Contents

Introduction

If we were to name the Layer 1 blockchain that has seen the most significant business growth in this bull market cycle, most people would likely answer: Solana.

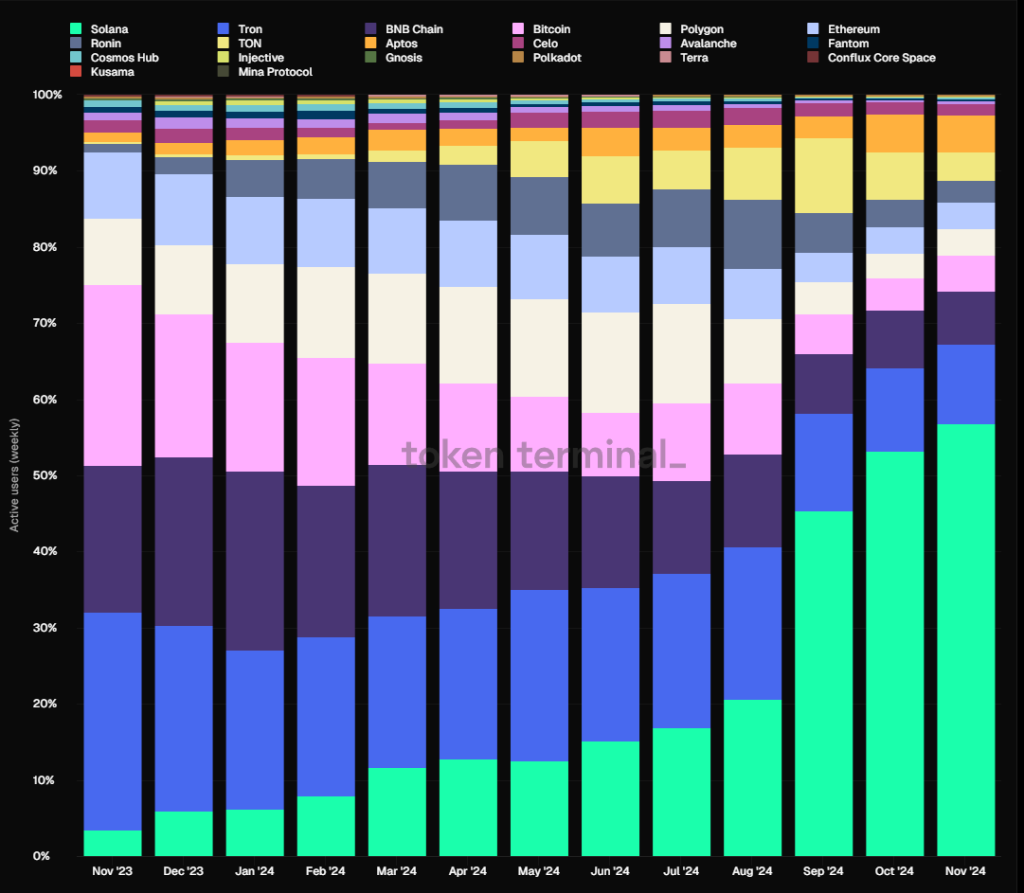

Whether it’s the number of active addresses or transaction fee revenue, Solana’s market share among Layer 1s has expanded rapidly:

Active addresses: Solana’s share of active addresses has grown from 3.48% to 56.83%, a year-on-year increase of 1533%.

Data source: Token Terminal

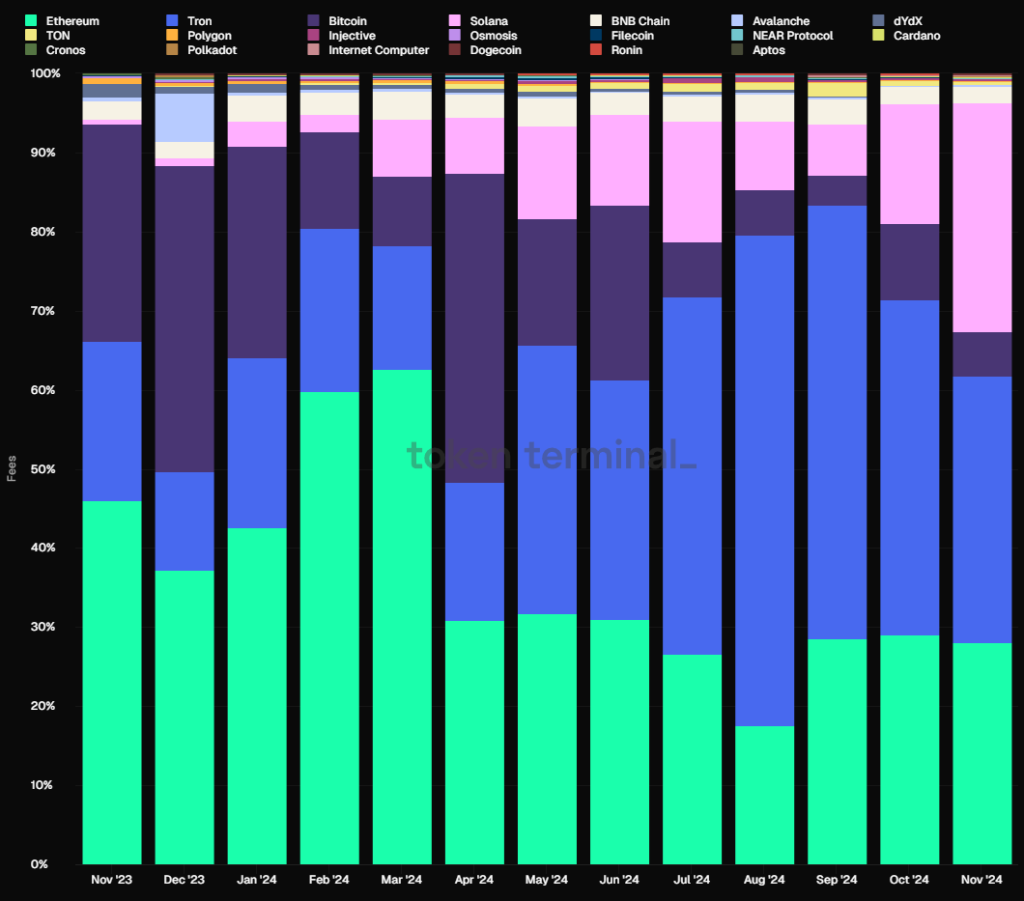

Fees: Solana’s fee revenue share grew from 0.62% to 28.92%, representing a year-on-year increase of 4564%.

Data source: Token Terminal

The rapid growth of Solana’s core metrics during this cycle has been largely driven by the Meme wave. Besides Solana, other projects like Raydium, a decentralized exchange (Dex), have also benefited significantly from this trend. The surge in Meme-related trading activity has contributed enormous transaction volumes and protocol revenue to these platforms. As a result, Raydium’s token price recently hit a new high for this cycle.

In this article, I will focus on another project that has also greatly benefited from the massive asset issuance on Solana: Metaplex.

This piece will discuss and analyze the following four questions:

- What is Metaplex’s business positioning and business model? Does it have a competitive moat?

- What do Metaplex’s business metrics look like, and how is its business developing?

- What are Metaplex’s team background and funding situation, and how can the project team be evaluated?

- What is Metaplex’s current valuation level, and does it offer a margin of safety?

This article represents my thoughts as of the time of publication. These views may change in the future and are highly subjective. It is also possible that there are errors in facts, data, or reasoning logic. Criticism and further discussion from industry professionals and readers are welcome. However, this article does not constitute any investment advice.

Below is the main body of the article.

Metaplex’s Business Positioning and Business Model

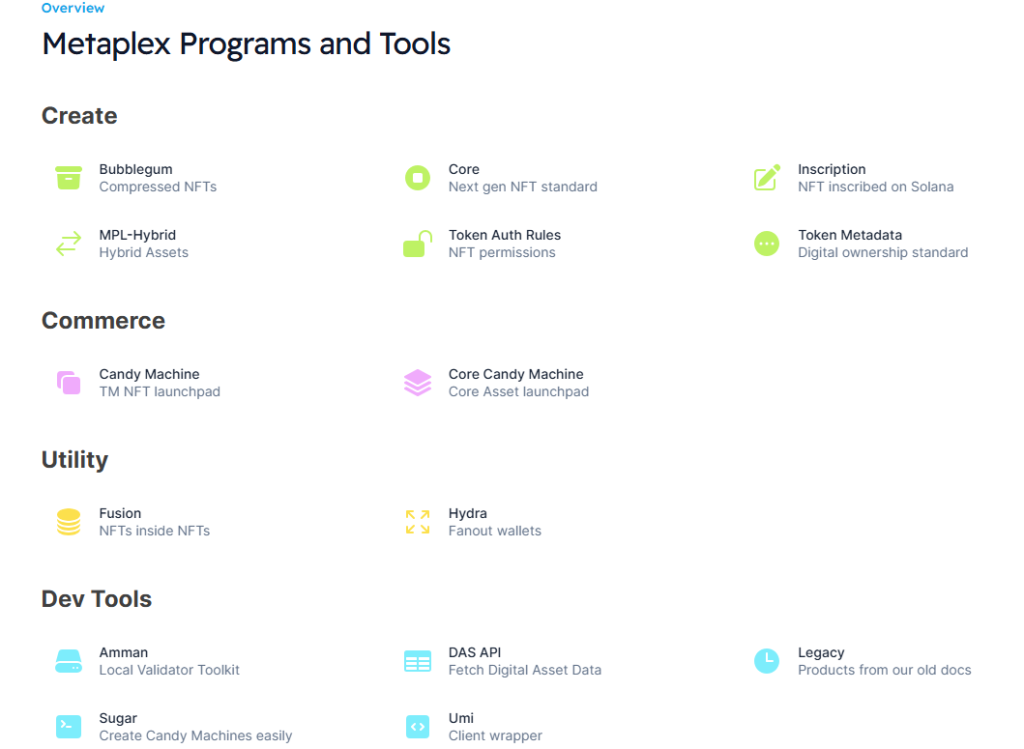

The Metaplex protocol is a system built on Solana and other blockchains that support the SVM (Solana Virtual Machine), designed for the creation, sale, and management of digital assets. It provides developers, creators, and businesses with the tools and standards needed to build decentralized applications. Metaplex supports various types of crypto assets, including NFTs, FTs (fungible tokens), real-world assets (RWA), gaming assets, and DePIN assets.

Recently, Metaplex has also expanded its business horizontally into other foundational service areas within the Solana ecosystem, such as data indexing (Index) and data availability (DA) services.

In the long term, Metaplex is expected to become one of the most important multi-domain foundational service projects within the Solana ecosystem.

Metaplex Product Matrix

Metaplex, as a system for asset issuance, management, and standardization, supports both NFTs and fungible tokens (FTs) as its target asset types. The following products form a comprehensive matrix designed to serve assets within the Solana ecosystem.

Core

Core is the next-generation NFT standard on the Solana blockchain. It utilizes a “single account design,” which significantly reduces minting costs and computational power requirements. Additionally, it supports advanced plugins and enforces royalty payments.

Background Knowledge: Solana Account Model

To understand the advantages of the “single account design”, it’s essential to first comprehend Solana’s account model and the way traditional NFTs are stored.

On the Solana blockchain, all state storage (e.g., token balances, NFT metadata, etc.) is associated with specific accounts. Each account can store a limited amount of data due to its size constraints, and maintaining these stored data requires paying “rent.” Therefore, efficiently managing on-chain accounts and storage is a critical issue that developers on Solana must address.

Traditional NFT Design

In traditional NFT design, each NFT typically involves multiple accounts to store different types of information. For example, a typical NFT might involve the following accounts:

- Main Account: Stores ownership information of the NFT (e.g., who the current holder is).

- Metadata Account: Stores metadata for the NFT (e.g., name, description, image links, etc.).

- Royalty Account: Stores information related to royalties for the creator.

While this multi-account design offers flexibility, it also brings some challenges in practice:

- Complexity: Managing and interacting with multiple accounts increases complexity, especially when frequent querying and updating of data are required.

- Costs: Each account requires “rent” to maintain its storage state. More accounts mean higher costs.

- Performance: Since multiple accounts are involved, operations may require more blockchain resources, impacting performance and transaction speed.

Advantages of the “Single Account Design”

Metaplex Core introduces the “single account design” standard to address the above issues. This approach consolidates all NFT-related information (such as ownership, metadata, royalties, etc.) into a single account. Simplifying the account structure reduces account costs, improves interaction efficiency, and enhances the scalability of NFTs.This design is particularly well-suited for large-scale NFT projects (such as games or DePIN applications) on high-performance, low-cost blockchains like Solana.

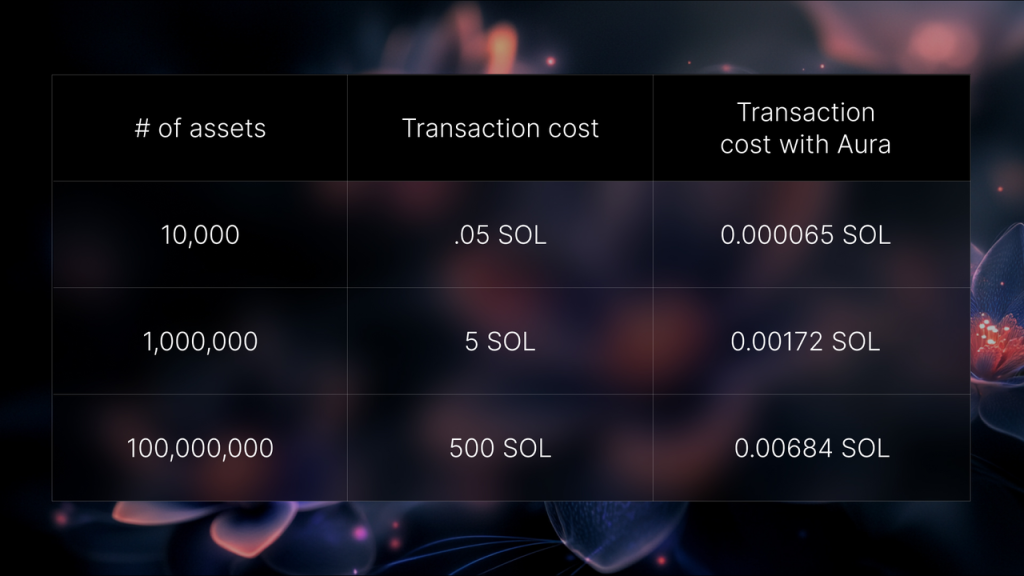

Bubblegum

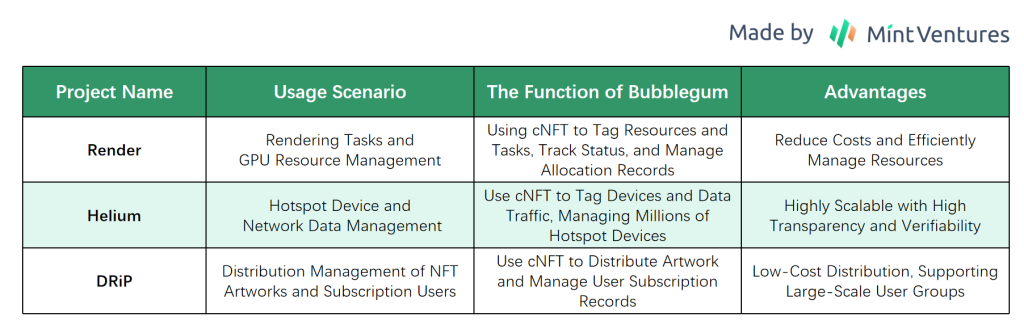

Bubblegum is a program developed by Metaplex for creating and managing compressed NFTs (cNFTs). Through compression technology, creators can mint a massive number of NFTs at an extremely low cost—minting 100 million NFTs costs just 500 SOL (reducing costs by over 99% compared to traditional minting methods). This provides unprecedented scalability and flexibility. Thanks to the introduction of Bubblegum technology, large-scale, low-cost NFT minting has become possible. Projects like Render and Helium within the DePIN ecosystem have begun migrating to Solana, and innovative NFT platforms like DRiP have emerged as a result. Below is a table listing how these three representatives utilize Bubblegum technology.

Token Metadata

The Token Metadata program allows attaching additional data to fungible and non-fungible assets on Solana. While Token Metadata is naturally essential for data-rich NFTs, it is also widely used by fungible token projects on Solana.

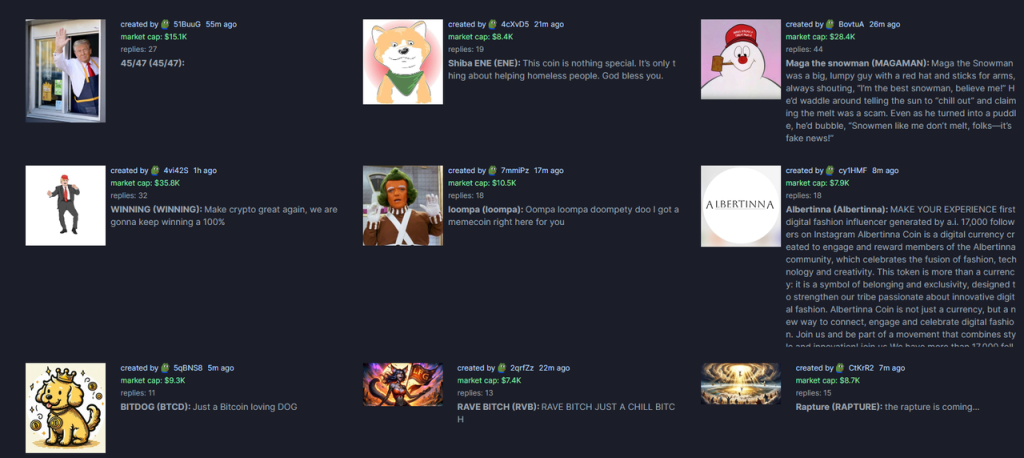

What most people don’t know is this: The largest meme token issuance platform on Solana, Pump.fun, uses Metaplex’s Metadata service for all tokens created on the platform. Currently, the primary demand for Token Metadata doesn’t come from NFTs but from the vast number of meme token projects being issued.

For meme projects, the benefits of using the Token Metadata program when issuing tokens are very clear:

- First, it ensures standardization and compatibility for the issued tokens. By utilizing Metaplex’s Metadata service, these tokens can be more easily recognized by mainstream wallets (such as Phantom and Solflare). Their names, icons, and other additional details can also be correctly displayed on trading platforms and seamlessly integrated with other Solana applications.

- Secondly, it provides on-chain storage and transparency. The Metaplex Metadata service stores the token’s metadata on-chain, making the token’s information and data easier to verify and safeguarding it from tampering.

- Additional details, such as images and text, offer multi-dimensional materials for meme speculation. This elevates memes beyond just a name and a contract, providing rich resources for meme dissemination, secondary creation, and storytelling.

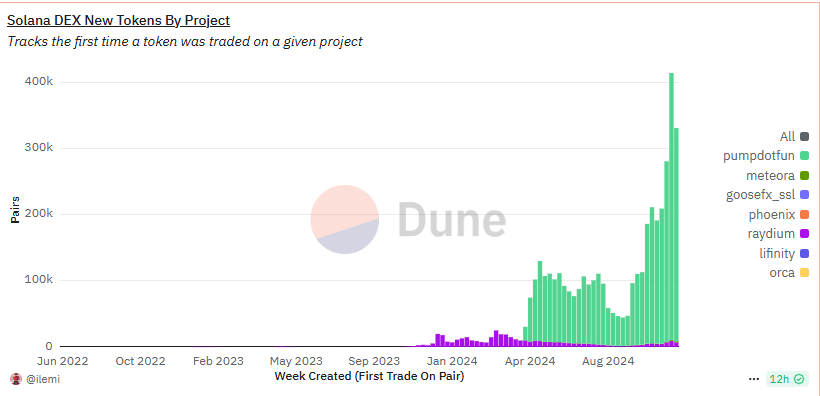

As the meme token craze on Solana continues to heat up, more than 90% of Metaplex’s protocol revenue has already been contributed by fungible tokens (memes). This reality sharply contrasts with the public perception that “Metaplex is a foundational NFT protocol within the Solana ecosystem,” revealing a significant gap in understanding.

Candy Machine

Metaplex’s Candy Machine is the most commonly used NFT minting and distribution program on Solana. It enables efficient, fair, and transparent launches of NFT collections.

Other Product Portfolio

Metaplex also offers the following services:

MPL-Hybrid: A hybrid NFT storage and management solution designed to combine the advantages of both on-chain and off-chain storage. It provides an efficient and cost-effective way to store NFTs, especially for large files (such as high-resolution media) or NFT projects that require dynamic updates.

Fusion: An NFT merging feature that allows users to combine multiple NFTs into a new one. This can enhance user interaction and offer more creative use cases for NFT projects. It is applicable in areas like gaming, collectibles, and art projects.

Hydra: A high-performance and scalable large-scale NFT minting solution specifically designed for projects that need to mint massive quantities of NFTs, such as games, social platforms, or loyalty programs.

……

Metaplex’s Current Product List (Asset Services):

Aura

In addition, in September, the Metaplex Foundation officially announced the launch of Metaplex Aura—a decentralized indexing and data availability network designed to serve Solana and SVM. With the indexing and data availability services provided by Aura, Solana and other blockchain projects adopting the SVM standard can read asset data more efficiently and support batch operations at significantly lower costs, reducing operational expenses by over 99%. See the image below for reference:

Source: Metaplex official Twitter

When the product preview was released, Metaplex also outlined partnership agreements supporting the product. Many of these are well-known projects within the Solana ecosystem, and they are likely to become potential users of Aura in the future.

From asset service systems to data indexing and data availability service agreements, as its horizontal service offerings expand, Metaplex is evolving into a full-stack foundational service platform for the Solana ecosystem.

Metaplex’s Business Model

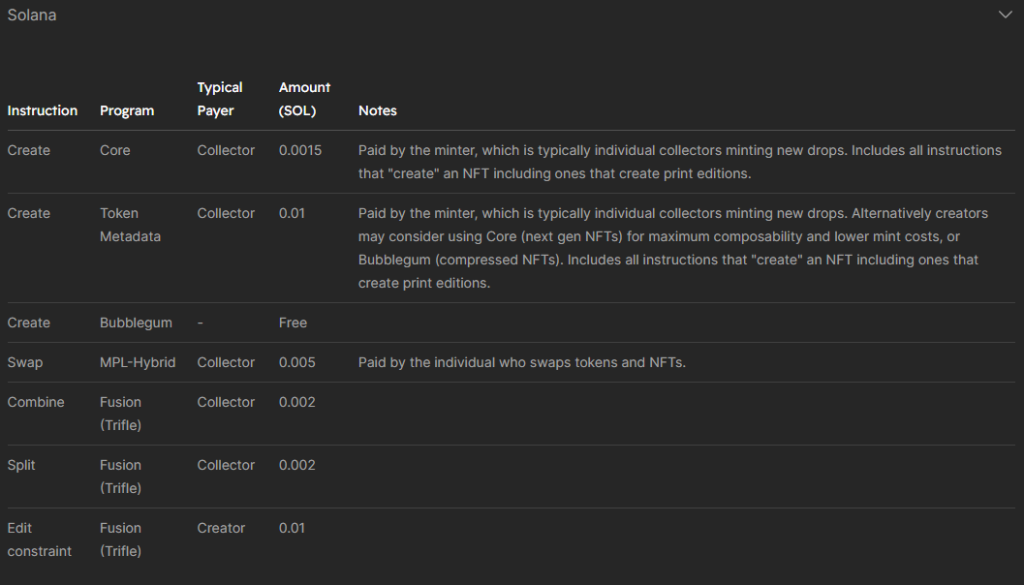

Metaplex’s business model is straightforward: it charges for providing services related to on-chain assets. Some services in the product lineup mentioned above are free, while others come with a fee.

Although Metaplex’s direct collaborators are other projects on Solana—essentially operating as a B2B expansion model—the majority of its revenue actually comes from smaller projects or retail users utilizing the services enabled by these larger B2B projects. This includes project teams creating various types of fungible tokens as well as individuals minting NFTs.

In my opinion, compared to charging large-scale B2B collaborators (such as Pump.fun), charging decentralized users is a better business model for several reasons:

- Smaller project teams or retail users tend to make decisions based more on emotion and are less price-sensitive than B2B clients. Since Metaplex’s service fees only account for a small portion of their total costs, the absolute amount a single small user pays isn’t high. However, when aggregated across a large number of such users, the total revenue can become substantial.

- Large B2B projects can serve as distribution channels for Metaplex’s services, helping to extend the reach of its offerings to a wider pool of decentralized users. This allows Metaplex to avoid additional expenditure or effort on marketing and distribution.

- With a dispersed and decentralized user base, it is difficult for users to collectively bargain with foundational service providers like Metaplex. This enables Metaplex to maintain its profit margins, and it might even afford the opportunity to raise prices when appropriate.

Specifically, the pricing standards for Metaplex’s products on Solana are as follows:

As we can see, the absolute cost for users to invoke Metaplex’s product services individually is not expensive. For instance, the cost for a user to mint an NFT is only 0.0015 SOL; if a meme token issuer wants to add text and image descriptions to their project by using Token Metadata, it costs just 0.01 SOL per use. Such costs are negligible, or virtually insignificant, compared to the expected returns for users.

Of course, it’s important to point out that the large-scale issuance of homogenous tokens, especially meme tokens, has a dual impact on Metaplex. On one hand, it generates revenue for the platform; on the other hand, the sustainability of the meme craze remains uncertain, which could affect the long-term stability of Metaplex’s income. Even a strong ecosystem like Solana is no exception to the volatility of meme token activity. For instance, during the “coldest” week in September, the number of new tokens listed on DEXs was only about one-third of what it was during May’s peak. By mid-November, that number had increased tenfold again.

Source: Dune

The Moat of Metaplex

In the world of business, a company’s or project’s “moat” can stem from various advantages, such as cost advantages driven by scale or geographic location, value accumulation through network effects, high user stickiness and premium pricing enabled by brand recognition, or competitive barriers established by regulatory licenses and patents.

Projects with a strong moat are characterized by their resilience in a competitive landscape. When new competitors enter the same market, they find it very difficult to catch up, or the overall cost of catching up is so high that it far exceeds their expected returns. As a result, the number of competitors in that field tends to stay relatively low. Financially, such projects often demonstrate steadily growing profitability and maintain low ratios of marketing and development costs relative to their revenue.

In the world of Web3, projects with a strong moat are relatively few. Examples include Tether in the stablecoin space and Aave in the centralized lending sector.

In my view, Metaplex also qualifies as a project with a strong moat. Its moat is built upon two core factors: “high switching costs” and “setting the standard.”

Firstly, When developers and users become deeply reliant on Metaplex’s tools and protocols for asset issuance and management, transferring these assets to another protocol for management in the future will inevitably involve significant time, technical, and economic costs.

Secondly, When Metaplex’s asset formats (including NFTs and FTs) become the de facto standard within the Solana ecosystem, forming a common compatibility consensus among the ecosystem’s foundational infrastructure and applications, this will naturally make Metaplex the first choice for new developers and projects when selecting an asset service platform, as its asset formats offer superior ecosystem compatibility.

Thanks to this moat, the Solana ecosystem currently lacks projects capable of competing with Metaplex on the same level, ensuring Metaplex’s strong profitability—a point that will be analyzed in the next section.

Beyond its asset services, Metaplex is currently testing data indexing and data availability services, which could potentially create a second growth curve for the platform in the future. Considering that the target audience for these services highly overlaps with Metaplex’s existing customer base, this new business expansion is likely to be more easily accepted and experienced by its current partner clients.

Metaplex Business Data: Strong Product-Market Fit (PMF) and Robust Growth in Key Metrics

Metaplex’s current core business focuses on providing asset-related services. We can evaluate its performance by analyzing several key metrics, including the number of active users, the number of projects minting assets, and protocol revenue.

Metaplex Monthly Active Users

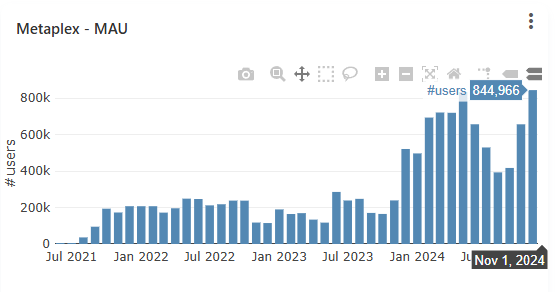

Metaplex’s monthly active users refer to the unique wallet addresses that have conducted transactions with the Metaplex protocol within a given month.

Data source: Metaplex Public Dashboard, same for the following data.

As of the writing of this article (November 30, 2024), the latest monthly active user count for Metaplex has reached 844,966, setting a new all-time high for a single month and representing a year-over-year growth of 253%.

Number of Assets Minted via the Protocol

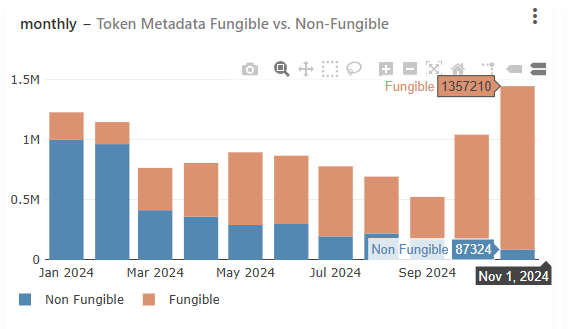

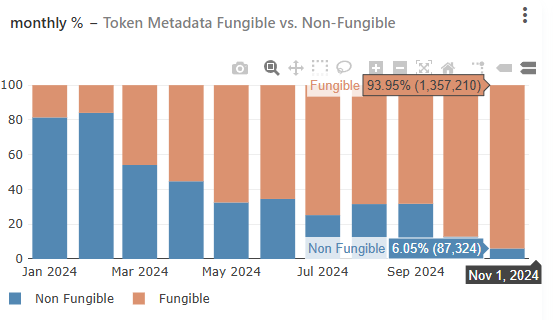

The number of assets minted via the protocol refers to the types of assets minted through the Metaplex protocol.

As of the writing of this article (November 30, 2024), Metaplex has also set a new historical record in this metric, with the total number of asset types minted in November exceeding 1.44 million.

What’s even more noteworthy is that 94% of these assets are fungible tokens (FTs), while only 6% are NFTs. Back in January of this year, the split was 18.6% FTs versus 81.4% NFTs. This means that, In terms of business volume, Metaplex’s primary business has now shifted to fungible token services rather than NFT services. Moreover, a significant portion of these fungible tokens were minted as part of the ongoing Meme trend.

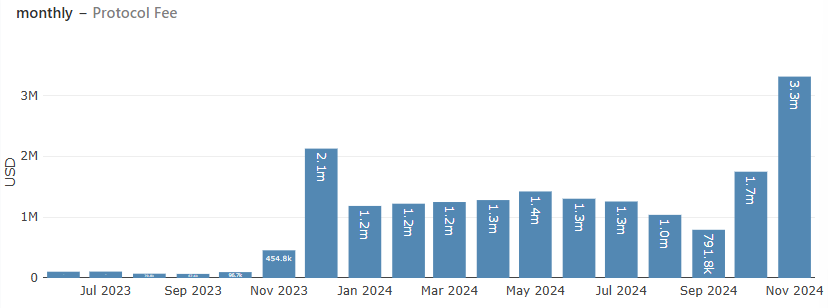

Protocol Revenue

Protocol revenue refers to the fees Metaplex earns through providing services.

As of the time of writing (November 30, 2024), Metaplex’s monthly protocol revenue has reached an impressive $3.3 million, marking a new all-time high.

It is worth noting that, unlike many projects in the Web3 world that rely on token subsidies to drive product demand—essentially exchanging project tokens for protocol revenue—Metaplex’s business revenue is exceptionally organic. The project does not rely on direct token subsidies and is a typical example of achieving PMF (Product-Market Fit).

From the data in this section, we can observe the following:

- As an underlying asset protocol, Metaplex directly benefits from the growth of the Solana ecosystem. Its core metrics rise in sync with Solana’s key indicators, particularly its protocol revenue.

- Metaplex benefits from activity in both NFTs and FTs, meaning it is not just an “NFT asset service protocol.” Looking beyond the Meme wave, if Solana fosters more active verticals such as DePIN, gaming, or RWA, the potential demand for Metaplex could expand even further.

- Metaplex’s business demand is organic—its revenue is not reliant on token subsidies.

Next, let’s take a look at the team behind the Metaplex project and the status of its project tokens.

The Metaplex Team: EcosystemOG Close to Solana’s Core Circle

Metaplex was founded by Stephen Hess, who also serves as the Chairman of the Metaplex Foundation. He established Metaplex Studios in November 2021.

As a graduate of Stanford University’s Symbolic Systems program (a field focused on the design of human-computer interaction systems), Stephen Hess was also one of Solana’s earliest employees, joining the company just a year after its launch. It was Solana co-founder Raj who invited him to join, where he took on the role of Head of Product. During his tenure, Hess participated in key initiatives such as Solana Stake Pools (Solana’s staking system), the SPL governance system, and the development of Wormhole. He was also part of the team that built the first version of the Solana NFT standard, which eventually evolved into Metaplex.

Shortly after its creation in January 2022, Metaplex secured 46 million in strategic investment from notable firms such as Multicoin, Jump, and Alameda. Based on the 10.2% allocated to the strategic financing round in the token distribution table, Metaplex’s 46 million funding at the time implies a valuation of approximately 450 million. This was a remarkably high first-round valuation, even during the bull market period.

Just as Metaplex was nearing its one-year anniversary in November 2022, FTX collapsed dramatically due to massive financial mismanagement. Although Metaplex’s financial health was not directly impacted by the FTX meltdown, Stephen Hess quickly announced a layoff decision on Twitter, preparing in advance for the impending downturn in the Solana ecosystem. In hindsight, his approach proved to be remarkably prudent, demonstrating a clear vision of the future. Unlike many Web3 teams that spend lavishly, Hess emphasized cost control.

According to Metaplex’s current Linkedin profile, the team consists of just over 10 members, remaining lean and efficient. However, judging by the monthly project progress reports released by the company, this compact team exhibits strong execution capability and a proactive approach to product work. They demonstrate high efficiency in both product iterations and the development of new products.

Source: The Official blog

Looking back at the professional backgrounds of Metaplex’s founders and the project’s development history, Metaplex largely aligns with my vision of the key elements that make up an excellent Web3 team:

- Core team members possess education, skills, and professional experience directly relevant to their entrepreneurial venture, with no history of credit issues or misconduct.

- They are closely connected to the core circles of their blockchain ecosystem, maintain clear communication channels, and have product philosophies recognized by the blockchain’s community.

- They exhibit strong product intuition (avoiding unnecessary detours), work diligently, and deliver results consistently.

- They have a strong sense of cost control and avoid wasteful spending.

- They have secured investment from top-tier industry VCs and possess excellent overall business resources.

Additionally, on September 9, 2024, The Block revealed that leading institutions such as Pantera Capital and ParaFi Capital purchased a substantial amount of Metaplex (MPLX) tokens earlier this year from Wave Digital Assets. These tokens were originally held by FTX, and it is said that the aggregate purchase cost was approximately 0.2–0.25 per token (with certain lock-up terms attached).

MPLX: Token Utility and Valuation Levels

Basic Token Information

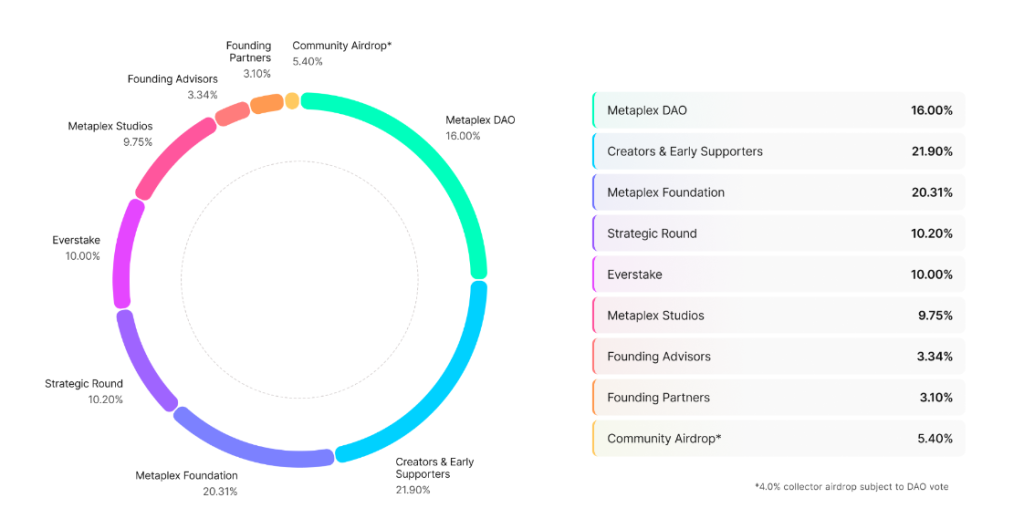

Metaplex’s protocol token is MPLX, with a total supply of 1 billion.

Details of Token Allocation:

- Creators and Early Supporters (21.9%): 50% distributed via airdrop within the first year (initial airdrop started in September 2022). The remaining 50% is released monthly over the following year; fully unlocked.

- Metaplex DAO (16%): No lock-up period; distributed according to DAO proposals.

- Metaplex Foundation (20.31%): No lock-up period.

- Strategic Round (10.2%): 50% unlocked one year after the initial airdrop (September 2022). The remaining 50% was released monthly over the following year. fully unlocked.

- Partner Everstake (10%): Locked for two years. Released linearly over one year;fully unlocked.

- Metaplex Studios (9.75%): Locked for one year . Released linearly over two years; fully unlocked.

- Community Airdrop (5.4%): Released immediately.

- Founder Advisors (3.34%): Locked for one year. Released linearly over one year; fully unlocked.

- Founding Partners (3.1%): Locked for one year. Released linearly over one year; fully unlocked.

Based on the current circulation data provided by the official source, MPLX’s circulation rate is 75.6%, with the majority already in circulation. Investor shares, in particular, have largely been unlocked and are now circulating. As a result, the unlocking-related sell pressure is relatively low.

The “non-circulating” portion of the total supply primarily comes from the shares controlled by Metaplex DAO and Metaplex Foundation, tokens held in the treasury.

Token Utility

Currently, the primary utility of MPLX is governance voting. In addition, starting from March 2024, Metaplex announced that 50% of the protocol’s revenue (including historically accumulated revenue) will be used for token buybacks. The repurchased tokens will be moved into the treasury to support the development of the protocol ecosystem.

The protocol officially began token buybacks in June 2024, and since then, it has consistently spent 10,000 SOL per month on MPLX buybacks. This process has continued for 5 months to date.

With the rapid growth of protocol revenue, starting next month, Metaplex will increase the monthly buyback amount from 10,000 SOL to 12,000 SOL.

Beyond governance and buybacks, MPLX’s next key utility will be tied to the Aura feature mentioned earlier. Once the Aura functionality officially launches, MPLX is expected to serve as the staking asset for Aura nodes, capturing the yield generated by Aura.

Protocol Valuation

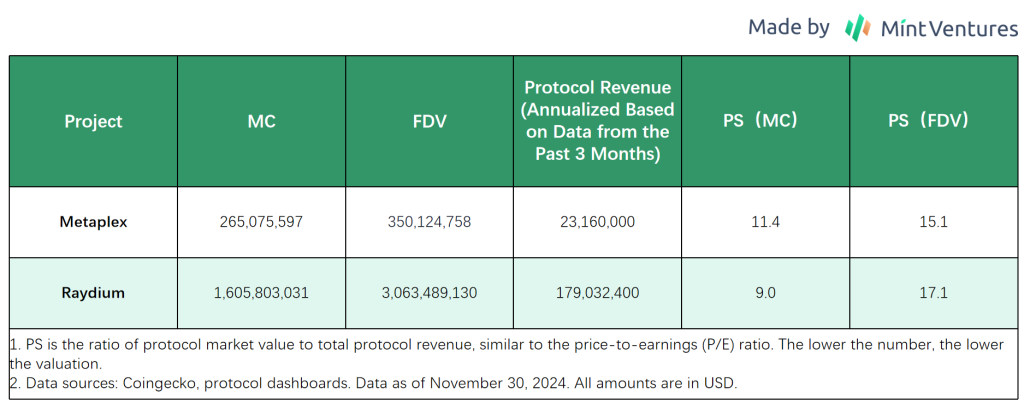

When evaluating the valuation of Metaplex, we still use the comparative valuation method. However, considering that there are no directly comparable projects within the same niche on Solana, the author ultimately chose Raydium—a project also within the Solana ecosystem—as the benchmark for comparison. Like Metaplex, Raydium has seen a significant increase in protocol revenue this year, fueled by the Meme trend, and it also features a buyback mechanism, making it a suitable reference point for valuation.

From the perspective of comparing protocol revenue and market capitalization, Metaplex’s valuation is relatively higher.

However, it is important to emphasize that while the two projects share some similarities, they operate in two entirely different tracks within the same ecosystem, with vastly different business focuses. Therefore, the above valuation comparison should only be considered as a rough reference.

Potential Growth Drivers and Risks

Overall, Metaplex has several clear advantages:

- Strategic position upstream in the asset servicing track, holding control over asset standard-setting, and directly benefiting from the prosperity of the Solana ecosystem.

- Product-market fit (PMF) has been fully validated, enabling the project to achieve positive cash flow without relying on token subsidies. It also possesses a clear and defensible business moat.

- On the foundation of its current business, the team is actively pursuing a second growth curve.

- A strong and capable team with a close connection to the core of the ecosystem. They are diligent, enterprising, and cost-conscious.

- The token has a buyback mechanism, and the project’s total valuation is relatively low (current circulating market cap: 260M+, FDV: 350M+), meaning it’s relatively “light” in scale.

Potential drivers for Metaplex’s future market cap growth include:

- Expansion into new vibrant tracks within the Solana ecosystem beyond the current Meme trend, further enlarging the market for asset issuance. This could include DePIN, gaming, RWA, or even the long-dormant NFT sector.

- Listing on larger trading platforms, such as Binance or Coinbase, which would significantly enhance liquidity and valuation premiums. Considering the project’s quality and its relatively low market cap, the author believes Metaplex is a strong candidate for such listings. Projects with real business demand and positive cash flow are rare and highly valued in the market.

- Directly increasing service fees. Currently, the project’s pricing base is low, giving it clear room to raise fees. Even a 100% price increase would make minimal difference to users, as asset creation costs paid to Metaplex remain negligible for them.

Of course, Metaplex also faces some potential risks and challenges:

- The decline of the Solana Meme trend could lead to a sharp drop in asset minting numbers and reduced revenue.

- Metaplex’s income is currently based on one-time fees tied to the type of assets created. For projects with more fixed asset types, this model cannot generate sustainable, long-term revenue for Metaplex.

Conclusion

Contrary to the common perception that “Metaplex is just an NFT asset protocol,” the reality is that Metaplex is a foundational protocol for all types of assets within the Solana ecosystem. It has also been a direct beneficiary of the ongoing Meme trend that began earlier this year.

If you remain optimistic about the future of the Solana ecosystem, then Metaplex, which occupies the upstream niche of “asset issuance and management,” is a project worth long-term attention.