Contents

Introduction

Mint Ventures has always been keeping a keen eye on Web3 gaming. Although the once-popular Play-to-Earn model, brought by the previous bull market, has fallen out of the discussion—highlighted by the dramatic collapse of Axie Infinity and StepN as Ponzi schemes—their peak engagement levels showcased millions of daily active users, marking the crypto space’s first encounter with “Massive Adoption.” Unlike social products, another category with the potential for Massive Adoption, games naturally feature a richer and more complex economic ecosystem. This affords teams refined space and greater control to implement various taxation strategies, coupled with the immersive experiences and irrational consumption brought about by exquisite design, thereby more likely to maintain a relative balance in the ecosystem for a long time. Furthermore, Web3 gaming adeptly leverages crypto’s tokenization opportunities, leading to widespread investor optimism about its future.

Following the era of Axie and StepN, Web3 gaming has enjoyed the following favorable conditions:

- The ongoing enhancement of infrastructures. In 2024, game developers are presented with an abundance of choices in blockchain technology. Whether opting for existing Layer1 solutions like Solana, Layer2 solutions like Arbitrum, employing one-click blockchain deployment services offered by platforms such as Avalanche Subnets and OP Stack, or embracing the trend towards modular blockchain for a custom design, developers now have access to a variety of efficient and cost-effective options. On the wallet front, both MPC and Abstract Account (AA) wallet technologies have reached commercial viability, effectively addressing the issue of private key management for ordinary users.

- Gradual Recovery of Market Conditions, notably spurred by the recent approval of Bitcoin ETFs, has ignited a robust rally across the crypto space, making crypto once again attract more attention from the general public. This provides a significant boost to the potential user base for Web3 game projects.

Compared to traditional Web2 games, Web3 games maintain clear competitive edges:

- The lifecycle of a typical Web3 game, marked by “NFT sales – FT issuance – game launch,” provides various revenue streams through NFT royalties and FT transaction fees even before the game’s official launch. This model enables game development teams to start earning revenue from day one of their project, helping to balance out the lengthy development process and significant costs involved. Post-launch, the ability to levy fees across different aspects is far more flexible than in Web2 games. The prospect of earlier and more varied monetization strategies is an attraction for game development teams toward the Web3 space.

- Web3 gaming has yet to be dominated by powerful distributors, which means high user acquisition costs common in Web2 gaming are not a concern here. Put simply, Web3 gaming isn’t as fiercely competitive, presenting an open field ripe for development by talented teams.

We’ve observed a lot of skilled game development teams venturing into Web3 gaming. These teams are creating many games with excellent narratives, engaging gameplay, and high playability. The supply side of Web3 games has seen significant development, which also forms the favorable conditions of Web3 games.

Given these developments, Mint Ventures maintains its keen interest in Web3 gaming. Ultiverse is a game project that Mint Ventures has been continuously following since the previous bear market stage. Despite the downturn, Ultiverse has continued to build, constantly enriching its product matrix, actively enhancing its storytelling, and also possesses an excellent investment background. Recently, they have launched several airdrop activities aimed at attracting new users, which are worth keeping an eye on.

Disclosure: Mint Ventures participated in Ultiverse’s ElectricSheep NFT Builder Round and holds ElectricSheep NFTs.

Ultiverse Landscape

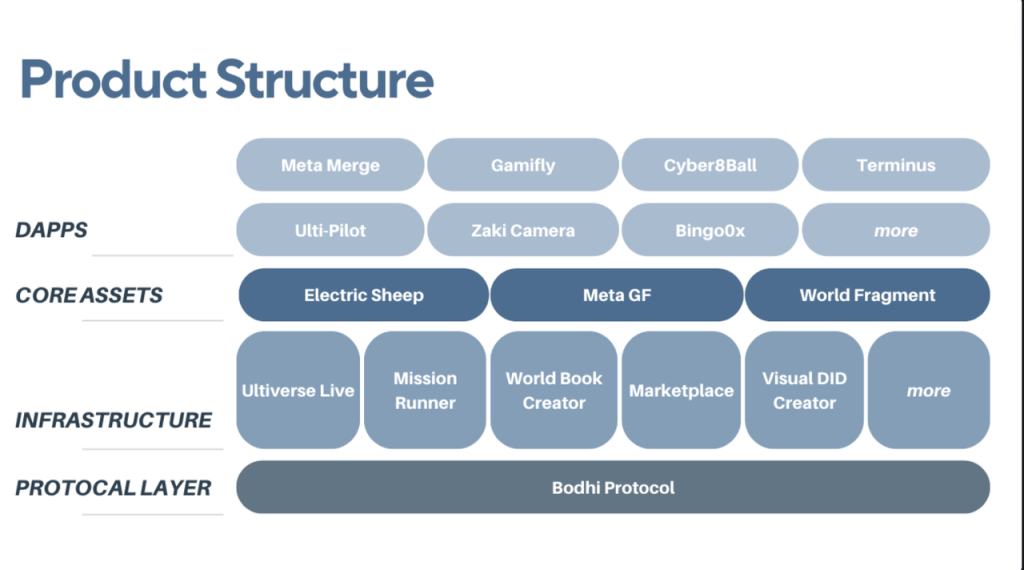

Ultiverse is a blockchain-based metaverse with deep integration with AI. Its architecture is divided into 4 layers:

Protocol Layer: Ultiverse uses the Bodhi Protocol as the foundation of the entire ecosystem. According to its official documents, the Bodhi Protocol employs large language models and Stable Diffusion to generate a variety of in-game content. This AI-driven approach helps to provide comprehensive support across the ecosystem by producing more intelligent non-player characters (NPCs) and enriching narrative backgrounds.

Infrastructure: Ultiverse abstracts a series of gaming infrastructures into SDKs, which will be available for developer utilization. These infrastructures include MPC wallets, AA wallets, native marketplaces, and a DID system. Moreover, its proprietary live streaming platform, Ultiverse Live, has captured the attention of 350,000 followers on Binance live, alongside receiving close to 40 million likes, offering substantial visibility for its collaborators. Additionally, Ultiverse’s infrastructure features its dedicated task platform, Mission Runner.

Core Assets: Ultiverse’s prime assets presently encompass the Electric Sheep NFT, Meta GF NFT, and World Fragment.

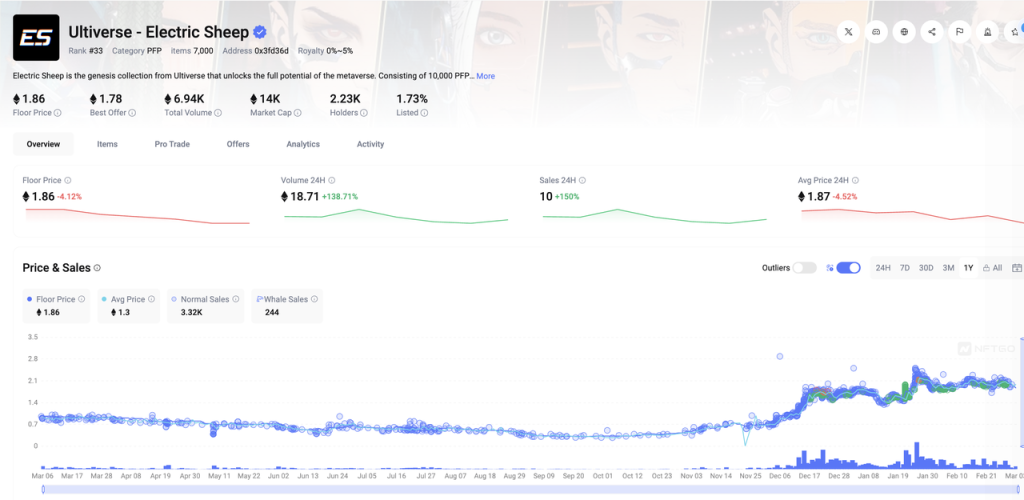

Electric Sheep NFT, as the first asset of the Ultiverse ecosystem and one of its core assets, has a total supply of 7000. Launched in July 2022 at 0.5 ETH, its floor price now hovers around 2 ETH, providing holders with quadruple returns in ETH and octuple in USD, significantly strengthening its community foundation. Holders of Electric Sheep gain early access and boosted rewards across numerous Ultiverse ecosystem projects, in addition to being eligible for airdrops of Ultiverse’s governance token, $ULTC.

The Meta GF NFT was issued at the end of 2022, positioned as an AI companion that supports customizable appearances, designed to join players in their explorations within the Ultiverse.

Meanwhile, the World Fragment NFT, pending release, is designated to be airdropped to Electric Sheep NFT holders. As detailed in official documents, players can merge fragments to forge unique worlds. Ownership of varied World NFTs can unlock distinct, AI-driven personal experiences in the game. This includes divergent storylines, characters, world objectives, and core conflicts, among other elements, suggesting that different NFTs pave the way for unique gameplay experiences.

Dapp, also known as “Micro Worlds” within the Ultiverse ecosystem, are divided into two categories: those in partnership with Ultiverse and those developed internally by Ultiverse. Partner Dapps includes the likes of the casual education simulation game Meta Merge and the upcoming racing game BAC on Blast. These partnerships extend beyond mere collaboration for traffic acquisition to encompass a deeper level of asset interoperability. For example, Meta Merge once airdropped its token $MMM to Electric Sheep holders, and Meta Merge’s NFT holders can also receive a portion of the upcoming $ULTC airdrop. The other category consists of Dapps developed in-house by Ultiverse, including Ulti-pilot, Terminus, and Endless Loop, which were just launched at the end of February.

Launched in March, Terminus is a pivotal platform within the Ultiverse ecosystem, built using the cutting-edge UE5 engine, and is available in both PC and VR versions. Official documentation reveals Terminus as a distinctive virtual world where, different from average games, all NPCs are powered by sophisticated AI. These NPCs can engage players in diverse, highly interactive dialogues and interactions, which could significantly influence the gameplay and its outcomes. Furthermore, the game’s characters are also AI-operated, allowing for their continuous evolution even when the player is offline. This feature cements Terminus as an eternally active game universe.

Ulti-pilot was launched in February and serves as the gateway for users to experience the Ultiverse world. Users can dispatch their characters to explore the Ultiverse world and can earn substantial $Soul incentives, which are redeemable for the governance token, $ULTC, in the future.

Endless Loop is an MMORPG game within the Ultiverse, also built upon the UE5 engine. The game has not yet been launched.

The product structure of Ultiverse reveals that it aspires to be more than a game; it aims to evolve into an AI-driven metaverse platform. This ambition entails connecting with a vast user base while simultaneously engaging with many Web3 projects, thereby bringing its Meta-Fi concept to fruition.

In the future roadmap, Ultiverse is poised to focus on the comprehensive rollout of its products in 2024, which includes launching both the PC and VR editions of Terminus and fostering collaborations with additional gaming partners. In the latter half of 2024, they aim to introduce a Game Launchpad and initiate their Rollup. This approach is designed to enhance support for their gaming collaborators and to further solidify their vision of a Web3 gaming ecosystem.

Financing and Partners

Ultiverse has completed three rounds of financing, with an impressive lineup of investors:

On March 18, 2022, Ultiverse completed a $4.5 million seed round financing at a valuation of $50 million. This round was co-led by Binance Labs and Defiance Capital, with participation from Three Arrows Capital and SkyVision Capital.

Following closely on March 25, 2022, Binance Labs made an additional investment of $5 million in Ultiverse, executed through an equity purchase. Nicole Zhang, the director at Binance Labs, emphasized that this investment aims to ensure that Binance Labs retains a voice in the strategic direction of Ultiverse’s team moving forward.

On February 14, 2024, Ultiverse successfully closed a strategic funding round, securing $4 million on a valuation of $150 million. The round was led by IDG Capital, with notable contributions from many leading investors such as Animoca Brands, Polygon Ventures, MorningStar Ventures, Taiko, ZetaChain, Manta Network, and DWF Ventures. This round was also marked by the engagement of prominent NFT influencers and KOLs, including Dingaling, Grail.eth, Christian2022.eth, and 0xSun, among others.

Overall, Ultiverse boasts a remarkable investment pedigree, featuring top-tier VCs, market makers, exchanges, public blockchains, and influencers, all of which can support Ultiverse’s multifaceted development.

Frank, the founder of Ultiverse, graduated from Carnegie Mellon University and had a deep passion for gaming. With over 200 members, the team’s background is equally impressive, boasting veterans from esteemed gaming companies such as Gameloft, Blizzard, Ubisoft, and Tencent who contributed to the development and design of well-known games like Elden Ring, Assassin’s Creed, and Prince of Persia.

As its goal is to become a platform that connects players with games, Ultiverse has forged an extensive network of partnerships, collaborating broadly with various projects and communities within the gaming ecosystem.

An example is the “Finding Your Path Partners” campaign held by Terminus in March, a concerted effort by Ultiverse alongside a variety of collaborators, including public blockchains like Zetachain, other gaming ventures such as Ainchess, infrastructure service providers like Rpggo and Particle Network, gaming guilds including N9Club and GuildFi, and NFT communities like the Weirdo Ghost Gang.

Moreover, Ultiverse recently revealed that it has established collaborations with more than 300 teams in the AI and gaming realms across both Web2 and Web3. This extensive partnership network includes virtually all the top Web3 gaming projects, advancing Ultiverse’s ambition to develop a comprehensive gaming platform.

Tokenomics

Ultiverse has unveiled the utilities and tokenomics of its governance token $ULTC:

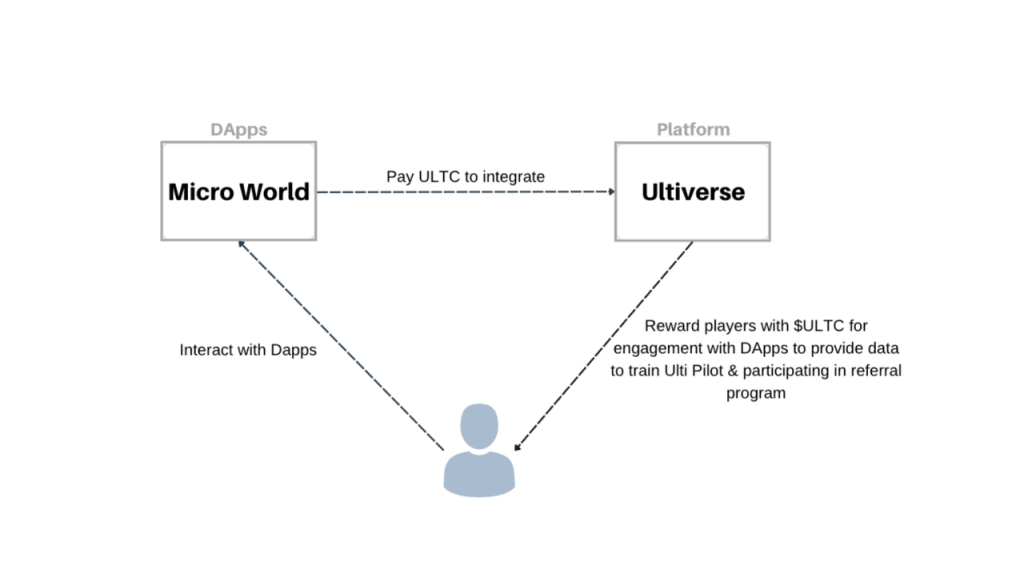

In the Ultiverse ecosystem, $ULTC has three primary utilities:

- Governance

- Entry Pass, Dapps looking to integrate with the Ultiverse ecosystem are required to pay with $ULTC, with a portion of these tokens allocated to users

- Payment Method, $ULTC serves as a payment method for assets within the Ultiverse ecosystem

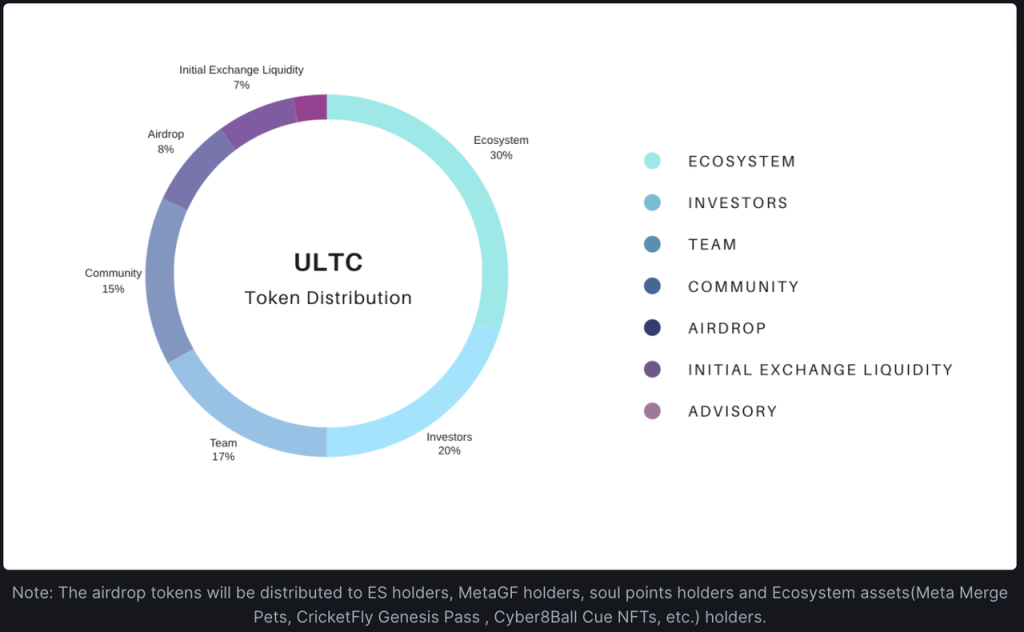

The total supply of $ULTC is set at 10 billion tokens, with its allocation detailed as follows:

A point of interest is that 8% of the total token supply will be allocated for airdrops, targeting holders of the Electric Sheep NFT and MetaGF NFT, $Soul token holders, and holders of other assets within the ecosystem.

The current floor price of Electric Sheep NFT is around 2 ETH, with a total market cap of approximately 14,000 ETH, equivalent to about $47.6 million. If we base our calculations on Electric Sheep NFT holders receiving 2% of the $ULTC supply, this would equate to a fully diluted market cap for $ULTC of $2.38 billion. Such a valuation aligns closely with that of another Game+Ai project, Portal, which was recently listed on Binance, suggesting a fair valuation. Beyond the $ULTC airdrop, the Electric Sheep NFT carries several additional benefits within the Ultiverse ecosystem, including access to the previously mentioned World NFT.

$Soul represents the “points” system within the Ultiverse ecosystem, initially available through staking Electric Sheep NFT as a reward for early holders. The team previously announced the redeem ratio of $Soul to $ULTC as 100:1. After unveiling the tokenomics, Ultiverse sparked a series of initiatives aimed at drawing new users, aiming to leverage Soul to further promote the Ultiverse brand. Among these, the Ulti-pilot campaign that started in late February will release 10 billion $Soul (equivalent to 100 million $ULTC, accounting for 1% of the total supply), drawing significant user participation.

Conclusion

Ultiverse stands out as a project meriting attention for the following reasons:

- It occupies a favorable position in Web3 gaming, poised for breakout success in the bullish cycle.

- Throughout the bear market, Ultiverse’s team has consistently built upon its foundation, delivering not only engaging products but also cultivating a tightly-knit community.

- With the striking progress of artificial intelligence over the past year drawing global interest, Ultiverse’s strategic integration of AI throughout its platform anticipates positive reception as the AI+gaming narrative gains prominence.

- The project benefits from a robust investment background.