Contents

TL, DR

Hot Takes

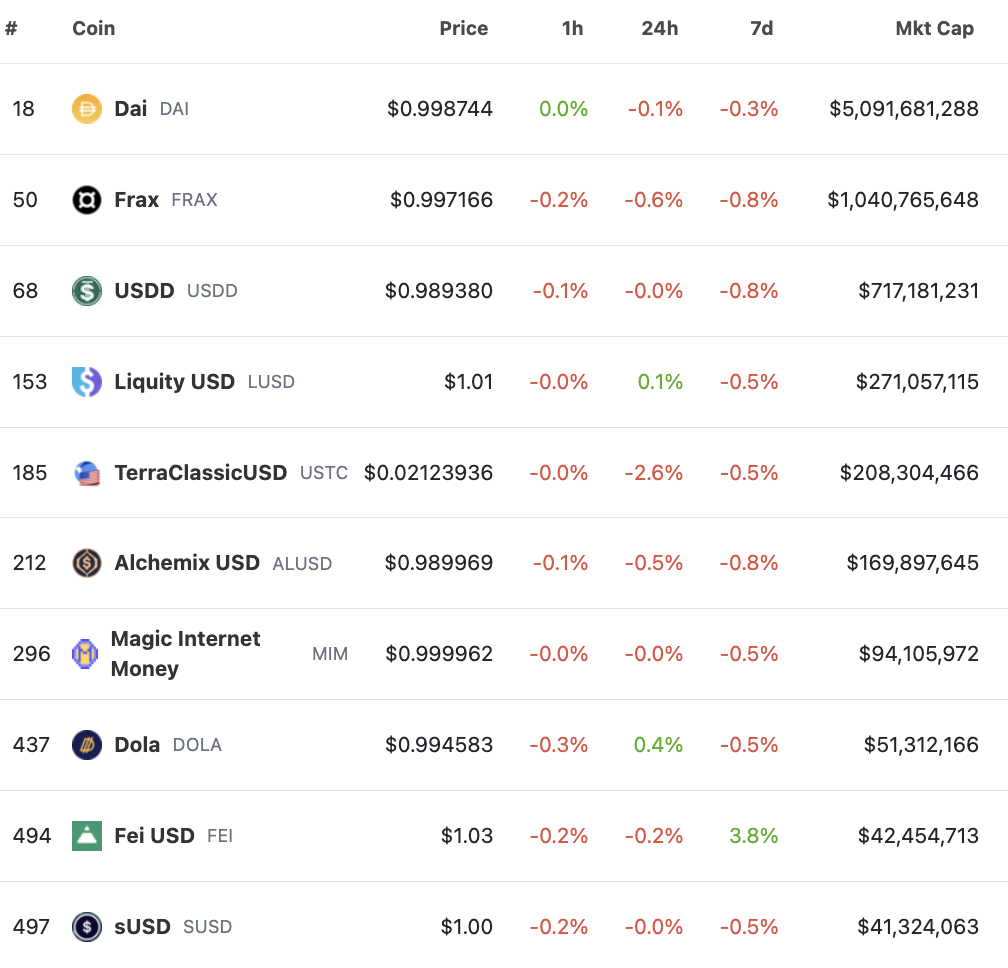

- LUSD manages to become the 1st (fully) decentralised stablecoins, although there is still a significant gap remaining when compared to DAI, the industry leader.

- Chicken Bonds, Liquity’s new feature in recent 2 years, has not attracted new users or built new use cases for Liquity. All users face great negative feedback when entering chicken bonds. The negative feedback may significantly impact the growth and expansion of Chicken Bonds.

- Fully-decentralized and well-designed product mechanisms are significant advantages when compared with other stablecoins.Given the intense regulatory trend in the US, any regulatory action against stablecoins may present an opportunity for Liquity.

- Governance-free may limit the expansion of the protocol’s use cases and hinder its adaptability to new changes. With the DeFi and Web3 boom only commencing within the past five years, projects that give up the right to change now may struggle to adapt to the changing environment and fierce competition in the future.

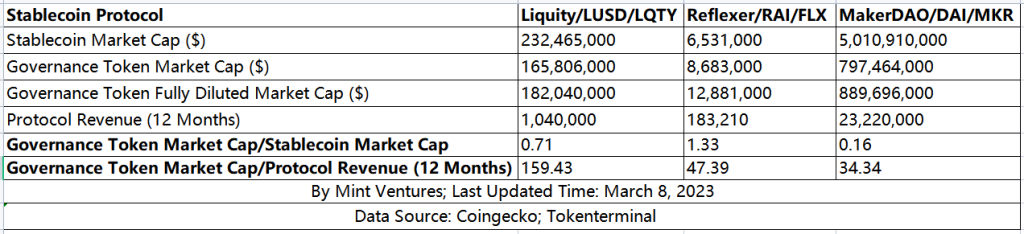

- Protocol fee structure and insufficient future incentives may limit the expansion of the protocol’s use cases.The fee structure results in LQTY a higher P/S than MKR or FLX. Only 8% of total LQTY is reserved for future protocol incentives , which may indicate Liquity facing increased challenges in future expansion.

Introduction of Liquity

Liquity’s only business is stablecoin. They have been launched on ETH mainnet since April 5, 2021. Their stablecoin LUSD, has been integrated into leading lending protocols like Aave and Euler.

Liquity raised a seed funding round led by Polychain Capital in September 2020, and also a Series A round of financing led by Pantera Capital in March 2021.

The Liquity team operates under their authentic appellations, with both core members residing in Europe. The founder, Robert Lauko, formerly a researcher at Dfinity, oversees the comprehensive protocol design. Rick Pardoe, the co-founder, is predominantly accountable for research and development. The team comprises approximately ten members.

Business Performance of Liquity

LUSD Manages to Become the 1st (Fully) Decentralized Stablecoins

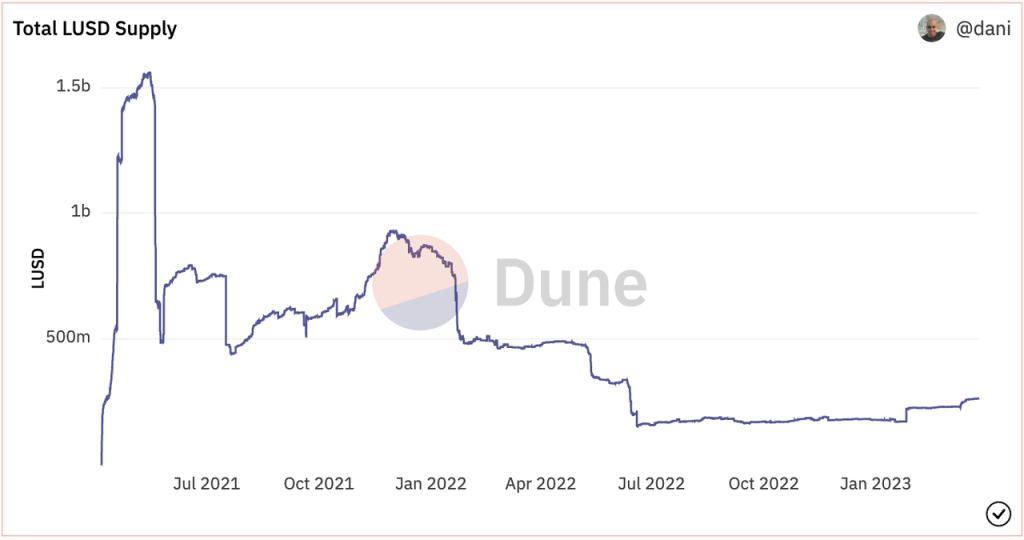

LUSD’s supply surpassed $1 billion within a month of its launch. At its pinnacle, LUSD’s circulation approached $1.6 billion, supported by a TVL exceeding 1.1 million ETH ($4.6 billion USD).

The following 519 market crash, while validating Liquity’s core mechanism, led to a dramatic decline in Liquity’s TVL, with LUSD circulation dropping to under 500 million. As the market gradually recovered, LUSD circulation rose once more, reaching $930 million by the end of November 2021. However, the 2022 crypto bear market brought LUSD circulation back down to around 500 million. Between May and July 2022, as UST, Three Arrows, and Celsius succumbed to market pressures, a severe liquidity crisis emerged, causing LUSD circulation to plummet to a mere 158 million—less than 1/10 of its peak value. Naturally, the entire decentralized stablecoin market experienced significant setbacks during this period, with the issuance sizes of stablecoin protocols shrinking considerably.In February 2023, LQTY’s listing on Binance and the USDC de-pegging event spurred significant user growth for Liquity.

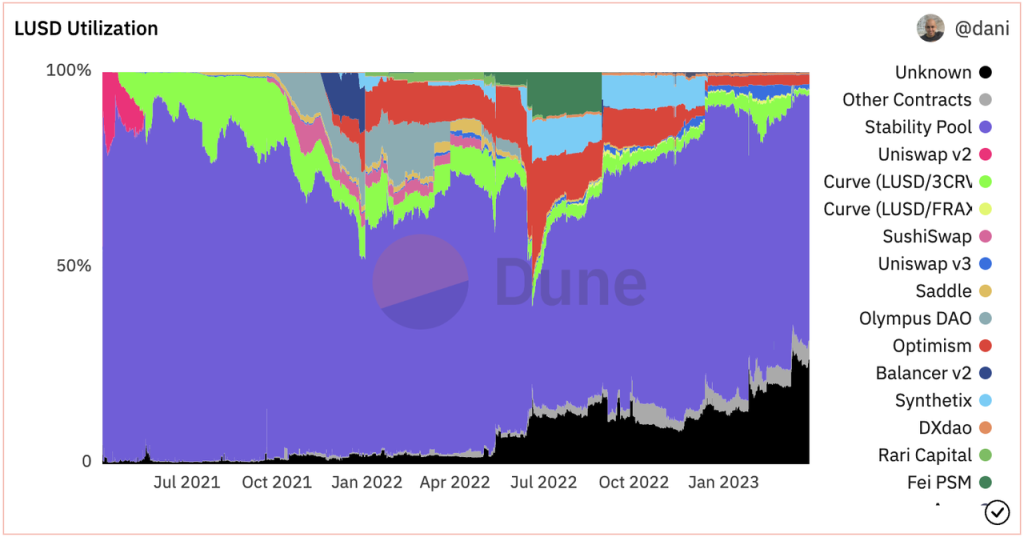

However, LUSD’s expansion into new use cases has been rather lackluster, producing no remarkable outcomes thus far. Most (64.6%) of LUSD still resides in the Stability Pool.

Chicken Bonds: Review and Analysis

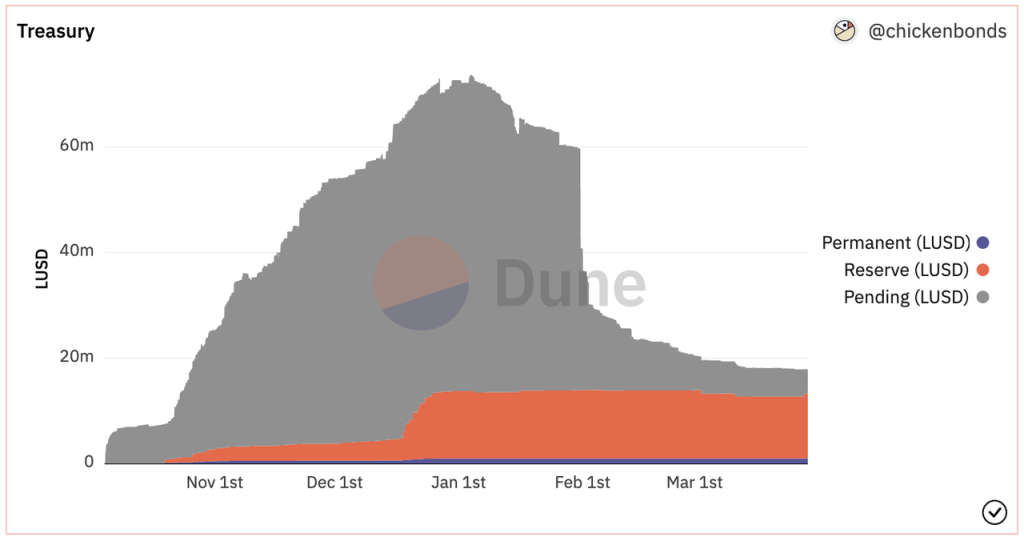

Liquity, with its governance-free nature, has seen minimal updates on the protocol layer since its launch. Over the nearly two-year period since going live, the LUSD Chicken Bonds, introduced at the end of September 2022, represent one of the few major updates on the use application layer.

Liquity’s Chicken Bonds is actually a solution to incentivize POL (Protocol Owned Liquidity).

Chicken Bonds has a substical is essentially a fund that only accepts LUSD as an asset. The majority of the fund’s capital is invested in the Stability Pool, with a smaller portion in Yearn and Convex. The primary purpose of the fund is to provide higher yields to users while helping maintain the stability of the Liquity protocol and bootstrap LUSD liquidity. Fund shares are denoted by bLUSD, but users do not claim shares immediately upon purchase; instead, they engage in a series of mutual games that help maintain the fund’s size while increasing yields for certain users. The fund allows users to redeem their shares at any time, and the fund shares also have a well-liquid secondary market. The amount in the Permanent Pool serves as the fund management fee.

In my opinion, chicken bonds have quite a subtle mechanism to encourage participants to play game-theoretical zero-sum games. But it is important to note that Chicken Bonds has not added new underlying assets to Liquity or introduced new product types. The increase in bLUSD yields has come entirely from a zero-sum game among current LUSD holders. Chicken Bonds has not attracted new users or use cases to Liquity. Its growth in market cap has not come from organic user demand but rather from the fueling of earlier Ponzi-like structures.

Liquity’s Competitive Advantages

Fully-decentralized

The most prominent advantage of Liquity and LUSD is their fully decentralized nature. Currently, LUSD is generated solely from over-collateralized ETH, a fully decentralized asset, thus making LUSD a fully decentralized asset as well.

The decentralized stablecoins listed above, except sUSD and LUSD, exhibit significant dependence on other centralized stablecoins:

- Currently, DAI has over 60% reliance on centralized stablecoins;

- The proportion of centralized stablecoin as collateral assets in FRAX exceeds 75% (based on the Decentralization Ratio provided by Frax).

- Over 50% of the collateral assets backing decentralized stablecoins like alUSD, DOLA, and agEUR is derived from other stablecoins (USDT, USDC, DAI) or yield vouchers associated with stablecoins in other DeFi protocols. These stablecoins, too, exhibit a reliance on centralized stablecoins of more than 60%.

The market is well aware of the importance of decentralization. Binance’s listing of LQTY also provides excellent promotional exposure for Liquity. Looking forward, given the intense regulatory trend in the US, any regulatory action against stablecoins may present an opportunity for Liquity, which is likely to continue benefiting from its decentralized characteristics in the long run.

Excellent Mechanism Design

We hold an optimistic view regarding the design of the Liquity system. Even after nearly two more years, we have yet to witness a new stablecoin protocol that can hold a candle to Liquity in terms of mechanism design. In summary, the brilliance of Liquity’s mechanism design can be ascribed to the following aspects:

- At the protocol layer, Liquity stabilizes the LUSD price within a range of approximately 0.995 to 1.1, offering market participants an attractive arbitrage opportunity.

- Liquity’s Stability Pool, serving as the default liquidator, enables real-time liquidation without necessitating a complex and time-consuming auction process. This approach mitigates potential security risks arising from extreme network congestion, thereby fortifying the protocol.

- Liquity’s protocol security is effectively ensured by the Stability Pool, loans redistribution, and recovery model. As a result, the protocol permits users to borrow at an overcollateralization rate of 150% (in fact, risk assessment institute Gauntlet recommended Liquity to adjust the rate to 130%), thereby achieving high capital efficiency. In this way, Liquity seemingly accomplishes the stablecoin’s impossible trinity of decentralization, stability, and capital efficiency.

Boasting the exceptional mechanism design detailed earlier, Liquity stands as the most frequently forked stablecoin protocol. According to DeFiLlama, a total of 16 protocols have emerged from Liquity forks, significantly surpassing the mere 4 that originated from MakerDAO and Frax Finance. This remarkable mechanism design is the foundation for Liquity’s enduring growth and success.

Liquity’s Competitive Disadvantages

Governance-free

Being governance-free can also be seen as a drawback for Liquity, primarily because it may limit the expansion of the protocol’s use cases and hinder its adaptability to new changes.

Indeed, the willingness to govern can be seen, to some extent, as an indication of a team’s commitment to taking responsibility for the project’s development. While the current DeFi landscape features well-established business models and leading protocols within each niche, considering a five-year or even ten-year timeframe, DeFi continues to evolve and innovate rapidly, with new competitors emerging across various fields. In such an ever-changing external environment, a dedicated team with a profound understanding of DeFi is crucial for any project’s long-term success.

Protocol Fee Structure

For stablecoin protocols (or governance token holders), the circulating stablecoins represent liabilities on the protocol’s balance sheet, as the protocol is responsible for their redemption. Simultaneously, the collateral provided by users constitutes the protocol’s assets. If the protocol cannot generate profit based on the size of the circulating stablecoins, it implies that an increase in liabilities does not correspond to a proportional increase in revenue. This situation leads to greater risk exposure without equivalent returns, producing a distinct risk-return imbalance that negatively impacts the protocol’s owners (LQTY holders).

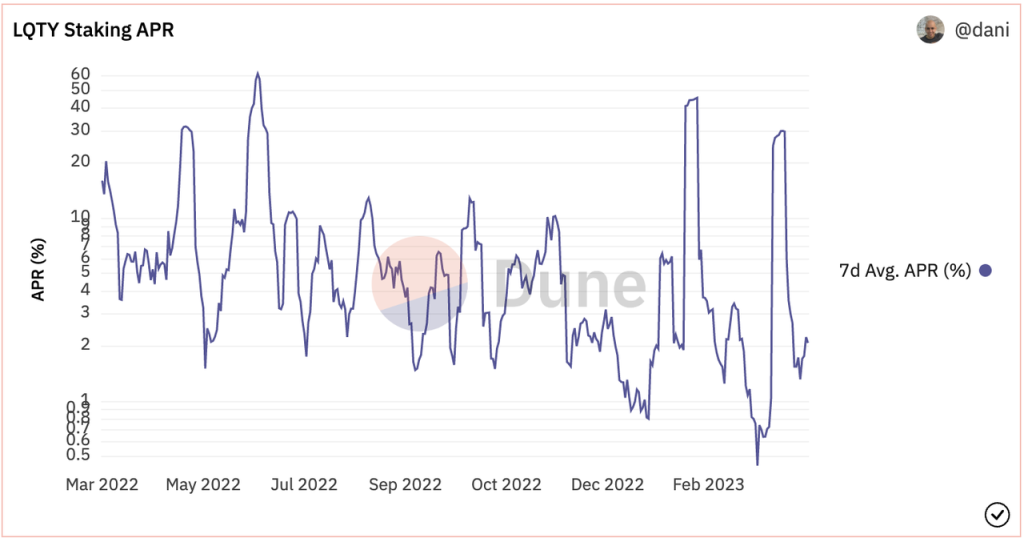

An additional observation is that LQTY has a relatively low staking APR, averaging around 5% over the past year. LQTY does not possess governance functionality, and its sole use case involves earning protocol minting and redemption fees through staking. This low APR may not be conducive to fostering a cohesive community.

Insufficient Future Incentives

Only 8 million LQTYs(8% of total) are allocated to the Stability Pool in the future, with 4 million LQTYs available for vesting from April 2023 to April 2024. At the current price of $2.2, just $8.8 million worth of LQTYs remain for Stability Pool incentives in the coming year. With the recent LUSD circulation at 268 million, the LQTY incentives for staking LUSD in the Stability Pool are diminishing, and APRs below 10% or even 5% will likely become the norm, as indicated by the calculation 8.8/268=3.7%.

Liquity protocol has not yet reached a stage where it can maintain its current size without incentives, let alone achieve further growth. Given that LQTY does not have any follow-on offering plans, the protocol may face increased challenges in promoting future expansion.