In this crypto cycle, where innovation has largely stalled, we haven’t seen the emergence of new narratives as transformative as DeFi, NFTs, or GameFi in the previous cycle. Speculation around meme tokens has become the primary trading focus in the market. However, with the mass production of such projects, the accelerated rhythm of liquidity extraction, and the exhaustion of thematic novelty, the meme market has inevitably entered a period of decline. Meanwhile, numerous AI-related projects — once viewed as a potential new narrative — have struggled to find a meaningful product-market fit between crypto and AI. The commercial logic behind these projects remains fragile, making it difficult to attract long-term institutional capital or sustained investment from the industry.

The overall stagnation in the commercialization of Web3 applications and the lack of solid, industry-backed investment narratives have been key reasons why most crypto assets — aside from Bitcoin — have entered a “bear market” ahead of time. The stagnation of application-layer projects has directly contributed to the declining valuations of the public blockchain platforms that host them, leading to a continued drop in the exchange rate of assets like ETH against BTC.

In contrast, Bitcoin has benefited from a multi-dimensional improvement in fundamentals — such as the opening of regulated investment channels, adoption by governments, inclusion on the balance sheets of publicly listed companies and sovereign funds, and a more favorable regulatory environment. After a few months of mid-term correction, BTC has returned near its all-time highs, generating substantial unrealized profits.

Naturally, there remains a strong demand among these profit-taking investors to reallocate funds into altcoins with greater upside potential.

The question is: what should they buy?

RWA may be one of the most promising categories to focus on compared to other crypto sectors.

In my previous article, “Tokenizing U.S. Stocks and STOs: A Hidden Narrative Yet to Unfold,” I outlined the rationale behind this view: from a business logic standpoint, the value proposition of tokenizing U.S. equities and other real-world assets is clear, with both supply and demand sides showing relatively defined needs. Furthermore, improvements in the regulatory landscape — particularly in the U.S. — provide a catalyst for this sector’s growth. Major traditional financial institutions are also eager to explore this space.

With this context, I have recently conducted research on several RWA projects, and among them, Ondo stands out as a key project worth deeper analysis.

In this report, I will analyze Ondo from multiple dimensions, including its current business model, team background, competitive landscape, challenges, and risks. I will also evaluate its current valuation compared to other projects in the same sector.

Note: This report reflects the author’s thinking as of the time of publication. Future developments may lead to changes in perspective. The views expressed are highly subjective and may contain errors in facts, data, or logical reasoning. None of the content should be construed as investment advice. Feedback and discussion from industry peers and readers are welcome.

Contents

1. Current Business Overview

1.1 Product Matrix

Ondo Finance is an institutional-grade platform focused on tokenizing traditional financial assets—commonly referred to as Real-World Assets (RWA)—and bringing them on-chain. Among the RWA projects that have already launched tokens, Ondo stands out as one of the most recognized brands, with the most comprehensive product suite.

Ondo’s offerings span a wide range of verticals, including tokenized funds, yield-bearing stablecoins, lending platforms, tokenized asset issuance protocols, tokenized asset trading platforms, and its own compliance-focused blockchain. In short, it covers the full RWA value chain—from issuance and custody to trading and liquidity.

These offerings can broadly be categorized into Asset Products, Protocol Products, and Infrastructure Products.

Let’s take a closer look at Ondo’s core products:

1.1.1 Asset Products

OUSG (Ondo Short-Term US Government Bond Fund)

OUSG is a token backed by short-term U.S. Treasury securities, issued exclusively to Qualified Purchasers and subject to strict KYC and accreditation requirements. By purchasing OUSG, investors effectively hold a share in a professionally managed portfolio of short-term U.S. government bonds. The token’s intrinsic value increases in line with the net asset value (NAV) of the underlying fund, effectively compounding interest income on a daily basis. The underlying assets of OUSG include not only the BlackRock BUIDL U.S. Treasury fund, but also allocations from other institutional-grade funds such as Franklin Templeton (FOBXX), Wellington, WisdomTree, and Fidelity, which serve as reserve assets.

Revenue Model of OUSG

OUSG charges institutional clients a 0.15% management fee (which is currently waived and scheduled to begin on July 1, 2025) and a 0.15% fund expense fee (which is already being charged). The effective yield to investors is the interest income from the underlying Treasuries minus these fees.

USDY (US Dollar Yield)

USDY is a yield-bearing stablecoin issued to non-U.S. individual and institutional users. It is backed by interest earned from short-term U.S. Treasuries and bank deposits. While USDY has a base price of $1, interest is accrued daily and reflected in the token’s value, allowing holders to automatically earn yield without the need for staking or locking assets. The yield is typically calculated based on the risk-free rate (SOFR) minus a 0.5% fee.

Revenue Model of USDY

Each month, Ondo sets an annualized yield rate for USDY (e.g., 4.25% for a given month), distributing the majority of the base yield to token holders while retaining approximately 0.5 percentage points as a management fee. Both OUSG and USDY can be converted into rebasing versions—rOUSG and rUSDY. These tokens maintain a stable unit value, while the token balance increases as yield accrues. The design is similar to Lido’s stETH, where yield is reflected through rebalancing token quantity rather than token price.

Differentiation Between OUSG and USDY

Though similar in definition——both investing in high-quality, short-duration U.S. Treasury-like instruments—OUSG and USDY differ in several critical aspects:

- Asset Composition: OUSG invests indirectly in Treasuries through multiple regulated government bond funds (e.g., BlackRock’s BUIDL, WisdomTree’s WTGXX), offering a diversified and fully government-backed portfolio. USDY, by contrast, adopts a direct holding strategy, with most of its backing consisting of bank deposits and short-term Treasuries, and does not invest in any fund products. USDY has a significantly higher allocation to bank demand deposits.

- Yield and Risk Profile: Both offer yields closely aligned with risk-free rates (typically 4–5% APY), but with subtle differences. USDY provides more stable returns due to its bank deposit component, with NAV less sensitive to interest rate fluctuations. It includes a 3% over-collateralization buffer for added protection. However, USDY carries a small degree of bank credit risk (which is actively mitigated), whereas OUSG is almost entirely backed by U.S. government credit, making it purer in credit quality. In essence, USDY trades minimal bank risk for enhanced yield stability and risk separation, while OUSG is more directly exposed to Treasury rate movements.

- Liquidity and Redemption: OUSG is available only to Qualified Purchasers and offers instant subscription and redemption, with on-chain settlement. However, its secondary market transfer is restricted and limited to whitelisted KYC-approved institutional wallets. USDY, after an initial 40-day lock-up period, becomes a freely tradable yield-bearing stablecoin, increasing its liquidity and accessibility. Still, this lock-up period results in lower initial liquidity compared to OUSG. For redemptions, OUSG can be directly converted back into USDC, while USDY redemptions typically require an off-ramp to fiat and a minimum redemption amount, making secondary market trading the preferred exit path.

- Denomination: OUSG has a base face value of $100, whereas USDY is denominated in $1 units.

In simple terms: USDY is designed for open circulation and retail-oriented use, positioned as a stablecoin; while OUSG is optimized for instant liquidity in a Permissioned environment, targeted toward institutional use, and positioned more as a tokenized fund share.

1.1.2 Protocol Products

Flux Lending Platform

Flux Finance is a decentralized lending protocol built on the Compound V2-style asset pool model. It allows users to supply high-quality RWA assets (currently limited to OUSG) as collateral to borrow stablecoins, as well as lend out idle stablecoins to earn interest. Currently, Flux supports the deposit and borrowing of stablecoins such as USDC, DAI, USDT, and FRAX. To ensure compliance, Flux enforces permission controls on restricted assets like OUSG—only whitelisted addresses can use them as collateral. The protocol is governed by the Ondo DAO, meaning ONDO token holders control parameters and asset listings through governance proposals. Flux enables OUSG holders to unlock on-chain liquidity by collateralizing their holdings.

When OUSG is the only available collateral type, Flux doesn’t stand out, and its lending and borrowing volume—just tens of millions of dollars—isn’t particularly large. As more RWA assets are tokenized and brought on-chain, Flux is positioned to become a core component of the Ondo ecosystem, providing lending liquidity for a broad range of tokenized real-world assets.

Ondo Global Markets (GM)

At the inaugural Ondo Summit held in New York in February 2025, Ondo officially unveiled the design of its Global Markets (GM) platform. This platform represents Ondo’s strategic initiative to tokenize traditional financial assets, aiming to bring thousands of publicly traded securities—including stocks, bonds, and ETFs—onto the blockchain. Ondo has positioned the vision behind this product as “Wall Street 2.0.” Ondo GM is expected to be available to non-U.S. investors. All GM-issued tokens will be fully backed 1:1 by real-world securities and will be freely transferable like stablecoins, with the potential for use in DeFi applications. However, to ensure compliance, the issuance and redemption of these tokens will be subject to embedded permission controls. Ondo identifies several issues with the current traditional investment environment—such as high fees, limited access channels, and fragmented liquidity—and aims to solve these through blockchain technology by enabling lower costs, 24/7/365 trading, and instant settlement. For example, investors would be able to purchase tokenized versions of Apple, Tesla, or S&P 500 ETFs as easily as they acquire stablecoins, and trade them freely outside the U.S. or use them in on-chain financial services. The platform will also allow token holders to opt into securities lending programs to earn additional yield on their holdings.

However, as of now, Ondo Global Markets has not yet officially launched. The business webpage only vaguely states that the platform is “expected to launch later this year.” The product is likely still undergoing development on multiple fronts, including product design and regulatory compliance. A key prerequisite for the platform’s successful deployment will be clear regulatory guidance and enabling legislation from U.S. regulators regarding asset tokenization. Notably, Ondo Global Markets will operate on Ondo Chain, which will be detailed in a later section.

Nexus Asset Issuance Protocol

Ondo Nexus, launched in February 2025, is a new technical solution designed to provide instant liquidity for tokenized U.S. Treasuries issued by third parties. In simple terms, Nexus leverages the instant mint/redeem capabilities of OUSG to serve as a shared liquidity layer across different issuers. Ondo has expanded the list of eligible collateral for OUSG to include tokenized Treasury products issued by firms such as Franklin Templeton, WisdomTree, and Wellington. These yield-bearing instruments (e.g., Franklin’s FOBXX fund tokens) can now be accepted by Ondo and converted into OUSG, creating a bridge between various third-party Treasury tokens and stablecoins. Through Nexus, an investor holding a third-party tokenized Treasury can sell it to Ondo 24/7 in exchange for USDC or other stablecoins. Ondo, in turn, absorbs the token into its reserve pool and mints an equivalent amount of OUSG backed by it. This mechanism introduces instant redemption to an asset class traditionally limited by weekday-only redemption windows, effectively bringing real-time liquidity to tokenized fixed-income markets. Nexus also reinforces Ondo’s strategic partnerships with major asset managers like BlackRock and Franklin Templeton, cementing its position as a core liquidity coordinator in the tokenized Treasury ecosystem.

1.1.3 Infrastructure Products

Ondo Chain: A Compliance-Focused Permissioned Layer 1

In February 2025, Ondo announced the launch of its own semi-permissioned blockchain, Ondo Chain, specifically designed for institutional-grade issuance and trading of Real-World Assets (RWAs). Ondo Chain adopts a Proof-of-Stake (PoS) consensus mechanism, but unlike most blockchains, the staking assets are not limited to crypto—highly liquid real-world assets can also be staked. This is intended to reduce the impact of crypto market volatility on network security. Validator nodes will be operated by licensed, reputable financial institutions. Prospective validator participants include major traditional players such as Franklin Templeton, Wellington, WisdomTree, Google Cloud, ABN AMRO, Aon, and McKinsey, among others.

Ondo Chain aims to combine the transparency of public blockchains with the compliance and security of permissioned networks. The chain will allow open access and development on-chain, while the validator layer remains permissioned to mitigate MEV attacks and meet regulatory standards. It will also offer native support for critical financial operations, such as dividend distribution and stock splits, and provide on-chain Proof of Reserves, audited regularly by validators to ensure every token is fully backed by real-world assets. Additionally, Ondo Chain will feature a native cross-chain bridge powered by a decentralized validation network. The network is described as “open,” meaning anyone can issue tokens, build applications, or interact as users or investors. However, user identification and permissioning will be a core feature—allowing asset issuers and app developers to enforce access controls and transfer restrictions at the smart contract level. In essence, while access to the network is open, developers can define who can interact with their protocols and assets.

The chain aspires to serve as the foundational infrastructure for the future vision of “Wall Street 2.0”, enabling institutional functions like prime brokerage, cross-margin lending, and other advanced financial operations to occur seamlessly on-chain. Ondo Chain is expected to enter testnet in 2025, and it is reportedly working with PayPal, Morgan Stanley, BlackRock, and others to finalize network design.

Ondo Finance has thus built a comprehensive ecosystem covering asset issuance, liquidity provisioning, and infrastructure. Its product suite spans underlying real-world assets (Treasuries, bank deposits, public securities), on-chain protocols (lending, bridging), and dedicated infrastructure (its own chain), with each layer reinforcing the others.

1.2 Business Data

Although Ondo Finance has a broad and ambitious product roadmap, the number of products that are actually live remains relatively limited. Currently, the operational asset products include OUSG and USDY, while in the protocol category, only the lending product Flux is live.

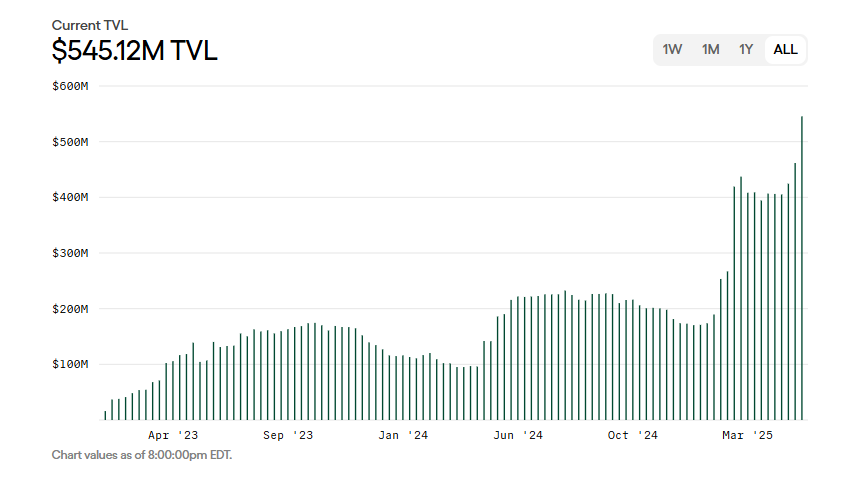

OUSG Business Metrics

Currently, OUSG has a total asset scale of $545 million. Since its launch in 2023, it has experienced three distinct phases of rapid growth. The most significant surge occurred from February 2024 to the present, during which assets under management grew from under $200 million to over $500 million.

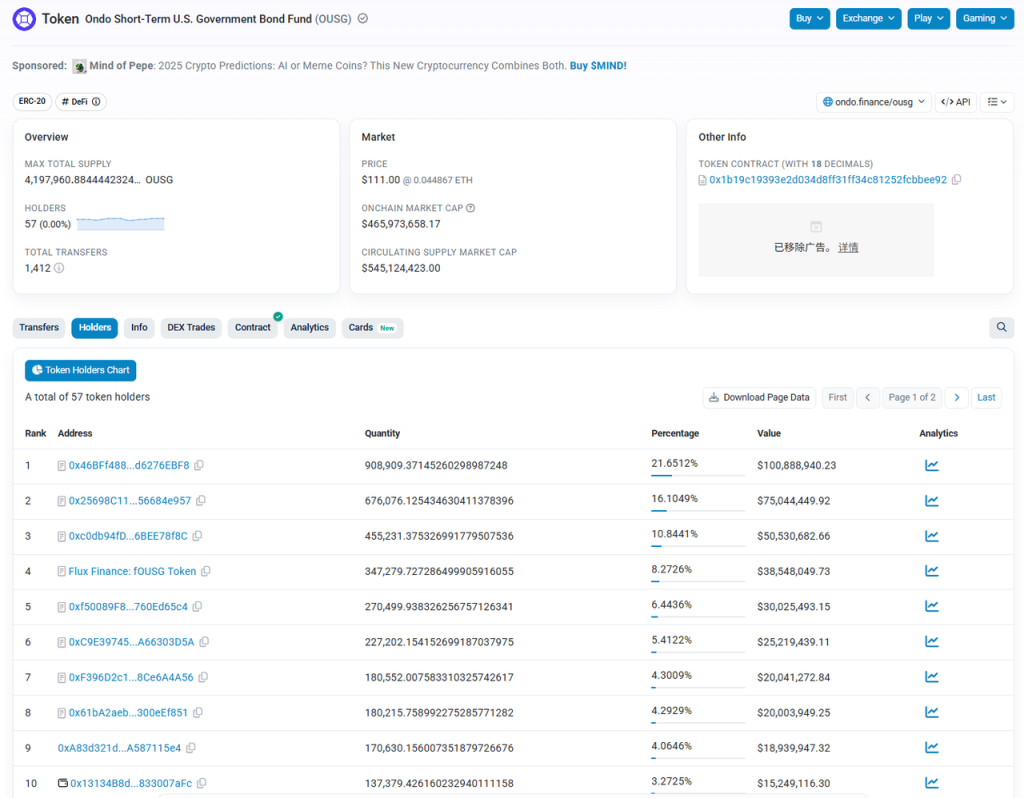

OUSG is available on three blockchains: Ethereum, Polygon, and Solana. However, the vast majority of issuance takes place on Ethereum, with only a negligible amount on the other two chains.

Looking at Ethereum wallet data, OUSG is held by just 57 addresses, and the top 10 addresses account for over 90% of the total token supply. This highly concentrated distribution aligns with OUSG’s positioning as a product exclusively available to compliant institutional investors.

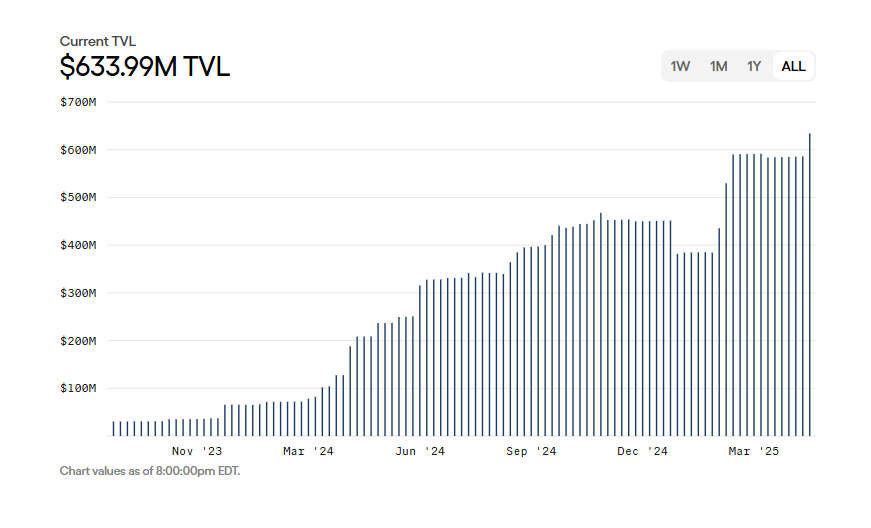

USDY Business Metrics

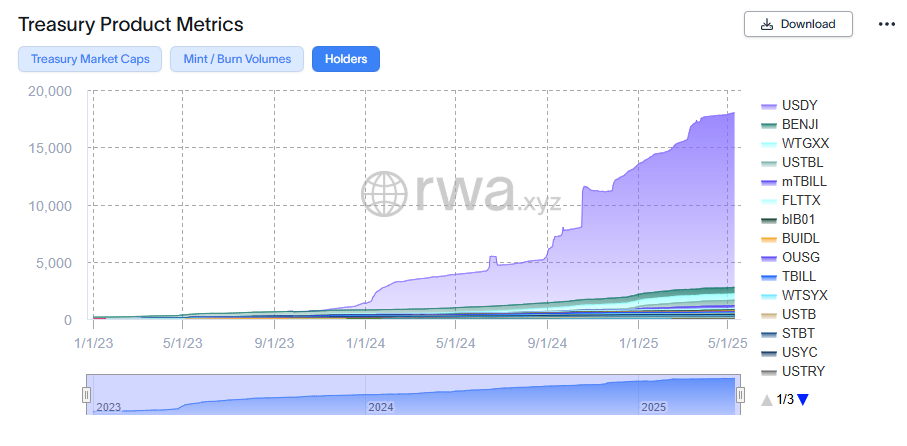

The current total asset scale of USDY is $634 million, and it is supported across eight blockchains, including Ethereum, Mantle, Solana, Sui, Aptos, Noble, Arbitrum, and Plume.

Ethereum remains the primary network for USDY issuance, with over half of the supply issued there, representing a market capitalization of approximately $330 million. Despite the large market cap, the number of holding addresses is relatively low, at just 316. Solana follows closely, with a market cap of around $177 million and a much higher holder count of 6,329 addresses, indicating stronger adoption among retail users.

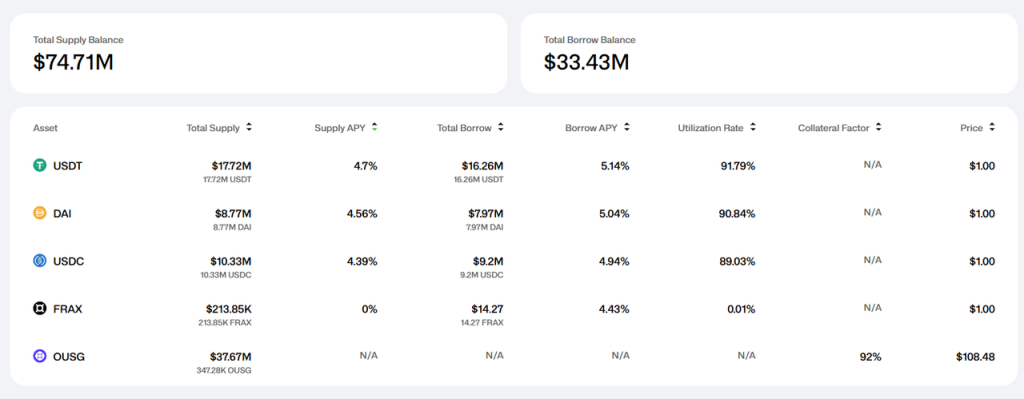

Flux Business Metrics

Currently, Flux only supports OUSG as a collateral asset, which limits its business scale. The total deposits on the platform amount to $74 million, while the total borrowed funds stand at $33.43 million. Flux’s future growth will depend on whether the Ondo ecosystem can onboard more tokenized RWAs.

1.3 Team Background

As an industry that combines strict regulatory compliance, DeFi, and traditional finance, whether a project team possesses extensive business connections with traditional financial institutions, has established smooth communication channels with government regulators, and holds deep expertise in financial compliance are important factors for assessing the project’s potential for successful future development.

Professional Backgrounds of Key Team Members

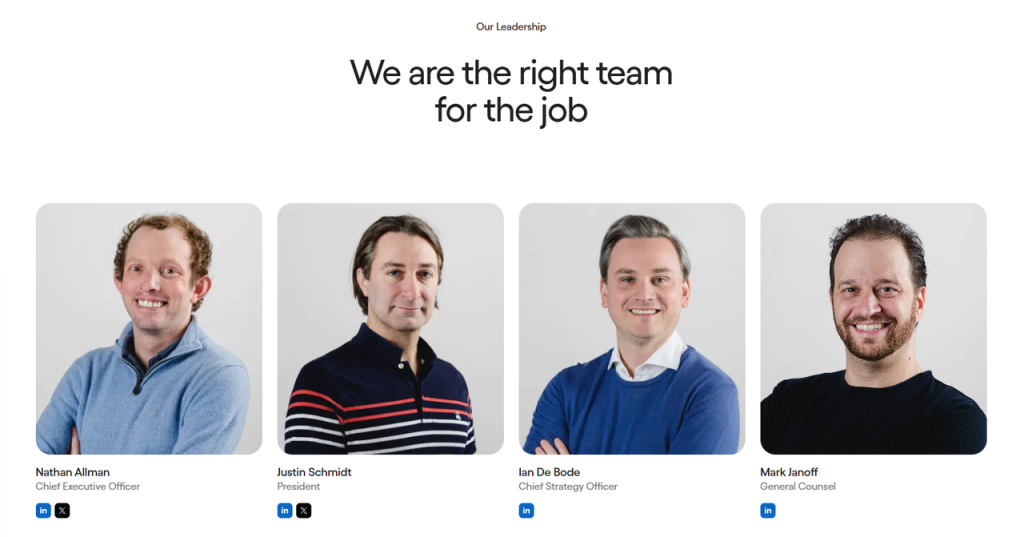

The founding and executive team of Ondo Finance mainly come from large Wall Street financial institutions and well-known consulting firms, with several members previously working in Goldman Sachs’ digital assets division. All core team members are fully named.

Among them, co-founder Nathan Allman previously worked in Goldman Sachs’ digital assets division. President and COO Justin Schmidt was formerly head of Goldman Sachs’ digital asset markets division and one of the founding members of Goldman Sachs’ digital asset team. Chief Strategy Officer Ian De Bode was a partner at McKinsey & Company before joining Ondo, specializing in digital asset consulting with nearly ten years of strategic advisory experience for financial institution executives. Chief Legal Officer Mark Janoff holds a law degree from Stanford Law School and has worked on legal matters for tech companies. The core team’s impressive resumes align well with the development needs of Ondo’s industry sector.

Government Relations: Active Participation in Policy Making and Industry/Public Initiatives

In April 2025, the Ondo team, together with its legal advisors, met with the U.S. SEC’s Crypto Asset Working Group and submitted a proposal on compliance frameworks for tokenized securities. According to meeting minutes, Ondo presented a plan to issue and sell on-chain tokenized U.S. securities under existing financial laws. Discussions covered key topics including tokenized securities structural models, registration and broker-dealer regulatory requirements, market structure regulations, anti-financial crime compliance, and state corporate law. Ondo even proposed that regulators consider “regulatory sandboxes” or temporary exemptions to allow enterprises space for innovation before formal regulations are implemented, balancing investor protection with innovation.

Ondo Finance’s interactions with government officials and regulators extend beyond private meetings to public events. In February 2025, Ondo hosted the inaugural Ondo Summit in New York, inviting many key figures from traditional finance and blockchain sectors. Notably, speakers included current and former officials from the U.S. Congress and regulatory bodies: Patrick McHenry, former Chair of the House Financial Services Committee, delivered a speech on the future regulation of digital assets; Caroline Pham, Commissioner and Acting Chair of the Commodity Futures Trading Commission (CFTC), participated in a fireside chat sharing recent regulatory developments. During discussions, McHenry urged the crypto industry to actively engage with Washington policymakers and emphasized the lengthy and complex legislative process. Caroline Pham highlighted recent federal policy enforcement progress.

Further, in early 2025, Ondo announced that Patrick McHenry would join the company as Vice Chair of Ondo Finance’s Advisory Board. McHenry, a longtime congressman involved in shaping financial regulation policies, is regarded as a key move for Ondo to strengthen its government relations.

Relationship with the Trump Family

In early February 2025, at the Ondo Summit held in New York, Donald Trump Jr., the eldest son of the U.S. president, made a surprise appearance and delivered a speech. Subsequently, Ondo Finance officially announced in February 2025 a strategic partnership with the crypto platform World Liberty Financial (WLFI), which is supported by the Trump family. The partnership aims to jointly promote the adoption of RWA (Real-World Assets) by bringing traditional financial assets onto the blockchain. According to the announcement, WLFI plans to integrate tokenized assets provided by Ondo (OUSG, USDY) into its network as reserve assets. Following this, an Ethereum address labeled as belonging to WLFI exchanged $470,000 worth of USDC for approximately 342,000 ONDO tokens. This address had first purchased $245,000 worth of ONDO two months earlier and deposited the tokens into Coinbase Prime custody.

Of course, many crypto projects have reached verbal cooperation agreements and received token purchases from WLFI addresses. Such collaborations and purchases tend to have a strong promotional nature and are more like commercial partnerships.

1.4 Business Summary

Based on the above information, the author summarizes Ondo’s business situation as follows:

- From asset issuance to trading, Ondo has a comprehensive product matrix centered around RWA, with a very high commercial potential.

- The core team has strong backgrounds, with solid connections in traditional financial institutions and government relations, enabling effective communication with regulators.

- Core products (Global Markets and Ondo Chain) have yet to launch and are awaiting regulatory approval, so current business development is still at an early, preparatory stage.

Overall, in the still largely untapped crypto blue ocean of RWA, Ondo is among the best-prepared crypto enterprises, well endowed with resources, awaiting the regulatory green light to move forward.

2. Competitive Landscape

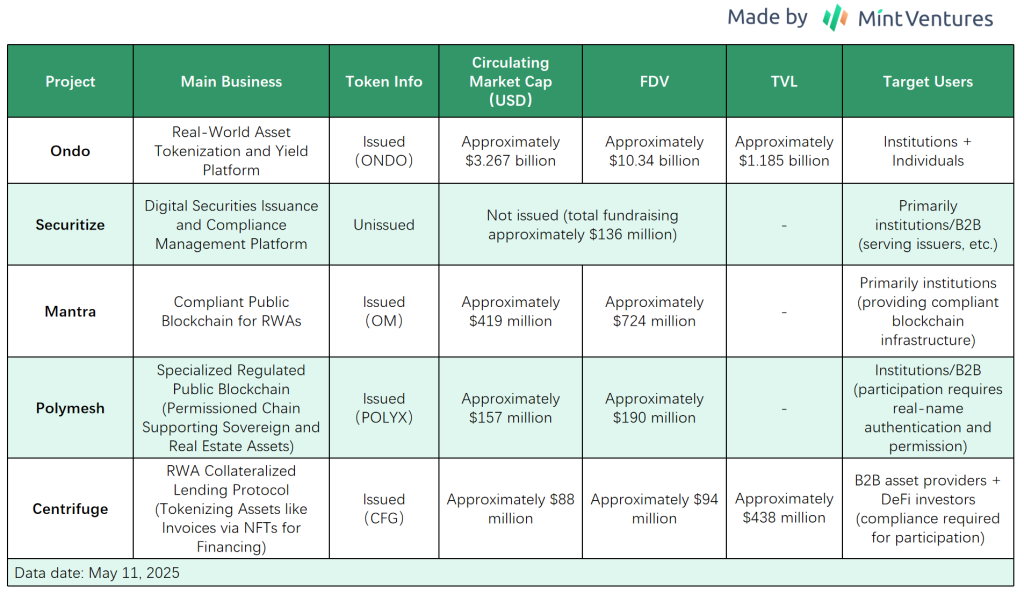

With the rising popularity of the RWA concept, Ondo faces competition at multiple business levels from various projects, including Securitize (no token issued), Centrifuge, and Polymesh (launched on Binance), among others.

Below is a comparison of Ondo and several competitors regarding market share, product differentiation, regulatory progress, and ecosystem partnerships:

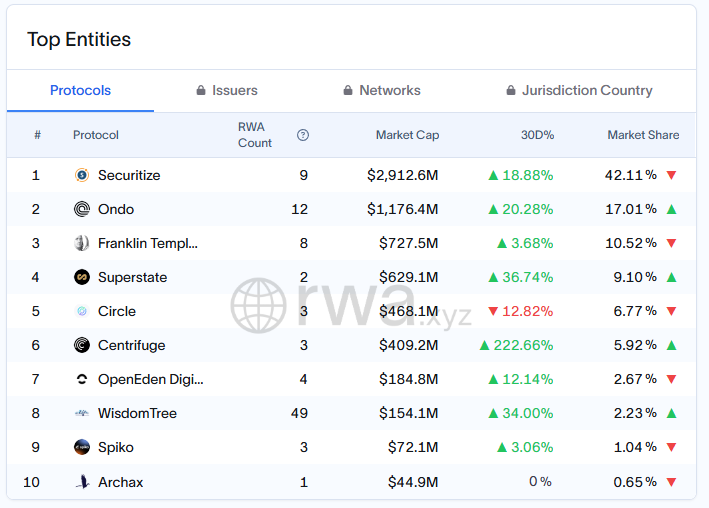

2.1 Market Position and Scale

According to data from the RWA data platform RWA.xyz, as of May 2025, Ondo ranks second in the U.S. Treasury-backed RWA market by locked assets, with a market share of approximately 17.01% and locked assets totaling about $1.17 billion. The top position is held by the Securitize platform, supported by BlackRock, with locked assets of around $2.912 billion and a market share of 42.11%. The third place is held by Franklin Templeton’s Benji platform, with $727 million locked and a 10.52% market share.

In the submarket of treasury yield tokens, Securitize and Ondo remain the leaders. Securitize has a larger asset scale, while Ondo’s growth rate is relatively fast, with a 20.3% increase in the past 30 days. Centrifuge focuses on private credit RWAs such as small and medium enterprise loans, with locked assets of about $409 million and a 5.96% market share, and it has seen a remarkable 222.66% business growth in just one month.

Data source: https://app.rwa.xyz/treasuries

Notably, Ondo leads significantly in terms of the number of holders——its U.S. treasury token holders account for over 90% of the entire market (because USDY is open to non-U.S. retail investors, resulting in a broad user base). In contrast, platforms like Securitize tend to serve institutional investors, with holders mainly consisting of a few large clients.

2.2 Product Positioning and Mechanism Differences

Ondo focuses on highly liquid, stable-yield USD assets (such as short-term Treasuries and money market funds) and strives to integrate them into DeFi applications. Its USDY is positioned as a “yield-bearing stablecoin” usable for payments and collateral. In contrast, Securitize, as a digital securities issuance platform, has a broader service scope including tokenization of private equity and fund shares. Regarding US Treasury yield products, Securitize collaborates with BlackRock to issue the BUIDL fund token (custodied by Coinbase), primarily targeting institutional and high-net-worth clients. Both BUIDL and Ondo’s OUSG are accumulation-yield fund tokens, but their liquidity mechanisms differ: BUIDL redemptions and subscriptions are generally limited to specific hours on US business days, whereas Ondo’s OUSG offers 24/7 instant minting and redemption. In terms of DeFi integration, Ondo clearly leads—USDY and OUSG are available in over 80 multi-chain applications and support on-chain collateralized lending (via Flux). Securitize, by contrast, focuses on trading via its own licensed ATS system and has yet to deeply integrate into public DeFi protocols, though its assets serve as key underlying yield sources for many projects, including Ondo and Ethena.

Centrifuge’s product is fundamentally different: its core is the Tinlake loan pool, which packages real-world assets like invoice factoring and mortgage loans into coupon-bearing securities sold to investors who accept higher risk for higher returns (typically annualized 5–10%+). These assets have longer durations and poorer liquidity, relying on large institutions such as MakerDAO for exit liquidity. Since 2021, MakerDAO has accepted senior debt tokens from Tinlake pools as RWA collateral, enabling asset holders to lock debt into Maker Vaults and borrow DAI at agreed rates. Accordingly, Centrifuge’s governance token CFG is primarily used for on-chain staking and security rather than retail payments, representing a more niche RWA segment.

Polymesh positions itself as a dedicated securities blockchain with built-in identity verification and permission controls, facilitating compliant issuance of various tokens (stocks, bonds, fund shares) by institutions. Polymesh evolved from the original Polymath project; its POLYX token is used for on-chain fees and governance. However, actual asset issuance on Polymesh remains limited and much smaller in scale compared to RWA activity on major chains like Ethereum. Interestingly, some heavyweight traditional institutions (such as WisdomTree) have chosen to partner with Ondo (issuing assets through Nexus and acting as design advisors for Ondo Chain) rather than build their own chains, suggesting Ondo has better prospects for real-world business deployment.

2.3 Compliance and Regulatory Progress

Different platforms adopt different compliance strategies.

Ondo collaborates with regulated financial entities and follows a “registration exemption + offshore issuance” model. Registration exemption means securities issued by institutions meet specific exemption clauses (e.g., not open to the general US public), avoiding SEC public registration to reduce compliance costs and improve issuance efficiency. OUSG is a private security available only to accredited investors in the US, while USDY is issued offshore targeting overseas investors. Ondo’s compliance team has strong backgrounds, with its chief compliance officer and several executives coming from Wall Street firms like Goldman Sachs, well-versed in regulatory frameworks.

Securitize holds multiple US financial licenses, including Broker-Dealer and SEC-registered transfer agent, granting it direct compliance authority in digital securities issuance. This allows it to legally serve large asset management plans, such as tokenized KKR fund shares. Securitize also collaborates with major banks to explore blockchain applications. By contrast, Ondo does not yet hold SEC licenses itself but operates legally through partnerships (e.g., with Clear Street broker and Coinbase custody). Globally, Ondo exploits regulatory arbitrage by not offering USDY to US persons, while Polymesh builds compliance into its protocol by requiring identity-linked addresses. Centrifuge uses offshore special purpose vehicles (SPVs) to hold underlying assets and provides legal opinions to ensure tokenized debt does not violate securities laws.

Regulatory policy risk is a shared challenge for all RWA platforms. Should the US classify such tokens as public securities in the future, both Ondo and Securitize would need to obtain broader licenses or adjust issuance methods.

Currently, Ondo maintains good communication with regulators, has established regulated US subsidiaries (like Ondo I LP), and operates under existing rules. Products such as USDY emphasize daily transparency reports from independent third parties, which helps mitigate enforcement risks. In contrast, some decentralized RWA projects that issue tokens to US users without registration are more likely to face regulatory crackdowns.

2.4 Ondo’s Competitive Edge in the Current Phase

Ondo’s current lead stems from its broad support within the traditional financial ecosystem, providing strong brand recognition. Through various product collaborations and PR efforts, Ondo has “cleverly” secured indirect endorsements from financial giants like BlackRock, Morgan Stanley, and Fidelity. For example, BlackRock’s issued BUIDL is one of the underlying assets of OUSG; although there is no direct partnership, aggressive marketing led the market to associate Ondo heavily with BlackRock. Top asset managers like Franklin Templeton and Wellington have directly participated in the Ondo Nexus program, contributing their Treasury products as part of Ondo’s ecosystem. Payment giants PayPal and card network Mastercard have also cooperated with Ondo—PayPal’s PYUSD stablecoin is used for OUSG redemptions, and Mastercard invited Ondo to join its Multi-Token Network (MTN) pilot to connect bank payment rails with on-chain settlement.

While the depth of these large-institution partnerships may vary, compared to other RWA projects, these collaborations have significantly boosted Ondo’s brand and provide demonstration cases for future business expansion.

Overall, Ondo connects “both ends”: upstream to traditional asset management giants for asset sourcing and brand prestige, and downstream to crypto markets for users and liquidity, aiming to open the market faster than competitors.

3. Key Challenges and Risks

Despite Ondo’s impressive progress, its business still faces several challenges and risks:

3.1 Intensifying Competition

Ondo’s current advantages are mostly relative to other Web3 projects. Compared to projects backed by major institutional platforms—such as Securitize, which is invested in by BlackRock—Ondo’s strengths appear less pronounced. As regulatory frameworks remain unclear, many large financial institutions have yet to fully enter the space. Since traditional finance (TradFi) giants still dominate the origination of real-world assets (RWAs), they have strong incentives to build their own ecosystems to capture value, rather than handing it over to emerging Web3 projects like Ondo.

3.2 Product Delivery and Execution Capabilities

Ondo’s core infrastructure products—such as Global Markets and Ondo Chain—have not yet been fully launched. The current offerings are primarily asset-based, and its lending protocol is a fork of Compound V2, which is relatively simple. Whether Ondo can withstand real-world pressures in terms of product innovation, operational scalability, and regulatory compliance remains uncertain.

3.3 Regulatory Uncertainty

Although the current U.S. administration is considered the most crypto-friendly in history, no formal crypto regulatory framework has yet been passed into law. For instance, the recent rejection of the GENIUS Act (a stablecoin bill) highlights this legislative uncertainty. With midterm elections coming in 2026, it remains unclear whether the Republican majority in both chambers can be maintained. If tokenization-related regulations cannot be passed before the midterms, future progress may become even more difficult, increasing overall uncertainty.

3.4 Token-Related Risks

- The current circulating supply of ONDO tokens is only about 34%, with a projected inflation rate of up to 64% over the next year—indicating significant potential sell pressure.

- The token’s value capture remains unclear. ONDO currently offers governance rights, but lacks a defined mechanism for fee sharing, buybacks, or token burns.

4. Valuation Reference

ONDO has a total supply of 10 billion tokens, with approximately 3.16 billion currently in circulation, representing around 31.6% of the total.

As of May 11, 2025, based on the current token price, Ondo’s circulating market capitalization is approximately $3.27 billion, with a fully diluted valuation (FDV) of around $10.3 billion.

Among similar RWA-related tokens, ONDO significantly outpaces other projects in both circulating market cap and FDV.

From a relative valuation perspective, the market cap ratio of ONDO to CFG is about 40x, while the TVL ratio of Ondo to CFG is approximately 2.7x. This indicates that ONDO’s price has already fully priced in optimistic expectations for future expansion, largely overestimating the potential upside and making this valuation quite vulnerable to various risk factors.

From a fundamental analysis standpoint, the current valuation of the ONDO token is still obviously very high.

Looking at Ondo’s current static situation: with a market cap of $3.27 billion, assuming the platform’s annual revenue mainly comes from management fees and spreads on USDY and OUSG (estimated with asset scale of $1 billion, average yield 5%, fee ratio 0.3-0.5%), annual revenue would be around $3-5 million, plus miscellaneous income from Flux and others, totaling less than $10 million annually.

Based on this, the static price-to-earnings ratio (P/E) calculated from circulating market cap exceeds 300x, and the fully diluted valuation (FDV) is over a thousand times earnings, making it extremely expensive by traditional valuation standards — especially considering ONDO tokens currently have no clear value capture mechanism.

The high valuation of ONDO tokens reflects the market’s very optimistic growth premium for Ondo over the coming years: if Ondo can expand to $10B+ TVL within 2-3 years (as per the official “Next Stop: $10B” goal) and successfully extend its business into equities and other fields, the revenue scale could increase by an order of magnitude, which would help absorb the current valuation.

Ondo’s elevated valuation also comes from its grand narrative as “Wall Street 2.0 on-chain.” If the Ondo Chain develops smoothly, Ondo could enjoy valuation levels similar to those of public blockchains — making a multi-billion dollar market cap and $10B+ FDV seem less exaggerated.

Of course, considering the many issues raised in the “Challenges and Risks” section, reaching this stage requires significant effort, luck, and a favorable market environment, with considerable uncertainty involved.

Key events to watch going forward

The following events and data will directly impact the project’s outlook and token price, thus requiring close attention:

- Project-specific progress:

- Deployment and launch of Ondo Chain mainnet and testnet

- Testing and launch of Ondo Global Markets

- Introduction and issuance of more new categories of RWA assets

- Ability to onboard more institutional partners and deepen existing relatively shallow collaborations with large financial institutions

- Continued growth of asset scale

- External environment changes:

- Legislative progress on U.S. asset tokenization laws

- SEC’s regulatory stance on asset tokenization, particularly clarity on “sandbox-style regulation” that would allow exploratory business operations prior to formal legislation

- Whether traditional TradFi giants will enter the market directly with self-built products and platforms, and whether this blue ocean market rapidly turns red