Contents

Key Takeaways

Last week, BTC touched a historical high against the USD, signifying our entrance into the official stage of this bull market. Unlike the initial rebound and warm-up from the depths of the bear market, the official bull market phase brings an amplified sentiment and even more pronounced volatility.

Each bull market’s official start is characterized by a set of common features, including:

- A shift from $BTC-led gains to altcoins spearheading the surge, resulting in a decline in Bitcoin’s market share.

- An increase in the velocity and magnitude of gains across various cryptocurrencies.

- A surge in popularity on social media and search engines, leading to a swift rise in public interest.

In this article, I explore the potential differences between this cycle and previous ones, offering my analysis and strategies for navigating ahead.

Please note that the insights above reflect my current thinking and may evolve. The perspectives are subjective and there may be factual inaccuracies or biases. This is not financial advice, but feedback and discussions are welcomed.

Let’s dive into the heart of this analysis.

The Catalysts for Crypto Bull Markets and Alpha Opportunities

Catalysts for the Bull Market

With Bitcoin’s valuation reaching significant levels, a retrospective of the last three cycles reveals that bull markets are typically ignited by a confluence of factors, including:

- The anticipated halving of Bitcoin, a critical adjustment to its supply and demand dynamics, is on the horizon for April in this cycle.

- Loosening monetary policies or the expectation thereof, with a market consensus that the zenith of interest rates is behind us and a strong anticipation for rate cuts in the upcoming quarter.

- The relaxation of regulatory policies. In this cycle, notable developments include updates to U.S. accounting standards that allow crypto assets to be accounted for at fair value on the balance sheets of public companies, and the SEC’s legal setback against Grayscale, which paved the way for the approval of ETFs.

- Innovations in asset and business models.

The current bull market has already seen the emergence of the first three factors.

Identifying Alpha Opportunities in Bull Markets

Historically, the most substantial gains in each bull market cycle have been captured by the newcomers or those who experienced their first major breakout during the cycle. For example, the 2017 bull market was dominated by the ICO craze, with platforms like Neo and Qtum, which facilitated smart contracts, leading the charge. Fast forward to 2021, and the spotlight shifted to Defi, Gamefi, Metaverse, and NFTs, with 2020 heralded as the year of DeFi, and 2021 marking the rise of NFTs and GameFi.

Yet, as we navigate through the current bull market, no new asset class or business model has achieved the transformative impact akin to that of smart contract platforms or DeFi in previous cycles.

As for the current landscape of Defi, Gamefi, NFTs, and Depin, there seems to be a stagnation in terms of innovation in product or narrative evolution, regardless of whether the projects are new or established. Most advancements are merely iterations or refinements of existing functionalities, leading to the perception that these are merely “old concepts” being recycled.

The current cycle has witnessed the emergence of two particularly novel categories within the crypto ecosystem:

- Bitcoin Ecosystem Innovations: This category includes inscription assets, exemplified by $ORDI and Node Monkeys, and projects that leverage Bitcoin’s Layer 2 solutions.

- Web3 + AI: This includes both decentralized computing projects from the previous cycle, like Akash and Render Network, and novel AI-centric initiatives such as Bittensor (TAO), which have surged to prominence in this cycle.

It’s crucial to underline, however, that AI does not inherently derive from within the blockchain. The surge of interest in Web3+AI projects is largely a spillover from the AI boom, particularly triggered by developments in ChatGPT in 2023. This positions AI-related projects as a “partially new narrative” within this cycle.

Speculations and Strategies for the Current Bull Market

Potentially Overestimated Alphas

In many recommended investment portfolios, I’ve seen a common inclination towards including Gamefi, DePIN, and DeFi-related altcoins within the asset pool. The prevailing logic suggests that due to their smaller market capitalization and higher volatility, these cryptocurrencies are expected to significantly outperform $BTC and $ETH in the bull market’s peak phases(after BTC reaches new highs), achieving Alpha returns.

However, as previously pointed out, “the most substantial gains in each bull market cycle have been captured by the newcomers or those who experienced their first major breakout during the cycle.” Given that DeFi, GameFi, NFT, and DePIN do not fit the characteristic of being “new assets or new business models” of this cycle, and considering they’re embarking on their second round, expecting them to replicate their inaugural cycle’s price performance is optimistic. It’s essential to understand that an asset class tends to enjoy its most substantial valuation bubble only during its first appearance in a cycle.

In their debut in the bull market, new business models or asset classes grapple with the challenge of “disproval.” This is a tough hurdle to clear amid the bullish euphoria. Conversely, in the second bull market, they face the necessity to “prove their mettle,” demonstrating that their growth potential is still untapped and their room for imagination substantial. This is equally challenging as reigniting faith in previously told tales isn’t straightforward, especially when they are still wary of being trapped at the high peaks of the previous bull market.

Some might argue that the Layer1 track was the “brightest star” in both the 2017 and 2021 bull markets, posing a counterexample.

This is not the case.

The demand for L1 solutions in the 2021 bull market experienced exponential growth, propelled by the meteoric rise of several product categories, including DeFi, NFT, and GameFi. This growth spurt resulted in a swift expansion of the market for both users and developers, creating an unparalleled demand for blockchain capacity. This not only elevated Ethereum’s market valuation but also catalyzed a boom among alternative L1 platforms due to overflow demand from Ethereum, making 2021 the watershed year for these Alternative L1s.

Can this current cycle replicate the previous cycle’s explosive growth in decentralized applications and asset classes, leading to further demand for L1?

At this juncture, we may not witness this replication. Hence, the conditions that allowed L1 platforms to enjoy a meteoric rise in their last cycle seem absent now, suggesting a need to moderate expectations for Alternative L1 platforms in this bull market’s context.

$BTC and $ETH: The Better Choices

In this current bull market phase, the most significant propulsion seems to be the capital inflow triggered by the facilitation of ETF approval, alongside optimistic expectations for long-term inflows. Consequently, the main beneficiaries of this cycle are primarily BTC and potentially ETH (as a likely candidate for ETF listing). Taking into account the perspectives on GameFi, DePIN, DeFi, and L1s discussed earlier, achieving Alpha in this bull market seems more challenging, indicating that a strategic investment in BTC and ETH could yield a more favorable risk-reward balance compared to the last cycle.

When deliberating between $BTC and $ETH, both likely to gain from ETF endorsements, which emerges as the superior target?

From my perspective, $ETH might edge out in the short term. This is attributed to the market having already adjusted $BTC prices in anticipation of its ETF approval, with little else to drive its value post-April’s halving. $ETH, conversely, stands at a comparative low against $BTC, and with rising speculation about its ETF prospects, $ETH appears to offer better short-term potential than BTC.

Looking towards the future, $BTC could emerge as the more favorable investment choice. $ETH increasingly mirrors the characteristics of a technology stock, with its valuation closely tied to its role in providing blockchain capacity, similar to a Web3 cloud computing venture. This sector is marked by intense competition, with $ETH under continual threat of losing narrative appeal and market share to other blockchain capacity offerings (including L1s, Rollups, and DA projects) and a variety of novel technological solutions. Missteps in Ethereum’s technological development or delays in product updates could prompt investors to withdraw their support.

In contrast, $BTC’s status as “digital gold” is progressively being cemented. The steady growth of its market valuation, coupled with the facilitation provided by ETFs, solidifies its position. The consensus on $BTC as a hedge against fiat inflation is slowly gaining endorsement, extending from financial institutions and publicly traded companies to smaller nations.

The once-popular argument that “$ETH’s potential as a store of value could surpass $BTC” is increasingly becoming a thing of the past.

Crafting a Bull Market Strategy: A Comprehensive Overview

Acknowledging the improved risk-reward proposition of favoring $BTC + $ETH in this cycle over the last doesn’t negate the value of diversifying with other altcoins. It simply suggests a more deliberate approach to determining their share in the investment portfolio.

The cornerstone of my current strategy involves:

- Elevating the allocation for $BTC and $ETH

- Exercising restraint in investments within established sectors like DeFi, GameFi, Depin, and NFTs.

- Identifying and leveraging new tracks for seeking Alpha, including:

- Memecoins: Positioned as the best speculative vehicles, with each cycle presenting renewed concepts and are known for generating remarkable wealth narratives, making it the easiest asser category to understand and to trigger widespread popularity.

- AI-related Projects: Emerging as a fresh commercial frontier within Web3, gaining traction from non-crypto groups.

- $BTC Ecosystem: Particularly the inscription assets, and to a lesser extent, Bitcoin L2 solutions. The former is favored for introducing a novel asset class in this cycle, whereas the latter is perceived as a conceptual iteration of Ethereum’s Rollups — essentially old wine in a new bottle.

Market Cycles Persist with an Accelerated Timeline

Furthermore, in the context of market cycles, my analysis diverges from the traditional pattern observed in past bull markets, where the year after a halving marked the primary ascent. Instead, I posit that the pinnacle of this cycle’s bull run will be in 2024, rather than 2025.

Historically, the Bitcoin halving events occurred in 2012, 2016, and 2020, with the forthcoming cycle slated for 2024.

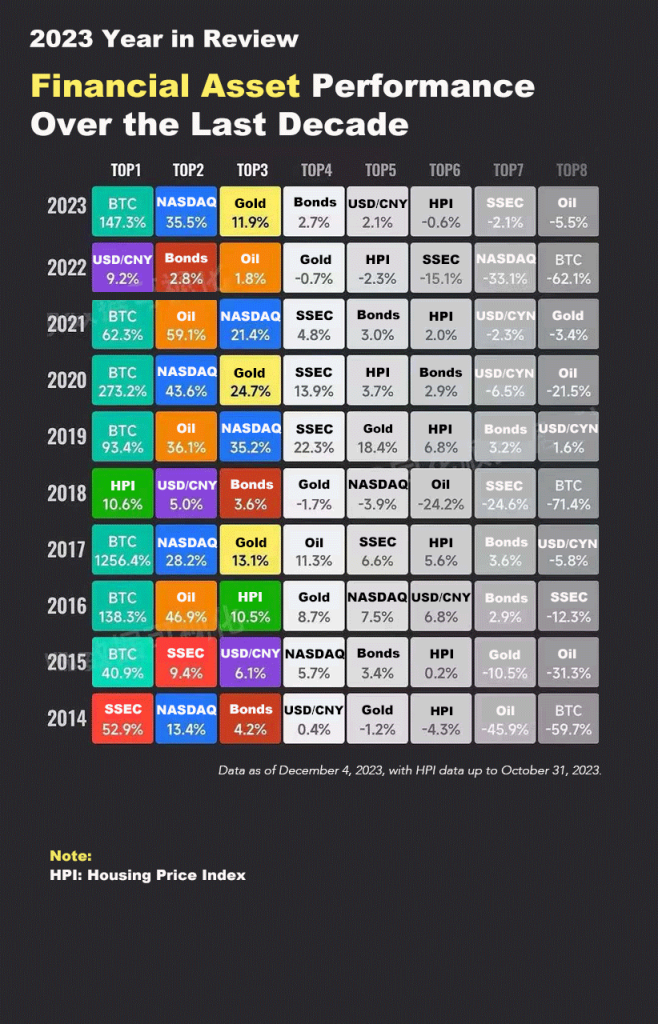

Last year, Hithink Finance conducted a comparison of the returns of major financial assets over the last decade, summarized as follows:

Generally, Bitcoin adheres to a “three-year rising, one-year falling” principle, correlating with its price increasing in the year leading up to the halving, the halving year itself, and the year following, before undergoing a decline.

In the first cycle of Bitcoin’s halving, the halving year of 2012 experienced a 186% price surge, followed by a monumental 5372% increase in 2013. Similarly, 2017 followed a comparable pattern, where, before the 2017 bull market cycle, $BTC price trend aligns with the principle of “moderate gains before the halving, followed by a substantial surge in the subsequent year.”

Nonetheless, this established pattern started to shift in the most recent cycle. Notably, the year preceding the halving, 2019, registered a notable rise of 93.4%, outpacing the 40.9% growth observed in 2015. The halving year of 2020 posted a 273% gain, surpassing the 62.3% increase recorded in the post-halving year, 2021.

The current cycle prominently showcases a shift towards an earlier “bull phase.” In 2023, the year before the halving, BTC achieved a 147.3% increase, outperforming the pre-halving year of the previous cycle (2019). As we venture into the first quarter of 2024, $BTC has already secured nearly a 60% increase.

I believe that it’s highly probable that 2024 will be the year of the main bull run for this cycle. Waiting for a boom in 2025 may lead to missed opportunities; thus, strategically increasing your investment now seems to be a more cautious approach. The year 2025, in contrast, might be apt for scaling down investments and harvesting gains.

Lastly, I extend my best wishes for a prosperous and rewarding journey through this bull market to all.