Contents

Introduction

The landscape of Ethereum staking, along with its derivatives, has been a focal point in the crypto community for the last couple of years. Key developments like the Beacon Chain, The Merge, and Shapella, alongside innovations in Liquid Staking Tokens (LST), Derivative Staking Tokens (DST), Restaking, and LST-fi have marked the rapid evolution of Ethereum staking. This surge is largely attributed to fundamental shifts in Ethereum’s staking model. It’s crucial to explore how Ethereum’s staking framework will continue to evolve and its consequential effects on the ecosystem, including various stakeholders and staking derivatives.

Vitalik Buterin, in his article published on October 7 titled “Protocol and Staking Pool Changes That Could Improve Decentralization and Reduce Consensus Overhead,” puts forth a series of optimization proposals for the existing Ethereum staking mechanism. These suggestions offer a reference path for further reducing centralization and minimizing consensus overhead in Ethereum. Some of these ideas could significantly revamp the staking mechanism while aligning with the primary trends in Ethereum’s development. Therefore, we will interpret this article and analyze the potential impacts of these proposals on the staking paradigm and its broader implications in the Ethereum ecosystem.

Overview of Vitalik’s Insights

The Status of Two-Tiered Staking

Vitalik Buterin describes the current Ethereum staking landscape as predominantly two-tiered, where there are two classes of participants:

- Node operators, individuals or entities actively running Ethereum nodes.

- Delegators, participants who stake some quantity of ETH in any other way beyond running a node

The prevalent method for staking in this environment is through staking pools offering Liquid Staking Tokens (LSTs), notable examples being Lido and Rocket Pool.

Existing Challenges

This emergent two-tiered staking has brought two main flaws:

- Centralization risk in node operators. After delegators finish staking $ETH, service providers like Lido assume the responsibility of node selection, inherently carrying the risk of centralization. For instance, in a DAO-voting mechanism where Lido dictates node operators, there’s a tendency for operators to accumulate significant holdings of $LDO tokens to enhance their market share. Similarly, Rocket Pool’s model, which allows anyone to become a node operator by submitting an 8 ETH deposit, favors financially robust operators who can effectively “purchase” market share.

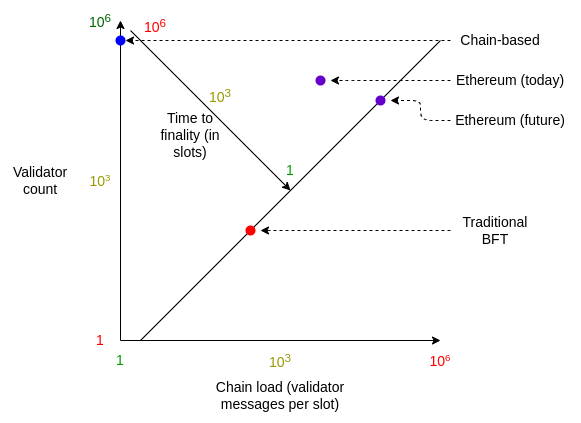

- Needless consensus layer burden. The current staking model imposes a significant load on Ethereum’s consensus layer, which is tasked with aggregating and verifying about 800,000 signatures per epoch. Achieving Single Slot Finality (SSF) would demand the same volume of signatures to be processed per slot, effectively condensing the time frame to 1/32nd of its original duration. This intensifies the hardware requirements for nodes. From the current two-tiered staking structure, most of the verification work is carried out by node operators. Although there’s a large number of validators, the diversity of these validators is limited. Consequently, increasing node numbers doesn’t necessarily decentralize the network but rather amplifies the consensus layer overhead. A potential solution could be to reduce the number of validating nodes (and thus the number of signatures needed), which might initially seem to favor centralization. However, accompanying strategies to mitigate centralization risks are discussed in subsequent sections.

Glossary

Slot: This refers to the time required for a new block to be proposed by a validator in the proof-of-stake system. In Ethereum, a slot is approximately 12 seconds. In each slot, the network randomly selects one validator as the block proposer, who is responsible for creating a new block and broadcasting it to other nodes in the network. Additionally, a committee of validators is also randomly chosen for each slot. Their votes determine the validity of the proposed block. Importantly, not every validator participates in the validation process for each slot. Only those selected for the committee are engaged in active validation. Achieving consensus on the slot’s state requires the affirmation of two-thirds of the committee’s votes. This selective participation of validators in different slots is a strategic design to optimize network efficiency and manage load.

Epoch: It represents the number of 32 slots. In Ethereum, an epoch is approximately 6.4 minutes. Within any given epoch, a validator is limited to joining a single committee. Throughout the epoch, all active validators on the network are obliged to submit evidence of their ongoing active status. The first slot of each epoch (under normal circumstances) is also known as the checkpoint.

Finality: In a distributed network, a transaction has “finality” when it becomes part of a block and cannot be reverted unless an attacker commits to losing a large amount of staked ETH, causing a blockchain rollback. Ethereum manages finality through “checkpoint” blocks. If a pair of checkpoints (the first slot of adjacent epochs) attracts votes representing at least two-thirds of the total staked ETH, the checkpoints are upgraded. The more recent of the two (target) becomes “justified”. The earlier of the two is already justified because it was the “target” in the previous epoch and now it is upgraded to “finalized”. while the older one, previously justified, advances to “finalized” status. On average, finality for a typical transaction occurs in about 2.5 epochs or around 16 minutes. This duration is calculated based on the transaction’s placement in the middle of an epoch and the time taken for subsequent checkpoints to become justified and then finalized. Ideally, achieving justification for an epoch’s checkpoint occurs at its 22nd slot, leading to an average transaction finality time of approximately 14 minutes.

Single Slot Finality (SSF): It refers to that blocks could get proposed and finalized in the same slot. The current time to finality has turned out to be too long and most users do not want to wait 15 minutes for finality, and it is inconvenient for applications that might want high transaction throughput. Having a delay between a block’s proposal and finalization also creates an opportunity for short reorgs that an attacker could use to censor certain blocks or extract MEV. The mechanism that deals with upgrading blocks in stages is also quite complex and has been patched several times to close security vulnerabilities, making it one of the parts of the Ethereum codebase where subtle bugs are more likely to arise. These issues could all be eliminated by reducing the time to finality to a single slot. As part of Ethereum’s long-term roadmap, particularly in The Merge branch, SSF is a crucial milestone. However, SSF is in the research phase and it is not expected to ship for several years, likely after other substantial upgrades such as Verkle trees and Danksharding.

Proposed Solutions by Vitalik

Vitalik Buterin suggests that the current role of delegators in Ethereum staking is not as impactful as intended. He advocates for empowering delegators with more rights and responsibilities to address existing challenges. The two main strategies proposed are ‘Expanding Delegate Selection Powers’ and ‘Consensus Participation’.

Expanding Delegate Selection Powers

Expanding delegate selection powers aims to provide delegators with greater autonomy in choosing staking service providers and node operators, thereby playing a more active role in the staking process. Delegate selection already exists in a limited form today, in the sense that rETH or stETH holders can withdraw their ETH and switch to a different pool, but lack direct influence over node operator selection and face restrictions in withdrawal flexibility.

Vitalik proposed three ways to expand delegate selection powers:

- Better voting tools within pools. This involves developing more sophisticated voting systems within staking pools, allowing users to directly influence the selection of node operators. The practice does not exist today: in Rocket Pool, anyone can become a node operator, while in Lido, node operator selection is controlled by the LDO token holder although Lido has a proposal for LDO + stETH dual governance.

- More competition between pools. Vitalik suggests increasing the competitive landscape among staking pools, offering delegators a broader spectrum of choices. However, smaller staking pools face challenges in competing with dominant players like Lido, as their LSTs often lack liquidity, trust, and dApp compatibility. To counter these issues, Vitalik proposes measures like capping slashing penalties to a smaller amount, enabling more flexible withdrawals to enhance LST liquidity and trust, and introducing a unified LST token standard for seamless dApp integration across different staking pools’ LSTs.

- Enshrined Delegation. This means that delegation functionalities can be directly executed on the Ethereum Mainnet, which would involve protocol-level specifications that require delegators to select a node operator at the time of staking.

What is Slash

Ethereum’s protocol design incentivizes validators to make a consensus on the prerequisite of staking a certain amount of ETH. If any validator is found to have dishonest behaviors, a significant part of their staked ETH is burned. There are mainly two types of misconduct that lead to slashing: Proposing two different blocks for the same slot and double voting by attesting to two candidates for the same block.

Why Capping the Slash Amount Can Reduce Risks for Delegators?

In the current two-tiered staking structure, delegators stake their ETH but don’t directly control validator actions, which are managed by node operators. Thus, when a node operator acts maliciously, it’s the delegators who bear the indirect consequences of slashing. Projects like Rocket Pool require node operators to stake ETH as a security measure, addressing the principal-agent dilemma. Capping the slashing amount at the Ethereum protocol level to a threshold that can be covered by the node operator’s share would significantly lower the risk for delegators. This change would allow staking service providers more flexibility in permitting delegators to withdraw their funds at any time, without the need to maintain a high level of liquidity for potential slashings.

Consensus participation

The idea of “Consensus Participation” aims to engage delegators more directly in Ethereum’s consensus process, without adding extra overhead to the Ethereum consensus layer. Vitalik acknowledges that many delegators prefer to stake their ETH passively, primarily through Liquid Staking Tokens (LSTs). However, he also believes that some delegators might be interested in playing a more active role in the consensus process. This active participation can contribute to a more decentralized and robust network. Vitalik suggests two potential pathways for consensus participation: enshrined two-tiered staking solution in protocol, or implemented as staking pool features.

Enshrined in protocol

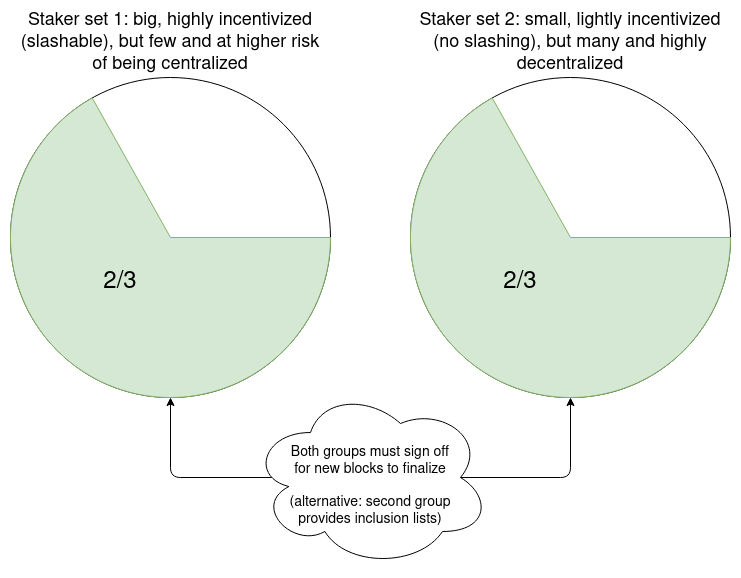

At the protocol level, validators can be divided into two categories: higher-complexity slashable tier and lower-complexity tier, which aims to optimize network performance and enhance decentralization.

- Higher-complexity Slashable Tier: These validators handle the main verification and computational tasks on Ethereum and are required to remain online at all times. Validators in this tier would need to stake a significantly higher amount of ETH (eg. 2048 ETH) and they would be subject to the risk of slashing. The total number of higher-complexity slashable tier validators in the network would be capped at 10,000.

- Lower-complexity Tier: These validators face no cap on numbers and have no minimum staking requirement. They are exempt from slashing and their participation in the consensus process is required only during specific slots.

- Lower-complexity validators also referred to as ‘small-stakers’ in Vitalik’s post, are primarily drawn from two groups: Delegators contributing their ETH to higher-complexity validators and independent participants who opt to become validators without relying on staking services.

- Operational Modes for Lower-Complexity Validators:

- In each slot, 10000 small-stakers are randomly chosen, and they can sign off on what they think is the head of that slot.

- A delegator can send a transaction declaring to the network that they are online and are willing to serve as a small-staker for the next hour. They are responsible for voting on the block header they support. At the end of their duty, they must sign off, indicating the completion of their participation.

- A delegator can send a transaction declaring to the network that they are online and are willing to serve as a small-staker for the next hour. For each epoch, 10 random delegators are chosen as inclusion list providers, and 10000 more are chosen as voters. These small-stakers do not need to manually sign off and their online status expires naturally over time.

- These three modes have a common goal: they prevent a 51% majority of node operators and enhance Ethereum’s resistance to censorship. The first and second focus on preventing a majority from engaging in finality reversion. The third focuses more directly on censorship, empowering small-stakers to take on additional responsibilities.

- Prerequisite for Lightweight Participation: The availability of an ultra-light client for lower-complexity tier validators is essential, enabling them to complete validation tasks via smartphones or web browsers. This involves research into Ethereum’s client architecture, including the integration of technologies like Verkle Trees and statelessness, aimed at lowering the entry barrier for validators.

Implemented as Staking Pool Features

Implemented as staking pool features refers to enabling delegators to actively participate in the consensus process through upgrades within staking pools. The core idea is to incorporate joint signatures from delegators and validators in the consensus voting process to reflect the collective will of the delegator group. Vitalik has proposed three methods to facilitate this integration:

- Each staking pool that wants to become a validator is allowed to specify two staking keys: a persistent staking key ‘P’ and an Ethereum address which, when called, outputs a quick staking key ‘Q’. Nodes track the fork choice of messages signed by P and messages signed by Q. If the two agree, the verification will be successful, Conversely, if the two disagree, they do not accept any block as finalized. Staking pools are responsible for randomly selecting delegators as the Q-key holders for the current slot.

- Validators randomly generate a staking public key ‘P+Q’ for each slot, which means the signature required for a slot’s vote is a joint computation effort of both validators and delegators. Given that a different key is randomly generated for each slot, accountability in the event of slashing poses a significant challenge. Addressing this requires careful design to ensure traceability and responsibility.

- Instead of delegators directly holding the Q-key, it could be embedded within a smart contract. This approach allows for more complex and variable triggering conditions and the staking pool can introduce a richer and more dynamic voting logic.

Summary

Vitalik Buterin says that if the proposed solutions are done right, tweaks to the PoS staking design could solve two birds with one stone: reducing staking centralization and minimizing the consensus layer overhead.

- Give people who do not have the resources or capability to solo-stake today an opportunity to participate in staking that keeps more power in their hands: both power to select node operators and power to actively participate in consensus in some way that’s lighter but still meaningful. Vitalik mentioned that not all participants would take either or both options, but any that do would significantly improve the current PoS landscape.

- Reduce the number of signatures that the Ethereum consensus layer needs to process in each slot, even in a single-slot-finality regime, to a smaller number like about 10,000. This would also aid decentralization, by making it much easier for everyone to run a validating node.

Many of these solutions, including better voting tools within pools, more competition between pools, and in-protocol enshrinement, operate at different layers of abstraction. However, they share the common goal of addressing the issues of centralization in staking and the consensus layer overhead. Vitalik underscores the importance of meticulous planning and assessment in implementing these solutions, and minimal viable enshrinement, minimizing both protocol complexity and level of change to protocol economics while still achieving the desired goal, is generally the optimal choice.

Analysis of Potential Impacts on Staking Landscape

Overview of Staking Landscape

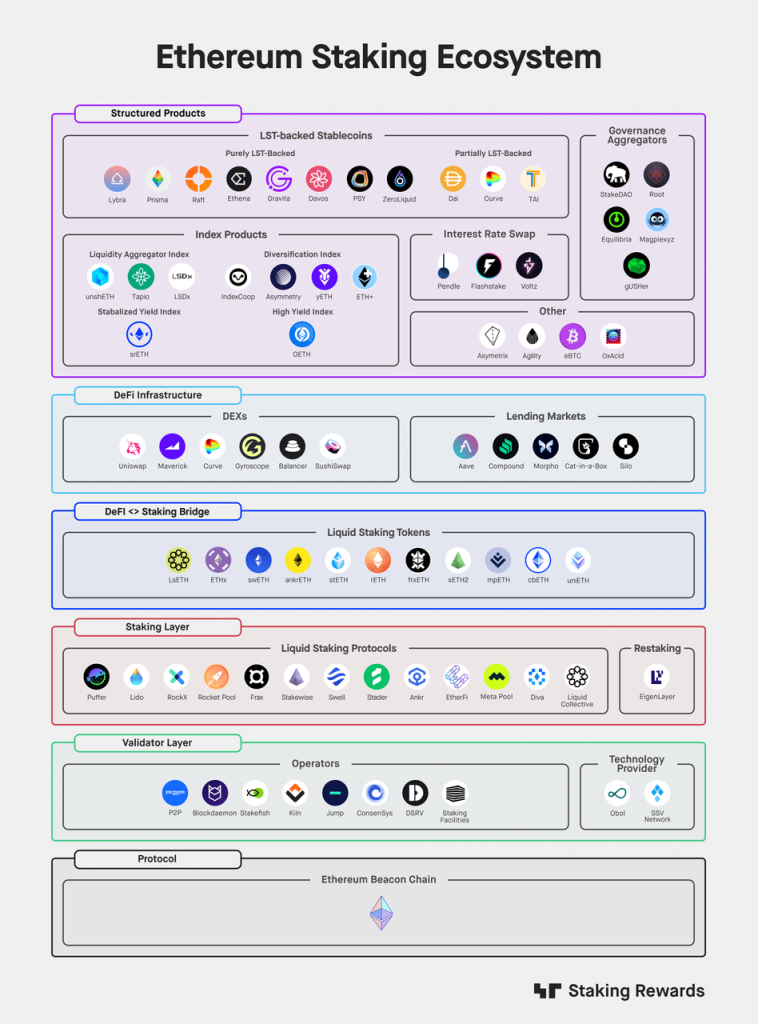

The Ethereum staking ecosystem, as classified by @StakingRewards, comprises the Validator Layer, Staking Layer, Staking Bridge, DeFi Infrastructure, and Structured Products. The internal logic and individual value propositions of each layer can be outlined as follows:

- Validator Layer provides essential hardware resources for the staking layer and solo stakers, as represented by node operators like P2P, and Stakefish and including Distributed Validator Technology (DVT) service providers such as SSV and Obol. This layer addresses hardware and technical needs for the Staking Layer.

- Staking Layer acts as an intermediary between delegators and node operators, facilitating the consensus validation process on Ethereum, as driven by staking service providers like Lido and Rocket Pool, and innovative EigenLayer, which introduced the concept of Restaking. This layer packages the indirect participation of delegators in the PoS mechanism into a more accessible financial product. By doing so, it lowers the entry barriers for participation in staking and increases the availability of staking shares within the Ethereum ecosystem.

- Staking Bridge refers to the Liquid Staking Tokens (LSTs) issued by the Staking Layer. LSTs serve as a bridge for users to engage with various DeFi protocols. Staking service providers facilitate LST-ETH trading pairs on platforms like Curve, offering liquidity to delegators. This feature allows delegators to exit their staking positions prematurely if necessary, thus reducing the opportunity cost associated with staking.

- DeFi Infrastructure and Structured Products: This layer focuses on leveraging the value storage and income-generating capabilities of LSTs to develop derivative products and services, creating more application scenarios for LSTs, enriching the DeFi ecosystem, and attracting users to participate in staking.

In the staking ecosystem, the Staking Layer plays a pivotal role. This layer is instrumental in not only expanding the availability of staking shares within Ethereum but also channels liquidity into the DeFi system through LSTs. Given its central role, any modifications or advancements within the Staking Layer have the potential to exert substantial influence across the entire staking ecosystem. Therefore, our analysis will focus on examining the impact of Vitalik Buterin’s proposed solutions on various projects within the Staking Layer. In the context of this discussion, the term “staking landscape” will be used specifically for the Staking Layer.

Potential Impacts of the Proposed Solutions on the Staking Landscape

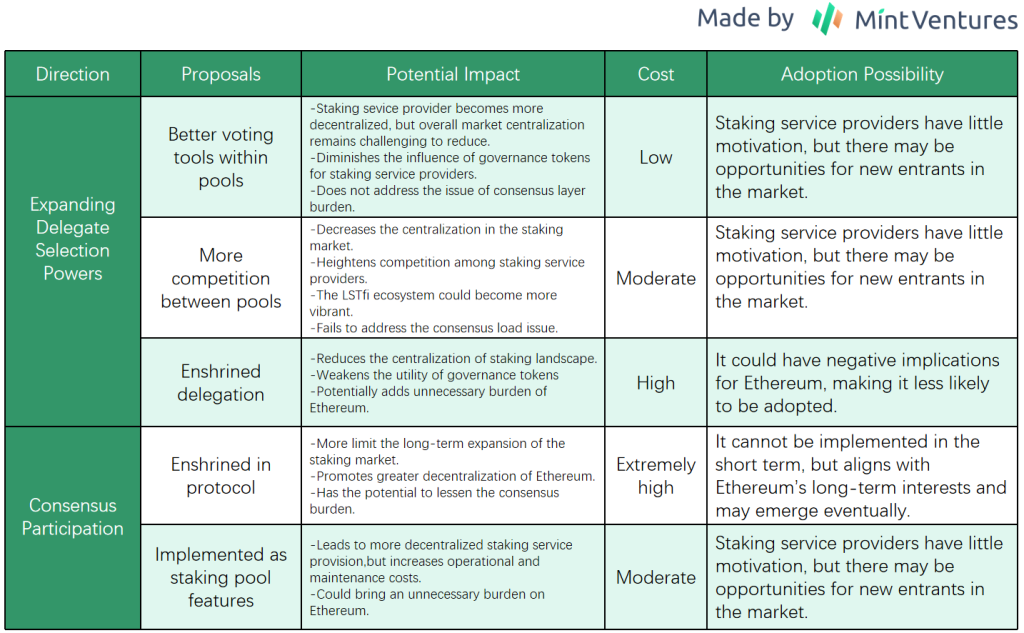

Each of Vitalik Buterin’s proposed solutions, while distinct in their implementation, is likely to influence the dynamics of the Ethereum staking landscape. This section will delve into the possible effects of these solutions and evaluate their practicality.

Expanding Delegate Selection Powers

Here is a closer examination of the potential impacts of Vitalik’s three proposals for expanding delegators’ power in selecting node operators:

- Better voting tools within pools: This would involve refining the voting processes within staking pools, empowering pool users to directly choose their node operators.

- Potential Impact: Optimizing voting systems could lead to increased decentralization within individual staking service providers. Despite these changes, the overall market centralization in the staking landscape may not diminish because users often prefer established, top-tier staking pools due to trust and reliability factors. By shifting some control over the selection of node operators from staking service providers to delegators, this approach could potentially dilute the value captured by the governance tokens originally held by these providers.

- Analysis of Adoption Probability

- Low Implementation Cost: This solution requires no changes to the Ethereum consensus layer, only modifications to the internal mechanisms of staking service providers.

- Lack of Incentives for Existing Staking Providers: This proposal requires current staking service providers to voluntarily implement changes, incurring significant costs, including development expenses and the potential reduction in the utility and value of their governance tokens.

- Summary: This approach partially addresses the issue of centralization in staking but fails to solve the problem of consensus overhead. The overall effectiveness might be moderate. While implementation costs are relatively low, existing staking service providers lack the motivation to adopt this change, making its likelihood of adoption quite low. However, this could open opportunities for innovation and competition among new entrants in the staking services market.

- More Competition Between Pools: This involves intensifying the competition among staking pools, providing delegators with a wider range of choices. Currently, the key differentiators among various staking pools in attracting users are the liquidity, trust, and dApp compatibility of their LSTs. Vitalik proposes reducing the amount of slashing penalties and introducing a unified LST standard to minimize these differences, thereby intensifying the competition among staking service providers.

- Potential Impact: Enhanced competition could diminish the disparities among staking service providers, possibly reducing the dominance of major players like Lido. This shift could lead to decreased centralization in the staking ecosystem. A more competitive landscape could result in the flourishing of the LSTfi ecosystem, as dApps may extend support to LSTs from a larger array of staking pools. Service providers may start to compete on different aspects, such as the staking returns of their LSTs, focusing on strategies to maximize MEV.

- Analysis of Adoption Probability:

- Moderate Implementation Cost: Technically, the costs are not substantial, as this does not necessitate changes to the Ethereum consensus layer. The key lies in developing a new LST standard and consensus among staking service providers to lower slashing penalties. During the process, significant migration costs could arise, requiring existing LST holders to transition to the new unified standard.

- Lack of Incentives for Existing Staking Providers: This proposal requires current staking service providers to voluntarily implement changes. They might be reluctant to adopt this approach due to the development costs, risks of LST migration, and potential market share erosion.

- Summary: This solution could effectively reduce centralization in the staking landscape but does not tackle the consensus overhead issue. Despite the moderate cost, the lack of strong incentives for existing service providers could hinder adoption. Similar to the previous solution, this scenario might open doors for new staking providers to enter the market, using the proposed changes as a unique competitive edge.

- Enshrined Delegation: This means that delegation functionalities can be directly executed on the Ethereum Mainnet, which would involve protocol-level specifications that require delegators to select a node operator at the time of staking.

- Potential Impact: With the backing of the Ethereum protocol layer, the security and legitimacy of the transition process in delegation would be enhanced. However, this integration could add to Ethereum’s consensus overhead, as the delegation process at the protocol level introduces an extra verification workload.

- Analysis of Adoption Feasibility:

- High Implementation Cost: This would require an upgrade to the Ethereum consensus layer to support new delegation functionalities natively.

- Possible Deviation from Ethereum’s Principles: This mechanism increased the consensus overhead and might inadvertently edge toward a Delegated Proof of Stake (DPoS) system, which could diverge from the initial design ethos and goals of Ethereum. Vitalik Buterin might be cautious of such an outcome.

- Summary: Enshrined Delegation, although promising in terms of reducing centralization, will increase the consensus overhead. Given the high costs and potential deviation from Ethereum’s foundational principles, the likelihood of this solution being adopted is extremely low.

Consensus participation

The core concept of Consensus Participation is to engage more validators, particularly those in the low-complexity tier, in Ethereum’s consensus process. This can be achieved either through native integration within the Ethereum network or via third-party projects.

Enshrined in Protocol

According to Vitalik’s concept, validators on the Ethereum network would be categorized into high-complexity and low-complexity tiers. High-complexity tier validators would have a higher staking threshold, potentially set at 2048 ETH, and their numbers would be capped at 10,000. They would be required to be continuously online, handling the primary verification and computational tasks essential for network stability and security. Low-complexity tier validators would operate lightweight clients and participate in consensus processes during specific times. Their tasks would be less demanding, focusing mainly on activities like voting.

Note: Vitalik Buterin’s reference to a 2048 ETH staking requirement in his seminal article carries substantial practical implications for the future evolution of Ethereum’s staking mechanism. This figure, as elaborated in “Paths toward single-slot finality” and his citation of EIP-7251, is not merely theoretical but has considerable operational significance. Setting a staking threshold of 2048 ETH is strategically designed to optimize the number of validators, achieving a balanced network state. This approach is pivotal in reducing the consensus overhead for Ethereum, thereby facilitating the transition toward Single Slot Finality (SSF). In his article “Protocol and Staking Pool Changes That Could Improve Decentralization and Reduce Consensus Overhead,” Vitalik proposes a pragmatic path forward: initially adopting EIP-7251 as an interim measure. This step would entail elevating the maximum validator balance to 2048 ETH while maintaining the existing minimum of 32 ETH. Eventually, the 2048 ETH would become the standard staking requirement, enabling validators to autonomously choose their tier. In light of these considerations, the 2048 ETH figure emerges as a critical reference point in our analysis, offering insightful guidance on the potential structuring of Ethereum’s validator tiers.

- Potential Impact:

- Enhanced Decentralization and Reduced Consensus Overhead: The proposed native integration offers a streamlined, cost-effective avenue for a large number of delegators and regular users to engage in Ethereum’s consensus process. This inclusivity significantly bolsters the network’s decentralization. Capping high-complexity tier validators at 10,000 and setting a staking requirement of 2048 ETH simplifies the consensus mechanism. It reduces the overall complexity and the volume of aggregated signatures needed per slot, thereby easing the overhead on Ethereum’s consensus system.

- Increased Value and Penetration of Staking Service Provider and DVT: With the higher responsibilities and continual online presence required from high-complexity tier validators, the operational demands, particularly in terms of hardware, are elevated. This change underscores the importance of security technologies like DVT. The 2048 ETH staking threshold may encourage users who were previously solo staking to opt for a delegator role. This shift could amplify the market presence and adoption of staking service providers and technologies like DVT.

- Market Limitations for Staking Providers: In Vitalik’s model, low-complexity tier validators participate in the consensus by running light clients independently. Consequently, the ETH staked by these delegators does not contribute to the TVL in staking services. Users who opt to become low-complexity tier validators can do so without the intermediation of staking service providers. By running their ultra-light nodes, they eliminate the need to entrust their stakes to service providers and incur associated fees. As a result of these dynamics, the TVL that staking service providers can capture is likely to reach a maximum threshold, theoretically capped at around 20.48 million ETH.

- Analysis of Growth Prospects for Staking Service Providers

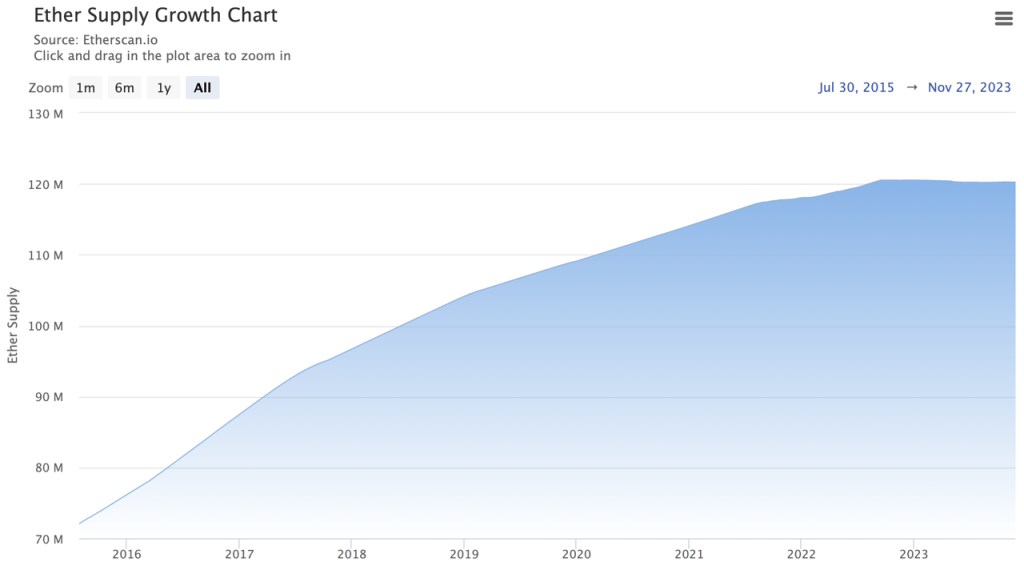

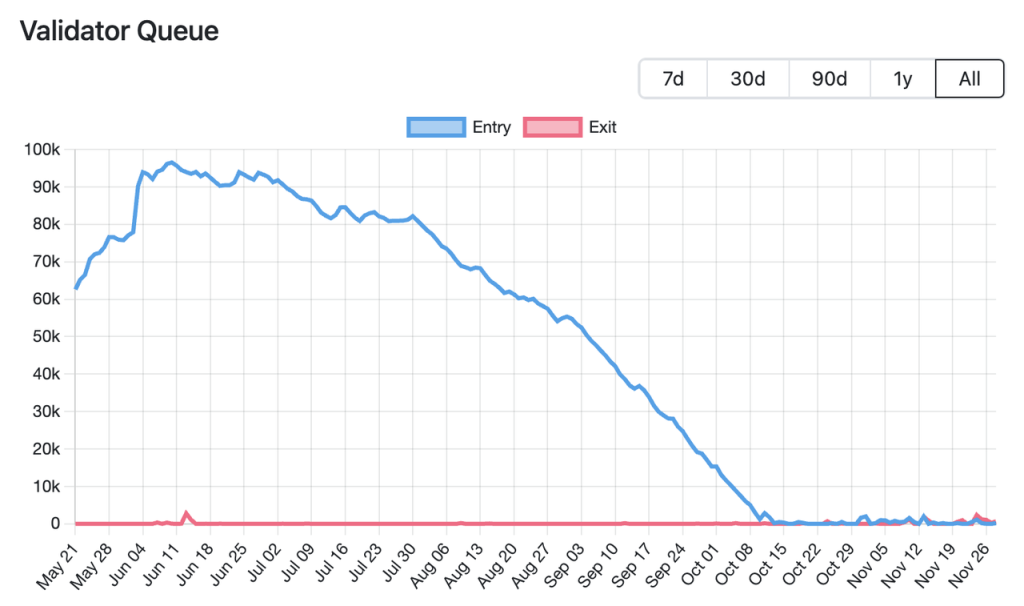

- Short to Medium-Term Growth Potential with Limitations: Post-EIP-1559 and the Merge, Ethereum’s total supply stabilizes around 120 million, with about 28 million ETH currently staked. This equates to a staking rate of approximately 23.29%, indicating some potential for growth in the staking sector. The increasing wait times for validators to join or exit and the declining staking rewards suggest that the growth in ETH staking is approaching a saturation point. Without a substantial boost in MEV earnings, driven by increased on-chain transactions, the quantity of staked ETH may stabilize, offering limited incentives for further growth.

- Long-Term Stagnation for Staking Providers and DVT Projects: Staking service providers like Lido and DVT projects such as SSV primarily generate revenue by taking a cut from the staking yields they manage. With a potential upper limit of 20.48 million ETH set for delegators’ funds under the new proposed structure, this cap would be lower than the current staked amount of 28 million ETH. The future growth and revenue potential of these service providers are closely tied to the increase in MEV income. If MEV earnings do not rise significantly (resulting in no substantial increase in the staking ratio), the absolute revenue size within the staking ecosystem may not only cease to grow but could potentially decrease.

- Analysis of Adoption Probability:

- Extremely High Implementation Cost: This process involves modifications to Ethereum’s consensus layer.

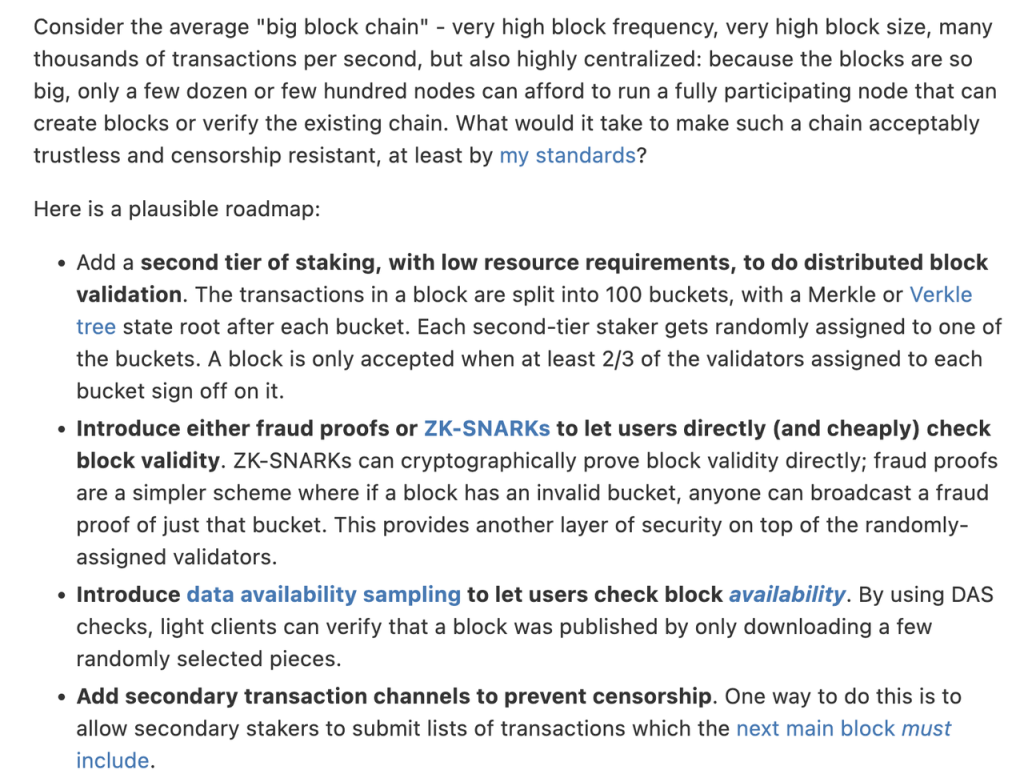

- The introduction of a tiered validator structure can align with Ethereum’s strategic long-term objectives and could be integrated into the network. As noted by Vitalik Buterin in “Endgame,” block sizes will increase gradually (due to the state bloat), which may eventually lead to a scenario where only a few dozen or a few hundred nodes can afford to run a fully participating node. Ethereum needs to find another lightweight way to allow more people to participate in consensus, making such a chain acceptably trustless and censorship-resistant. For features like SSF, collaboration between diverse types of validators is essential. The tiered approach, with different validators bearing varying responsibilities, supports this goal.

- The concept of a tiered validator system is a recurring theme in Ethereum’s roadmaps and blogs. Ongoing research and development projects are focused on creating conditions for low-complexity tier validators, such as through the development of lightweight client solutions.

- In major upgrades like PBS (Proposer/Builder Separation) and Danksharding, a similar philosophy of tiered validators and division of labor is evident: assigning more demanding tasks (such as storing blobs and constructing blocks) to specialized nodes to ensure efficiency, while enabling a larger number of lightweight nodes to participate in the consensus process to ensure decentralization.

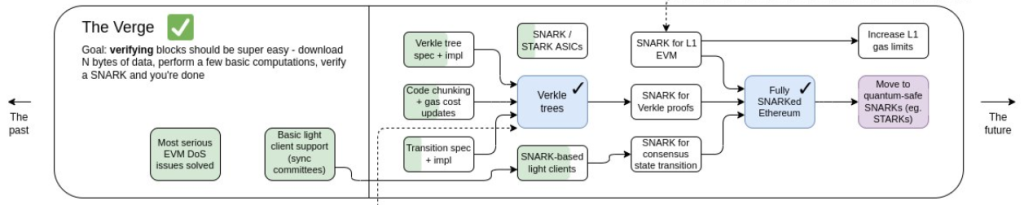

- In the strategic framework presented in Vitalik Buterin’s “Endgame,” a key concept emerges: the SNARK-ification of the Ethereum verification process. This refers to the implementation of lightweight clients, a cornerstone in facilitating the participation of low-complexity tier validators in the Ethereum consensus mechanism. Within the broader Ethereum roadmap, there are notable research initiatives, such as Stateless Ethereum and The Verge, which are focused on this objective.

- Summary: This approach can simultaneously address the issues of centralization in staking and consensus overhead. However, the implementation cost is extremely high, as it requires changes to the PoS rules at the Ethereum consensus layer. Despite this, it aligns with Ethereum’s long-term developmental interests, and the Ethereum roadmap has already shown some preparatory work in this direction. While it may be adopted in the longer term, the likelihood of short-term implementation is relatively low.

Implemented as Staking Pool Features

Vitalik also proposed an implementation that relies solely on staking pools, without direct modifications to Ethereum’s protocol layers. This method involves the division of a validator’s private key into two components, P and Q, which are allocated to the validators and the user, respectively. The consensus process is then facilitated through the joint signatures of both P and Q keys.

- Potential Impact: This method may moderately mitigate centralization within staking services, although its overall effectiveness remains uncertain. The intricacies involved in this process, particularly for users, could lead to lower engagement due to its complexity. Given that the solution primarily entails internal modifications within staking service providers, its influence on the broader staking landscape may be restricted.

- Analysis of Adoption Probability

- Moderate Implementation Cost: This solution does not require significant changes to the Ethereum consensus layer. However, it does necessitate fairly complex upgrades by existing staking service providers, including the management and joint signing of split keys and establishing user-friendly consensus participation mechanisms.

- Challenges for Existing Service Providers: Existing staking services may encounter considerable costs and complexities in implementing these changes. The required alterations in key management and user experience design could be resource-intensive, without a clear path to increased returns.

- This method could add complexities to Ethereum’s consensus mechanism, including processes like matching messages signed by both P and Q keys, which might inadvertently contribute to increased overhead.

- Summary: While this approach offers a novel way to address centralization in staking services, its effectiveness and scope of impact are not assured. The potential costs and complexities associated with this method may deter existing staking service providers from adopting it. New staking service providers might utilize this feature as a unique selling point to distinguish themselves in the market.

Summary

Vitalik Buterin has not explicitly favored any particular solution in his discussions. However, an analysis of the potential impacts of each proposal, in conjunction with insights from his previous articles and the Ethereum development roadmap, allows us to speculate on possible future directions.

- Analysis of “Expanding Delegate Selection Powers” Proposals

- Issue of Incomplete Resolution: The solutions under this category mainly target the centralization of staking. However, their capacity to effectively resolve this issue is uncertain. The existing two-tiered structure, involving delegators and staking pools, inherently resembles a Delegated Proof of Stake (DPoS) system. The proposed enhancements within this framework don’t fundamentally transform this structure and might even amplify DPoS-like features. In particular, the idea of native integration of delegation could potentially increase the overhead on Ethereum’s consensus mechanism.

- Conflicting Interests of Existing Providers: Existing staking service providers might find these proposals counterproductive to their interests. The suggested improvements in pool voting mechanisms and increased competition between pools require the cooperation of these providers, who may not be incentivized to support changes that could dilute their market dominance.

- Opportunities for New Projects: The new staking service providers could leverage these proposals to offer more decentralized staking alternatives in the market, positioning themselves as innovative challengers to established providers.

- Analysis of “Consensus Participation” Proposals

- Native Support as a Long-Term Solution: The proposal for native support within Ethereum is poised to address both the centralization of staking and the overload of Ethereum’s consensus mechanism. Indications from Ethereum’s development roadmap suggest that groundwork for a tiered validator structure is already in progress. Despite the complexities and challenges associated with its implementation, particularly in the short term, the proposal for native integration within Ethereum presents a highly feasible long-term solution.

- Compared to the proposals under “Expanding Delegate Selection Powers,” the third-party integration approach could more effectively mitigate the issue of centralization in staking. However, like the previous proposals, it falls short in addressing the consensus overhead problem in Ethereum and existing staking service providers may lack sufficient motivation to adopt this approach. However, this proposal opens opportunities for new staking service providers to differentiate themselves in the market by leveraging this feature.

Conclusion

Vitalik Buterin’s discourse and writings reflect a fundamental philosophy for Ethereum: a commitment to neutrality and minimalism. Ethereum, while capable of integrating numerous advanced features such as Account Abstraction, Liquid Staking Services, and Stealth Address, often refrain from directly incorporating these functionalities into its protocol layer. Instead, it adopts a strategy that encourages the development of these features through third-party projects. This approach has allowed these external entities to address Ethereum’s challenges effectively, carving out unique market niches and contributing to the ecosystem’s diversity and resilience. However, as Ethereum undergoes continuous evolution, the landscape for these third-party projects is also in flux. Adapting to the changing dynamics of Ethereum is not merely a test of these projects’ adaptability; it’s also an opportunity for strategic foresight and market positioning. Being attuned to Ethereum’s trajectory and proactively anticipating future developments is key to long-term success in this space.

In our analysis, we have endeavored to interpret the potential future challenges and uncertainties facing projects within the current staking landscape, drawing upon Vitalik Buterin’s visions and insights. While Vitalik has proposed various potential “endgames” for Ethereum, the future of this blockchain platform is inherently unpredictable, subject to shifting market demands and ongoing technological innovation. In this ever-evolving environment, the projects that thrive will likely be those that not only adapt to immediate changes but also strategically position themselves for future scenarios, leveraging their foresight and adaptability to stay ahead in the long-term race.

Reference

- <Protocol and staking pool changes that could improve decentralization and reduce consensus overhead>

- <Should Ethereum be okay with enshrining more things in the protocol?>

- <Paths toward single-slot finality>

- Ethereum Roadmap: Single slot finality

- <A Proof of Stake overview>

- <Can we find Goldilocks? Musings on “two-tiered” staking, a native Liquid Staking Token design.>

- <Endgame>

- <The Beacon Chain Ethereum 2.0 explainer you need to read first>

- FAQ on EIP-7251; Increasing the MAX_EFFECTIVE_BALANCE – HackMD