At the end of July, the leading figure in decentralized stablecoins, Liquity, announced that its V2 would introduce “Delta Neutral Stablecoins”. Similarly, the newly-funded Ethena Finance aims to hedge its reserve assets through risk mitigation strategies, thereby achieving high capital efficiency in a truly decentralized framework. In this article, we will delve deeply into these stablecoin protocols that attempt to solve the stablecoin trilemma.

Contents

The Stablecoin Trilemma

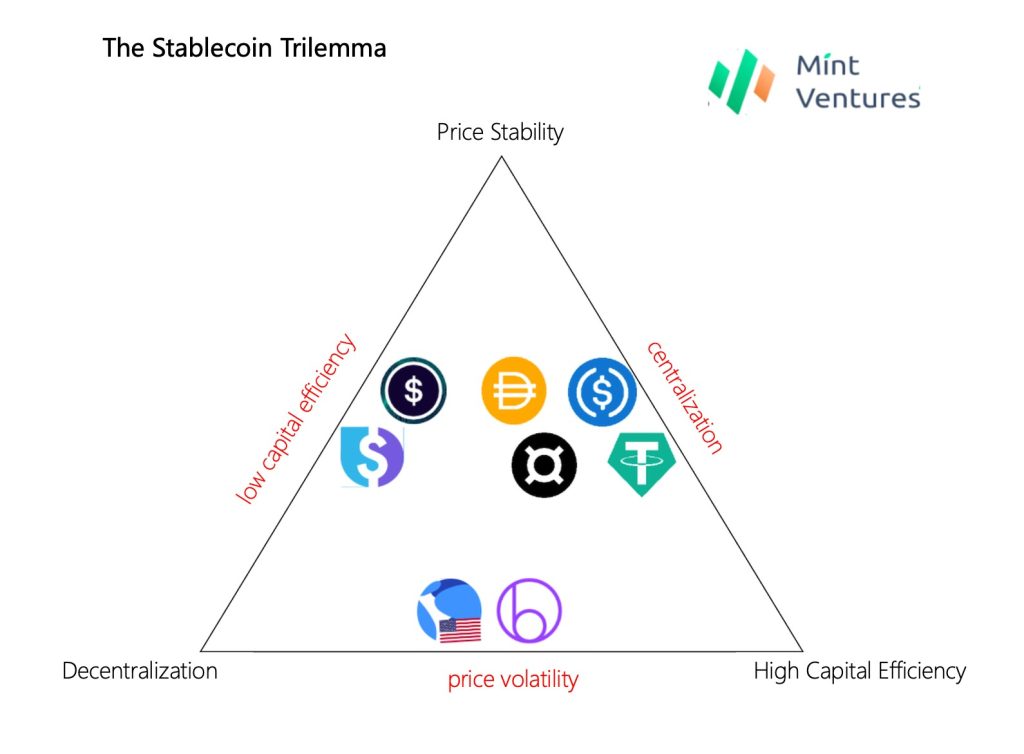

In the realm of crypto stablecoins, there exists a trilemma: the incompatibility among price stability, decentralization, and capital efficiency.

Established centralized stablecoins, such as USDT and USDC, have carved a niche by delivering unparalleled price stability within the blockchain framework, boasting up to 100% capital efficiency. However, they come with the inherent risk of centralization. This was demonstrated when BUSD had to halt new business due to regulatory constraints and the ripple effect the March SVB incident imparted on USDC’s operations.

The algorithmic stablecoin craze that began in the latter half of 2020 tried to achieve under-collateralization on a decentralized basis. High-profile projects of this wave, such as Empty Set Dollar and Basis Cash, met with a swift downfall. Subsequently, Luna used the credit of an entire blockchain as implicit collateral. It didn’t require over-collateralization for users minting UST and managed to merge decentralization, capital efficiency, and price stability for a considerable time (from 2020 to May 2022). Regrettably, even this formidable player wasn’t immune to market forces and succumbed to a credit collapse, spiraling into decline. Emerging initiatives like Beanstalk ventured into the realm of under-collateralized tokens, but they failed to capture significant market traction. The difficulty in maintaining price stability has been the Achilles’ heel of these tokens.

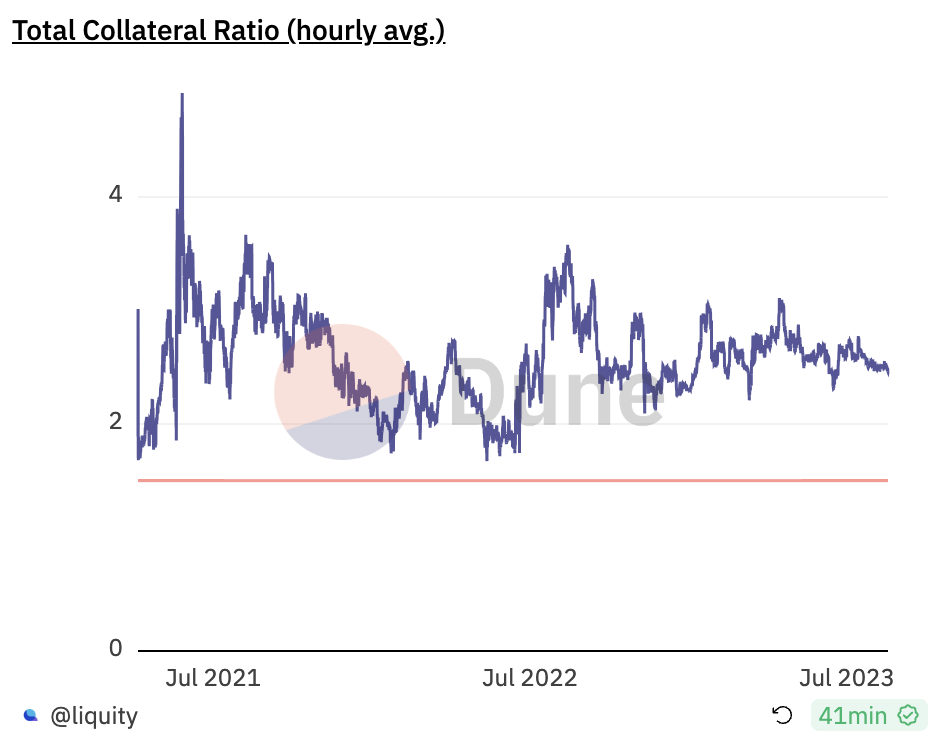

Another path originated with MakerDAO, which hoped to achieve price stability through the over-collateralization of decentralized assets at the sacrifice of capital efficiency. Currently, LUSD, created by Liquity, is the largest-scale stablecoin fully backed by decentralized assets. Yet, in its quest for LUSD’s price stability, Liquity grapples with palpable capital inefficiency. The system’s collateral ratio consistently hovers above 250%, meaning every circulating LUSD requires $ETH worth over $2.5 as the collateral. Synthetix’s sUSD amplifies this dilemma due to the higher volatility of its collateral, SNX, leading to a usual minimum collateralization ratio exceeding 500%. Low capital efficiency inherently caps the potential growth scale and, invariably, diminishes its attraction for users. Liquity’s planned V2 primarily aims to address the low capital efficiency of V1, and Synthetix also plans to diversify its collateral portfolio in its V3 to reduce the minimum collateralization requirement.

Rewinding the clock to 2020 and earlier, DAI also struggled with low capital efficiency. Moreover, due to the smaller market capitalization of the entire crypto market at the time and the substantial volatility of DAI’s collateral, ETH, DAI’s price was quite unstable. To address this issue, MakerDAO introduced the PSM (Peg Stability Module) in 2020, paving the way for centralized stablecoins like USDC to mint DAI. This move represented a compromise in DAI’s balance among decentralization, capital efficiency, and price stability, partially sacrificing decentralization. This strategy endowed DAI with a more stable price and higher capital efficiency, enabling it to grow rapidly alongside the overall development of DeFi. Launched at the end of 2020, FRAX similarly uses centralized stablecoins as its primary collateral. Currently, DAI and FRAX are the top two decentralized stablecoins in circulation, a fact that undoubtedly validates their strategies. They provide users with stablecoins that more closely meet their needs but also indirectly highlight the constraints that maintaining decentralization places on stablecoin scalability.

However, a distinct breed of stablecoins is emerging, driven by the ambition to meld high capital efficiency with robust price stability while maintaining the principles of decentralization. The key attributes they endeavor to provide users are:

- The capacity to mint stablecoins from decentralized assets, such as ETH, ensures freedom from censorship risks.

- A one-to-one generation mechanism with the U.S. dollar, sidestepping the cumbersome over-collateralization hurdles, thereby bolstering scalability.

- A relentless commitment to maintain price stability

Conceptually, this offers an almost utopian vision of what a decentralized stablecoin should embody. We adopt Liquity V2’s terminology for such protocols—Decentralized Reserve Protocols—as the designation for this type of stablecoin. It’s important to note that these differentiate these from traditional over-collateralized stablecoins. In the realm of Decentralized Reserve Protocols, once users deposit their assets to mint stablecoins, the protocol assumes ownership of these assets. Consequently, from a user’s perspective, it mirrors an $ETH-to-stablecoin swap transaction. This mechanism bears a striking resemblance to the workings of centralized stablecoins, such as USDT. Here, an asset worth $1 can seamlessly be traded for a stablecoin valued equivalently, and the reverse holds true. The distinguishing facet of Decentralized Reserve Protocols is their readiness to embrace crypto assets.

Some might argue that since the collateral no longer belongs to the user, such stablecoins miss out on offering a leverage component, which, to them, is an inherent advantage of certain stablecoin models. However, I believe that as they function in our daily transactions, they don’t necessarily offer or require a leverage facet. Notably, centralized stablecoins like USDT and USDC don’t embed this leverage feature. At the crux of any currency—be it fiat or crypto—are three foundational pillars: a medium for settlement, a unit for accounting, and a store of value. Leverage is merely a specific feature of CDP (Collateralized Debt Position) type stablecoins, not a general use case for stablecoins.

The reason why previous stablecoin protocols faltered in delivering this idealized stablecoin model. The primary culprit is the inherent volatility associated with decentralized assets. Faced with these erratic price fluctuations, how can protocols ensure the redemption of the stablecoins they issue while maintaining a 100% collateralization ratio?

When viewed from the perspective of a stablecoin protocol’s balance sheet, the collateral deposited by users is the asset, while the stablecoins issued by the protocol are liabilities. The critical question is: how can it be ensured that assets will always cover the liabilities?

Imagine a situation where a user deposits 1 ETH (valued at 2,000 USD) into the protocol. In return, they receive 2,000 stablecoins. Now, the unpredictable nature of the crypto market comes into play, and the value of ETH plummets to 1,000 USD. Here lies the dilemma: How can the protocol guarantee the redemption of the 2,000 stablecoins for assets equivalent to 2,000 USD?

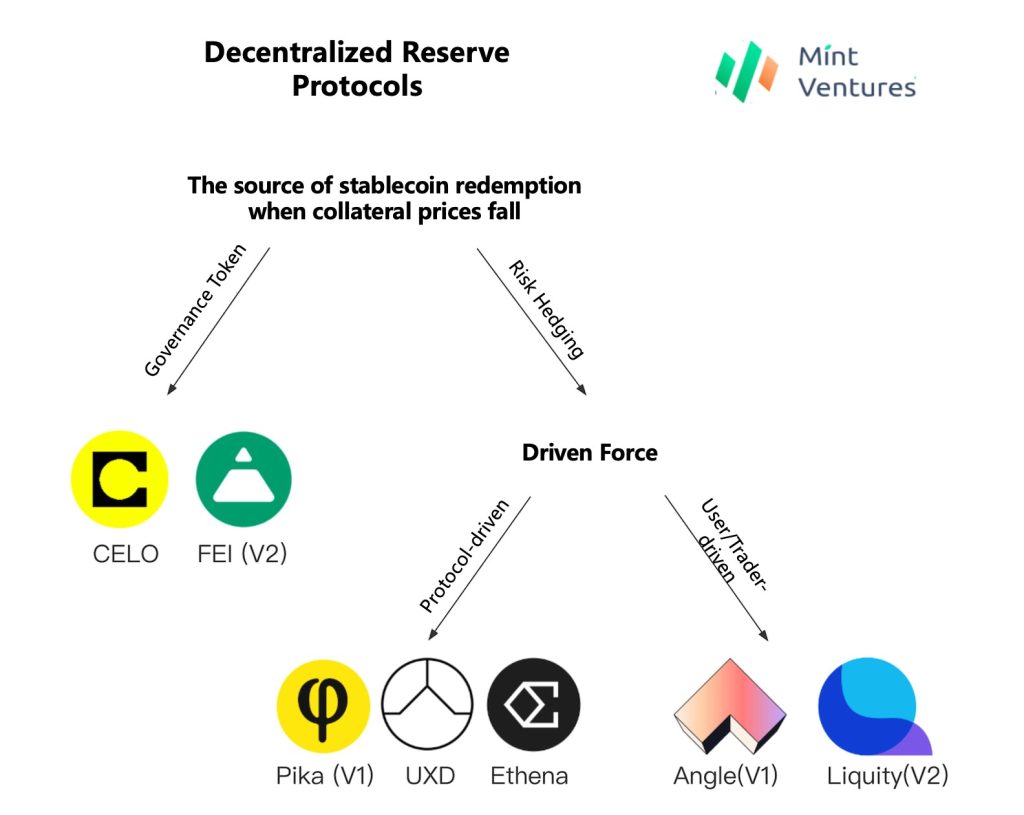

Historically, decentralized reserve protocols have crafted two primary strategies to address this challenge: utilizing governance tokens as reserves and risk hedging with reserve assets. Based on the method of risk hedging, there are further subdivisions: protocol-driven hedging and user-driven hedging. Let’s delve into each of these approaches.

Decentralized Reserve Protocols: Governance Tokens as Reserves

The first category of protocols operates on the premise of using the protocol’s governance tokens as supplementary collateral. When the price of the collateralized assets experiences a sharp decline, the protocol issues additional governance tokens to redeem the stablecoins held by users. This can be referred to as a Decentralized Reserve Protocol with governance tokens serving as reserves. To break this down with our previous example: when $ETH drops from $2,000 to $1,000, these specialized reserve protocols would intervene, supplementing the deficit by minting governance tokens. In essence, if a user seeks to redeem their 2,000 stablecoins, they would receive assets comprising 1,000 USD in ETH and an equivalent value, of 1,000 USD, in the protocol’s governance tokens.

Among the projects employing this methodology are the Celo and Fei Protocol.

Celo

Since its launch in 2020, Celo has been a noteworthy presence in the stablecoin space. Originally operating as an independent Layer1 blockchain, it undertook a pivotal change in strategy. In a proposal initiated by its core team and passed this July, Celo began its transition to the Ethereum ecosystem, leveraging the capabilities of the OP stack. Here’s a deep dive into how Celo’s stablecoin mechanics function:

Celo’s stablecoin is backed by a reserve pool consisting of a diversified set of underlying assets. The reserve ratio (the value of reserve assets divided by the circulating market cap of stablecoins) consistently stays well above 1, providing fundamental support for the intrinsic value of its stablecoin.

The process of minting Celo’s stablecoins doesn’t involve over-collateralization. Instead, they are minted by sending $Celo to the official stability module, Mento. Here’s how it works: Users send 1 USD worth of CELO to the Mento and receive 1 USD worth of stablecoins like $cUSD. The process works seamlessly in reverse as well, allowing users to exchange $cUSD for an equivalent amount in $CELO. Under this mechanism, if the market price of cUSD falls below $1, opportunistic traders will buy $cUSD at this discounted rate to exchange for $CELO each valued at one dollar. Similarly, when the price of $cUSD exceeds 1 USD, traders will opt to mint $cUSD by sending $CELO and then sell it, capturing the profit. This continuous arbitrage mechanism acts as a self-correcting tool, ensuring that the market price of $cUSD rarely strays far from its intended peg.

Celo has meticulously put into place a triad of mechanisms to ensure the continued solvency of its reserve pool: 1. If the reserve ratio slips below a predetermined threshold, newly minted $CELO from block rewards is funneled into the reserve pool to ensure the reserve remains adequately funded. 2. Though presently inactivated, a transaction fee could be levied to supplement the pool. 3. The Mento module charges a stability fee, acting as yet another tool to help the reserve pool maintain its financial health.

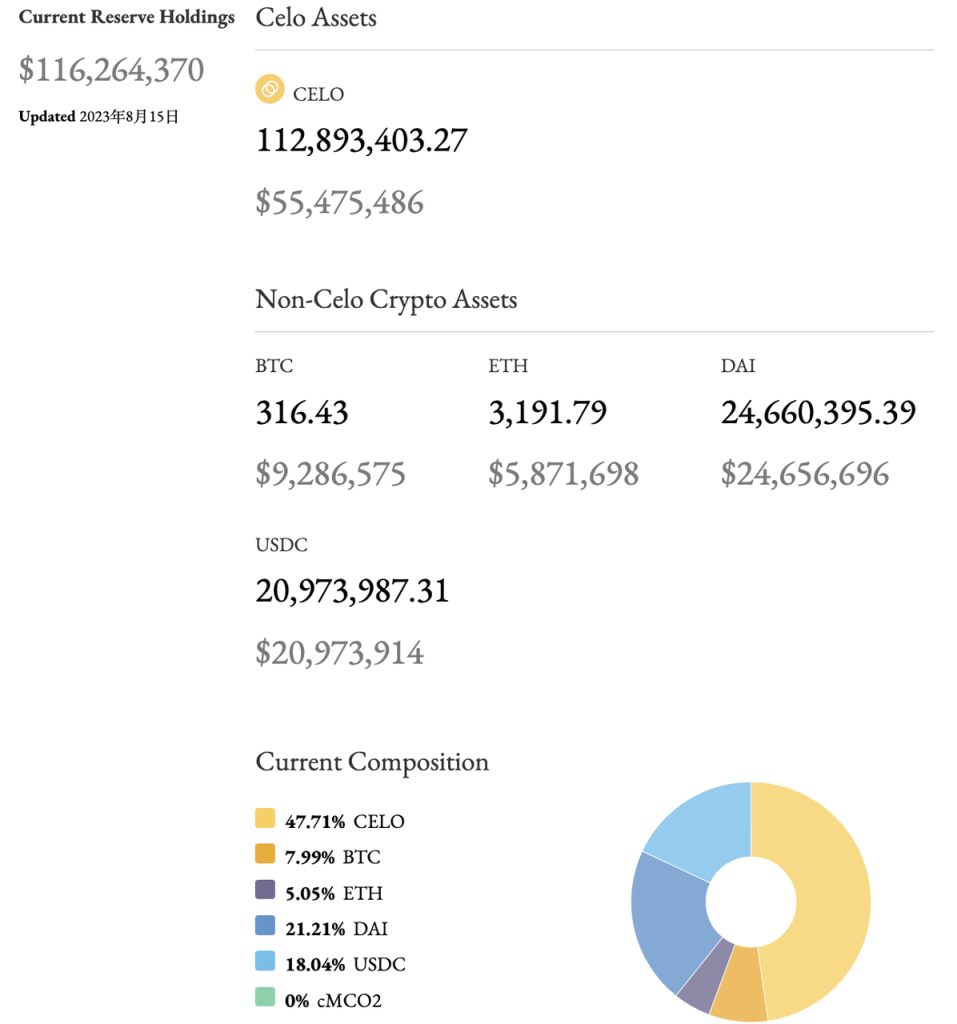

To enhance the security of the reserve funds, Celo’s asset portfolio is diversified. As of now, the pool incorporates $CELO, $BTC, $ETH, $DAI, and an environmentally-conscious choice, the carbon credit token $cMCO2. Such diversification stands in stark contrast to projects like Terra, where the native token $LUNA singularly shoulders the responsibility as the primary collateral for its stablecoin.

Source: Mint Ventures

It’s evident that Celo shares similarities with Luna, operating as a stablecoin-centric Layer1 blockchain. Its minting and redemption mechanisms are also closely aligned with Luna’s $UST. The main distinction lies in its approach during potential under-collateralization scenarios: Celo primarily utilizes block-produced $CELO as protocol collateral to ensure the redemption of its stablecoin $cUSD.

With a total reserve holding of $116 million against a $46 million market cap in circulating stablecoins, Celo boasts a substantial over-collateralization ratio of 254%. Despite the system’s over-collateralized state, users can effortlessly swap $CELO valued at $1 into one $cUSD stablecoin, demonstrating the excellent capital efficiency of Celo. However, it’s worth noting that half of its collateral originates from the centralized stablecoin $USDC and the semi-decentralized $DAI, which means Celo cannot be considered a fully decentralized stablecoin.

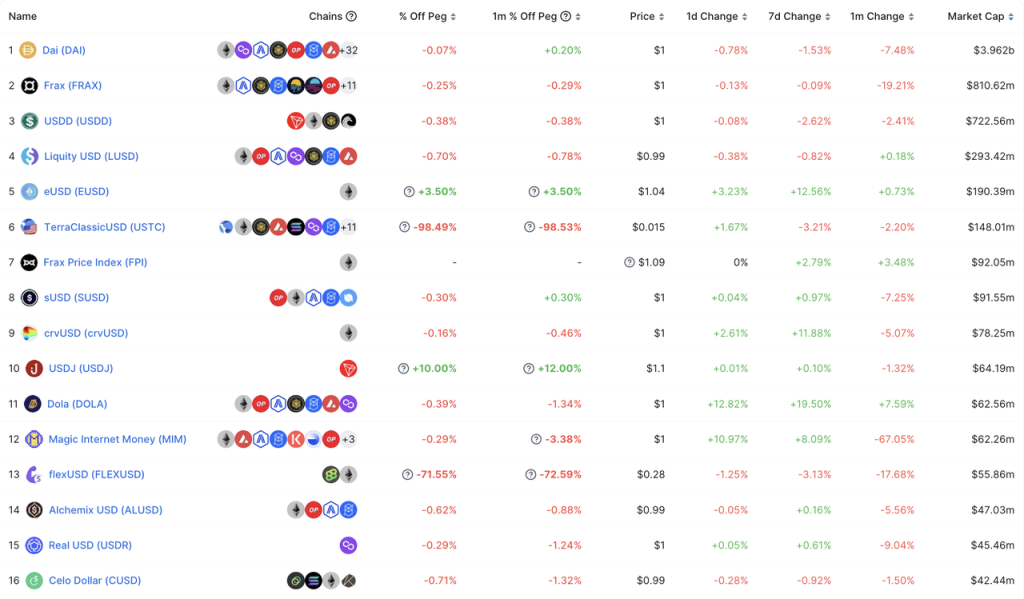

At present, Celo’s stablecoin ranks 16th among decentralized stablecoins in terms of market cap. However, if we set aside UST and flexUSD (owing to their depegging), $CELO ascends to the 14th position.

Fei

In early 2021, Fei Protocol, which attracted significant market attention due to its trendy algorithmic stablecoin concept at the time, raised $19 million from VCs like A16Z and Coinbase. At its initial launch phase at the end of 2021 March, it drew in 639,000 $ETH for the minting of its stablecoin, $FEI, pumping the circulating volume to a massive 1.3 billion $FEI. In a short span, the market cap of $FEI sprinted, positioning itself as the second largest decentralized stablecoin, with $DAI leading at a $3 billion market cap.

However, the demand for FEI was overly satisfied during the genesis phase, driven primarily by the allure of Fei Protocol’s governance token, $TRIBE. The resultant $FEI oversupply, combined with its nascent stage and lack of robust use cases, resulted in its price remaining below $1 for an extended period. This situation was soon followed by market volatility in May, where panic due to plummeting prices led users to redeem their $FEI, leaving the protocol struggling ever since its launch.

To get back on track, Fei Protocol unveiled its V2 version at the end of 2021. The refreshed blueprint brought nuanced changes, such as a refined price stability mechanism. This revamped model allowed users to mint $FEI by depositing collaterals like $ETH, $DAI, and $LUSD, maintaining a 100% collateralization ratio. Post-minting, these assets merged into the Protocol Controlled Value (PCV). When the collateralization ratio(PCV/total circulating $FEI) is above 100%, indicating healthy appreciation of protocol assets and stress-free $FEI redemption, the protocol mints some $FEI to purchase $TRIBE, thereby reducing the collateralization ratio. Conversely, when the ratio falls below 100%, signaling potential default on $FEI redemption, the protocol mints $TRIBE to buy $FEI, thereby increasing the collateralization ratio.

Under this mechanism, the governance token $TRIBE acts as a reserve for potential risks, also reaping additional rewards during system growth (a mechanism somewhat similar to the Float Protocol, which launched alongside Fei V1). Regrettably, the launch of Fei V2 coincided with the peak of the bull market. Subsequently, the price of ETH began to fall, and FEI Protocol unfortunately suffered a hack in April 2022, losing 80 million $FEI. Ultimately, the decision was made to cease protocol development in August 2022.

Decentralized reserve protocols, which utilize governance tokens as reserves, essentially dilute the stake of all governance token holders to ensure stablecoin redemption. During a bull market, as the market cap increases, the value of governance token tends to rise as well, easily creating a flywheel effect. However, in a bear market, as the value of the collateral assets decreases, the market cap of the governance token also falls. Excessive minting can then exacerbate the price drop, leading to a “death spiral” of the governance token. If the governance token’s market cap falls below that of total circulating stablecoins, doubt about the protocol’s capacity to redeem the stablecoin among holders will increase, accelerating the exodus and causing a systemic collapse. The survival game, particularly during bear markets, becomes pivotal for these stablecoins. Celo’s successful survival amid the bear market is closely tied to its over-collateralization strategy. During the previous market high, Celo allocated a relatively larger portion of its reserves to assets like $USDC, $DAI, $BTC, and $ETH, enabling the protocol to remain secure even as the price of $CELO fell from $10 to $0.5.

Decentralized Reserve Protocols: Embracing Risk Hedging for Stability

This type of protocol is also called “risk-neutral stablecoin protocol, which involves risk hedging for reserve assets(usually in the form of cryptocurrency) of the protocol. When the price of the collateral assets plummets drastically, the hedging generates profits, ensuring that the stablecoin protocol’s assets can always repay its liabilities. We refer to this type of protocol as decentralized reserve protocols with reserve assets risk hedging, or risk-neutral stablecoin protocols. If you were to deposit 1 $ETH valued at $2000 into one of these protocols, it would, in anticipation of potential market volatility, hedge this asset, possibly by initiating a short position on a crypto exchange. When $ETH drops from $2000 to $1000, the profit ($1000) generated by hedging can compensate for the dip in value, ensuring that the protocol can still redeem 2000 stablecoins to the user.

Specifically, depending on the actual hedger, these are further divided into decentralized reserve protocols where the protocol itself hedges the risk, and decentralized reserve protocols where the users hedge the risk.

Decentralized Reserve Protocols with Protocol-Driven Risk Hedging

Stablecoin protocols adopting this approach include Pika Protocol V1, UXD Protocol, and Ethena, which recently announced its financing.

Pika V1

Pika Protocol is a derivatives protocol deployed on the Optimism network, but in its initial V1 version, Pika had planned to launch a stablecoin, with hedging achieved through Bitmex’s Inverse Perpetual. An original creation of Bitmex, Inverse Perpetuals stands apart from the typical linear perpetual saturating the market. Unlike the popular “linear perpetual”, which employs USD as a foundation for tracking crypto values, inverse perpetual has a distinct architecture – they harness the token itself as a margin to trace its USD equivalent price. Here’s an example to illustrate the earnings from inverse perpetual:

A trader goes long 50,000 contracts of XBTUSD at a price of 10,000. A few days later the price of the contract increased to 11,000.

The trader’s profit will be: 50,000 * 1 * (1/10,000 – 1/11,000) = 0.4545 XBT

If the price had in fact dropped to 9,000, the trader’s loss would have been: 50,000 * 1 * (1/10,000 – 1/9,000) = -0.5556 XBT. The loss is greater because of the inverse and non-linear nature of the contract. Conversely, if the trader was short then the trader’s profit would be greater if the price moved down than the loss if it moved up.

Source:https://www.bitmex.com/app/inversePerpetualsGuide

Upon closer analysis, it’s evident that inverse perpetual is a perfect match for Decentralized Reserve Protocols aimed at hedging risks for reserve assets. Taking our previous example, let’s assume that when ETH is priced at $2000, Pika Protocol, on receiving 1 ETH from a user, strategically deploys it as collateral, shorting 2000 units of $ETH inverse perpetual on Bitmex. Should the market act up and ETH value slide to 1000 USD, then Pika Protocol’s profit is: 2000 * 1 * (1/1000 – 1/2000) = 1 ETH = $1000

This means when the $ETH price falls from $2000 to $1000, Pika Protocol’s reserves change from 1 $ETH to 2 $ETH, still effectively covering the redemption of 2000 stablecoins held by users (transaction fees and funding fees are not considered here). Pika Protocol V1’s product design is entirely in line with the $NUSD product design mentioned by Bitmex founder Arthur Hayes in his blog post, able to perpetually and perfectly hedge long positions in coin margin.

Regrettably, characterized by their counterintuitive and non-linear return properties (the relationship between token price and contract price is not linear), the inverse perpetual are not easily understood by the average investors who get used to USD-Margined features. Fast forward to the present, it’s clear that inverse perpetual, or coin-margined perpetual contracts, have struggled to find their footing in a market dominated by their more accessible counterparts – the linear perpetual, otherwise known as USD-margined perpetual contracts. A snapshot of major exchanges reveals a stark contrast: Inverse Perpetuals account for a mere 20-25% of the trading volume when stacked against Linear Perpetuals. Affected by regulations, BitMex has gradually receded from being a top-tier perpetual exchange to one with less than 0.5% of the current perpetual market share. Recognizing the limitations of linear perpetual contracts for their hedging strategies and the dwindling market appetite for inverse perpetual, Pika embarked on a strategic pivot. In its V2 version, Pika abandoned the stablecoin business and officially shifted to a derivatives protocol.

UXD

UXD Protocol operates on the Solana network and was launched in January 2022. In 2021, UXD finished $3 million in funding led by Multicoin and raised $57 million during its IDO. In January 2023, UXD decided to expand its operations to the Ethereum ecosystem, launching on Arbitrum in April, with plans to debut on Optimism in the near future.

Upon its initial launch, UXD Protocol allowed users to deposit $SOL, $BTC, and $ETH to mint its stablecoin, UXD, on a 1:1 value basis pegged to the USD. To maintain the integrity and redemption of UXD, the deposited collaterals were hedged using short positions through Solana’s renowned lending and perpetual platform, Mango Markets. The funding fees collected from the short positions would serve as protocol revenue, while funds raised by the protocol would cover any payable funding fee costs. For an extended period post-launch, the UXD Protocol functioned smoothly. The protocol even had to impose a cap on UXD issuance due to Mango Markets’ overall open interest being under the $100 million mark. A surge in UXD’s short positions, especially if they escalated into the tens of millions, could pose tangible redemption threats. Additionally, an excess of short positions could tilt the funding rate towards becoming negative, subsequently elevating hedging costs.

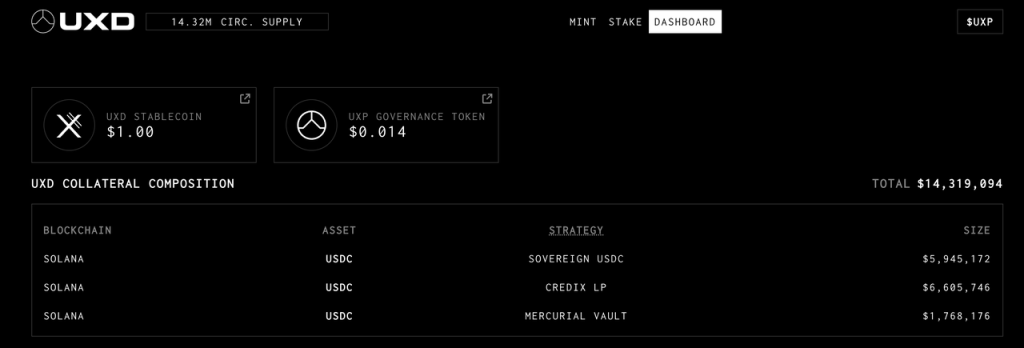

Unfortunately, in October 2022, Mango Markets suffered from a governance attack, leading to a nearly $20 million loss for UXD Protocol. At the time, UXD’s insurance fund had a balance of over $55 million, allowing for normal redemptions for UXD. Although Mango Markets later returned the funds to UXD Protocol, the damage was done, and Mango Markets struggled to recover. The situation was exacerbated by the FTX crisis, leading to a rapid capital outflow from Solana. As a result, UXD couldn’t find suitable exchanges to hedge their long positions. The protocol limited its collateral support to just $USDC, a stablecoin that inherently did not necessitate hedging. They channeled deposited $USDC collateral into various on-chain $USDC vaults and Real-World Assets (RWA). Recognizing the need to diversify and mitigate risks, they made the strategic decision to foray into the Ethereum ecosystem. Following a successful launch on Arbitrum in April, they have plans to deploy on Optimism. Amidst this expansion, UXD remains on the hunt for optimal on-chain hedging platforms to fortify its operations.

Currently, UXD has a circulating supply of $14.3 million, with a protocol insurance fund balance of $53.2 million.

Ethena Finance, a stablecoin protocol that recently announced $6 million in funding led by Dragonfly, with investments from centralized exchanges such as Bybit, OKX, Deribit, Gemini, and Huobi, also employs hedging strategies to hedge its reserve assets. Given the backing from numerous second-tier derivative exchanges, this will likely benefit their collateral hedging efforts. Furthermore, Ethena has set its sights on collaborating with Synthetix, a renowned decentralized derivatives protocol. This partnership aims to initiate short positions utilizing Synthetix as a liquidity provider. Moreover, it will diversify the utility of its stablecoin, USDe, by enabling it to serve as collateral within select pools.

The merits of such decentralized reserve protocols with risk-hedging strategies are evident. By hedging the crypto assets that serve as collateral, the protocol can achieve a risk-neutral position, ensuring stablecoin redemptions. This approach melds the promise of 100% capital efficiency with the trustless nature of decentralization—a match largely dependent on the quality of hedging venues. Furthermore, if the protocol can hedge its position with high capital efficiency, the reserved collateral can be channeled into multiple avenues to yield returns. Additionally, funding fees can serve as protocol revenue. This flexibility allows for multiple possibilities: the generated returns could be distributed to stablecoin holders, creating an interest-bearing stablecoin and enhancing its utility. Alternatively, the profits could also be distributed to governance token holders.

The governance tokens within a stablecoin protocol inherently act as the ultimate lender for their associated stablecoin. In situations where reserve asset risks are hedged, these stablecoin protocols can leverage their governance tokens as a redemption mechanism during extreme circumstances. For stablecoin holders, this dynamic offers an extra protective layer when compared to stablecoins solely backed by governance tokens. Conceptually, the act of hedging reserve assets is streamlined. The underlying principle is that it should remain resilient across market cycles. Consequently, this mitigates the need to verify the robustness of the governance token during downtrends.

But as with all innovations, there are hurdles on the horizon. Here’s a breakdown:

- The Centralization Paradox: The current financial landscape sees centralized exchanges reigning supreme in perpetual contract liquidity. Furthermore, most decentralized derivatives exchanges are not designed for stablecoin protocols to do hedging, leading to an inevitable centralization risk. This risk poses a twofold problem:

- Centralized exchanges, by their very nature, come with inherent risks.

- With limited hedging venues, any single venue becomes crucial to a protocol’s health. A hiccup in one venue can have a substantial impact on the protocol. The UXD Protocol’s halt in operations due to the attack on Mango Markets is an extreme example of such centralization risks.

- Limitations in Choosing Hedging Tools. The current mainstream linear perpetual contracts cannot perfectly hedge their long positions. Taking $ETH as an example, a stablecoin protocol would ideally seek a hedge using ETH-denominated short positions with ETH as collateral. However, prominent linear perpetual contracts lean on $USDT as collateral, mapping their profit curves to USD, which cannot perfectly hedge against the $ETH position. Even if the stablecoin protocol tries to borrow against $ETH for $USDT, it increases operational costs and complexities in position risk management, while also reducing capital efficiency. Pika Protocol’s experience underscores how inverse perpetual contracts might be the holy grail for these protocols. Sadly, their market footprint remains undersized.

- Scale Growth Has Inherent Limitations. With the growth of a protocol’s stablecoin market cap, comes an amplified demand for perpetual contract short positions for hedging purposes. Beyond the complexities of obtaining a sufficient number of short positions, the more short positions the protocol holds, the higher the liquidity requirement from the counterparty when closing positions. This can lead to potentially negative funding rates, implying potentially higher hedging costs and operational complexities. For a stablecoin with a scale of tens of millions of dollars, this might not pose significant challenges. However, if one aims to scale further, reaching hundreds of millions or even billions, this issue can significantly cap its growth potential.

- Operational Risks. Regardless of the hedging mechanism employed, there’s inevitably a high frequency of opening positions, adjusting portfolios, and managing collateral. These processes require manual intervention, leading to significant operational and even moral risks.

Decentralized Reserve Stablecoin Protocols with User-Driven Risk Hedging

Protocols that have adopted this approach include Angle Protocol V1 and Liquity V2.

Angle V1

Angle Protocol was launched on the Ethereum network in November 2021. Before its launch, they closed a $5 million financing round led by a16z.

While the details of the Angle Protocol V1 are extensively discussed in a report by Mint Ventures, here we provide a brief overview:

Like other decentralized reserve stablecoin protocols, under ideal conditions, Angle allows users to mint its stablecoin, agUSD, by depositing 1$ worth of collateral in the form of $ETH. What differentiates Angle is its target audience. Beyond the archetypal stablecoin users, Angle Protocol has a dedicated offering for perpetual contract traders. Within the ecosystem of Angle, these traders are distinctly termed as the Hedging Agency (HA).

Note: Angle’s first stablecoin was pegged to the Euro, termed agEUR, the logic remains the same. For the sake of consistency in this context, we’ll use the USD-pegged stablecoin as an example.

Using the same example, suppose ETH is currently valued at $2000. A user deposits 1 $ETH to Angle, consequently minting 2000 USD-pegged stablecoins. Concurrently, Angle sanctions a leveraged position equivalent to 1 $ETH for the benefit of traders. Under the assumption that the Hedging Agency (HA) utilizes 0.2 $ETH (worth $400) as collateral, and opens a position with 5x leverage, the protocol’s total collateral amounts to 1.2 $ETH. In monetary terms, this is a sum of $2400 stacked against a liability of $2000 in stablecoins.

When the price of $ETH rises to $2200, the protocol only needs to retain enough $ETH to back the $2000 stablecoins, which is approximately 0.909 $ETH. The remaining 0.291 $ETH (valued at $640) can be withdrawn by the HA.

Conversely, if $ETH drops to $1800, the protocol still has to maintain enough $ETH to back the $2000 stablecoins, which would be around 1.111 $ETH. The HA’s collateral position would then reduce to about 0.089 $ETH (worth $160).

For traders maneuvering within the Angle Protocol, their engagement is fundamentally analogous to taking a long position on $ETH-margined perpetual. When the price of $ETH rises, they not only benefit from the appreciation but also from the surplus $ETH in the protocol (in the above example, a 10% surge in the price of $ETH resulted in a 60% gain for the trader). Yet, the inverse is just as pronounced. A deceleration in ETH’s price by 10% triggers a sharp 60% erosion in the trader’s position. From the point of the Angle Protocol, these traders serve as an insulating barrier against the volatility or depreciation of the collateral. This very function earns them the title of “Hedging Agency”. The leverage level for traders is determined by the ratio of the hedging position available in the protocol (0.2 ETH in this example) to the protocol’s stablecoin position (1 ETH in this example).

For perpetual contract traders, Angle offers the following advantages:

- No Funding Fees: Traditional centralized platforms require long-position holders to pay funding fees to their counterparts holding short positions.

- Slippage-Free Oracle Price: Angle attempted to create a win-win scenario for both stablecoin holders and perpetual contract traders where stablecoin holders benefit from high capital efficiency and decentralization, while contract traders enjoy an enhanced trading experience.

Actually, there might be instances where there are no traders to open long positions. In such cases, Angle introduces the Standard Liquidity Provider (SLP) to offer additional collateral (stablecoins) to ensure the protocol’s security, while simultaneously earning yields, transaction fees, and governance token($ANGLE) rewards.

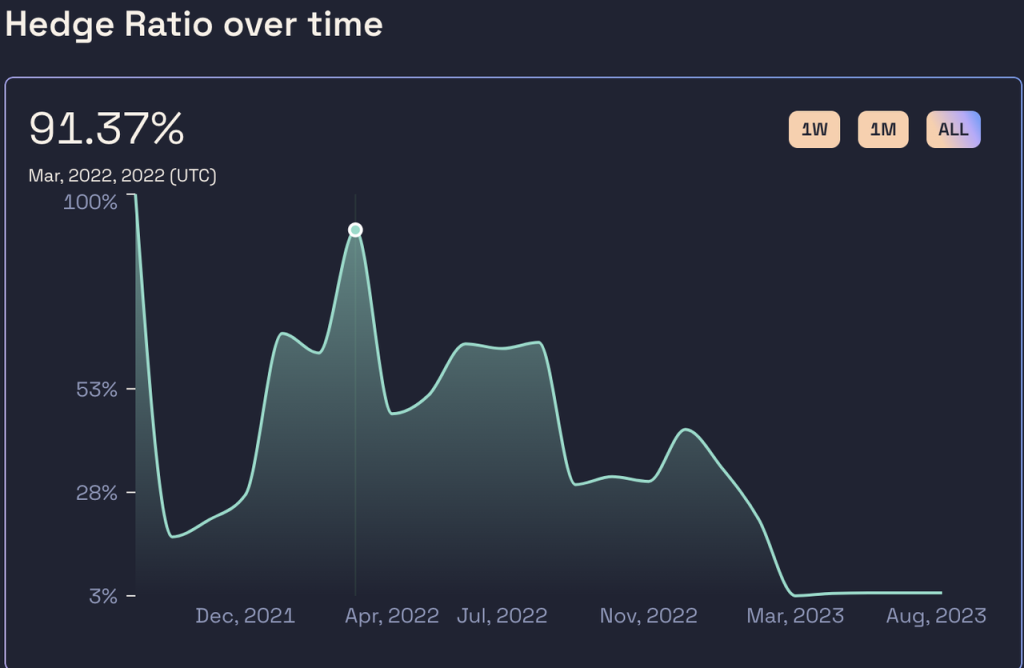

However, Angle’s real-world performance hasn’t been optimal. Even though traders receive a large amount of $ANGLE as a reward, the protocol’s collateral isn’t fully hedged most of the time. The core issue is that Angle hasn’t offered a product compelling enough for traders. As the price of the $ANGLE token declined, the TVL (Total Value Locked) of Angle Protocol also plummeted from its initial $250 million to around $50 million.

Source: https://analytics.angle.money/core/EUR/USDC

In March 2023, the interest-bearing reserve assets of Angle unfortunately fell victim to a hacker attack involving Euler. Although the hacker eventually returned the stolen assets, the incident severely impacted Angle’s momentum. By May 2023, Angle announced the discontinuation of Angle Protocol V1, and introduced plans for V2. Angle Protocol V2 shifted to a traditional over-collateralized model and was launched in early August.

Liquity V2

Since its launch in March 2021, LUSD issued by Liquity, has become the third-largest decentralized stablecoin in the market (following DAI and FRAX) and is the largest fully-decentralized stablecoin. For a deeper dive into Liquity, you can read our comprehensive reports released in July 2021 and Apr 2023 shed light on the mechanics of Liquity V1, along with its subsequent product updates and case expansions.

The Liquity team stands proud of LUSD’s accomplishments in achieving both decentralization and price stability. Yet, when analyzing the metrics of capital efficiency, Liquity’s performance has been somewhat mediocre. Historical data indicates that, since its inception,Liquity’s collateralization ratio has consistently hovered around 250%, implying that for every circulating LUSD, there’s an ETH collateral worth $2.5 backing it.

On July 28th, Liquity officially unveiled the features of its V2, with the heart of this upgrade being the inclusion of LSD as an eligible collateral type. However, the standout feature remains its ambitious claim of achieving high capital efficiency via delta-neutral hedging across the entire protocol.

Currently, Liquity has not publicly released detailed product documentation. The available information on V2 primarily originates from founder Robert Lauko’s talk at ETHCC, previous introductory articles released by Liquity, and discussions on Discord. Our subsequent summary is primarily based on these sources.

In terms of product logic, mirroring the structure of Angle V1, Liquity’s V2 has a foundational premise to onboard traders to execute leveraged operations on its platform. These traders’ margins then function as supplementary collateral for the protocol, thereby strategically hedging the protocol’s overarching risk spectrum. For the traders, Liquity offers an attractive trading product.

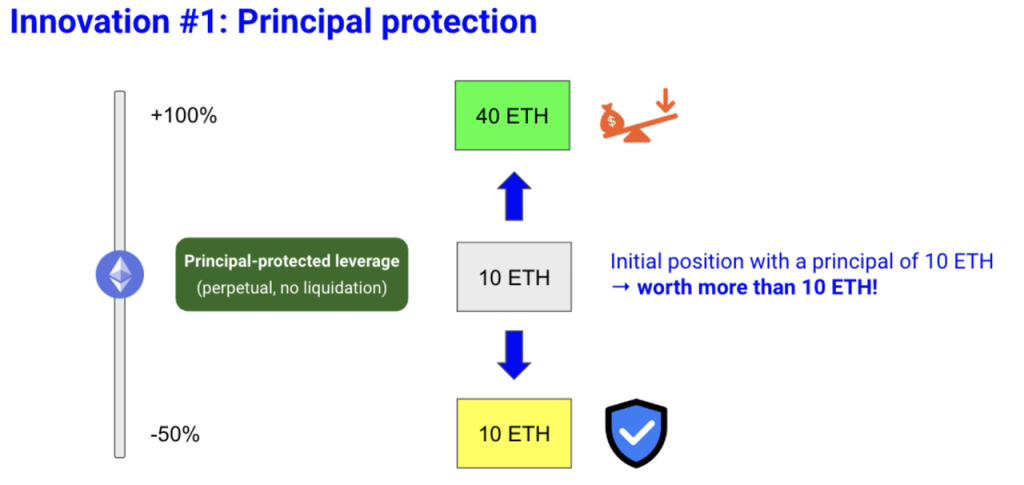

Diving into the specifics, Liquity has rolled out two groundbreaking novelties. The first, aptly termed as “Principal Protected Leverage Position”. This offering allows traders to access a unique leveraged trading paradigm where their principal stands safeguarded. Upon remitting a designated premium, users can unlock this utility, which provides an insurance net against significant ETH price downturns, ensuring they still pocket a predetermined amount of USD. Illustrating this with a scenario laid out in Liquity’s blog: When ETH stands at a valuation of $1000, an investor parting with 12ETH (split into 10 ETH for principal and a 2 ETH premium) can leverage a 2x position on the initial 10 ETH, coupled with downside fortification. Translated, if the ETH price sees a twofold surge, the 2x leveraged position becomes active, resulting in the user receiving a total of 40 ETH. However, if the ETH price goes down, the purchased put option becomes active, allowing the user to withdraw their initial $10000 (10 * 1000).

Liquity’s product innovation clearly seeks to iterate and expand on the foundational concepts introduced by Angle Protocol, with the spotlight being on the “principal protection”. While Liquity remains tight-lipped about the detailed mechanisms, piecing together insights from their design drafts and lively chatter on Discord, this “principal protection” seems very much akin to a call option.

Liquity believes that this combo product, due to its capacity to protect the principal, will be highly attractive to traders. This call option is crafted to empower traders with the dual advantage of leveraged returns when prices rise and ensuring their principal when prices fall. Through the trader’s lens, this presents a potentially more enticing proposition compared to Angle’s unembellished leveraged trading pitch – though the allure’s potency would be contingent on how Liquity calibrates its premium pricing. From the protocol’s perspective, the premium paid by users can serve as a safety buffer. When the ETH price falls, Liquity can use this premium as supplementary collateral to repay stablecoin holders; when the price rises, the appreciated part of Liquity’s collateral can be distributed to contract traders as profit.

An evident challenge lurks within Liquity’s innovative design. Zooming in, when traders look to liquidate their positions prematurely and extract their ETH, Liquity faces a dilemma. While granting traders the autonomy to bow out as they wish, any such withdrawal concurrently slashes the protocol’s hedged proportion, introducing potential fragility as chunks of “collateral” are pulled out. In fact, a similar problem arose in the practical operation of Angle Protocol, where its system’s hedging rate remained low for extended periods, indicating that traders weren’t sufficiently hedging the overall protocol position.

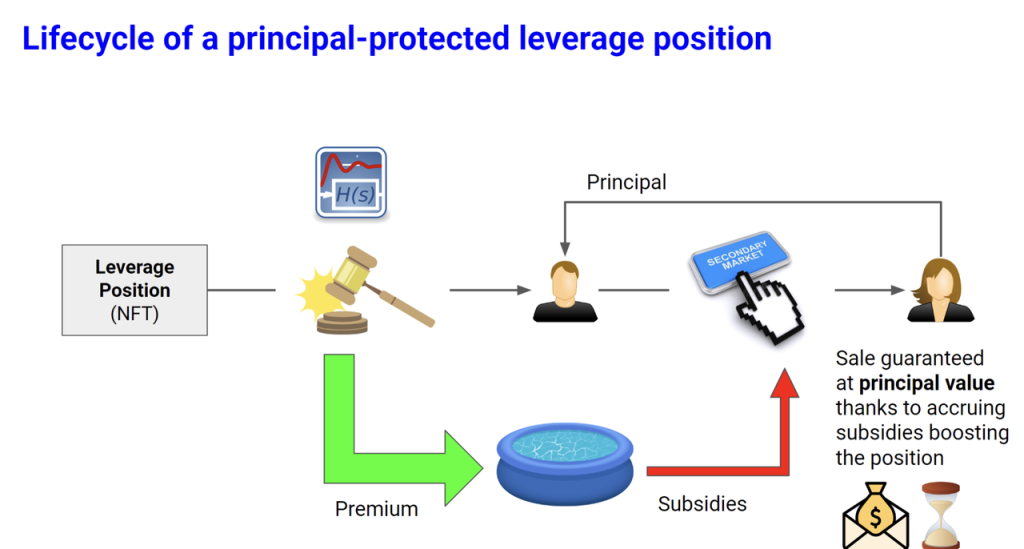

To tackle this challenge, Liquity introduced the second innovation: its secondary marketplace to subsidize positions.

This means that within Liquity V2, leveraged trading positions (tokenized as NFTs) can not only be opened and closed like regular leveraged positions but can also be sold on a secondary market. In reality, Liquity’s primary concern is traders liquidating their positions, as this could reduce the protocol’s hedging ratio. When a trader wants to close a position, if another trader is willing to purchase it on the secondary market at a price higher than its inherent value, the original trader benefits from receiving more cash, which results in a win-win. For Liquity, even though this “inherent value” is subsidized by the protocol, a relatively small subsidy can maintain the overall system’s hedging ratio. As a result, at a relatively low cost, the protocol’s security is enhanced.

Imagine a scenario where Alice opens a position with 10 ETH, at an ETH market price of $1000, and she pays a premium of 2ETH. This position represents a leveraged long of 10 ETH with principal protection. However, if the price of ETH then falls to $800, the $12,000 worth of ETH that Alice initially invested can now only be swapped for 10 ETH (valued at $8000). At this juncture, Alice can either directly liquidate her position to get the 10 ETH ($8000) or sell this position on the secondary market for a price between $8000 and $12000. From Bob’s perspective, a potential buyer, purchasing Alice’s position would be akin to buying ETH at $800 and obtaining a call option with a strike price of $1000. This option certainly has value, ensuring Alice can get a price higher than $8000 for her position. For Liquity, if Bob acquires Alice’s position, the protocol’s collateralization remains unchanged since the premium is still retained within the protocol’s pool. If no one, like Bob, steps up to buy Alice’s position promptly, Liquity will gradually increase the value of Alice’s position over time (though the exact method isn’t specified, mechanisms like lowering the strike price or increasing the quantity of the call option could enhance the position’s value). The subsidized amount would be sourced from the protocol’s premium pool. However, this could slightly decrease Liquity’s overall over-collateralization. Liquity believes that not all positions would require protocol subsidization, and even if they do, it might not entail subsidizing a significant portion of the position. Thus, subsidizing the secondary market can effectively maintain the protocol’s hedging ratio.

Lastly, despite these innovations, it might still be challenging to entirely address the liquidity shortfall in extreme scenarios. Liquity would also adopt a mechanism similar to Angle’s standard liquidity provider system as a final supplement. This could possibly involve the protocol allowing users to deposit some V1 LUSD into a stability pool, which would act as a backup to support V2 LUSD redemptions when the crypto waters get choppy.

Liquity V2 is planned to launch in the second quarter of 2024.

Overall, Liquity V2 shares many similarities with Angle V1 but has also introduced targeted improvements in response to the challenges faced by Angle. They’ve innovated with the “principal protection” feature, offering a more appealing product for traders. They’ve also introduced a “protocol-backed subsidized secondary market” to protect the protocol’s overall hedging ratio.

However, at its core, Liquity V2 remains akin to the Angle Protocol. It represents an attempt to branch out and craft an innovative derivatives product that, in turn, supports their stablecoin operation. While Liquity’s proficiency in the stablecoin domain is well-established, it remains to be seen whether they can successfully design a top-tier derivative, achieve Product-Market Fit (PMF), and promote it effectively.

Conclusion

The prospect of a decentralized reserve protocol that achieves decentralization, high capital efficiency, and price stability is certainly exhilarating. However, a sophisticated and well-thought-out mechanism design is just the first step for a stablecoin protocol. What’s even more crucial is the expansion of stablecoin use cases. At present, the stride of decentralized stablecoins in proliferating use cases has been somewhat languid, with most pigeonholed into a singular role: indispensable tools for liquidity mining. But the lure of mining incentives isn’t eternal.

In a provocative turn of events, PayPal’s foray with PYUSD has sounded the clarion call for crypto stablecoin protocols. It indicates that well-known entities within the Web2 domain are venturing into the stablecoin arena, suggesting that the window of opportunity for current stablecoins might be narrowing. Indeed, when we discuss the centralized risks of custodial stablecoins, our concerns largely revolve around the potential unreliability of custodians and issuing entities. For instance, Silicon Valley Bank, ranks 16th in the U.S., whereas both Tether and Circle, albeit influential, remain quintessentially ‘crypto-native’. If a “too big to fail ” entity from the traditional financial world, such as JP Morgan, were to issue a stablecoin, the inherent national credit backing it could eclipse competitors like Tether and Circle instantly. Furthermore, it introduces a quandary: if centralized entities offer robust stability, does the call for decentralization become muted?

With that said, we hope to see decentralized stablecoins diversify their application spectrum, cementing themselves as the Schelling point in the ever-evolving stablecoin narrative. Realizing this, however, is a difficult task.