Recently, the tokenized US stocks sector has witnessed several new developments:

- Centralized exchange Kraken announced the launch of its tokenized stock trading platform, xStocks.

- Centralized exchange Coinbase announced it is seeking regulatory approval for its tokenized stock trading services.

- Public blockchain Solana submitted a framework for blockchain-based tokenized US stock products.

Both US-based public blockchains and exchanges are accelerating their efforts in tokenized US stocks. Combined with the recent enthusiasm following Circle’s IPO, this momentum is fueling optimism about the future prospects of tokenized US equities.

In fact, the value proposition of tokenized U.S. stocks is very clear:

1. Expanded the scale of the trading market: It provides a 7×24-hour, borderless, and license-free trading venue for US stock trading, which is currently unavailable to Nasdaq and NYSE (although Nasdaq has applied for 24-hour trading, it is expected to be realized in the second half of 26)

2. Superior composability: By combining with other existing DeFi infrastructure, U.S. stock assets can be used as collateral, margin, to build indexes and fund products, and derive many currently unimaginable gameplays.

The needs of both supply and demand are also clear:

Suppliers (US-listed companies): Through the borderless blockchain platform, they have reached potential investors from all over the world and obtained more potential buying orders.

Demand side (investors): Many investors who were unable to trade U.S. Stocks directly in the past for various reasons can now directly allocate and speculate on U.S. stock assets hrough blockchain.

Quoted from “U.S. Stocks on the Blockchain and STO: A Hidden Narrative“

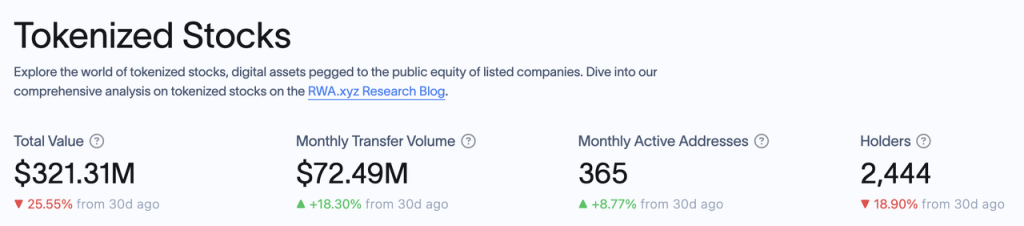

In this round of tolerant crypto regulatory cycle, progress is a high probability event. According to RWA.xyz data, the current market value of tokenized stocks is only 321 million US dollars, and there are 2,444 addresses holding tokenized stocks. The huge market space is in sharp contrast to the current limited asset size.

In this article, we will introduce and analyze the product solutions of current players in the tokenized U.S. stock market and other players who are promoting the tokenization of U.S. stocks, and list potential investment targets under this concept.

This article is the author’s interim thinking as of the time of publication. It may change in the future, and the views are highly subjective. There may also be errors in facts, data, and logical reasoning. All views in this article are not investment advice, and we welcome criticism and further discussion from colleagues and readers.

According to data from rwa.xyz, the current tokenized stock market has the following projects by issuance size:

We will take a look at the business models of Exodus, Backed Finance, and Dinari (Montis Group targets European stocks, and SwarmX is similar to Backed Finance but on a smaller scale), as well as the progress of several other important players who are currently working on tokenized US stock business recommendations.

Contents

Exodus

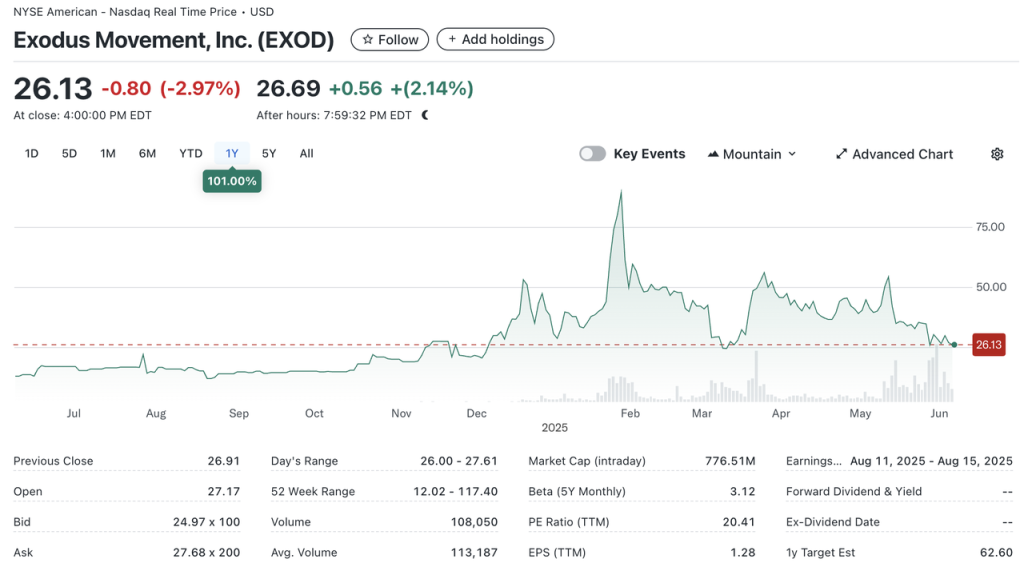

Exodus (NYSE.EXOD) is an American company that develops non-custodial crypto wallets. Its stock is listed on the New York Stock Exchange (NYSE.EXOD). In addition to its own branded wallets, Exodus has also collaborated with NFT market MagicEden to launch a wallet.

As early as 2021, Exodus allowed users to migrate their common shares to the Algorand chain through Securitize, but the tokens migrated to the chain could not be traded or transferred on the chain, nor did they include governance rights or other economic rights (such as dividends). The Exodus token is more like a “digital clone” of real shares, and its symbolic significance on the chain is greater than its actual significance.

The current market value of EXOD is US$770 million, of which approximately US$240 million is on-chain.

Exodus is the first stock approved by the SEC to tokenize its common stock (or to be more precise, Exodus is the first tokenizable stock approved by the SEC to be listed on the NYSE). Of course, this process was not smooth sailing. The listing time of Exodus stock was delayed again and again since May 2024, and it was not officially listed on the NYSE until December.

However, Exodus’ stock tokenization is only for its own stocks, and the tokenized stocks cannot be traded, which is of little significance to us Web3 investors.

Dinari

Dinari is a company registered in the United States. They were founded in 2021. Since its establishment, they have been focusing on stock tokenization under the US compliance framework. They completed a $10 million seed round of financing in 2023 and a $12.7 million Series A financing in 2024. Investors include Hack VC and Blockchange Ventures, Coinbase CTO Balaji Srinivasan, F Prime Capital, VanEck Ventures, Blizzard (Avalanche Fund), etc. Among them, F Prime is a fund under the asset management giant Fidelity. The investment of Fidelity and VanEck also shows the recognition of the tokenized US stock market by traditional asset management institutions.

Dinari only supports non-US users. The process of trading US stocks is as follows:

- User completes KYC

- The user selects the US stocks they want to buy and pays with USD+ issued by Dinari (a short-term Treasury bond-backed stablecoin issued by Dinari that can be exchanged from USDC)

- Dinari submits the order to the cooperating broker (Alpaca Securities or Interactive Brokers). After the broker completes the order, the shares are kept in the custodian bank, and Dinari mints the corresponding dShares for the user.

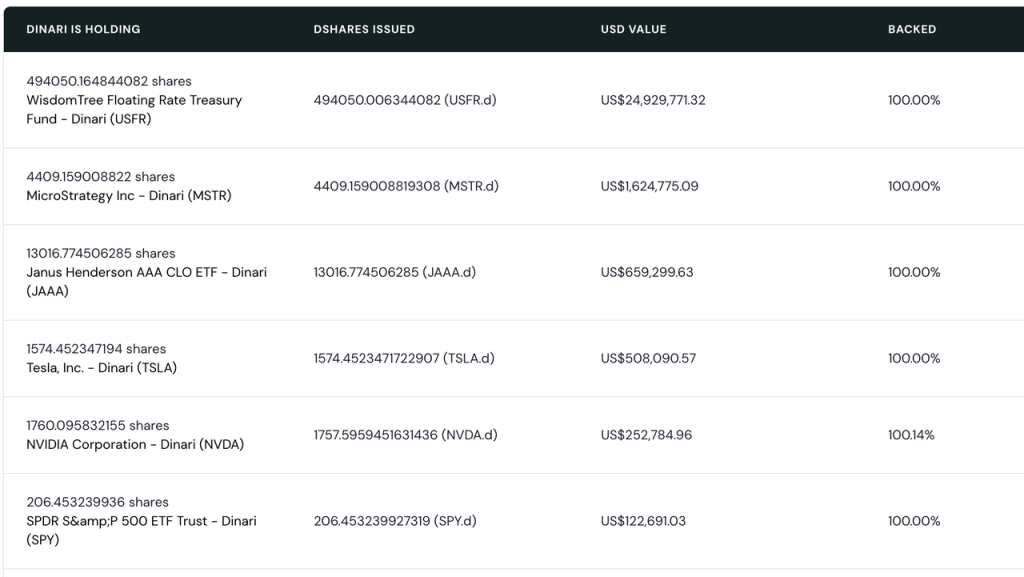

Currently, Dinari operates on Arbitrum, Base, and the Ethereum mainnet. All dShares have a 1:1 correspondence with real-world equity. Users can view the equity corresponding to their dShares through the Dinari official website. Dinari can also distribute dividends or stock splits to users holding its dShares.

However, dShares cannot be traded on the chain. If you want to sell dShares, you can only trade through the Dinari official website. The actual transaction process is the reverse of the purchase process. dShares transactions must also follow US trading hours and cannot be bought or sold outside of trading hours. In terms of product form, in addition to direct stock trading, they also offer stock trading APIs that can work with other trading front ends.

In fact, Dinari’s business process, namely “KYC->payment exchange->clearing and settlement by compliant brokers”, is consistent with the current mainstream way for non-US users to participate in US stock transactions. The main difference is that the asset categories paid by users are Hong Kong dollars, euros, etc., while the asset categories accepted by Dinari are encrypted assets. The rest are completely implemented in accordance with the SEC’s regulatory framework.

As a company mainly engaged in the tokenization of US stocks, Dinari’s courage to register the company in the United States (the registration place of the corresponding entities of most other projects is in Europe) shows its confidence in its compliance capabilities. Their US stock tokenization products were officially launched in 2023. At that time, the former SEC Chairman Gary Gensler, who was known for his strict supervision of cryptocurrencies, could not find fault with its business model; and after the new SEC Chairman Paul Atkins took office, the SEC once held a special meeting with Dinari, asking Dinari to demonstrate its system and answer relevant questions (source), which showed that its products were impeccable in terms of compliance and the team’s strong resources in compliance.

However, since Dinari’s tokenized US stocks do not enable on-chain trading, cryptocurrency serves merely as an entry point and payment method for Dinari. Functionally, Dinari’s product offers little distinction from platforms like Futu or Robinhood. For its target users, Dinari’s product experience provides no advantage over its competitors. For a user in Hong Kong, trading US stocks on Dinari offers no improved experience compared to using Futu. Additionally, it lacks access to trading features like margin trading, and users may even face potentially higher fees.

Perhaps precisely for these reasons, Dinari’s tokenized stock market has remained small in scale. Currently, only the tokenized stock MSTR has a market capitalization exceeding $1 million, and just five tokenized stocks have market caps above $100,000. Presently, the vast majority of its TVL is participating in its floating-rate treasury products.

Overall, Dinari’s tokenized stock business model has received regulatory certification. However, strict compliance requirements prevent its tokenized stocks from being traded/staked on-chain, eliminating composability. This results in an inferior user experience for dShare holders compared to traditional brokerages, diminishing the product’s appeal to mainstream Web3 users.

Among current market players, projects similar to Dinari include the meme coin Stonks community project mystonks.org. According to the project’s self-disclosed reserve report, their U.S. stock portfolio currently exceeds $50 million in market value, with significantly higher user trading activity than Dinari.

However, the regulatory framework of mystonks.org remains flawed. For instance, the qualifications of its securities custody account are not clearly specified, and users cannot verify its reserve reports.

Backed Finance

Backed Finance is a Swiss company, also founded in 2021. Its product launched in early 2023, and in 2024 it completed a $9.5 million funding round led by Gnosis, with participation from Cyber Fund, Blockchain Founders Fund, Blue Bay Capital, and others.

Like Dinari, Backed does not serve U.S. users. Its operational process is as follows:

- Issuers (professional investors) complete KYC verification and review on Backed Finance.

- The issuer selects the U.S. stocks they wish to purchase and pays in stablecoins.

- Backed Finance submits the order to a partner brokerage to complete the stock purchase. After the purchase, Backed Finance mints the corresponding bSTOCK token and delivers it to the issuer.

- Both bSTOCK and its wrapped version wbSTOCK can be freely traded on-chain (the wrapping primarily facilitates handling dividend distributions, etc.). Retail investors can directly purchase bSTOCK or wbSTOCK on-chain.

As can be seen, unlike Dinari where retail investors directly purchase stocks, Backed Finance currently relies on professional investors buying the stocks and then transferring them to retail investors. This significantly improves overall operational efficiency and enables 24/7 trading. Another key difference is that the bSTOCK tokens issued by Backed are unrestricted ERC-20 tokens, allowing users to form LP on-chain for others to purchase.

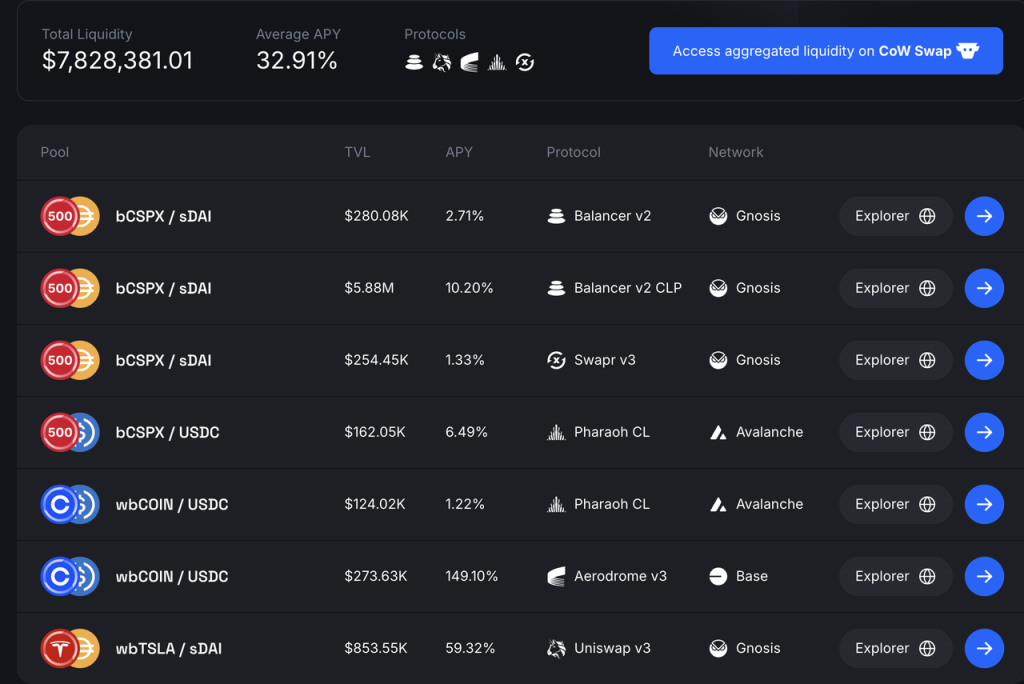

Backed Finance’s on-chain liquidity primarily derives from the SPX index, Coinbase, and Tesla. Users create liquidity by pairing bSTOCK tokens with stablecoins in AMM pools. The current TVL across all liquidity pools approaches $8 million, with an average APY of 32.91%. Liquidity is distributed across Balancer and Swapr on Gnosis Chain, Aerodrome on Base, and Pharaoh on Avalanche. Notably, the bCOIN-USDC liquidity pool currently offers an APY reaching 149%.

A critical operational distinction is that Backed Finance imposes no restrictions on on-chain trading of its bSTOCK tokens. This creates a secondary pathway for token holders, where on-chain users – without undergoing KYC verification – can directly purchase bSTOCK using stablecoins such as USDC or sDAI.

This approach effectively bypasses KYC restrictions while delivering a trading experience indistinguishable from trading standard on-chain tokens, making it more readily adoptable by Web3 users. Moreover, by issuing unrestricted ERC-20 tokens, Backed unlocks composability for tokenized stock holders – exemplified by stablecoin pairings generating LP yields averaging 33% APY. This likely explains why Backed Finance’s TVL is nearly 10 times larger than Dinari’s.

Regarding compliance, Backed Finance operates through a Swiss-registered entity. Its business model – where “ERC-20 tokens representing tokenized stocks are freely transferable” – has received approval from European regulatory authorities (source). Backed also publishes proof-of-reserve audits conducted by The Network Firm.

However, the U.S. SEC has not yet commented on Backed’s operations. Notably, all securities tokenized by Backed are U.S. stocks. While Swiss regulatory approval is certainly beneficial, the more critical factor is how U.S. regulators will ultimately assess this model.

Among comparable projects, SwarmX operates under an identical model but falls significantly short of Backed Finance in both operational scale and compliance rigor.

Despite Backed Finance’s tokenized stocks having a market cap ten times larger than Dinari’s, its $20 million-plus assets under management and $8 million TVL still represent relatively modest scale, while on-chain trading activity remains notably low. The core reasons for this include:

- Limited Use Cases: Tokenized stocks currently only serve LP purposes on-chain. Their composability potential remains largely untapped, likely due to concerns from integrated protocols (e.g., lending/stablecoin) regarding regulatory uncertainty.

- Liquidity Constraints: As Backed itself is not an exchange, its tokenized stocks lack organic liquidity support. Existing liquidity relies entirely on issuers, specifically, their willingness to hold tokenized stocks and provide LP capital. Current data indicates that issuers lack the incentive to increase exposure in these areas.

Should the SEC establish clearer regulatory frameworks affirming Backed’s model, both issues could be alleviated.

xStocks

In May this year, the U.S. exchange Kraken announced plans to collaborate with Backed Finance and Solana to launch xStocks.

On June 30th, the xStocks product officially launched. Its partners include Backed, Kraken, and Solana, as well as centralized exchanges Kraken and Bybit, Solana-based decentralized exchanges Raydium and Jupiter, lending protocol Kamino, Bybit-incubated DEX Byreal, oracle Chainlink, payment protocol Alchemy Pay, and brokerage firm Alpaca.

The legal architecture of xStocks is identical to that of Backed Finance. It currently supports over 200 stock products, with Kraken offering 24/5 trading hours. Key partnerships include: Kraken, Bybit, Jupiter, Raydium, and Byreal as supporting exchanges; Kamino enables xStocks to be used as collateral, while Kamino Swap facilitates trading of xStocks; Solana as the underlying blockchain; Chainlink providing reserve attestations; and Alpaca serving as a brokerage partner.

Due to its relatively short time since launch, comprehensive data metrics remain limited, and trading volumes are currently modest. However, xStocks demonstrates significantly stronger partner integration compared to Backed Finance’s native offering:

CEX like Kraken and Bybit may leverage their existing market makers and user bases to enhance liquidity for xStocks. Within the on-chain ecosystem, multiple DEXs and Kamino support xStocks. Significantly, Kamino has pioneered new use cases for tokenized U.S. stocks beyond liquidity provision. Additional protocols are expected to integrate xStocks in the future, further expanding its composability potential.

Given these strategic advantages, the author maintains that despite its nascent launch status, xStocks will rapidly surpass existing providers to become the dominant tokenized U.S. stock issuer.

Robinhood

Robinhood, which has been actively expanding its cryptocurrency business, submitted a report to the SEC in April 2025 calling for the establishment of an RWA regulatory framework covering tokenized stocks. In May, Bloomberg reported that Robinhood would create a blockchain platform enabling European investors to trade U.S. stocks, with Arbitrum or Solana being candidate public chains.

Also on June 30, Robinhood officially announced the launch of its tokenized U.S. stock trading product for European investors. The product supports dividend distributions and offers 5*24 market access.

Robinhood’s tokenized stock product was initially issued on Arbitrum. In the future, its tokenized stock infrastructure will operate on Robinhood’s proprietary L2, which is also built on Arbitrum.

However, according to Robinhood’s official documentation, its current tokenized stock product does not constitute genuine tokenized equity, but rather derivative contracts tracking the prices of corresponding U.S. Stocks, with the underlying assets securely held by licensed U.S. institutions in Robinhood Europe accounts. Robinhood Europe issues these contracts and records them on the blockchain. Currently, these tokenized stocks can only be traded within Robinhood and are not transferable.

Other Players Venturing into the Space

Beyond the projects with operational deployments discussed above, numerous other players are venturing into tokenized U.S. equities, including:

Solana

Solana demonstrates a significant commitment to tokenized equities beyond its involvement with xStocks. It has established the Solana Policy Institute (SPI), which aims to “educate policymakers on why decentralized networks like Solana represent foundational infrastructure for the future digital economy.” Two projects are currently being advanced. One is named Project Open, “enable compliant blockchain-based issuance and tradingof securities. This initiative seeks to harness blockchain technology to create more efficient, transparent, and accessible capitalmarkets while maintaining robust investor protections.” Members of Project Open, besides SPI, include the Solana-based DEX Orca, RWA service provider Superstate, and the law firm Lowenstein Sandler LLP.

Since April this year, Project Open has repeatedly submitted public written comments to the SEC’s Crypto Task Force. On June 12, the SEC’s Crypto Task Force held a meeting with them, after which Project Open members separately submitted further explanations regarding their respective business operations.

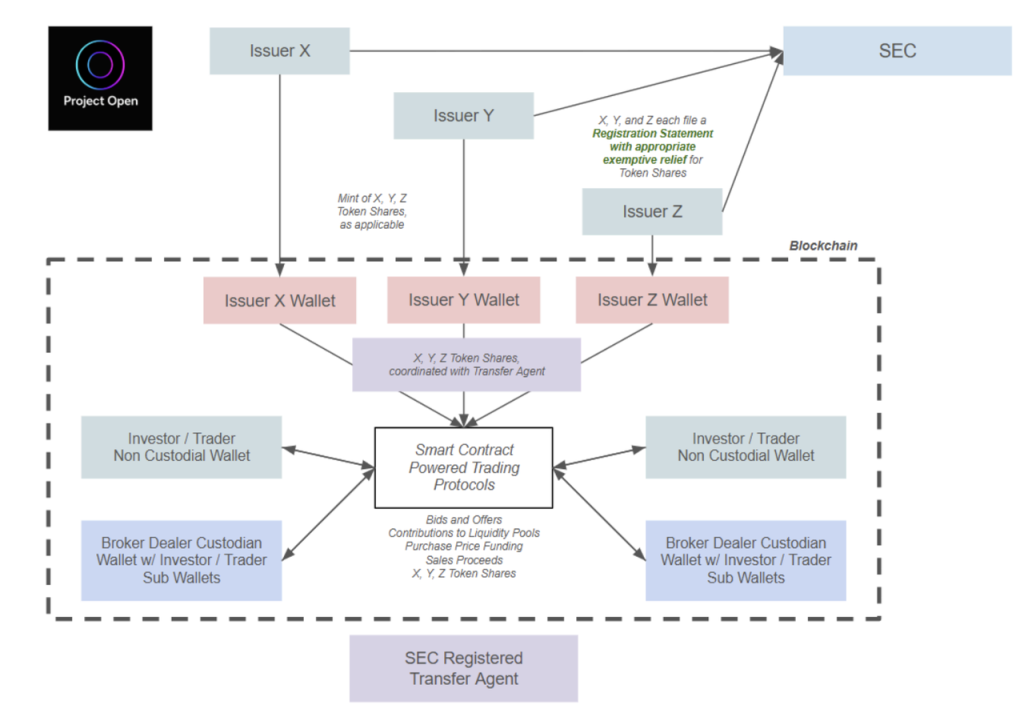

The tokenized U.S. stock issuance and trading process advocated by Project Open is as follows:

The process is summarized as follows:

- Issuers must pre-apply for SEC approval. Upon approval, they may issue tokenized U.S. stocks.

- Users wishing to purchase tokenized U.S. stocks must complete KYC verification beforehand. After completion, they may use cryptocurrency to purchase these issuer-approved tokenized stocks.

- SEC-registered transfer agents will record share transfers on-chain.

Project Open specifically advocates for SEC permission enabling peer-to-peer trading of tokenized U.S. stocks via smart contracts. This would allow tokenized stock holders to trade through AMM, thereby unlocking on-chain composability. However, per the proposed framework, all holders of tokenized U.S. stock positions must complete KYC. To implement this process, Project Open has requested 18-month exemptive relief or confirmatory guidance for multiple operations (see references for details).

Overall, Project Open’s proposal builds upon Backed Finance’s existing framework by adding KYC requirements. From the author’s perspective, approval under the current SEC leadership, which has shown relative tolerance toward DeFi, appears almost certain. The only remaining question is the timing of approval.

Coinbase

As early as 2020, when Coinbase applied for a Nasdaq listing, its filing included plans for on-chain issuance of tokenized COIN. However, this initiative was abandoned due to non-compliance with SEC requirements at the time. Recently, Coinbase has been seeking a no-action letter or exemptive relief from the SEC for its tokenized stock trading business. While detailed documentation remains unavailable, a key confirmed detail from press releases states: Coinbase’s tokenized stock trading program will be accessible to U.S. users.

This represents the key distinction from other current tokenized stock market players and enables Coinbase to directly compete with online brokerages like Robinhood and traditional brokers such as Charles Schwab. For Web3 investors, however, this development holds far less significance than its implications for Nasdaq:COIN.

Ondo

Ondo, which has established a proven presence in the treasury bond RWA market (see Mint Ventures’ earlier coverage on Ondo), has long planned a tokenized U.S. stocks business. According to their documentation, their tokenized stock product features:

- Accessibility to non-U.S. users

- 24/7 trading availability

- Real-time token minting and redemption

- Permission to use tokenized stock assets as collateral

Judging from these specifications, Ondo’s product closely aligns with the new framework proposed by Solana. Ondo has also announced at Solana’s Accelerate conference its intention to launch the tokenized stock product on the Solana network.

Ondo’s tokenized stock platform, Ondo Global Markets, is scheduled to launch later this year.

The above outlines the current landscape of the tokenized U.S. stock market and key players expanding into this space.

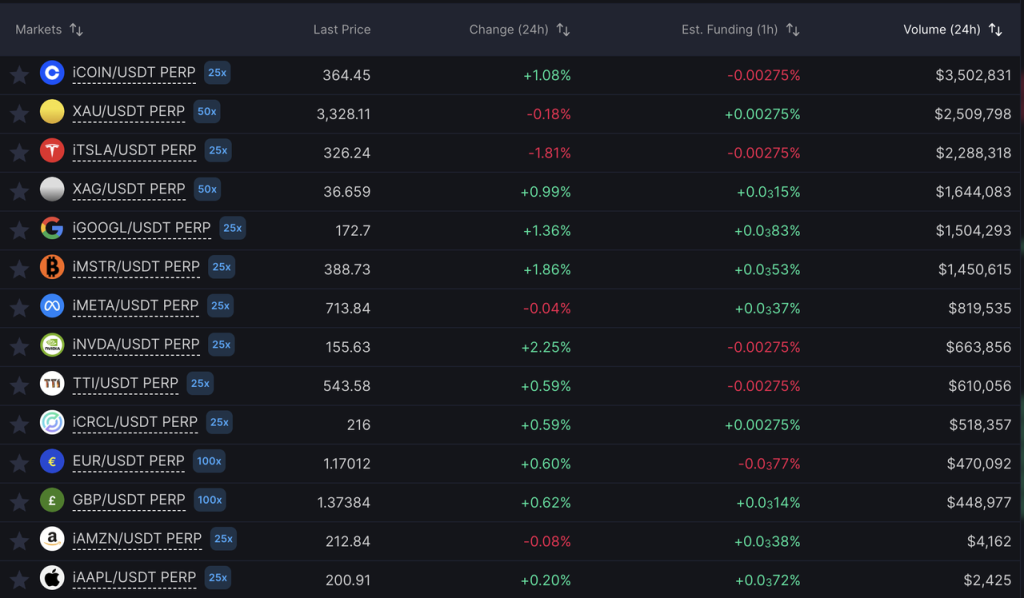

Fundamentally, users’ primary motivation for purchasing tokenized stocks is to profit from price fluctuations. Their focus centers on: exchange liquidity, settlement guarantees, and the ability to trade while bypassing KYC. Whether the tokenization is performed by compliant institutions is not a user priority. Consequently, the Web3 market has consistently offered derivative-based solutions for synthetic U.S. stock exposure.

U.S. equity trading via derivative-based instruments

Platforms providing U.S. stock derivatives services primarily include Gains Network (on Arbitrum and Polygon) and Helix (on Injective). Their users do not actually trade U.S. equities, thus eliminating the need for tokenization.

Their core product logic applies perpetual contract mechanisms to U.S. stocks, typically featuring:

- No KYC requirements for traders, and stablecoins as collateral with leveraged trading

- Trading hours synchronized with U.S. market sessions

- Asset prices sourced directly from trusted oracles like Chainlink

- Funding rates balancing on-platform prices against fair market values

However, neither current platforms (Gains/Helix) nor predecessors (Synthetix/Mirror) have achieved significant trading volumes with synthetic stock models. Helix processing under $10 million daily in synthetic U.S. stock derivatives, and Gains Network handling less than $2 million in comparable activity. This underperformance stems from two critical factors:

- This model carries significant regulatory risks. Although they do not actually facilitate trading of U.S. stocks, they effectively function as exchanges, enabling users to trade U.S. equities. Regulators impose clear requirements on any exchange, with KYC being one of the most fundamental compliance obligations. While regulators may overlook such platforms when they remain under the radar, they will inevitably come under scrutiny if their profile grows substantially.

- Furthermore, none of these platforms currently possesses sufficient liquidity to meet genuine user trading demands. Their liquidity models rely entirely on internal, self-contained solutions without access to third-party liquidity sources. Consequently, none of them can provide users with viable trading depth.

On the centralized exchange front, Bybit recently launched a U.S. equities trading platform based on MT5. This product similarly adopts perpetual contract-like mechanics, executing no actual equity transactions but facilitating index trading with stablecoins as collateral.

Additionally, the upcoming Shift project introduces the concept of Asset-Referenced Tokens (ART), claiming to enable KYC-free U.S. stock trading through the following operational flow:

- Shift purchases U.S. stocks and custodies them with regulated brokers (e.g., Interactive Brokers) and uses Chainlink Proof-of-Reserve for asset verification

- Issues ART backed by reserved stocks, each ART corresponds to underlying equities, but does not constitute tokenized stocks.

- Retail investors can purchase ART without KYC

Shift’s model maintains 100% reserve backing between ARTs and underlying U.S. equities. However, ARTs do not constitute tokenized stocks and confer no share ownership rights, dividend entitlements, or voting privileges. Consequently, they fall outside existing regulatory frameworks, enabling KYC-free trading (Source).

From a regulatory logic perspective, ART is not permitted to be pegged to securities assets. It remains unclear how the Shift team intends to implement ‘pegging ART to U.S. stocks’ in practice, nor is it certain whether the final product design will truly operate according to the above-described mechanisms. However, by leveraging certain loopholes in regulatory provisions, this solution achieves KYC-free U.S. stock trading and warrants ongoing monitoring.

What Kind of Tokenized U.S. Stock Products Does the Market Need?

Regardless of the tokenization approach, all solutions share this core two-step process:

- Tokenization: The process is typically managed by regulated entities that provide periodic proof-of-reserves. Fundamentally, it enables KYC-compliant users to access U.S. equities through blockchain representation after traditional acquisition. Minimal divergence exists across current implementation frameworks.

- Trading: End-users transact with tokenized equities. The critical divergence across solutions manifests here: certain platforms prohibit trading entirely (Exodus); others restrict transactions to licensed broker channels (Dinari and mystonks.org); while several enable native on-chain trading (Backed Finance, Solana, Ondo, Kraken). Notably exceptional is Backed Finance, which currently leverages Swiss regulatory frameworks to allow non-KYC users direct AMM purchases of its tokenized U.S. stock products.

For end-users, the tokenization process primarily concerns regulatory compliance and asset security, criteria currently met by most market players. The pivotal differentiator lies in trading mechanisms. Platforms like Dinari restrict transactions to licensed broker channels while offering no liquidity mining or lending, substantially diminishing the utility of tokenized equities. Regardless of compliance rigor or operational refinement, such limitations inherently deter user adoption.

Conversely, models like xStocks, Backed Finance, and Solana represent more consequential long-term solutions. By enabling native on-chain trading—bypassing traditional brokerage systems—they fully harness DeFi’s core advantages: 24/7 accessibility and programmable composability.

However, on-chain liquidity remains insufficient to rival traditional venues. Low-liquidity exchanges functionally equate to unusable platforms; tokenized equities cannot scale without deeper liquidity pools. This is also why the author is optimistic about xStock.

Ultimately, as regulatory clarity emerges and tokenized stocks proliferate across Web3, market share will likely consolidate toward exchanges with pre-existing advantages: superior liquidity and established trader networks.

In fact, we can see from the few examples in the previous cycle that Synthetix, Mirror, and Gains all launched products featuring U.S. stock trading in 2020. However, the most influential U.S. stock trading product was FTX. FTX’s approach was actually quite similar to the current solution offered by Backed Finance, but FTX’s trading volume and AUM for stocks were far higher than Backed Finance’s.

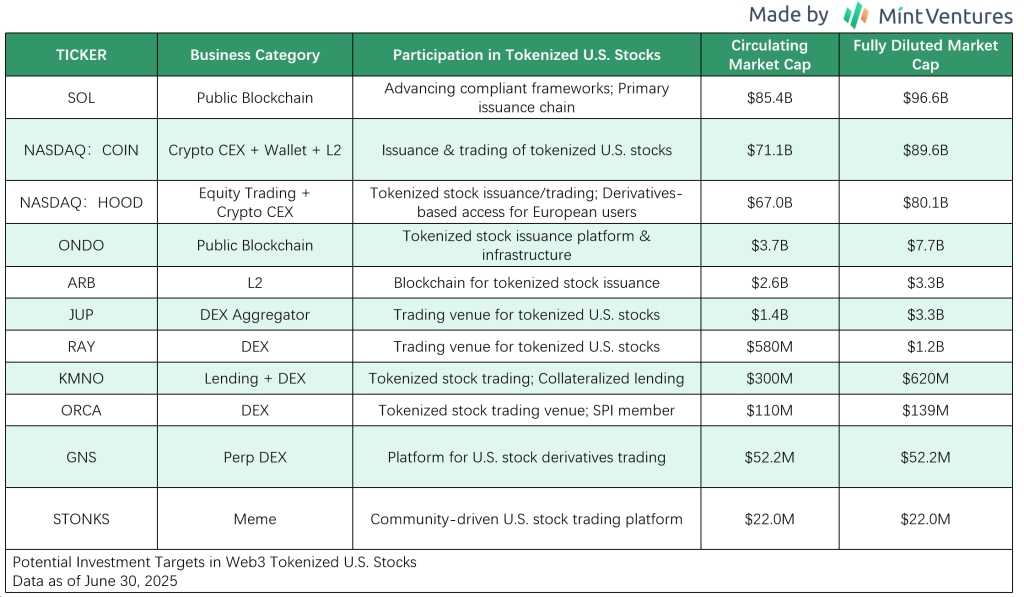

Potential Investment Targets

Although the market potential for tokenized U.S. stocks is significant, there are currently very few investable options available to investors.

Among existing players, neither Dinari nor Backed Finance has issued a token. Dinari has even explicitly stated that it will not issue one. The only potential investment target in this category is the meme token STONKS, associated with mystonks.org.

As for actively involved players, the tokens of Coinbase, Solana, and Ondo already have relatively high market capitalizations. Moreover, tokenized U.S. stocks are not their core business. While progress in tokenized equities may have some influence on their tokens, the extent of that impact is hard to predict.

xStock’s partners include leading Solana-based DEXs such as Raydium and Jupiter, as well as the lending protocol Kamino. However, these collaborations are unlikely to bring significant growth to the mentioned protocols.

Among the members of the SPI Project Open initiative, Phantom and Superstate have not issued tokens, while only Orca has.

In the derivatives space, Helix has yet to launch a token, leaving GNS as the only investable option.

Since these projects vary widely in their business models and approaches to tokenized U.S. stocks, it’s not possible to conduct a meaningful valuation comparison. Instead, we provide a summary of the basic information for the relevant tokens below:

References

https://x.com/xrxrisme69677/status/1925366818887409954

https://www.odaily.news/post/5204183

Project Open References:

- Initial Framework Submitted in April: https://www.sec.gov/files/ctf-written-project-open-wireframe-04282025.pdf

- June 12 Meeting Between SEC Crypto Working Group and Project Open Team: https://www.sec.gov/files/ctf-memo-solana-policy-institute-et-al-061225.pdf

- June 17 Updates by SPI

- Updated Proposal Framework by SPI: https://www.sec.gov/files/project-open-chain-equities-infrastructure-061725.pdf

- Supplemental Materials from SPI: https://www.sec.gov/files/project-open-061725.pdf

- Phantom Technologies Submission: https://www.sec.gov/files/phantom-technologies-061725.pdf

- Superstate Submission: https://www.sec.gov/files/ctf-superstate-letter-061725.pdf

- Orca Creative Submission: https://www.sec.gov/files/orca-creative-061725.pdf

Project Open submitted an application for exemptive relief or confirmatory guidance, which includes:

- Blockchain, as a technological tool, does not in itself require or mandate any SEC registration.

- Network fees on blockchain are considered technical costs and are not treated as securities transaction fees.

- Peer-to-peer transactions conducted via smart contract protocols are permissible and do not fall under the regulatory definition of exchange or ATS transactions, as they are bilateral transactions, similar to those envisioned under Section 4(a)(1) of the Securities Act of 1933.

- Relief for broker-dealers to participate in Section 4(a)(1) transactions (serving in a limited administrative role).

- Non-custodial/self-custodial wallets (and their providers) are not classified as broker-dealers.

- Holding tokenized equities in non-custodial/self-custodial wallets that have passed proper whitelisting and KYC is allowed.

- Broker-dealers may create sub-wallets for clients to hold tokenized equities. For custodial purposes, this satisfies the SEC’s requirement for “possession and control” of securities.

- Transfer agents may fulfill their responsibilities using blockchain if they have access to the KYC information of whitelisted wallet owners and modernized accredited investor educational materials, enabling the enforcement of: a) Transfer restrictions; b) Restrictive legends (e.g., for securities held by affiliates).

- Registration statements may be used to register tokenized equities, provided appropriate exemptive relief is granted. This includes: a) Proposals on content and format requirements; b) Proposals on methods of periodic reporting.

- Direct purchases of shares from the issuer, as envisioned above, would not cause purchasers to be considered underwriters or broker-dealers. These purchases are not made in the capacity of a broker or dealer.

- Requests for appropriate exemptions from Reg NMS, such as: Order Protection Rule, Best Execution, and Access Rule.