Contents

Key Insights

Core Investment Logic

With a well-designed stablecoin mechanism, Angle Protocol integrates the demands of stablecoin, margin trading, and single-coin staking, therefore guaranteeing a win-win situation for all parties:

- Enable the stablecoin users to mint and redeem stablecoins freely with both capital efficiency and security.

- Provide margin traders with a platform for trading without fees and slippage.

- Offer more yields for the single-coin stakers.

On the one hand, the protocol has not been tested by market volatility; on the other hand, even if it is validated, the scalability of the use case will be crucial to the success of stablecoin. As a result, we actually need to keep an eye on Angle’s use case scaling.

Main Risks

We believe that the project’s principal risks include:

- Inadequate Marketing

- The Failure of Core Mechanisms

- The Risks brought by Oracles and Smart Contracts

More information can be found in Chapter The Risks.

Business Overview

Business Scope

Angle Protocol is a decentralized stablecoin project deployed on Ethereum, intending to create a decentralized stablecoin that is capital efficient and over-collateralized. During the implementation of the stablecoin, margin traders and single coin stakers were introduced, to form three current use cases of the Angle Protocol. The protocol was launched on November 4, 2021.

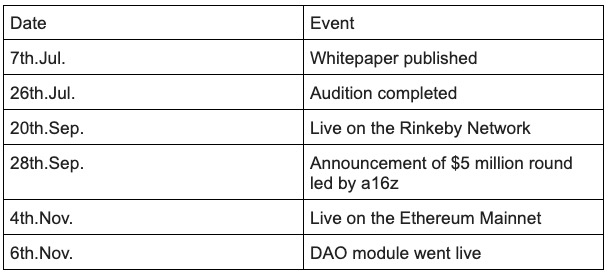

Milestones

The stablecoin on the protocol is agEUR, which is pegged to the Euro and backed by USDC and DAI as collateral. Its current TVL is $150 million.

Data Source: https://analytics.Angle.money/#/home

Angle’s Team

The core members of the Angle team are Pablo Veyrat, Guillaume Nervo, and Picodes (pseudonym), all of whom are from France.

Their a16z posts and LinkedIn accounts indicate that they have been École Polytechnique classmates since 2016. During their graduate studies in computing science at Stanford University in 2019, they met the a16z partners. The team has six members, according to Twitter, with no information on the remaining members. Veyrat, one of Angle’s core members, has participated in the ETHCC and the recent crypto seminar in Lisbon.

As illustrated by the articles on the team’s blog, they have a thorough awareness of stablecoins’ current state and deep insight into other stablecoins’ collapses.

Overall, Angle is a small but youthful team with a solid educational background in the core team, but little experience in the crypto world.

Financing

On September 28th, Angle Protocol announced a $5 million round led by Andreessen Horowitz(a16z), joined by several world-class investors including Fabric VC, Wintermute, Divergence Ventures, Global Founders Capital, Alven, and individual investors Julien Bouteloup (a core contributor to Curve) and Frédéric Montagnon.

Business Analysis

The State of Stablecoins

Our views on the stablecoin market are summarized as follows:

- The market capitalization of stablecoins is growing rapidly with this year’s growth rate being higher than the previous year.

- The growth rate of decentralized stablecoins is 3x that of centralized stablecoins.

- Bull market is not a decisive factor of stablecoin market size, compared to the whole crypto market cap, the market cap of stablecoins rebounded.

- Although facing strict regulations, decentralized stablecoins may have just arrived at their golden age and we can expect them to maintain a high growth rate in the future.

Landscape of Stablecoins Competition

The success of stablecoins comes from the two factors:

- the reliability of the stablecoin mechanism

- the use cases, user scenarios and user growth of stablecoins

Since Angle Protocol has launched, we can probe into the stability by studying its core mechanism, then doing research about the overall mechanism and background (including team background and funding background) to see whether it has the potential to grow its popularity.

As mentioned in Angle’s documentation, the protocol involves 3 groups:

- Stable Seekers and Holders (or Users)

- Hedging Agents (HAs) who can get on-chain leverage under the form of perpetual futures

- Standard Liquidity Providers (SLPs) who bring extra collateral to the protocol and automatically earn interests, transaction fees and rewards

Let’s take a look at the stability of Angle:

The Stability

Angle’s design basically allows anyone to easily mint stablecoins or redeem collaterals at oracle value with small transaction fees.

For example, if the oracle price for 1 ETH is $4,000, and if the transaction fees are 0.3% of the transaction, then a user giving Angle 1 ETH will receive 3988 agEUR. When there exists strong market demand for agEUR, it is profitable to do arbitrage for price deviations of higher than 0.3% by selling this newly minted agEUR on the market. The same procedure works when users are willing to cash out.

This is actually similar to centralized stablecoins. It is guaranteed that centralized stablecoins such as USDC can be converted 1-to-1 to collaterals and vice versa. Generally speaking, centralized stablecoins are backed by fiat money or cash equivalents, while the minting and redeeming process is not instant due to the restrictive payment system and high cost.

If a system is open for stablecoins’ minting and redeeming, the slippage will be small when striking a balance between supply and demand, thus making the stablecoins of good liquidity and strong stability, which is the most friendly solution for stablecoin users.

However, it is not over-collateralized when minting agEUR. How can the system ensure that users always have sufficient collateral to redeem if the value of the collateral decreases? Here is an example:

Imagine there is 1 ETH worth $4,000, and Alice spends 10 ETH($40,000) to mint agEUR, under this condition the protocol should pay off $40,000 agEUR debt(leaving out the transaction fees).

- If the price of ETH increases to $5,000, the collateral’s value will climb to $50,000, but the debt will still be $40,000. As a result, the protocol will be over-collateralized and in good condition.

- If the price of ETH falls to $3,000, the value of the collateral lowers to $30,000, but the debt stays at $40,000, leaving no collateral for the remaining agEUR owners.

Thus, this model by itself is ineffective. To ensure the protocol against the volatility of the collateral, Angle introduced a new model: the Hedging Agents (HAs). As detailed above, HA serves as ETH long position traders, they can deposit ETH and open leverage long positions on ETH. With the combination of HA, the above process would become:

- If the price of ETH is $4,000, Alice spends 10 ETH ($40,000) to mint agEUR and Bob contributes 5 ETH to open a long position, there are 15 ETH in the protocol with a debt of $40,000 agEUR, of which 10 ETH are for redemption and 5 ETH will be a surplus of the protocol.

- If the price of ETH increases to $5,000, the value of the collateral will be up to $50,000 but the debt amount remains $40,000. Currently, just 8 ETH are required to redeem $40,000 worth of agEUR, and Bob will receive the remaining 2 ETH as profit.

- If the price of ETH decreases to $3,000, the value of the collateral will be $30,000 but the debt amount remains $40,000. At this point, 3.3 of Bob’s 5 ETH are needed to redeem the corresponding agEUR. This leaves Bob with only 1.67 ETH of his margin.

In the case mentioned above, collateral fell by 25%, but the protocol remained overcollateralized and secure.

The over-collateralization provided by HA provides the initial safety barrier for Angle Protocol stability. Overall, surges in collateral prices can be beneficial to the protocol and drops are less desirable as the protocol gets under-collateralized. As long as there is enough HA, the protocol could keep a healthy condition. The main advantage of opening positions with Angle is that there is no funding fee. Perpetual futures or margin traders usually pay a recurring fee to maintain their positions. Depending on CEX market conditions, it can go up more than 100%/year. On the other hand, no slippage as trading prices are directly applied to the Oracle prices without AMM; and finally due to HA’s contribution to the security of the protocol, they can also receive $ANGLE reward distributed by the protocol.

However, it is an obvious contradiction that HAs are unwilling to buy long on ETH as the ongoing sell-off continued during a bear market. When Hedging Agents do not fully cover the collateral that was brought by users, and when the protocol’s reserves are not fully insured, the stability will be broken. Therefore, Angle introduced the Standard Liquidity Provider (SLP) as the buffer:

As the name reveals, SLPs serve as the liquidity provider in Angle Protocol. SLPs can deposit collateral in the protocol and provide liquidity for stable seekers and holders who want to redeem the collateral. Because the common claim preferability are stablecoin users > HAs > SLPs, who will take a bigger risk when lending money to over-collateralize the protocol, SLPs should be incentivized for a fraction of the transaction fees paid by users minting and burning stablecoins and the funding fees paid by HAs opening and closing positions. Besides, part of the reserves can then automatically be transferred to DeFi protocols (like Yearn or Compound) responsible for getting yield on it. In this case, after putting a certain amount of lending returns on reserve as surplus, Angel will distribute the rest to SLPs. Actually, SLPs are allowed to get a multiplier effect on their interest by leveraging not only their own capital but also the collateral deposited by stablecoin users and HAs. SLPs are also able to stake their positions to receive ANGLE rewards.

We need to note that Angle has an emergency module that allows its governance token $ANGLE to be used as protocol collateral to pay out when there is not hedged enough by HAs, and there are not enough SLPs to over-collateralize it. Angle will not activate the emergency module which is also commonly used by many stablecoins that are not over-collateralized.

The creation of HA and SLP reflected the DeFi composability of Angle Protocol that combines stablecoins, long margin trading and single-token yield farming in an effective way, bringing benefits to multiple groups:

- For stablecoin seekers and holders, they can easily mint stablecoins in a decentralized way and redeem collaterals freely with no interest.

- For HAs, they can open no-interest leverage or coin-margined perpetual futures(long positions) in Angle Protocol. Compared to trading on CEX, they do not carry a funding fee or interest, but only need to pay a little transaction fee, which is favorable to long-term position traders and hedgers. Oracles to get access to price feeds allows swaps between collateral and stable assets at oracle value with no slippage. However, Angle Protocol prescribes a limit to both collateral and tokenpairs.

- For SLPs, although they can gain big rewards from transaction fees and capture great incentives via the multiplier effect that comes from investing funds into yield-earning strategies, they have to undertake liquidity risk.

- For Angle Protocol, HAs and SLPs provide the payout surplus for the protocol, because with the existence of HA and SLP, the protocol can make the best of the over-collateralized approach while the user is under-collateralized to mint stable coins, thus achieving the combination of capital efficiency and protocol security.

*Due to limited space, we haven’t explained all the details of Angle Protocol which consists of elaborate modules around collateral ratio, including ranged collateral ratio that will decide the transaction fees of minting and redeeming stablecoins, as well as the funding rate of opening and closing positions for HAs. All these factors will influence the stablecoin users’ and HAs’ willingness and engagement in the protocol and protocol’s external yield-earning strategies. Check out https://docs.Angle.money/ to learn more about Angle Protocol.

Focus on Non-dollar Stablecoins

When we talk about stablecoins in the cryptocurrency space, what we are really talking about is stablecoins pegged to the US dollar, which is dominant in the whole stablecoins field. Despite the fact that the US dollar also plays a leading role in foreign exchange reserves, its share is not as high as that in the crypto world.

In the absence of a trustworthy Euro stablecoin with scalability and the market cap of Euro-pegged stablecoin is only $250 million, with a 24-hour trading volume of $15 million, only representing 0.002% of the U.S. dollar stablecoin economy. In 2020, the U.S. dollar depreciated overall by 10% against the Euro, which means Europeans should gain a 10% return via USD stablecoins to break even on Euro. For all non-dollar users, they should get rid of the volatility of their local fiat currency against the U.S. dollar.

In fact, DAI and USDC are the only collaterals supported by Angle Protocol and the agEUR is the only stablecoins open to be minted. As far as the current mechanism is concerned, Angle Protocol is more like a currency converter for Euro users in the crypto world. Those who want to buy long on the Euro can swap DAI or USDC to agEUR and those who go long can deposit DAI or USDC as collateral, which is a relatively clear use case of agEUR.

The Angle team chose agEUR, a Euro-pegged stablecoin, as its first issued stablecoin, with the intention of going into the blue ocean market and niche market in the stablecoin space, as well as to gain better access to users. In its roadmap, it will take more fiat currencies into consideration, such as the Swiss Franc, Yen, Pound, KRW, etc.

In addition to the core mechanism of the protocol, choosing the differentiated market is also a major feature of Angle stablecoin.

Protocol Revenues

The revenue of Angle protocol is contributed by the following parts:

- The transaction fees(ranging from 0.2%~0.4%, according to the current collateral ratio) paid by users minting and burning stablecoins

- The funding fees(ranging from 0.2%~0.4%, according to the current collateral ratio) paid by HAs opening and closing positions

- Yield earnings from protocol’s collateral

Currently, revenue is divided between the SLP and the protocol surplus fund, with each pool establishing a separate allocation ratio. SLPs receive 40% of the USDC pool’s generated fees, while the surplus fund receives 60%. Additionally, 20% of the fees earned by the DAI pool are allocated to the SLPs, while the remaining 80% are sent to the surplus fund.

By introducing stablecoin holders, HAs, and SLPs, the protocol organically combines stablecoins, coin-margined perpetual futures and single-coin staking. So the revenue source of the protocol is broader and the stability of revenue will be more robust.

Angle’s Revenue: Since its launch on November 4, the protocol surplus fund has gathered a total of $1.2 million in revenue, which is relatively significant but earned primarily by stablecoin minting inspired by $ANGLE liquidity mining. It is a one-time profit, and the future income and profit are uncertain.

Angel’s Potential and Stablecoin Use Cases

The holders and daily active users of Angle Protocol is around several hundred.

Data source for the agEUR contract’s active users: https://etherscan.io/token/0x1a7e4e63778b4f12a199c062f3efdd288afcbce8#tokenAnalytics

Due to the brevity of the launch window and high Gas fees on ETH, there are few active users and holders integrating with the contract.

The team is quite active in collaborating with other projects, including:

- The team is communicating with Curve to add agEUR-sEUR pairs

- Proposal to add FEI as collateral for agEUR, and is waiting for the consequence of community discussions on FEI

- Proposal to add FRAX as collateral for agEUR, and is still in the community discussion phase

- Proposal to sell agEUR-ANGLE LPs through Olympus PRO, which is voting in the community

As for future development, a16z’s investment should significantly boost Angle in terms of stablecoin use cases and its partnership with other projects.

In addition, Julien Bouteloup, a core contributor to Curve, may have made a more significant investment. Curve is now a pillar of DeFi protocol and stablecoin projects. All stablecoin projects are actively collaborating with Curve to go live with Curve, which can generate recurring revenue based on Curve LP, thereby providing their tokens with compelling use cases.

Analysis of Intratype Competition

Top 12 Stablecoin Projects by Market Cap; Source: Coingecko

The top 12 decentralized stablecoins in terms of market capitalization include DAI/UST/MIM/FRAX/LUSD/FEI

In terms of mechanism, the stablecoins above can be divided into exactly two categories:

- DAI/MIM/LUSD, whose core feature is over-collateralization;

- UST/ FRAX/ FEI, whose stability relies on the provisioning (or invisible payment) function undertaken by the ‘volatile’ tokens (LUNA/FXS/TRIBE) in their system.

Angle’s competitive advantage over those above decentralized stablecoin protocols lies primarily in its mechanism. With its mechanism functioning ideally:

- For stablecoin users, Angle’s stablecoin is more capital efficient than the over-collateralized stablecoins represented by DAI/MIM/LUSD, as it can be minted without over-collateralization.

- UST/FRAX/FEI stability relies on users’ trust in their ‘volatile’ tokens (LUNA/FXS/TRIBE). So when the users lose faith in them, depeg will occur. (In fact, UST was depegged because LUNA fell below UST market cap; while FEI was depegged for quite a long time after launch due to high PCV; Frax’s USDC collateralization rate has been above 80%, so we can assume that Frax is basically minted by USDC collateralization up to now). Angle is still over-provisioned for stablecoins in circulation, so for stablecoin users, Angle’s stablecoin will be more ‘safe’.

Angle’s competitive disadvantage is mainly due to its late start. Since stablecoins have a strong network effect, thus latecomers who want to capture a portion of the market must have very full fundamental benefits and distinct yield advantage.

Unlike Terra and Celo, which are public chains built around stablecoins, Angle is deployed on Ethereum, which means that Angle’s use cases depend mainly on how it scales within the Ethereum (and sidechain) system. As we have emphasized before, we believe that for stablecoins, such as MIM, the star stablecoin in the Ethereum ecosystem recently, its achievements are more in token use cases rather than stablecoin mechanism innovation.

In addition, there are very few Euro use cases on the entire Ethereum ecosystem, so it is also tricky for Angle, which currently launches only one stablecoin that is pegged to the Euro.

Tokenomics

ANGLE, the protocol’s governance token, has a total supply of 100,0000,000, and the token distribution is broken down as follows:

- 40% to the Community, HA and SLP through Angle Liquidity Mining Program

- 20% to the DAO Treasury

- 18% to Angle Core Team, which are subject to 3-year vesting

- 12% to Angle’s current and future strategic partners, for grants, advisors of the project and valuable community members

- 10% to Early Backers, which are subject to a 3-year vesting

ANGLE governance token utility across the protocol are as follows:

Governance:

ANGLE holders are responsible for parameters tuning, deploying new stablecoins, accepting new collateral types for a given stablecoin, handling the strategies earning yield on this collateral and choosing which proportions to distribute this yield to SLPs and protocol upgrades and integrations.

Surplus Accumulation:

There is a proportion between the SLP and the surplus fund of Angle’s revenue. The DAO will be responsible for deciding what to do with this surplus. And it is clearly indicated in its documentation that when the time comes to do so, ANGLE will do the buyback in the form of auctions as Maker DAO did.

A Way to Incentivize the Community:

By incentivizing stablecoin users, HAs and SLPs with ANGLE can bring more users to the protocol and maintain the protocol’s security.

The Risks

According to the importance, we think the project’s risks are as follows:

Inadequate Marketing

Although the excellent mechanism of stablecoins is essential, more critical are the use cases. The project has a good investment background and strong ability in product and development, which we can see from the team members’ experience. However, they have not yet demonstrated their power in operational and marketing.

In addition, the lack of scenarios for the euro within the entire DeFi ecosystem is a concern for Angle use cases to scale.

The Influence of Core Mechanism Failure

Despite the subtlety of the protocol’s core mechanism setup and the very well-set risk parameters and management system, the protocol was launched for a short period and did not experience significant market volatility. As a stablecoin project, if it meets the depeg soon after launch, it will destroy the project’s reputation and prevent the use case expansion (e.g., FEI).

The Risks Brought by Oracles and Smart Contracts

Angle’s reliance on oracles is mainly reflected in two aspects: 1) the minting and burning price should be based on oracles; 2) the need to follow the oracles price for HA transactions. Angle has written an article to explain their awareness of oracles risks and set up a series of means to prevent oracles attacks, such as accessing both Chainlink and UniswapV3 oracles, setting more than 1 hour between HA purchases and sales, etc. Angle’s smart contract has passed the audit of Chainsecurity and Sigma Prime, and it had done an adequate test with three months of test network time before the main net went live.

Thus, this risk is relatively small, but cannot be completely avoided.

Valuation

Five Core Issues

What’s the Development Stage of the Project?

With only 10 days till the launch of the product, the project is still in its infancy. Despite the mechanism’s superior design, its capacity to handle complex and unexpected attacks is unknown.

Does the Project Have a Substantial Competitive Advantage? What is This Competitive Advantage Based On?

Due to the relatively excellent mechanism and funding background, the project has achieved a successful cold start. And also, the team has a solid understanding of the stablecoin industry. Since its launch over one week ago, it has also actively cooperated with other projects, showing its team’s aggressiveness in business expansion. However, it remains to be seen whether the aforementioned advantages can be maintained in the fierce market competition.

Is the Long-term Investment Logic of the Project Clear? Is It in Line With the General Trend of the Industry?

Stablecoin has a broad market space, and thanks to the lack of regulatory policy for the stablecoin, it is more favorable to decentralized stablecoin. In addition, by focusing on non-USD stablecoins, the project cuts into the current stablecoin market segment.

What are the Main Variable Factors in the Operation of the Project? Are Such Factors Easy to Quantify and Measure?

The primary variable factor in the project’s operation is the scalability of stablecoin’s use cases. Determining the mechanism’s efficacy is just the first step in stablecoin projects. The ability to drive up the demand for stablecoin through cooperation with other projects (such as MIM) or creating its ecology (such as UST) is the key to developing stablecoin projects.

This factor can be easily measured by how well their stablecoins are issued, how active they are, and how well they are progressing with other projects.

What are the Project’s Management and Governance, and How is Their DAO?

The protocol’s DAO module went live on November 6, and there are not enough cases to judge how their DAO is going. From what we have seen so far, the discussions within the project governance forum are pretty active, and the core team pays close attention to community opinions.

Value of Assessment

As a stablecoin project, Angle has been online for a relatively short period. In addition, due to the Farming, the business data at the time of launch will have a significant bias, so we do not assess the valuation of Angle at this stage.

Conclusion

With a well-designed stablecoin mechanism, Angle Protocol integrates the demands of stablecoins, margin trading, and single-coin staking, therefore guaranteeing a win-win situation for all parties:

- Enable the stablecoin users to mint and redeem stablecoins freely with both capital efficiency and security.

- Provide margin traders with a platform for trading without fees and slippage.

- Offer more yields for the single-coin stakers.

On the one hand, the protocol has not been tested by market volatility; on the other hand, even if it is validated, the scalability of the use case will be crucial to the success of stablecoin. As a result, we actually need to keep an eye on Angle’s use case scaling.

Reference

a16z: https://a16z.com/2021/09/28/investing-in-Angle/

Angle Labs: $5m Seed Round for Capital Efficient Stability by Fabric Ventures: https://medium.com/fabric-ventures/Angle-labs-5m-seed-round-for-capital-efficient-stability-3fbefbca68c8

Angle Protocol Stablecoin Series, Part 4: Derivatives-Backed Protocols by Angle: https://blog.Angle.money/Angle-protocol-stablecoin-series-part-4-derivatives-backed-protocols-99060f79c715

FIP Proposal: https://tribe.fei.money/t/potential-proposal-putting-some-fei-in-the-Angle-protocol/3612

FIP Proposal: https://tribe.fei.money/t/potential-proposal-putting-some-fei-in-the-Angle-protocol/3612

Gyroscope is Different, Part 2: Algorithmic Stablecoins by Ariah Klages-Mundt: https://medium.com/gyroscope-protocol/gyroscope-is-different-part-2-algorithmic-stablecoins-78c53c005e89

FIP Proposal: https://tribe.fei.money/t/potential-proposal-putting-some-fei-in-the-Angle-protocol/3612