Contents

Key Insights

Core Investment Logic

As the LSD narrative grows, an increasing number of market participants are calling for the development of advanced tools built on Decentralized Finance. Greater emphasis is being placed on bond market analysis and extrapolation, with Pendle emerging as a valuable player tapping into innovative trading strategies.

- Pendle’s V2 version boasts a restructured Automated Market Maker (AMM) model, which draws inspiration from Notional Finance’s proposal and has led to a marked improvement in trading efficiency.

- In the realm of underlying assets, Pendle has steadily established four layers of fixed-rate markets, each catering to different risk levels, effectively addressing the requirements of a diverse user base, including conservative investors, arbitrageurs, liquidity providers, and yield speculators.

The introduction of the Ve-model has enabled the PENDLE token to gradually develop a more resilient value capture mechanism. As key business metrics, such as Total Value Locked (TVL), show consistent growth, PENDLE is increasingly attracting the attention of moderate investors.

Main Risks

- Smart Contract Risk: In the event of a significant disruption, both the project’s regular operations and the token’s value capture could be adversely affected. This risk extends beyond Pendle itself, as its underlying assets originate from other DeFi projects. Consequently, any contract risk stemming from these projects could potentially impact Pendle as well.

- Strategy Risks: If the project fails to select the appropriate assets or public chains bearing the assets, it may fall behind competitors in the next stage of competition. Pendle teams must identify the optimal underlying assets and possess a clear understanding of the fierce nature of public chain competition.

- Market Risks: A substantial market downturn during the project’s operation could lead to a decrease in underlying assets, which would be unfavorable for those who regard USDT as the standard currency.

Valuation

According to the “FDV/TVL” metric, Pendle’s present valuation appears to be relatively lower compared to its rivals who have previously launched tokens.

Business Analysis

User Base

Pendle offers suitable products catering to four different user bases: conservative investors, interest rate traders, liquidity providers, and arbitrageurs.

- Conservative Investors: They can buy PTs (principal tokens) to earn a fixed yield. PT is the equivalent of zero-coupon bonds, which are sold at a discount and accrue interest during the holding period. As the maturity date approaches, the price increases, and the PT is paid at par upon maturity.

- Interest Rate Traders: They can buy YTs (yield tokens) and earn high yields when the yield rises as expected;

- Liquidity Providers: They can opt to supply liquidity and earn swap fees, underlying asset yields, and incentives if the estimated APY remains relatively stable.

- Arbitrageurs: In cases where yields are misaligned or when underlying asset changes have yet to impact Pendle, these investors can exploit arbitrage opportunities by buying various assets.

Business Details

Pendle’s yield tokenization is the splitting of yield-bearing tokens into two parts: Principal Tokens (PT) and Yield Tokens (YT).

We can take the principal token (PT) as the equivalent of a zero-coupon bond, where the price approaches par value as the maturity date gets close.

The yield token (YT) holders receive all rewards during the holding period, such as interests and COMP incentives provided by Compound.

It is important to note that in this process, YT+PT=SY.

Business Classification

Transitioning from late V1 to V2, Pendle implemented several adjustments, ceasing operations on Avalanche and going live on Arbitrum. Furthermore, its underlying assets expanded beyond public chain tokens and stablecoins, evolving in four directions, three of which are deployed on Ethereum:

- On Ethereum, underlying assets now include liquid staking derivatives (LSD) such as stETH and ankrETH.

- Expansion of popular, high-yield staked tokens like APE and LOOKS.

- Providing peripheral services for relatively popular tokens, exemplified by the APE Compounder, which offers reinvestment services for token holders and introduces a corresponding yield token pool.

Pendle’s operations on Arbitrum encompass the fourth strategic direction: integrating higher-yield and lower-risk underlying assets such as GLP and gDAI.

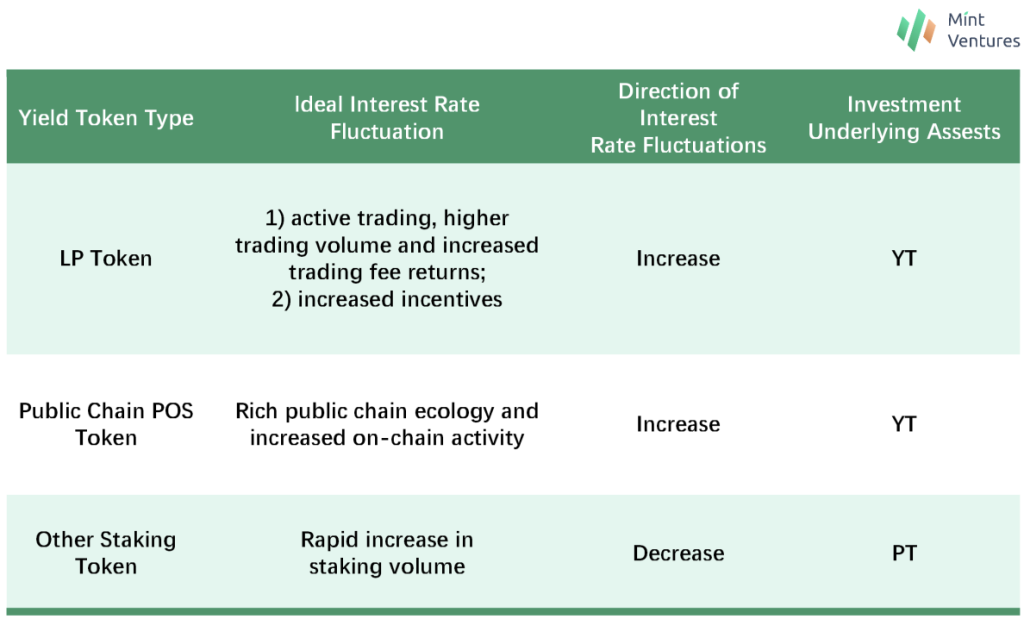

Different investment strategies can be tailored based on the distinct attributes of the underlying assets.

The Potential of Yield Tokenization

Classifications

Pendle initially positioned itself in the fixed yield market. However, based on the changes made in V2, it seems the Pendle team has segmented the “on-chain fixed yield market” into several layers:

- Low-risk fixed yield markets, represented by LSDs: This category features very low-risk underlying assets, relatively stable yields, and minimal cyclical impact on yields.

- Relatively-low-risk fixed yield markets, represented by LSD-LP tokens and stablecoin-LP tokens: This market category is characterized by lower-risk underlying assets with more pronounced cyclicality. Yields may be high during periods of market volatility.

- Medium-risk fixed yield markets, represented by GLP and gDAI: This category is marked by high yields and high risks. Derivatives traders on their chains heavily influence yields, causing violent fluctuations in response to market conditions.

- High-risk yield markets, represented by APE: This market category exhibits dramatic volatility following the underlying assets, with high but potentially unstable yields. Yields can drop sharply as staking frenzies occur among individual projects’ users.

Market Cap

The LSD Market

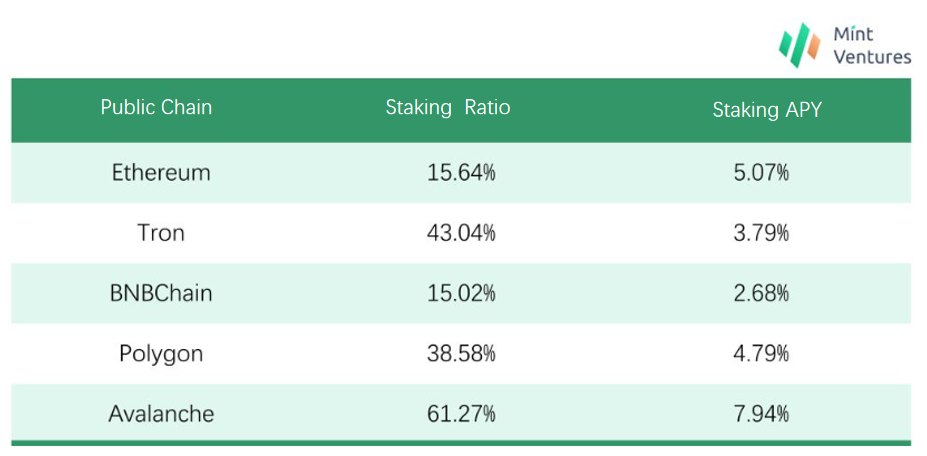

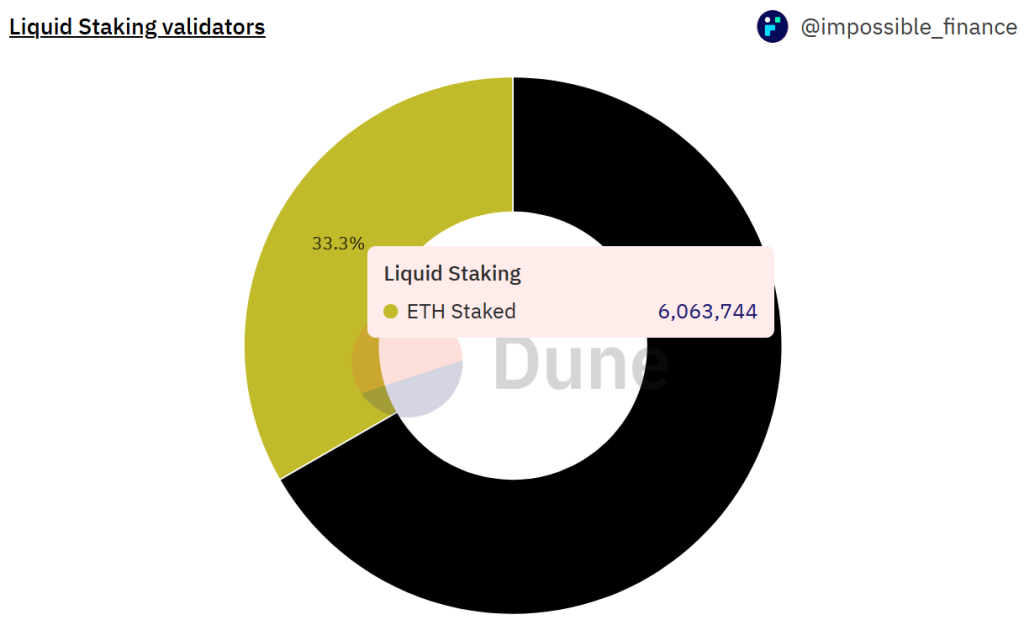

Focusing on the Top5 PoS public chains with the highest TVL, the average staking ratio currently stands at around 35%. There is still room for growth in the development of public chains, including Ethereum.

If Ethereum’s staking ratio increases to 50% within the next three years, approximately 16.5% of ETH will eventually become derivatives such as stETH. Based on Ethereum’s current market valuation of around $230 billion, the LSD market cap could reach around $38 billion.

The LSDLP Market

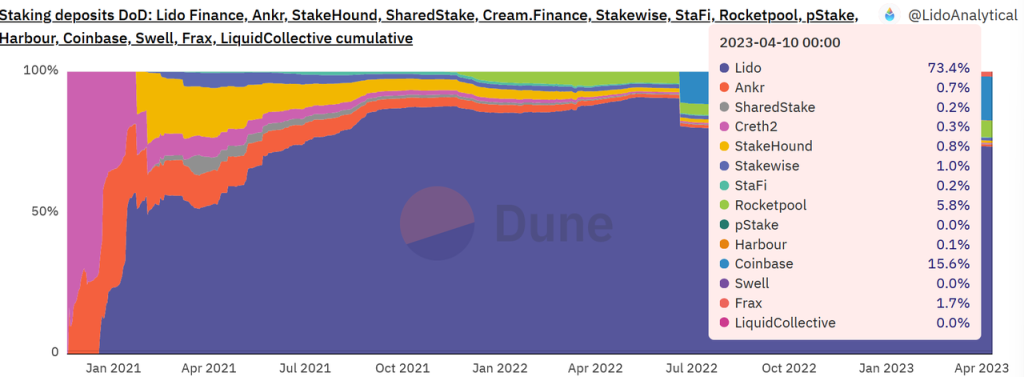

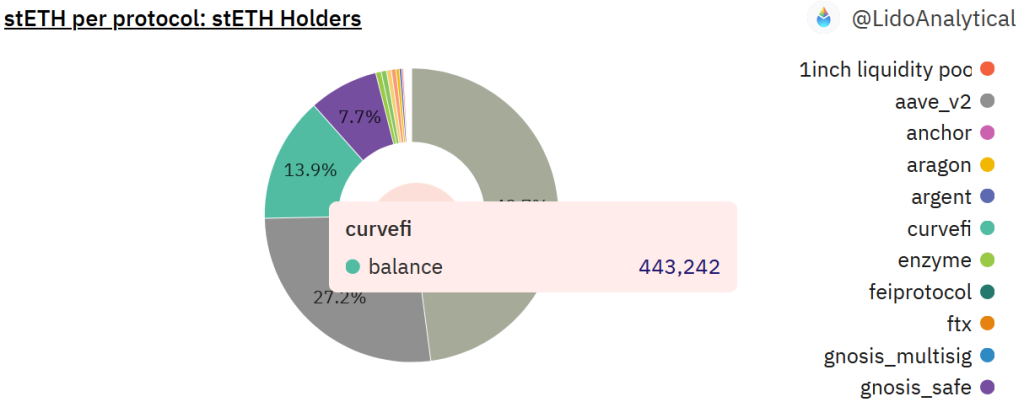

Lido accounts for about 73.4% of Ethereum’s liquidity staking market with about 14% of Lido’s liquidity staking derivatives flowing into Curve.

Assuming Lido’s market share remains stable and the primary destination for LSD in DEX is Curve, approximately $3.9 billion worth of LSDs will become LPs in Curve in the future. Consequently, the total size of LSDs + LSD LPs would be close to $46 billion. This number will likely increase further as Ethereum’s market cap grows, the staking ratio rises, and more LSDs are added to DEX.

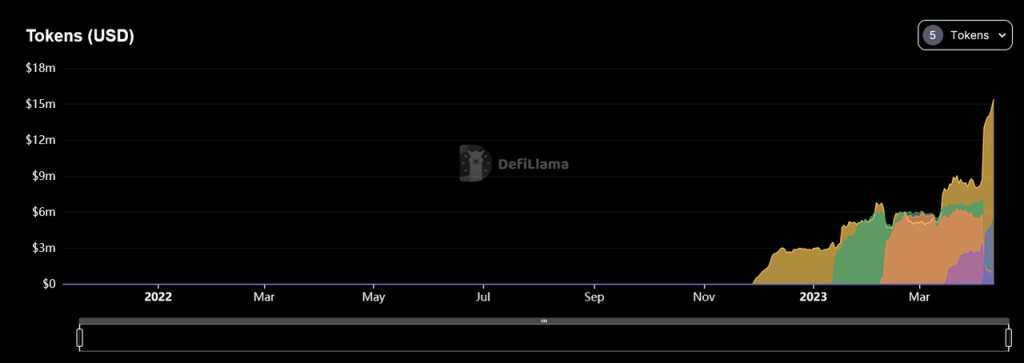

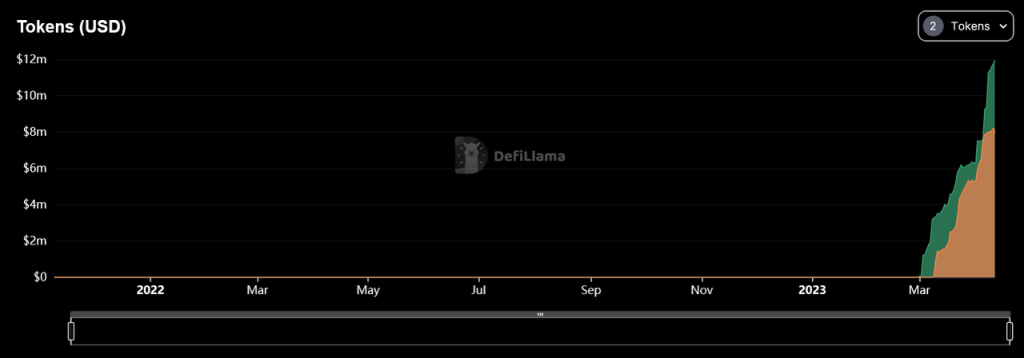

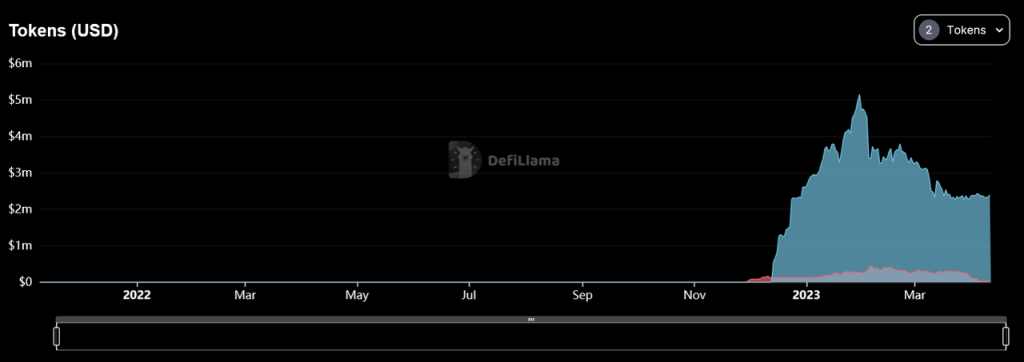

Demand for LSDs and LSD LP tokens in the fixed yield market is robust. TVL has reached a volume of $24 million to date since the LSD LP pool launched on Pendle.

Stablecoin LP Token Market

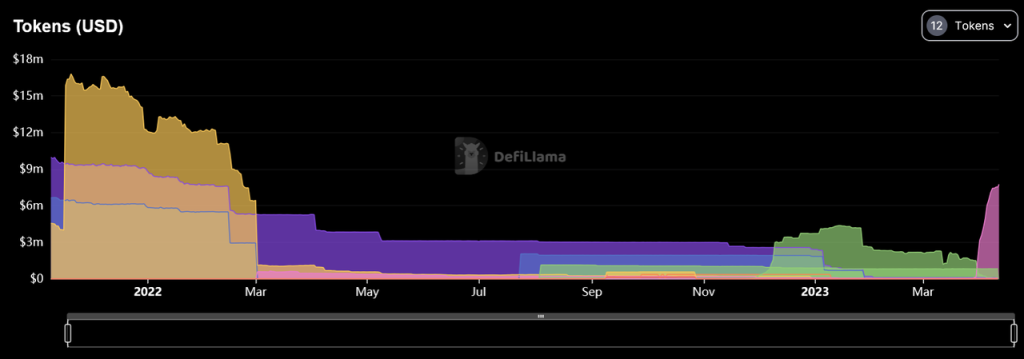

Although stablecoins are frequently swapped, the market appears to be less enthusiastic about stablecoin-based LP tokens. These pools have been online for over a year and generally exhibit declining liquidity.

Medium-risk Market Represented by GLP and gDAI

Demand in this market is relatively straightforward, with about $20 million TVL since the pool’s launch, compared to $530 million FDV of GLP.

However, only GMX and its clone projects have managed to achieve significant business scale. As a result, the growth potential of derivative assets is constrained by the development of these types of projects. In the short term, the possible market cap is estimated to be within $1 billion.

High-risk Fixed Rate Market represented by APE & LOOKS

The growth of the high-risk fixed rate market is related to the market cap of their native tokens and the declining speed of staking rewards. If staking rewards have a quick slump, it will be challenging to expand these pools.

However, the strategy for these pools may not be to hope that one single pool can achieve a large market cap, but rather to compete for growth rate: as soon as a token with a higher market cap and higher staking yield becomes available, a fixed rate pool for that token should be swiftly launched. A single pool might have a TVL of a few million to tens of millions of dollars, but the combined TVL of a series of similar pools will be higher.

Tokenomics Utilization

Token Value Capture

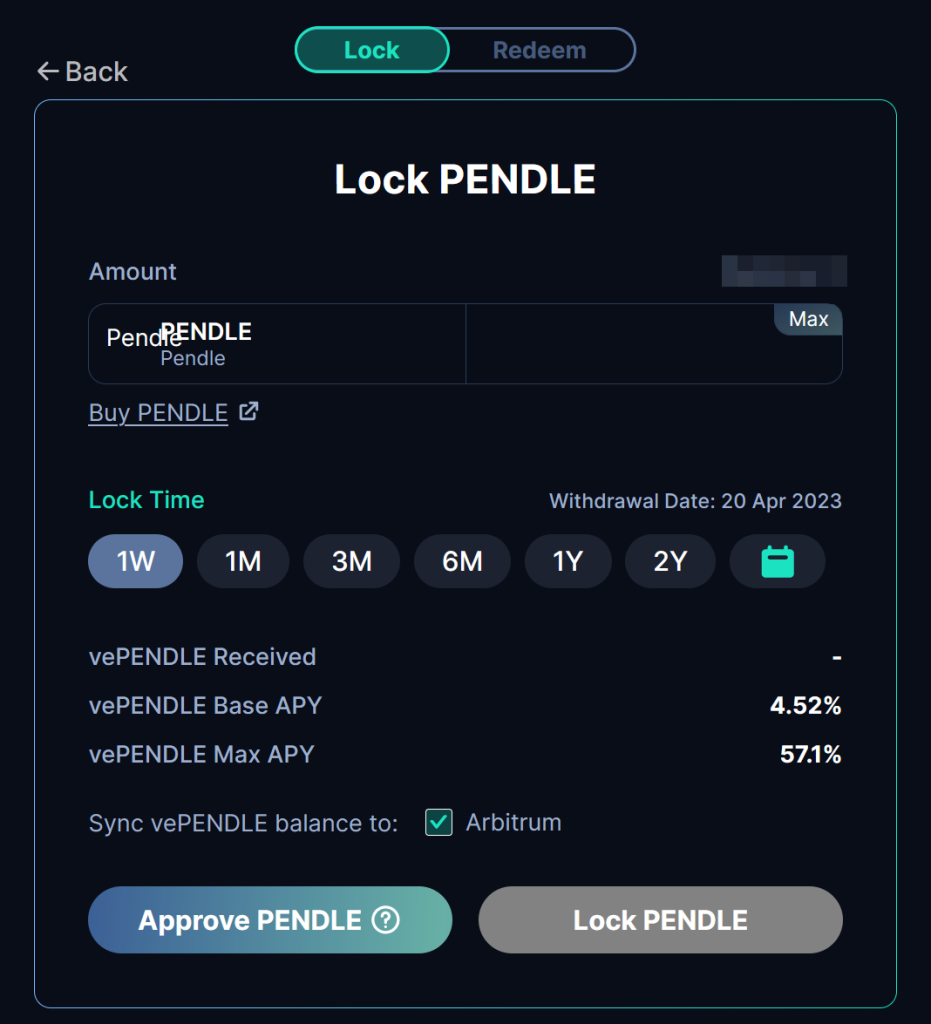

In the V2 version, the Pendle team formally integrated the Ve model into the PENDLE token, effectively enabling the token to capture value.

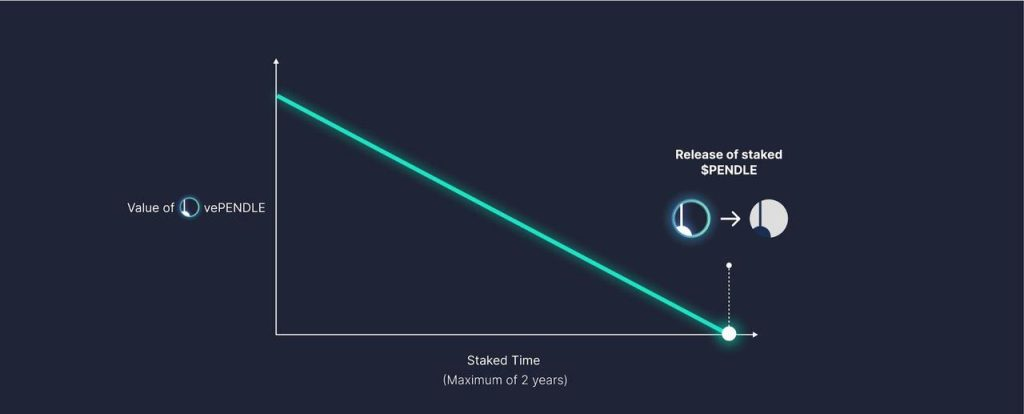

Users can now choose a lockup period ranging from a minimum of one week to a maximum of two years. Similar to veCRV, the value of vePENDLE will decay over time.

In terms of value capture, vePENDLE holders can primarily benefit from participating in the distribution of fees and yields.

vePENDLE holders vote for and direct the flow of rewards to different pools, effectively incentivizing liquidity in the pool they vote for. Voting for a pool also entitles vePENDLE holders to share the swap fees. Pendle collects a 3% fee from all yield accrued by YT. Currently, 100% of this fee is distributed to vePENDLE holders. A portion of yield from matured unredeemed PTs will be distributed pro rata to vePENDLE holders as well.

Additionally, vePENDLE holders who are also LPs can receive up to 250% of the incentive provided by Pendle.

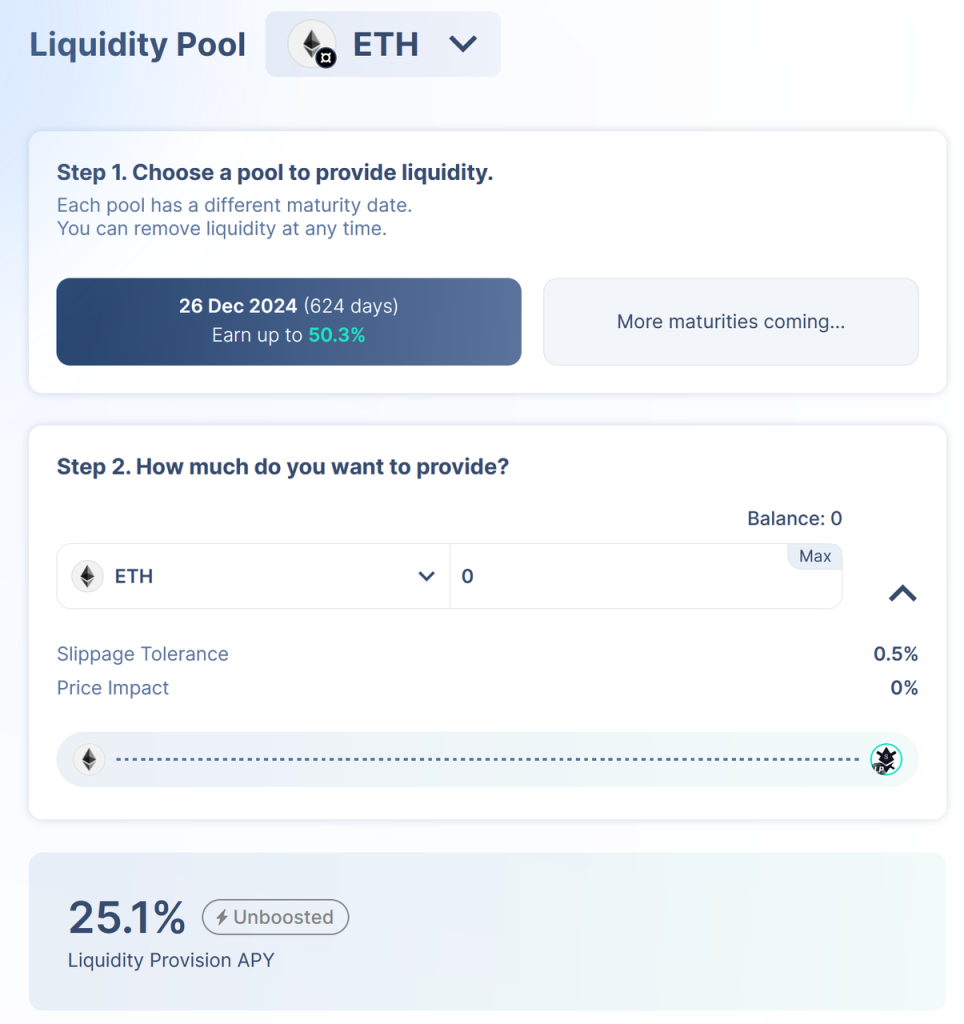

Taking the sfrxETH pool as an example, the base APY for LPs is 25.1%, and the maximum APY available along with the vePENDLE incentive is 50.3%.

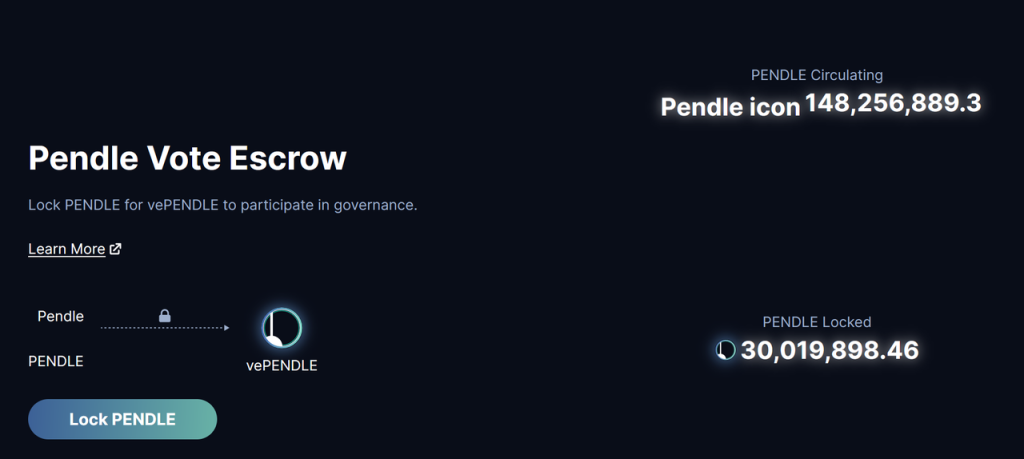

The significant boost in APY has spurred the growth of locked PENDLE on the platform. Currently, about 30.02 million Pendle tokens have been locked, which is close to 20% of the total circulating supply of PENDLE tokens.

User Base of Pendle

Following the adoption of the vePENDLE model, the PENDLE ecosystem has become more diverse in its user base:

- Liquidity Providers (LPs): The vePENDLE model has proven beneficial for LPs, who now experience a substantial increase in yields. Consequently, a segment of investors may opt to acquire PENDLE tokens and lock them, simultaneously holding vePENDLE to capture pool yields and a proportion of swap fees.

- Long-term PENDLE Investors: PENDLE’s appeal to investors seeking long-term cash flow is growing, thanks to the distribution of fees and yield shares. Although the current estimated annual revenue for vePENDLE stands at roughly $200,000, a relatively insignificant sum compared to the number of locked PENDLEs, token holders are primarily focused on the potential for future growth.

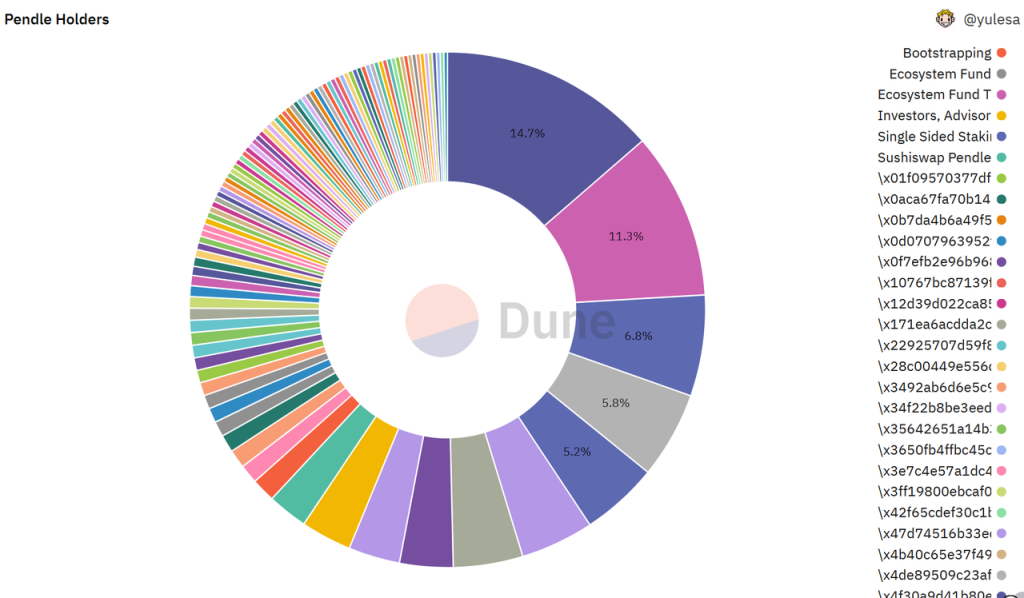

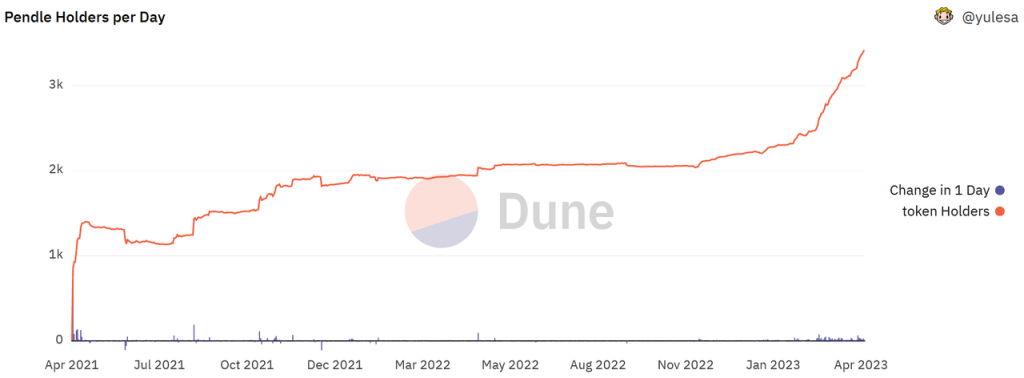

Following the launch of V2, the number of PENDLE holders has experienced a significant increase, with nearly 50% growth, amounting to 3,415.

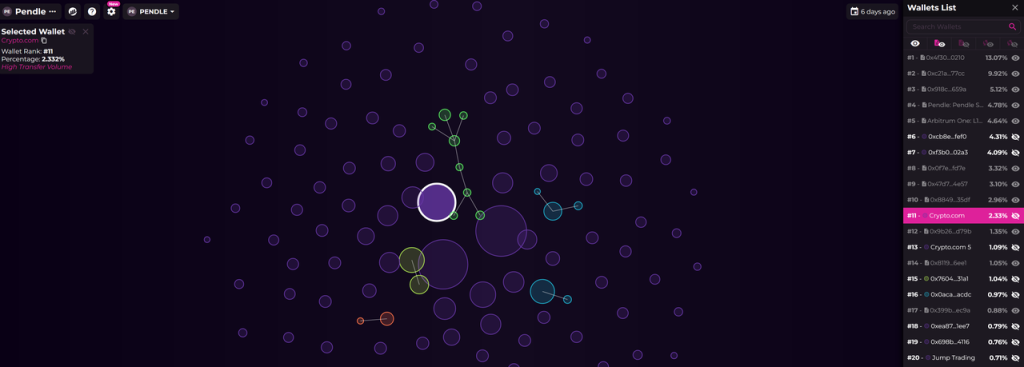

When examining distribution of holders, it is evident that TOP 5 holders possess approximately 44% of PENDLE tokens. Some private sale investors, such as Crypto.com, continue to hold tokens at this stage. According to Bubblemaps, about 3.4% of PENDLE tokens are held by Crypto.com.