Unless otherwise noted, data in this report is as of September 15, 2025.

Contents

1. Research Summary

Key Takeaways on Circle’s Valuation and Investment Outlook:

- A Scarce Investment Opportunity in the Stablecoin Sector: Circle operates within the stablecoin industry, which is currently in a phase of rapid expansion. The gradual clarification of the U.S. regulatory framework has further solidified the long-term certainty for the industry’s development, attracting accelerated entry and strategic positioning from multiple industry giants. While this intensified competition poses certain pressures on Circle, it also validates the market’s recognition of the stablecoin sector’s enduring value. Circle currently secures the second-largest share of the stablecoin market and is the only publicly investable entity in this space. This scarcity is a critical factor in investment decision-making.

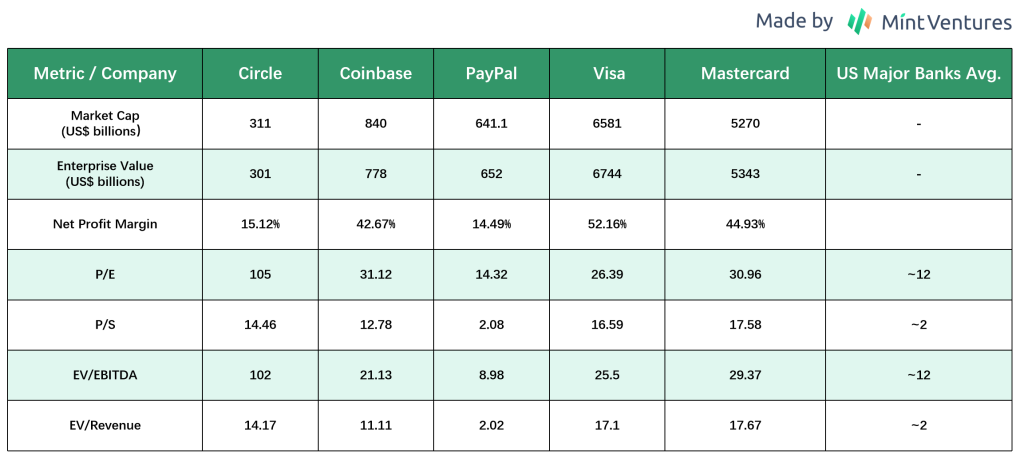

- Valuation Already Embodies High Growth Expectations: Multiple valuation metrics indicate that Circle is trading at a premium, reflecting that its growth prospects are already substantially priced in by the market. Some of the valuation logic even appears to be based on its potential future role as a leading financial infrastructure provider. Consequently, future stock price performance will be highly dependent on whether the company’s actual financial results meet or exceed these market expectations. Should quarterly earnings or key operational metrics fall short of optimistic forecasts, it could trigger a valuation correction.

- Mid-Term Financial Pressure: Circle’s financial performance hinges on three main drivers. USDC supply is expected to grow in line with industry expansion and operational optimization. However, with U.S. Treasury yields entering a downward cycle and distribution/transaction costs still elevated, Circle’s revenue and profit margins are likely to remain under pressure in the near term.

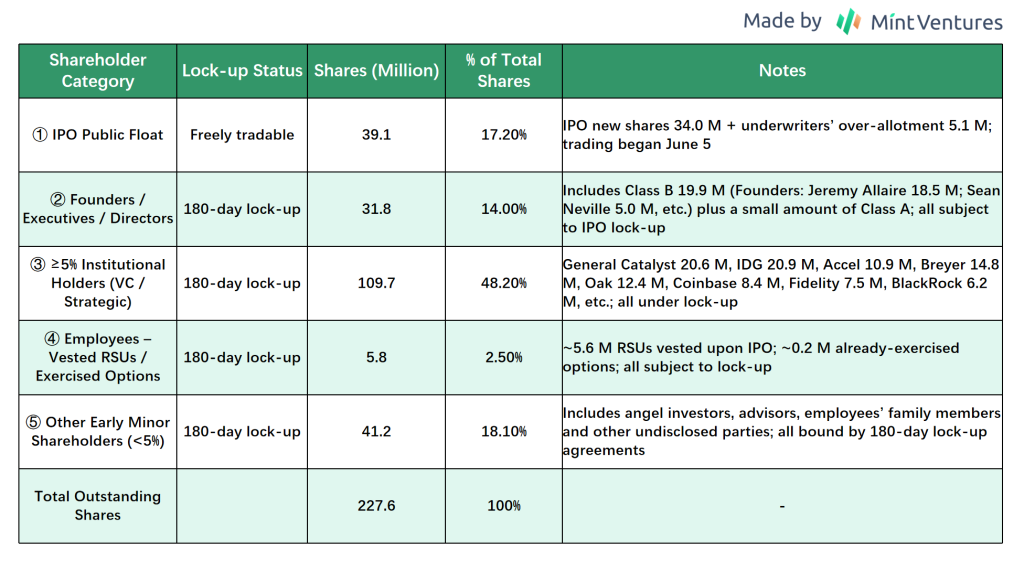

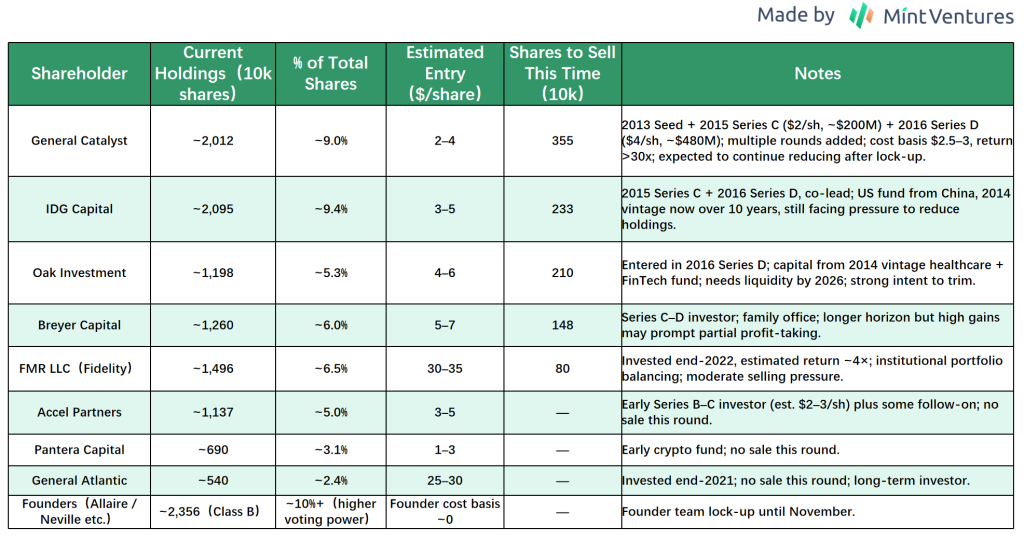

- Large Share Unlock in November–December: Early investors’ shares are set to be unlocked in November–December, most of which have been held for nearly or more than a decade. Strong exit demand from these investors could exert notable selling pressure on Circle’s stock.

- Potential Catalysts: Several near- to medium-term catalysts may influence Circle’s valuation

- Banking License Approval – If Circle secures an OCC trust charter, it would become the first stablecoin bank in the U.S., significantly enhancing its status and credibility, potentially prompting a re-rating.

- Progress in Business Diversification – The announcement of new revenue streams (e.g., launching a transaction fee model) that exceed market expectations would mitigate its perceived over-reliance on interest income and could boost its valuation.

- M&A and Partnerships – Any deepened collaboration with major banks or tech companies, or a potential acquisition (e.g., by a larger financial institution), would influence market perceptions of its terminal value.

- Conversely, negative catalysts such as sudden Fed rate cuts, the launch of a competitor’s stablecoin, or security breaches would weigh on its valuation.

Investment View

Overall, we take a “Neutral” stance on Circle’s stock. While its long-term outlook remains bright, the current price already fully—and perhaps prematurely—reflects optimistic expectations, leaving a narrow margin of safety. Given ongoing macro and industry uncertainties, short-term volatility risk is high.

Disclaimer: This document represents the author’s views as of the time of publication and is subject to change. The opinions expressed are highly subjective and may contain errors in facts, data, or logical reasoning. Nothing herein should be construed as investment advice. We welcome critique and further discussion from industry peers and readers.

2. Business and Product Lines

Circle Internet Financial was founded in 2013 by Jeremy Allaire and Sean Neville with the mission of “enhancing global economic prosperity through frictionless value exchange.” Since its inception, the company has focused on the crypto payments space, though its growth path has not been without challenges. Along the way, Circle actively explored other business directions, including establishing the crypto market-making platform Circle Trade, acquiring the cryptocurrency exchange Poloniex, and purchasing the crowdfunding platform SeedInvest.

In 2018, Circle co-founded the Centre Consortium with Coinbase and launched the U.S. dollar–pegged stablecoin USD Coin (USDC), positioned as a compliant and transparent digital dollar. USDC quickly grew into the world’s second-largest stablecoin, second only to Tether (USDT). Subsequently, Circle gradually divested non-core assets such as Poloniex and SeedInvest, refocusing its strategy on stablecoins and related services.

Today, Circle’s core business revolves around stablecoins and extends into adjacent areas such as payment settlement, corporate treasury services, developer platforms, and wallet solutions, among others. Specific segments include:

2.1 Stablecoin Issuance and Reserve Management

USDC Issuance

USDC is Circle’s flagship product, minted and redeemed on demand by its regulated subsidiaries. As of September 15, 2025, USDC had 72.7 billion in circulation. Circle pledges that for every USDC issued, it holds an equivalent one U.S. dollar in reserve assets within regulated bank accounts or compliant funds, ensuring a 1:1 peg to the dollar. The company employs daily monitoring and a T+2 settlement mechanism: when a user submits a request through a Circle account to mint USDC, Circle verifies the fiat deposit and then immediately generates the corresponding USDC on-chain and delivers it to the user’s wallet. Redemption works in reverse—Circle burns the USDC and returns an equal amount of fiat currency. This “mint-and-burn on demand” process supports a stable supply and instant convertibility.

Reserve Composition

Circle follows a stringent reserve management policy, investing only in cash and U.S. government securities with maturities under three months to maintain safety, high liquidity, and transparency. According to the latest disclosure on July 31, 2025, approximately 85% of USDC reserves were held in U.S. dollar money market funds (primarily U.S. Treasuries), and 15% in deposits at global systemically important banks (GSIB). This means the vast majority of reserves can be redeemed daily to meet large-scale withdrawal demands.

In partnership with BlackRock, Circle established the Circle Reserve Fund, an SEC-registered fund where Treasury assets are managed directly by BlackRock. Fund holdings and net asset values are publicly disclosed on a regular basis. Circle acts as the fund’s sponsor and beneficiary but does not intervene in investment decisions, thereby enhancing the professionalism and transparency of reserve operations. The remaining cash reserves are distributed across multiple GSIBs (such as BNY Mellon and JPMorgan) to support daily redemptions and integration with payment systems.

Reserve Transparency and Audits

Circle regards transparency as the cornerstone of trust in USDC. Since its launch in 2018, the company has engaged an independent audit firm monthly to produce Reserve Attestation Reports, disclosing the circulating supply of USDC and the detailed composition of its corresponding reserve assets. These attestation services are currently provided by Deloitte. The audit reports consistently indicate that the total value of the reserve assets slightly exceeds the total value of USDC in circulation, demonstrating a 100% reserve ratio and a risk buffer mechanism. Circle maintains strict segregation and custody of its corporate funds from the USDC reserves, eliminating the risk of misappropriation.

Compared to Tether, which faced regulatory penalties due to reserve opacity, Circle’s strategy of self-discipline and transparency has earned trust from regulators and institutional clients. In 2023, Circle proactively responded to SEC accounting guidance by detailing the holdings of the USDC reserve fund in its Form 10-K annual report. As the company advances through the public listing process, Circle will submit quarterly financial and operational data to the SEC, further enhancing operational transparency and market confidence.

EURC and Expansion into Other Currencies

Beyond the U.S. dollar-backed stablecoin, Circle launched Euro Coin (EURC), a euro-pegged stablecoin, in 2022. EURC maintains a 1:1 peg to the euro. It follows the same management framework as USDC, with its reserve assets consisting of euro-denominated cash and short-term European government bonds. Although EURC’s current market capitalization remains relatively modest (approximately €200 million), it holds significant growth potential. This is driven by the upcoming enforcement of the EU’s Markets in Crypto-Assets (MiCA) regulation and a shifting attitude towards digital finance within the eurozone.

Circle has indicated plans to explore the issuance of stablecoins for other G10 currencies (such as GBP and JPY), contingent on market demand and the evolving regulatory landscape. The company recently secured an in-principle approval in the Abu Dhabi Global Market (UAE) to offer payment services, including stablecoins. This move suggests a potential strategic expansion into the Middle East market, possibly involving the launch of a stablecoin pegged to a local currency, like the dirham. Through this multi-currency expansion strategy, Circle aims to build a comprehensive stablecoin ecosystem covering major fiat currencies, thereby solidifying its leading position in the global stablecoin landscape.

2.2 Payment Settlement & Corporate Treasury Services

Circle Account for Enterprises

Circle offers a comprehensive Circle Account service for its enterprise and institutional clients. Through a single account, clients can seamlessly exchange, send, receive, and manage balances between fiat currency and digital assets like USDC. Consider a cross-border e-commerce example: a company can fund its Circle Account with USD, instantly convert it to USDC, and directly pay its overseas supplier in USDC. The supplier can then convert the USDC into their local fiat currency at any time. This entire process takes only minutes, significantly enhancing efficiency compared to traditional SWIFT wire transfers.

The Circle Account supports multiple fiat currencies on-ramps and off-ramps, including ACH, SWIFT, wire transfers, and SEPA, achieving broad coverage through integrations with global banking and payment networks. For blockchain payments, the account supports multi-chain USDC receiving addresses, allowing clients to choose a network (e.g., Ethereum Mainnet or Solana) based on cost and speed requirements. Furthermore, the Circle Account provides treasury management features such as multi-user permission controls and transaction history export to meet corporate financial operational needs.

Payments API

Circle’s Payments API enables developers to integrate fiat and stablecoin payment functionalities into their own platforms. Via API calls, merchants can receive customer payments and convert them into USDC in real-time. For instance, if a customer pays $100 using a credit card, the merchant can use the Circle API to instantly convert that amount into USDC deposited into their Circle Account. This approach avoids the high fees and exchange rate risks associated with cross-border settlement while maintaining a seamless and transparent payment experience for the end-user.

Merchants can also utilize the “Payouts” feature via the API to convert USDC into local fiat currency and distribute it to end-users through banking networks. Currently, Circle’s payment network spans over 100 countries, effectively connecting unbanked users with the digital wallet ecosystem.

Treasury & Exchange Services

Circle provides critical treasury infrastructure for digital asset exchanges and brokerages. Whereas traditional banking channels often suffer from slow speeds and complex compliance, exchanges integrated with Circle Accounts can quickly convert user-deposited USD into USDC, enabling near real-time on-chain settlement. For withdrawals, USDC facilitates cross-chain transfer and subsequent local currency conversion, greatly improving efficiency and user experience.

Currently, numerous trading platforms, including Coinbase, widely use USDC as a dollar substitute. Although USDC’s trading volume share on centralized platforms remains lower than USDT’s, it accounts for approximately one-third of volume on major exchanges like Binance. Through its OTC minting and redemption services for large clients, Circle supports exchanges and institutions in executing bulk USDC subscriptions and redemptions efficiently, which helps stabilize liquidity, especially during periods of market volatility.

Additionally, Circle’s API supports large-scale OTC trading and settlement—for example, using USDC for inter-institutional settlement of loans or securities transactions—to avoid delays inherent in bank-mediated cross-border settlements. In summary, Circle’s payment and treasury services not only directly serve end-use cases like e-commerce and remittances but also act as the underlying financial infrastructure for exchanges and institutions. This enterprise-centric model broadens the USDC application ecosystem, enhancing business stickiness and strengthening client relationships.

2.3 Developer Platform & Wallet Services

Wallet APIs & Developer Tools

Circle has launched a suite of developer tools to lower the barrier for integrating blockchain functionality. The Wallets API enables businesses to quickly create and manage digital asset wallets without handling private key management or on-chain interactions internally. Developers can use API calls to generate USDC wallet addresses for users, check balances, and initiate transfers, while Circle’s backend uniformly handles secure key custody and transaction signing.

These services are particularly suitable for traditional enterprises looking to incorporate digital asset capabilities. For example, a gaming company can use the Wallets API to create USDC wallets for players, distribute in-game rewards, and enable withdrawals and exchanges, without needing deep in-house blockchain expertise. Circle also provides blockchain node services and smart contract interfaces, supporting interactions with multiple chains like Ethereum and Solana, thereby improving development efficiency.

In 2022, Circle further strengthened its institutional-grade security features, such as multisig wallets and advanced permission management, through the acquisition of CYBAVO, helping clients securely custody large digital asset holdings. These initiatives aim to position Circle as the “AWS for Blockchain,” driving the adoption of stablecoins within traditional applications via underlying digital currency services. Although revenue from API services currently constitutes a small portion of total revenue, their strategic importance lies in expanding the application scale and circulation of USDC, indirectly promoting the growth of the core business.

Cross-Chain Interoperability & CCTP

USDC is currently deployed on over 10 blockchains, including the Ethereum mainnet, various Layer 2 networks (such as Arbitrum and Optimism), Solana, Avalanche, and Tron. To address the issue of fragmented liquidity across these multiple chains, Circle developed the Cross-Chain Transfer Protocol (CCTP), which allows users to transfer USDC between different blockchains without relying on centralized exchanges or third-party bridges.

CCTP facilitates cross-chain transfers by burning USDC on the source chain and minting an equivalent amount on the destination chain, with Circle issuing attestations to ensure the process is secure and trustworthy. Gaining significant traction in 2023, CCTP is regarded as a major innovation for mitigating the security risks associated with cross-chain bridges and enabling efficient value transfer. The protocol not only enhances Circle’s ability to manage USDC’s cross-chain liquidity but also improves USDC’s consistency in a multi-chain environment (the total supply remains constant, with only inter-chain migration), further solidifying Circle’s central role within the stablecoin ecosystem.

2.4 Future Product Line Expansion

Looking ahead, Circle is actively expanding its new products and services to diversify revenue streams and consolidate its ecosystem advantages:

- Stablecoin BlockchainARC: In August 2025, Circle announced ARC, an open-source Layer 1 blockchain specifically designed for stablecoins. Using USDC as the native gas token, ARC features a built-in foreign exchange engine, supports 24/7 peer-to-peer on-chain settlement, and is EVM-compatible. The ARC testnet is expected to launch this fall, with the mainnet planned for 2026. ARC is poised to become the core platform for Circle’s future business, with multiple services being built on it.

- Cross-Border FX Conversion: Once ARC is live, Circle can leverage USDC/EURC to develop cross-border foreign exchange services, enabling rapid conversion between USD and EUR. This offers superior exchange rates and efficiency compared to traditional FX channels, positioning Circle to tap into the multi-trillion-dollar foreign exchange market.

- Digital Identity & Compliance: To meet regulatory requirements, Circle may introduce on-chain identity verification services, allowing institutions to verify the KYC status of counterparty addresses. This would help build a “permissioned stablecoin” ecosystem, attracting financial institutions sensitive to anonymous transactions to use the USDC network.

- Lending & Yield Products: Although current regulations restrict stablecoins from paying interest to the general public, Circle can still facilitate USDC lending services at the institutional level—for example, accepting collateral and lending out USDC to earn interest income, similar to securities lending. Should regulations permit, Circle may relaunch periodic yield products for institutions (e.g., “Circle Yield”) under strict risk controls to expand profit channels.

- CBDC Collaboration: As multiple central banks advance their Central Bank Digital Currency (CBDC) initiatives, Circle could serve as a technology provider or distributor. For instance, Circle may participate in the UK’s planned digital pound pilot as a private-sector distributor, offering exchange and custody services. The company is also actively exploring collaborations with other national CBDC teams to maintain its central role in the digital currency landscape.

In summary, Circle is evolving from a single stablecoin issuer into an integrated digital finance ecosystem encompassing “stablecoins + payments + developer + banking services.” Through both horizontal and vertical business expansion, Circle is not only opening up new growth avenues but also embedding itself more deeply into digital economic infrastructure. As synergies across business lines materialize, Circle is well-positioned to build a USDC-centric digital finance network, creating long-term value for shareholders.

3. Management & Governance

3.1 Core Management Team

Co-founder and CEO Jeremy Allaire is a serial entrepreneur in the internet industry. He previously founded the video streaming platform Brightcove and successfully led it to a public listing. With deep insights into the open internet and fintech sectors, he is widely regarded as a leading figure in the stablecoin industry, frequently participating in U.S. Congressional hearings and policy discussions where he actively advocates for sensible industry regulation.

The other co-founder, Sean Neville, served as President in the company’s early days, laying the product and technological foundation. He transitioned to a board advisor role in 2019 and remains a shareholder.

The senior management team also includes CFO Jeremy Fox-Geen, who joined Circle in 2021. Formerly a Managing Director at Barclays Investment Bank, he brings extensive traditional finance and capital markets experience and led the company’s SPAC merger and IPO preparation efforts.

COO Elisabeth Carpenter and CLO Flavia Naves both hail from traditional finance or major tech corporations, providing valuable operational and compliance management expertise. The legal team has played a key role in navigating the complex regulatory environment and securing licenses in various jurisdictions.

Overall, Circle’s management team combines innovative technological thinking with rigorous compliance awareness, establishing a solid foundation for the company’s steady operations amidst rapid growth.

3.2 Board of Directors and Governance

In 2018, Circle and Coinbase established the Centre Consortium as a 50:50 joint venture to manage USDC-related affairs. In 2023, Circle restructured its collaboration with Coinbase, taking over direct management of USDC operations. Coinbase relinquished its original equity stake in the consortium in exchange for a minor equity holding in Circle, while retaining a 50% revenue share from USDC (refer to Section 5.2 “Distribution and Transaction Costs” for details on this arrangement). Consequently, Coinbase continues to play a significant role in USDC’s development and currently holds a seat on Circle’s Board of Directors.

Beyond Coinbase, Circle’s Board comprises seasoned industry experts and representatives from strategic investors. Chairman Jeremy Allaire is joined by directors representing investment firms such as Goldman Sachs, Excel, and Breyer, ensuring corporate strategy balances investor interests. Furthermore, Circle has appointed several independent directors, including individuals with substantial regulatory backgrounds like former FDIC Chairman Heath Tarbert, providing robust support for the company’s public listing process and compliance operations.

3.3 Governance Structure and Shareholder Rights

Circle utilizes a dual-class share structure: Class A and Class B Common Stock. Class A shares are offered to public investors, while Class B shares, held by founders and early investors, carry enhanced voting rights. This mechanism ensures that Co-founder and CEO Jeremy Allaire retains strategic control post-IPO, safeguarding long-term development plans from short-term market pressures.

Prior to its IPO, Circle implemented several internal governance enhancements, including establishing board committees—such as the Audit Committee and the Compliance and Risk Committee—chaired by independent directors to oversee financial reporting and risk management. According to its IPO prospectus, Circle has built a comprehensive internal control system covering areas like anti-money laundering (AML) and sanctions compliance, supported by a dedicated team of compliance officers and subject to annual external audit assessments.

Circle has also established clear reserve management policies and contingency plans. For instance, during the March 2023 Silicon Valley Bank incident, Circle temporarily lost access to $3.3 billion in cash reserves, causing USDC to de-peg briefly. Management responded swiftly with transparent communication, committing corporate funds to cover any potential shortfall. Ultimately, the reserve assets were fully recovered following Federal Reserve intervention, and USDC re-pegged. This event demonstrated management’s capability in crisis response and risk communication, with timely and effective measures containing potential user panic.

3.4 Compliance and Regulatory Relations

Since its inception, Circle has consistently placed the highest priority on compliant operations, earning a reputation as a “poster child for embracing regulation.” In 2015, Circle became one of the first holders of a New York State BitLicense, widely regarded as one of the most stringent state-level regulatory licenses for the digital currency industry, demonstrating the company’s strong commitment to meeting compliance requirements.

Subsequently, Circle has obtained money transmitter licenses from 46 U.S. states, an Electronic Money Institution license from the UK’s Financial Conduct Authority (FCA), and a payment service exemption in Singapore, among other qualifications. The company invests significant resources annually to meet Anti-Money Laundering (AML) and Know Your Customer (KYC) obligations. Its internal compliance team conducts real-time monitoring of large and unusual transactions, promptly reporting suspicious activities.

This compliance-first image has provided Circle with a foundation of trust in its communications with regulators. CEO Jeremy Allaire has spoken multiple times in the U.S. Congressional hearings, supporting the establishment of federal-level stablecoin regulations and expressing willingness to serve as a test case for stricter oversight in exchange for the industry’s long-term healthy development.

In June 2025, following the passage of a stablecoin bill by the U.S. Senate, Circle swiftly initiated the application process for a federal trust bank charter, aiming to be among the first compliant stablecoin issuers. It can be said that Circle’s relationship with regulators is primarily cooperative. Management clearly recognizes that proactively embracing regulation is essential for gaining mainstream market acceptance. This governance philosophy will help Circle maintain a leading position in the evolving regulatory landscape and continue to build a positive image with governments and the public.

4. Industry Analysis

4.1 Overview of the Global Stablecoin Market

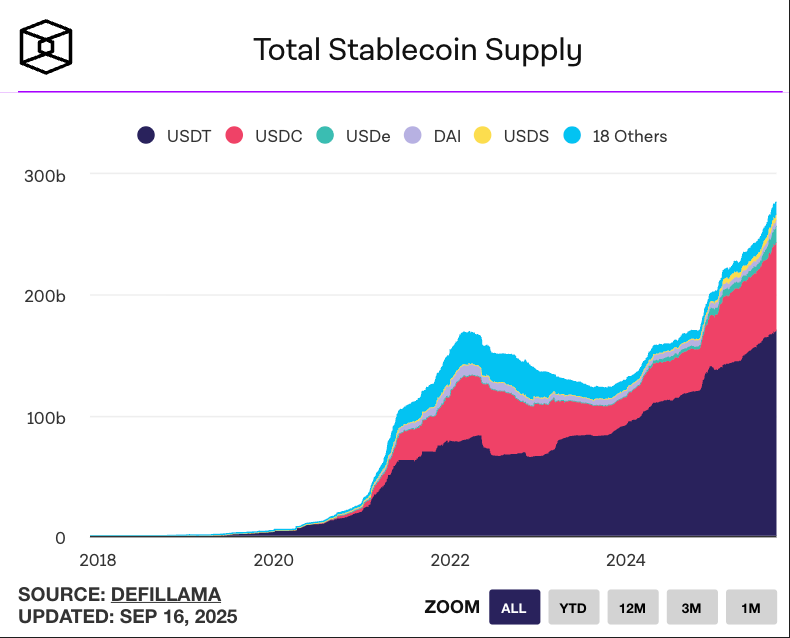

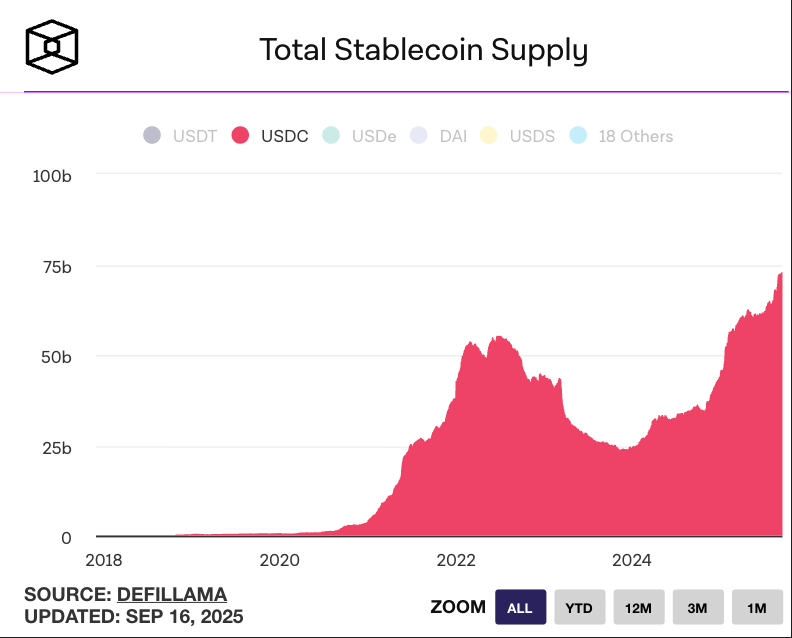

Stablecoins are a type of cryptographic digital currency pegged to the value of a fiat currency or other assets. They aim to combine the price stability of fiat currency with the efficiency of blockchain technology, serving as a crucial bridge connecting the crypto ecosystem with the traditional financial system. Since 2020, the stablecoin market has experienced explosive growth, with its total market capitalization surging from under $100 billion to nearly $2 trillion by 2022. Although a correction in the cryptocurrency market led to a temporary decline, the total market cap has since rebounded, now exceeding $2.7 trillion. As of July 2025, the stablecoin supply accounts for over 1.2% of the U.S. M2 money supply (total U.S. M2 is $22.12 trillion), indicating its already substantial scale.

The current stablecoin market is predominantly led by USD-denominated products, which comprise over 95% of the market. Stablecoins for other currencies, such as the Euro and British Pound, remain in the early stages of development. Within the USD stablecoin segment, USDT and USDC collectively hold approximately an 85% market share, forming a duopoly.

The demand for stablecoins primarily stems from the following areas:

- Cryptocurrency Trading Demand

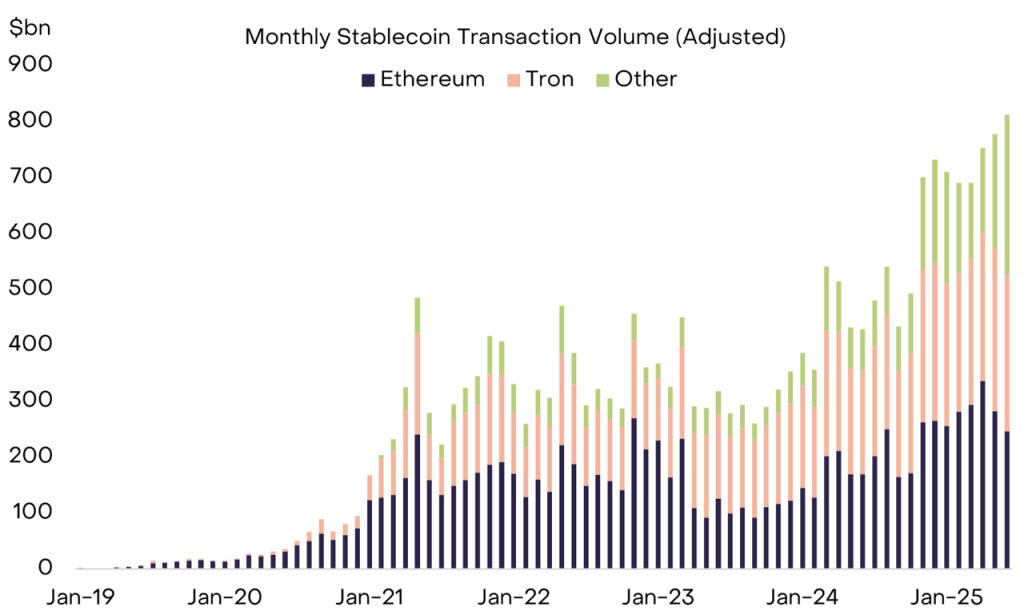

Stablecoins continue to serve as the primary unit of account and safe-haven asset within digital asset markets, enabling traders to swiftly switch between different cryptocurrencies and lock in value during market volatility. The medium of exchange for crypto market trading had fully shifted from BTC to stablecoins during the 2019-2021 cycle. Currently, over 95% of spot trading volume comes from trading pairs between cryptocurrencies and stablecoins. Furthermore, stablecoin-denominated perpetual contracts have developed rapidly in recent years, with their trading volume now multiples of the spot trading volume and demonstrating comparable market depth. The proliferation of perpetual contracts has further increased the penetration of stablecoins among traders.

Settlement demand from cryptocurrency trading remains the primary source of stablecoin demand.

- Cross-Border Payments and Financial Inclusion

Leveraging advantages such as speed, low cost, and 24/7 availability for cross-border transfers, stablecoins show significant potential in international remittances and trade settlement. Traditional remittances, reliant on multiple intermediaries, can take days and incur high costs, whereas using stablecoins like USDC enables near-instantaneous peer-to-peer settlement. Numerous payment service providers and remittance companies are actively piloting integrations with stablecoin networks, while traditional payment giants like Visa and Mastercard are also closely monitoring technological convergence in this area.

- DeFi and Digital Finance Applications

Within the decentralized finance (DeFi) ecosystem, stablecoins act as fundamental collateral and units of account for lending, market-making, and derivative protocols. Users can deposit stablecoins into DeFi platforms to earn interest or participate in liquidity mining, giving them a deposit-like function. During the 2021 DeFi boom, on-chain lending demand for USDC surged, leading Circle to introduce “Circle Yield” to offer fixed-term yield services to institutions. However, following industry shocks in 2022 (such as the collapse of the Terra algorithmic stablecoin), such yield-bearing services have adopted a more cautious approach.

- Macroeconomic Environment Impact

Geopolitical and global financial trends are also driving stablecoin adoption. Despite growing discussions about “de-dollarization,” stablecoins are objectively expanding the use of the US dollar: due to their high convenience, many markets outside the US prefer holding USDC or USDT over local currency, thereby reinforcing the US dollar’s practical influence. According to ARK Invest analysis, the total amount of US Treasury bonds held indirectly via stablecoins exceeds the holdings of countries like Germany and South Korea. Stablecoins are becoming significant new buyers of US Treasuries and a new vector for dollar internationalization, to some extent bolstering the dollar’s reserve currency status. Particularly in emerging markets, high inflation and capital controls are driving residents to use stablecoins as dollar substitutes for daily payments and store of value. For example, in countries like Argentina and Nigeria, USDT and USDC are already widely used, forming a “parallel monetary network” that compensates for shortcomings in the local financial system.

Additionally, it is worth mentioning the Agentic Payments Protocol 2 (AP2), jointly launched by Google and Coinbase on September 17th. AP2 is designed to securely initiate and process AI agent-led payments across platforms and introduces stablecoins as the primary payment method, which is expected to boost stablecoin circulation in the short term. Furthermore, the inherent characteristic of stablecoins being bound to blockchain addresses rather than human biometrics makes them naturally more suitable for economic activities between AI agents compared to other payment systems. In the future, economic interactions between AI agents may also contribute to further expansion of the stablecoin market.

4.2 Competitive Landscape

The current stablecoin market exhibits a “Two Superpowers, Multiple Strong Contenders” competitive structure: Tether (USDT) and Circle (USDC) hold the first and second positions, respectively. Based on the current issuance scale, USDT holds a market share of approximately 58%, while USDC holds about 25%. USDT is issued by the offshore company Tether and maintains its dominance through first-mover advantage and deep integration with numerous exchanges. However, its operational transparency and compliance have long been questioned, with insufficient reserve disclosures and audits being a key focus for regulators in the US and Europe.

In contrast, Circle’s USDC is renowned for its compliance and transparency, holding money transmitter licenses from multiple US states and a New York BitLicense, among other permits. Circle proactively undergoes monthly audits, with its reserve assets consisting of 100% of cash and short-term U.S. Treasury bonds, the vast majority of which are held in U.S.-regulated funds. This prudent strategy has significantly enhanced institutional trust in USDC. As global regulations tighten, USDC is expected to gain further market share in jurisdictions with high compliance requirements (such as the US and EU), while USDT may face constraints in certain regions (e.g., under the EU’s MiCA regulation).

Other significant competitors include:

- Payment Giants: PayPal launched its USD stablecoin, PYUSD, in 2023, leveraging its vast user and merchant network to promote stablecoin payments. While PYUSD’s current circulation of 1.17 billion tokens remains far smaller than USDC, PayPal’s brand strength and channel capabilities make its potential significant. Recently, Stripe also announced the launch of its stablecoin L1, Tempo, while Visa and Mastercard are positioning themselves in the stablecoin payments space through partnerships and investments.

- Financial Institutions: JPMorgan issues JPM Coin for inter-institutional settlements, and Société Générale has launched a euro stablecoin. Following the passage of stablecoin legislation, more banks are expected to enter the competition, leveraging their credit standing. However, their applications will likely focus on B2B scenarios like corporate payments and on-chain settlement, presenting limited direct competition to USDC in the retail market.

- Decentralized Stablecoins: Examples include Ethena’s USDE, DAI, and USDS issued by MakerDAO. By issuance volume, USDE and USDS+DAI are currently the third and fourth largest stablecoins (with circulations of 13 billion and 9.5 billion tokens, respectively). USDE innovatively incorporates funding rate arbitrage from cryptocurrency perpetual contracts into its stablecoin system, offering yields significantly higher than short-term U.S. Treasuries, demonstrating product-market fit. Nonetheless, in terms of absolute scale and application scenarios, these stablecoins remain relatively niche, often perceived primarily as yield-generating tools by users, and do not pose an immediate significant threat to USDC.

- Other Compliant Issuers: This group includes USDP issued by Paxos and BUSD, which was launched by Binance but ceased in 2023 due to regulatory pressure. While institutions like Paxos hold U.S. trust charters and maintain high compliance standards, their market promotion and ecosystem development still lag behind Circle’s. Since 2025, compliant stablecoin projects have emerged rapidly, such as USD1 (associated with the Trump family, circulation exceeding $2.5 billion), the Plasma project’s governance token XPL (pre-market cap once exceeding $7 billion), and Ethena’s fiat-backed stablecoin USDTB (circulation over $1.6 billion), with numerous smaller projects also entering the market.

In summary, Circle, leveraging the long-term accumulation of compliance capabilities and ecosystem partnerships around USDC, has established a certain first-mover advantage. However, as regulatory frameworks for stablecoins become clearer and more participants enter the competition, the market environment Circle faces is becoming increasingly intense.

4.3 Regulatory Environment and Policy

The trend of stablecoins transitioning from “unregulated growth” to being “brought under regulatory oversight” is inevitable. The 2022 Terra stablecoin incident served as a global regulatory wake-up call, prompting jurisdictions worldwide to explore regulatory frameworks.

In July 2025, the U.S. Congress passed the Guiding and Establishing National Standards for Innovative Uses of Stablecoins Act (GENIUS Act). This legislation establishes a federal regulatory framework for stablecoins that are backed by payments. Key provisions of the Act include:

- Requiring stablecoins to be fully backed 1:1 by reserves held in highly liquid assets (e.g., cash, short-term U.S. Treasury bonds).

- Mandating that issuers publish monthly reports on reserve composition and undergo an independent audit or review; reserves cannot be commingled or rehypothecated.

- Requiring stablecoin issuers to maintain adequate capital and liquidity buffers and implement robust risk management practices commensurate with their business scale and risk profile.

- Prohibiting the direct payment of interest or yields to holders to avoid stablecoins being classified as deposits or securities.

- Clarifying that primary regulatory authority over payment stablecoins falls to banking regulators (like the Federal Reserve, OCC, FDIC) and state financial regulators, explicitly excluding direct jurisdiction by the SEC or CFTC for these assets.

Overall, the GENIUS Act establishes a federal compliance baseline for stablecoins in the U.S., providing clear rules on issuer qualifications, reserve transparency, and redemption obligations. The Act will be fully implemented 18 months after its effective date (around the end of 2026), after which unapproved entities will be prohibited from issuing payment stablecoins in the United States.

It is anticipated that the GENIUS Act will eliminate substandard issuers, promoting industry consolidation. For Circle, which already adheres to high compliance standards (holding money transmitter licenses in 46 states, a NY BitLicense, and permits in jurisdictions like Bermuda and the UK), the new federal licensing hurdle will further accentuate its compliant advantages and is likely to squeeze the market share of non-compliant competitors.

Beyond the U.S., the European Union passed the Markets in Crypto-Assets (MiCA) regulation in 2023, bringing stablecoins (classified as Electronic Money Tokens) under a unified regulatory regime requiring licensing and adherence to reserve and capital requirements. Circle became the first global stablecoin issuer to comply with the MiCA framework in 2024, paving the way for its expansion in the European market. In Asia, international financial centers like Singapore and Hong Kong are also developing stablecoin licensing regimes. The Hong Kong Monetary Authority (HKMA) outlined proposed rules for stablecoin regulation in late 2023, requiring full 1:1 backing for HKD-linked stablecoins. Japan has authorized the issuance of stablecoins under trust company regulation. Globally, major jurisdictions are racing to introduce stablecoin regulations, aiming to ensure financial stability while attracting related businesses. This regulatory competition benefits leading, compliant operators. Circle, with its portfolio of licenses in multiple regions (such as the UK FCA Electronic Money Institution license and the Bermuda DABA Digital Asset Business Act license), is well-positioned to quickly enter compliant markets and gain a first-mover advantage in international expansion.

4.4 Industry Trends Outlook

Several major development trends are worth watching in the stablecoin industry over the coming years:

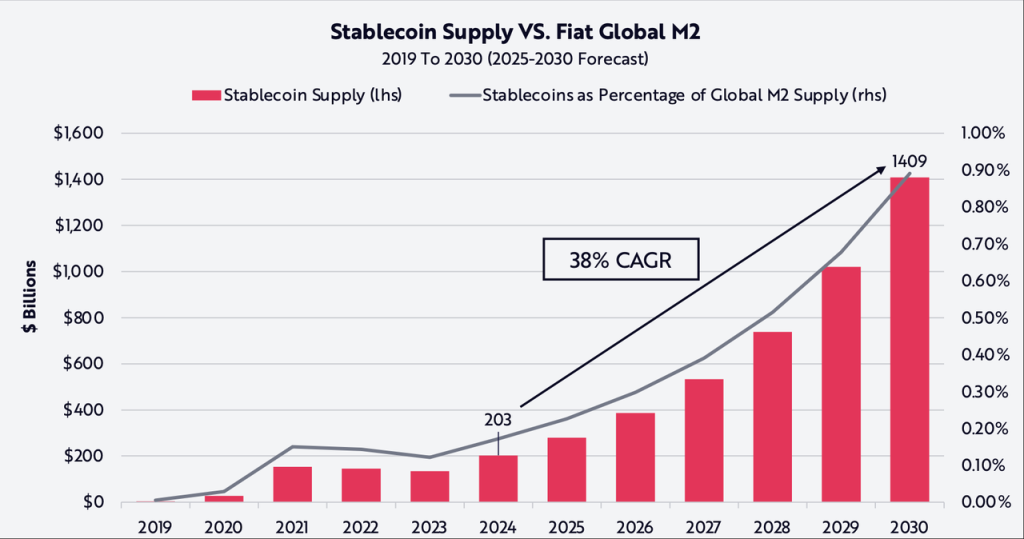

- Rapid Market Scale Growth: Ark Invest projects that by 2030, stablecoins could account for 0.9% of the global M2 money supply, representing a scale exceeding $1.4 trillion.

While JPMorgan holds a more conservative view—predicting a stablecoin market capitalization of only $500 billion by 2028—most institutions are significantly more optimistic. They believe stablecoins are still in the early stages of adoption and could achieve 5-10x growth over the next five years. Particularly as regulatory frameworks become clearer, traditional financial institutions and markets are expected to adopt stablecoins on a large scale for settlement and liquidity management, such as in pilot projects for securities settlement or as alternatives in government bond market settlement. Standard Chartered even forecasts the stablecoin market could reach $2 trillion by 2028.

- Shift from Trading to Payments and Commerce: Currently, approximately 94% of stablecoin demand still comes from cryptocurrency trading and DeFi scenarios, with only about 6% used for real-world payments and settlement. However, with payment companies like PayPal entering the space, the integration of networks like Visa, and clear legislation defining stablecoins as payment instruments, the proportion used for payments and settlement is expected to gradually increase. A Grayscale report referred to 2025 as the “Summer of Stablecoins,” noting that large US corporations (such as Amazon and Walmart) are also exploring stablecoin applications. In the future, stablecoins are likely to be embedded into e-commerce payments, supply chain finance, gaming, and entertainment, enabling large-scale commercial payment applications.

- Deeper Integration with Traditional Finance: Stablecoins are gaining increasing recognition from traditional financial institutions. Giants like JPMorgan Chase and Bank of America are participating in related investments or pilots; infrastructure providers like the DTCC are exploring the use of stablecoins to improve settlement efficiency; and even US mortgage agencies are beginning to consider including digital assets in borrowers’ net worth calculations. Stablecoins may eventually become tools for bank liquidity management and cash management, with some banks potentially holding USDC directly as a reserve asset. US Treasury officials have also noted the role of stablecoins in purchasing US Treasuries, suggesting policymakers may gradually accept and support stablecoins as a “private-sector complement” to the US financial system. It is foreseeable that stablecoin issuers might eventually be integrated into payment systems (such as connecting to the FedNow real-time payment network), enabling seamless integration between traditional banking and on-chain digital dollars.

- Technological Evolution and Multi-Chain Deployment: Stablecoins will expand to more high-performance public blockchains and Layer 2 networks to meet the needs of different scenarios. USDC is currently issued on over 10 blockchains (including Ethereum, Solana, Tron, Algorand, Arbitrum, etc.). With the rapid development of new Ethereum Layer 2 solutions and cross-chain protocols in 2025, Circle launched the Cross-Chain Transfer Protocol (CCTP) to facilitate the circulation of USDC across different chains. Looking ahead, Circle may issue stablecoins pegged to more currencies (e.g., Asia-Pacific region currencies) or support interoperability with CBDCs issued by central banks, further consolidating its position as a global hub for digital currency circulation.

In summary, the stablecoin industry is transitioning from a phase of unregulated growth to a new stage of compliant competition. With its leading market share and compliance advantages, Circle is well-positioned in this process. However, given the industry’s rapid evolution, the company must continue to innovate and operate prudently to maintain growth in an environment full of both opportunities and challenges.

5. Operational and Financial Performance

5.1 Historical Performance Review

User and Usage Growth

Since its launch in 2018, USDC has experienced steady growth, with its supply surging during the 2020 DeFi boom and the 2021 bull market. At the end of 2020, the circulating supply of USDC was approximately $4 billion, which soared to over $42 billion by the end of 2021. Although the market entered a bear phase in 2022, USDC’s circulating supply continued to grow, nearing $50 billion.

However, in March 2023, affected by the successive failures of crypto-friendly banks Silvergate and Signature, USDC faced a liquidity crisis. Redemption demands spiked sharply, leading to a brief de-peg. Despite the Circle team’s relatively prompt response and successful processing of all redemptions, the event caused USDC’s circulating supply to drop rapidly from $43 billion to $30 billion within a month.

From 2024 to 2025, driven by favorable regulatory developments and accelerated institutional adoption, USDC’s circulating supply gradually recovered. By March 2025, its circulating supply had rebounded to a historical high of $60 billion. Subsequently, with the passage of the stablecoin bill (GENIUS ACT), USDC’s circulating supply continued to hit new highs, exceeding $72 billion currently.

In terms of users, the cumulative number of on-chain addresses had already exceeded 8.5 million by 2022, with monthly active addresses surpassing 1.1 million. By 2025, the average number of daily active addresses was about 280,000, and the annual number of transactions grew by 118%. On-chain transaction volume also increased significantly: as of mid-2025, the total on-chain transaction volume for USDC over the past 12 months reached approximately $17.5 trillion, primarily from large exchange transfers and DeFi protocols. This data indicates that USDC has become one of the widely used stablecoins within the blockchain ecosystem, with a solid user and foundational base.

Assets, Liabilities, and Cash Flow

Circle’s balance sheet structure is relatively straightforward. The largest asset item is the investments corresponding to the USDC reserves, which are matched by an equivalent liability for USDC in circulation and are not included in shareholder equity.

Excluding reserve assets, the company’s own assets primarily consist of raised capital and retained earnings from previous years. Following the IPO in 2025, which raised $1.05 billion, and according to the Q2 report, the company’s cash reserves now exceed $1.1 billion. Additionally, on August 15, Circle raised an additional $455 million through a secondary offering of 3.5 million shares at $130 per share. The company currently maintains ample cash on its balance sheet. Circle has long been without interest-bearing debt, as its business model requires almost no leveraged financing (reserve assets belong to users and are not classified as company borrowings).

Regarding operating cash flow, influenced by the nature of the USDC business, Circle’s daily operational cash flow mainly comes from interest income, indicating a very healthy state. In 2024, net operating cash inflow exceeded $1 billion, far exceeding capital expenditures and dividend payments (Circle has not yet paid dividends, retaining all profits). Therefore, the company’s financial structure is robust, with sufficient internal funds to withstand market volatility or support investments in new business areas.

Revenue and Profit Trends

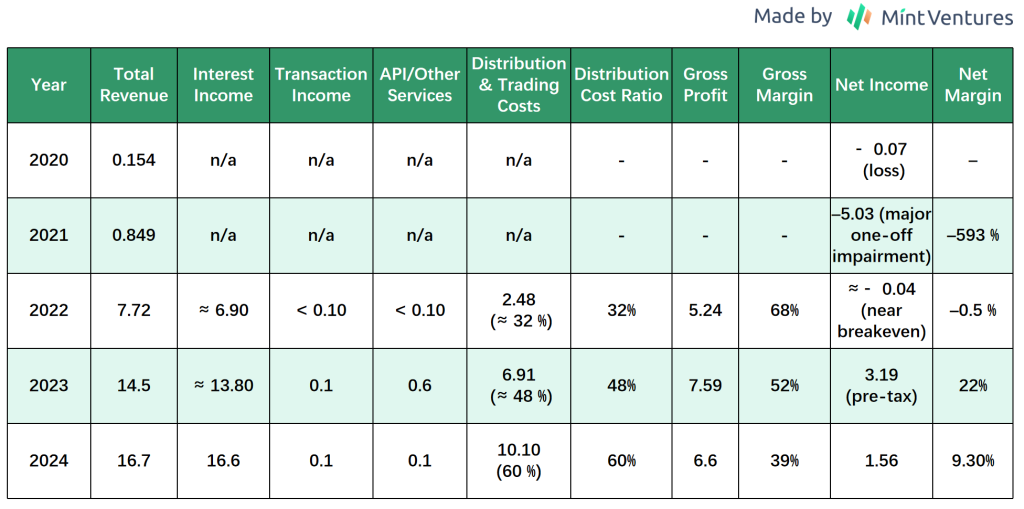

Circle’s revenue can be divided into two main categories: interest income and non-interest income, with interest income (i.e., investment income from USDC reserves) being the dominant source.

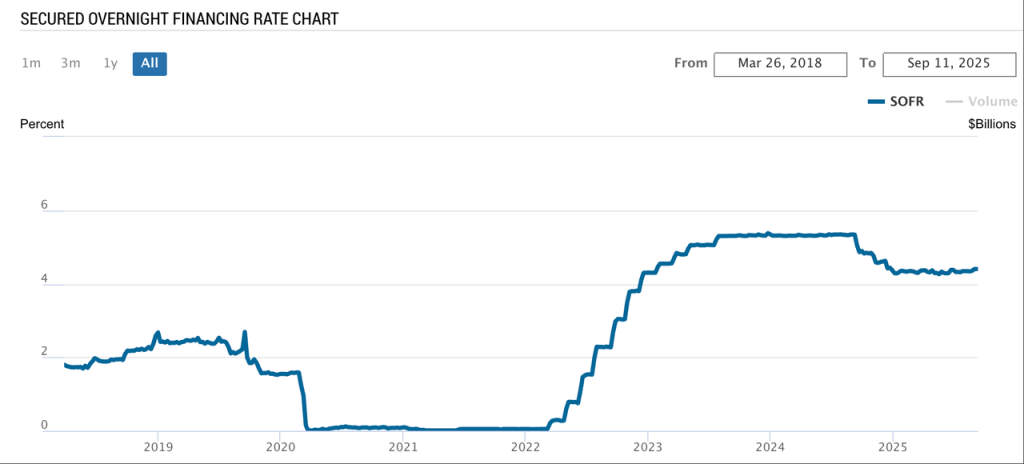

The essence of Circle’s business model is earning the spread between the “cost of user deposits” and the “investment return on reserves” – similar to a bank. Therefore, changes in interest rates significantly impact Circle’s revenue.

During the Federal Reserve’s zero interest rate policy in 2020, Circle’s total revenue was only $15.4 million, primarily from transaction and other miscellaneous fees. Starting in the second half of 2021, as USDC supply expanded and interest rates rose, reserve interest income became the core revenue source, with annual revenue jumping to $84.9 million that year. In 2022, with rapidly rising interest rates (the federal funds rate reached 4.5% by year-end) and the average annual circulating supply of USDC doubling, the company’s annual revenue surged to $772 million.

In 2023, as the Fed raised rates above 5% and maintained high levels, Circle’s full-year revenue further doubled to approximately $1.43 billion. Revenue for the full year 2024 reached $1.676 billion, a year-on-year increase of 15.6%, indicating a slowdown in growth rate. In the first quarter of 2025, the company achieved revenue of approximately $579 million, a record high. Annualizing this pace suggests full-year 2025 revenue could exceed $2.3 billion, demonstrating strong profitability in a high-interest-rate environment.

Non-interest income (including API service fees, transaction fees, etc.) has consistently accounted for a very small proportion, less than 1% of total revenue. This is because Circle proactively sets USDC issuance and redemption fees to zero to encourage ecosystem adoption, not charging users minting fees. While this strategy sacrifices some direct revenue, it has effectively promoted the rapid expansion of the stablecoin ecosystem. In the long term, as payment, API, and other businesses develop, the proportion of non-interest income is expected to increase, but it will likely remain low in the short term.

The table below summarizes key performance data for Circle from 2020 to 2024 (all figures in USD hundreds of millions).

We now proceed to a detailed analysis of the key drivers of Circle’s financial metrics.

5.2 Key Drivers

The key drivers of Circle’s financial metrics include the supply of USDC, the level of short-term U.S. Treasury yields, and the proportion of distribution and transaction costs.

5.2.1 USDC Supply

The supply of USDC directly determines the scale of reserves held by Circle, which in turn impacts the asset base that generates interest income. Circle’s revenue exhibits a significant positive correlation with the circulating supply of USDC. Changes in the USDC supply primarily depend on the following two aspects:

(1) Overall Market Conditions of the Stablecoin Sector:

The prosperous development stage of the stablecoin market naturally lifts the supply of USDC, currently the second-largest stablecoin. The primary driver of the stablecoin market remains the crypto market bull-bear cycle. During bull markets, active cryptocurrency trading and DeFi activity increase demand for stablecoins, driving the expansion of USDC supply. The opposite occurs during bear markets.

(2) The Competitiveness of USDC Itself:

If USDC holds distinct advantages over other stablecoins, it can increase its share of the total stablecoin market, thereby boosting its own supply. If Circle can leverage its strengths in compliance and transparency, capitalize on opportunities presented by regulatory policies, and expand applications within traditional finance scenarios, the share of USDC’s supply within the total stablecoin market is expected to increase further.

Currently, the cryptocurrency market as a whole has been in an upward trend from 2023 to 2025, providing sustained growth momentum for stablecoins like USDC. Demand from other areas, such as payments, is also continuously growing. The overall market vitality of the stablecoin sector is expected to increase further in the future. The competitiveness of USDC itself has improved relative to its main competitor, USDT, as regulatory policies have gradually become clearer. Simultaneously, USDC has recently begun to collaborate frequently with centralized exchanges, using operational strategies (such as providing rebates to exchanges, indirectly returning a portion of the reserve interest to users) to enhance the willingness to hold USDC. The competitiveness of USDC has thus increased. Both factors are expected to drive an increase in the supply of USDC.

5.2.2 Level of Short-Term U.S. Treasury Yields

Short-term U.S. Treasury yields are another key variable determining Circle’s interest income. The Fed’s aggressive interest rate hikes in 2022-2023, which raised rates to 5.25%, drove Circle’s effective average yield in 4 (after deducting some non-interest-bearing cash) to 2.68%. Excluding the Coinbase revenue share, this yield corresponds to an overall return on reserve assets of approximately 5%, which is basically in line with the 3-month U.S. Treasury yield during the same period.

Comparing the trends in USDC supply, short-term interest rate levels, and Circle’s revenue reveals that interest rate fluctuations are significantly more volatile than changes in USDC supply. Consequently, interest rate movements have a more pronounced impact on Circle’s operating revenue. For instance, although the average USDC supply throughout 2023 was considerably lower than in 2022, Circle’s revenue doubled compared to 2022 due to rapidly rising interest rates. Similarly, while the USDC supply in 2024 was much higher than in 2023, Circle’s revenue increased by only 15% year-over-year in 2024 as interest rates began to decline.

Looking ahead, the trajectory of interest rates carries uncertainty, but the market generally anticipates a cycle of rate cuts. According to an ARK report forecast, if the Federal Reserve lowers rates by 2 percentage points to around 3% starting in 2025, Circle’s annual interest income could decrease by approximately $631 million (based on 2024 figures), turning a net profit of $156 million into a net loss of $475 million. This illustrates the significant impact that declining interest rates would have on Circle’s profitability. Conversely, if interest rates remain high or even increase further, Circle’s profits would expand rapidly.

The prevailing expectation is that the Fed will gradually lower interest rates to a neutral level (approximately 2-3%) during 2025-2026. This implies that the growth of Circle’s interest income is likely to slow, and the absolute amount may even decline.

5.2.3 Share of Distribution and Transaction Costs

Distribution and transaction costs represent Circle’s most significant direct expense. In 2024, these costs amounted to $1.01 billion, accounting for 60% of the company’s total revenue. Among these, fees paid to its core partner, Coinbase, reached $908 million, constituting 54% of total revenue. Distribution and transaction costs primarily include incentives paid to partners for USDC distribution, expenses related to on-chain transactions, and reserve asset management fees.

- Coinbase Revenue Share Mechanism

The majority of USDC distribution incentives are directed to Coinbase, stemming from a long-term and complex partnership. The current cooperation agreement is effective from August 2023 to August 2026, with the terms for renewal or adjustment post-expiry yet to be determined. The revenue-sharing mechanism can be summarized as follows: Coinbase first receives a share of the net income proportional to the amount of USDC it custodies, then receives 50% of the remaining net income. Specific terms include:

- First, a “Payment Amount” base is determined, based on the daily income generated from the reserves backing USDC, after deducting third-party management fees (e.g., for asset management and custody) and other related expenses.

- Circle retains a portion of the revenue (annualized between approximately 0.08% and 0.20%, described as a “low-double-digit basis point to high tenth of a basis point”) to cover indirect costs associated with issuing the stablecoin and managing reserves, such as accounting, finance, regulatory, and compliance costs.

- Coinbase receives a daily share of the net Payment Amount proportional to the percentage of USDC held in wallets it custodies or manages. For example, if Coinbase custodies 20% of all USDC, it first receives 20% of the Payment Amount.

- After deducting amounts payable to other approved participants (such as Binance, Bybit, etc.), Coinbase also receives 50% of the remaining Payment Amount.

Actual Revenue Share:

- From 2022 to 2024, Coinbase’s weighted average custody share of USDC was 3%, 8%, and 18%, respectively.

- During the same period, revenue received by Coinbase from Circle was $248.1 million, $691.3 million, and $907.9 million, constituting the vast majority of distribution and transaction costs.

- Circle’s reserve revenue for 2022-2024 was $735.9 million, $1.4306 billion, and $1.6611 billion, respectively. Coinbase’s share accounted for 33.7%, 48.32%, and 54.65% of this revenue.

Data for Q1 and H1 2025 shows that the amount of USDC custodied by Coinbase was 7.594 billion and 7.275 billion tokens, representing 12.6% and 11.86% of the circulating USDC supply at those times, slightly below the 2024 average. Coinbase’s average custody share for 2025 is projected to be between 11.8% and 12.3%, with its share of Circle’s reserve revenue expected to remain between 50% and 53%.

- Partnerships with Other Exchanges

Beyond Coinbase, Circle actively expands other distribution channels. In November 2024, Circle entered a two-year strategic partnership with Binance, involving a $60.25 million upfront prepayment and agreed monthly incentive fees.

These incentive fees are calculated based on the amount of USDC held on the Binance platform and in its treasury, expressed as a percentage of a benchmark rate (approximately equivalent to Circle’s composite reserve yield, based on the 3-month SOFR rate), which is reset quarterly at a discount to SOFR. The incentive percentage increases with the amount of USDC held by Binance, ranging approximately from a “mid-double-digit percentage to a high-double-digit percentage” of the benchmark rate.

For example, assuming a discount-adjusted benchmark rate of 5% for a quarter:

- If Binance holds 3 billion USDC (an agreed level), with an incentive percentage of ~50% (mid-double-digit), the annualized incentive rate is 2.5%. Circle would pay Binance approximately $75 million annually.

- If holdings increase to 4.8 billion USDC, the incentive percentage could reach 80% (high-double-digit), resulting in a 4% annualized rate and payments of ~$216 million annually.

The agreement requires Binance to hold a minimum of 1.5 billion USDC, typically expecting holdings above 3 billion. In essence, under this model, Binance also shares in the reserve interest based on its share of the total USDC circulation, but unlike Coinbase, it does not receive the full reserve interest – only a “mid-to-high double-digit percentage.” Based on the latest reserve data, Binance holds 8.15 billion USDC, representing 11.3% of the circulating supply, already well exceeding the 3 billion threshold. It is expected to receive a share at the “high-double-digit percentage” rate. In July 2025, Circle established a similar USDC revenue-sharing arrangement with Bybit, although specific details were not disclosed.

Partnering with exchanges has become a primary method for Circle to expand USDC circulation, incentivizing partners to hold and promote USDC by sharing a portion of the reserve interest. While this strategy has been effective, it significantly diverts Circle’s interest income.

From a shareholder perspective, the USDC for which Circle fully retains the interest income is primarily the portion held on-chain in non-custodial wallets, such as on decentralized exchanges. The circulation share of this type of USDC more directly impacts the company’s EBITDA. It is worth noting that the decentralized derivatives exchange Hyperliquid currently holds a share equivalent to approximately 7.5% of the total USDC circulation, falling into this category of “shareholder-favorite” holders. However, Hyperliquid recently announced plans to develop its own stablecoin, USDH, which could significantly impact its USDC holdings.

In summary, Circle’s distribution and transaction costs may rise further in the future. We project that this cost as a percentage of reserve income will reach 60%–63% in 2025 (the ratios for 2022-2024 and Q1 2025 were 38.99%, 50.31%, 60.85%, and 60.08%, respectively). This will continue to squeeze Circle’s profit margins, exerting pressure on the company’s overall profitability.

On-Chain Transaction Costs

On-chain transaction costs primarily include Gas fees incurred by Circle to support USDC operations across multiple chains, custody fees, and fees paid to underlying blockchain protocols. Although these costs are relatively small compared to major interest sharing (typically a few percentage points of revenue), the specific amount fluctuates based on blockchain network congestion. For instance, large USDC minting and burning operations incur higher Gas fees when networks like Ethereum are congested.

To cover these expenses, Circle holds approximately $31 million in crypto assets on its balance sheet specifically for on-chain transaction costs. Looking ahead, with the gradual launch and adoption of Circle’s proprietary ARC blockchain, on-chain transaction efficiency is expected to improve, potentially leading to a significant reduction in these costs.

Reserve Management Fees

Circle collaborates with BlackRock to manage the USDC reserve assets. Under the latest agreement, BlackRock manages approximately 90% of the USDC reserves and has committed priority support for Circle’s stablecoin business. In return, BlackRock charges investment management and custody fees based on Assets Under Management (AUM), amounting to approximately $100 million annually.

This fee is accounted for as a transaction cost and effectively erodes part of the yield from the stablecoin assets, accounting for about 6% of Circle’s total revenue in 2024. If USDC scale continues to expand while market interest rates enter a downward cycle, the proportion of management fees (calculated on AUM) to revenue could increase, as fees are based on AUM while interest income is proportional to interest rates.

In summary, assuming Circle’s revenue-sharing agreement with Coinbase remains unchanged upon renewal after 2026, we project that Circle’s Distribution & Transaction Costs as a percentage of revenue will slowly increase from 60% in 2024, remaining within the 60%–63% range by 2028. This ratio is subject to uncertainty: if expansion continues to rely heavily on incentivizing centralized exchange partnerships, the cost ratio may remain high; whereas increasing the proportion of direct user connections could help reduce costs.

Every percentage point change in the distribution cost ratio significantly impacts Circle’s overall profitability. Therefore, the company must carefully balance ecosystem expansion with profitability, while actively pursuing cost control through technological upgrades (like the ARC chain) and optimization of partnership structures for long-term sustainability.

5.2.4 Summary and Outlook

Among the three core drivers affecting Circle’s financial performance – USDC supply, USD short-term interest rate levels, and distribution & transaction costs – we believe only the USDC supply shows promise for positive growth in the future.

A decline in USD short-term interest rates will directly lead to a reduction in Circle’s interest income. In an extreme scenario, if the Federal Reserve reverts to the zero interest rate policy of 2020-2022, Circle’s revenue under the current business model would contract significantly, forcing the company to seek other revenue sources for sustainable operation.

Furthermore, under the current promotion strategy centered on exchange partnerships, an increase in USDC supply is often accompanied by a synchronous rise in distribution costs. Even ignoring interest rate changes, a situation where “revenue growth is lower than the increase in USDC supply” could occur, continuously squeezing profit margins.

In conclusion, we maintain a cautious, even negative, outlook for Circle’s revenue prospects over the next three years. The company urgently needs to develop non-interest revenue streams, optimize partnership structures to control distribution costs, and proactively address the challenges posed by a potential interest rate downtrend.

5.3 Other Financial Matters

Given that Circle has no long-term debt or complex derivative exposures, interest expense and investment gains/losses have a relatively limited impact on the company’s profits. However, it is worth noting its holdings of certain strategic investments and crypto assets. For instance, Circle has held digital assets such as Bitcoin and Ethereum as liquidity reserves or long-term investments and has participated in investments in several blockchain startups. Fluctuations in the fair value of these assets can lead to unrealized gains or impairment charges. For example, during the significant crypto market downturn in 2022, Circle recognized an impairment loss of tens of millions of dollars on digital assets, resulting in negative other comprehensive income for that year. It is important to note that such gains and losses are primarily non-operating items; when the overall crypto market rises, these assets also have the potential to generate unexpected gains, boosting company profits.

Furthermore, as Circle progresses in its application for a banking charter, final approval could subject the company to certain capital requirements and necessitate corresponding provisions, potentially slightly impacting return on equity. On the other hand, under a federal regulatory framework, Circle might need to further segregate USDC reserve assets, potentially even managing a portion of the reserves on the bank’s balance sheet. The specific policy impacts remain to be clarified and are not currently factored into financial forecasts.

6. Competitive Advantages and Moat

As a pioneer in the global stablecoin sector, Circle’s ability to succeed in competition and achieve a successful public listing is underpinned by its unique competitive advantages and the “moat” it has built. These are manifested in the following areas:

Compliance and Trust Advantage:

Circle’s most critical moat lies in its strict compliance and the widespread trust this has fostered. Within the stablecoin industry, users are highly sensitive to the issuer’s ability to consistently maintain the 1:1 peg. Since the launch of USDC, Circle has consistently adhered to high compliance standards, operating with licenses, disclosing reserve status monthly, and undergoing audits by top-tier accounting firms. This level of transparency far exceeds that of its main competitor, Tether, which has repeatedly faced market skepticism due to insufficient information disclosure.

Currently, Circle holds money transmitter licenses from most U.S. states, a New York BitLicense, and relevant permits in jurisdictions like the UK and the EU, making it one of the few crypto companies compliantly licensed in multiple regions. The company has also applied for a U.S. national trust bank charter; if approved, it would be subject to supervision similar to traditional banks. These compliance initiatives remove barriers to acquiring large institutional clients (e.g., banks, public companies), who prefer compliant, transparent, and regulated options like USDC over stablecoins with offshore issuers and lower regulatory transparency.

It is anticipated that as stablecoin regulatory frameworks solidify in the U.S. and elsewhere, Circle’s compliance foundation will allow it to obtain licenses first. At the same time, some non-compliant competitors may be forced to restructure or exit the market. This compliance moat is difficult to replicate quickly, requiring long-term investment and accumulation of a strong reputation. Trust itself is a form of “currency.” Leveraging its leading position in trust, Circle has not only won user loyalty but also established USDC as a “safer haven” even during market crises. For example, during the brief USDC de-peg in March 2023, most users still expected Circle to receive official support, a belief grounded in its long-established compliance credibility.

Technology and Product Advantage:

Although the stablecoin itself follows a simple 1:1 peg mechanism, the surrounding technical infrastructure and service ecosystem constitute significant barriers to entry. Through years of accumulation, Circle has built mature and reliable technological systems in areas like digital wallet custody, cross-chain transfer, and payment APIs.

For instance, Circle developed the Cross-Chain Transfer Protocol (CCTP), which enables intermediary-free cross-chain transfers of USDC through an atomic burn/mint mechanism. The technical implementation of this protocol is challenging, but Circle not only successfully deployed it but also open-sourced it, enhancing USDC’s uniformity and liquidity across multiple chains while strengthening the industry ecosystem.

Furthermore, Circle’s Payments API and business account system are not merely interface services but integrated solutions combining KYC processes, fiat settlement, and compliance mechanisms, reflecting the team’s deep integration and understanding of financial services and blockchain technology. Competitors aiming to provide services of equivalent standard would need not only cross-domain technical capabilities but also long-term market validation. This “full-stack service capability” allows Circle to win enterprise clients as a solution provider rather than just a token issuer, building an invisible product and technology moat.

Brand and Market Recognition:

Through years of ethical operation and continuous market education, Circle has established strong brand recognition and reputational capital within the industry. USDC has become almost synonymous with “safe, transparent stablecoin,” enjoying broad acceptance, particularly in the US and European markets. Corporate users tend to prefer familiar and trusted brands when selecting financial tools, a soft power that Circle possesses.

For example, even after PayPal launched its own stablecoin, PYUSD, it continued to support USDC within its ecosystem, indicating that even competitors acknowledge USDC’s market position. Additionally, Circle has gained public endorsement from top investment firms like BlackRock and ARK Invest, further solidifying market confidence. This brand value cannot be quickly acquired through short-term subsidies or capital investment; it requires long-term accumulation and maintenance. Barring a major crisis of trust, Circle’s brand moat will continue to influence customer decisions.

Ecosystem Network Effects

The stablecoin business exhibits strong network effects. Currently, the stablecoin with the most pronounced network effects is still USDT, which serves as the primary settlement tool within centralized crypto exchanges, giving it a solid moat. However, Circle’s current market position already allows it to benefit from such network effects to a significant extent.

On one hand, USDC is supported by almost all major cryptocurrency exchanges, wallet services, and DeFi protocols, making it a fundamental liquidity component within the crypto ecosystem. Developers launching new tokens or projects (especially on-chain projects) often prioritize integrating USDC, sometimes even over USDT, to leverage its broad user base, high liquidity, and compliance advantages. On chains with higher recent on-chain activity like Solana, Base, and Hyperliquid, USDC holds a majority share of the on-chain stablecoin market (69.16%, 89.65%, and 95.15%, respectively). This widespread integration itself creates an industry barrier; new stablecoins would need to invest significant time and resources to achieve similar ecosystem penetration.

On the other hand, Circle continuously expands its partnership network through collaborations with internationally renowned institutions, creating a “flywheel effect.” The company partners with Visa and Mastercard to advance stablecoin payment applications, with MoneyGram for offline conversions, and with BNY Mellon for asset custody services. These partners are typically large and resource-rich, and their support significantly expands USDC’s use cases. For instance, Visa piloted using USDC for cross-border credit card settlements as early as 2021, marking the first integration of a stablecoin into a traditional payment network. As more major players join Circle’s ecosystem, it becomes increasingly difficult for new entrants to secure support at a comparable level. The network effect means that scale itself becomes a moat: the more users and applications USDC has, the greater its utility, thereby attracting more users and creating a virtuous cycle.

Sustainability of the Moat:

Although the above advantages place Circle in a favorable position in current competition, its moat is not impregnable and requires continuous investment to maintain and expand:

- Regulatory advantages may become standardized: As industry regulatory frameworks mature and standardize, compliance could shift from a differentiating advantage to a basic entry requirement. Once competitors achieve full compliance, Circle will need to maintain leadership through superior service and product experience.

- Network effects rely on application scenarios: If the expansion of use cases stalls, newcomers might poach users through incentive strategies (e.g., offering interest or lower fees). Although the U.S. stablecoin bill prohibits direct interest payments to users, in practice, as described earlier, issuers often use exchanges as channels to indirectly pay interest to users, an area where Circle itself incurs significant distribution costs.

- Technological leadership requires sustained investment: Blockchain technology evolves rapidly. Circle must maintain leadership in performance, security, and new features, otherwise risking being overtaken by more agile competitors.

- Brand reputation requires long-term maintenance: The company must rigorously avoid any events that could damage trust, adhering to transparent operations and communication to maintain market confidence.

In summary, Circle’s current moat is among the strongest in the stablecoin industry, robustly supporting its market position for the coming years. If it can successfully leverage its compliance advantage to expand into traditional finance, its moat will widen further, realizing the Matthew effect of “the strong get stronger.” However, existing advantages could be eroded by strategic missteps or poor management. Therefore, Circle must continuously strengthen compliance, deepen partnerships, maintain technological leadership, and uphold its brand reputation to sustain its leadership position throughout the ongoing normalization of the stablecoin industry.

7. Key Risks and Challenges

1. Interest Rate Dependency Risk

Circle’s revenue structure is highly dependent on the level of US short-term interest rates, with interest income accounting for 99% of its total revenue in 2024. This concentration means that once the US enters an interest rate-cutting cycle, the company’s revenue and profits face the risk of a sharp decline. The market generally expects the Federal Reserve to begin cutting rates in 2025-2026. If this occurs, Circle’s profitability could significantly decrease from the 2024 peak.

In the long term, if the global economy returns to a low-interest-rate environment (like the 2010s), Circle will need to develop non-interest revenue sources; otherwise, the sustainability of its business model will be challenged. Furthermore, interest rate dependency makes the company’s valuation highly sensitive to macroeconomic data—any lower-than-expected inflation or dovish signals from the Fed could trigger market concerns about profit declines, thereby increasing stock price volatility. To address this risk, Circle needs to actively expand its non-interest businesses, optimize its profit-sharing mechanisms, and build profit reserves during high-rate periods to prepare for future downturns. However, the effects of these measures are limited in the short term, making interest rate risk a significant uncertainty that investors must confront.

- Competition and Substitution Risk

Although Circle is a leader in the compliant stablecoin space, the evolving competitive landscape still poses threats to its market share and growth:

- Existing Competitors: Tether (USDT) still possesses a larger user base and deeper liquidity pools, maintaining dominance in some markets (especially regions less sensitive to compliance). If it improves operational transparency or adjusts its strategy, it would become more difficult for Circle to gain market share.

- New Entrants: PayPal has launched PYUSD and is steadily promoting it, leveraging its massive user and merchant network. Multiple banking institutions are also exploring issuing their own stablecoins. If these players achieve rapid penetration using their existing ecosystems, they could erode Circle’s presence in payment applications.

- Emerging Alternatives: Innovative products like Ethena’s USDe, which claims full compliance and offers yields tied to treasury strategies, could attract users away if they provide higher returns.

- Central Bank Digital Currencies (CBDCs): If the US or EU launches an official digital currency and promotes its use through policy guidance, it could squeeze the market space for private stablecoins. Although the industry generally believes CBDCs and stablecoins can coexist, the risk of structural impact from policy倾斜 (tilting) needs vigilance.

- Technological Disruption: Emerging technological solutions, such as decentralized stablecoins, could fundamentally challenge Circle’s business model if they solve the problem of achieving price stability without fiat currency backing (although this is currently extremely difficult).

Facing this competition, Circle must continuously enhance its product experience, deepen customer relationships, offer differentiated enterprise-grade services, stay abreast of industry technological advancements, and adjust its strategic direction if necessary, such as actively participating in CBDC ecosystem cooperation, to maintain competitiveness in a changing market.

- Policy and Regulatory Risk

Regulatory uncertainty was previously a major risk for the entire stablecoin industry. However, following the successful passage of the US GENIUS Act, this risk has diminished significantly, although uncertainties remain regarding the specific implementation of the law. Nevertheless, the gradual finalization of regulations will inevitably increase Circle’s compliance costs, thereby reducing its profit margins.

Changes in the political environment also warrant caution. While current US government policy is relatively business-friendly, a future change in administration (e.g., a potential Democratic government post-2028) could shift policy towards heightened regulatory scrutiny, or even promote a CBDC to constrain the development space for private stablecoins. Internationally, some countries might impose restrictive policies on USD stablecoins to protect their local currency status or financial stability. Regulations limiting the use of USDC in major economies like the EU or India would directly impact Circle’s global strategy.

Overall, the current regulatory status represents the most favorable historical period for Circle. A policy reversal or significant regulatory tightening would directly impact its business expansion and market confidence. Therefore, Circle needs to actively engage in policy communication, adjust its compliance strategy in a timely manner, and reduce reliance on a single policy environment through diversification (e.g., applying for a bank charter, exploring CBDC cooperation).

- Credit and Operational Risk