Contents

Investment Thesis

- Gelato has been deeply involved in the developer services field for many years and has developed a comprehensive suite of tools and services for developers. It is expected to achieve a breakthrough in business by integrating these offerings with its newly minted Rollup-as-a-Service (RaaS) platform, launched at the end of 2023.

- The RaaS projects are currently in a phase of vigorous token issuance, with notable projects such as Altlayer, Dymension, and Saga having recently launched their tokens. In addition, the sector includes well-funded competitors such as Conduit and Caldera. Given the influx of attention and funding, the RaaS landscape is anticipated to remain a focal point of market interest and activity in the foreseeable future.

Risk Factors

- Challenges in Revenue Generation: The business models of Gelato’s dual-core services—smart contract automation and Reliability as a Service (RaaS)—present challenges in generating sustainable revenue streams.

- Competitive Pressures: In the smart contract automation sector, Gelato faces formidable competition from Chainlink. In the RaaS domain, rivals such as Altlayer, Conduit, Caldera, and Dymension significantly challenge Gelato’s market position, as its competitive advantages are not sufficiently strong.

- Limited Token Utility

Overview of Gelato

Gelato’s business covers merely all aspects of developer services, such as account abstraction(AA) wallet services, multichain payment services, RELAY services that can help developers better onboard users, Verifiable Random Function (VRF) that used by NFT & Game projects, etc. But among them, two most important businesses are: Automate(of smart contracts) and RaaS(Rollup as a service).

Automate

We published a research report in December 2021 about Gelato, which interested parties can refer to for further information.

At that time, Gelato’s primary business strategy centered on “automated smart contracts.” This process involves the conditional automation of operations within smart contracts, specifically triggering operation B when condition A is met. The products introduced by Gelato included the following three features:

- AMM Limit Orders: This feature automates trade execution when a token’s price hits a specified threshold. Gelato’s pioneering limit order service, Sorbet Finance, has been directly integrated into the platforms of major decentralized exchanges (Dexes) such as PancakeSwap, QuickSwap (the largest Dex on Polygon), and SpookySwap (the largest Dex on Fantom).

- Loan Liquidation Protection: Designed to protect loans from liquidation by automatically managing the Loan-to-Value (LTV) ratio, this feature swaps collateral for debt and repays the debt when the LTV ratio reaches a critical level. Gelato introduced this feature through a consumer-oriented product, Cono Finance. This feature also received a grant from Aave and was integrated into Instadapp.

- G-UNI, Position Management Tool for Uniswap V3: This tool adjusts the liquidity provision (LP) market-making range on Uniswap V3 based on token price movements, optimizing the position management process. In 2022, the strategic decision to spin off GUNI as Arrakis Finance and plan for its token issuance marked a pivotal evolution in its offering.

Beyond the three core functionalities previously outlined, Gelato’s Automate platform extends its capabilities to a vast array of use cases, becoming an indispensable tool for numerous DeFi protocols. Notably, it facilitates automatic yield harvesting within Yield Farming protocols and ensures timely updates to oracles, among other applications.

Gelato plans to upgrade its automation services to “Web3 Function” in June 2024. This strategic upgrade will broaden the scope of trigger conditions available to developers, empowering them to initiate on-chain transactions in response to a diverse array of off-chain data sources, including APIs and subgraphs. These advanced trigger conditions will be securely stored on IPFS before being seamlessly submitted to Gelato for execution.

RaaS

As the year 2023 concluded, Gelato made a significant stride by launching its Rollup-as-a-Service (RaaS) offering. This innovative service is designed to guide developers through the selection of the optimal technology stack, thereby streamlining the Rollup deployment process.

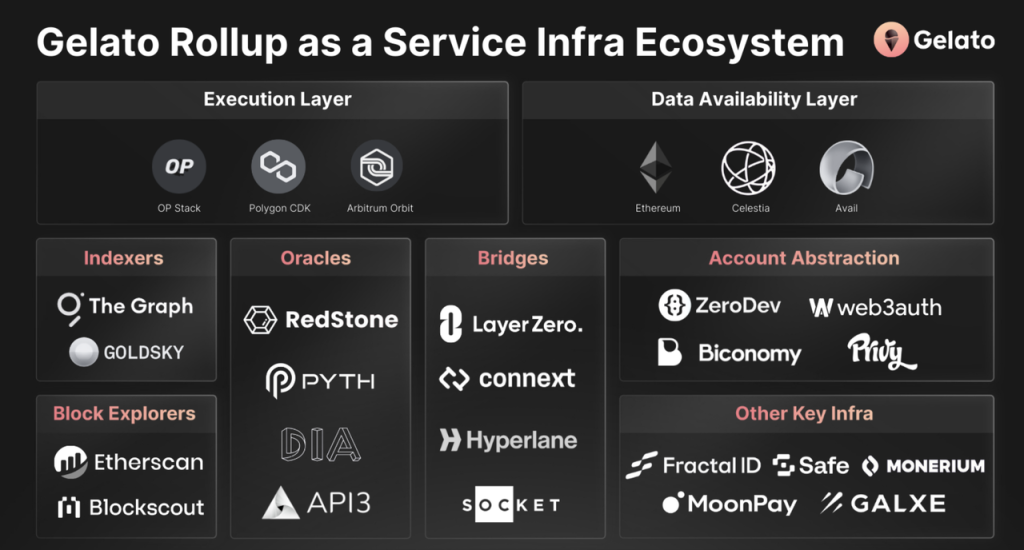

Gelato’s RaaS offering has already integrated a multitude of infrastructure service providers:

- Execution Layer Integration: Gelato has incorporated leading solutions such as the OP stack, Polygon CDK, and Arbitrum Orbit.

- Data Availability Layer Integration: Gelato has partnered with Ethereum, Celestia, and Avail.

- Cross-Chain Solutions: Gelato has integrated with Layerzero and Connext.

- Oracle Services: Gelato has integrated Oracle services from Redstone, Pyth, and API3.

- Indexers: Gelato has integrated with The Graph and Goldsky.

- Fiat Payment and Other Services: Gelato also extends its offerings to include fiat payment solutions with Moonpay and Monerium, KYC services through Fractal ID, and wallet services via Safe.

Business Analysis

Automate

In the world of Web3, scenarios requiring the automatic execution of smart contracts are widespread, such as periodic reinvestment of earnings, regular salary payments, liquidity rebalancing, and more. For developers, designing and executing a complete set of monitoring, computation, and operational programs is both labor-intensive and time-consuming. Automation service providers can help developers avoid “reinventing the wheel”. For providers like Gelato, the marginal cost of serving new users is meager. There is no difference between the process of conducting limit orders on Uniswap and Quickswap, which not only fosters economic synergies between Gelato and decentralized exchanges but also solidifies the business rationale underpinning such collaborations.

However, a potential challenge lies in the relatively low technical barriers to entry for the services Gelato provides, leading to a ceiling on the value developers are prepared to pay. This dilemma mirrors the experiences of Web2 automation platforms like IFTTT, which, despite offering valuable tools, struggle to convert free users into paying customers.

According to insights from IOSG, Gelato commands an impressive 80% share of the smart contract automation market. Achieving dominance in a niche market also involving the Web3 infrastructure leader Chainlink is no small feat. Unfortunately, a high market share has not translated into stable revenue streams, and the product is in a state of being “liked but not widely adopted,” presenting hurdles to effective commercialization.

From a competitive standpoint, Gelato’s early market entry and current leadership pose significant advantages. However, in the medium to long term, Chainlink possesses stronger brand recognition, superior developer engagement channels, more substantial financial resources, and the synergy of cross-selling with its array of services. For Gelato to sustain its competitive edge over Chainlink will not be easy.

RaaS

With the rapid development of Ethereum Layer2 solutions, the scalability issues that Ethereum once faced seem to have been largely addressed through Rollups. Especially with the upcoming Dencun upgrade, the cost of Rollups is expected to decrease significantly, laying the groundwork for potential widespread commercial adoption.

Embracing Ethereum’s Layer2 solutions and the broader adoption of Rollup technology is expected to persist into the future. In the process of developers constructing Rollups, there remains a series of issues and trade-offs for developers to consider. These include selecting a Rollup solution that aligns with their project’s unique requirements, the intricacies of building and managing a Sequencer, mitigating MEV issues, and choosing appropriate oracles and indexing services. RaaS platforms, serving as one-stop service providers and offering a suite of toolkits, clearly have a relatively stable demand in this context.

Despite its relatively recent emergence, the RaaS field is characterized by its highly competitive environment. Gelato’s competitors in RaaS field are as follows:

Drawing from an analysis of the current landscape, possible ways for RaaS providers to generate revenue or capture value have been identified:

- Hosting sequencers and engaging in MEV extraction at the execution layer emerge as the most direct and promising revenue sources.

- Becoming the settlement layer for Rollups or Appchains.

- Instead of charging fees on user transactions, RaaS providers can explore revenue generation by offering a suite of integrated infrastructure services, such as wallets, and explorers, and engaging in technical consulting services.

- RaaS providers can institute subscription fees for access to their services.

Furthermore, the Restaked rollup, which Altlayer is exploring in collaboration with Eigenlayer, is designed to utilize $ALT more as economic bandwidth, coupled with Restaking mechanisms, to capture value for the token. However, this method of value capture is not closely related to the RaaS services they provide.

Overall, due to the limited number of launched RaaS projects, viable business models of revenue generation remain uncertain. Yet, an analysis of the revenue and cost structure of existing Rollups illustrates the challenges RaaS providers face in revenue generation.

In the competitive landscape of RaaS providers, given the primary target audience consisting of developers and project builders, the ability to attract and retain developer interest becomes a pivotal factor. Despite the presence of unique technological features across different RaaS platforms, the scope and nature of the services offered are inherently influenced by the underlying framework on which they operate. This dependency on the core framework results in a level of service homogeneity among RaaS providers.

Given the relatively uniform service offerings within the RaaS space, The ecosystem influence of the project may be a deciding factor for its success.

For RaaS platforms with strong network effects, the business development capabilities are critical determinants of their long-term success and scalability.

In such a niche market that appears ripe with opportunities but may, in reality, be approaching saturation, Gelato does not necessarily have an advantage in terms of influence or business development prowess compared to its competitors. Rather, Gelato’s true strength is rooted in the team’s longstanding commitment to serving the developer community, allowing it to offer a more comprehensive suite of development tools.

Team, fundraising and Partners

Gelato’s co-founders, Hilmar Orth (X: @hilmarxo) and Luis Schliesske (X: @gitpusha), are both esteemed developers. They initially architected the core functionalities that underpin Gelato’s innovative products. They have been close friends since their university days and have worked together ever since. Before founding Gelato, they co-founded a startup aimed at pioneering new business models for large European enterprises through the strategic use of smart contracts. Their prowess and innovation were further showcased through their active participation and notable successes in a series of high-profile hackathons, including ETHParis, ETHBerlin, ETHCapeTown, and the Kyber DeFi Hackathon. These achievements paved the way for securing grants from Gnosis and MetaCartel, which were crucial in the establishment of the Gelato Network.

Gelato has conducted four rounds of fundraising, including three private rounds and one public round:

- In September 2020, Gelato embarked on its fundraising journey with a seed round that culminated in $1.2 million, supported by investors including IOSG, Galaxy Digital, D1 VC, The LAO, Ming Ng, MetaCartel, and Christopher Jentzsch. The valuation of $GEL, Gelato’s native token, was pegged at $0.019 during this round.

- In September 2021, Gelato announced a fundraising of $11 million from investors such as Dragonfly, Parafi, IDEO, Nascent, and Stani Kulechov (the founder of Aave). The cost of $GEL for this round rose to $0.2971.

- The public sale also occurred in September 2021 and Gelato conducted a public sale that raised $5 million, with $GEL priced equally at $0.2971.

- In December 2023, Gelato completed a bridge round led by IOSG. The specific details regarding the amount raised and the financing method remain undisclosed.

In addition to the fundraising rounds, Gelato received grants from Gnosis and MetaCartel at the inception of the project.

Partnerships have been a cornerstone of Gelato’s strategy, underpinning its RaaS offering and establishing it as a key player in the developer services industry. The project has numerous partners, which have been listed in the previous part.

Furthermore, a testament to Gelato’s innovation was its recognition as one of the winners of Most Valuable Builders III on BNB Chain in 2021.

Valuation

Whether in the realm of smart contract automation or RaaS, there exists a significant gap in accessing detailed revenue metrics for projects operating in these areas. This scarcity of precise financial data makes the process of accurately valuing these projects challenging. In this context, our analysis focuses on presenting the circulating market cap and the fully diluted market cap of various projects that are in direct competition with Gelato for reference.