In 2023, the Cancun upgrade has firmly established itself as one of the most pivotal events in the crypto world since the Shanghai upgrade. Layer2 projects that stand to gain from it are central to our focus for the year.

It is said that the Cancun upgrade, proposed in EIP-4844, is projected to be implemented between October 2023 and January 2024. Meanwhile, tokens of forefront Layer2 solutions—ARB (Arbitrum) and OP (Optimism) underwent retracements after marking fresh all-time highs earlier this year. This suggests that the current climate might still present an opportune window for strategic engagement.

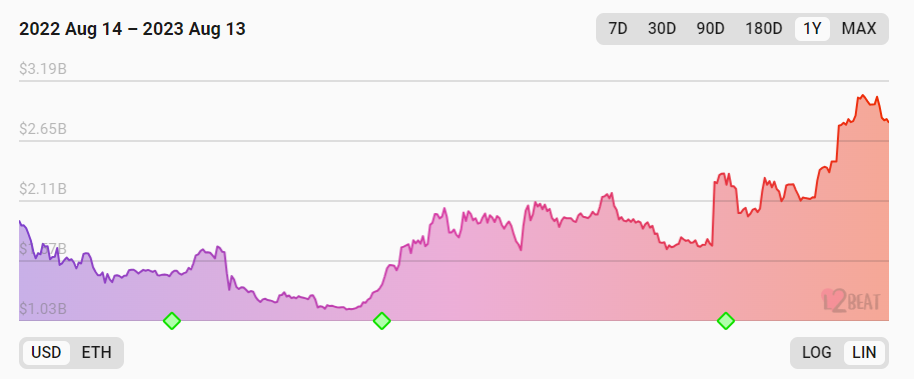

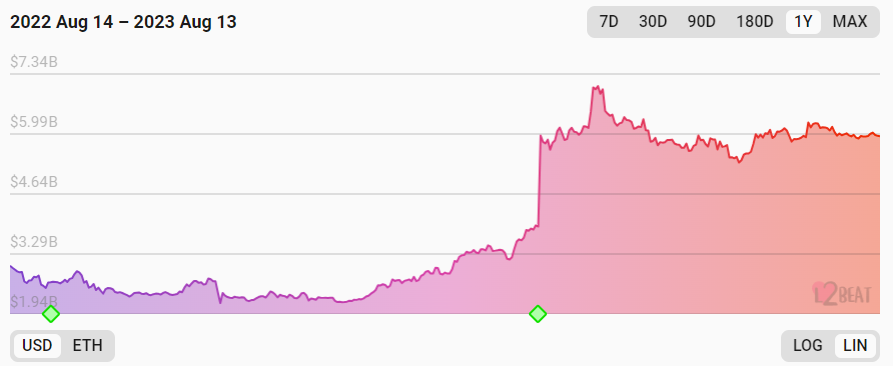

Certainly, when evaluated by market capitalization, the market cap of OP has been consistently breaking records since 2023, whereas ARB has largely been trading in a consolidation phase at lower levels. Through this article, we aim to unpack the following aspects:

- The inherent value and business model behind Layer2.

- OP vs. ARB: A comprehensive analysis of their competitiveness and key performance indicators.

- The transformative impact the Cancun upgrade could have on Layer2 fundamentals.

- Unveiling the potential risks associated with Optimism.

The insights and opinions presented in this article reflect my views as of the publication date primarily through a business lens, with a limited delve into the technical intricacies of Layer 2 and may contain factual inaccuracies or biases. This article is intended for discussion purposes only, and feedback is welcomed.

Contents

Unpacking the Inherent Value and Business Model of L2

Source of L2’s Value and Its Defensive Moat

Layer 2 (L2) solutions can be seen as the natural evolution of Layer 1 (L1) protocols, echoing their fundamental promises: delivering a robust, censorship-resistant, and universally accessible block space. A fitting analogy might be to view L2 as a specialized on-chain cloud service. L2’s competitive advantage primarily emerges in its economic efficiency. As a case in point, Optimism showcases gas expenditures that are just 1.56% of those on Ethereum.

However, one must recognize the niche nature of “block space as a specialized cloud service”. Not all online services demand the distinctive functionalities L1 or L2 platforms provide. In the traditional world fraught with restrictions and obscured financial operations, blockchain emerges as a beacon, creating an environment for myriad practical applications.

L2’s block space valuation is intrinsically tethered to its demand, driven by both service providers and users.

Much like L1, L2 has the ability to cultivate a robust defensive moat through the power of network effects.

Within the L2 paradigm, as the user base broadens and diversifies, collaboration becomes more frictionless, streamlining interactions within this ecosystem. This not only nurtures the path-breaking service innovations but also further expands the user pool. Every newcomer that joins and establishes their presence on the L2 network amplifies the intrinsic value for the existing users.

In the Web3 landscape, the network effect prowess of L1 & L2 platforms is eclipsed only by stablecoins, with USDT standing as a prime exemplar. The leading L1 & L2 platforms inherently present higher entry barriers, and as a result, often command a more elevated valuation premium.

Profit Model of Layer2

L2’s revenue structure is straightforward. On one side, L2 secures its data by procuring storage capacity from reliable Data Availability (DA) layers. This serves as an insurance policy—ensuring that if any disruptions occur on L2, the data remains safeguarded and can be readily restored using these backup layers. On the flip side, L2 offers users an affordable block space, and in return, charges them accordingly. The resultant profit margin is primarily a function of the fees garnered on L2 (base fees plus MEV earnings), offset by the costs remitted to the DA service providers.

Delving deeper with Optimism and Arbitrum as illustrative examples, both platforms have strategically allied with Ethereum for their Data Availability needs, capitalizing on Ethereum’s peerless decentralized stature and its gold standard reputation in the L1 realm. They pay in Gas to Ethereum, facilitating the archival of their condensed L2 data within the Ethereum framework. Their revenue stream is predominantly anchored in the Gas and MEV fees accrued when their user base—which spans everyday users to sophisticated developers—interact on their L2 platforms. Deducting operational costs from this revenue gives a clear picture of their gross profit.

It’s pivotal to emphasize that “gross profit” here is a metric that doesn’t encompass subsequent project-associated financial commitments—like salaries, ecosystem incentives, promotional activities, and other overheads.

The fee collection on L2, as well as expenses to L1, both executed by the L2 sequencer. Profits from these operations flow directly to the sequencer. In the current landscape, both Optimism and Arbitrum have their sequencers operated by the official team, with consequent profits enriching their treasury. Naturally, having a centralized sequencer poses an elevated single-point vulnerability. Therefore, both Optimism and Arbitrum have committed to transition towards a more decentralized sequencer framework in their roadmaps.

The decentralization of sequencers is poised to adopt a PoS (Proof of Stake) framework. Under this model, decentralized sequencers would be required to stake native L2 tokens like ARB or OP as collateral. If they fail to uphold their obligations, these staked tokens risk being slashed. Users have the choice to either stake on their own as sequencers or leverage staking services provided by entities like Lido. In this arrangement, while users supply the staked tokens, specialized and dispersed sequencer operators oversee the sequencing and data uploading tasks. Users who participate in staking can then earn a substantial portion of the L2 fees and MEV rewards, with Lido’s model earmarking 90% of these rewards for stakers.

As this narrative unfolds, both ARB and OP will be infused with economic utility beyond their foundational governance role.

ARB VS OP

The Competitive Advantage of Optimism

Since its inception, ARB has consistently outperformed OP on several business-centric metrics, reinforcing its superior positioning in the market. Leveraging its inherent strengths of network effects, Arbitrum seemed poised for not just market dominance but also for commanding a higher valuation premium.

However, the trend began to shift following Optimism’s introduction of the Superchain strategy in February 2023 and the strong push behind the OP Stack.

OP Stack is an open-source L2 technology suite, offering a streamlined solution for emerging projects seeking to leverage L2 capabilities. By utilizing the OP Stack, they can expediently roll out their personalized L2 solutions, significantly slashing both development and trial costs. The “Superchain” stands as Optimism’s visionary blueprint for the future. By embracing the L2 built upon the OP Stack, a uniformity in technical architecture is achieved. This facilitates seamless, ultra-secure, and high-speed atomic-level communication and interaction of both information and assets across different platforms. Drawing parallels with the Cosmos Interchain concept, this innovative framework has been named the “Superchain.”

Following the introduction of the OP Stack and Superchain, Coinbase was among the early adopters, launching its Layer2 Base Chain built on the OP Stack in February and by August 10th, the platform officially went live. Coinbase’s pioneering approach served as a catalyst, setting the stage for a surge in OP Stack adoption throughout the crypto ecosystem. This ripple effect saw major players like Binance introducing their opBNB. Other prominent entrants to the OP Stack community included the Paradigm-endorsed NFT project, ZORA, and the Loot ecosystem’s Adventure Gold DAO. The Gitcoin-affiliated public service endeavor, Public Goods Network (PGN), the renowned options trading platform, Lyra, and the distinguished on-chain analytics provider, Debank, also made their alignments clear with this trend. Notably, Celo, traditionally an L1 solution, has embraced OP Stack for its L2 strategy.

Historically, L2 solutions primarily catered to users, treating block space as a unique domain for their operations. Yet, the introduction of the Superchain and OP Stack has revolutionized this perspective, expanding the definition of ‘users’ to include L2 operators themselves. As a result, L2’s domain, which was traditionally a B2C model (with L2 developers also counted as consumers), has morphed into an inclusive B2B2C framework. This evolutionary step has carved out new value pathways for Optimism and solidified its competitive defenses.

- Network effects in the multi-chain era. Expanding the traditional understanding of “network” from a single chain to encompass a “multi-chain ecosystem”, seamless integration of funds and information across diverse chains is achieved via the uniform OP Stack. Entrusted with user acquisition and engagement, L2 operators strive to bolster the cumulative user base of this multi-chain ecosystem. As this collective user population grows, the intrinsic value of each L2, as well as every individual user within this network, experiences a surge.

- Economies of scale. Optimism bears the fixed costs of the technical framework—maintaining and updating the OP Stack. However, the constant feedback and refinements offered by its diverse user base elevate its overall quality. This cost-efficient strategy not only diminishes the expenses linked to single-chain maintenance and updates, sequencers, and indexing incentives but also amplifies its allure for prospective L2 solution seekers.

- Synergistic Ecosystem. By weaving major Web3 players into the fabric of the Optimism ecosystem, a shared vision and mutual interests emerge. This alignment paves the way for robust support in areas like technological improvements, user acquisition, developer engagement, and investment drives.

Evolving from a single-chain ecosystem to a cross-chain ecosystem, Optimism not only reaps the advantages of anticipated growth in users and developers across the full spectrum, but its core metrics on the OP Mainnet are steadily inching closer, even surpassing the once-distant leader, Arbitrum, as proved by the following metrics:

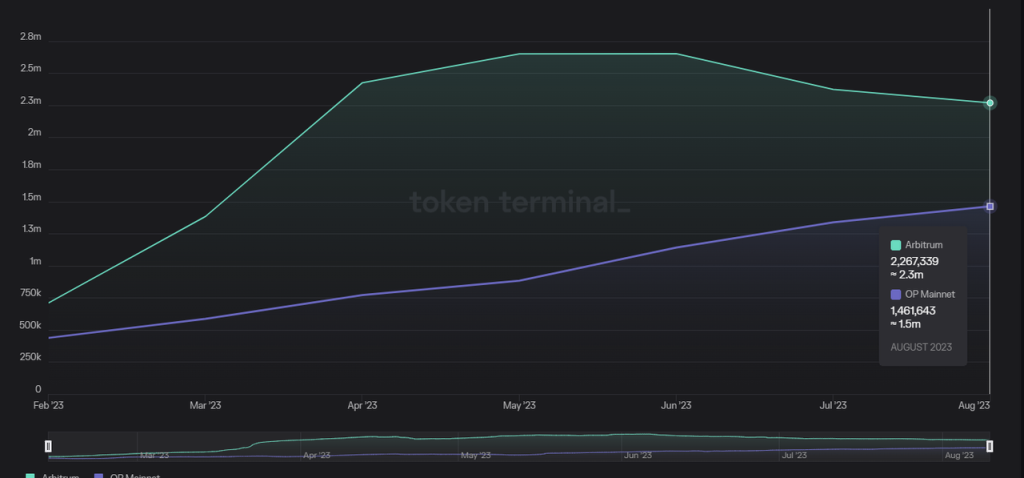

a. Monthly Active Addresses: The proportion of Optimism to Arbitrum’s monthly active addresses has surged from a previous low of 32.1% to its current rate of 73.6%.

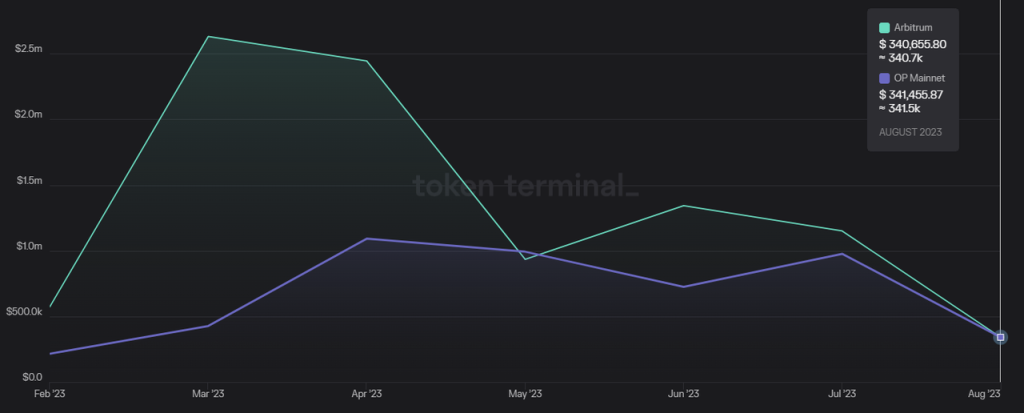

b. Monthly L2 Profits: The L2 profit ratio of Optimism relative to Arbitrum has surged from a mere 16.4% to 100.2%, now surpassing Arbitrum.

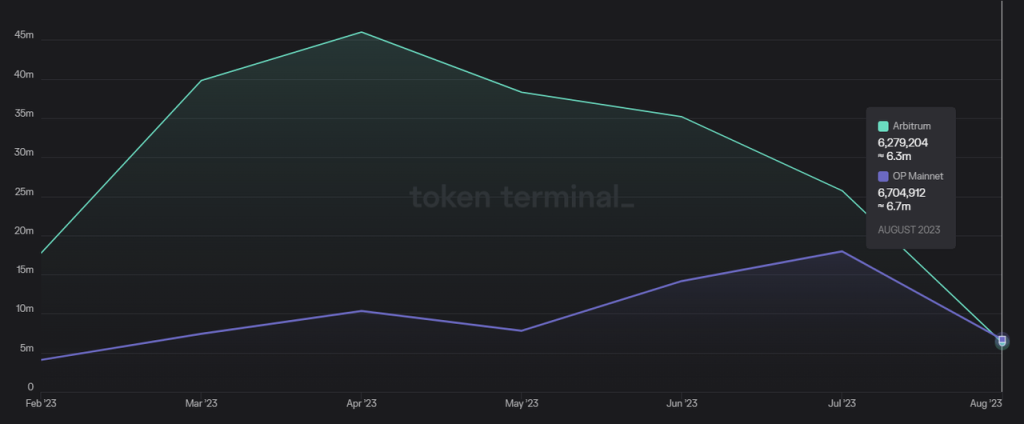

c. Monthly Interaction Counts: The interaction count ratio of Optimism compared to Arbitrum has swelled from a previous 22.4% to 106.5%.

d. TVL: The TVL ratio of Optimism relative to Arbitrum has grown from a trough of 1/3 to the present level of 1/2.

The TVL on the OP Mainnet was approximately $20 billion in March and has since risen to an estimated $30 billion.

The TVL on the Arbitrum was approximately $60 billion in March (reaching a high of about $70 billion) and continues to hover around $60 billion currently.

Comparison of Valuations: OP vs. ARB

As Optimism’s operational metrics continue their swift ascent, the valuation of OP Mainnet relative to Arbitrum is increasingly attractive.

P/E Ratio (circulating market cap/L2’s annualized profit): Based on the revenue data of the most recent week, Optimism’s P/E ratio has moderated to slightly under 80, compared to Arbitrum’s which is positioned at 113. This is particularly noteworthy considering OP’s strong price performance and the continuous vesting and growth of its circulating supply over the past few months.

The Vigorous Expansion of the Optimism Ecosystem

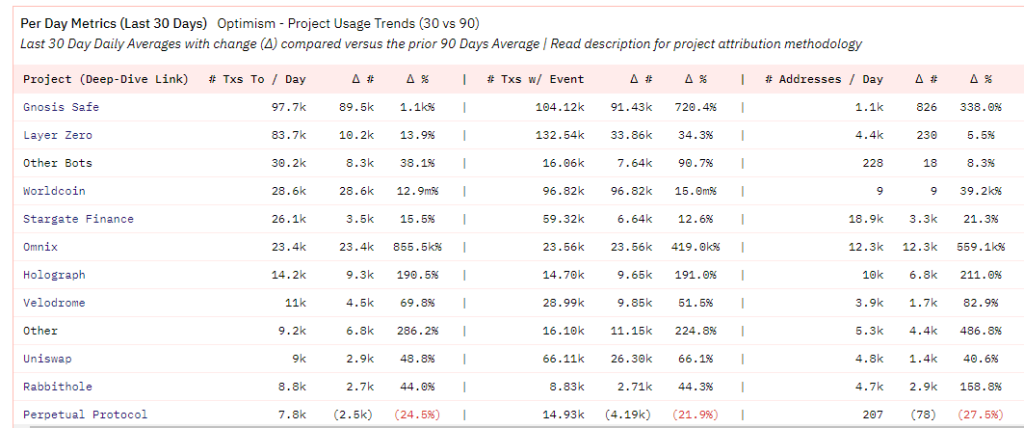

While OP Mainnet metrics progressively advance against Arbitrum, driven in part by a rejuvenation within its own ecosystem, it’s the contributions from new entrants to the Optimism community that have had a pronounced impact A case in point is evident when examining the projects that have contributed the most transactional volume to the OP Mainnet over the last 30 days, where Gnosis Safe contract operations stand out in the top spot, with Worldcoin securing the fourth position.

Intriguingly, a substantial portion of the transactions on Gnosis Safe are initiated by the Worldcoin team. By the end of June 2023, World App had successfully deployed in excess of 300,000 Gnosis Safe accounts. This surge is primarily attributed to the migration of World App accounts to the OP Mainnet.

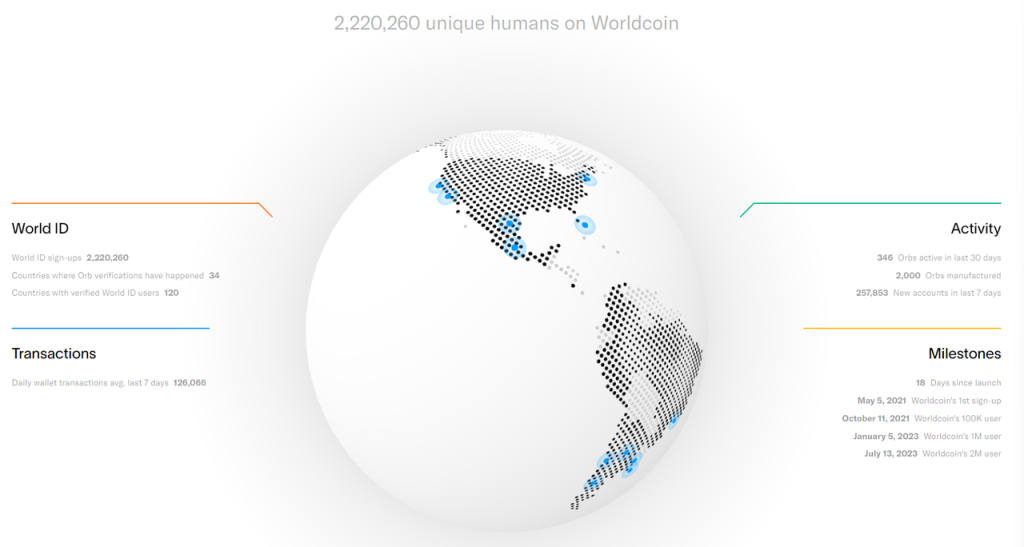

According to data released on Worldcoin’s official site on August 11th, the platform claims a user base exceeding 2.2 million. Remarkably, just in the previous week, they have seen the addition of 257,000 new accounts. World App’s daily transaction count reaches an impressive 126,000, constituting approximately 21% of the total daily transfers across both the OP Mainnet and Arbitrum.

At present, Worldcoin has migrated its ID system and tokens to the OP Mainnet, with future plans to develop an application chain grounded in the OP Stack. This strategic move is anticipated to usher in a wave of active users and developers.

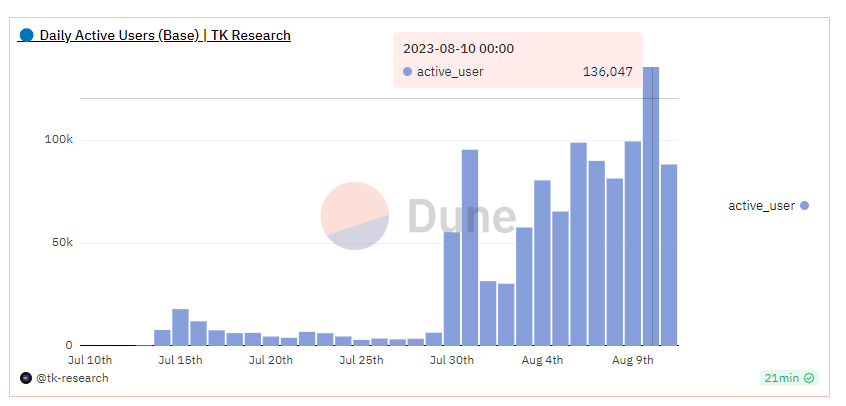

Beyond Worldcoin, the momentum in the wake of Base launch has been nothing short of extraordinary. Coinbase, standing as the inaugural and paramount proponent of the OP Stack, registered a noteworthy 136,000 active addresses as of August 10th. This figure closely mirrors that of the L2 market frontrunner, Arbitrum, which hosts 147,000 addresses.

Among all L1 & L2 smart contract platforms, these metrics are only eclipsed by Tron (1.5M), BNBchain (1.04M), Polygon (0.37M), and Arbitrum (0.14M). Interestingly,, post the official debut of Base on August 10th, the application that made a breakout wasn’t rooted in the conventional domains of DeFi or meme tokens. Rather, it was a socially-oriented application named friend.tech, adding an unexpected twist to the narrative.

Arbitrum’s Dilemma

Arbitrum finds itself in a complex situation owing to its strategic positioning. Although it features a robust L2 mainnet, marked by the stellar performances of Arbitrum One and the superior Arbitrum Nova, it concurrently launched its L3 stack, Orbiter, setting it in competition with OP Stack. However, in an environment where L2 is still in its ascendancy, there’s a reluctance among many to pigeonhole themselves into the L3 category and use Arbitrum one as their primary DA layer. Significantly, projects with substantial industry assets—whether in terms of users, developers, or intellectual property—are often inclined towards building on L2. This preference translates to a higher valuation potential and a broader user outreach.

Indeed, the emergence of platforms like ALTLayer, offering Rollups-as-a-Service (RaaS) solutions, represents a shift in how smaller projects and developers approach the implementation of rollups. ALTLayers offers solutions that simplify the process of building and operating rollups, essentially providing a low-threshold, less-code avenue for integration. They assist users in seamlessly integrating various rollup modules available in the market into diverse programs, allowing for a Lego-like building experience.

Within the diverse array of Rollup options that RaaS platforms offer, Arbitrum’s Orbiter is but one choice among many. Smaller entities, upon evaluating the breadth of available offerings, may opt for more cost-effective L2 solutions, avoiding constraining themselves within an L3 classification.

In this unfolding landscape, despite the marginal lead that Arbitrum One, a standalone L2, holds over its Layer 2 counterparts in transaction volume, it is experiencing a swift decline in market share. This decline is predominantly attributed to both new and existing users transitioning to Optimism-aligned and other diverse Layer 2 ecosystems.

Overall, Optimism leverages its open-source L2 toolkit to create a network effect, attracting users via a B2B2C model. This approach seems to have a competitive advantage over Arbitrum’s solid, but single-chain methodology. If Arbitrum doesn’t reassess and adjust its strategic direction promptly, its position as the preeminent L2 single-chain leader could be at serious risk.

How the Cancun Upgrade Enhances L2 Project Fundamentals

Current Project Valuations for Arbitrum and Optimism

To accurately assess the prevailing valuation metrics of Arbitrum and Optimism, we have leveraged revenue data from the recent quarter and contrasted it against their current market valuations.

Maintaining a constant P/E ratio and considering the projected 90% reduction in L1 costs for Arbitrum and Optimism post-Cancun upgrade (based on the conservative estimates outlined in EIP-4844, forecasting a 90-99% decrease for L2 projects in L1 expenses), the adjusted valuation for $ARB and OP, assuming a consistent L2 pricing model, are detailed below:

The Cancun upgrade results in a substantial decrease in L1 costs, thereby directly contributing to improved profitability and an ensuing increase in project valuations.

The Impact of Cancun Upgrade on L2 Valuation

Indeed, the Cancun upgrade, which brings about a reduction in L1 costs, necessitates a re-evaluation of the L2 fee structure for both Arbitrum and Optimism, as maintaining the current fees is untenable. Consequently, our valuation assessment needs to incorporate two crucial variables:

- To what extent will Arbitrum and Optimism transfer the savings to users by diminishing L2 fees?

- As L2 fees decrease, what magnitude of surge in L2 transactional activity is anticipated?

Based on the assumption that the P/E multiple remains unchanged, the analysis endeavors to deduce the prices of $ARB and OP after the Cancun upgrade based on the alterations in the “Ratio of Cost Savings Transferred to Fee Savings” and “Ratios of Fee Savings to Transfers Increase”.

The fundamental rationale behind the two token price projection tables is:

- The smaller the proportion of L2 users benefiting from the massive cost reductions post the Cancun upgrade, the higher the operational profit for L2.

- The greater the increase in transactional activity due to L2s reducing fees, the higher the operational profit for L2.

Furthermore, given that current gas fees on Optimism are about 30-50% lower than that of Arbitrum, Optimism possesses more flexibility with the decline in L1 costs, giving it greater room to decide how much of the savings it retains. Consequently, it is inferred that Optimism will redistribute between 60-100% of its cost savings to benefit users, while for Arbitrum, this redistribution is likely to be in the range of 70-100%.

If we only consider the impact of the Cancun upgrade on the mainnet chain of Optimism and Arbitrum, their potential for price appreciation seems closely aligned.

Certainly, the analysis outlined above regarding the price sensitivity of Arbitrum and Optimism post-Cancun upgrade follows a relatively linear logic, and there are at least two factors not incorporated in these projections:

- The calculations are predicated on the present project P/E ratios, which have likely already integrated expectations about the Cancun upgrade.

- Post-Cancun upgrade, Optimism is anticipated to introduce a greater quantity of tokens into circulation than it currently holds. If we maintain the assumption that the projected circulating market capitalization remains steady, this influx would naturally infer a decline in the token price.

Despite these caveats, a fundamental axiom persists: as the operational profits of L2 soar, so does the intrinsic value of its tokens, paving the way for the possibility of achieving higher market evaluations. Whether it manifests as a reduction in operational costs or a boost in on-chain engagement,, Cancun upgrade offers tangible enhancements to L2 projects.

The Potential Risks of Optimism

Drawing from earlier discussions, Optimism has seamlessly transitioned from being a single-chain L2 solution to establishing itself as a nexus in the inte-rchain L2 ecosystem, bolstered by the Superchain narrative and the extensive integration of the OP Stack. By leveraging a B2B2C model in collaboration with OP Stack partners, it has onboarded a wider user base. Over the long haul, this positioning grants Optimism more robust network effects, economies of scale, and a coalition of stakeholders sharing mutual interests, presenting a more lucrative business model than Arbitrum. Furthermore, recent metrics suggest that the primary transaction data on the OP Mainnet is progressively narrowing the gap with, if not surpassing, that of Arbitrum. Concurrently, emerging L2 platforms within the OP Stack ecosystems, such as BASE, are witnessing swift growth, intensifying the competition for Arbitrum’s market position.

Given the similar upside potential for the token prices of OP and $ARB, spurred by the Cancun upgrade, the added allure of Optimism Superchain storyline arguably positions it as a more attractive investment target.

Nevertheless, the L2 landscape remains highly competitive. Investors should be aware of the ensuing risks associated with Optimism.

Arbitrum Mulls Over Opening Its L2 License, Echoing Optimism’s Strategy to Capture the User Base

At present, Arbitrum operates under a Business Source License (BSL), constraining partners who wish to utilize the Arbitrum stack for developing their Rollup ecosystems to either secure formal authorization from Arbitrum DAO or Offchain Labs—the driving force behind Arbitrum—or resort to developing on L3 using Arbitrum One. However, with the OP Stack witnessing rapid expansion and significant user adoption in recent months, a sense of urgency is discernible within the Arbitrum community. On August 8th, an Arbitrum team representative, stonecoldpat, spurred a dialogue on the governance forum, inviting community reflections on the pivotal question of “When, and How, Should the Arbitrum Foundation Issue a License for the Arbitrum Technology Stack to a New Strategic Partner”, delineating specific areas of discussion:

- Assessing the community’s perspective on licensing Arbitrum’s code to external entities.

- Discuss the possibility of attaching specific conditions to code authorization licenses.

- Devise an evaluation framework to determine the eligibility of potential licensees.

- Sketching out Short-term and Medium-term Roadmaps for the Above Points:

- In the short term, the intent is to identify and green-light licenses to those partners who satisfy a set benchmark.

- In the medium term, there’s a move to streamline the licensing process. Any project aligned with the conditions can get the license.

The main feedback can be summarized as the following:

“It appears to be a strategic blunder that the Arbitrum Foundation or Offchain Labs have not already issued a license to large strategic partners to use the Arbitrum software stack. This dithering may actually be harming the Arbitrum ecosystem.”

“We have not had any feedback that the Arbitrum Foundation should not issue a license for the Arbitrum technology stack to strategic partners. It has mostly focused on the criteria for doing so, conditions that should be attached to it and allowing the DAO to give its initial input on that process.”

Given the current dynamics, Arbitrum will shift towards an Optimism-like strategy is undeniably on the horizon, positioning itself for a foray into the competitive landscape of the “L2 interchains.” This strategic shift potentially challenges the currently flourishing ecosystem of OP Stacks.

On August 9th, Andre Cronje, the co-founder and chief architect of the Fantom Foundation, during an interview with The Block, revealed that they’re actively evaluating the Optimism L2 solutions. Their scope of evaluation spans both the OP Stack and Arbitrum stack.Given Fantom’s esteemed standing as a foremost L1, it remains improbable that they would acquiesce to functioning as an L3 within Arbitrum. Consequently, Cronje’s mention of the “Arbitrum stack” seemingly refers to the L2 solutions.

The real challenge lies in the timeline: how long will it take for the Arbitrum community and its partners to strike a consensus and subsequently roll out these licenses? By the time they do, what will the competitive landscape look like, and how many pivotal clients will remain up for grabs? The protraction of this process only serves to benefit the OP Stack ecosystem, as more collaborators might lean towards it, further complicating Arbitrum’s dilemma.

The Escalating Heat in the L2 Service Landscape

Beyond Arbitrum and Optimism, the L2 landscape, particularly the ZK-based solutions, is witnessing swift advancements or is queued up for launch. There’s ZKsync, showcasing compelling operational metrics (though somewhat inflated due to airdrop enthusiasts), Linea, fortified by its affiliation with Consensys (with Metamask under its umbrella boasting 30 million monthly users and Infura catering to over 400,000 developers), and the eagerly awaited Scroll, among others. Furthermore, platforms exemplified by Altlayer, offering Rollup as a Service, are paving the way for a seamless integration and operation experience for Rollup developers via service aggregators. By diving directly into the OP Stack’s precursor stages, these platforms could indeed dilute the bargaining prowess within the Optimism ecosystem.

Assessing Value Transmission in the Superchain Ecosystem: Ripple Effects on the Optimism Foundation and the OP Token

Currently, OP lacks a direct mechanism for value capture. Among the myriad of OP Stack adopters, only BASE has explicitly committed to donating 10% of its L2 profits to the Optimism Foundation. Other collaborating projects haven’t provided analogous assurances. Validation of the value capture of OP may be on hold until the launch of its decentralized sequencer protocol and the acceptance degree by OP Stack adopters. Should the community rally behind and integrate a decentralized sequencer protocol collateralized by OP, it would undeniably boost direct demand for OP, culminating in effective value transfer. On the flip side, if other L2 projects persist in maintaining their own sequencer standards and node infrastructure, it might not only hinder the value capture of OP but also weaken the synergies between L2s within the Optimism ecosystem.

Valuation Risk

In the previous section on the valuation of OP, it was highlighted that the forecasted price elevation of OP, attributed to the Cancun upgrade, operates on the assumption that “the PE of Optimism after the upgrade remains consistent with the current level.” Considering that the Cancun upgrade is one of the most anticipated events in the market this year, the current PE valuation of Optimism has more or less priced in this expectation. For those who hold a pessimistic view, they may even believe that the current PE has already priced in the positive impact of Cancun.