Contents

Introduction

Ethena stands out as a rare phenomenon in the current cycle of DeFi projects, with its token once achieving a circulating market capitalization exceeding 2 billion (corresponding to an FDV surpassing 23 billion.) However, since April of this year, the token’s price has experienced a swift decline, with Ethena’s circulating market cap retreating over 80% from its peak and the token price plummeting as much as 87%.

Since September, Ethena has accelerated its collaborations with various projects, expanding the use cases for its stablecoin, USDE. The stablecoin’s scale has also started to recover from its low point, with its circulating market cap rebounding from a September low of approximately 400 million to around 1 billion currently.

In my article published in early July, titled “As Altcoins Keep Falling, It’s Time to Reassess DeFi,” I discussed Ethena, expressing the view that:

“…Ethena’s business model—a public fund focused on perpetual contract arbitrage—still exhibits notable limitations. The substantial expansion of its stablecoin (which had reached a scale of $3.6 billion at the time) heavily relies on secondary market participants being willing to purchase its ENA tokens at inflated prices, thereby providing generous yield subsidies for USDE. This somewhat Ponzi-like structure is susceptible to negative spirals in both business performance and token price during periods of poor market sentiment. The pivotal moment for Ethena’s business transformation hinges upon whether USDE can, at some point, evolve into a stablecoin with a significant number of ‘natural holders,’ thereby completing the shift from a public arbitrage fund to a stablecoin operator.”

Subsequently, the price of ENA fell further by 60%, and even though it has recently rebounded by nearly 100% from its low, it still remains over 30% below the previous price at that time.

I am reassessing Ethena at this juncture and will focus on the following three key questions:

1. Current business performance: The essential operational metrics of Ethena, including scale, revenue, overall costs, and real profit levels.

2. Future business outlook: The promising narratives and potential developments for Ethena.

3. Valuation level: Is the current price of ENA situated in an undervalued strike zone?

The following represents my current-stage reflections up until the time of publication, which may evolve in the future. The views presented here are highly subjective and may contain factual errors, data inaccuracies, or flawed reasoning. I welcome critique and further discussion from peers and readers. This article does not constitute any investment advice.

The main content follows below.

Business Performance: Ethena’s Current Core Business Situation

Ethena’s Business Model

Ethena positions itself as a synthetic dollar project with “native yields.” In essence, it operates within the same realm as MakerDAO (now SKY), Frax, crvUSD (Curve’s stablecoin), and GHO (Aave’s stablecoin) —— the stablecoin sector.

In my view, the business models of current stablecoin projects in the crypto sphere tend to be quite similar:

1. Raising funds by issuing debt (stablecoins), thereby expanding the project’s balance sheet.

2. Utilizing the raised funds for financial operations to secure financial returns.

When the yields generated from the operational funds surpass the total costs associated with fundraising and project management, the project becomes profitable.

Taking Tether, the centralized stablecoin issuer of USDT, as an example: Tether raises dollars from users, issues a debt certificate (USDT) in return, and invests the gathered funds in treasury bonds, commercial papers, and other interest-bearing assets to gain financial returns. Given the widespread utility of USDT, which users perceive to hold equivalent value to the dollar, yet affords capabilities that traditional dollars do not (such as instant cross-border transactions), users are inclined to provide their dollars to Tether in exchange for USDT without compensation. Additionally, redeeming USDT from Tether often incurs a redemption fee.

As a later entrant in the stablecoin market, Ethena clearly faces disadvantages in network effects and brand trust compared to established projects like USDT and DAI. This disadvantage manifests in higher fundraising costs, as users are only willing to exchange their assets for USDE if they anticipate significantly high returns. To raise capital, Ethena incentivizes users by offering its native token, ENA, and yield from the stablecoin (derived from the project’s financial revenue).

Core Business Metrics of Ethena

USDE Issuance Scale and Distribution

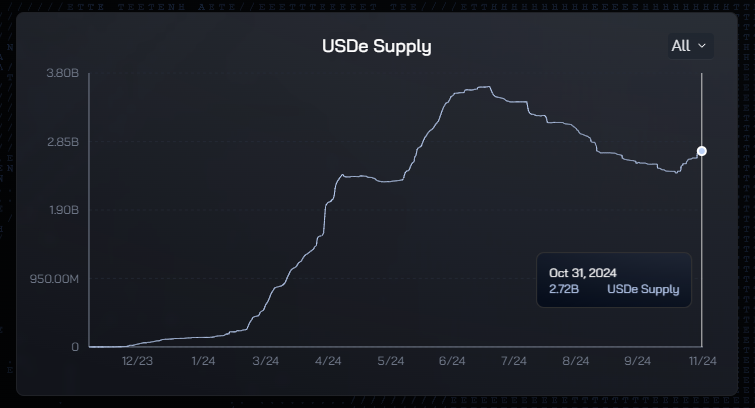

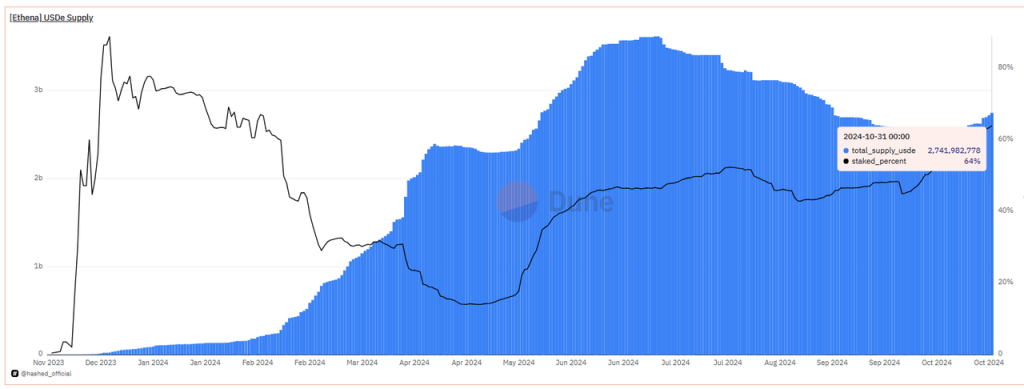

Following a peak issuance of USDE at 3.61 billion in early July 2024, the scale has steadily declined to 2.41 billion by mid-October, before gradually recovering to approximately 2.72 billion as of October 31.

Of this 2.72 billion, 64% of USDE is currently staked, with a corresponding APY of 13% (according to official data).

It is evident that the primary motive for most users holding USDE is to generate investment income, with a 13% APY representing the “risk-free return” of USDE, as well as the financial cost Ethena incurs to attract user funds.

During the same period, the yield on short-term U.S. Treasury bonds was 4.25% (as of October 24), while the deposit rates for USDT on the largest DeFi lending platform, Aave, stood at 3.9%, and USDC at 4.64%.

Thus, it is clear that Ethena continues to maintain a relatively high cost of capital in order to expand its fundraising base.

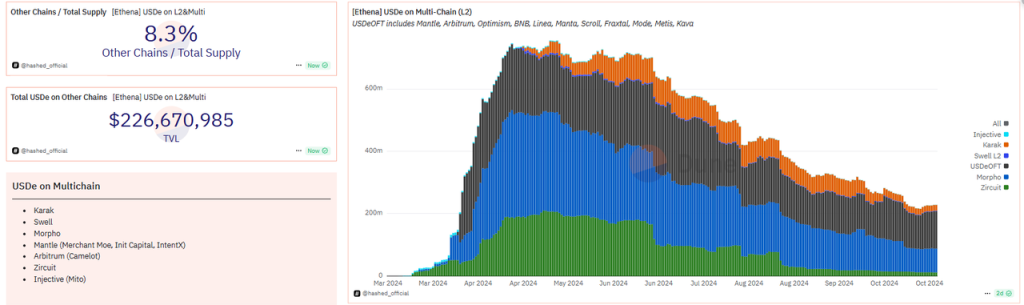

USDE is not only issued on the Ethereum mainnet but is also being extended across multiple L2 and L1 networks. Currently, the issuance of USDE on other chains amounts to 226 million, accounting for approximately 8.3% of the total supply.

Additionally, Bybit, as an investor and key collaborative platform for Ethena, not only supports the use of USDE as collateral for derivatives trading but also offers a yield of up to 20% on USDE deposited with Bybit (which has since been adjusted to a maximum of 10% in September). Consequently, Bybit stands as one of the largest custodians of USDE, currently holding 263 million, down from a peak exceeding 400 million.

Data Source:https://dune.com/hashed_official/ethena

Protocol Revenue and Distribution of Underlying Assets

Ethena’s current sources of protocol revenue are threefold:

1. Returns generated from staked ETH among the underlying assets;

2. Funding rates and basis income derived from derivatives hedging and arbitrage;

3. Investment income: holdings in stablecoins to earn interest or incentive subsidies, such as rewards from Coinbase’s loyalty program, which offers cash incentives for USDC at an annualized rate of approximately 4.5%; as well as holdings in sUSDS (formerly sDAI) on Spark.

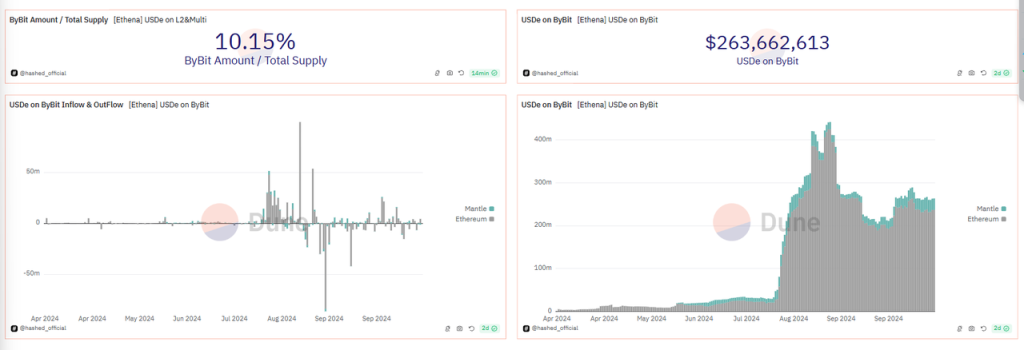

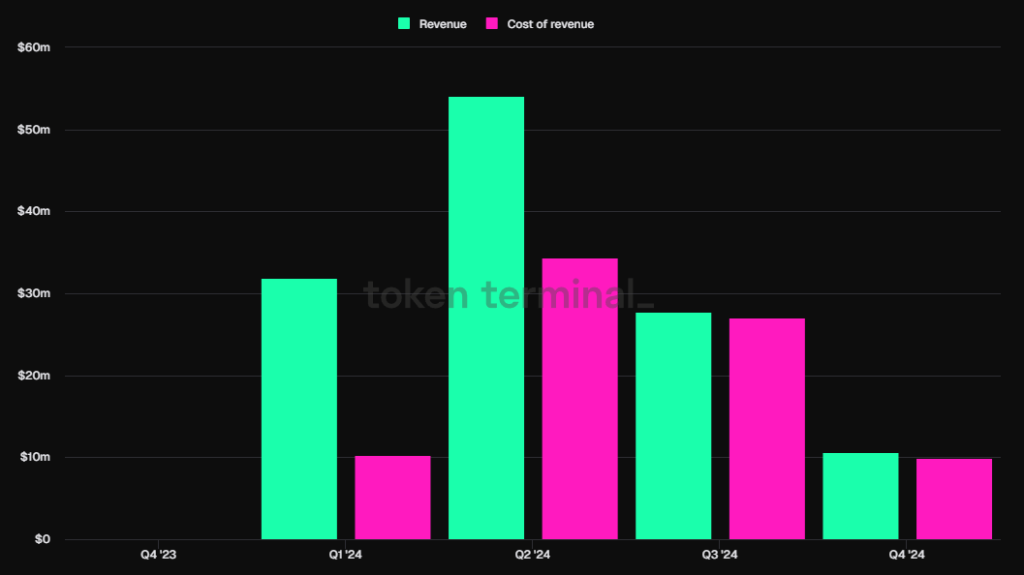

According to data validated by Ethena and analyzed by Token Terminal, Ethena’s revenue has rebounded from last month’s trough, with October’s protocol revenue reaching 10.63 million USD, reflecting a month-on-month growth of 84.5%.

A portion of the current protocol revenue is allocated to USDE stakers, while another portion is directed into the protocol’s Reserve Fund, intended to cover expenditures during periods of negative funding rates and various risk events.

The official documentation states that “the amount of protocol revenue allocated to the Reserve Fund must be determined through governance.” However, the author could not find any specific proposals regarding the distribution ratio of the Reserve Fund in the official forum; such changes were initially announced only in their official blog. The reality is that the distribution ratio and logic of Ethena’s protocol revenue have undergone multiple adjustments since its launch. During this process, while the team initially considered community feedback, the final distribution plan remains subjectively decided by the team without formal governance procedures.

As evidenced by the data from Token Terminal in the diagram above, the division of Ethena’s income between USDE stakers (represented by the red bars indicating the cost of revenue) and the Reserve Fund has been quite volatile.

During the early stages of the project, when protocol revenue was relatively high, a significant portion of the revenue was allocated to the Reserve Fund, with 86.7% of the protocol income distributed to the Reserve Fund account during the week of March 11. However, as April commenced and the price of ENA began to decline rapidly, the returns from ENA tokens proved insufficient to stimulate demand for USDE. To stabilize the scale of USDE, the allocation of Ethena’s protocol revenue began to tilt towards USDE stakers, with the majority of income directed to USDE stakers. Only in the past two weeks has Ethena’s weekly protocol revenue started to significantly exceed the expenditures allocated to USDE stakers (excluding ENA token incentives).

At present, the underlying assets of Ethena indicate that 52% are allocated to BTC arbitrage positions, 21% to ETH arbitrage positions, 11% to ETH staking asset arbitrage positions, and the remaining 16% comprises stablecoins. Thus, Ethena’s principal source of revenue derives from BTC-centric arbitrage positions. The once-prominent ETH staking returns contribute negligibly, given their limited asset proportion.

data source: https://app.ethena.fi/dashboards/hedging

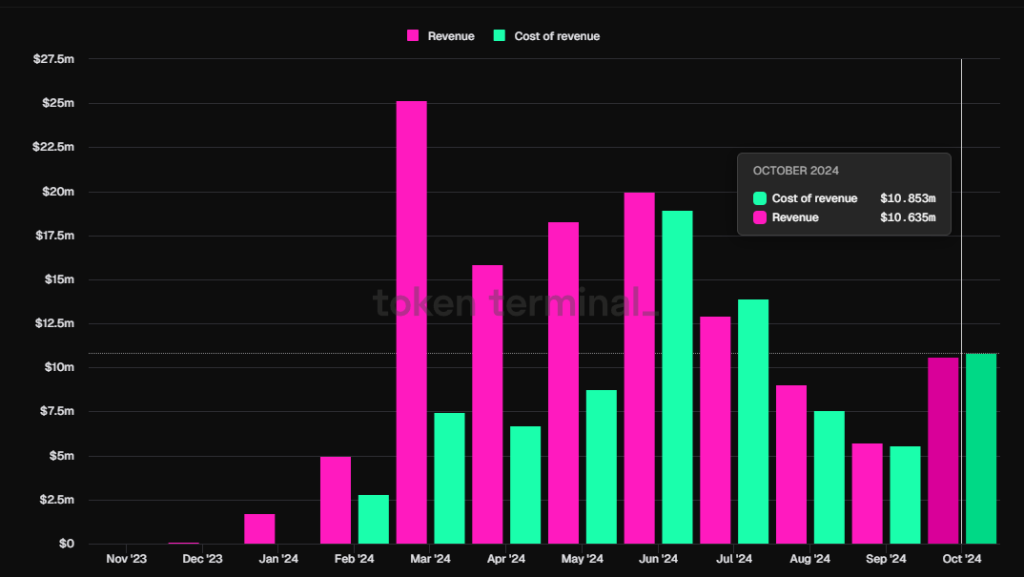

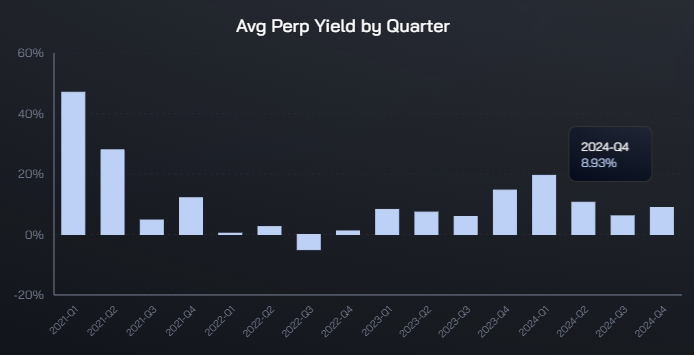

From the perspective of the average return rate trend of BTC perpetual contract arbitrage, the average return for the fourth quarter has already emerged from the stagnant range of the third quarter, returning to the levels observed in the second quarter of this year. To date, this quarter’s average annualized return exceeds 8%. Notably, even during the subdued market conditions of the third quarter, the overall average annualized return for BTC arbitrage remained above 5%.

Similarly, the annualized return rate for ETH perpetual contract arbitrage mirrors that of BTC and has also returned to above 8%.

Now, let’s examine Sol’s market contract scale, which is set to become a part of Ethena’s underlying assets. Despite a significant increase in Sol’s contract holdings this year due to rising prices, currently reaching 3.4 billion, there remains a considerable gap compared to ETH′s 14 billion and BTC’s $43 billion (not including CME data).

Regarding Sol’s funding fees, when examining the largest positions on Binance and Bybit, the recent annualized funding rate is comparable to that of BTC and ETH, with the current annualized funding rate hovering around 11%.

Data source: https://www.coinglass.com/zh/FundingRate

In other words, even if Sol is subsequently included as a contract arbitrage target in Ethena, it currently lacks a distinct advantage in both scale and yield compared to BTC and ETH, and is unlikely to generate significant incremental revenue in the short term.

Ethena’s Protocol Expenditures and Profit Levels

Ethena’s protocol expenditures are divided into two categories:

1. Financial Expenditures: Paid in USDE, directed towards USDE stakers, with the source of earnings derived from Ethena’s protocol income (including derivatives arbitrage, ETH staking, and stablecoin investment).

2. Marketing Expenditures: Paid in ENA tokens, directed towards users participating in various growth activities (Campaigns) within Ethena. These users earn points through their participation (different stages of the Campaign have varying point names, such as initially called Shards and later referred to as Sats), which can be exchanged for corresponding ENA token rewards after each season’s activities conclude.

The financial expenditures are relatively straightforward; for users staking USDE, there are clear expectations of returns. The official website prominently displays the current yield for USDE:

The complexity lies in the continuous array of marketing campaigns launched since Ethena’s inception, each with distinct rules and incentivizing user behavior through points, combined with a weighting mechanism that involves comprehensive calculations across multiple partnered platform activities.

Let us briefly review the series of growth activities since Ethena’s launch:

1. Ethena Shard Campaign: Epoch 1-2 (Season 1)

Duration: February 19, 2024 – April 1, 2024 (just under one and a half months)

Primary Incentive Actions: Providing stablecoin liquidity for USDE on Curve.

Secondary Incentive Actions: Minting USDE, holding sUSDE, depositing USDE and sUSDE into Pendle, and holding USDE across various partnered L2s.

Scale Growth: During this period, the scale of USDE expanded from under 300 million to 1.3 billion.

ENA Distributed for Marketing Expenses: A total of 750 million, accounting for 5%. Of this, the top 2,000 wallets can immediately claim 50%, with the remaining 50% distributed linearly over the next six months. Other smaller wallets face no unlocking restrictions. According to the Dune dashboard created by @sankin, nearly 500 million ENA was claimed before June, with ENA prices peaking at approximately $1.50 and dipping to around $0.67, yielding an average price of about $1. Following early June, ENA rapidly declined from $1 to around $0.20, averaging around $0.60, with the remaining 250 million ENA largely claimed during this period.

Rough Estimation: The value corresponding to 750 million ENA is approximately 5×1+2.5×0.6, totaling around $650 million.

Essentially, the scale of USDE increased by approximately 1 billion in less than two months, with marketing expenditures reaching an impressive 650 million, excluding the financial costs paid for USDE.

Of course, as ENA’s first airdrop, the marketing expenditure at this stage is particularly significant due to the unique nature of this phase

2. Ethena Sats Campaign: Season 2

Duration: April 2, 2024 – September 2, 2024 (5 months)

Primary Incentive Actions: Locking ENA, providing liquidity for USDE, using USDE as collateral for lending, depositing USDE into Pendle, participating in restaking protocols, and depositing USDE on Bybit.

Secondary Incentive Actions: Locking USDE on the official platform, holding and utilizing USDE on partnered L2s, and using sUSDE as collateral, among others.

Scale Growth: During this time, the scale of USDE grew from 1.3 billion to 2.8 billion.

ENA Distributed for Marketing Expenses: Similar to the first season, the second season rewards also total 5%, equating to 750 million ENA (with the top 2,000 wallets facing a 50% TGE and subsequent unlocking over six months). Based on the current ENA price of 0.35$, the value of 750 million ENA is approximately 260 million.

3. Ethena Sats Campaign: Season 3

Duration: September 2, 2024 – March 23, 2025 (just under 7 months)

Primary Incentive Actions: Locking ENA, holding USDE within designated partner protocols (primarily DEXs and lending), and depositing USDE into Pendle.

Scale Growth: As it currently stands, despite plans for the third season, the growth of USDE’s scale has hit a bottleneck, with the scale at approximately 2.7 billion, slightly below 2.8 billion at the start of the third season.

ENA Distributed for Marketing Expenses: Given that the duration of the third season is close to 7 months, slightly longer than the second season, and that ENA incentives are expected to continue declining, the total ENA reward for the third season is likely to remain at 5%, or around 750 million.

By this point, we can roughly calculate the total protocol expenditure for Ethena from its launch up to October 31:

Financial Expenditures (paid in stablecoins to USDE stakers): $81.647 million

Marketing Expenditures (paid in ENA tokens to participating users): 650 million+260 million = 910 million (this does not yet include potential expenditures post-September).

During the same period, the total protocol revenue was $124 million.

This indicates that, contrary to the popular perception of “Ethena being highly profitable,” the reality is that after deducting financial and marketing expenses, Ethena’s net loss has reached a staggering $868 million as of the end of October this year. This figure does not take into account the ENA token expenditures from September to October, so the actual loss may be even greater.

An 868 million net loss is the price paid for achieving a market capitalization of 2.7 billion for USDE within a year.

In fact, similar to many DeFi projects from the last cycle, Ethena has adopted a strategy of subsidizing tokens to enhance its core business metrics and increase protocol revenue. However, Ethena has implemented a unique point system this time, delaying token issuance and incorporating more partners as channels for participation, making it difficult for users to intuitively assess their financial returns from engaging with Ethena. This, in a sense, has enhanced user retention.

Future Business Outlook: Promising Narratives and Developments for Ethena

In the past two months, ENA has rebounded nearly 100% from its low, even amid the opening of Season 2 rewards in early October. This period has also been rich in news and positive developments for Ethena, such as:

October 28: The on-chain options and perpetual contracts project Derive (formerly Lyra) included sUSDE as collateral.

October 25: USDE was integrated as collateral for OTC trading by Wintermute.

October 17: Ethena proposed to integrate its liquidity and hedging engine into Hyperliquid.

October 14: The Ethena community initiated a proposal to incorporate SOL as a base asset for USDE.

September 30: The first project on the Ethena ecosystem, the derivatives exchange Ethereal, promised a 15% token airdrop for ENA users. Subsequently, Ethena Network announced it would release more information on product launches and new ecosystem applications based on USDE in the coming weeks.

September 26: Plans were announced to launch USTB—a new stablecoin purportedly in collaboration with BlackRock. However, USTB is actually a stablecoin backed by the on-chain treasury bond token BUILD issued by BlackRock, with only limited direct relations to BlackRock.

September 4: In collaboration with Etherfi and Eigenlayer, the first stablecoin AVS collateral asset—eUSD was launched, allowing users to receive it by depositing USDE into Etherfi. eUSD went live on September 25.

It can be said that in these past two months, the scenarios for USDE and sUSDE have increased significantly, although the demand stimulation for USDE may not be immediately apparent. For instance, the AVS collateral asset eUSD, launched in collaboration with Etherfi and Eigenlayer, currently has a scale of only a few million.

In reality, what truly propelled this surge in ENA prices was a strong endorsement from renowned trader and crypto KOL Eugene @0xENAS, who published a powerful article on Ethena titled “Ethena: The Trillion Dollar Crypto Opportunity” on October 12.

This article, which garnered nearly 400 shares, over 1,800 likes, and more than 700,000 views, propelled ENA’s price from $0.27 to $0.41 within four days, marking an increase of over 50%.

In his piece, Eugene not only reflected on several features of Ethena’s products but primarily emphasized three reasons. However, in my view, aside from the first reason, the remaining two are riddled with shortcomings:

1. The decline in U.S. interest rates have led to a decrease in global risk-free rates, making USDE’s APY appear more attractive, thereby drawing in more capital.

2. The newly launched USTB stablecoin, purportedly in partnership with BlackRock, is described as an “absolute gamechanger,” significantly enhancing the adoption of USDE because, when the market’s perpetual arbitrage returns are negative, the underlying assets can be switched to USTB, allowing for risk-free returns from Treasury bonds.

Shortcoming: USTB is underpinned by BUILD, which doesn’t mean it is a stablecoin jointly launched by BlackRock and Ethena. Just as Dai has a substantial amount of USDC as its underlying asset, it is not a stablecoin co-launched by Circle and MakerDAO. To secure Treasury bond returns during periods of negative perpetual yields, USDE can directly switch to holding Build or sDAI, or convert to USDC and earn a 4.5% annualized yield on Coinbase, making the issuance of USTB entirely unnecessary. USTB appears more as a gimmick to leverage BlackRock’s visibility, and labeling such a lackluster product as an “absolute gamechanger” raises doubts about the author’s understanding or motivations.

3. The rate of ENA emissions is set to decrease, which should alleviate selling pressure more rapidly than before.

Shortcoming: The actual Season 2 rewards still include 5% of ENA’s total supply, equating to 750 million tokens incentivized for circulation over the next six months, which is not significantly lower than the total incentive from the previous season. Furthermore, in March of next year, a massive unlocking is anticipated for both the team and investors, casting a pessimistic outlook on ENA’s inflation in the coming six months.

However, Ethena still has promising narratives to look forward to in the upcoming months to year.

Firstly, as expectations rise for Trump’s potential return and the Republican Party’s victory (By the time this article is published, the Republican Party and Trump have already claimed victory), the warming crypto market may benefit the perpetual arbitrage yields and scales of BTC and ETH, increasing Ethena’s protocol revenue.

Secondly, with the emergence of more projects in the Ethena ecosystem following Ethereal, ENA’s airdrop revenue is likely to rise.

Thirdly, the launch of Ethena’s own public chain could attract attention to ENA and create nominal use cases for staking, although I anticipate this will occur after the accumulation of more projects mentioned in the second point.

Nevertheless, what remains most crucial for Ethena is the widespread acceptance of USDE as collateral and a trading asset by leading CEX.

Among prominent exchanges, Bybit has already established a deep partnership with Ethena.

Coinbase is focused on operating its own USDC, and given its status as a domestic U.S. company, the complexities of regulation render the likelihood of it supporting USDE as collateral and for stablecoin trading pairs virtually nonexistent.

In the case of Binance and OKX, the possibility of OKX incorporating USDE into stablecoin trading pairs and contract collateral does exist, as it participated in two rounds of financing for Ethena, suggesting some financial alignment. However, such a possibility remains low, as this move could expose OKX to operational and reputational risks associated with Ethena. Comparatively, Binance, which only participated in one round of investment into Ethena, is even less likely to adopt USDE for trading pairs and collateral, especially since it already supports its own stablecoin project.

Eugene viewed USDE becoming a margin asset for contracts across major exchanges as a reason for his optimism toward Ethena, but I remain skeptical.

Valuation Level: Is ENA’s Current Price Within an Undervalued Striking Range?

We will analyze ENA’s current valuation from both qualitative and quantitative perspectives.

Qualitative Analysis

Favorable events that could positively influence ENA’s token price in the coming months, with a high likelihood of occurrence, include:

- The rise in arbitrage gains due to a recovering crypto market, reflected in improved protocol revenue expectations, leading to an increase in ENA’s price and growth of USDE’s scale.

- The inclusion of SOL as an underlying asset, which could attract the attention of SOL ecosystem investors and projects.

- The potential for the Ethena ecosystem to see the launch of more projects similar to Ethereal in the coming months, resulting in more airdrops for ENA holders.

- Before the next substantial ENA unlock, the project team has an incentive to support ENA’s price, fostering an upward spiral for both business and token value.

Additionally, based on Ethena’s performance over the past six months, the project’s team has demonstrated exceptional business acumen, arguably outpacing many stablecoin projects in external partnership expansion and being more proactive and efficient than leading stablecoin project MakerDAO.

Conversely, factors detrimental to ENA’s token valuation, suppressing its price, include:

- ENA lacks true monetary yield distribution, primarily providing speculative staking scenarios (such as acting as AVS collateral for Ethena’s multi-chain security) and self-mining operations.

- The project’s actual profitability remains subpar, with massive subsidies implemented to open markets leading to significant net losses, which ultimately burden ENA token holders.

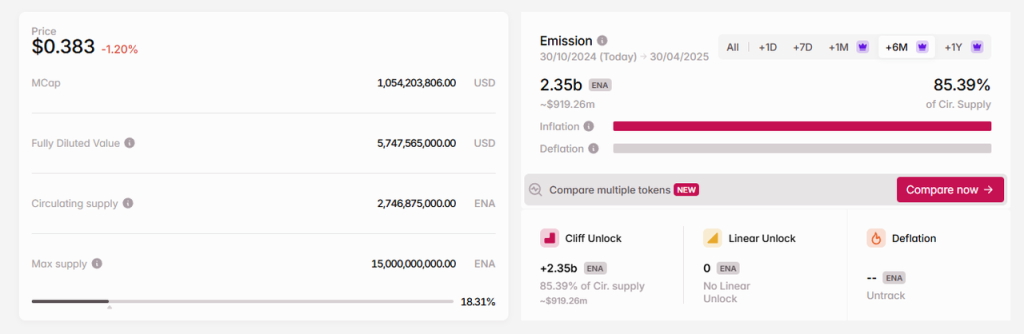

- ENA continues to face considerable inflationary pressure in the next six months, stemming from the expenditures associated with marketing activities and the upcoming massive unlocks for core team members and investors in late March next year. According to Tokenomist data, ENA token holders may face an inflationary pressure of 85.4% relative to the current circulating supply over the next six months.

Quantitative Comparison

Ethena’s business model is fundamentally similar to that of other stablecoin projects, with its innovation lying in the utilization of raised assets, specifically profiting through perpetual contract arbitrage.

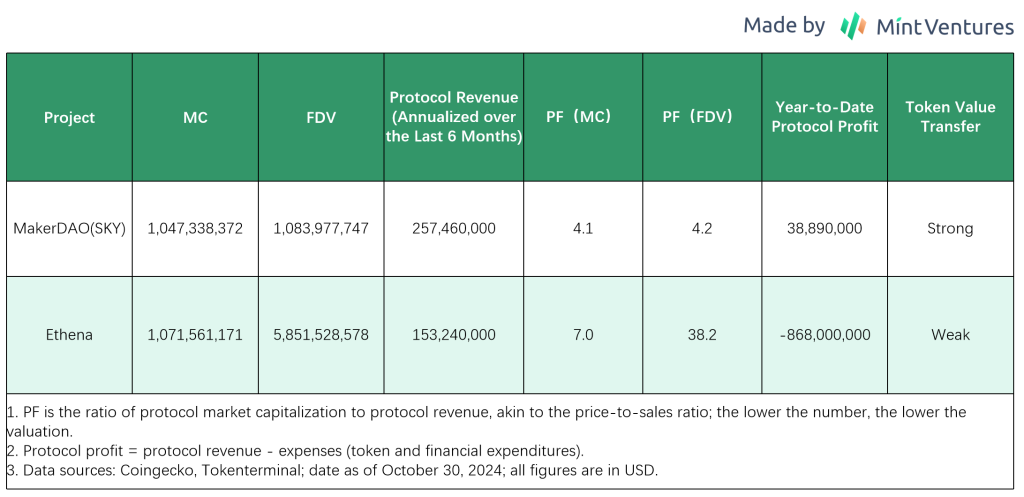

Therefore, we will use MakerDAO (currently referred to as SKY), the largest stablecoin project by circulating market capitalization, as a benchmark for valuation comparison.

It is evident that, compared to the established protocol MakerDAO, the token ENA from Ethena lacks cost-effectiveness in terms of protocol revenue and profitability at its current price.

Summary

While many refer to Ethena as a highly representative innovative project in this cycle, its core business model is not distinct from other stablecoin projects; all aim to raise funds for financial operations and strive to promote the usage and acceptance of their bonds (stablecoins) to minimize fundraising costs.

At this stage, Ethena, still in the early promotional phase of stablecoins, is experiencing immense losses and is not, as many influencers suggest, a “highly profitable project.” Its valuation is not underestimated when compared to the leading stablecoin project MakerDAO.

However, as a new player in this arena, Ethena has demonstrated remarkable business development capabilities, being more aggressive than other projects. Similar to many DeFi projects from the previous cycle, rapid scalability, and increased project adoption can elevate the optimistic expectations of investors and analysts regarding the project, subsequently pushing up the token price. Rising prices will lead to higher APYs, further boosting the scale of USDE, and creating a self-reinforcing upward spiral.

Eventually, such projects reach a critical point where people begin to realize that growth is driven by token subsidies, and the rise in the price of newly minted tokens seems to rely solely on optimistic sentiment, lacking a fundamental value connection.

At this point, a game of ‘Run Fast’ has begun.

Ultimately, only a handful of projects can rise from such a downward spiral. The previous star stablecoin Luna (UST issuer) has already perished, Frax’s business has significantly shrunk, and Fei has ceased operations.

As a product that exhibits a clear Lindy effect (the longer it exists, the stronger its vitality), Ethena and its USDE will require more time to validate the stability of its product architecture and its survivability post-subsidy decline.

References and Data Sources

Asset Prices: https://www.coingecko.com/

Token Unlock Information: https://tokenomist.ai/

Financial Data: https://tokenterminal.com/

Project Dashboard: https://app.ethena.fi/dashboards/transparency

Official Announcements: https://mirror.xyz/0xF99d0E4E3435cc9C9868D1C6274DfaB3e2721341

Influencer Eugene’s Commentary: https://x.com/0xENAS/status/1844756962854212024