Contents

Preface

With the completion of the Ethereum Shanghai upgrade, a multitude of Liquid staking derivatives (LSD) projects have witnessed exponential growth. The user base and net worth of LSD assets have seen a substantial increase. As the crypto space anticipates the forthcoming Cancun upgrade and the open-source of the OP stack, 2023 is increasingly being heralded as the “Year of Rollups.” Pioneering services anchored to the Rollup infrastructure—including the Data Availability(DA) layer, shared sequencer, and Rollups-as-a-Service (RaaS) offerings—are carving out their niche in the market. One standout in this arena is EigenLayer. This avant-garde entity floated the innovative “Restaking” paradigm grounded in LSD assets, with a vision to cater to a diverse array of Rollups and Middlewares. Throughout this fiscal year, the buzz around EigenLayer has been palpable. Their funding round in March fetched an impressive $50 million at a valuation of $500 million. Yet, the grapevine suggests that their Over-The-Counter (OTC) token pricing has catapulted to a staggering $2 billion valuation, comparable to the level of public-chain projects.

In the following analysis, we will delve deep into EigenLayer’s business model and provide an exploratory valuation of the project, attempting to answer the following questions:

- What are Restaking services, who is its target audience, and what problems is it trying to solve?

- What are the challenges to the widespread adoption of the Restaking model?

- Is the $500 million—or the speculated $2 billion—valuation for EigenLayer a tad ambitious?

The insights and opinions presented in this article reflect my views as of the publication date primarily through a business lens, with a limited delve into the technical details of EigenLayer, and may contain factual inaccuracies or biases. This article is intended for discussion purposes only, and feedback is welcomed.

The Business Logic of EigenLayer

Before we plunge into the detailed operations of EigenLayer, let’s introduce a few frequently used terms that will appear throughout the text:

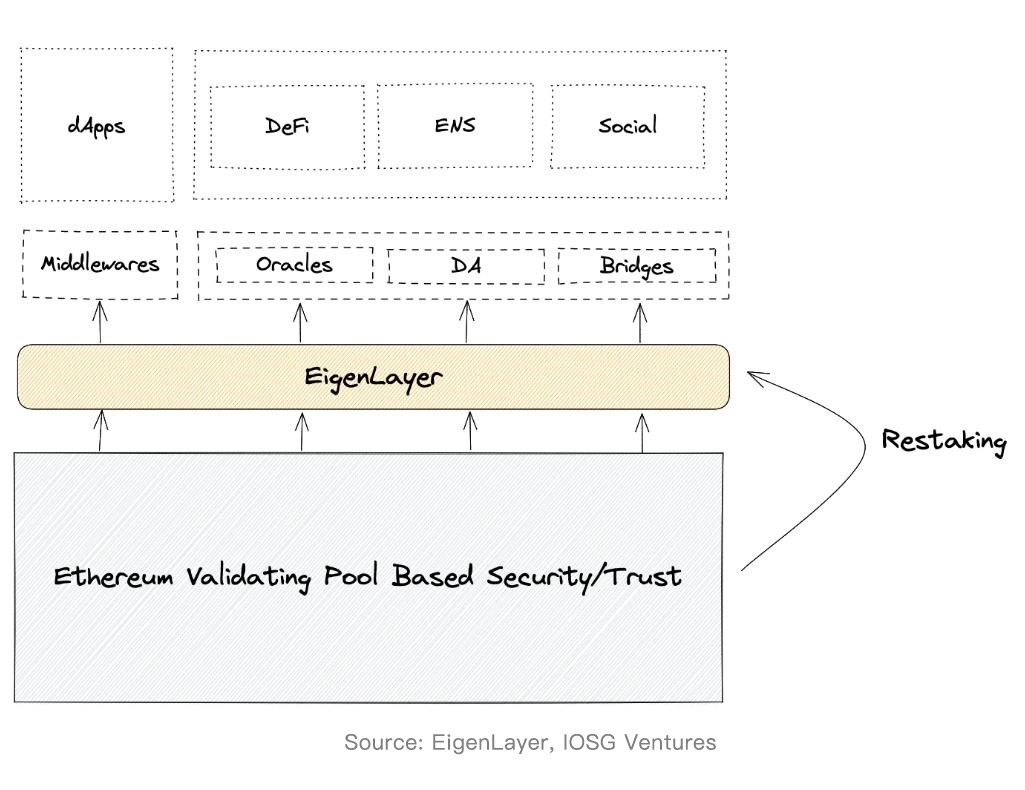

Middleware: In the realm of Web3, this term refers to the services that bridge the gap between the core blockchain infrastructure and decentralized applications (Dapps). Quintessential middleware components in this space include oracles, cross-chain bridges, sequencers, Decentralized Identity (DID), and the DA layer, to name a few.

LSD: Stands for Liquid Staking Derivatives, an example being Lido’s stETH.

AVS: Refers to Actively Validated Services. At its core, AVS is a decentralized node system that bestows projects with enhanced security and a guarantee of decentralization. The most iconic representation of AVS is the Proof-of-Stake (PoS) mechanism inherent to public blockchains.

DA: An abbreviation for Data Availability. Projects (like Rollups) can back up their transaction data on the DA layer, ensuring that if required in the future, they can access and restore all historical transaction records.

Business Scope

EigenLayer offers a matching market grounded in cryptoeconomic security.

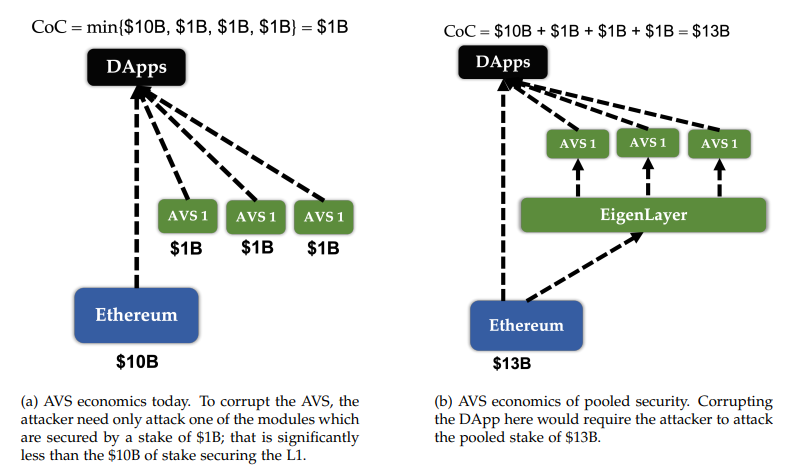

Cryptoeconomic security is the assurance provided by various Web3 projects. To ensure smooth operation and maintain a permissionless and decentralized nature, the primary service providers of the network, known as validators, are mandated to stake tokens as a gesture of their commitment. If these validators fail to fulfill their obligations, their staked tokens are subject to be slashed.

EigenLayer, as a platform, performs a dual role. At its core, EigenLayer serves as a nexus for LSD asset holders, pooling their assets. Concurrently, leveraging these aggregated LSD assets as collateral to offer convenient and cost-effective AVS services to middlewares, side chains, or Rollups. EigenLayer positions itself between LSD providers and those with AVS demands, facilitating a matchmaking service. A dedicated collateral service provider ensures the safekeeping and security of the staked assets.

Beyond the core services, the parent company behind EigenLayer has offered data availability services to Rollups or application chains that require DA layer services. This product is named “EigenDA”. There’s a synergistic relationship between EigenDA and EigenLayer in their operations.

EigenLayer aims to address the following pain points:

1. For Diverse Blockchain Initiatives: EigenLayer can help to reduce the high costs associated with independently building their trustless network. Instead of doing it all in-house, projects can directly purchase staking assets and node operators on the EigenLayer platform.

2. For the Ethereum Ecosystem: EigenLayer enhances the utility of LSD. By positioning $ETH as a preferred security collateral option for multiple projects, EigenLayer bolsters the demand for $ETH within the broader market.

3. For LSD Asset Holders: EigenLayer enhances the capital efficiency of LSD assets, ensuring holders receive better returns on their investments.

The Clientele of EigenLayer

EigenLayer offers a range of services tailored to different parties in the blockchain ecosystem. Let’s break down the primary users and their specific needs:

- LSD Asset Providers: Their main goal is to earn more yield from their LSD assets beyond the standard PoS rewards. They are willing to provide their LSD assets as collateral to node operators, even though they face potential slashing.

- Node Operators: They obtain LSD assets through EigenLayer to provide node services to projects in need of AVS services. Their revenue is derived from node rewards and transaction fees provided by these projects.

- AVS Demanders: These are typically projects that require AVS to ensure their security and are looking to reduce associated costs. Examples might include a particular Rollup or cross-chain bridge that utilizes LSD assets as collateral for node operation. These projects can conveniently purchase AVS services from EigenLayer without the complexities of setting it up themselves.

The primary demand for EigenDA stems from diverse Rollups and application chains.

Operation Mechanism in EigenLayer

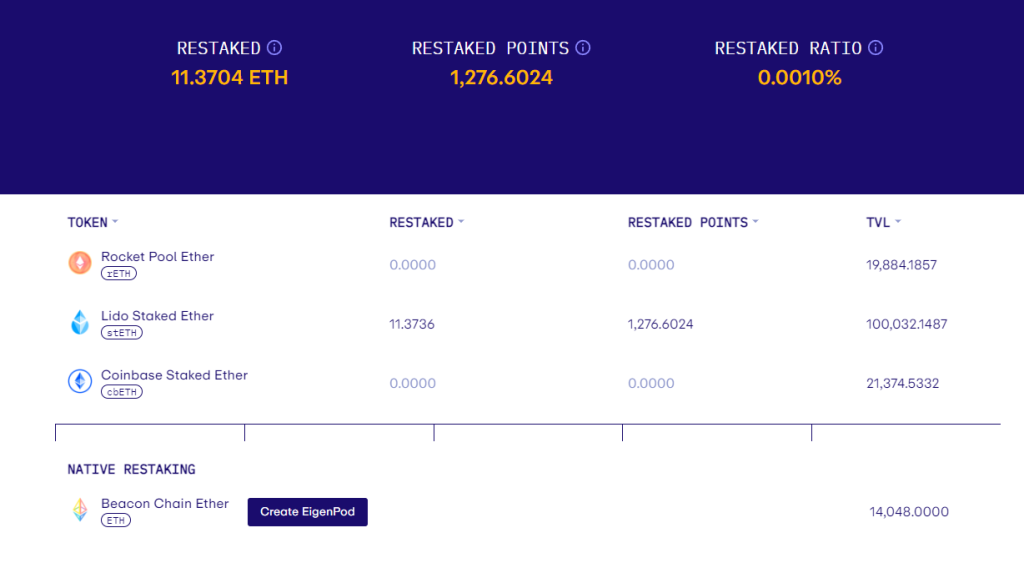

EigenLayer provides users with the ability to restake their tokens, which were originally staked on the Ethereum network. This includes a variety of tokens such as stETH, rETH, and cbETH. The staking service providers play a pivotal role in ensuring that these tokens are matched with the appropriate security network demanders, facilitating the provision of AVS services. The primary collateral for AVS consists of the tokens users have staked on EigenLayer. As a gesture of appreciation and compensation, the projects on the receiving end of these services distribute a “security fee” to these stakers.

Advancements in Product Offerings

At present, EigenLayer has rolled out its restake feature exclusively for LSD. The platform is still in the throes of developing node operation staking and LSD-based AVS services. During their two public LSD asset deposit events, there was a significant user turnout, with deposits swiftly reaching their maximum limits. A major driving force behind this overwhelming participation was the speculation surrounding potential airdrop rewards from EigenLayer. Additionally, users have the option to deposit batches of 32 ETH to engage in Restake. Despite these deposit restrictions, EigenLayer boasts a collection of approximately 150,000 staking ETH.

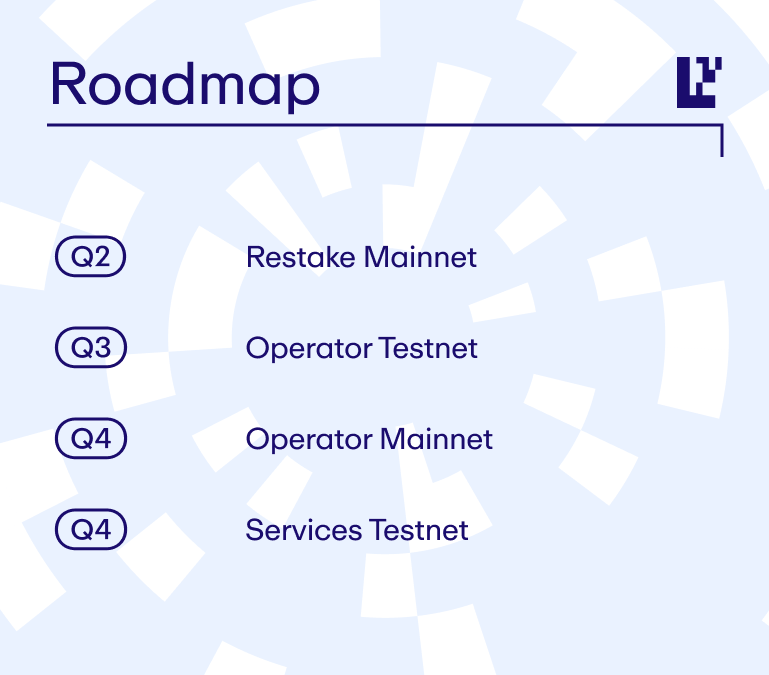

According to EigenLayer’s officially released roadmap, the primary focus for the ongoing Q3 revolves around the development of the Operator testnet, which is geared towards node operators. The subsequent Q4 is earmarked for the initiation of the AVS service testnet development.

When it comes to EigenDA, its first confirmed clientele is the rollup project Mantle, which is based on a fork of Optimistic Virtual Machine. Mantle is currently using a test version of EigenDA as its DA.

Tokenomics

EigenLayer confirmed that it will issue tokens, but details regarding the tokenomics and related information remain undetermined and are yet to be unveiled to the public.

Team and Funding Background

The Core Team

Renowned as an associate professor in the Department of Computer Engineering at the University of Washington, Dr. Kannan also wears the entrepreneurial hat as the driving force behind Layr Labs – the umbrella entity steering EigenLayer’s vision. With an impressive portfolio of over 20 academic papers in the blockchain sector, Dr. Kannan completed his undergraduate studies in telecommunications at the Indian Institute of Science, and later acquired a master’s degree in mathematics and a Ph.D. in information theory and wireless communication from the University of Illinois at Urbana-Champaign. After serving as a postdoctoral researcher at the University of California, Berkeley, currently, he’s currently at the helm of the University of Washington Blockchain Lab (UW-Blockchain-Lab) while nurturing the next generation of blockchain enthusiasts.

After graduating from Cornell University with a dual major in philosophy and economics, Liu boasts an impressive trajectory in data analysis, business consulting, and business strategy. He played a pivotal role as the head of strategy at Compound for nearly four years before joining EigenLayer in 2022.

A graduate with an MBA from the Stern School of Business at New York University, Chris brings with him extensive experience in cloud service product project management. Before joining EigenLayer, he held the position of Senior Vice President of Product at Domino Data Lab, a machine learning platform. He also served in various leadership roles at Amazon AWS, including General Manager and Director, where he led several cloud service projects aimed at game developers. Chris became a part of EigenLayer in early 2022.

The EigenLayer team is expanding rapidly, with a current headcount of over 30 employees, most of whom are based in Seattle, USA.

Founded in 2021 by Dr. Kannan, Layr Labs is the parent company behind EigenLayer.

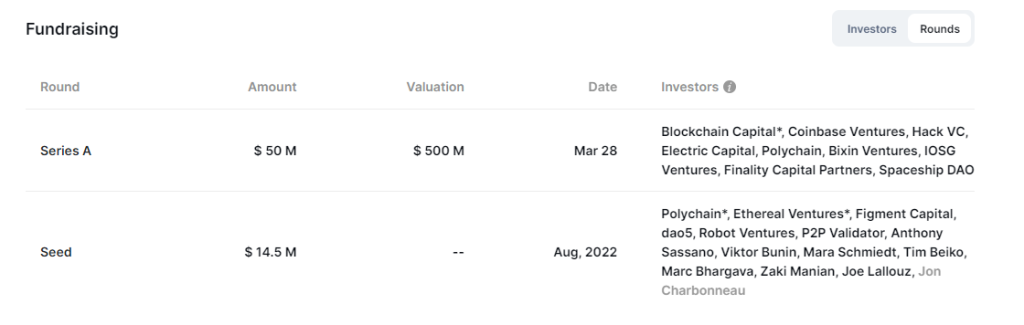

Funding Details

EigenLayer has conducted two public funding rounds to date. In 2022, they raised $14.5 million in a seed round (valuation undisclosed), followed by a Series A round in March 2023 where they secured $50 million at a valuation of $500 million.

Some of the well-known VCs are listed below:

In the same timeframe of 2023, Layr Labs also completed an equity financing round, raising close to $64.48 million. Detailed information can be found in the SEC Filing Document

Market Size, Narrative, and Challenges of the Restaking Business

The Projected Market Size of the Restaking Business

EigenLayer has introduced the innovative concept of restaking, offering “cryptoeconomic security as a Service.” Catering primarily to middleware entities such as oracles, bridges, and DA layers, EigenLayer also extends its offerings to side chains, application chains, and Rollups. The primary pain point it aims to address is to considerably minimize the security expenses for decentralized networks, obviating the need for individual projects to construct their trust networks.

Theoretically, any project that requires staked-token-gated and utilizes game theoretic principles for sustaining consensus in a decentralized network emerges as a probable client for EigenLayer’s services. It’s challenging to precisely estimate the market cap of restaking businesses, but optimistically, it might evolve into a market worth tens of billions of dollars within the next three years.

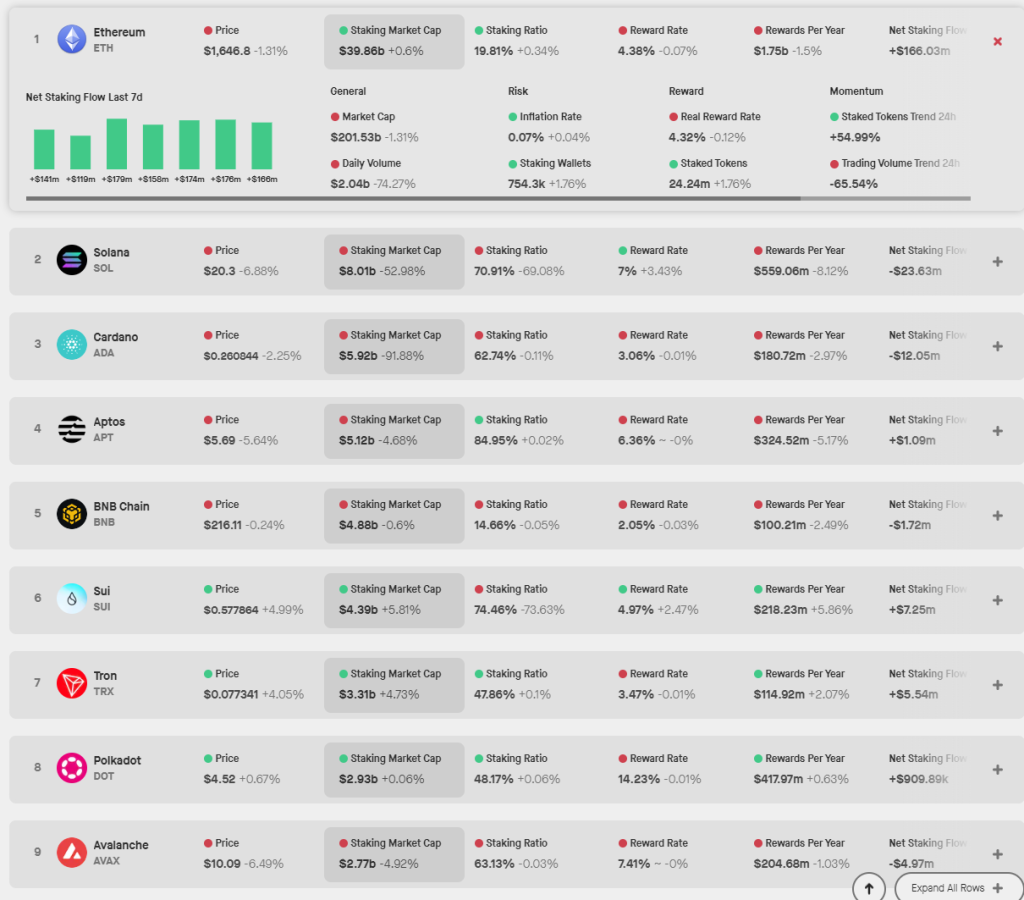

As of August 30, 2023, the total staked ETH has peaked at a remarkable $42 billion, a figure that’s juxtaposed against its circulating market cap hovering around the $200 billion mark and the total on-chain value under Ethereum is gauged between $300 billion to $400 billion. Given that EigenLayer’s primary future clients will likely be smaller and newer projects compared to Ethereum, which holds a dominant position with $40 billion in staking scale, EigenLayer’s total staking amount might range between $10 billion to $100 billion in the short term.

The Narratives Fueling EigenLayer’s Operations and Growth

Demand Side

- With the integration of the much-anticipated Cancun upgrade and the open-source of the OP Stack, smaller Rollups and application chains are rapidly developing, increasing the overall demand for cost-effective AVS.

- The modularization trend in public chains, Rollups, and application chains has triggered a need for affordable DA layers that operate outside the Ethereum ecosystem. The strategic growth of EigenDA thus becomes instrumental in fueling the demand for EigenLayer, showcasing a synergistic effect where the growth of one bolsters the expansion of the other.

Supply Side

- Ethereum’s increasing staking ratio and the expansion in the community of stakers have brought forth an opulence of LSD assets along with an extensive user base. These stakers, are perpetually in pursuit of avenues to optimize the capital efficiency and yield of their LSD holdings. In the future, EigenLayer also hopes to broaden its LSD offering beyond just ETH.

Issues and Challenges

- For AVS demanders, one lingering ambiguity is the real-world savings they can achieve by sourcing collateral assets, coupled with the specialized validation node services offered by EigenLayer. The assumption that leveraging ETH LSDs as collateral naturally translates into acquiring Ethereum’s massive security infrastructure, valued at tens of billions, doesn’t hold up to scrutiny. In essence, a project’s economic security is determined by the cumulative magnitude of ETH LSDs and the proficiency of the validation node’s operations. While EigenLayer offers a potentially expedited solution than building an AVS from scratch, the tangible savings concerning cost might fall short of expectations.

- Introducing external assets as collateral for AVS might diminish the utility of a project’s native tokens. While EigenLayer offers a hybrid staking mechanism that integrates both its proprietary tokens and EigenLayer Restaking, this approach may still encounter notable hesitancy in its adoption.

- Projects might have an over-dependence on EigenLayer for constructing their AVS, leading to a passive long-term development strategy and potential “bottlenecks” in the future. As these projects burgeon and evolve, a strategic shift towards leveraging their tokens as the prime security collateral seems likely.

- When projects use LSDs as security collateral, they also need to consider the inherent credit and safety risks associated with the LSD platform, adding another layer of risk.

The Competitive Landscape

“Restaking” is a relatively new concept, pioneered by EigenLayer. Currently, the market landscape is relatively sparse when it comes to competitors imitating this model. However, the main challenge is for prospective clients to make the strategic decision of whether to invest in building a proprietary security network from the ground up or to delegate this intricate task to EigenLayer. EigenLayer still needs a robust portfolio of client implementations to demonstrate the superiority and efficiency of its solution.

Valuation Derivation

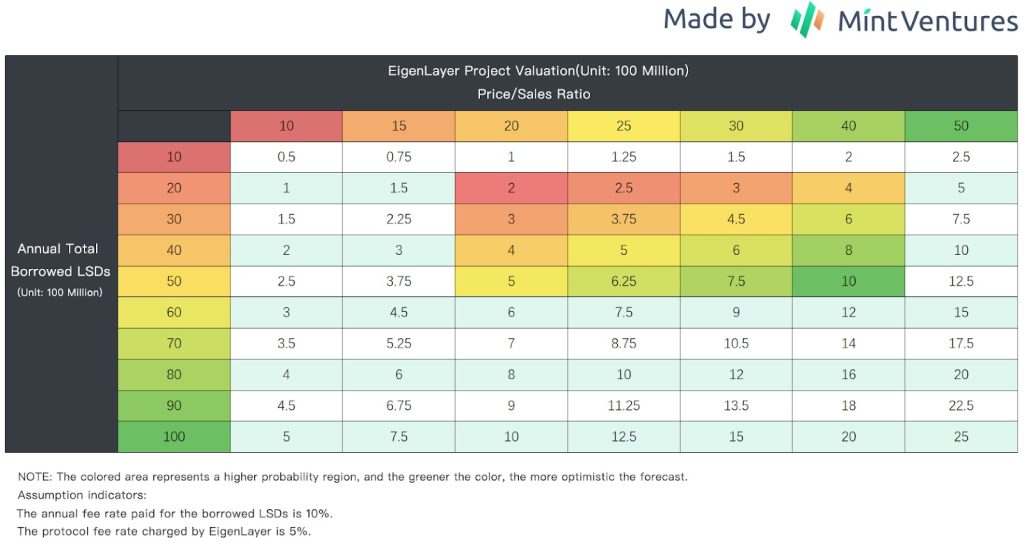

EigenLayer, as a novel business project, lacks clear benchmark projects and valuation metrics. Consequently, our approach hinges on extrapolating its valuation via forecasted annual protocol revenue and the Price-to-Sales (PS) ratio.

Before delving into the formal estimation, we need to make a few assumptions:

- EigenLayer’s primary business model revolves around collecting a commission of security fees from AVS service clients. Out of the service fee, 90% goes to LSD depositors, 5% to node operators, and EigenLayer retains a 5% commission, a metric aligned with the standards of Lido.

- AVS service clients pay an average annual security fee equivalent to 10% of the total borrowed LSDs.

The rationale behind this 10% threshold is grounded in prevailing market dynamics. Contemporary mainstream PoS projects bestow annual rewards ranging between 3-8% for PoS stakers. Given the nascent phase of most EigenLayer clients, they’re incentivized at a marginally higher rate. Consequently, our chosen metric of 10% aptly reflects the average security fee ratio.

Based on the above assumptions, and considering the volume of borrowed LSDs channeled by EigenLayer with the respective PS, we can delineate specific valuation spectrums. The colored segments represent the valuation ranges we believe are more probable, with greener shades indicating more optimistic forecasts.

I would characterize the overlap of “annual borrowed LSDs with a volume of $2-5 billion and P/S at 20-40x” as a high probability valuation range. The reason is as follows:

- At present, the aggregate PoS staking token market capitalization of the top ten public chains touches the $73 billion mark. When we factor in projects like Aptos and Sui, this figure surges to nearly $82 billion. However, a significant portion of the staking for the two projects derives from unreleased tokens held by core teams and institutions. Exercising prudence, we’ve opted to sideline these potential anomalies. Out of caution, I’ve excluded Sui and Aptos. I’ve assumed, albeit a bit arbitrarily, that EigenLayer’s share of LSDs could account for 2.5%-6.5% of the total PoS staking market, corresponding to a market cap of $20-50 billion. The viability of this market share figure is open to interpretation and subjective to individual perspectives.

- The PS interval of 20x-40x is deeply influenced by Lido’s extant 25x PS, a figure rooted in data as of August 30, 2023, and extrapolated from the fully diluted market cap. It’s noteworthy that emerging narratives, particularly in their inception stages, often warrant a premium valuation.

Based on the above calculations, a valuation range of $2-10 billion might be reasonable for EigenLayer. For primary investors participating in the project at a midpoint valuation of $5 billion, and taking into account potential constraints linked to token vesting, there might not be much of a safety margin left. If market whispers hold weight, and there exist players eager to buy EigenLayer tokens over the counter at a $20 billion valuation, they should proceed with utmost caution.

While we’ve explored EigenLayer’s potential valuation trajectory, it’s vital to differentiate between the overall project valuation and the intrinsic value of its native token. A spectrum of factors will affect the ability of value capture within the business ecosystem. For example:

- What percentage of the protocol’s revenue will be distributed to token holders?

- Beyond just buybacks or dividends, does the token have a robust utility in the business to increase its adoption?

- Will EigenDA and EigenLayer utilize the same token, providing more scenarios and demand for the token?

If EigenLayer fails to adequately address the first two considerations, the inherent worth of its token may be compromised. Conversely, unforeseen developments related to the third point could bolster the token’s value.

Moreover, as EigenLayer makes its market debut, its valuation will inevitably be swayed by the overarching bullish or bearish sentiments prevalent in the crypto landscape.

The ultimate appraisal? Only the market will tell.