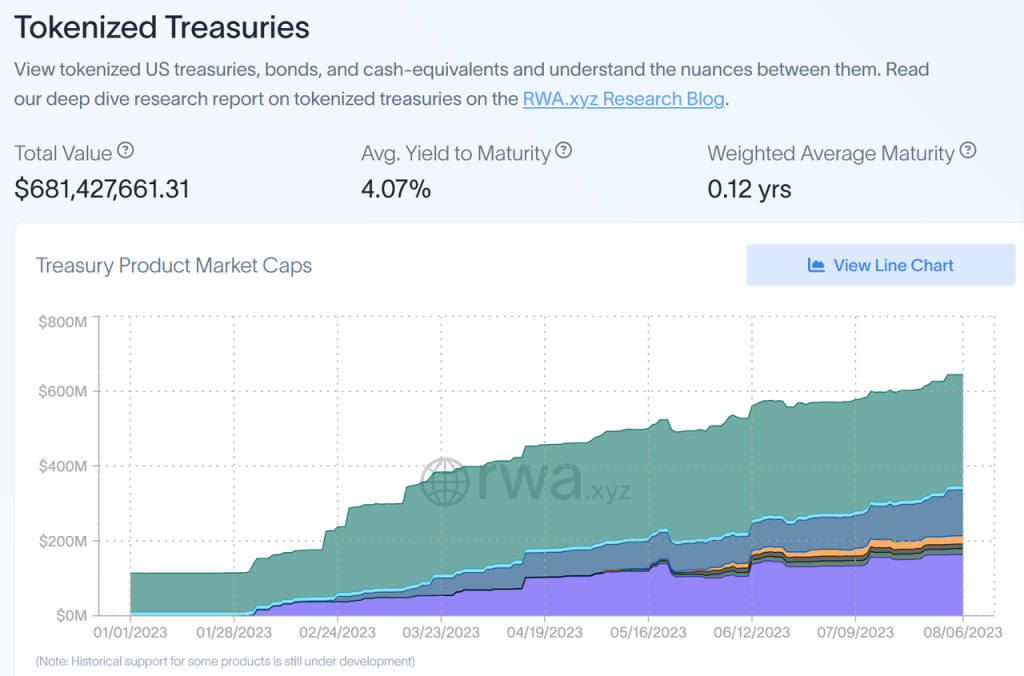

In our previous analysis, we pinpointed Treasury RWAs as the sector poised for an explosive growth in both market cap and user engagement in the mid term. According to data from rwa.xyz, projects dedicated to tokenized treasury bond assets, excluding the bonds within MakerDAO, have approached a market cap of nearly $700 million, representing a growth of around 240% since the beginning of 2023. Additionally, the treasury bond within MakerDAO has rapidly expanded to billions of dollars. This trajectory underscores a swift growth in the tokenized treasuries.

Given this compelling backdrop, let’s pivot to an in-depth analysis of the dominant tokenized treasury products currently shaping the market.

Contents

The Strategic Importance of Tokenized Treasury Bonds

In our recent explorations, notably “An Exploration of Risk Free Rate in The Crypto World” and “The Outlook of The On-chain Bond Market,” we delved into the intricacies of benchmark interest rates in the crypto world, alongside the nascent contours of a potential bond market. Within this context, yields derived from Proof of Stake (PoS) protocols on public blockchains can be conceptually aligned with the crypto equivalent of a risk-free rate, laying the groundwork for a burgeoning bond market orbiting these very yields.

While the immediate emergence of a crypto-native bond market mirroring the magnitude of its traditional counterpart remains a forward-looking conjecture, the inception of an ‘on-chain risk-free rate’ (often abbreviated as LSD) carries profound implications for the investors. This is particularly salient for investors who use public blockchain tokens (e.g., ETH) as their monetary standard can secure low-risk returns even in bear markets. From this perspective, some investment strategies from traditional markets can smoothly transition to the crypto-native industry, such as balanced portfolios toggling between stocks and bonds.

Tokenized Treasury Bonds, like LSD, can enable USDT-dominated investors to implement traditional portfolio strategies once the risk-free rates from traditional financial markets are introduced into the on-chain world. There are several advantages to this:

- USDT-dominated investors will have a relatively safe and stable income source even in bear markets. Take the stablecoin market as an example. After gradually entering a bearish trend in mid-2021, the overall stablecoin market has shrunk from $188 billion to less than $130 billion. The reduction in the scale of the stablecoin market has also impacted the overall market liquidity.

- It paves the way for the smoother introduction and market assimilation of commingled financial products consisting of stocks and bonds. In traditional markets, these commingled funds are familiar to most investors. Their introduction into the on-chain universe is a catalyst for innovation within the DeFi asset management.

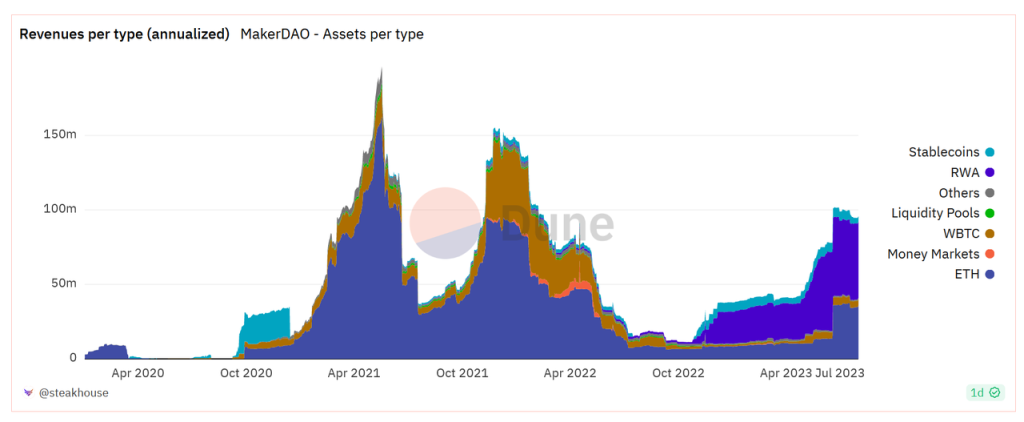

The most typical example is MakerDAO. During a bear market and significant increases in U.S. Treasury yields, MakerDAO expanded its investment portfolio to include U.S. treasury bonds and their profitability witnessed a substantial improvement after 2023.

Hence, there is reason to believe that MakerDAO serves as a compelling case study within the DeFi landscape. After witnessing MakerDAO’s enhanced profitability through its RWA strategy, it’s plausible to anticipate that other DeFi protocols will follow suit, seeking to bolster their financial robustness through more diverse strategies like RWA. Particularly during bear markets, RWA can function as a dependable and robust revenue stream that undergirds a project’s longevity and operational stability.

Business Model for Tokenized Treasury Bonds

At present, tokenized treasury bonds have fostered the development of five business models: the Agency Model, Platform Model, Service Provider Model, Proprietary Model, and the Hybrid Model.

The agency model neither directly participates in wrapping underlying assets nor provides KYC services to users. Its primary focus is customer onboarding via crypto-native methodologies, emphasizing business marketing, fund acquisition, and the expansion of the ecosystem and use cases. Projects like TProtocol adopted similar infrastructures to established platforms such as Aave and Compound. These initiatives typically secure liquidity by establishing liquidity pools of capital. This approach involves aggregating funds from various users, which are then allocated to a single borrower tasked with the acquisition of underlying assets, a prominent example being U.S. treasury bonds.

The platform model — with notable projects like Desmo Labs — offers a gamut of services including on-chain integration, sales, and KYC. However, it maintains a strategic distance from the direct assets wrapping. These types of projects generally offer three categories of services: the tokenization of assets or equities, on-chain verifiable information services and comprehensive KYC services. In theory, these projects can assist in wrapping any type of asset/equity from traditional markets, their focus extends beyond treasury bonds. Operationally, they resonate more with traditional internet platforms. Thriving in this competitive space demands their all-in-one solution’s usability and ability to acquire customers.

The Service Provider Model specializes in the on-chain integration of RWAs, procurement of assets, and comprehensive asset management, with representatives like Monetalis Group. However, they maintain a degree of separation from direct interactions with end-users or institutional buyers of treasury bonds.

The proprietary model, where the project team actively seeks corresponding assets and collaborates with external partners to establish the business framework, will ensure risk isolation of assets and tokenize assets/equities. Notable adherents to this paradigm include the likes of MakerDAO, Franklin OnChain U.S. Government Money Fund, and Frax Finance. This type of model, in comparison to the first two models, involves a higher degree of complexity in off-chain operations, requiring significant efforts in legal navigation, the erection of corporate structures, and the meticulous selection of assets and partners. Despite these demands, the model’s strength lies in its complexity: the underlying assets are relatively controllable, allowing the project team to manage risks proactively.

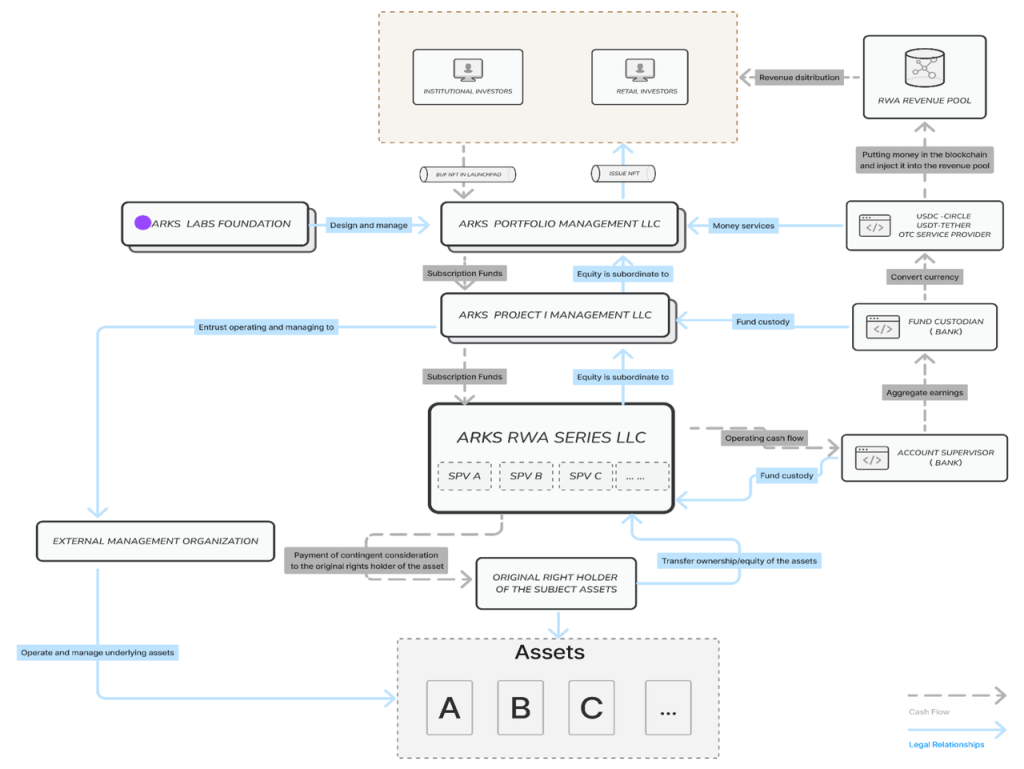

The hybrid model can be a combination of the four models mentioned above. Projects under this model, such as Fortunafi, Centrifuge, and ARKS Labs, offer a spectrum of services that include on-chain integration and KYC processes, whilst maintaining an active role in asset acquisition and presenting direct investment avenues to their clients. A closer examination of Fortunafi reveals a quartet of service categories:(1) Access Capital, which furnishes investees with crucial funding streams; (2) Earn Yield, featuring an array of wrapped assets available for direct investment after completing KYC; (3) Protocol Services, delivering governance, treasury management, and additional protocol-centric services; and (4) Whitelabeled products, providing end-to-end on-chain services for RWA. It is worth noting that the RWA services offered by these projects are not limited to treasury bonds, potentially extending to the on-chain wrapping of a diverse asset.

Naturally, the landscape of blockchain’s intersection with real-world assets (RWAs) extends beyond the five detailed models. There exist entities primarily centered around transactional operations, a notable example being platforms like DigiFT. Further elaboration on this topic is not provided here.

Asset Side: The Underlying Assets and Its Framework

Underlying Assets

Currently, several underlying assets are currently making waves in the market:

- U.S. Treasury ETFs. Pioneers that utilize the U.S. Treasury ETFs include Backed Finance, Swarm, MakerDAO, and ARKS Labs, among others. The advantage of adopting this type of underlying asset is its simplicity: the management of underlying assets is delegated to the issuer and manager of the ETF, including liquidity and the rolling-over of bonds. Consequently, projects adopting these ETFs are spared the operational rigmarole, allowing them to sidestep significant risk issues that haven’t notably surfaced thus far. Hence, the operational risks synonymous with asset management don’t pose a significant concern. Instead, these ventures can channel their focus on enveloping the most substantial and liquid assets the market has to offer.

- U.S. Treasury Bonds. A distinct set of projects, with noteworthy mentions including OpenEden, TrueFi, and Matrixdock, opt for direct U.S. Treasury Bonds. These projects typically lean towards the shorter end of the maturity spectrum, ensuring an asset liquidity profile that mirrors cash. However, these projects must engage directly with counterparties, thus inheriting the associated asset management risks. The careful selection of suitable partners is crucial in such projects.

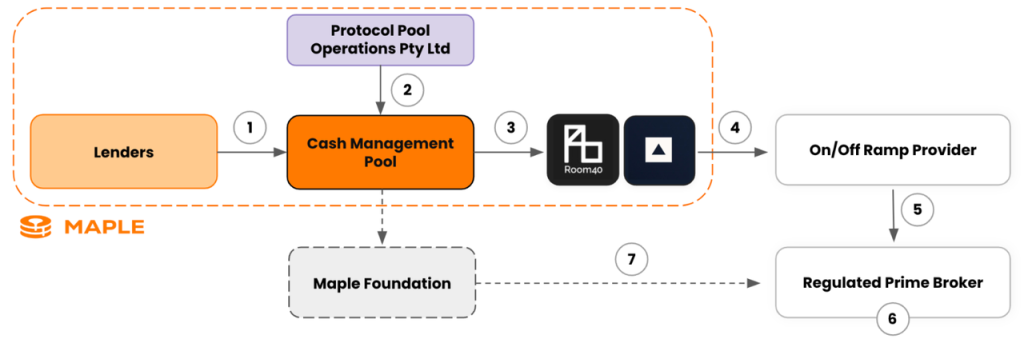

- A combination of U.S. Treasury Bonds, U.S. Government Agency Bond, and Repurchase Agreements. Certain projects such as Franklin OnChain U.S. Government Money Fund, Superstate Trust, TProtocol, Arca Labs, and Maple Finance, have adopted this diversified portfolio. Similarly, these projects delegate the management of underlying assets to professional managers, and issues related to the rollover and liquidity of underlying assets are directly relevant to the project. At the operational level, if the project fails to select a high-quality manager, problems may arise.

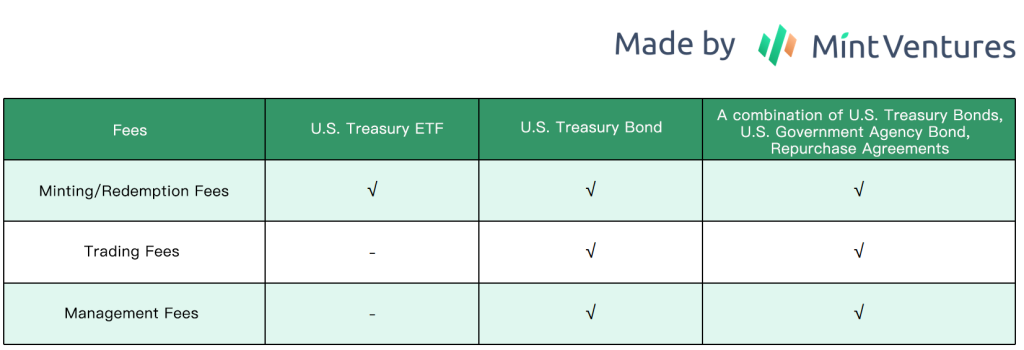

Fee Structure

The diversity in underlying assets, as dissected in the prior section, inherently gives rise to distinct fee structures. Without considering gas fees resulting from on-chain transactions, the primary fee structures are as shown in the following diagram:

Since the management of the U.S. Treasury Bond ETFs are entrusted to ETF custodians, the primary cost arises from the minting and redemption processes, with fees typically ranging from 0.05% to 0.5%. For the other two types, as they involve the management of underlying assets, additional management and transaction fees come into play. The range of management fees is approximately 0.3% to 0.5%, while transaction fees encompass various aspects like bank transfer fees, and their rates are also around 0.2%.

The Business Structure

The choice of underlying assets inevitably shapes the business structure within the projects. Currently, the market features several categories:

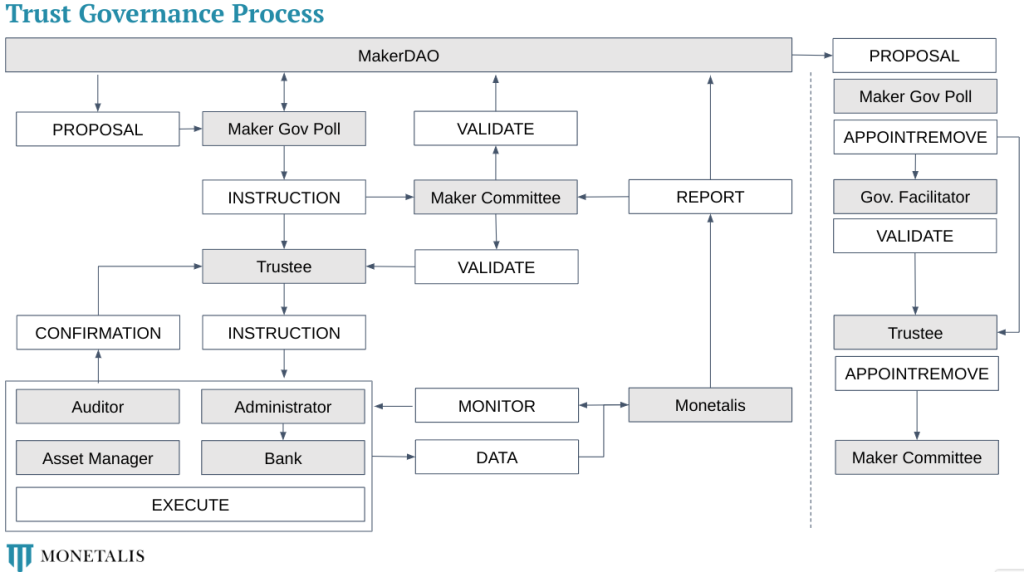

Trust: Projects adopting this approach include MakerDAO, among others.

This framework operates by having a sponsor allocate assets to a Special Purpose Vehicle (SPV), effectively creating a trust. The sponsor, in turn, gains rights to the trust income, which are then passed on to investors as trust beneficiaries. In the context of MakerDAO’s integration with the U.S. Treasury Bonds, the structure engages diverse roles like managers and auditors. A key participant in this arrangement is Monetalis Group, responsible for managing substantial aspects of the off-chain operations — ranging from the acquisition of underlying assets to regular reporting and the facilitation of on-chain activities. Meanwhile, MakerDAO maintains a significant influence, directing factors such as operational scale and the choice of underlying assets through its established governance protocols.

Limited Partnership SPV: Another noteworthy framework being leveraged by blockchain projects like Maple Finance and Matrixdock. This model is distinctive for its proactive engagement in asset selection and liquidity acquisition.

The SPV operates as a separate entity, primarily established to pool investor capital for the purpose of asset securitization or acquisition. One of the fundamental reasons for creating an SPV is to insulate stakeholders from bankruptcy risks. It’s essential to note that the trust structure, as previously discussed, is technically a form of an SPV. However, the evolution of SPVs has brought to the table more refined benefits. These include:

- Streamlining Financial Management: By avoiding the convoluted departmental involvements and ambiguous operational flows common in conventional corporate frameworks, SPVs bring clarity and efficiency to financial processes.

- Enhancing Transparency: SPVs typically correspond to a single project or asset, which promotes management clarity. In traditional settings, like commercial banks, investors often face barriers in gaining penetrating insights of underlying assets due to limited disclosure. Such information may only be accessible at the management accounting level within the bank. Take individual housing loans as an example; in public financial statements and annual reports, the characteristics of such loans are not detailed, let alone information about individual borrowers. However, if individual housing loans are bundled into an SPV, it’s likely that comprehensive loan data—covering terms, interest rates, collateral details, and loan amounts—would be required for disclosure, offering investors a deeper insight into their investments.

- Tax and Fee Reduction: SPVs can also be structured to enjoy more favorable tax treatments, depending on the nature of the underlying assets.

In this business model, two primary layers can be discerned:

- The User-SPV Interaction: Here, users essentially hold debt obligations against the SPV. The security of user returns hinges significantly on the SPV’s punctuality and consistency in meeting its obligations.

- The SPV-Bank Dynamics: In this layer, SPVs immerse themselves in the treasury bond market while also engaging in repurchase agreements within the commercial banks. In this process, defaults in interbank repurchase agreements potentially pose a more substantial risk compared to direct holdings of U.S. treasury bonds.

Beyond these two layers, users stand exposed to an additional risk concerning the SPV itself.

ARKS Labs has expanded upon this business structure by nesting smaller SPVs within a more expansive business framework. This nested configuration allows for the scalability of business operations, making it convenient to add new underlying assets in the future. Interestingly, this strategic architecture is very similar to the MakerDAO’s architecture, as mentioned in our analysis Ramblings on RWAs: Underlying Assets, Business Structure, and Their Evolution in Crypto World.

Lending Platform + SPV: TProtocol stands out for implementing this distinctive business structure. This model diverges from the previously discussed SPV framework primarily in the role and relationship dynamics around the SPV. In the conventional SPV setup, the project team plays an active part in uncovering and wrapping assets. TProtocol breaks from this norm; here, the SPV is independent, tied not to TProtocol but to the originators of the RWA assets.

Taking the diagram below as an example, the SPV initiators can vary, spanning a range of institutions. This variability extends to subsequent on-chain service providers and asset intermediaries, infusing TProtocol’s operational structure with a higher degree of flexibility. However, this flexibility isn’t without its trade-offs. As partners increase, the control over the SPV’s subsequent management, including the ability to inspect and manage service providers, may decrease to some extent.

The On-chainization of Fund Shares: Similar to traditional fund purchases, it requires detailed information about the purchasers, aligned with their respective blockchain addresses. Franklin OnChain U.S. Government Money Fund has adopted such a business structure. Projects of this type are more akin to what has often been called ‘blockchainization,’ where the project team brings offline assets and purchaser information onto the blockchain. Future transaction information will also be recorded on the blockchain in a ledger-like method.

While the RWA sector is in its early phase, current user demand and capital requirements for such business structures remain moderate. Nonetheless, as the intrinsic value of treasury bond-backed RWAs gradually gains recognition from investors, the scalability of these structures is thrust into the spotlight. The ability to seamlessly integrate new assets and engage additional off-chain service providers could be a determining factor during the rapid development phase of the sector.

User End: KYC and Other Requirements

The diversity in underlying assets and operational structures inevitably leads to different prerequisites at the user end. Presently, these can be broadly segmented into three aspects:

Minimum Investment Threshold: Projects like MakerDAO, ARKS Labs, and TProtocol do not impose a minimum investment amount limit on users. However, projects like Maple Finance, TrueFi, Arca Labs, Backed Finance, and others have set explicit minimum investment amount limits. The ‘no-limit’ approach aligns more with the habits of current DeFi users, while projects with a minimum investment amount exceeding $100,000 target high-net-worth individuals primarily.

KYC Requirements: Based on the complexity of KYC, it can be categorized into three types: no-KYC projects, such as Flux Finance, ARKS Labs, and TProtocol; basic KYC, like Desmo Labs, where users only need to upload documentation such as passport details; strict KYC, such as OpenEden, Ondo Finance, Maple Finance, Matrixdock, etc., requiring KYC information on par with the traditional financial industry. Elevated KYC requirements not only signify higher thresholds in the traditional financial sector but are also less palatable for DeFi users.

Other Requirements: Certain projects impose geographical constraints on their clientele, limiting their services to non-U.S. participants or barring users from specific jurisdictions like the U.S., Singapore, or Hong Kong, typically employing IP filtering mechanisms.

It’s noteworthy that many projects delegate KYC verifications and region-specific restrictions to specialized third-party agencies, thereby abstaining from direct involvement in the KYC verification process.

Revenue Allocation Strategy and Composability

Revenue Allocation Strategy

Currently, profit-sharing strategies predominantly fall into two primary categories:

The first and most common strategy involves direct profit allocation through debt obligation relationships. Here, users, whether they’re holding debt obligations in an SPV or accessing treasury bonds — through ETFs or other instruments — stand to receive the lion’s share of the yields these bonds generate. Users can expect to receive approximately a net profit of around 4%, excluding profits earned in minting and burning processes and profits earned by agencies.

This revenue allocation method bears striking resemblance to LSD projects: the bulk of the staking rewards are funneled back to the users, with a nominal percentage appropriated as fees.

The second strategy is currently exclusive to the MakerDAO project, employing a saving rate mechanism. Since user funds do not directly correlate with underlying assets, MakerDAO utilizes an approach similar to traditional banking’s interest rate spread model. On the asset side, capital is channeled into higher-yield ventures like RWAs. Conversely, on the liability side, user returns are governed by the Dai Savings Rate (DSR). The DSR hasn’t been static; it has experienced four noteworthy recalibrations to date: 1) An escalation from 1% to 3.49%. 2) A reduction to 3.19% from 3.49%. 3) A significant leap to 8% from 3.19%. 4) A moderation to 5% from the peak of 8%.

This strategy has granted team members greater flexibility. However, its drawbacks may become evident. Users are thrust into a scenario with no concrete predictive framework for anticipating future returns. In the case of RWA backed by the U.S. Treasury Bonds, users might reasonably expect yields akin to those of the bonds themselves. However, due to monetary policy adjustments, such as the recent decision by MakerDAO to distribute excess earnings to depositors, rates have surged to 8%. In the future, if the number of depositors increases significantly, yields could fall back closer to U.S. Treasury bond rates. Such fluctuations may not be favorable for investors seeking stable yield levels.

For treasury bond-backed RWAs, having a precise and predictable yield is of utmost importance. In this context, the first distribution strategy may be preferred over the second. However, should a project following the second strategy stabilize its yield, aligning closely with treasury bond rates, the differential in investor returns between the two methodologies could become negligible.

Composability

Composability within the RWA tokens, specifically those backed by treasury bonds, encounters fragmentation, primarily due to prevailing KYC requirements:

Several projects, particularly those enforcing strict KYC protocols — including Ondo Finance, Matrixdock, Franklin OnChain U.S. Government Money Fund, among others — impose allowlist constraints on address accessibility. This regulatory measure dictates that, despite the existence of pertinent token liquidity pools, transactional activities are permissible solely under the conditions of allow-listing and user accreditation.

Relevant token liquidity pools are present on-chain, unrestricted trading remains an unattainable luxury without requisite access permissions.

Unless they can significantly expand the scale of the underlying assets, these projects face challenges in gaining support from various DeFi projects for enhanced composability.

Conversely, projects without KYC requirements currently do not face composability challenges. The only limitations to composability for these projects are their business resources, prowess in business expansion, and the overall magnitude of the project itself.

Summary

Analyzing the landscape of RWA projects centered on tokenized treasury bonds, certain business models emerge as potentially successful strategies in the short to medium term:

Underlying Assets: Choosing U.S. Treasury Bond ETFs as the underlying asset appears to be a judicious move, delegating the intricacies of liquidity management to stalwarts of the traditional financial arena. For projects venturing into the direct acquisition of U.S. Treasury bonds or a blend of assets, the prowess in forging alliances with adept partners will be under scrutiny.

Business Structure: Utilizing established and adaptable models is preferable, especially those with solid scalability, to facilitate rapid expansion in scale and integrate new asset classes in the future.

User Base: In the medium to short term, projects with no KYC requirements and minimum investment thresholds tend to attract a broader user base. Moving forward, should regulatory bodies mandate KYC procedures, the adoption of a more streamlined, or basic KYC process could gain prominence as a mainstream solution.

Yield Distribution: In order to provide investors in the U.S. Treasury Bond RWAs with a more stable and assured expectation of yield, the optimal solution is for the project to provide users with a yield that is consistent with the ratio of Treasury yields.

Composability: Until regulatory restrictions limit access to on-chain treasury bond RWAs, expanding the utility of RWA tokens held by users becomes an essential strategy. Projects must focus on this aspect to spur substantial business traction in the medium to long term.

Peering into the longer horizon, as regulatory frameworks become more pronounced and intricate, projects that can efficiently navigate and comply with basic KYC protocols may find themselves at an advantageous point, poised for sustained success.