Contents

Key Insights

- Compared to the other two reputable Web3 metaverse tokens, $APE is not relatively overvalued. $APE should not be considered overpriced compared to $SAND and $MANA when comparing land trading volume & total value of each project.

- The staking system may extract massive circulation of $APE and NFT, thus leading to acute price change. Due to the decent ROI in the first quarter of staking launch, it’s highly likely that a good % of $APE will be locked in the staking system.

- Otherside is expected to be the superstar in Metaverse-related projects. Although Metaverse has long been an investment hotspot, solid use cases with a massive user base in Web3 are pretty rare. The Otherside may evolve with high interoperability, attractive narratives, and compelling gameplay, thus capturing the premium upside of Web3 Metaverse.

- Yuga Labs tends to be the most creative team in Web3, with promising storytelling in its ecosystem. Yuga Labs, along with Animoca and Improbable, all put their strength in the Otherside. Yuga is skilled in storytelling, Animoca is a Web3 game giant and Improbable provides the game with a strong infrastructure.

Potential Risks

- The SEC is still investigating NFT/ApeCoin-related topics. Though it was started earlier this year, Bloomberg’s report recently has drawn a lot of attention to the overhanging risks from regulators.

- $APE has no value capture mechanism from Yuga Labs’ main revenue. Use cases are mainly 3 folds: Governance, Payment Method(which is quite limited for now), and Staking(which will fade as the rewards are distributed).

- Narratives on NFT and tokens are still vulnerable, mainly relying on price, though Yuga Labs’ storytelling is sophisticated. The previous fluctuation of $APE and NFT prices has raised panic in the Ape community. Once the consensus on BAYC is disrupted, the Ape ecosystem evaporates.

- It’s hard to build an ecosystem to capture sharp inflation in the long term, selling pressure within a year seems inevitable. The inflation rate of actual circulation may increase to >100% within a year, and the value capture mechanism, as said before, is quite limited.

Brief Intro to Yuga Labs Ecosystem

The Ape ecosystem has three core components and one common token.

3 Separate Entities

- Yuga Labs

- Otherside

- ApeCoin DAO

Yuga Labs’ Revenue Estimation 2022

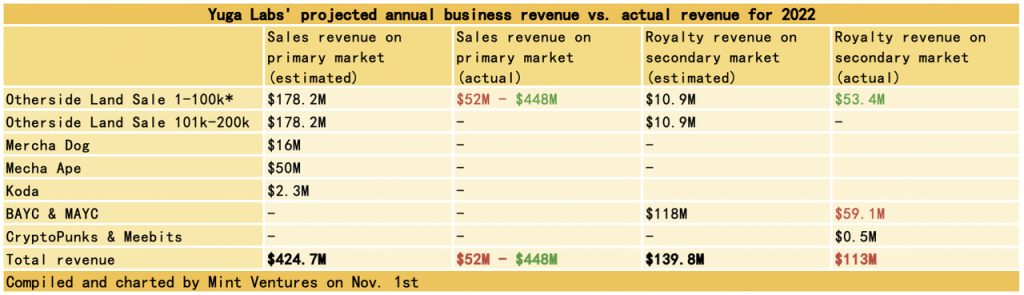

Based on the estimates in the (so-called leaked) Yuga Labs Pitch Deck, projected revenue and actual revenue for 2022 are compared as follows:

While Yuga Labs’ revenue for January through October 2022 was less than expected, the result was largely dependent on the recent dismal NFT market and the delayed launch of several NFT series.

Otherside: the (probably) Most Promising Metaverse

Compared to Sandbox, Decentraland, and other Metaverse projects that have already officially launched with quite limited user engagement and low playability, Otherside aims to create a Metaverse that is “immersive, interactive, and collaborative in a way that’s never been done before”.

In the past two Otherside load tests, Improbable has demonstrated excellent load capacity and operability with up to 4,500 people online in real-time within the same scenario.

However, to judge the full gameplay in narratives and experience, players need to play the game themselves.

ApeCoin DAO: A DAO That’s Building Along the Way

It’s been 8 months since ApeCoin DAO was established in March 2022. But some of the biggest expenses of the Ecosystem Fund were incurred by internal proposals related to the Foundation: launch staking system, operating expenses, Guy Oseary’s branding partnership on behalf of ApeCoin DAO, and the Bug Bounty.

Currently, except for API-103, which asked for $1M in $APE and is proposed by the community, most other accepted proposals that solely came from the community were asking for quite limited ecosystem fund allocation.

It indicates that the whole community is cautious about the allocation of funds. ApeCoin DAO is still in its formative years when very few projects meet the expectation of being supported by the community.

More Hypes and Less Players: Web3 Metaverse Current Dilemma

Overview

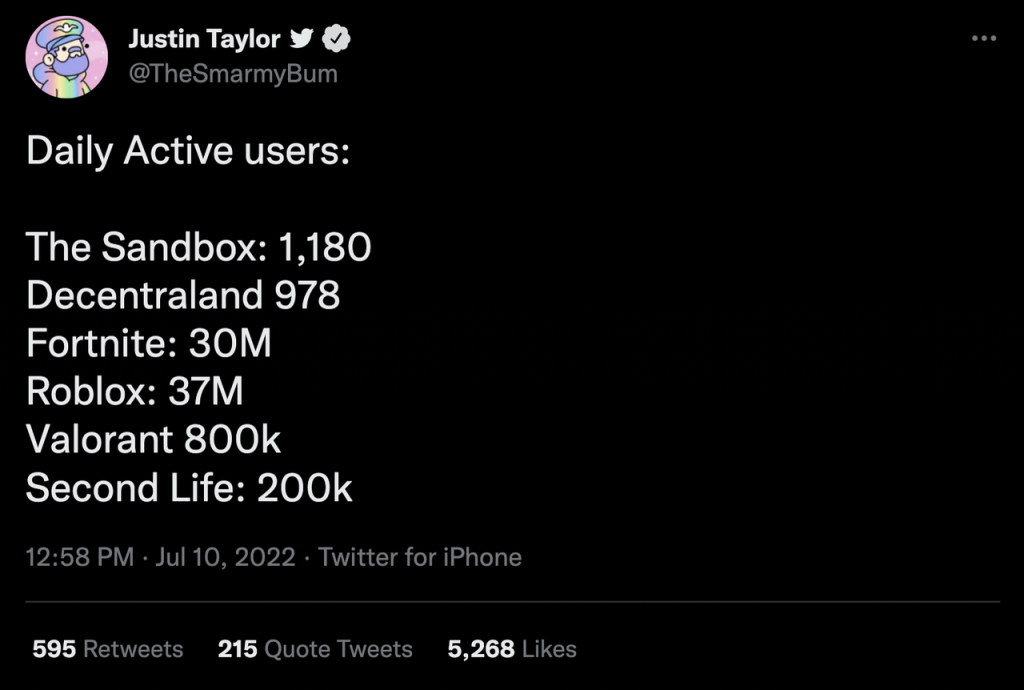

While the Web3 Metaverse concept remains hot and the leading projects have a multi-billion dollar market cap, Web3 Sandbox games are facing a rather dismal number of daily active users, as compared to a tweet by Justin Taylor, Twitter’s director of marketing. On July 10, 2022, Justin Taylor made a data comparison in his tweet:

Why does Web2 Roblox have 37 million DAUs while its two Sandbox games go unnoticed?

Web3 Roblox? May Never Exist

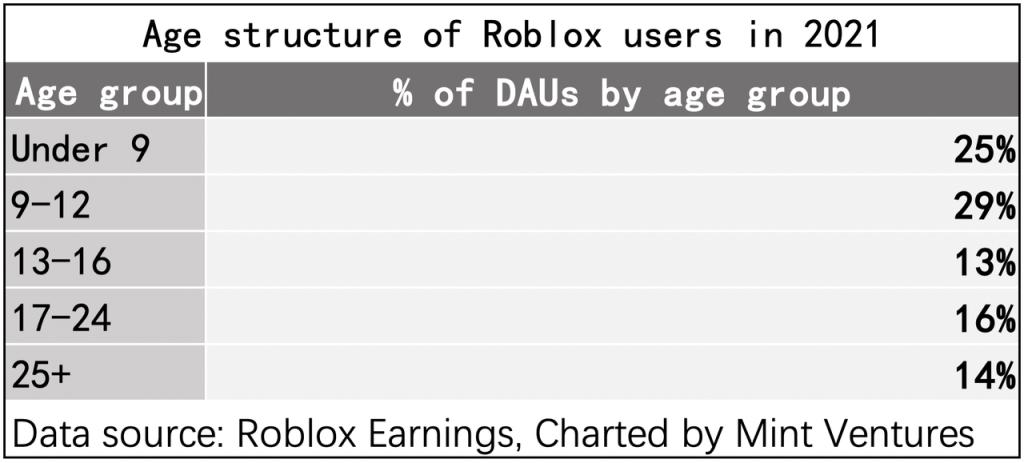

If we look at the age composition of Roblox users, the answer is clear: the users of Web3 and Roblox are totally different.

Therefore, 70% of Roblox users are under the age of 18, and 51% are younger than 13. Moreover, it is very possible that the actual user age is even younger due to the rating system of Roblox, because adolescents might lie about their age in order to play more. Although Roblox has been trying to recruit more adult users, it has achieved little. In 2020, 54.86% of users are under 13 years old. This number was 59.3% in 2019, and 57.76% in 2018.

The user portrait of pure UGC Sandbox games like Roblox is very clear. That is children and teenagers who are innocent and enjoy exploring the virtual world with their friends. Most of them are quite addicted to the games and happy to spend much time, in marked contrast to the user profile of Crypto, who have been trained by X-to-Earn, sticking to “time is money”.

That is why there are only a few thousand users returning to Sandbox and Decentraland in a bear market. Some players come back for parties or poker from time to time, and others go home more often because they are not reconciled to the falling price and market focus of the project.

Example of Potential Sandbox-like Gameplay in Web3: Fortnite Creative Mode

Does the market failure of Decentraland and Sandbox in user acquisition foreshadow the failure of other metaverses? Still, we have to go back to Web2 games to find solutions. Fortnite, which was released in 2017 and achieved a revenue of $5.8 billion in 2021, is a perfect example. The producers originally wanted to create a game combining Sandbox and shooting elements, inspired by Sandbox games such as Minecraft and Terraria.

In 2018, The team first released Fortnite: Save the World and received much positive market feedback. But it is the Fortnite Battle Royale that took the world by storm, in which the buildings in the game were set in Sandbox mode. Later, the team finally found a way to integrate the Sandbox and gameplay in Fortnite Creative. Launched in 2019, this mode allows each player to have access to a private island so that people can construct buildings and objects, invite friends to their own island and participate in unofficial games.

The Sandbox game that integrated with the core gameplay within a unified worldview has astonishing user activity. The real-time online players of Fortnite Creative achieved 458,565 in July 2021, which exceeds the users (317,295) on Call of Duty: Warzone at that time. By contrast, the number of online users in the Decentraland has remained at around 300 since July 2022, and most players are gambling in ICE poker rooms.

To conclude, the high flexibility and composability of Sandbox games are indeed important components of people’s vision of the metaverse. But Sandbox alone is not interesting enough to keep users addicted. The Otherside metaverse already has a strong narrative style and characteristics. If the gameplay is improved and innovated, integrating the boundaries between PGC and UGC, The Otherside will possibly become the true pioneer of the Web3 metaverse.

Staking System Rolling Out: Potential Impact on Circulation Might be Large

According to Horizon Labs, the $APE staking reward will begin distributing on Dec. 12th, although the website will ban access from some countries due to legal concerns, users can still interact with the staking system via smart contract. Once the system goes live, a good % of $APE would be locked in the contract.

Also, BendDAO, the NFT liquidity protocol, has passed an AIP to help users match NFT and $APE to earn higher ROI, which may also push the total staking % higher.

Impact on Actual Circulation When Staking System Rollout

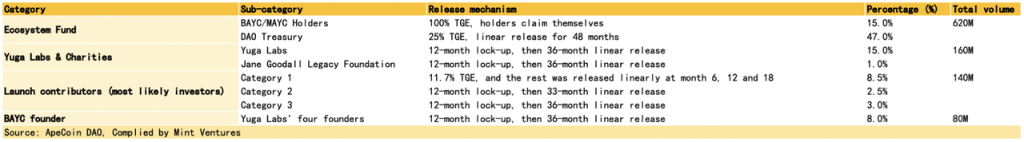

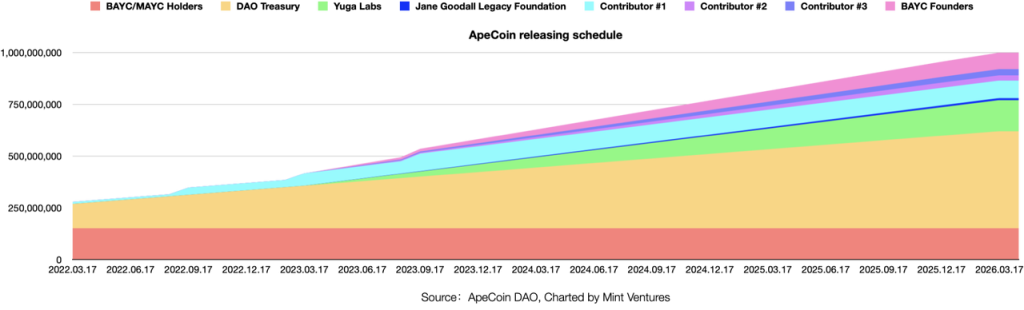

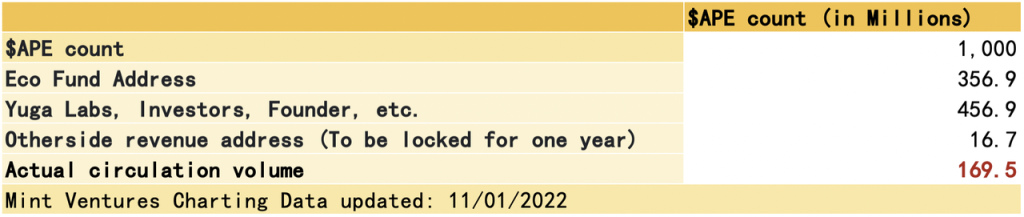

The total number of $APE is fixed at 1 billion. According to the contract, no additional tokens will be issued or burned.

The chart above shows the nominal circulation, and actual circulation is far less than expected. As $APE is not released periodically as per the protocol under the smart contract, 100 million $APEs were equally allocated to 200 addresses, and multiple transfers were made.

Based on the first 400 transactions of Etherscan, it is possible to count the token holdings of an address “not interacting with the exchange wallet”, which is considered a “Moral-Lock” and helps infer the actual circulation of $APE in the market, as evidenced by the ecological fund addresses and subsequent transfers given by ApeCoin DAO on its website.

(“Moral-Lock” includes both tokens whose unlocking period has not yet expired and those that have been unlocked but not yet spent in the ApeCoin DAO Ecosystem Fund. Besides, ApeCoin DAO can use the Ecosystem Fund only if its proposal is approved by the community, and is governed by the APE Foundation. Therefore, the Ecosystem Fund is not freely circulated and does not count as “actual circulation”.)

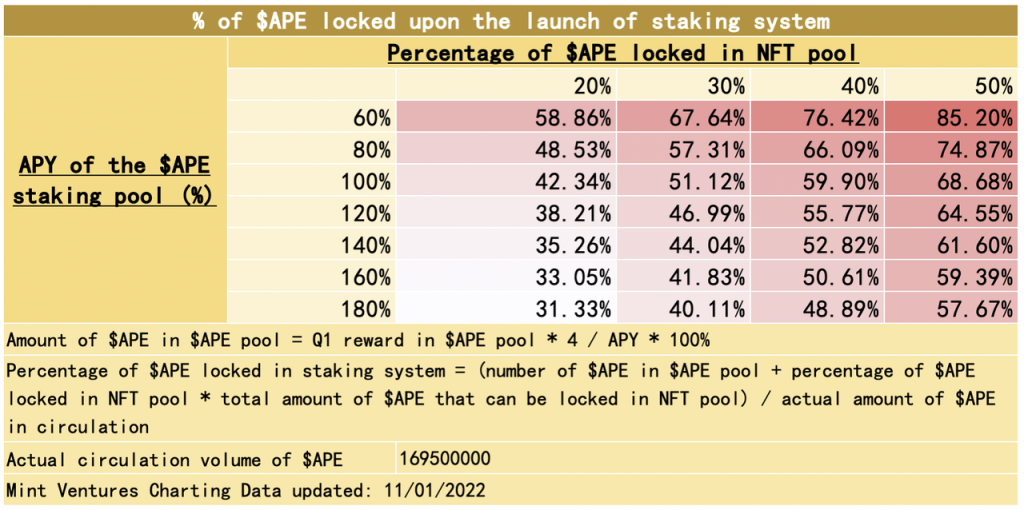

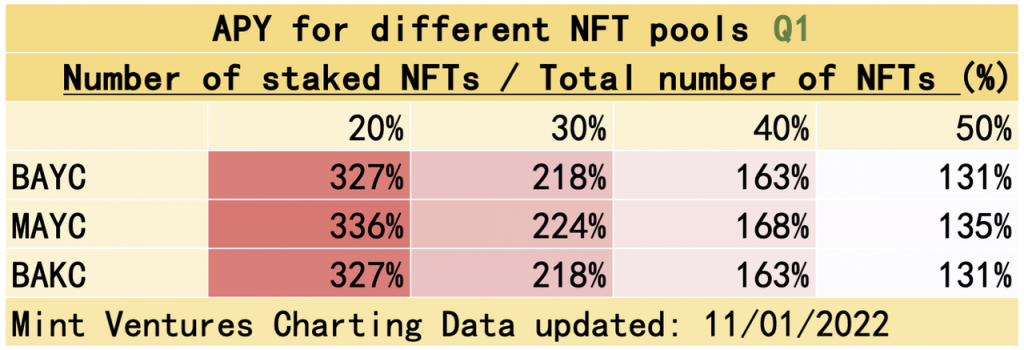

We may calculate changes in actual liquidity at the launch, based on 2 factors: the % of $APE staked in NFT pools, and APY of $APE pool:

When the staking system is introduced on December 12th, the approximate absorption of liquidity could range from 31.33% to 85.20%.

If the $APE staking pool has an APY of 180% denominated in $APE and the NFT pool is locked at 20% of the cap, it will absorb 31.33% of the actual liquidity, at which point the NFT pool will have an APY of 327 – 336%, a significant APY figure in a bear market.

If the $APE staking pool has an APY of 60% denominated in $APE and the NFT pool is locked at 50%, it will absorb 85.20% of the actual liquidity, and the NFT pool will have an APY of 131% – 135%.

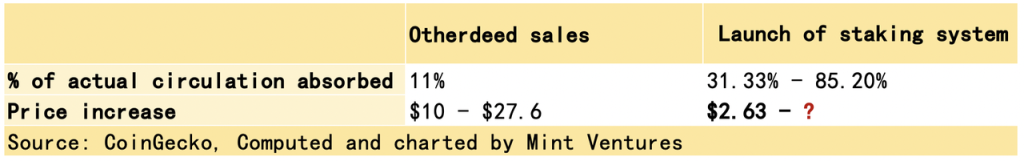

To conclude, the launch of the staking system will have a significant impact on the actual circulation, so a simpler and more crude comparison can be made in the context of the last Otherdeed land sale.

$APE was priced at 3.87 on Nov. 27th, and it soared before Otherdeed for Otherside sales, whereas the launch of staking system, which may impose a huge impact on liquidity, has not priced in based on current price change.

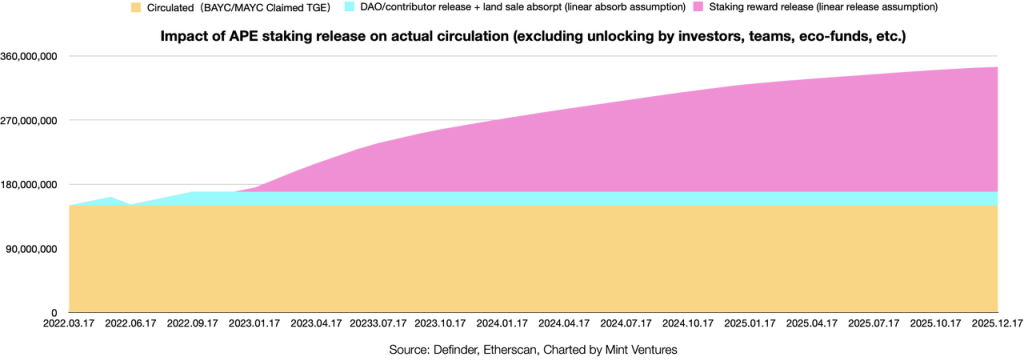

Increase in Circulation Due to the Staking Reward

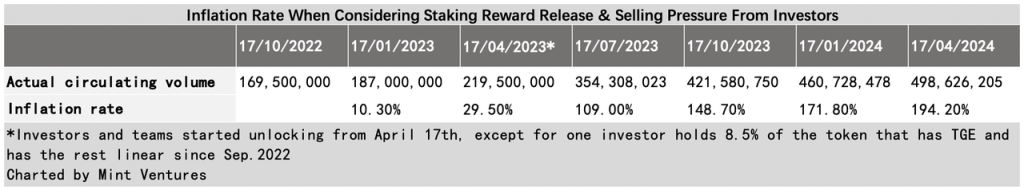

On April 17, 2023, actual liquidity is expected to increase by 35.4% over October 2022 figures as investors and teams unlock tokens in large numbers.

If the investors and the team also sell their $APE immediately after unlocking, and Otherdeed $APE income is sold outright at the end of its lock-in period, the actual liquidity increases by 151.7% after one year and 196.6% after one and a half years, even though the $APE sell-off by Eco fund is not taken into account.

It will be quite difficult to build a follow-on ecosystem to resist such sharp inflation, and the price of $APE may come under greater pressure in the medium to long term.

*Since the locked (but partially untransferred) and unlocked tokens are “morally locked” and not locked in a smart contract for regular release, uncertainties such as theft or sell-off by team accounts may have a significant and unpredictable impact on token prices.

Recent Regulations Overhang and FUDs on NFT Prices

On July 21, 2022, Yuga Labs NFT and $APE investors announced a class action lawsuit filed with SEC, demanding that Yuga Labs return the losses from NFT and token price drops.

Since Yuga Labs is located in the U.S. and the SEC strictly regulates token offerings, rulings in such lawsuits have an uncertain impact on the project development.

According to a Bloomberg release on October 12, 2022, SEC is reviewing whether NFTs issued by Yuga Labs is more similar to a stock to determine whether it needs to follow the stock regulation and disclosure principles.

SEC has reportedly been investigating the NFT field since March 2022, and this review may be a part of that investigation.

Also, due to the FTX collapse, the community has severe FUD. Their concerns are two folds:

- Amy Wu, the former manager of FTX Ventures, was on the Special Council of ApeCoin DAO for 9 months(resigned recently)

- Due to the non-transparency of Yuga Labs’ bank account, it’s hard to figure out whether Yuga has lost its funds or not

Out of the above two concerns, there’s a decline in the price of $APE and Ape-related NFTs, especially BAYC. @Franklinisbored, found the “market making” opportunity based on the mechanism of BendDAO.

He listed many BAYC near the floor price, and sold some at quite low prices, which caused FUD of other holders, causing a dump of NFT floor prices that made several BAYC in BendDAO liquidated. As prices fluctuated out of fear, tens of BAYC were on auction every day. People who firmly believed the floor price would go up, bidding and making profits.

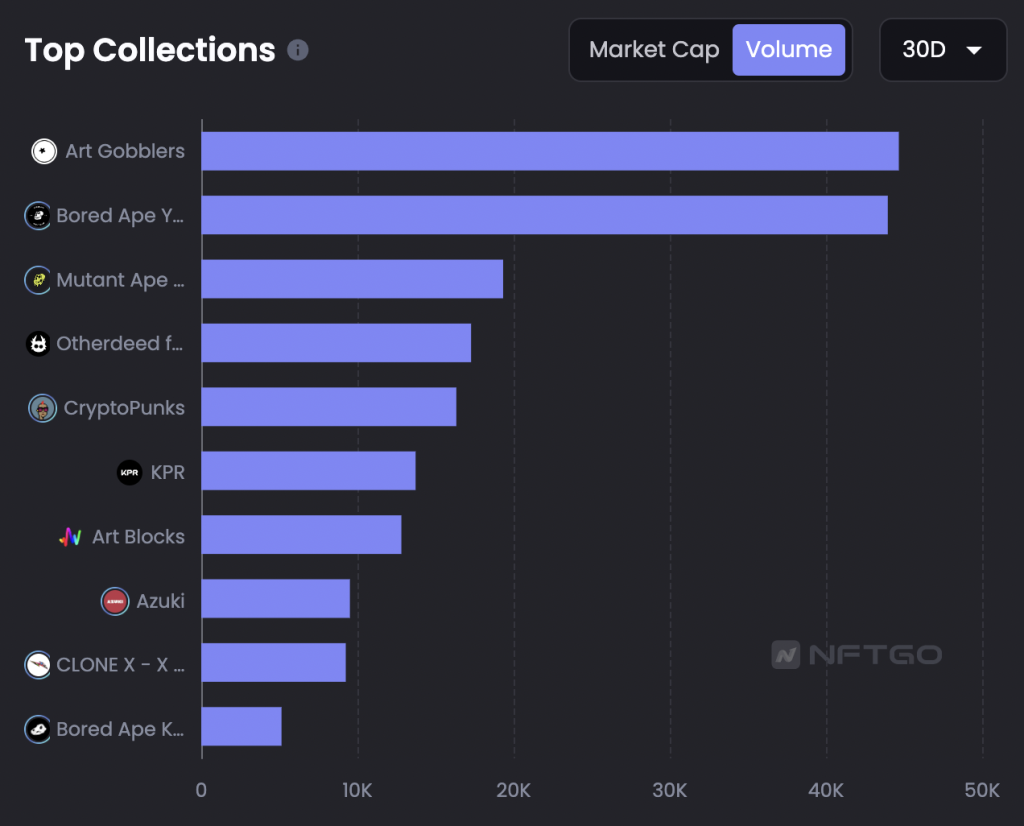

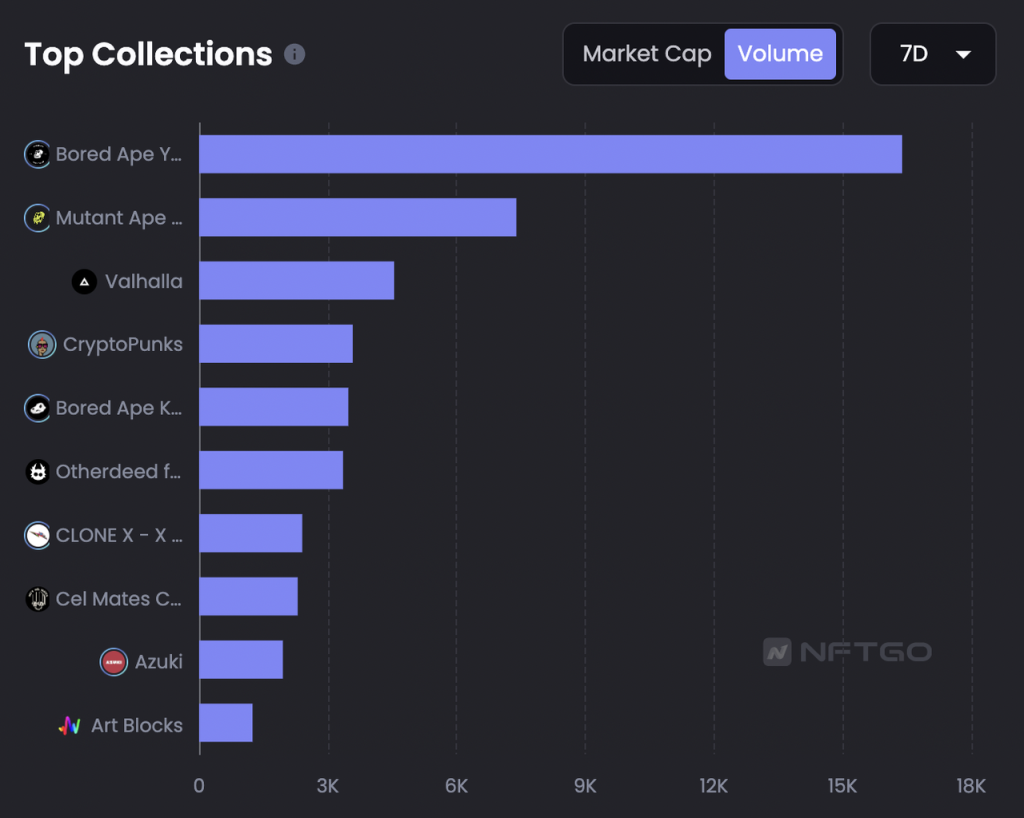

The “market making” strategy worked pretty well, as BAYC was the most trading NFT over the past 3 weeks, far surpassing Art Gobblers, which was undoubtedly the king of the week before the BAYC fud. Also, floor prices of BAYC are gradually recovering, currently around $80k, while they were around $100k before such severe FUD.

Ending Thoughts

Since the $APE staking reward is projected to distribute on 12/12, the short-term impact on the ecosystem is quite explicit.

In terms of oversight from governments, It’s a long-standing resistance to the entire industry rather than a black swan event. But in the long run, Further observation will be needed to monitor the operations of Otherside Metaverse and ApeCoin DAO. The performance of the Otherside is pending to be assessed due to its TBD full release.

In general, the DAO is still very nascent since there are not enough projects to generate decent revenue. We may expect innovations in all aspects to emerge in the near future.