Contents

Key Insights

Core Investment Logic

At the forefront of DeFi, Trader Joe has established itself through a robust and creative team coupled with unparalleled delivery prowess. This innovative blend of product experience and an innovative Liquidity Book mechanism has sparked a substantial surge in user base. The platform’s current growth catalyst is primarily driven by the integration of Arbitrum.

Notwithstanding these strengths, the decentralized exchanges (DEXs) landscape remains fiercely competitive, consequently diluting the bargaining leverage of any particular project for traders and liquidity providers. Most DeFi protocols currently operate within this landscape with minimal profits, and sometimes even losses. Although turning this market scenario around optimistically in the short term seems challenging, the unique volatility of the crypto market and DEXs provides a glimmer of hope, with projects like Trader Joe expected to outperform the broader market.

Main Risks

The main risks stem from the fiercely competitive nature of the DeFi space, with Avalanche, Trader Joe’s main base, facing potential ecosystem contraction as well as stiff competition from Uniswap v3. Arbitrum, currently the prime driver of growth, is still in its nascent stages where lower prices and volume-driven incentives are more prevalent, rendering the growth of trading volumes and fees somewhat erratic. This inconsistency makes Trader Joe more reliant on event-driven projects to stimulate business volume.

Valuation

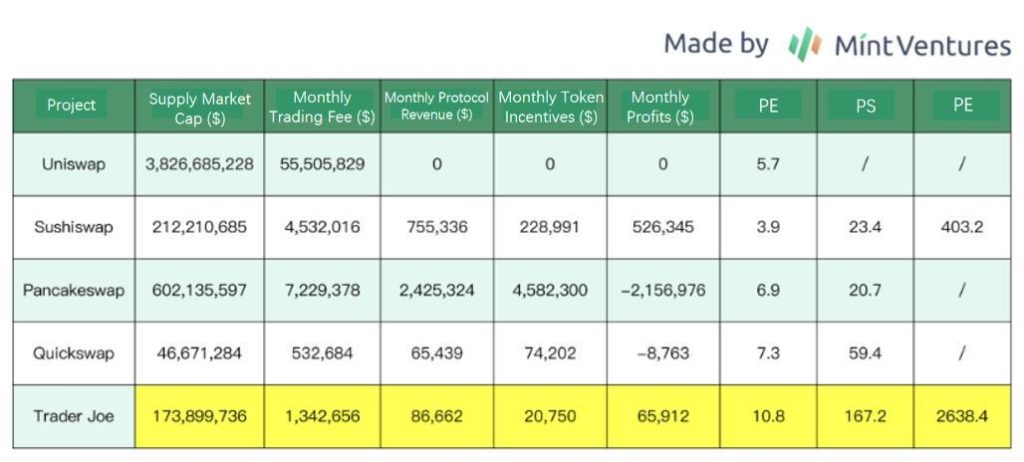

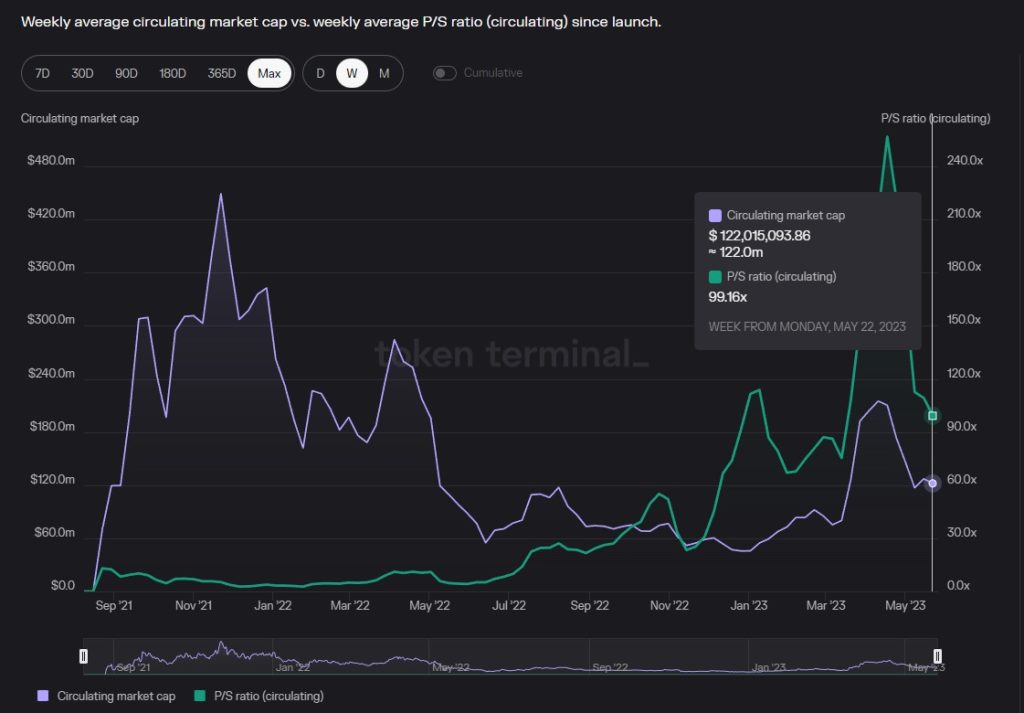

Contrarily, Trader Joe enjoys an enviable position when compared to its peers on specific financial metrics. As highlighted in section 4.2 of our Valuation analysis, Trader Joe currently holds higher valuations in terms of Price-to-Fees Ratio (P/F), Price-to-Sales Ratio (P/S), and Price-to-Earnings Ratio (P/E).

The Overview of Trader Joe: The Innovator of the On-Chain Order Book Model

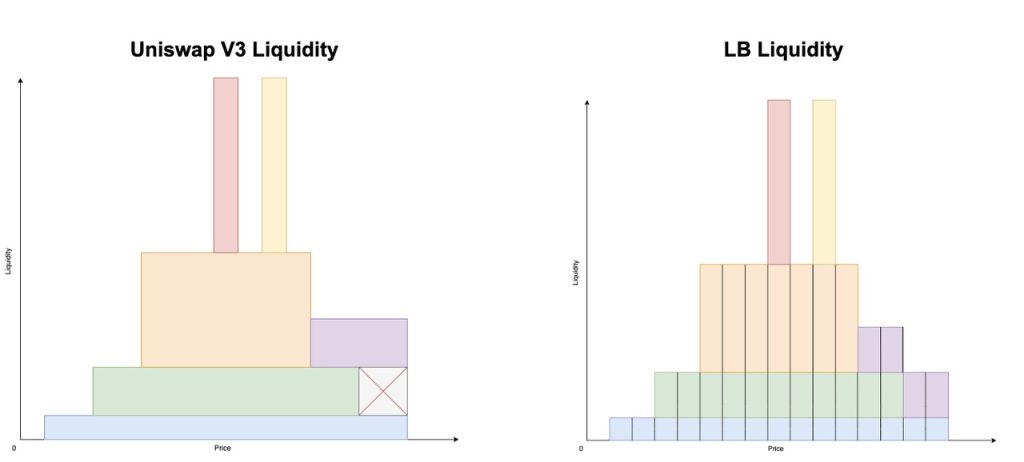

Trader Joe is a comprehensive DeFi protocol featuring a decentralized exchange and lending platform ‘Banker Joe’, an NFT marketplace ‘Joepeg’, and a launchpad ‘Rocket Joe’. Its central operation is its Decentralized Exchange (DEX) business, notably through its Liquidity Book (LB), an innovative enhancement of Uniswap V3’s “concentrated liquidity” concept. LB uses ‘Bins’, each representing a unique price range filled with liquidity, akin to the order book matching model used by Centralized Exchanges (CEX).

Unlike Uniswap V3’s liquidity model, LB vertically accumulates liquidity within each bin. Furthermore, Trader Joe’s LB uses a system similar to the ERC-1155 token standard that supports both fungible and non-fungible tokens under a single contract. This helps to lower gas fees, simplifies the calculation of trading fees, and reduces the complexity of the protocol’s accounting system. These features allow projects and users to explore a variety of strategies based on the Liquidity Book.

Encompassing an extensive array of services, Trader Joe is a fully-fledged DeFi protocol which includes ‘Banker Joe’, a decentralized exchange (DEX) and lending platform; ‘Joepeg’, an NFT marketplace, and ‘Rocket Joe’, a launchpad. It has successfully extended its trading operations across Avalanche, Arbitrum, and the BNB Chain, with spot trading being its primary business segment.

At the heart of Trader Joe’s operations is its DEX business, which has seen numerous product and mechanism innovations, particularly manifested in its V2 product, the Liquidity Book (LB).

The LB is an advanced evolution of Uniswap V3’s “concentrated liquidity” concept, combining the functionalities of an “order book” and a “liquidity pool”.

Team

Trader Joe was founded by two anonymous figures known as @cryptofishx and @0xmurloc. @cryptofishx, once a medical doctor, overcame losses in the 2017-2018 bear market and transformed his career to become a successful full-stack engineer, contributing to various Web3 projects, including Google, before founding Trader Joe. @0xmurloc, who also has a strong background in full-stack engineering and product management, previously served as a product leader for a recently listed unicorn company. The Trader Joe team, despite their undisclosed size, has shown commendable dedication and has successfully developed and launched various product directions within just two years. Regarding funding, Trader Joe secured $5 million at a $50 million valuation in a September 2021 strategic sale led by Defiance Capital, GBV, and Mechanism Capital, among other notable investors.

Business Analysis: Decentralized Exchanges and Trader Joe’s Performance in the Competitive Crypto Landscape

Decentralized exchanges (DEXs) remain a key area of interest for Mint Ventures due to the rising popularity of spot trading in the crypto world. As of May 2023, DEXs represent 14.75% of the total cryptocurrency spot trading volume.

Source: DefiLlama

Liquidity purchase service is another important aspect of DEXs, with revenues surpassing those of spot trading. However, the sustainability of DEXs is in question as they face losses when veToken incentives are considered as liquidity costs.

The overall expansion of the cryptocurrency sector, growing demand for asset autonomy, increased capital efficiency, and the trend of native Web3 projects favoring DEXs, have all contributed to the growth of DEXs. However, the industry faces fierce competition, with DEXs such as Uniswap V3 offering free services and new players introducing innovative strategies. To overcome this, DEXs need to build significant competitive moats and start turning a profit.

We also explore Trader Joe’s DEX metrics such as Total Value Locked (TVL), trading volume, fees/revenue, and active users. Despite a decrease in TVL during a bearish phase, there’s been a rise in the number of active users on Trader Joe, which can be attributed to its user-friendly interface.

Trader Joe’s current strategy seems to prioritize the development of the Arbitrum market with low or zero protocol fees, exemption of fees for mainstream stablecoins, and regular fees for insignificant businesses like the BNB Chain. Higher fees are levied on new projects,like ARB and LOTUS.

The competition landscape is tough with Trader Joe’s primary focus on Avalanche, and plans to expand into Arbitrum. Trader Joe faces direct competition from Uniswap V3 in Avalanche, and several other DEX projects in Arbitrum. Despite this, Trader Joe shows a high capital efficiency and a substantial month-on-month TVL increase. The growth is attributed to the introduction of the Liquidity Book (LB) mechanism and the advent of new assets.

Tokenomics:Trader Joe’s Tokenomics and Utility of $JOE Token

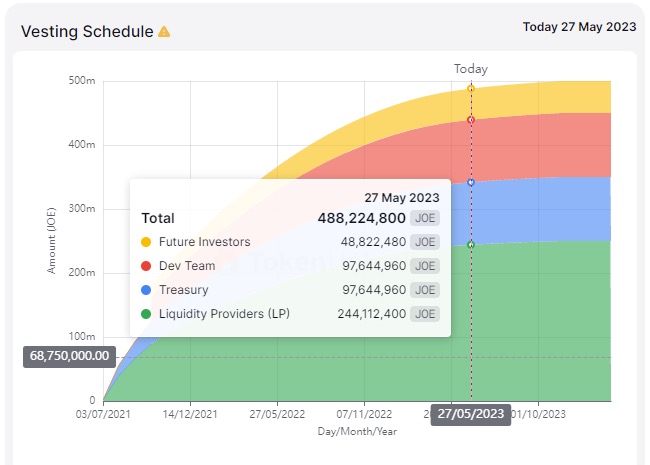

Trader Joe’s utility token, $JOE, has a total supply of 500 million, set to be released over a 30-month period. The token distribution plan earmarks 50% for liquidity providers, 20% each for the treasury and development team, and 10% for strategic investors. As of May 27th, the circulating supply was approximately 488 million.

Interestingly, despite minimal liquidity incentive emission, Trader Joe has maintained profitability for five straight weeks.

To encourage liquidity, Trader Joe has implemented a flexible, phased incentive plan called the “Liquidity Book Rewards Program”. This program rewards liquidity providers based on the fees collected by the liquidity pool during a specific epoch. It features a score-based ranking system and short operational cycles to quickly adapt to market fluctuations. However, to qualify, providers must accrue more than 1% of the total market fees during the epoch.

Trader Joe’s $JOE token serves multiple purposes, with the primary being staking rewards. Tokens can be staked to earn a portion of trading fees, and these can be unstaked at any time. Staking $JOE tokens also allows users to obtain veJOE, which unlocks enhanced $JOE yield. Moreover, staking once facilitated participation in the Launchpad via rJOE, but this mechanism was discontinued in 2023. Additionally, $JOE serves as the project’s governance token, but governance rights are limited.

The overarching design of $JOE’s tokenomics aims to empower $JOE with economic ability, capture the revenues of Trader Joe’s core business, and function as a prerequisite for key operations, while maintaining limited governance rights. Despite attempts in tokenomics and value capture, the team opted for the straightforward staking-for-reward model, avoiding overly complex designs.

Valuation

The valuation of Trader Joe is examined using vertical and horizontal comparisons, focusing on the Price-to-Fees and Price-to-Sales Ratios.

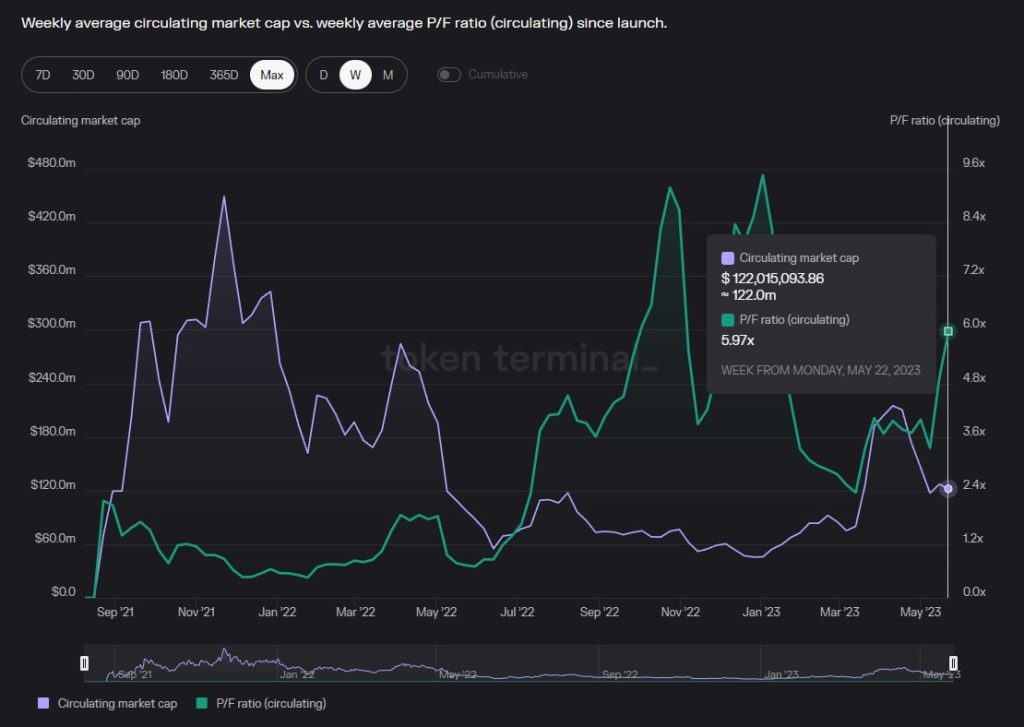

The vertical assessment shows a strong cyclicality in DEXs, similar to traditional financial firms. During bull markets, increased trading activity leads to a decrease in Price-to-Fees and Price-to-Sales ratios, while bear markets see the reverse.

The horizontal comparison is made with similar DEXs: Uniswap, Pancakeswap, Sushiswap, and Quickswap. Current data suggests Trader Joe is receiving a relatively high valuation, potentially due to market optimism about the team’s resilience and innovative capabilities or future development of the LB mechanism.