As a research analyst and investor covering NFT at work, I was asked many times "What do you think of Blur?" and my answer without hesitation was "Blur changed my NFT trading habits." This is the most outstanding achievement of Blur by virtue of its tokenomics, intuitive UI design, and one-of-a-kind bidding feature by then, which accumulated decent numbers of quality users, creating network effects simultaneously. However, Blur still needs the underlying mechanism or technological innovation in the long run to fundamentally improve the liquidity of NFT, in order to build a more robust moat.. At the end of the day, all investments boil down to an understanding and insight into human nature. Blur's go-to-market strategy and airdrop design remind me of history when WeChat revolutionized our way of communication and interaction, and even changed the way we live from different perspectives. Blur digests user intention very well into its product and still reshaping the original NFT trading paradigm along the way.

In this article, I will be covering opportunities and challenges that Blur may encounter, what we have seen from Web3 entrepreneurship and investment point of view along with in-depth analysis of Blur, then shedding lights on potential opportunities..

Contents

Challenges and Opportunities

$BLUR price implied that the market was very optimistic about Blur even during the bear market, with the FDV much higher than the valuation in its latest unofficially-announced round of financing. The public is anticipating that Blur may overtake OpenSea. However, we spotted that NFT liquidity is still overhanging and Blur may come across challenges as below:

Challenges

Lack of Fundamental Innovations to Resolve NFT Liquidity Other Than Token Incentives

Blur has incentivized NFT liquidity with token models, but without disruptive technical innovations on the protocol level, Blur’s model can be copied or even surpassed by competitors with even more enticing token incentives to initiate a vampire attack. Currently, Blur’s advantage lies in its trader-friendly and intuitive products, capturing users with better UI design, airdrops, and innovative collection bidding features. Yet, the NFT liquidity issue has not been fundamentally resolved, but has slightly improved recently due to the airdrop on the tokenomics level. If a competitor launches a similar product with higher token incentives, faster refreshing speed, more intuitive user interface, and more user-friendly features, we may see a competition similar to SushiSwap and Uniswap.

Recently, Gem V2 has been doing private beta testing. An impression after testing Gem V2 is that it has optimized product design which looks like Blur. The updated Gem V2 can possibly compete with Blur due to a similar information refresh speed, intuitive display, and trait-based offers. The demand for trait-based offers is very clear, especially for Otherdeed with Koda. Many users who would like to buy Otherdeed with Koda have repeatedly asked Blur publicly for that function.

The moat of Web3.0 products is a critical aspect that investors and projects value the most. It may be too early to draw a conclusion about what would be the moat for Blur, the product itself, or the tokenomics. User stickiness has become a big challenge for Web3 products. In an open-source environment, vampire attacks, these potential threats could happen at any time. On the other hand, Projects that can survive the bull and bear markets, such as Curve, Uniswap, Aave, and Compound, have achieved proper product-market-fit, sustainable tokenomics, strong work ethic, and superior risk mitigation protocols, all of which make their product long-lasting in the market. Whether Blur can fully possess the above elements to survive and succeed remains to be seen. The revolution in UI and Tokennomics may be a solid starting point but the “money-printer” model will drain out eventually. Blur may need some fundamental or protocol-level innovations to establish a stronger moat and maintain a long-term advantage.

Risk of Losing Users and Volume Due to Future Parameter Adjustments

The current transaction fee is 0%, and the minimum royalty is 0.5% for certain NFT collections. This rule seems to be an interim growth strategy, and it is impossible for the protocol to maintain a 0% transaction fee for good. In the future, if Blur wants to support more NFT creators and communities, flexible royalty policies might also be lifted. All these adjustments may fundamentally increase the transaction costs for traders and increase the friction in the NFT market. When the cost increases, users will likely choose a marketplace with a lower cost. Blur may lose some competitive advantage, especially when token incentives come to the end.

Changes In the Competitive Landscape After the Token Subsidy Ends

Some Web3 projects may encounter the fact that token issuance is limited, and token incentives will be drained eventually . If the money-printer model continues, it will also bring a large amount of selling pressure to tokens. Blur will also have a day when airdrops no longer continue. All things being the same, it is expected that NFT liquidity will decrease when the airdrop stops, and the market will start to question whether Blur can compete with OpenSea, thereby reducing expectations and valuation. The sustainability of the token incentives model will also be one of the potential risks of Blur.

Overly High Expectations for the Season 2 Airdrop

Season 1 airdrop was very rewarding to NFT communities, users and KOLs. High public sentiment has been boosting the awareness and confidence of the project, which will directly reflect in the token price. However, we found that Season 2 airdrop allocation only consists of 10% of all token issuance, less than that in Season 1 (12%). The hype created by Season 1 may bring more participants (users, bots, communities, etc) in Season 2. According to the official documentation of Blur, Season 2 airdrop token is likely to be circulating by 2023 Q4(Subject to change). When there are more users competing for airdrops over a likely longer period than Season 1, users may have some disappointments in terms of token amount in Season 2. Furthermore, it may lead to greater market FUD and shake the confidence of users and token holders, if the token price shows a downward trend due to the expectation of a large amount of airdrop selling at the time of unlocking.

Weak Ability in Token to Capture Protocol Value

Currently, the value of $BLUR lies only in protocol governance and voting rights without any protocol revenue-sharing mechanism. The protocol has not yet generated any revenue so far but is subject to change later under community proposal and governance. The “F-Switch” on the roadmap also implies a “fee switch” idea similar to that in Uniswap context. If the protocol revenue is collected in the future and revenue sharing with token holders takes place, the value captured by the token will be strengthened. Protocol may see business growth and governance participation by NFT projects, communities, users, KOLs as they will be more willing to hold $BLUR by then. In that case, Blur will have much better prospects in the long run.

Opportunities

Improvements in the Macroenvironment and NFT Market

The market capitalization and trading volume of NFTs are currently concentrated on Ethereum and are highly correlated with the overall cryptocurrency market. As the cryptocurrency market slowly recovers from the bear market, the NFT market is expected to have an upward trend as well. Despite the high volatility and unclear prospects before the bull market comes, the resilience of blue-chip NFT projects has been proven during the roller coaster market last year and has become more robust after various crises in 2022. Yuga Labs and other blue-chip projects are expected to bring new narratives such as metaverse and construct more utilities around PFPs.

According to NFTGo’s NFT Annual Report 2023, the total number of NFT traders on Ethereum in 2022 was 1.87 million, and the data from Dune@sixdegree showed that the number of active addresses on Ethereum was 48.16 million, more than 25 times the number of NFT traders. During the bear market, Blur’s airdrop and TGE attracted many users out of the NFT niche to trade NFTs and $BLUR tokens. A lot of attention has also been put on the marketplace to beat OpenSea. If Blur continues to maintain its leading position in the industry, $BLUR’s valuation will likely be lifted when the bull market comes.

Leading Position in the NFT Race Helps Business Expansion

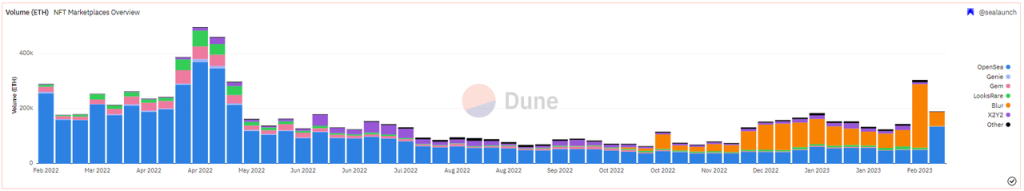

Since the public launch of Blur at the end of October 2022, the cumulative trading volume has surpassed that of major marketplaces such as OpenSea, X2Y2, and LooksRare. The token airdrop in Season 2 is expected to continue to stimulate NFT trading volume on the Blur. When users get used to trading on Blur as a routine, NFT pro-traders and whales are more likely to be retained as loyal customers after token incentives end.

From Blur roadmap, the team would love to expand business horizontally into the ERC1155 assets, open up the fee switch (F-Switch), and initiate and support Liquidity Projects. The roadmap suggests that Blur will further expand its business vertically in the NFT ecosystem, revealing Blur’s ambition to become a one-stop-shop as a key NFT infrastructure (This is the author’s interpretation of the Blur roadmap and does not represent Blur team ideas). There is also a form for applying for NFT APIs on the official website. As far as I know, many NFT protocols and products are waiting for Blur API to retrieve and push data in order to have better NFT price feed, and more efficient liquidation.

OpenSea recently lowered its trading fees and changed the rules of its flexible royalties, making the market validate the threat Blur poses to OpenSea. In general, OpenSea is more like a “multi-chain NFT supermarket” where many NFT projects choose to launch in the first place due to the high traffic. NFT novices would find it handy to enter NFT space and get to know different categories of NFTs. Blur is positioned as an “NFT professional trading tool” that focuses on serving NFT veterans including pro-traders, whales, market makers, and flippers. The different positioning has resulted in OpenSea, which has the largest number of traders, but the overall proportion of secondary NFT trading volume is lower than Blur. After the Season 2 airdrop ends, the trading volume and the number of traders on the two platforms will tell the result of the competition between the two.

Various Business Growth Points and Potential Catalysts Driven by Tokenomics

Blur is an NFT marketplace with tokenomic. This would be the most fundamental distinction from OpenSea. Chirs Dixon (a16z partner) and Fred Ehrsam (Paradigm founder) mentioned in a podcast in 2017 that cryptocurrencies are potentially a universal solution to bootstrap problem. When a new platform does not have enough network value, tokens can be used to incentive early users, and then the value of the token incentives will gradually narrow as network value grows. This is also why Blur can surpass OpenSea in such a short period of time. The NFT marketplace embedded with a tokenomics allows each participant, including core contributors, NFT communities, users, market makers, to receive token incentives and potentially share the network effect dividends generated by the product created by themselves. Token incentives will continue for a period of time as the Season 2 airdrop event goes on. The network effects that Blur gradually accumulates will enhance user trust, thereby generating a positive cycle of the business flywheel.

From a detailed perspective, the tokenomic of $BLUR enables open options for DAO governance of all parties holding $BLUR. In the governance mechanism, Blur has set up three committees to coordinate the governance process. The Incentive Committee is responsible for managing the incentives that the protocol gives to the community. It also proposes that if the current incentive budget is used up (12% of the token airdrop in the first quarter, 10% of the token airdrop in the second quarter), more incentive allocation can be obtained through governance (the remaining 39% of the community token).

Founder @PacmanBluronce mentioned his opinions on the value capture ability of tokens in an interview, which is product growth should be prioritized and a good product could always find a way to capture value for its token holders. Discussions on the market about Blur’s adoption of the Voting Escrow model for better value capture ability of $BLUR emerged. We also spotted that Blur tends to develop the veToken model (but the specific progress is unknown). In the future, if $BLUR captures the protocol revenue (if any), while the protocol still remains in the leading position among NFT marketplaces, the token valuation will be lifted due to a better tokenomic mechanism.

Some Thoughts Provoked by Blur Boom

About Web3 Entrepreneurship

Blur demonstrates the team’s deep understanding of the pain points in the NFT market and users’ real needs. Blur’s seamless product design has attracted a large number of quality NFT traders and whale users. Its well-designed airdrop events even appealed to non-NFT crypto users. The continuous airdrop expectations and feature updates constantly indicate Blur’s ambition to further cultivate user habits and disrupt the conventional NFT marketplace competition landscape.

A Clear Understanding of User Intention, Creating Products that Truly Solve Pain Points

Blur officially launched on October 19, 2022, and has since received rave reviews. In addition to the airdrop expectations, Blur’s killer feature is speed, 0% transaction fees (which may be raised later), and a one-of-a-kind collection bidding function. The simple but thoughtful features have improved the efficiency of the NFT trading to the next level. The combination of refreshing speed, explicit information display, and well-planned airdrop events has made Blur’s opponents seem that they have never truly understood NFT users and the market.

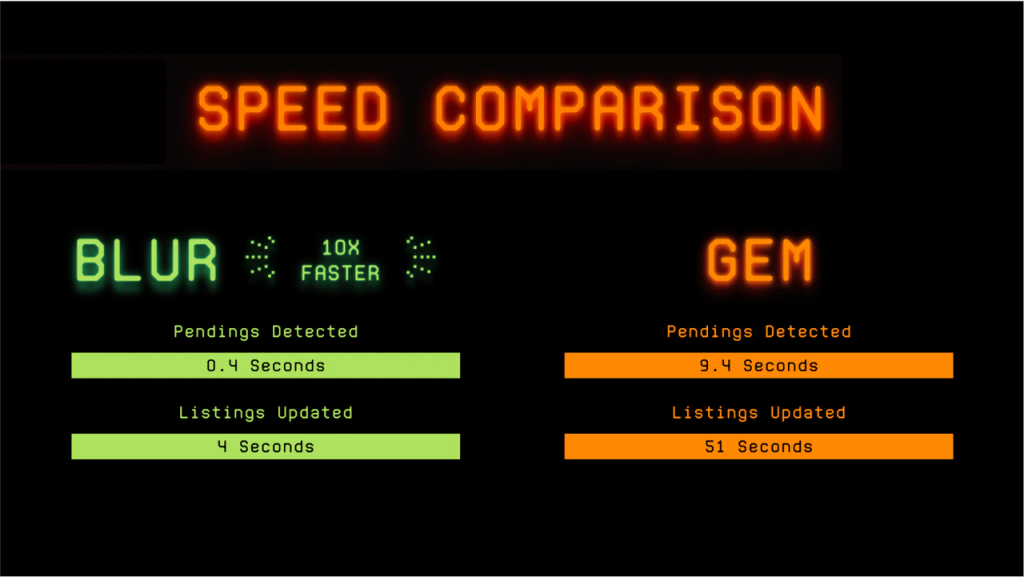

- Speed: Blur’s speed advantage is mainly reflected in the UI interface’s refreshing rate for (1) pending transactions and (2) listing information. The simple function is Blur’s killer move that allows it to stand out in crowded NFT marketplaces.

This seemingly ordinary feature is game-changing for pro traders, and it is also the key to attracting users for Blur. In the FT token trading market, the speed of price updates is no longer sensitive to users because we assume that the data update speeds of various exchanges are similar and do not cause significant arbitrage differences. However, in the NFT trading market, users had to accept slow quote information from several conventional marketplaces.

Michael Lewis’s “Flash Boys” describes how Wall Street’s high-frequency traders spare no expense to lay fiber-optic lines for the extremely high level of information transmission speed. The importance of speed to trading profitability is self-evident in traditional finance. Although ordinary NFT trading has not yet developed to the phase of high-frequency trading, NFT MEV and NFT robots have already proven that information flow speed can create enormous value. Therefore, when Blur emerged with the fastest information flow speed, it brought a trading experience that crushed other platforms to users (especially professional users with strong demand for sweeping NFTs). NFT flippers and whales quickly and naturally switched their trading marketplace from others to Blur and gave positive feedback on Twitter. Blur is considered as one of the few first platforms that truly recognize the importance of information flow speed for NFT trading, and therefore quickly wins the market.

- Cost: Blur has been trying its best to provide users with an environment with the lowest transaction cost. Reducing costs is one of the most direct ways to solve liquidity problems. Transaction fees, royalties, gas fees, and the price of NFTs themselves constitute the main costs for traders. Users are highly sensitive to transaction costs, and the market will switch to the platform with the lowest cost quickly. This article only discusses transaction fees and royalties.

- Transaction fees (currently 0%) Since its launch, Blur has been applying 0% transaction fees, which is a powerful blow to OpenSea’s 2.5%, X2Y2’s 0.5%, LooksRare’s 2%, and SudoSwap’s 0.5% transaction fees. For sellers, they can transfer the fees to buyers through the NFT’s price, but reducing transaction fees itself plays a role in promoting transactions and bringing buyers and sellers closer together. In the future, Blur may increase transaction fees under community governance, but it still maintains this level in the short term.

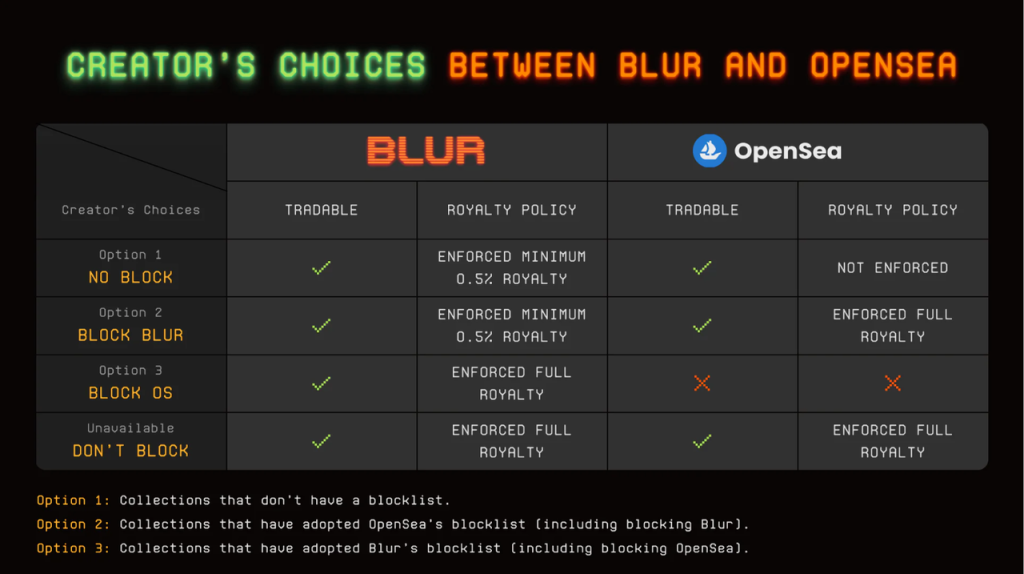

- Royalties (initially 0% at minimum, later adjusted to 0.5% at minimum) Blur did not enforce creator royalties when Blur was publicly launched in October 2022. Sellers could set the minimum royalties to 0% or follow the original creator royalty plan, but Blur explicitly encourages traders who pay 0.5% royalties with more airdrops. In other words, Blur supports creators but also knows that reducing royalties is a key point in boosting transactions. Later, Blur adjusted the royalty rules to a minimum of 0.5%. Although the threshold has risen, it has not caused as much controversy in the community as when X2Y2 changed its royalty rules back and forth. After the token launch, Blur quickly announced new royalty rules to counter a series of “sanction” policies implemented by OpenSea against Blur from the perspective of attracting creators.

Background on OpenSea’s sanction policy:

In November 2022, OpenSea launched Operator Filter Registry tool, blacklisting many non-royalty-enforced NFT marketplaces including Blur. NFT creators can choose to use this tool to block transactions on platforms that do not enforce royalties. However, the benefit is that OpenSea will enforce royalties on NFT collections that use this tool. NFT collections that do not adopt this blacklist can be traded on multiple trading markets, but OpenSea will not enforce royalties on buyers. This measure has put many creators in a dilemma. If they choose OpenSea’s blacklist, they are guaranteed a share of royalty income but sacrifice the liquidity of their NFT on trading markets like Blur and X2Y2. If they choose the liquidity of multiple platforms, they have to sacrifice some of their royalty income.

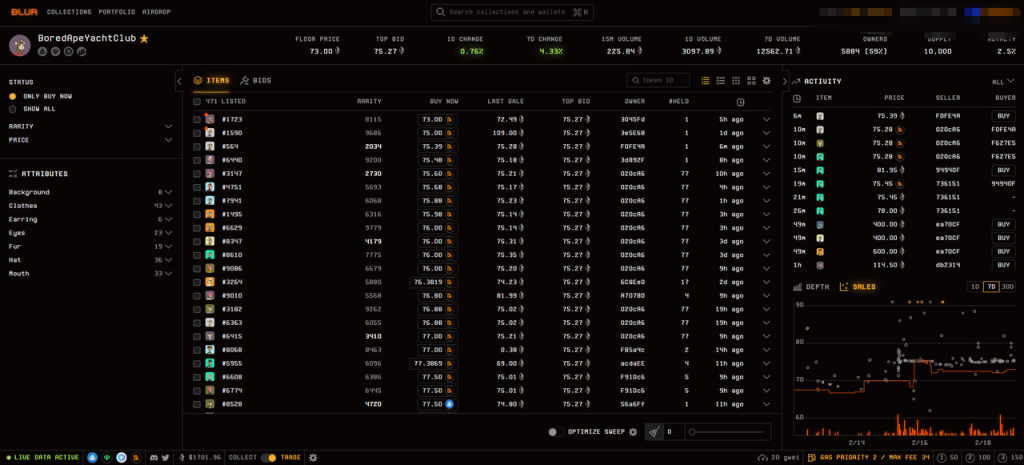

- UI Display: Blur provides NFT users with comprehensive trading information, reducing the time cost of switching between different marketplaces and data analytics platforms, and enhancing user experience. The refined optimization of the data dashboard facilitates faster NFT trading decisions, which is conducive to increasing trading frequency.

According to NFTGo’s recently-released NFT Annual Report 2023, the trading habits of professional NFT traders have changed over time. Users used to discover projects on social media and then complete transactions on OpenSea, but now they discover projects and trade on marketplaces and aggregators after conducting some research on data analytics platforms.

Blur’s UI interface is similar to Bloomberg and provides NFT traders with multidimensional trading information, including historical trading trends, trading depth, bidding information, and basic information about the NFT collection, including total issuance, royalties, and holder distribution. The explicit UI interface eliminates the need for traders to pull up information from other marketplaces and data analytics dashboards multiple times, and avoids the need to jump to multiple web pages to obtain the information prior to making trading decisions. In a nutshell, Blur’s UI design reflects the team’s meticulous comprehension of NFT traders.

In comparison, Gem and Genie, also NFT aggregators, are far behind in product design. Traders still need to jump to multiple web pages to obtain data and information. Although they seem to provide more comprehensive information, information redundancy slows down the decision-making process and reduces the trading frequency. Gem’s interface directly integrates Dune Analytics’ data display and Bubblemaps’ holder address mapping function. While the data is comprehensive, it lacks the intuitiveness and relies entirely on third parties for data accuracy. In contrast, Blur provides limited information and data, but focuses on key information for NFT trading, making the information more intuitive and readable. Blur’s team’s understanding of NFT traders’ trading habits and industry pain points are reflected in their proactive product design.

Blur aims to continuously change the trading paradigm of the NFT industry, which can be discovered from its UI optimization over competitors. The current UI design simplifies the user’s trading process, but its business layout currently focuses on the secondary trading of NFTs. NFT novice users will likely land on OpenSea as their first stop to enter the NFT world, as OpenSea has the advantages of being more NFT novice-friendly, displaying multi-chain, and multi-category NFTs. On February 17, 2023, Blur updated and added the “Trending” dashboard function, providing users with the recent popular NFT projects on Blur, and including trading signals that are more frontline and early-stage in the display scope.

Blur is moving forward to becoming a one-stop-shop platform and expanding its business vertically and horizontally as it continuously increases its user base. After accumulating a large number of users in the protocol, and user habits gradually forming, Blur will have a better position to grow different businesses.

- Collection Bidding: In addition to having features such as sweeping and bulk listing that are common on other platforms, Blur has also won the favor of many professional NFT traders with its collection bidding feature. The bidding feature on other trading platforms is only available for individual NFTs or simply not available at all. Before the collection bidding feature existed, only the listing information is transparent, public, and clear in the market. Yet, none marketplace or aggregators had a clear display for the bidding or offering price list for a particular NFT collection. Blur’s collection bidding feature fills in this critical gap. When designing this feature, Blur also launched stolen NFT protection to prevent stolen NFTs from being bought through bidding. The Bid feature allows users to directly bid with ETH, eliminating the cumbersome process of exchanging ETH for WETH on some platforms and further saving users’ transaction time.

By Positioning Its Product in A Niche Market, Blur has Actually Gained Hot NFT Money and Active NFT Users

With a coding-style UI interface that resembles Bloomberg, Blur’s pro-trader-friendly feature is very distinctive. This is also related to its initial product positioning in serving the niche market of NFT professional traders and flippers. In the NFT industry, a pattern has already emerged, with blue-chip PFP assets on Ethereum as the mainstream assets and a large number of longtail NFT assets.

Over the years, a group of experienced NFT traders, flippers, and market makers have gradually taken NFT trading and flipping as a serious business. Although this group of people is not the main driver behind NFT “mass adoption” thesis, they control a large number of blue-chip assets, with professional experience in NFT trading/flipping, and are the most active NFT liquidity providers. By serving the need of these active professional users, Blur has attracted lots of assets that are willing to join NFT trading. The NFT user market is difficult to cater to, and Blur has not chosen a simple and cute UI design that is more friendly to new and inexperienced users. Instead, it has chosen a coding-style interface and entered the professional-level market, capturing more active, high-value trading users with larger fund sizes and more liquidity resources. As the user base grows later on, new users are also expected to gradually transform into high-level players.

For NFT whales, NFT flippers, active traders, NFT funds, and market makers, there has always been a lack of a one-stop-shop tool. Blur solved this pain point to some extent for professional players. The UI design and bidding feature have brought a brand new user experience and has received excellent word-of-mouth effects within the community.

Growth-First Strategy to Quickly Attract Users

Founder @PacmanBlur mentioned in a public interview that Blur values early user growth and building a product that brings real value to users, and the 0% marketplace fee is the strategy to grow fast in the early days. A good product doesn’t need to worry about a long-term business model and monetization strategy once it establishes a strong position in the market.

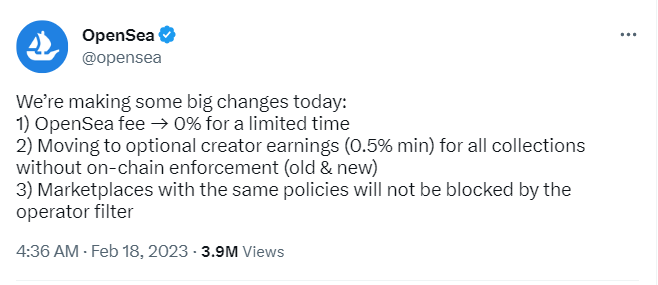

On February 18th, 2023, OpenSea announced a policy of implementing a 0% transaction fee for a short period of time, while adopting an optional royalty policy for all NFT collections (previously only for new NFT collections), with a minimum royalty level of 0.5% (consistent with Blur’s minimum royalty threshold) and canceling the blacklist tool for Blur. This movement can prove that OpenSea has felt the enormous threat posed by Blur and has to adopt lower fees and more flexible royalty policies to fight back. (Note: NFT collections that have adopted on-chain mandatory royalty collection do not apply to the optional royalty policy.)

The Continuous Airdrop Events and the Pace of New Product Feature Launches are Perfectly Aligned, Which Keeps Users and the Market Fixated

The whole marketing strategy before Token Generation Event is also worth noticing. The “airdrop culture” has always been able to attract more traffic and attention, but some projects may struggle with exploiting it properly. Blur is a relatively successful case of using airdrops as an effective tool and maximizing their value.

- Clear Instructions: Season 1 airdrop before TGE was divided into three rounds, gradually “training” users to use the Blur platform. The first round of Season 1 airdrop was given to users who participated in the closed beta testing. The second round of Season 1 airdrop was an incentive for users who listed NFTs. The third round of Season 1 airdrop incentivize uses who bid close to the floor prices. Except for the first round, which was announced after the end of closed beta phase, round 2 and 3 airdrop rules were announced at the beginning, giving clear instructions to users and helping strengthen user habits on listing and bidding. For users who usually blindly participate in airdrop campaigns, this approach provides greater certainty and clearer instructions, which cultivates user habits and allows users to “earn what they work for”.

- Progression: Each of the three rounds of airdrops in the Season 1 was larger than the previous one (Round 2 was 1-2 times the size of Round1, and Round 3 was 10 times the size of Round 2), providing more incentives for users who joined later. In addition, when Blur announced the third round of airdrops, it also launched the one-of-a-kind “Collection Bidding” function, which gave the most rewards to users who used this function, using airdrop incentives for the promotion of new product features and the strengthening of user habits. The “Collection Bidding” function filled a gap in the market, and the team’s operational ingenuity made it natural and smooth to promote the new feature.

However, duplicating their tactics on airdrops may not be a universal solution for all Web3 projects. The success of Blur’s operation and marketing strategy lies in the team’s deep understanding of the airdrop culture in crypto. The airdrop was utilized to its most by Blur team with a good rhythm to promote new features.

The Token Economics Reflect the Team’s Long-term Goal of Building the Project and Their Vision for Decentralized Governance

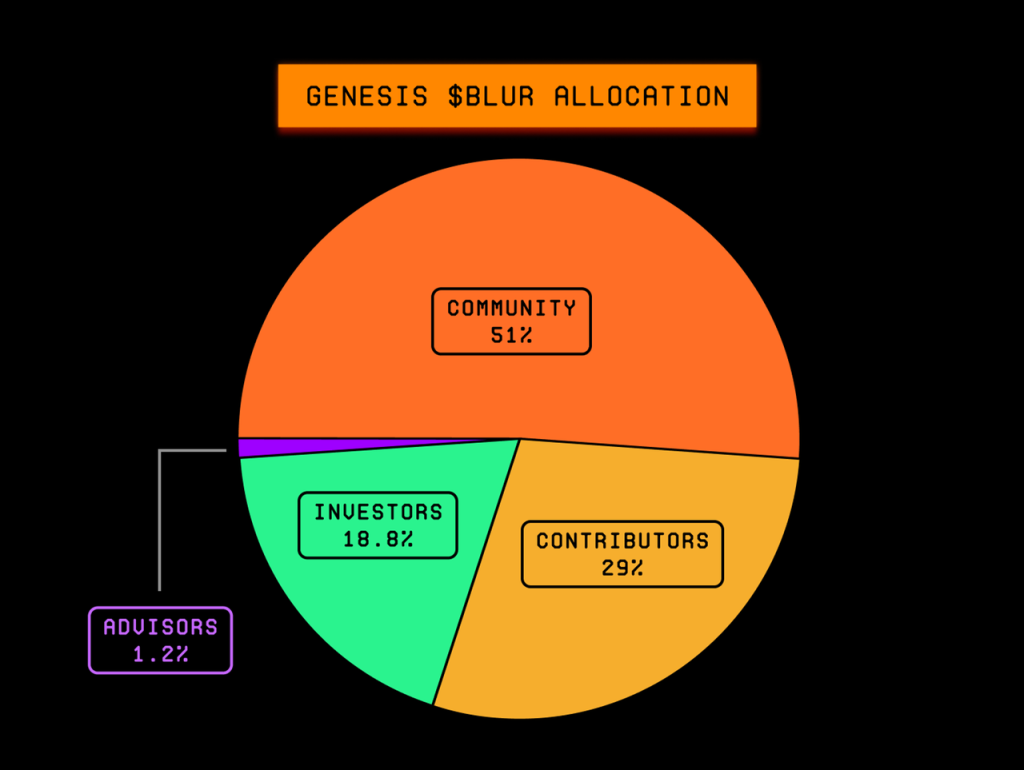

Founder @PacmanBlur has mentioned multiple times on Twitter Spaces and interviews that the tokenomics of Blur were designed in collaboration with their investor Paradigm, and was inspired by various DeFi projects, including Uniswap, GMX, and dYdX. From the tokenomics document, it is evident that the team understands the token to be a bridge connecting the community, with the majority of tokens (51%) ultimately being distributed to community participants, as follows:

🎉51% Blur community members = 12% for the Season 1 airdrop + 10% for the Season 2 airdrop + 29% for other community projects/incentives, etc.

The team places great emphasis on decentralized community participation in the protocol’s future governance. The tokenomics also provide ample incentive space for NFT creators, which is beneficial for attracting NFT creators and communities during the protocol’s period.

From Web3.0 Investment Perspective

What Web3.0 Most Urgently Needs to “Mass Adopt” is Not Crypto Users, But Entrepreneurs and Developers

NFT was born in 2017 when Dieter Shirley, the founder of CryptoKitties, put forward the concept of non-fungible tokens (NFT) to differentiate CryptoKitties from ERC20 in the market. In 2018, OpenSea was established, followed by Gem at the end of 2021, and X2Y2 and LooksRare were born in 2022. The market capitalization of NFT reached its highest level of 34.6 billion US dollars in May 2022.

However, the most basic bidding information aggregation and display was not introduced to the market until the fourth quarter of 2022 by Blur. This made me realize, as someone on the cryptocurrency investment side, that there are too few outstanding entrepreneurs and real builders in the industry. What we most urgently needed for “Mass Adoption” is excellent entrepreneurs and developers, and then users.

Recently, the founder of Blur doxxed on Twitter and publicly shared his past experiences. According to various interviews and public information, we learned that @PacmanBlur has an engineering education background. In 2016, he started his first business, which became one of the projects in 2016 winter batch of Y Combinator. During his study of mathematics and computer science at MIT, he met the person who became the other co-founder of Blur. In 2018, while they were still studying at MIT, the two started their own business together, and successfully sold the company in 2021. Quickly after selling their previous business, the two started working on Blur. @PacmanBlur himself became fascinated with NFT trading in 2021 as a user, but felt that the market lacked good infrastructure. This is where the idea of Blur came from. The team at Blur includes 7 engineers who previously worked at Citadel, Five Rings, and Twitch, and 1 designer from Square and Brex.

Overall, the Blur team has experience in trading companies in the traditional financial industry, product developing experience in well-established streaming platforms, and design experience from well-known companies. These lay a good foundation for Blur to launch products that later become popular among users. The past entrepreneurship and cooperation experiences of the two founders have also laid a solid foundation for their cooperation again.

Products that Solve Real Pain Points are Not Afraid of Red-ocean Competition

The Blur team was established in January 2022, began product internal testing in May 2022, started a public beta test in October, and launched the project about a year after the team was formed. The product development pace is not considered very fast in the cryptocurrency industry, but it can be seen that the team had a clear product vision from the beginning, and has always maintained a rhythm of developing products and launching new features in the bear market environment. Although there were many NFT marketplaces that had already taken the lead before the launch of Blur, industry pain points have always existed and have not yet been truly solved by any existing competitors. For a startup team, competition in the industry is one aspect that needs to be considered, but according to the first principles, the focus should be on solving industry pain points. If the product is able to provide a solid solution to solving the real pain points, it will revolutionize and establish a new norm for the entire industry.

Achieving success requires things to be favorable in terms of timing, geographical conditions, and people. Blur did not launch its product during the perfect timing (in a bear market), and even did not wait until the bull market to launch tokens. However, seeing from the results, Blur has already achieved a milestone victory, and has even become a project that creates its own narrative during the bear market period. However, with the market conditions, there may not be a huge difference for a good product that solves problems, but for ordinary projects, the situations under different market conditions can vary. The confidence and perseverance in building products under all kinds of market conditions are common in all successful startup teams I know.

Team’s Understanding and Vision of the Industry Determines the Product’s Potential

- The collection bidding feature fills in the gap in market information. Blur’s collection bidding feature is a key function that enhances liquidity and fills a huge information gap in the NFT market. Previously, NFT traders faced the problem of clear listing information (supply) but unclear bidding and offering aggregation display (demand). Users could not have a clear picture of the demand in the market on a certain NFT collection, just like FT or stock traders could only see selling orders but not the bidding offers. Blur’s collection bidding feature may not be innovative, but it provides users with an intuitive and clear view of bidding offers for a certain collection, implicitly making non-fungible tokens fungible. When the information gap is filled, users’ desire to trade is greatly enhanced. This feature also greatly facilitates NFT pro-traders, whales, flippers, and market-makers’ strategies.

- Token incentives for “liquidity,” not “trading volume”. In several Twitter Spaces and interviews, @PacmanBlur mentioned that the difference between Blur tokenomics and that of some other marketplaces is that it incentivizes “liquidity” rather than “trading volume,” which often leads to incentives for wash trades. As an NFT marketplace, the definition of decent NFT liquidity means NFT users can sell their inventories quickly and buyers can make the purchase quickly. Blur’s solution is to incentivize listings and biddings that are close to floor prices, i.e., those that help “match buy and sell orders” in the market. The airdrop rules encourage users to concentrate their funds on the buy and sell orders close to floor prices and when the price fluctuates a little, transactions will occur naturally and swiftly. There comes the liquidity. The liquidity incentives will ultimately be converted to higher trading volume, but it is obviously more “organic” than directly incentivizing that.

- Growth first, monetization later. When asked about the protocol’s 0% trading fee and zero revenue for now, @PacmanBlur‘s response was that the project focuses more on user growth and product development in the early stages, similar to Alibaba’s early strategies, when medium and small businesses benefited a lot from low marketplace fee. After the project secures a better competitive advantage, monetization will come naturally. The founder’s “growth first, monetization later” strategy may not apply to all startup projects and teams, but it shows their patience and confidence in building projects for the long term.

Investment is a Process of Mutual Selection and Growing Together

One of the reasons why many people are optimistic about Blur is the impressive background of its investors, including Paradigm. However, I believe that the combination is a result of “mutual selection” and “growing together”. The team’s vision of prioritizing growth over revenue aligned with Paradigm’s investment thesis. Furthermore, Blur also collaborated with Paradigm on designing tokenomics so that they could draw some pearls of wisdom from their team on other projects such as Uniswap. Both excellent teams play to their strengths, help each other grow and thrive, and bring value to each other, which is a process worth considering and learning from for all entrepreneurs and investors.

There are often two scenarios for web3.0 startups in the fundraising process: (1) well-known crypto funds compete against each other for a larger share; (2) no investor is interested and fundraising lasts for months. I believe there’s no “right choice” in investment but the “fit choice” at the moment of decision-making. In a market with asymmetric and insufficient information, investors and startups need to have a clear understanding of the value they can bring to the industry and to each other. For investors, it is important to identify the segments to invest in where they have the most resources or know-how, and keep enhancing the additional value they can bring to entrepreneurs such as research publications, strategy consulting, or tokenomics design experience. For entrepreneurs, each penny of financing brings different leverage effects. Choosing investors who share the same vision can avoid many unnecessary debates along the long road of entrepreneurship.

Upon some reflection on our post-investment deals, I found there is still room for improvement at work. The overall workforce in the cryptocurrency industry is young, and it is difficult to say whether the entrepreneurs or investors have more experience and knowledge. Regardless of past experience, entrepreneurs and investors should have long-term faith in the industry and always think independently in such a noisy environment. The market will not let down anyone who works hard in the right direction.

Some Potential Investment Opportunities Around Blur

Token Investment

The current circulating market capitalization of $BLUR token is around 300 million USD (as of March 1, 2023, with a circulation rate of approximately 13%), and the fully diluted valuation (FDV) is around $2.5 billion. According to our valuation of Blur, $BLUR currently is overvalued and has high expectations for the future of the project. Token investors need to take various risks and challenges that Blur faces and the macroenvironment into consideration.

NFT Investment

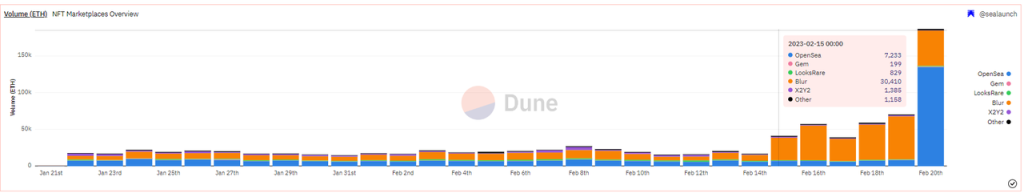

Since the launch of Blur in October last year, the NFT market has seen a boost in trading volume. Increased liquidity has made traders more willing to make transactions. On February 14, when Blur unlocked Season 1 token airdrops, it also announced Season 2 airdrop rules. NFT traders are actively participating in the airdrop events, as can be seen from the trading volume on February 15 and afterward. It is expected that during Season 2, the NFT trading volume will maintain heat.

More advanced NFT trading strategies involve using some NFT-Fi tools for leverage and risk hedging. NFTPerp, NFEX, Tribe3, and more are famous brands in NFT futures segment. Some NFT traders will frequently place orders or collection bids near the floor price to get more airdrops, and futures contracts can help hedge against the risks. Traders can also leverage their NFT position a bit using futures tools.

Having said that, many NFT-Fi protocols are still in their early stages and will also charge a certain cost. As the NFT market matures, market-making businesses are also gradually emerging. There are also situations in the NFT market where large holders manipulate prices, causing other traders to take bids they put for airdrops. Investors should be aware of this type of risk (this article is not intended as investment advice).

Blur and Paradigm Ecosystem Collaboration

Blur’s success and NFT liquidity can also benefit its partners and investors. In late October 2022, when Blur just launched, Paradigm and Justin Roiland’s social experiment project Art Gobblers started the free mint event. The floor price once soared to 14 ETH and higher. Blur’s investors and KOLs who helped promote Blur can directly participate in free mint and benefit from it. We can tell that Paradigm and Blur have a close relationship, and there may be more synergies between Blur and other projects in Paradigm ecosystem, including multiple DeFi, NFT, public chains, and MEV projects. Blur also has announced partnerships including Protecc, an NFT market-maker. As one of the partners and key community members, Protecc is likely to play a key role in providing liquidity on Blur.

Conclusion

Blur has a team that aims to resolve industry pain points and build a sustainable project. With the long-term vision of Paradigm and professional knowledge of tokenomics, Blur is changing the NFT trading paradigm and reshaping the NFT market.

Sources

- Blur Mirror

- Blur Official Website

- Blur Escalates Royalty Battle With OpenSea, Recommends Blocking Platform – CoinDesk

- OpenSea Launches First Royalty Enforcement Tool Amid NFT Marketplace Drama – CoinDesk

- @pandajackson42’s tweet about Blur

- Blur Tokenomics Interpretation – @jessicaxyshen

- Blur – the NFT marketplace for pro traders | Interview with Pacman | Token Terminal

- Blur Tokenomics

- NFT Market Overview – NFTGo

- NFT Marketplace Dune Dashboard by SeaLaunch

- Blur Airdrop & Roadmap

- Blur Rugs OpenSea – Web3 Academy

- Blur Github

- @0xPrismatic’s tweet about Blur and OpenSea

- Delphi Digital’s tweet about Blur

- 0xKofi’s tweet about Blur

- Chinese Transcript of the a16z podcast by Chris Dixon and Fred Ehrsam in 2017

Acknowledgments

Special thanks to @xuxiaopengmint@fanyayun for the suggestions on the article. I also really appreciate the discussion about the moat in general, NFT marketplaces, tokenomics in web3.0 with @MasterXDai. Thank @BTCdayu for correcting the Season 2 airdrop unlocking period estimation.