The “bond market” narrative has been placed high value in the blockchain industry by the market and investors after DeFi Summer. Companies such as Multicoin Capital explored the development model of the “interest rate market” and made investments during that period of time.

However, the well-anticipated on-chain bond market did not explode with relatively low TVL and other indicators spotted, and we did not see an unprecedented booming “bond market” in this cycle. We may wonder:

- Is there an on-chain bond market? Does it even exist?

- What could be the possible development model for the crypto-native bond market?

To answer these questions, it is fundamental to consider the crypto-native risk-free rate on determining the development direction of the bond market, as it is a key attribute of the discount factor of crypto-native assets. And then we would unveil what kind of economic activity in the crypto market may achieve risk-profit balance.

Contents

The Narrative of Public Chain

“How to view public chain” has become a major topic for institutional investors and researchers. “Fat Protocol“, introduced by Joel Monegro from USV in 2016, has taken root and is still considered by many investors as an important starting point for public chain narratives. In 2021, Tascha proposed a “Country Valuation” and questioned stock valuation model while valuing public chains, arguing that currency exchange rate models were more legitimate. In 2022, Jake Brukhman also suggested that blockchain technology, as a new way of human collaboration, is more like a public good, with the potential to achieve profitability.

Public chains provide a series of basic services, and no project based on public chains can exist on its own. From this perspective, I would be more inclined to elevate the narrative of public chains from “company” to “country”. Since public chains are considered as countries, it is necessary to discuss the risk-free rate of a “country”, which would be the cornerstone to pricing the assets of the “country”. When we start from a “country ” narrative, the next step is to define its currency. A country’s currency is, of course, issued by its authorities. It is the token of a public chain that should be recognized as the currency of that chain. For example, ETH for Ethereum, SOL for Solana, and FTM for Fantom.

Potential Risk-Free Rate

Risk-free rates, which do not include credit risk, duration risk, etc., are recognized as short-term Treasury rates, or benchmark interest rates set by the central bank in the real world. If we break down the nominal risk-free rate, we can see that one part of it is price expectation (inflation) and the other part is the growth expectation of the economy (the real interest rate). Taylor’s Rule, a well-known pricing model for the basic interest rate of a Central Bank, also indicates that those are the two factors that influence the risk-free rate. Of course, there are some prerequisites for this rate, such as the relative stability of the country, and regulators are not undermined, etc. A risk-free rate does not mean that there is absolutely no risk.

Now let’s take a look at a few of the major interest rates in the crypto market.

Borrowing Rates of Stablecoins

Some investors may recognize the borrowing rate of stablecoins as the risk-free rate of the crypto market. For example, the borrowing rates of USDC and USDT in Aave and Compound. However, if we think that USDC, USDT, and other stablecoins are directly anchored to USD prices and are not public chain tokens, their borrowing rates cannot be used as risk-free rates for the public chain itself. The price relationship between stablecoins such as USDC and public chains’ tokens is more like the exchange rates of different currencies, the interest rates of two kinds of currencies, and the different interest rate levels between the US dollar and currencies of other countries in an offshore center.

Borrowing Rates of Native Token

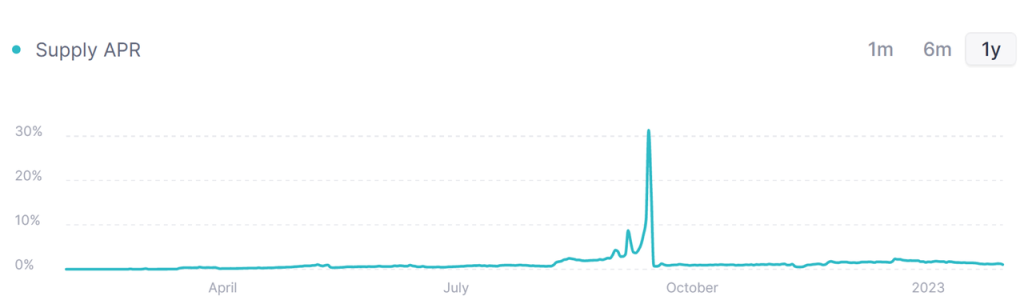

ETH, SOL, and other tokens also have borrowing pools in their borrowing protocols, with very low borrowing rates most of the time. Taking ETH that supplied in Aave as an example, its interest rate is at a relatively low level most of the time.

the high-interest rate in the chart occurred at the moment when ETH 2.0 was successfully upgraded.

However, the borrowing of public chain tokens is subject to default and liquidity risks such as counterparty risk and market risk respectively. Therefore these borrowing rates cannot be used as a benchmark for the “risk-free rate”.

POS/POW Yields of Public Chains

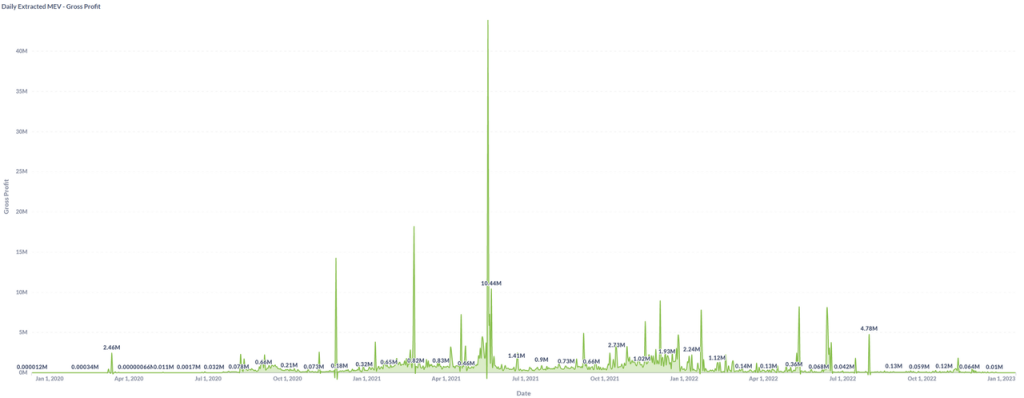

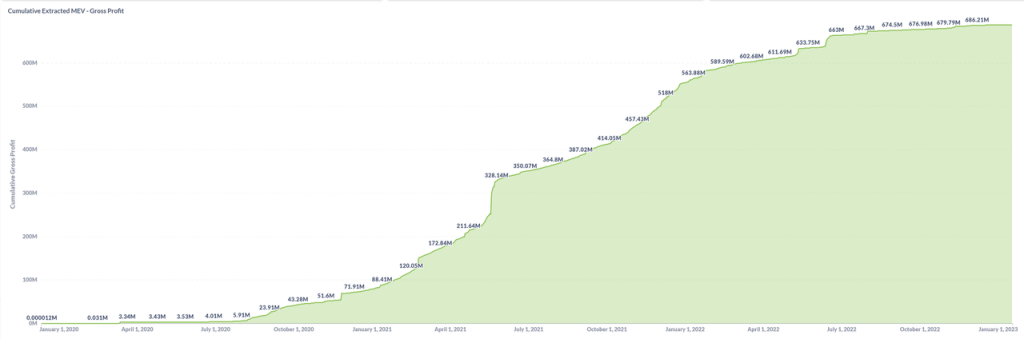

Both POS and POW mechanisms need to provide some rewards for miners/validators in order to keep the chain running properly. This part of yield includes the new issuance of public chain tokens (incentives), i.e. the inflation of the “national currency”, and also pertains to the activity level on the chain. Consider the POS mechanism, the main sources of MEV are arbitrage, liquidation, and sandwich attacks, all of which are related to the level of activity on the chain. As we can see from the daily profit of Ethereum MEV, MEV is higher in a bull market and much lower in a bear market.

Source: https://explore.flashbots.net/

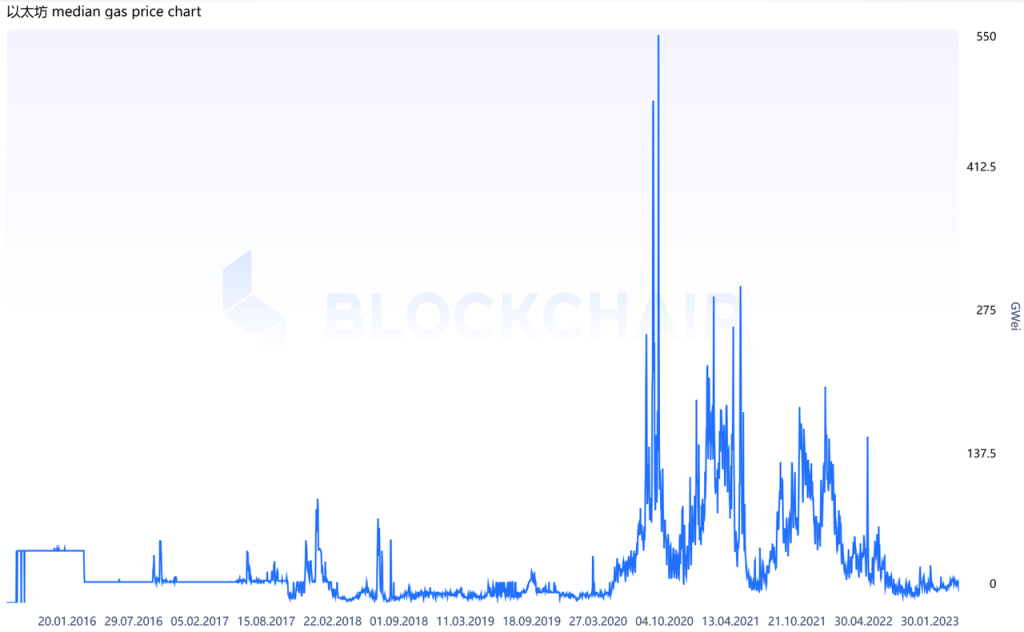

On-chain gas fee, which is another related indicator, also shows corresponding features.

However, from a risk perspective, are POS yields really completely risk-free? No.

To get these profits, you have to take risks of hardware, software (client), network risks, etc., but these are the risks that you have to take to keep the public chain running smoothly. Moreover, POS yields also include potential slashing, which is nevertheless a risk that cannot be avoided when running a public chain.

In general, the profit earned by miners/validators, including the inflation of public chain tokens and the profits from on-chain activity, which are relatively superior than the previous two interest rates. We can draw the conclusion that POS yields are more aligned with “risk-free rate” at the “country” narrative level.

Understanding Interest Rates of Other Tokens

Some people may wonder: “Most of my on-chain transactions are conducted with stablecoins such as USDC, why can’t I use the interest rate of the stablecoin as the risk-free rate”?

First of all, the USDC rate is generated by users’ borrowing behavior, which includes potential default risk and maturity risk. Those risks are mainly generated by users’ on-chain activities, including the possible credit issues of counterparties, which is inconsistent with the fact that the “risk-free rate” only reflects the fundamentals of money supply and economic growth.

Secondly, under the “country” narrative, public chain tokens are used as the local currency of the public chain, and all other tokens should be considered “foreign currencies”. Unlike a country in the traditional sense, where a country can only use its own currency for daily production and business activities with the support of violent institutions.

In the cryptocurrency market, there are no violent institutions and any kind of mechanism to force the usage of public chain tokens as the payment currency for any activity, so the public chain looks more like an extremely open “country” that accepts any tokens as payment instruments. Therefore, other non-public chain tokens such as stablecoins can be considered as “foreign currencies”.

Basic Use of POS Yield

The risk-free rate is a perspective from which to observe the holistic state of “public chain countries”, and real interest rates can assist in recognizing the maturity of the ecosystem and providing some guidance for investment strategies. Now let’s take a look at the POS yields of some public chains, and here we selected public chain projects with a minimum TVL of 100 million USD, POS yields and continuous inflation.

Overall, the more mature the economy is, the lower the interest rate offered by the economy is, which is very similar to that in the real world.

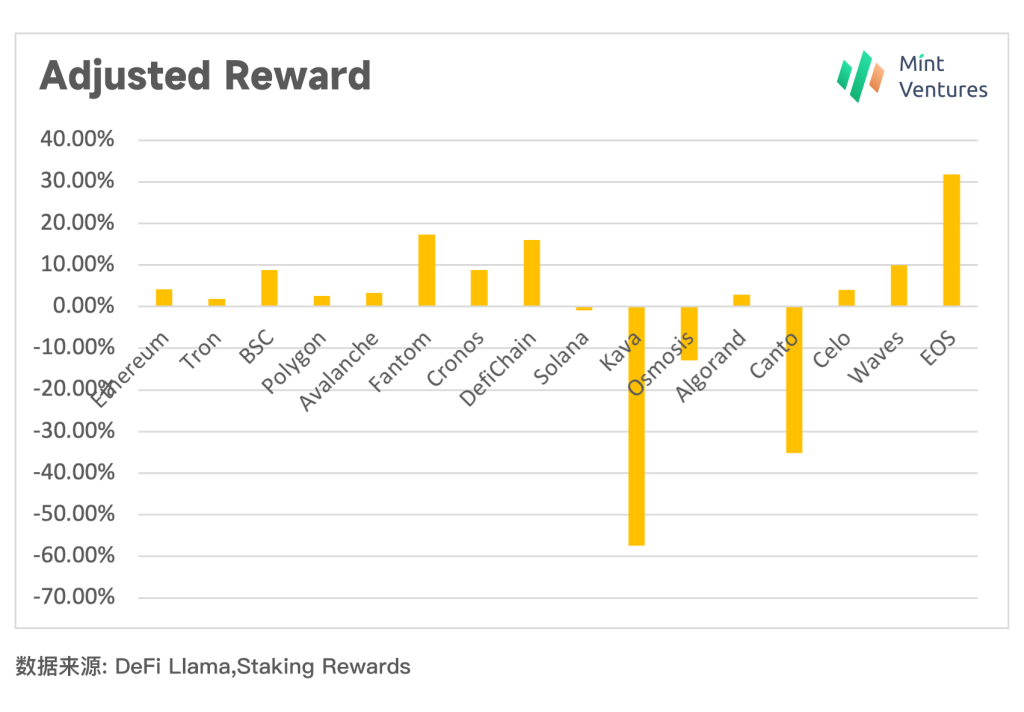

Then, Lets dive into the real interest rate. The real interest rate level of an economy is mainly related to the potential growth rate of the economy, demographics, and asset return divergence. Healthy economies would show positive real interest rates. Then, when mapped to public chains, the “population” can refer to the number of addresses and active addresses, and the “potential growth rate” can refer to the number of transactions, transaction fees, and the growth rate of deployed contracts. Staking Rewards gave an adjusted reward, which was calculated by adjusting the inflation of network supply. The adjusted reward can be used to represent the real interest rate.

The chart below shows that most of the public chain projects are still in a growth trend.

A brief observation of POS yield and TVL rankings is essential for deploying different strategies for public chain investment: a prudent investor shall identify public chain projects with low POS yield and positive actual POS yield as the underlying pool; for aggressive investors, perhaps projects with a higher profit-loss ratio can be found in public chains with high POS yield and negative actual POS yield.

Having discussed the risk-free rate for public chains, let’s tap into applying the risk-free rate in market pricing. Borrowing and bond markets are directly related to the level of interest rates. The lending market is quite prominent, but the bond market has been lukewarm. In the next article, we’ll discuss the status of the bond market, and the future direction of the market.

References

Exploring the Opportunity for DeFi Interest Rate Markets, Multicoin Capita

Fat Protocols, USV

Price layer 1 blockchain tokens like countries, Tascha Labs

Crypto Networks Are Monetizable Public Goods, Jake Brukhman

Determinants of the real interest rate, European Central Bank