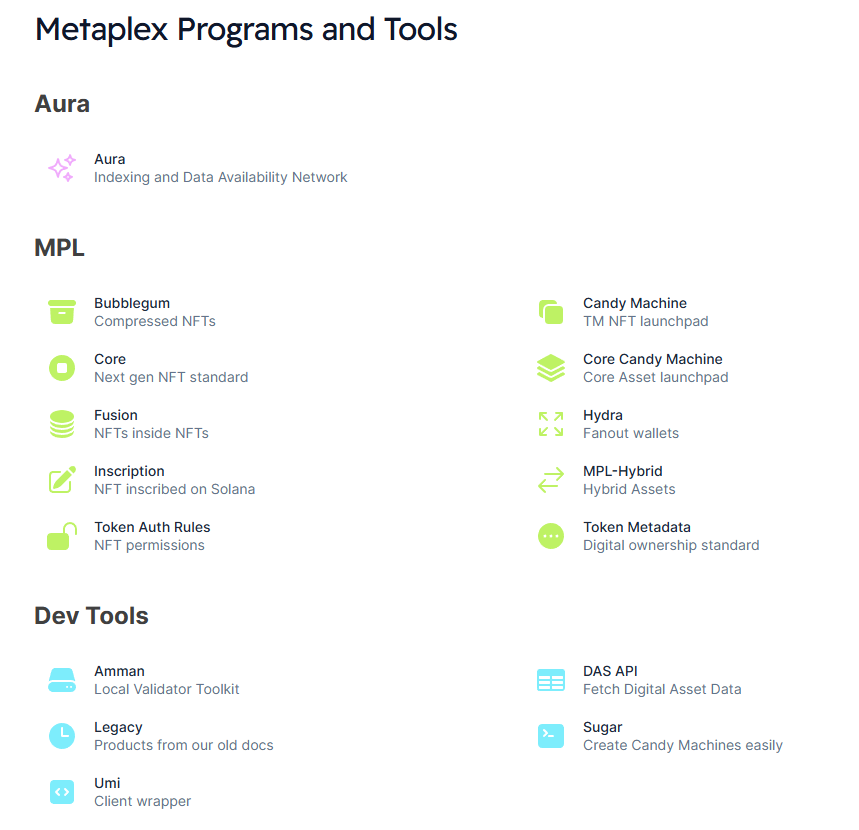

The Metaplex Protocol is a digital asset creation, sales, and management system built on Solana and SVM-compatible (Solana Virtual Machine) blockchains. It provides developers, creators, and enterprises with tools and standards to build decentralized applications. The crypto asset types supported by Metaplex include NFTs, FTs (Fungible Tokens), Real World Assets (RWA), gaming assets, and DePIN assets.

In terms of crypto asset services, Metaplex’s offerings can be divided into two main categories: Digital Asset Standards and Program Library (for asset issuance, sales, and management). The former provides asset issuers with token standards that are highly compatible with the SVM ecosystem and feature low creation/management costs, while the latter offers a suite of tools and services for creators to mint, sell, and manage their assets.

The majority of NFT and FT issuers on Solana are Metaplex users.

Over the past six months, Metaplex has further expanded its business horizontally into other foundational service areas of the Solana ecosystem through its new division, Aura Network, including digital asset indexing and Data Availability (DA) services.

In the long term, Metaplex aims to become one of the most critical multi-domain infrastructure service providers within the Solana ecosystem.

Beyond Solana, Metaplex currently also operates on the Sonic and Eclipse blockchains.

Revenue Model

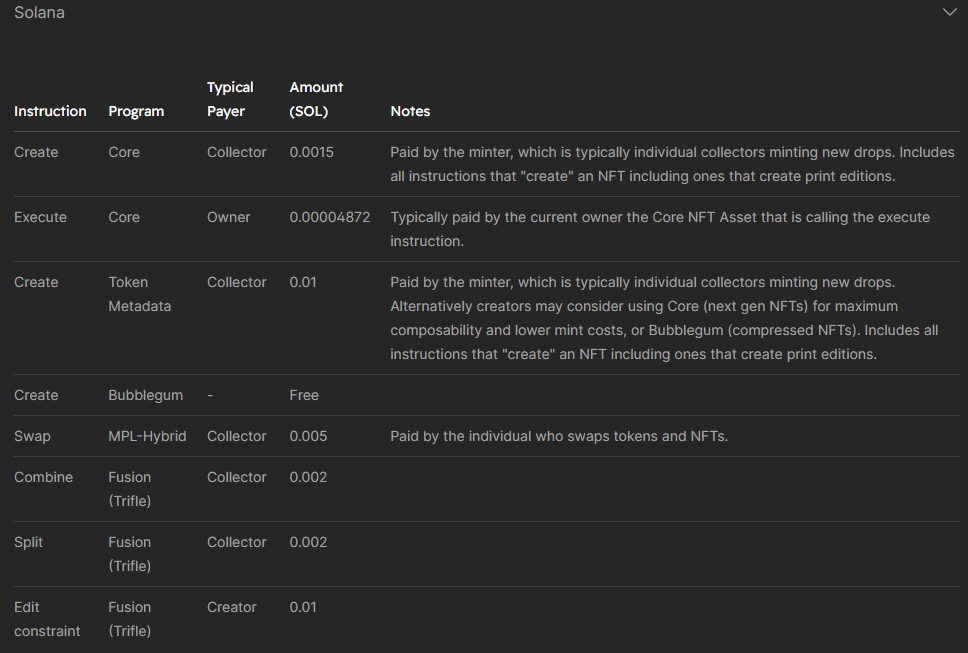

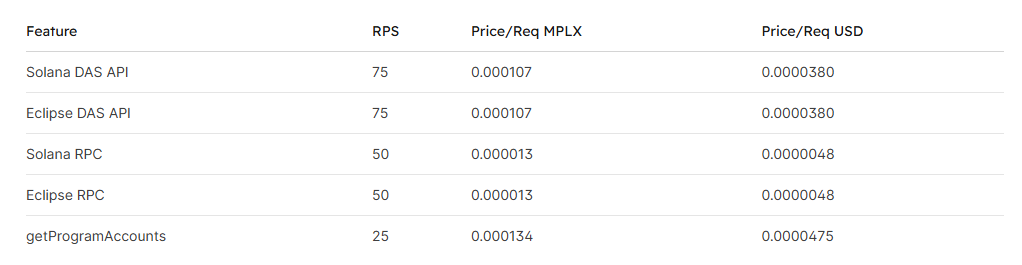

Metaplex’s business model is straightforward: It generates service fees by offering on-chain asset-related services, including asset minting, digital asset indexing, and data availability services.

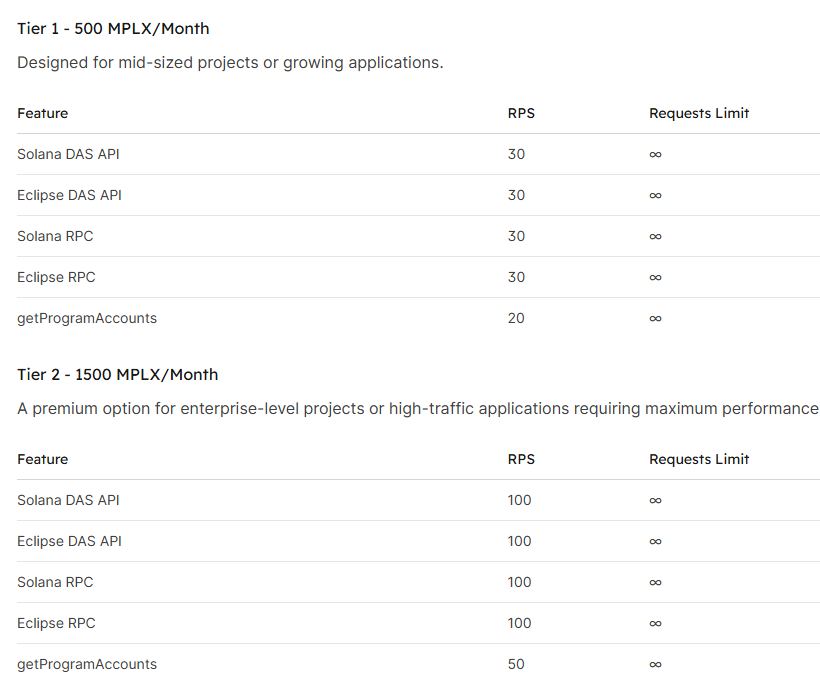

While Metaplex offers a wide range of services and products, not all are fee-based. A detailed fee schedule for specific services is provided below:

The Aura business line remains in its early stages, with the majority of Metaplex’s current revenue contributed by its asset minting and management services (MPL).

Business Data

We will focus on two core metrics: the number of assets minted through its services and Protocol revenue.

Before presenting and analyzing these two metrics, we will first examine the distribution of asset types issued via the Metaplex protocol.

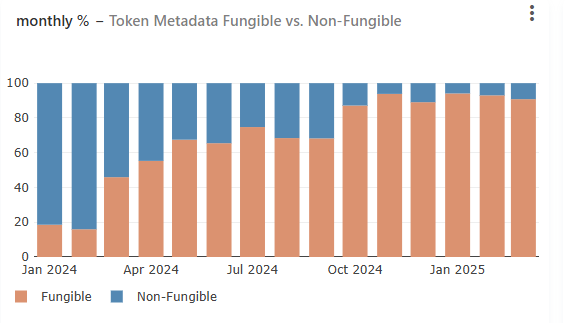

The chart above illustrates the trend in the proportion of NFT and FT assets utilizing Metaplex’s Metadata (which provides additional data for digital assets, such as images, descriptions, etc., and is used by nearly all assets).

We observed that in early 2024, NFTs still dominated the assets issued via the Metaplex protocol, accounting for approximately 80% of the total. However, starting in April 2023, the share of FT assets surged rapidly and has since become the primary asset category serviced by Metaplex, now representing over 90% of total activity.

Notably, the majority of these FT assets are Meme projects, whose issuers currently constitute Metaplex’s primary client base and revenue contributors.

This indicates that the current boom or decline of Meme projects on Solana directly impacts Metaplex’s business trajectory.

Let’s now examine the specific operational metrics.

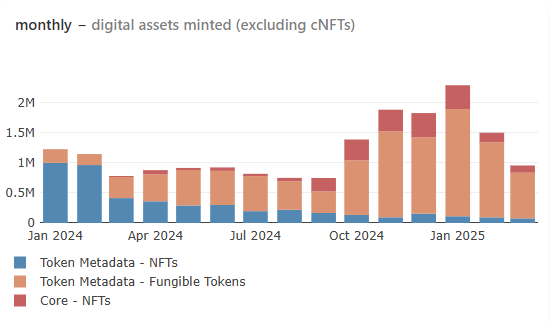

Number of Assets Minted (Monthly)

As observed, the number of assets minted via Metaplex began to rebound from its trough in September 2023, peaked at a historic high in January 2024 (with over 2.3 million assets minted), and subsequently declined gradually. By March 2024, the metric had largely retreated to levels seen in June 2023 (approximately 960,000 assets minted). This trend is closely aligned with the activity fluctuations of Meme trading within the Solana ecosystem. The higher the Meme activity, the greater the volume of assets issued through Metaplex.

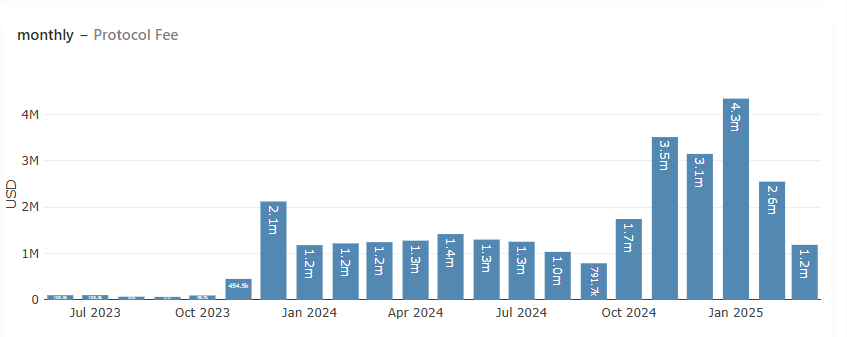

Protocol Revenue

Metaplex’s protocol revenue mirrors the trend in its asset minting volume, reaching a historic peak of 4.3 million USD in January 2024, followed by a rapid decline. The projected protocol revenue for March 2024 stands between 1.2 million and 1.3 million USD, returning to levels observed in the first half of 2023.

Protocol Incentives

Unlike most Web3 protocols whose operational metrics rely on subsidies, Metaplex’s revenue is entirely organic, driven by genuine demand from asset issuers. However, from January to early March 2024, Metaplex executed a $1 million USD token incentive program in collaboration with Orca, Kamino, and Jito to boost liquidity for its native token MPLX. This program has now concluded.

Competitive Landscape

As the earliest standard-setter for digital assets on Solana, Metaplex currently faces no formidable competitors in the realm of asset standards and their derivative services within the Solana ecosystem.

Competitive Advantages

Metaplex’s competitive edge stems from its role as the creator and maintainer of Solana’s core asset standards, which underpin the ecosystem’s digital assets—ensuring interoperability and liquidity across NFTs, FTs, Real World Assets (RWA), Decentralized Infrastructure (DePIN), gaming assets, and more.

This foundational position implies that asset issuers who build and manage assets using Metaplex would face significant time, technical, and economic costs if attempting to migrate their projects to alternative protocols.

Moreover, new developers and projects prioritizing ecosystem compatibility are incentivized to adopt Metaplex’s asset formats, as doing so guarantees seamless integration with Solana’s infrastructure (e.g., wallets) and products (e.g., DeFi platforms, trading interfaces).

Beyond asset services, Metaplex’s newly expanded offerings—Aura Network, which focuses on data indexing and data availability (DA) services—are poised to become a second growth trajectory for the protocol. Given the high overlap between Aura’s target users and Metaplex’s existing client base, these new services are likely to gain faster adoption among current partners.

Main challenges and risks

- The continued cooling of Solana Meme has led to a persistent decline in asset minting volume, resulting in reduced business revenue. This downward trend, which began in January, has shown no signs of reversal as of now.

- Metaplex’s current revenue model relies on one-time fees charged per asset type created. Projects with fixed or non-diversifying asset types cannot generate sustained recurring revenue for the protocol.

Valuation benchmark

Metaplex’s native protocol token is MPLX, with a total supply of 1 billion.

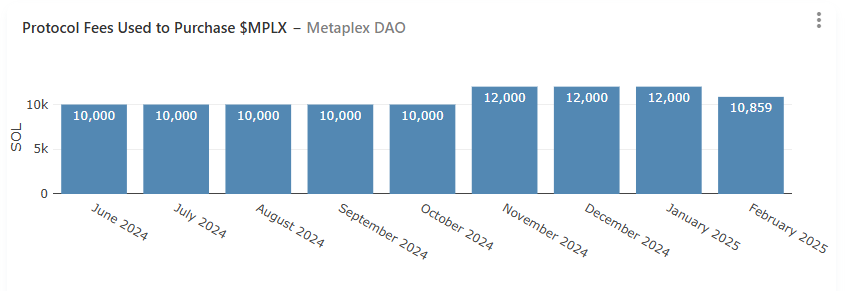

Currently, the primary utility of MPLX is governance voting. Additionally, since March 2024, Metaplex has announced plans to allocate 50% of protocol revenue to token buybacks (though in practice, the protocol has not strictly adhered to this threshold, with most buybacks ranging between 10,000 and 12,000 SOL). The repurchased tokens are deposited into the treasury to fund ecosystem development.

As of now, monthly buybacks have consistently exceeded 10,000 SOL.

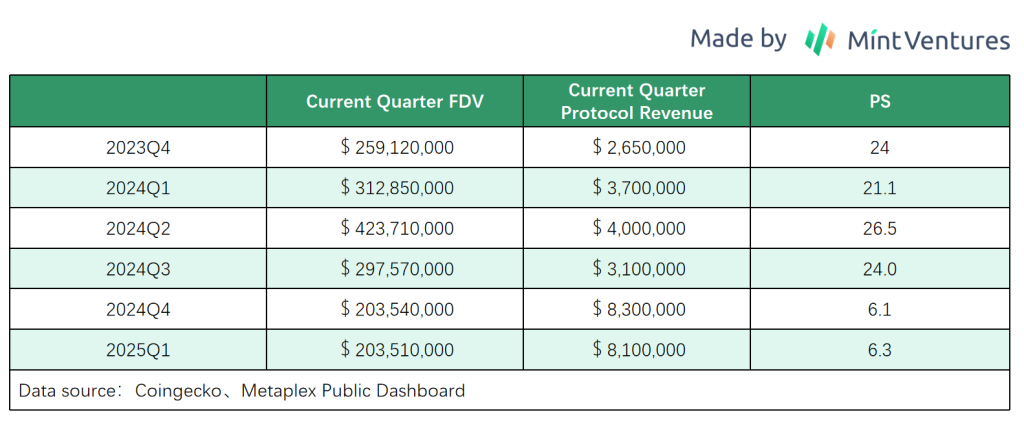

Given the absence of directly comparable projects in Metaplex’s niche, we primarily evaluate its valuation through the market capitalization-to-monthly protocol revenue ratio, using historical benchmarks for context.

As of now, Metaplex’s valuation relative to its Q1 protocol revenue remains at a multi-year low, reflecting the market’s pessimistic expectations for Solana’s asset issuance sector.

5. Hyperliquid: The Embattled Derivatives & L1 Hybrid

Hyperliquid stands out as one of the few functional new projects launched this cycle. Mint Ventures published an in-depth analysis of Hyperliquid in late 2024, which interested readers can refer to for further details.

Current Business Status

Hyperliquid’s operations can be divided into three segments: a derivatives exchange, a spot exchange, and a blockchain (L1). While all three are live, the derivatives exchange remains the core business in terms of trading volume and market influence.

For the derivatives exchange, trading volume and open interest are its key metrics.

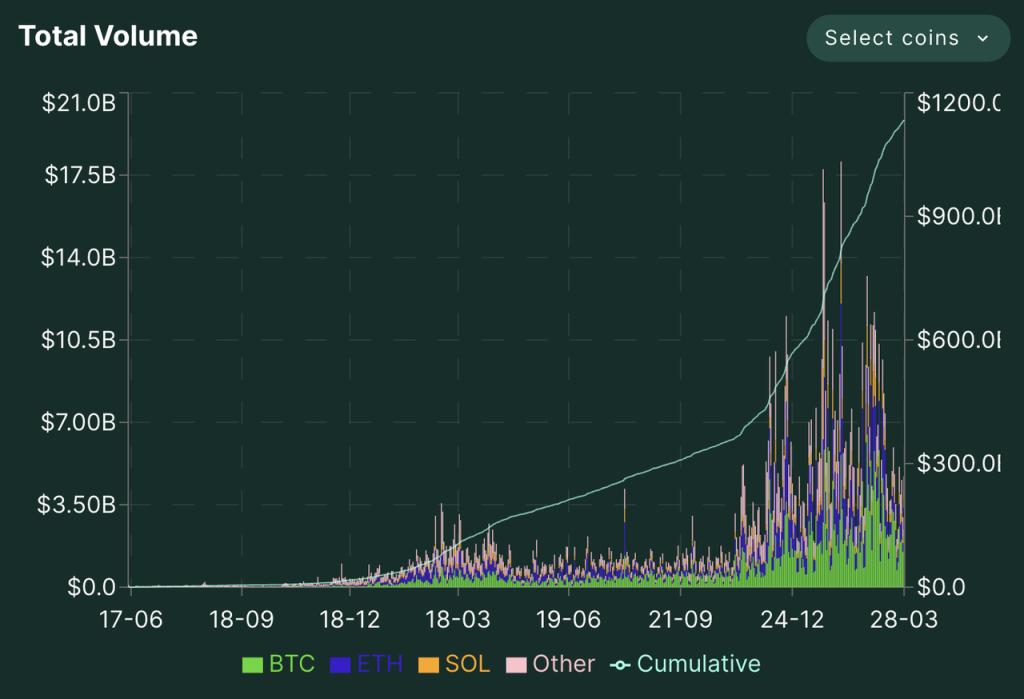

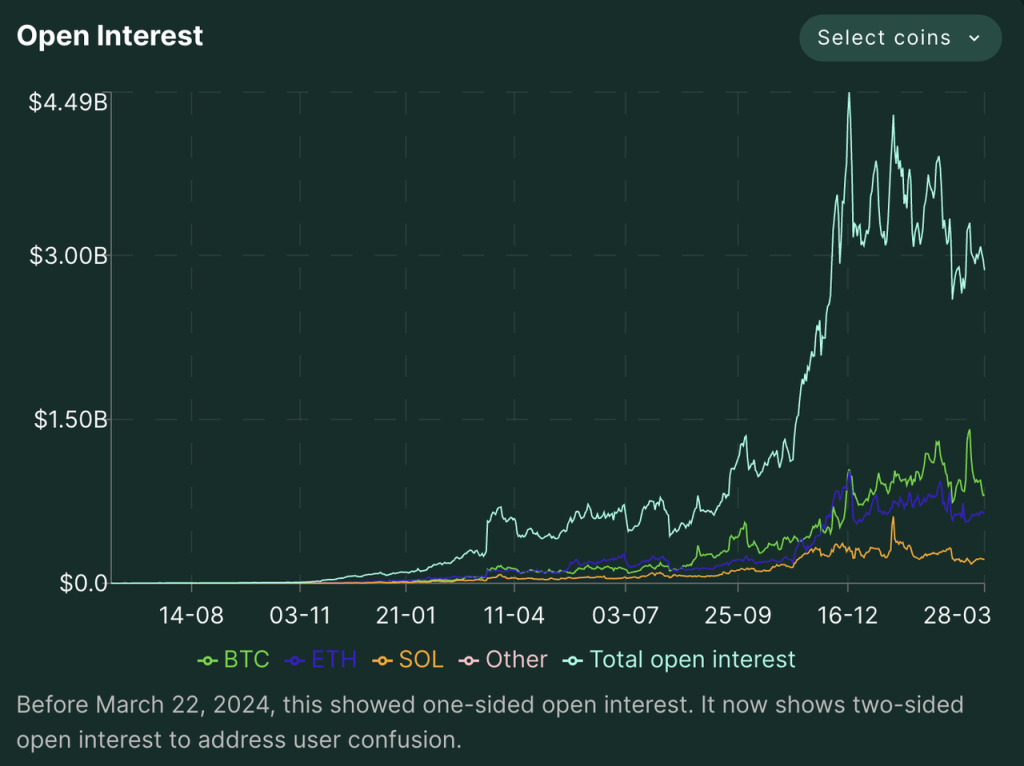

Hyperliquid’s derivatives platform soft-launched in June 2023, initiated a points program in November 2023, and saw a surge in trading volume and open interest following its official token airdrop in late November 2023. Since December 2023, Hyperliquid’s daily derivatives trading volume has averaged between 4 billion and 7 billion, peaking at a single-day record of 18.1 billion. Open interest has also risen sharply, fluctuating between 2.5 billion and 4.5 billion since December.

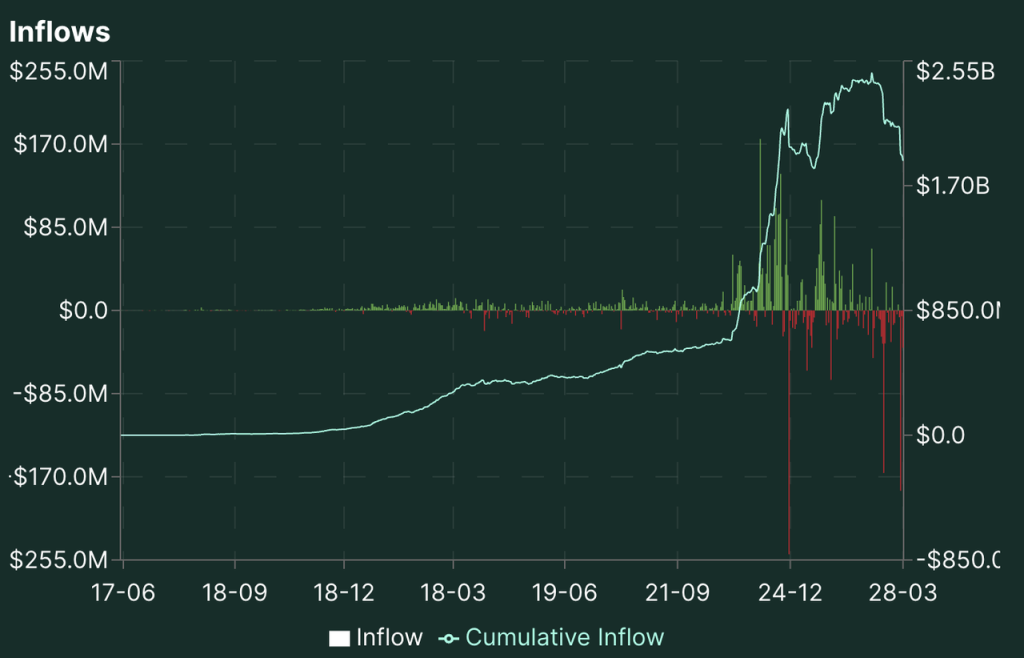

Hyperliquid’s custodial funds began surging in November 2023 and have since fluctuated around 2 billion USD. However, a series of recent attacks caused its custodial fund to stop tumbling from 2.5 billion USD to 1.8 billion USD within a short period.

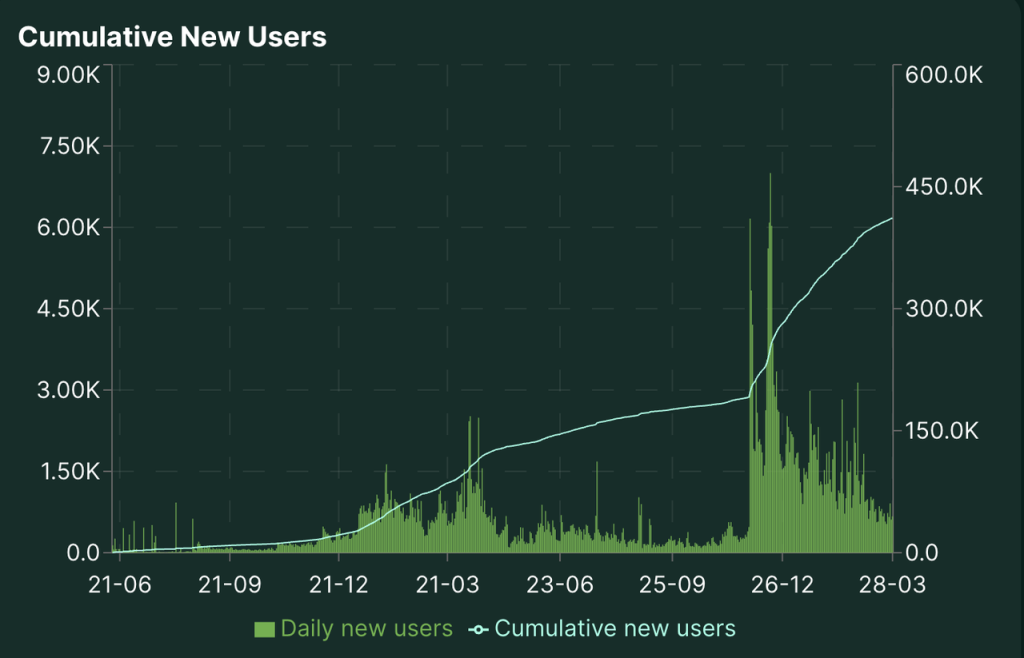

On the user front, Hyperliquid has seen a rapid surge in its address count, with cumulative trading addresses now approaching 400,000.

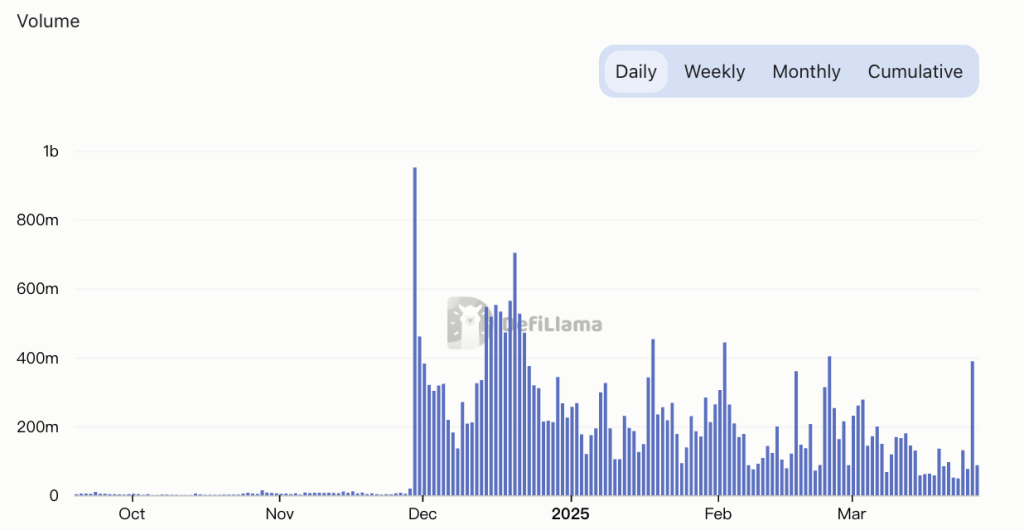

Regarding spot trading, Hyperliquid previously supported only native assets on its L1 blockchain, with HYPE dominating the majority of trading volume. However, in February 2024, Hyperliquid launched uBTC, a decentralized BTC spot trading solution tailored for its platform. Despite this addition, Hyperliquid’s BTC spot trading volume remains modest, averaging between 20 million and 50 million daily, which constitutes a relatively small portion of its total daily spot trading volume (approximately $200 million).

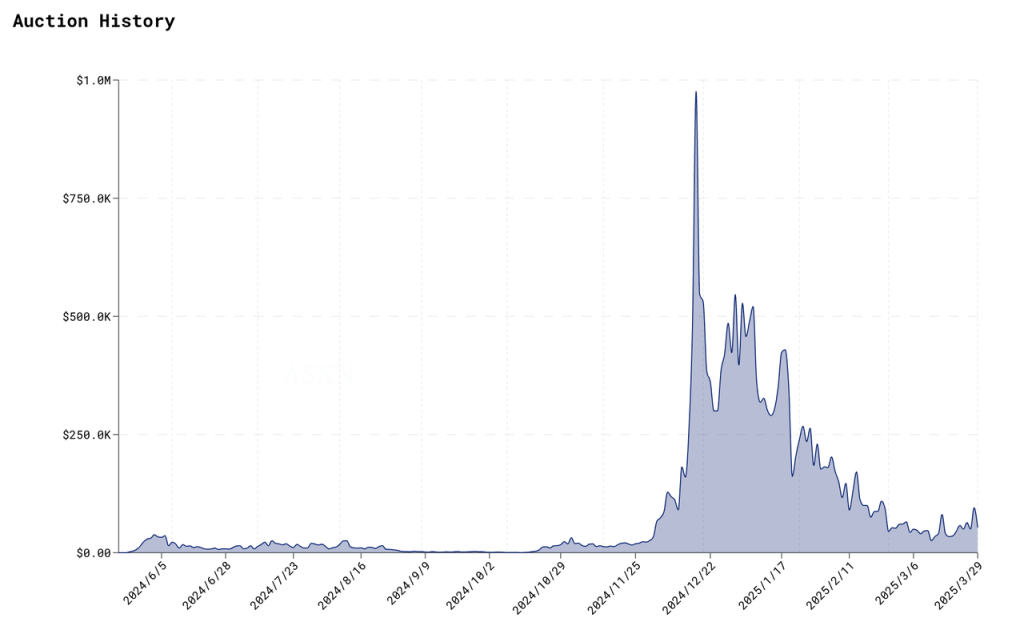

Additionally, Hyperliquid employs a decentralized mechanism (HIP-1) for spot asset listings, allowing public auctions for listing eligibility. The proceeds from these auctions effectively function as Hyperliquid’s “listing fees,” whose volatility is illustrated in the chart below:

As shown, Hyperliquid’s listing fees have experienced significant fluctuations. While they peaked at nearly 1 million USD in December 2023, they have since declined to around 50,000 USD amid waning market enthusiasm for altcoins.

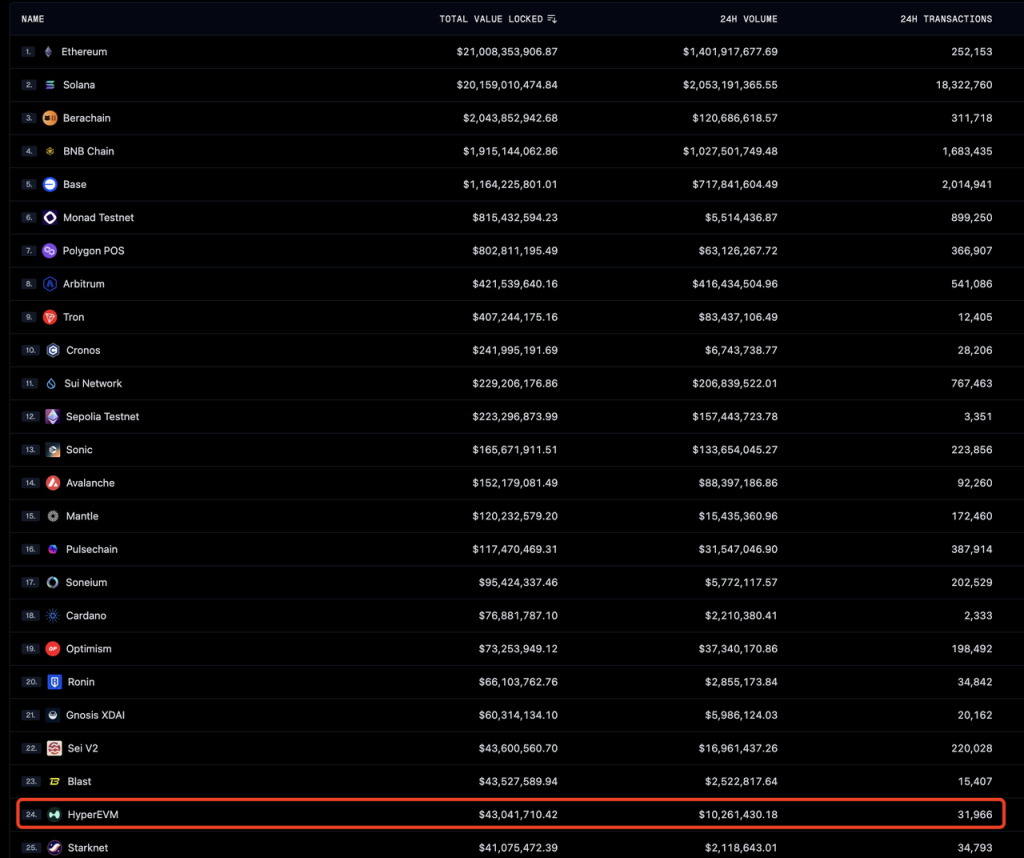

Regarding its EVM integration, Hyperliquid launched HyperEVM in alpha on February 18, 2024, and completed its integration with the existing HyperCore protocol on March 26, 2024. However, due to incomplete infrastructure—such as the absence of critical components like cross-chain bridges, limited deployment of EVM-compatible protocols, and a lack of official incentive programs—HyperEVM’s overall activity remains subdued. Metrics including TVL, trading volume, and transaction count place it roughly 20th among all blockchain networks.

Hyperliquid allocates all protocol-generated revenue—including derivatives trading fees, spot trading fees, and proceeds from listing eligibility auctions—to the Assistance Fund (AF) for $HYPE token buybacks after deducting the portion distributed to HLP (Hyperliquid’s liquidity provider program).

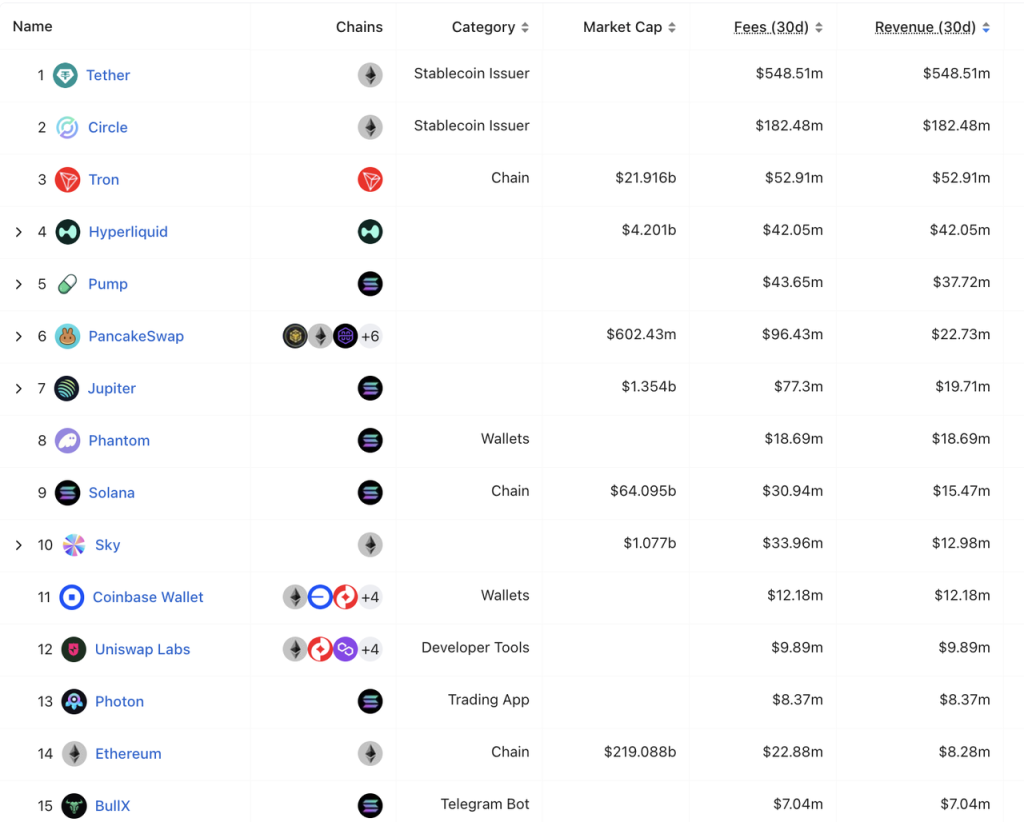

Over the past 30 days, Hyperliquid generated $42.05 million USD in revenue, ranking fourth behind Tether, Circle, and Tron, and surpassing major L1 blockchains like Solana and Ethereum, as well as applications such as Pump Fun and Pancakeswap. Notably, except for Tron, the revenue of other top-earning protocols is either unrelated to their native tokens or lacks an associated token entirely.

Competitive Landscape

Given that HyperEVM is currently in a “live testing” phase, we will analyze Hyperliquid’s competitive landscape by focusing on its two core segments: the derivatives exchange and the spot exchange.

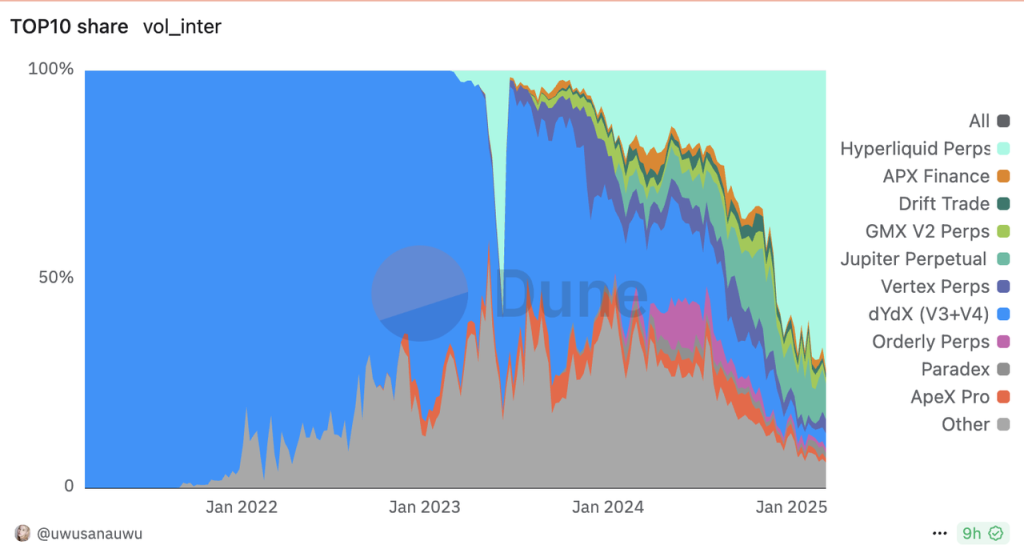

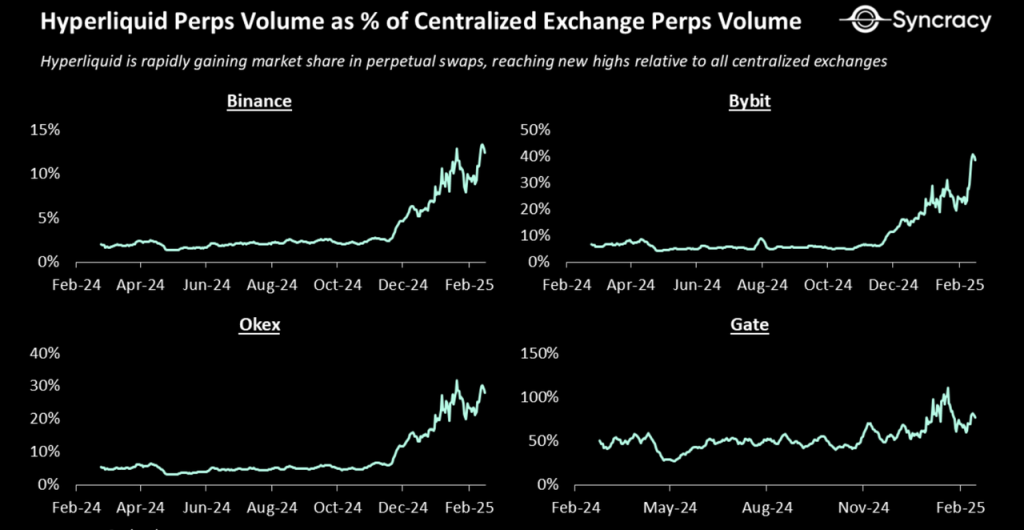

Hyperliquid has already established itself as the dominant leader in decentralized derivative exchanges.

Compared to leading centralized exchanges, Hyperliquid’s derivatives trading volume is also rising rapidly. The chart below illustrates the ratio of Hyperliquid’s derivatives trading volume to that of Binance, Bybit, OKX, and Gate:

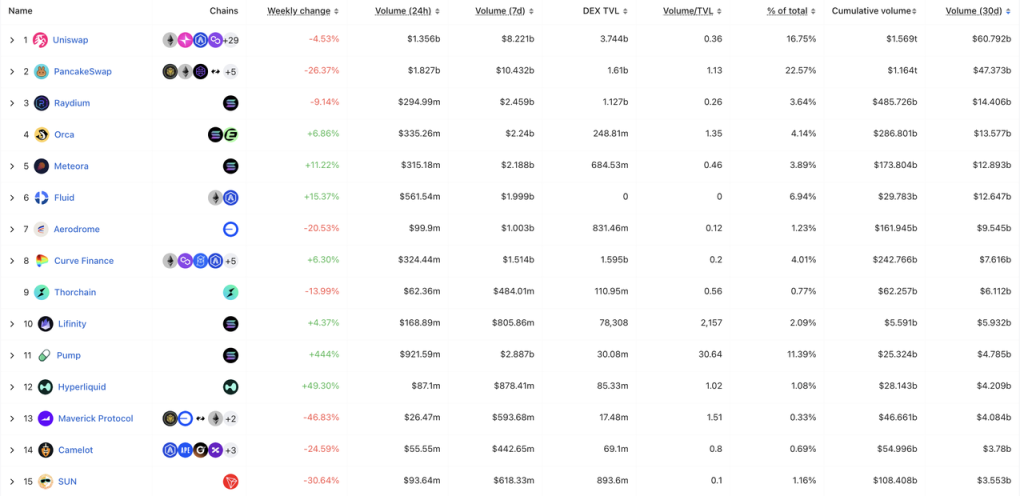

In the spot trading sector, Hyper’s average daily trading volume in the past month was around $180 million, ranking 12th among all Dex.

Hyperliquid’s Competitive Advantages

Hyperliquid’s rapid growth in derivatives trading is underpinned by the following factors:

- Adoption of the order book model, widely proven in trading ecosystems, enabling a seamless transition for users migrating from centralized exchanges and facilitating market maker participation.

- Aggressive contract listing strategy. Hyperliquid pioneered Pre-launch token futures and pure DEX token contracts while swiftly capitalizing on trending assets. This positions Hyperliquid as the exchange with the deepest liquidity for many newly launched tokens.

- Lower fee structure. Compared to GMX’s ~0.1% all-in fee (including 0.06–0.08% trading fees, slippage, and borrowing costs), Hyperliquid charges only 0.0225% (source: Mint Ventures), offering a significant cost advantage.

These factors have solidified Hyperliquid’s dominance in decentralized derivatives trading. Additionally, its points program (launched November 2023) and generous airdrop strategy further bolstered user loyalty, leaving Hyperliquid with no direct competitors in the decentralized derivatives space.

However, these advantages alone are insufficient to ensure long-term competitiveness, as rivals could replicate Hyperliquid’s mechanisms, listing strategies, and fee models. Currently, Hyperliquid’s sustainable competitive edges lie in:

- A lean, agile team with strong execution. Despite a compact team of 10–20 members, Hyperliquid has delivered three major products—a derivatives exchange, spot exchange, and L1 blockchain—within two years. While these products have imperfections, the team’s innovation and delivery capabilities outpace peers.

- Strong brand equity. Despite recent controversies (e.g., ETH and JELLY contract incidents), Hyperliquid maintains superior brand recognition and remains the go-to platform for on-chain derivatives traders.

- Network effects. Its market leadership since mid-2024 has entrenched Hyperliquid with deeper liquidity than competitors, creating self-reinforcing network effects.

Notably, full transparency of data—while user-friendly—does not inherently serve as a competitive advantage. In fact, this feature may harm Hyperliquid’s business in both the short and long term, as analyzed in the upcoming JELLY contract case study.

Main challenges and risks

Derivatives Trading Mechanism Risks:

Hyperliquid recently faced two major incidents:

50x Leveraged ETH Long Liquidation: A whale’s highly leveraged ETH long position was liquidated, resulting in a 4 million USD loss for HLP (Hyperliquid Liquidity Pool). The root cause was flawed retained margin rules, which have since been patched.

JELLY Contract Incident: Triggered by improper position size caps for low-market-cap assets. When JELLY launched, its market cap was about 200 million USD, and Hyperliquid applied a standard 30 million USD position cap. However, by the time of the incident, JELLY’s market cap had collapsed to under 10 million USD, yet the cap remained unchanged, creating an exploitable loophole. This led to 15 million USD in peak HLP losses (24% of HLP’s historical profits). Hyperliquid ultimately settled positions at pre-manipulation prices, sparking debates about its decentralization claims.

Both incidents exposed vulnerabilities in Hyperliquid’s core trading mechanics. While post-incident fixes were implemented, fundamental risks persist: Fully transparent on-chain positions (size, liquidation prices) inherent to decentralized derivatives exchanges, combined with HLP acting as the sole counterparty, create theoretically infinite attack vectors. No matter how rules are designed, loopholes may exist and be exploited in blockchain’s “dark forest.” Until these core mechanisms are revised, Hyperliquid remains susceptible to future attacks. This is currently the primary market concern regarding Hyperliquid.

Security Risks

Hyperliquid’s funds are primarily held in its Arbitrum bridge contract and a multi-sig wallet. The security of these components is critical. In December 2023, North Korean hackers probed Hyperliquid’s contracts, causing custodial funds to temporarily plummet from 2.2 billion USD to 1.9 billion USD.

Delayed HyperEVM Progress

A significant portion of $HYPE’s valuation hinges on HyperEVM’s success. However, progress has lagged since its launch. If delays persist: The L1 valuation premium (typically far higher than derivatives exchanges) embedded in $HYPE will erode. As a standalone derivatives exchange, $HYPE’s current valuation appears stretched (see analysis below).

Valuation benchmark

Hyperliquid’s current revenue primarily stems from derivatives/spot trading fees and spot listing fees. The protocol allocates this revenue uniformly: after subsidizing HLP (Hyperliquid Liquidity Pool) returns, 100% of the remaining funds are directed to the Assistance Fund (AF) for HYPE buybacks. Consequently, HYPE’s valuation can be analyzed using both P/S and P/E models since the buyback portion functions as revenue and approximates net profits for token holders.

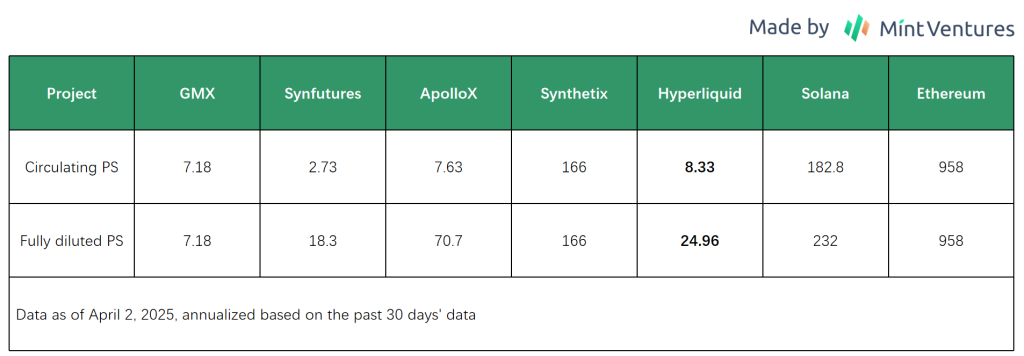

Hyperliquid’s revenue in the past 30 days was $42.05 million, with an annualized revenue of $502 million. Based on the current circulating market cap of $4.2 billion, its circulating PS is 8.33, while the fully diluted PS is 24.96. When calculated based on circulating PS, Hyperliquid’s valuation is comparable to that of GMX and ApolloX within the derivatives exchange sector. However, compared to Layer 1 protocols, Hyperliquid’s valuation remains relatively low.