The debate about Real World Assets (RWA) has been intensifying since the beginning of the year, with some opinions positing that RWAs could fuel the forthcoming crypto bull market. Reflecting this trend, several entrepreneurs have pivoted their business strategies to engage more directly with RWA-related initiatives, hoping to leverage the progressively warming narrative to drive rapid business growth.

The tokenization of RWA allows us to bring traditional assets in the physical world onto the blockchain, thereby enabling Web 3.0 users to purchase and trade these tokens. Investors of RWA tokens are entitled to the returns generated by these assets. A few years ago, Security Token Offerings (STOs) were primarily focused on corporate bond financing, the breadth of RWA now extends well beyond the confines of primary traditional assets. Any asset circulating in both primary and secondary markets can be tokenized and brought onto the blockchain, allowing Web 3.0 users to participate in investing. Hence, within the narrative of RWA, there lies a rich variety of asset classes and a broad range of potential yields.

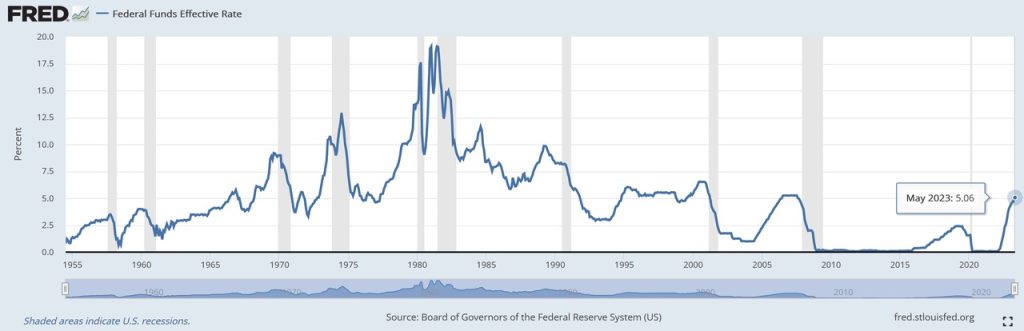

The increasing market attention towards Real World Assets (RWA) can be traced back to several reasons. Firstly, the current crypto market is experiencing a lack of low-risk assets pegged to the U.S. dollar. However, in the traditional financial markets, risk-free interest rates have risen to 4% or even higher amidst an interest rate hiking wave, presenting a highly attractive investment opportunity for crypto-native investors. This is reminiscent of the bull market of 2020-2021 when substantial traditional funds entered the crypto market to earn low-risk profits through strategies like arbitrage. By incorporating low-risk, high-yield products from traditional markets via RWA, we may see a positive reception from certain investors. Secondly, the current crypto market is not in a bull run, and even within the crypto-native market, there’s a shortage of compelling narratives. RWA stands out as one of the few fields with solid revenue support, and it has the potential for explosive business growth. Finally, RWA serves as one of the bridges linking traditional and crypto markets. Through RWA, there’s a chance to attract incremental users from traditional markets and pump new liquidity into the system, which is undoubtedly a positive development for the blockchain industry.

However, based on some of the RWA projects we’ve seen so far, key business metrics such as Total Value Locked (TVL) have not experienced rapid growth, suggesting that the market’s short-term expectations for RWA might be somewhat overstated. For an RWA project, several dimensions should be considered:

- Underlying Assets: This is the fundamental concern for any RWA project. Selecting appropriate underlying assets can provide substantial assistance for subsequent management efforts.

- Standardization of Underlying Assets: The standardization of underlying assets can be challenging due to the “heterogeneity” of different underlying assets. Assets with stronger heterogeneity will require higher levels of standardization and will involve more complex processes.

- Off-Chain Partner Institutions and Collaboration Modes: High-quality off-chain partner institutions can not only fulfill their obligations smoothly but also help fully unleash the value of underlying assets.

- Risk Management: Multiple aspects of an RWA project require effective risk management, including the maintenance of underlying assets, onboarding assets onto the blockchain, distribution of returns, and more. In case of bond, risk management extends to asset liquidation and debt collection following any default by the debtor.

Contents

The Underlying Assets

The cornerstone of any RWA project lies in the selection of its underlying assets.

The landscape of RWA currently features a wide array of assets categorized into several types:

- Bonds: Typically short-term U.S. Treasury bonds or bond ETFs. Notable examples include stablecoins like USDT and USDC, as well as lending projects such as Aave and Maple Finance. Currently, government bonds or bond ETFs make up the largest share of RWA.

- Gold: An example of this category is PAX Gold. Although it falls under the broad narrative of “stablecoins,” its development has been slow due to weak market demand.

- Real Estate: Represented by platforms like RealT and LABS Group, which essentially tokenizes real estate similar to how real estate is bundled into REITs. These projects often choose real estate from their home cities as their primary underlying assets.

- Loan Assets: This category is represented by entities like USDT and Polytrade, and includes a broad range of assets such as residential mortgage loans, corporate loans, structured financing tools, and auto loans.

- Equities: This space is populated by projects like Backed Finance and Sologenic, aiming for real asset trading but is greatly hindered by legal restrictions. Crypto-native “synthetic assets” trending in the direction of already listed and circulating stocks significantly overlap with this category.

- Other Assets: This category includes large-value, low-standardization assets like farms and artwork.

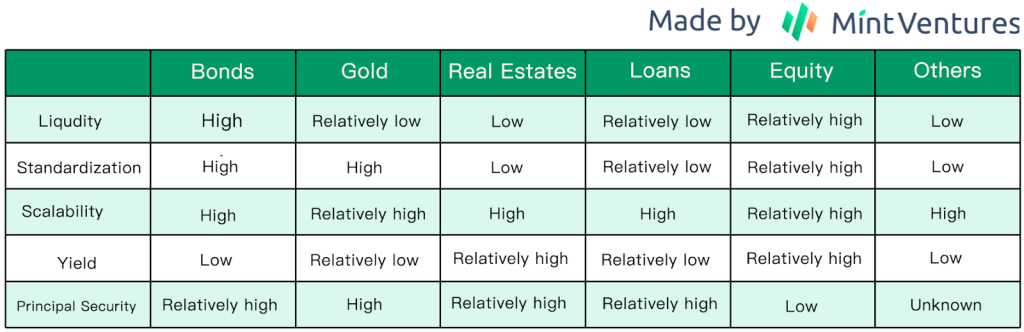

The decision on what assets to use as underlying assets should be evaluated against five critical dimensions: liquidity, level of standardization, security of principal, scalability, and yield. These dimensions can help to outline the characteristics of the assets mentioned above.

From the perspective of underlying assets, bond assets currently appear to be the most promising category to explore. Depending on their unique positioning, these can follow different paths, such as aligning with fiat-currency-pegged stablecoins or emulating money market funds in the crypto market. Although the fiat-currency-pegged stablecoin sector is presently dominated by a few leading projects that have established wide-ranging collaborations within their ecosystems, there is still significant potential to tap into areas like the crypto-market money market funds.

When it comes to real estate assets, while the REITs model is well-established, any project team deciding to select their assets and manage property diversity across different regions will undoubtedly increase operational costs. For instance, in the area of project maintenance, if properties are widely dispersed, the number of required property management personnel will increase, thus leading to higher costs in procurement, property maintenance, and transportation. During my examination of various projects, I’ve encountered situations where the project team aimed to keep the value of each property under $100,000, spread across more than five countries, with no limitations on property type, encompassing both residential and commercial real estate. While this approach may provide substantial diversification, it also introduces significant challenges in areas like information disclosure and property management. It also makes future rapid growth of underlying assets more difficult to achieve.

At the current stage, I would not recommend paying excessive attention to the “other” types of underlying assets, mainly due to their liquidity and standardization issues. Take agricultural-related underlying assets as an example. Due to their high degree of non-standardization, it becomes more challenging to determine the quality of these assets. Using a single farm as an example, the quality of crops it produces can vary. The processes of storage, transportation, and sales are all relatively specialized. To allow agricultural asset returns to be eventually delivered to investors, it may take years of in-depth cultivation in the industry. Economic crops face unpredictable fluctuations in production cycles and the impacts of weather factors. The final monetization also presents substantial difficulties.

If project teams seek to find assets themselves and wrap these assets independently, the project’s growth potential may be significantly affected. It’s even more challenging for such projects to achieve rapid growth.

In terms of underlying assets, focusing on bond-type assets as the core direction and REIT-like assets as a means to enhance returns may be a more practical and feasible approach.

Business Structure

If a few years ago the question of how to bring Real-World Assets (RWA) onto the blockchain was still a significant challenge, it’s now been largely addressed thanks to the explorations of leading projects such as MakerDAO.

The establishment of an RWA Foundation framework can significantly streamline the process of tokenizing RWAs. Under this architecture, MakerDAO can manage multiple RWAs through the RWA Foundation, and new RWAs can be seamlessly integrated into the system via the creation of Special Purpose Vehicles (SPVs) initiated directly by the RWA Foundation.

Secondly, for individual SPVs, a management approach can be adopted that’s reminiscent of the financing methods used in ABS (Asset-Backed Securitization) projects, where securities are underpinned by a pool of assets.

MakerDAO strategically invests in senior tranche to ensure fund safety, while other investors may act as junior investors. Other projects can determine the risk level of the assets they hold based on the risk preferences of their target user group.

One aspect in which MakerDAO’s single SPV model diverges from traditional asset securitization processes is the lack of settlement and fund custodial roles, replaced by a token issuance platform. However, as the regulatory environment surrounding RWAs becomes more explicit in the future, the need for roles such as settlement and fund custody may remain indispensable participants within the RWA ecosystem.

Risk Management

Risk management in the context of RWA can primarily be divided into three dimensions:

Underlying Asset Risk Management: The lower the degree of standardization for an asset, the greater the need for effective risk management. For instance, government bonds have a higher degree of standardization, superior liquidity, and stronger price discovery capabilities compared to assets such as timberland or farmland, making them less challenging to manage. However, even with the same asset type, the complexity of management can vary depending on the region or country. For example, in some developing countries where digitization is still limited, bond assets may still exist in paper form. This requires that during the holding period of these high-volume bonds, the project party must find a safe place to store them to prevent damage. Assets existing in physical form also carry a higher risk of being fraudulently swapped, and there have been numerous high-value cases involved in this type of event in various regions.

In summary, when it comes to managing the risks of underlying assets, the fundamental requirement is to ensure the authenticity and validity of the assets throughout the lifespan of the project. Secondly, it is necessary to safeguard the value of these assets from any artificial detrimental factors. Thirdly, it should be ensured that these assets can be liquidated at a fair market price. Finally, it is critical to guarantee that both the returns and the principal can be safely and smoothly delivered to investors. Risk Management of underlying assets aligns substantially with the characteristics of traditional assets, and there are existing risk management measures that can be referred to.

On-Chain Risk Management: Due to the necessity of uploading data onto the blockchain, there is a risk of misreporting if off-chain organizations are not properly managed. Analogous negative incidents often occur in traditional finance, such as fraudulent activities involving commercial papers, supply chain finance, and bulk commodities, to name a few. Even with real-time monitoring through sensors and designated delivery locations, it’s impossible to completely eliminate risk.

Considering that the RWA sector is still in its nascent stages, it’s plausible that similar incidents will occur. Moreover, in the current landscape where regulatory guidelines are lacking, the cost of non-compliance is relatively low, making the risk of data falsification on the blockchain a significant concern.

Counterparty Risk Management: This kind of risk leans more towards traditional measures, but the issue lies in the fact that there are currently no precise regulations specifically targeting RWAs. For instance, during the custody process, what constitutes a compliant custodian? In the auditing phase, can current accounting and financial standards accurately and fully represent the unique characteristics of RWAs? In the course of project operation, should a risk event arise, what risk mitigation procedures would best protect the interests of investors? There are no definitive answers to these questions as of now. Hence, there is still room for potential misbehavior by counterparties.

Current User Structure and User Demand

As mentioned in the previous article, “The Outlook on the On-chain Bond Market,” the extreme volatility and cyclical nature of the crypto market pose a challenge for conservative investors seeking steady, stable returns. This volatile market environment has shown that a substantial number of users have a high risk tolerance.

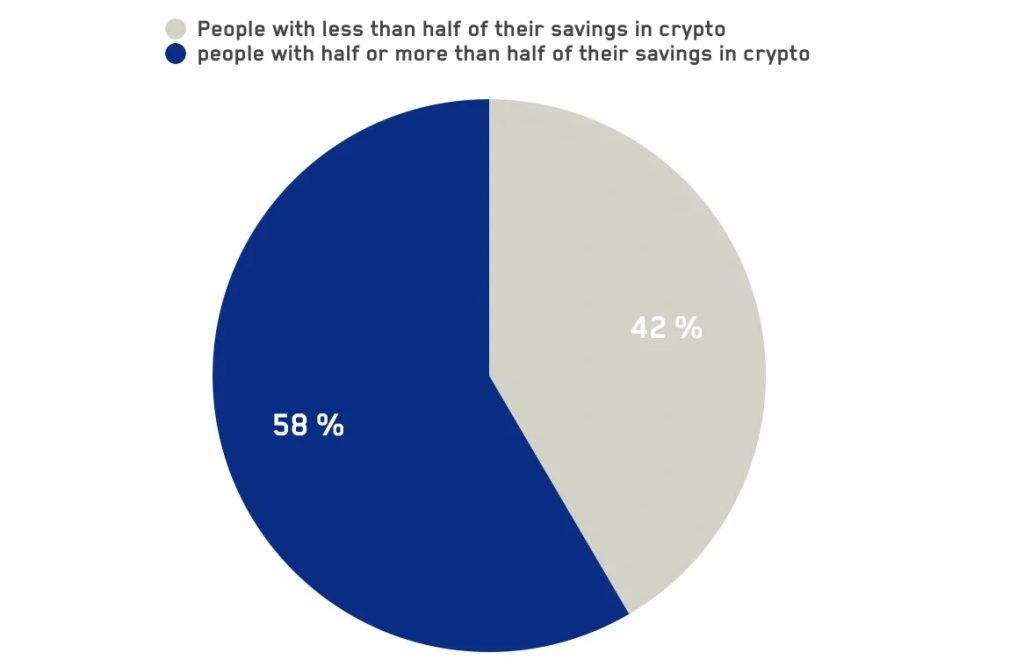

In a survey report released by dex.blue and other teams in 2020, it was found that half of the surveyed crypto market users had invested 50% or more of their entire savings into the crypto market. Additionally, survey reports released by Pew Research and Binance have respectively mentioned a higher proportion of young individuals among the current users of the crypto market. Given this market structure, the risk tolerance of crypto market investors tends to be higher than that of traditional market investors.

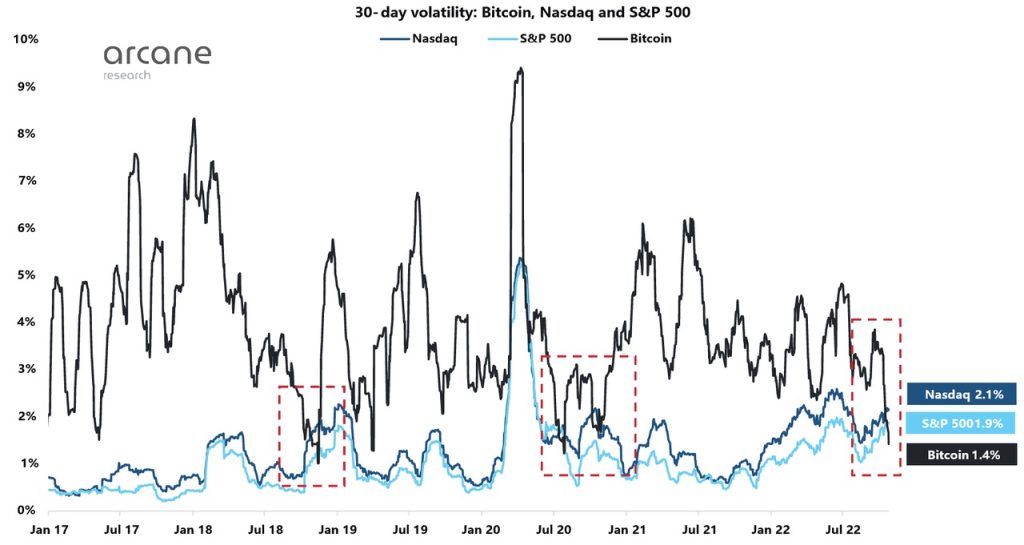

In the current market, dominated by “arbitrageurs and extremely aggressive investors,” its volatility also demonstrates similar characteristics: Research by K33 has shown that from the beginning of 2017 to October 2022, the volatility of Bitcoin has been higher than that of NASDAQ and the S&P 500 for the majority of the time, with only a few occasions when the volatility of U.S. stocks exceeded that of Bitcoin during extremely lackluster market periods.

There might be different yield demands among the two primary investor groups in the crypto market. For arbitrageurs, “low-risk” investment opportunities are easier to obtain. For instance, the annualized yield for opportunities such as the funding rate of BTCUSD perpetual future, has ranged between 15%-20% since their inception. This figure far exceeds the global stock market’s long-term APR of 5% and even surpasses the long-term yields of various types of bonds. For aggressive investors, their expected returns are substantially higher than those of arbitrage investors.

Thus, even with the tokenization of stocks, it might be challenging to satisfy the various user demands and their anticipated return levels. In the short term, the risk-return ratio of many RWA products seems to be unattractive.

Regulation: Perhaps a Potential Opportunity

In early June of this year, the U.S. Securities and Exchange Commission (SEC) announced its classification of multiple tokens, including BNB, BUSD, and MATIC, as securities. This sent ripples through the market, sparking concerns over increased regulation, and triggered a significant drop in the prices of the affected assets.

Should the SEC’s regulatory measures gain recognition from other G20 countries or more, an increasing number of tokens could be classified as securities and integrated into traditional regulatory frameworks. This could eventually extend to tokens issued on-chain. Looking at current regulatory policies, we can see the beginnings of such a trend: from the U.S. to Japan, and across European Union countries, measures for regulating stablecoins are increasingly mirroring those applied to traditional banks. This might suggest that the future regulation of tokens could also adopt, to some extent, the practices of securities regulation.

If such a scenario unfolds, it could offer greater reassurance to practitioners in traditional finance who are contemplating tokenizing their assets: while the assets may be local, they could attract global liquidity through blockchain technology. This approach has already won approval from some entrepreneurs engaged in RWA projects. Despite geographical limitations, they can attract investors from around the world via blockchain technology. For these practitioners, regulated asset tokenization could bring about two benefits:

- It opens access to global liquidity, hence financial resources are not limited by geographical factors, possibly resulting in access to cheaper funding;

- It potentially expands the investor pool, possibly including those who may demand lower returns than local investors, thus broadening the target users for RWA projects.

Meanwhile, regulatory measures from the user side are also advancing: namely, Know Your Customer (KYC) procedures. While crypto-native projects only require a wallet for access, there’s an increasing number of startups in primary markets that need KYC measures to verify whether users are eligible investors. Some RWA projects, such as Maple Finance, have made KYC an indispensable part of their customer acquisition process. If the trend of implementing KYC procedures becomes more prevalent in new projects, then a clearer, regulation-compliant blockchain industry, coexisting with KYC, might bring an additional benefit: an increasing number of average investors may feel more secure entering the market.

These investors tend to have a risk preference for familiar assets while showing some interest in emerging crypto-native assets. At this point, RWAs can become a significant investment direction for these investors.

Potential Development Trajectories for RWA

In the short term, RWAs can bring three key benefits to investors in the crypto industry:

Fiat-currency based and low-risk assets: Currently, the risk-free interest rates in major economies led by the United States have reached levels above 3%, significantly outperforming the lending rates in various types of stablecoin protocols within the crypto market. Without the need for cyclical leverage, this provides investors with very low-risk investment opportunities. At present, projects such as Ondo Finance, Maple Finance, and MakerDAO have launched investment projects based on the yields of U.S. Treasuries, which are highly attractive for investors who settle in fiat currencies. In this sector, money-market-funds-style projects may emerge in the crypto market.

Risk Diversification of Assets: For instance, Bitcoin demonstrates varying degrees of correlation with assets like gold and U.S. stocks, depending on the market phase.

Even in the macro-driven years following 2020, diversification benefits persist across various asset classes.

For portfolio-oriented investors, blending native crypto assets with different types of RWAs can enable an even more significant risk diversification of assets.

A tool for investors in developing countries to combat currency volatility: In some developing nations, such as Argentina and Turkey, persistent high inflation is a common issue. RWAs can provide these investors with a means to hedge against domestic currency fluctuations, enabling them to diversify their portfolio with a global asset allocation.

From these three perspectives, in the short to medium term, the most widely accepted RWAs are likely to be those related to government bonds from major economies. Given the current climate of rising interest rates, these RWAs offer higher yields and lower risk, making them particularly attractive investment options.

In the long run, as the regulatory framework becomes more clearly defined, an increasing number of mainstream investors gradually enter the crypto market, and operations within the crypto industry become more convenient, RWAs could potentially replicate the explosive growth witnessed in China’s internet finance sector a decade ago.

Blockchain-based RWA assets provide unprecedented “accessibility” to global retail investors: RWAs, as the most familiar asset type to everyday investors, may become the primary on-chain investment targets for those not native to the Web3 space. For these individuals, the borderless and permissionless nature of on-chain assets opens the door to a broader array of global investment opportunities. Conversely, for entrepreneurs within this space, this potentially offers access to an unprecedented breadth of users, growth, and extremely low customer acquisition costs. The rapid development and massive adoption of “on-chain dollars” such as USDT and USDC have already started to validate this trend.

RWA assets could catalyze new DeFi business models: LSD, as a novel underlying asset, has stimulated rapid growth in LSD-Fi. In this process, existing business paradigms like asset management, spot trading, and stablecoins have been reevaluated, while previously overlooked directions such as yield volatility have gained attention. If RWAs become a significant type of underlying assets, the introduction of substantial off-chain yields may foster new DeFi business models. In the future, RWAs could be combined with crypto-native assets and strategies to form hybrid assets, allowing more users willing to explore crypto-native assets to gain understanding in more familiar ways. From this perspective, the next RWA+DeFi project by high TVL could be an on-chain money market fund.

RWA industry and regulation will eventually strike a balance, allowing practitioners to find compliant methods of user acquisition: Whether in the West or in the East such as Hong Kong, the trend towards regulation is inevitable. As the crypto industry will grow to a market size of $10 trillion, regulators will not turn a blind eye. With the gradual clarification of regulatory policies, we can see that previously unrealizable business models are now taking shape in certain regions: In Hong Kong, it is already possible to issue stablecoins through compliant channels, and the Middle East is exploring the intersection of the blockchain industry with traditional sectors.

Looking at the long term, abundant liquidity is one of the critical factors for the robust development of the crypto industry. With the rollout of regulatory frameworks, RWAs, particularly those led by USD-pegged stablecoins, are poised for rapid growth. Especially in the face of the next round of global easy monetary policies, if new players are supported by a robust ecosystem and tools, compliant USD-pegged stablecoins could potentially follow in the high-growth footsteps of USDT.