Contents

Introduction

Circle’s stock price has been soaring since its IPO (though showing a noticeable pullback recently), and stablecoin-related stocks in global markets are also exceptionally volatile. The U.S. stablecoin bill, the Genius Act, has passed the Senate vote and is now making its way through the House of Representatives. Recently, news emerged that tokens for the Trump family’s flagship project, World Liberty Financial (WLF), might be unlocked and enter circulation ahead of schedule. This counts as major news in the recently overall lackluster altcoin market, which has been starved of compelling narratives.

So, how is World Liberty Financial actually performing currently? How is its token mechanism designed? And what benchmarks should be used for its valuation?

Through this article, the author will attempt to provide a multi-dimensional analysis of World Liberty Financial’s current business status, project background details, tokenomics, and valuation expectations, offering readers several perspectives for evaluating the project.

PS: This article represents the author’s preliminary thoughts as of the time of publication and is subject to change. The views expressed are highly subjective and may contain factual, data-related, or logical errors. All opinions herein are in no way investment advice. Constructive feedback and further discussion from industry peers and readers are welcome.

Business: Product Status and Core Competitive Advantages

World Liberty Financial (WLF) is a decentralized finance DeFi platform co-founded with participation from the family of U.S. President Donald Trump. Its core product is the USD1 stablecoin. USD1 is a 1:1 dollar-pegged stablecoin fully backed by reserves of cash and U.S. Treasury bonds. World Liberty Financial also has plans for lending services (built on Aave) and a DeFi app, though these are not yet live.

USD1 Business Data

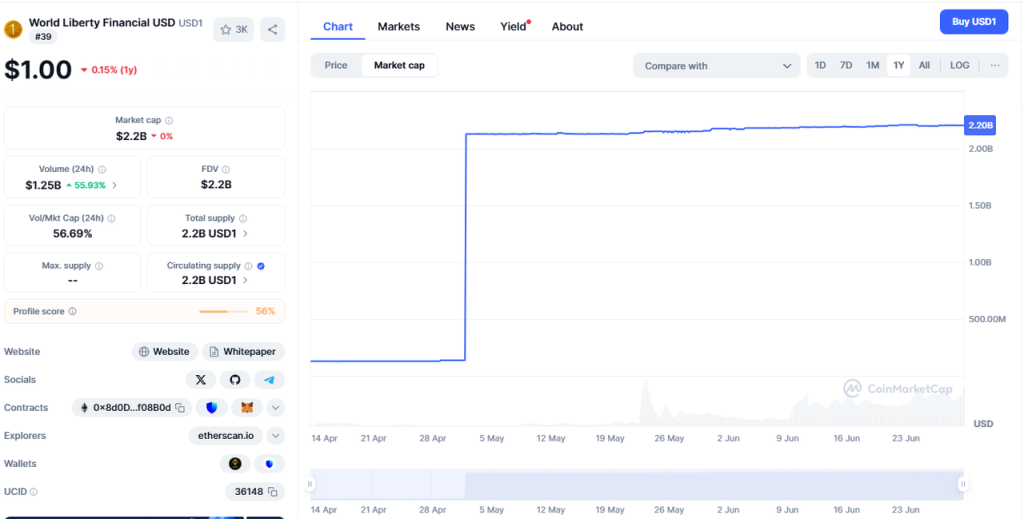

As of June 2025, the circulating supply of the USD1 stablecoin has reached approximately $2.2 billion. Among these, BNB Chain hosts 2.156 billion USD1 in circulation, Ethereum holds 48 million, and Tron maintains 26,000. BNB Chain accounts for 97.8% of the total supply, confirming that the vast majority of USD1 is issued on this network.

Regarding on-chain user metrics, BNB Chain leads with 248,000 wallet addresses holding USD1, followed by Ethereum at 66,000 addresses. Tron currently maintains merely one active address with USD1 holdings.

Analysis of token distribution reveals that on BNB Chain, 93.7% of USD1 (equivalent to 2.02 billion USD1) is held across two Binance-controlled addresses. Within this, 1.9 billion USD1 is concentrated in a single Binance address (0xF977814e90dA44bFA03b6295A0616a897441aceC).

Examining USD1’s historical market capitalization, we observe that prior to May 1, 2025, its market value remained around $130 million. However, on May 1 itself, the value surged to $2.13 billion, representing an overnight increase of nearly $2 billion.

The explosive growth primarily stems from Abu Dhabi investment firm MGX’s $2 billion equity investment in Binance in May 2025, where USD1 was selected as the payment currency. The current USD1 balance retained in Binance’s addresses aligns precisely with this $2 billion amount.

This implies:

- After receiving MGX’s USD1 investment, Binance did not convert it to USD or other stablecoins, making it USD1’s largest holder with 92.8% of total supply.

- Excluding this transaction-derived volume, USD1 remains a small-scale stablecoin with a circulating market value barely exceeding $100 million.

This business expansion model is likely to recur in future project development.

Business Partnerships

WLFI has established collaborations with multiple institutions and protocols to expand its market presence.

In June 2025, WLFI announced a partnership with London-based crypto fund Re7 to launch USD1 stablecoin vaults on Ethereum lending protocol Euler Finance and BNB Chain staking platform Lista. This initiative aims to amplify USD1’s footprint across Ethereum and BNB Chain ecosystems. Notably, Lista is a leading BNB staking platform backed by Binance Labs.

Additionally, Aave – currently the largest decentralized lending platform – has proposed integrating USD1 into its markets on Ethereum and BNB Chain. The draft proposal has already passed community voting.

For trading accessibility, USD1 is now listed on centralized exchanges including Binance, Bitget, Gate, and Huobi, as well as decentralized exchanges such as Uniswap and PancakeSwap.

World Liberty’s Competitive Advantages

World Liberty’s competitive edge is straightforward: the Trump family’s formidable political influence grants the project inherent advantages in specific business expansions unavailable to competitors. This initiative also serves as a potential conduit for interests among individuals, organizations, or even nations with commercial or political ties to Donald Trump.

A prime example is Binance’s use of USD1 – issued by World Liberty – as the capital vehicle for Abu Dhabi investment firm MGX’s massive funding. Binance continues to hold these assets interest-free (effectively boosting USD1’s TVL) while rapidly listing USD1 across its platforms.

However, World Liberty token holders face three primary risks:

- The Trump family maintains numerous channels for financial interests, and World Liberty may not be the ultimate choice for contributors. (For context on the Trump family’s diverse revenue streams, refer to Bloomberg’s late-May 2025 exposé: “THE TRUMP FAMILY’S MONEY-MAKING MACHINE“, detailing their multifaceted approaches.)

- WLFI tokens are fundamentally decoupled from World Liberty’s project value. (Analysed in the “Tokenomics” section below.)

- Potential operational abandonment by the Trump family post-token sell-off—or even during divestment—mirroring historical patterns observed in all Trump-affiliated crypto assets (from Trump Tokens to various NFTs).

Background: Backing and Financing Details

Core Team Background

World Liberty Financial’s core team hails from political and business circles, forming the foundation of the project’s competitive edge and influence.

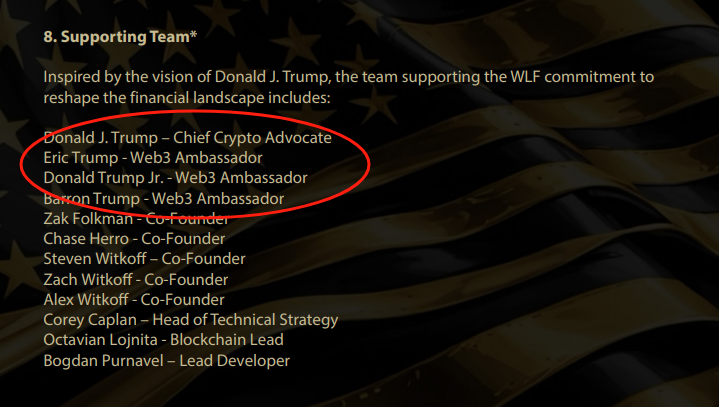

Undoubtedly, the project’s central figures are Donald Trump—the 45th and 47th President of the United States—and his three sons: Donald Trump Jr., Eric Trump, and Barron Trump (aged 17).

However, their listed roles on World Liberty Financial’s official website have undergone subtle yet notable shifts over the past month. As of mid-June, Donald Trump held the symbolic title of “Chief Crypto Advocate,” while his three sons were given equally vacuous roles as “Web3 Ambassadors.”

These definitions for all four Trump family members are identically stated in the project’s “Golden Paper”.

Nonetheless, the four Trump members are listed above all project Co-Founders in official placements.

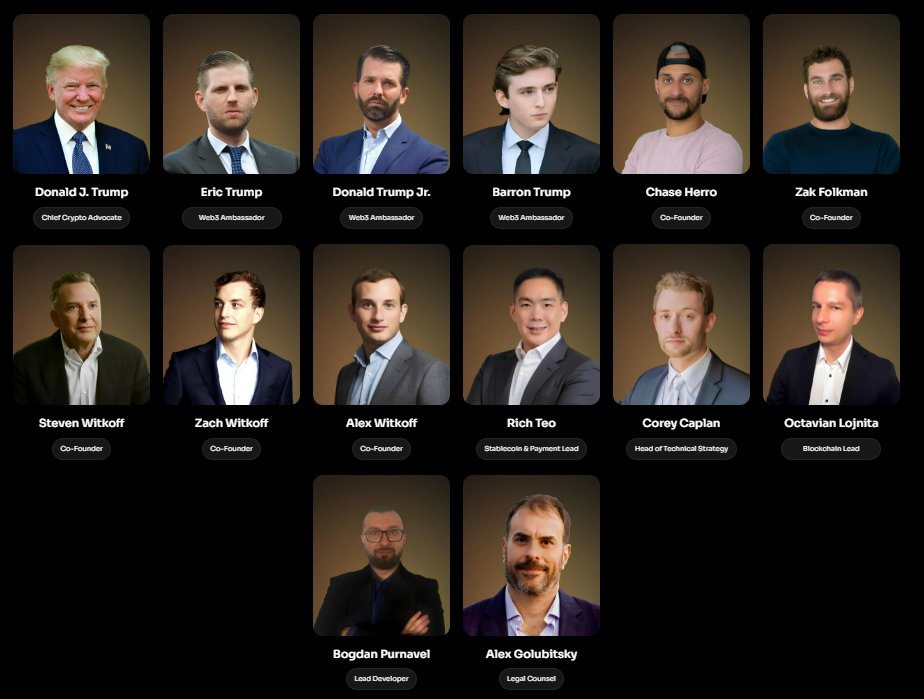

However, the project’s official team page has recently been updated with revised titles: Donald Trump is now listed as “Co-Founder Emeritus”, while his three sons have been designated as “Co-Founders.”

Another subtle detail: both Donald Trump and Steven Witkoff (another “Co-Founder Emeritus” whose title was downgraded from “Co-Founder” in the recent update) now have an almost imperceptible footnote marker “1” appended to their titles. At the bottom of the webpage, fine print clarifies: “Removed upon taking office”, indicating their honorary titles will be revoked if they assume public office.

This compliance mechanism aims to prevent conflicts of interest for government-affiliated figures by severing private commercial ties—a standard ethical requirement for U.S. public officials.

However, a critical contradiction exists: Donald Trump currently holds public office as the sitting U.S. President.

Beyond the Trump family, another pivotal figure is Steven Witkoff—a longtime business associate of Trump and prominent New York real estate magnate—serving as Co-Founder Emeritus. As founder and chairman of the Witkoff Group, he has maintained close ties with Donald Trump since the 1980s, frequently socializing on golf courses as widely recognized “longtime friends and business partners.”

Following Trump’s presidential inauguration, Witkoff was appointed “U.S. Special Envoy to the Middle East,” reporting directly to Trump. He played central roles in high-stakes negotiations involving Israel, Qatar, Russia, and Ukraine, additionally acting as Trump’s “private emissary” to Moscow for multiple meetings with Russian leadership.

The Witkoff family is deeply embedded in the project: Both sons, Zach Witkoff and Alex Witkoff, are WLFI Co-Founders.

Beyond political and business figures, WLFI’s technical and operational operations are primarily managed by crypto industry professionals. Zak Folkman and Chase Herro, both Co-Founders, are serial entrepreneurs in the cryptocurrency space. Their previous venture involved launching the DeFi platform “Dough Finance,” though the project failed following an early-stage hack, rendering their entrepreneurial track record unremarkable. Within WLFI, Folkman and Herro initially held primary control until January 2025, when they relinquished authority to a Trump-family-controlled entity.

Another key member is Richmond Teo, heading WLFI’s Stablecoin and Payments division. Teo previously co-founded the renowned compliant stablecoin firm Paxos and served as its Asia CEO. The team further includes blockchain practitioners such as Corey Caplan (Head of Technical Strategy) and Ryan Fang (Growth Lead), alongside traditional finance compliance experts, including Brandi Reynolds (Chief Compliance Officer).

The project has also enlisted several advisors, including Luke Pearson (Partner at Polychain Capital) and Sandy Peng (Co-Founder of Ethereum Layer-2 network Scroll). Notably, Peng provided operational support during WLFI’s token sale period.

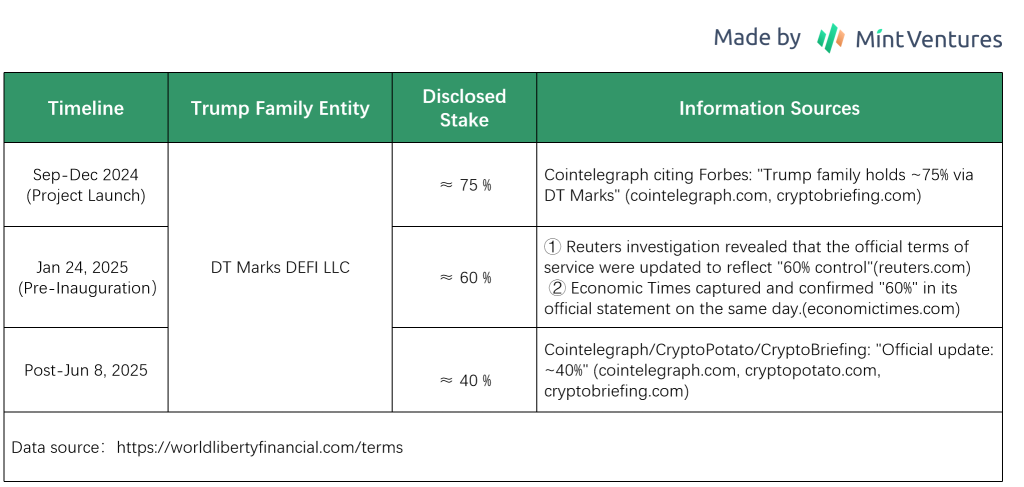

Equity Evolution of the Trump Family in World Liberty Financial

The Trump family’s stake in World Liberty Financial has steadily declined, from an initial 75% to the current 40%.

The decline from the initial 75% to 40% stake may involve transfers to Justin Sun, DWF Labs, and the recently announced $100M investor Aqua 1 Foundation (this remains unverified).

Financing Journey & Backers

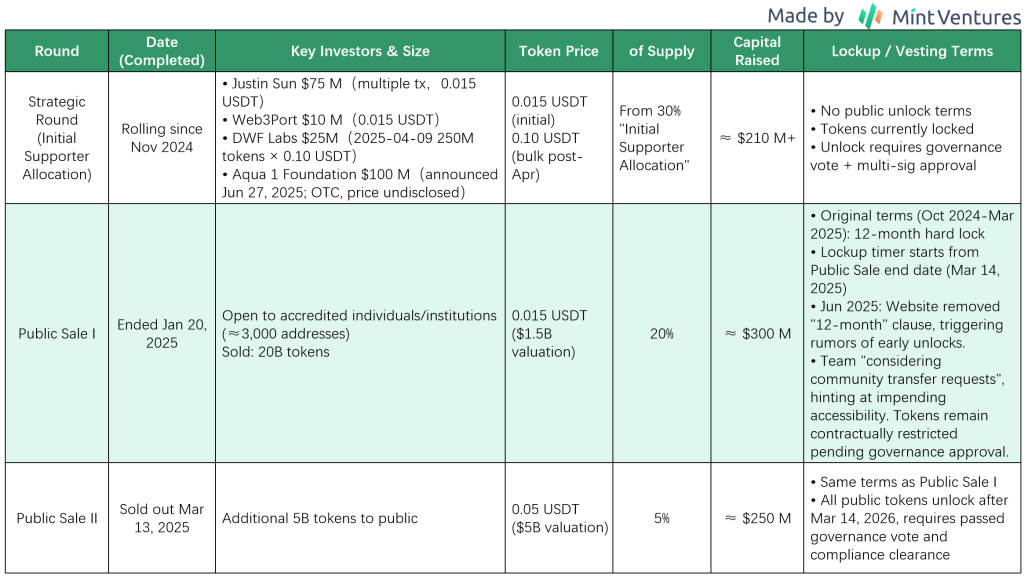

Since its September 2024 inception, World Liberty Financial has raised cumulatively over $700 million through multiple funding rounds, with its valuation surging rapidly post-Trump’s inauguration and token launch.

I delineate key funding rounds below:

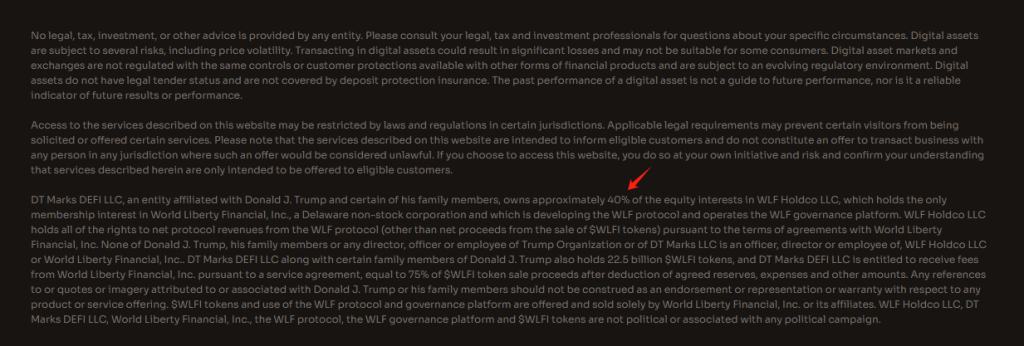

Notably, according to the project’s Gold Paper and website disclosures, the Trump family is entitled to 75% of net proceeds from token sales (through subsequent equity divestments, which represent an indirect resale of token sale proceeds) and 60% of future net profits generated by stablecoin operations.

Tokenomics: Allocation, Utility & Protocol Revenue

Token Distribution & Vesting Details

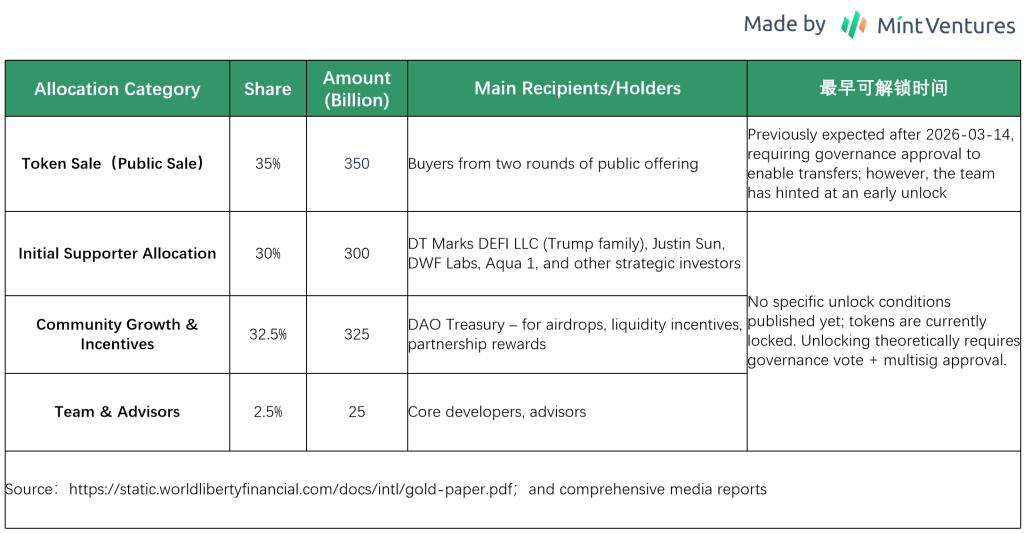

The governance token $WLFI has a total supply of 100 billion tokens. Per the token economic model outlined in the official “Golden Paper”, the allocation and vesting schedule are structured as follows:

Here are the key points to note: The team allocated 35% of the tokens for the token sale (public sale), but only 25% of that allocation has been completed so far. There is currently no information on how the remaining 10% will be handled.

Additionally, while the public sale portion of the WLFI tokens has an additional clause specifying an expected 12-month lock-up period, the tokens in the other allocation categories have no clearly defined unlock conditions or timelines. However, like public sale tokens, they are currently non-transferable.

The ambiguity surrounding the specific unlock terms for the non-public sale WLFI tokens creates significant uncertainty for the project.

Token Functionality

WLFI is a pure governance token. It does not confer any profit-sharing or income rights, nor does it represent equity claims in the project company. Its value primarily derives from governance participation.

Protocol Revenue Distribution

The official WLFI Gold Paper states the following regarding the handling of protocol revenue:

$30 million of initial net protocol revenues will be held in a reserve controlled by a WLF (the project is abbreviated as WLF here but later renamed WLFI) Multisig to cover operating expenses, indemnities, and obligations. Net protocol revenues include revenues to WLF from any source, including without limitation platform use fees, token sale proceeds, advertising or other sources of revenue, after deduction of agreed expenses and reserves for WLF’s continued operations. The remainder of net protocol revenues will be paid to DT Marks DEFI LLC, Axiom Management Group, LLC WC Digital Fi LLC, which are entities affiliated with our founders and certain service providers (“Initial Supporters”). These entities have indicated to WLF their intent to deploy the majority of the fees received on the WLF Protocol once launched.

In essence, protocol revenue primarily flows to corporate entities behind WLFI (though they have committed to allocating most funds to support the protocol). Crucially, WLFI tokens themselves have no direct linkage to business revenue.

Valuation: What is WLFI Worth Long-Term?

Since WLFI’s core business revolves around stablecoins, we can reference the valuation metrics of its major listed competitor, Circle, using its “Market Cap / Stablecoin Market Cap” ratio to roughly estimate WLFI’s fair valuation range.

As of late June 2025, Circle’s USDC stablecoin maintained a circulating supply of approximately $61.7 billion. During the same period, Circle’s market capitalization stood at $41.1 billion, with a fully diluted valuation (including options and convertible instruments) reaching approximately $47.1 billion. This establishes Circle’s “Market Cap to Stablecoin Supply” ratio within the range of 0.66 to 0.76 ($41.1B/$61.7B = 0.66; $47.1B/$61.7B = 0.76).

“Applying this benchmark to WLFI, which currently supports $2.2 billion in stablecoin supply, yields a projected valuation range of $1.452 billion to $1.672 billion ($2.2B × 0.66 = $1.452B; $2.2B × 0.76 = $1.672B), implies a theoretical token price range of $0.0145 to $0.0167 ($1.452B ÷ 100B = $0.0145; $1.672B ÷ 100B = $0.0167).”

Clearly, this is a figure that WLFI investors find difficult to accept. For first-round public offering investors, it’s barely above the break-even point. Expectations for WLFI are high, and possible reasons include:

- Early WLFI had incomplete unlocking: Its circulating market cap is significantly lower than its FDV, allowing WLFI to command a higher premium.

- WLFI is in its early stages: Its potential growth rate is far higher than Circle’s.

- WLFI possesses strong political resources: It should carry a “Trump premium,” attracting numerous projects eager to partner with WLFI.

- Sentiment and speculation in the crypto market are more aggressive than in the stock market: WLFI will enjoy a higher premium than Circle.

- WLFI may time its token issuance closely with the passage of the US GENIUS Act stablecoin bill: This would allow it to capitalize on high market sentiment and enthusiasm.

……

However, we can also present corresponding counter-arguments, such as:

- The stablecoin business has extremely strong network effects: The leader should have a stronger competitive advantage and command a higher valuation premium than a new entrant (consider the profit-generating power of the sector leader Tether compared to the second-place Circle).

- WLFI project revenue is unrelated to the WLFI token: The WLFI token lacks value capture and should be heavily discounted in valuation.

- 93% of WFLI’s current stablecoin market cap is held by Binance for support. This indicates very low organic adoption, and the business volume is heavily inflated.

- WLFI might be just one of many Trump family “white-label licensing projects”: They could be as ruthless in dumping and operations as they were with the Trump token and various Trump NFTs, likely incapable of long-term commitment.

- Liquidity in the crypto market, especially for altcoins, has long dried up: Secondary market players hardly believe any story not backed by solid business data, and most newly listed tokens go into free fall.

……

As an investor, which side of the argument you lean towards is a matter of perspective.

In the author’s view, the decisive factor for WLFI token’s short-term price movement after listing will depend, on one hand, on the final content and timing of the Genius Act’s passage. More importantly, however, it hinges on whether the Trump family, in its various backroom deals and transactions, is willing to position WLFI as a relatively central medium of exchange for mutual benefits. This would manifest as “influential individuals/business entities/sovereign nations” actively embedding USD1 (even symbolically) into their business processes to gain political and commercial advantages – such as using USD1 as an investment currency (equity investments) or a settlement currency (cross-border trade).

If there is a lack of such concentrated business news following the listing, WLFI likely holds a precarious position within the Trump family’s business empire. They undoubtedly have more lucrative channels.

Let’s wait and see how WLFI develops after its listing.

So, when specifically will the WLFI token become transferable?

I speculate it will be after the US “Genius Act” is formally enacted (it has currently passed the Senate). That will be the optimal time for the project team to act freely, and it’s not far off.