Contents

Preamble

Launched in April 2023, Lybra Finance has emerged as a highly talked-about LSDFi protocol, although not without its share of controversy. Questions have arisen over the provenance of its IDO funds, the integrity of its smart contract infrastructure, and cryptic social media hints suggesting a relationship with Lido—a well-known LSD protocol. Moreover, critics from the decentralized finance community have taken issue with the stablecoin design underpinning Lybra Finance, specifically its lack of pegging capability.

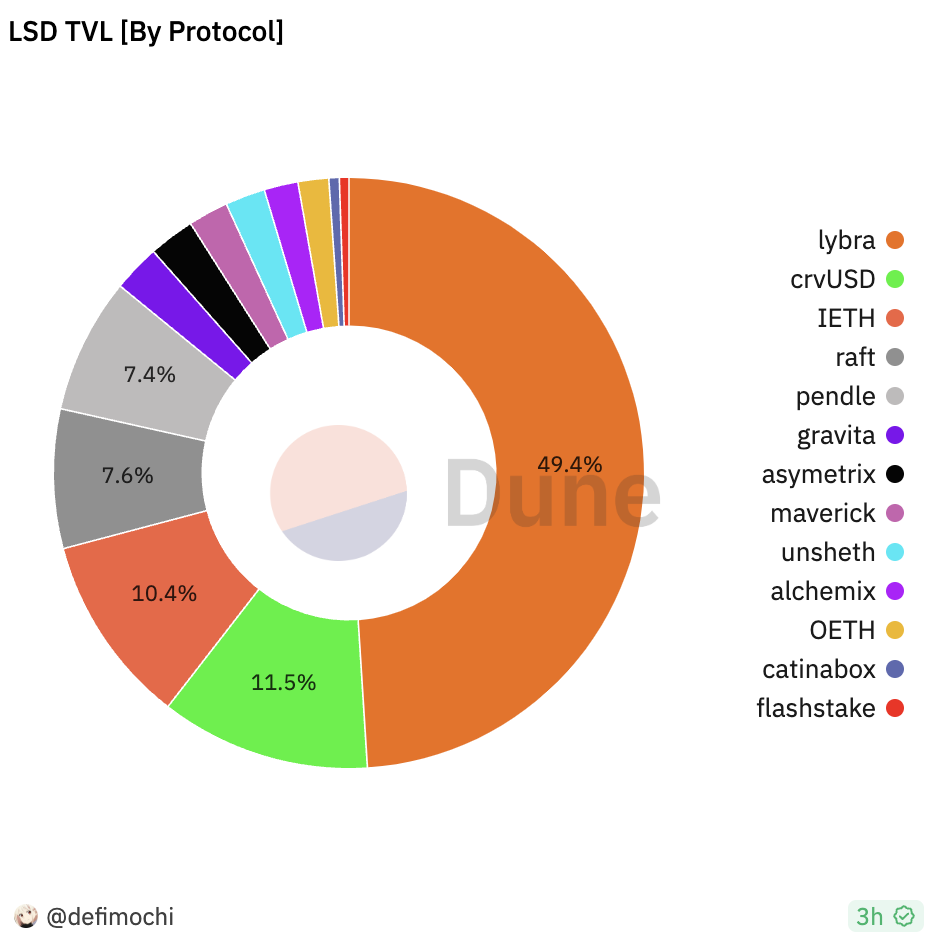

Despite the disputes surrounding it, Lybra’s Total Value Locked (TVL) has rapidly increased, capturing a noteworthy market share in the LSDFi summer.

Additionally, its governance token, LBR, has seen a staggering price escalation—nearly a 20x increase in just over 20 days in May. As of now, the token boasts a fully diluted market capitalization exceeding $150 million.

In this article, we aim to answer a trio of pivotal questions by closely examining the operational framework of Lybra Finance:

- What mechanisms underlie Lybra’s rapid success in the market?

- What challenges is Lybra currently confronting?

- How is Lybra Finance V2 slated to tackle these challenges?

We hope to provide readers with a comprehensive understanding of Lybra Finance and its native stablecoin eUSD.

The insights and opinions presented in this article reflect my views as of the publication date and may contain factual inaccuracies or biases. This article is intended for discussion purposes only, and feedback is welcomed.

The Overview of Lybra Finance

Lybra Finance is a stablecoin protocol featuring its native stablecoin eUSD and governance token LBR.

The history of Lybra Finance is relatively short. Lybra launched their testnet on April 11 and officially rolled out their product on April 24, making it just over three months since its inception.

Managed by an anonymous team, Lybra Finance did not undergo any private fundraising. Instead, it executed a public IDO on April 20, 2023, releasing 5 million LBR tokens, which accounts for 5% of the total supply. The IDO pegged the valuation at 1 ETH for 20,000 LBR, transacting at an aggregate valuation of 5,000 ETH. With Ethereum trading at $2,000 USD at that time, this placed Lybra Finance’s IDO valuation at a robust $10 million, and they raised at $500,000 USD.

Lybra’s TVL has surged rapidly post-launch, crossing the $100 million threshold within a single month. As of now, its TVL has burgeoned to nearly $400 million, ranking it as the 18th largest protocol on the Ethereum network in terms of TVL.

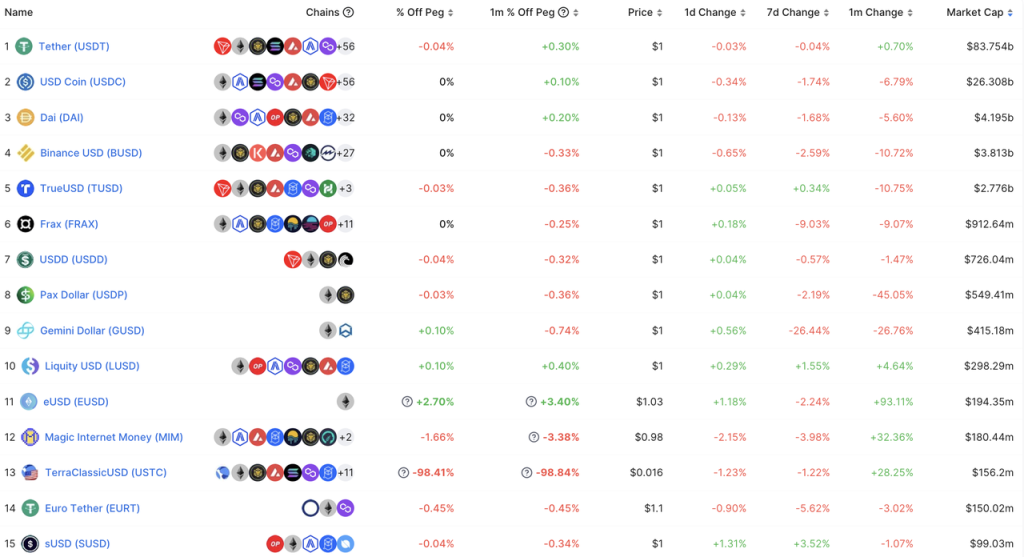

In terms of the stablecoin issuance size, eUSD is already making its presence felt. With a circulating supply nearing $200 million, it has ascended to the 11th position among stablecoins. Especially within the category of decentralized stablecoins, eUSD’s circulation is only surpassed by DAI, FRAX, and LUSD, and behind it there are many well-established decentralized stablecoins such as MIM and alUSD. eUSD has clearly emerged as an unignorable force in the decentralized stablecoin landscape.

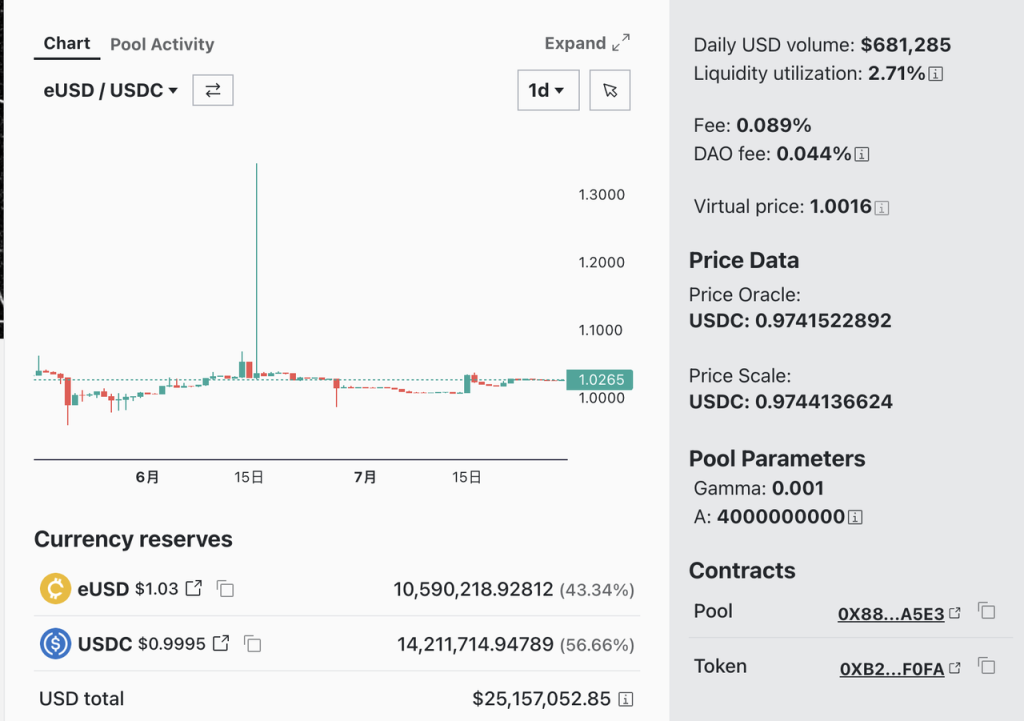

While the Lybra’s Curve pool boasts a liquidity of $25.5 million for eUSD, the stablecoin’s price stability has been under scrutiny. It has sustained a long-term premium state, peaking at $1.36 during a whale-induced buying spree of $900,000 worth of eUSD on June 16th. Though arbitrage actions subsequently re-aligned it closer to its peg, the premium issue remains a pressing concern, which will be further elaborated on in subsequent sections.

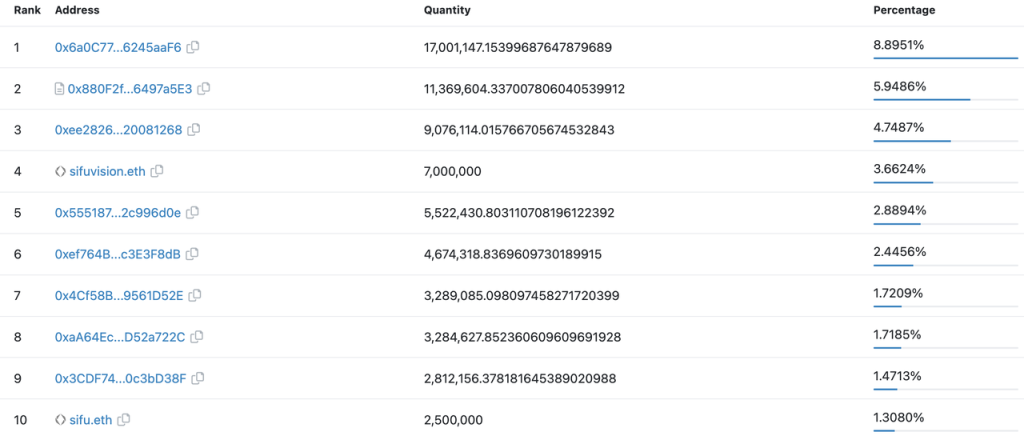

However, currently there are only 829 eUSD holding addresses, and apart from the Curve liquidity pool, the other top10 eUSD holding addresses are all personal addresses, indicating its decentralized token distribution.The on-chain use cases of eUSD are also rare, as most holders predominantly use it for yield generation. This is in part attributed to its current design limitations on composability, a topic to be delved into later in this analysis.

The Core Mechanism of eUSD

In the current V1 framework, eUSD is minted exclusively via an over-collateralization model reliant on stETH. Although Lybra Finance ostensibly supports direct ETH deposits, the back-end mechanics involve the conversion of user-deposited ETH into stETH via Lido Finance. The redeem process is also settled via stETH, making it clear that stETH serves as the central collateral asset for minting eUSD. A minimum collateralization ratio of 150% is mandated, meaning for each eUSD minted, there must be collateral worth at least $1.50 in stETH.

The core mechanism to maintain price stability in eUSD is the Rigid Redemption. This allows any user to redeem stETH valued at $1 USD with 1 eUSD at any time without limitations, subject to a 0.5% fee—which can be changed by Lybra DAO. Given the protocol’s over-collateralized nature, this creates a theoretical price floor for eUSD at $0.995. Similar price stability strategies have been effectively implemented by other protocols like Liquity, thus rendering Rigid Redemption the cornerstone of eUSD price stability mechanism.

In terms of price ceiling, Lybra V1 lacks the ability to restrain eUSD’s price when it hovers above the peg—commonly referred to as the ‘positive premium state.’ This is a major flaw in its current product design and we will explore the details in subsequent chapters.

When it comes to the framework of over-collateralized stablecoin protocols, the design of the liquidation module often emerges as a critical component in ensuring overall system security. A well-structured liquidation mechanism serves as an indispensable complement to an effective price stability mechanism.

On the liquidation front, Lybra has innovatively introduced dual roles: the Liquidator and the Keeper. The former provides eUSD as the liquidation funds, while the latter initiates the liquidation process and 9% of liquidation reward will be distributed to the liquidator and 1% to the Keeper. In order to better protect the deposited collateral, Lybra adopts a “mandatory partial liquidation” feature where the maximum liquidatable amount per transaction is capped at 50%.

Additionally, in a scenario where the system-average collateralization rate falls below 150%, a full liquidation is enabled for users with a collateral ratio less than 125%. This acts as an emergency lever to swiftly restore the protocol’s overall health.

Evidently, Lybra Finance takes its architectural cues from Liquity, particularly in foundational stablecoin mechanisms like minting, redemption, liquidation, and price stability. However, it diverges from being a mere Liquity clone. While adopting Liquity’s redemption and recovery mode, Lybra has opted to remove the stable pool, thereby forgoing certain tokenomics incentives. Instead, the protocol has introduced liquidators into its ecosystem to provide liquidation funds.

*Note: More information about Liquity, you can read “An Overview of the Leading Decentralized Stablecoin: Liquity” and “Liquity: The Emerging Stablecoin Protocol.”

With over two years of smooth operation, Liquity’s core framework has demonstrated robust stability, a factor that has influenced not just Lybra but other LSDFi stalwarts like Raft, Gravita, and Prisma. Lybra Finance, though young with a little over three months of operational history, has thus far exhibited promising performance metrics. Whether it can sustain this trajectory in the volatile world of decentralized finance remains an open question that only time can resolve.

Stablecoin Interest-Bearing Mechanism

Lybra Finance has turned heads by offering a compelling 8% APR on simple holdings of its stablecoin, eUSD, a feature that both serves as a robust user acquisition strategy and represents a notable innovation in stablecoin mechanisms. Let us dive into the interest-bearing mechanism of eUSD.

To fully grasp Lybra’s unique approach, it’s crucial to understand the workings of stETH issued by Lido Finance. stETH is engineered to maintain a 1:1 peg with ETH and generates yield directly from Ethereum’s consensus layer, facilitated by a daily Rebase mechanism. In this model, Lido Finance takes daily snapshots of all stETH holders and their balances on the Ethereum mainnet and distributes stETH “rebases,” or profit, proportionally among all stETH holders. From a user experience standpoint, this leads to a daily increase in the amount of stETH held by each user, mirroring their accruing profits. Conventionally, merely holding stETH is sufficient to earn staking rewards through Lido Finance, and most DeFi protocols that integrate stETH also distribute these earnings to their users.

However, Lybra adopts a completely different design. Upon depositing stETH into the Lybra protocol, any rebase-generated stETH is not allocated back to the original stETH holders. Instead, the protocol swaps this stETH on the secondary market for its native stablecoin, eUSD. These newly minted eUSD profits are then distributed proportionately among existing eUSD holders. Intriguingly, Lybra also skims an annual 1.5% fee off this eUSD issuance, calculated based on the scale of eUSD minted. This fee serves as protocol revenue and is distributed to holders of $esLBR, which are escrowed LBR tokens obtained either through staking or liquidity mining activities within the Lybra ecosystem.

In deploying this approach, Lybra Finance ingeniously ensures that “yields are allocated in accordance with liabilities.” To illustrate this nuanced mechanism, let’s walk through a hypothetical scenario:

Imagine on Day 1, ETH is trading at 2000 eUSD, and stETH offers an APR of 5%:

- Adam deposits 10 stETH into Lybra and mints 7000 eUSD. This sets Adam’s Collateral Ratio (CR) at 285.7%.

- Bob also deposits 10 stETH into Lybra but opts to mint 10,000 eUSD, resulting in a CR of 200%.

- Charlie follows suit, depositing 10 stETH but minting 13,000 eUSD, which leaves him with a CR of 153.8%—precariously close to the liquidation threshold of 150%.

- Adam, wanting to go long on ETH, sells his 7000 eUSD to David in exchange for David’s ETH, so David ends up holding 7000 eUSD;

- Lastly, we have Eric, who holds 10 stETH but chooses not to deposit them into Lybra.

Aggregating these actions, the entire Lybra ecosystem now comprises 30 stETH and 30,000 eUSD, yielding a system-wide CR of 200%.

Fast forward to Day 2, and the 30 stETH generates an additional 0.0041 stETH based on the 5% APR. Lybra then swaps this extra stETH for 8.219 eUSD and distributes it among Bob, Charlie, and David, corresponding to their eUSD holdings.

- Adam, having offloaded his eUSD to David, receives no new eUSD, rendering his Day 1 APR effectively 0%.

- Bob holds 10,000 eUSD and is allocated an additional 2.74 eUSD. This results in a Day 1 APR for Bob of 5%, calculated as [2.74*365/(10*2000)]. Factoring in Lybra’s 1.5% annual fee, his projected annual yield would be 3.5%.

- Charlie, with his 13,000 eUSD, gains an extra 3.56 eUSD, culminating in a Day 1 APR of 6.5%, calculated as [3.56*365/(10*2000)].

- David, the new holder of 7000 eUSD, receives 1.92 eUSD, which gives him a Day 1 APR of 10%, calculated as [1.92*365/7000]. It’s crucial to note that the denominator in David’s APR calculation differs from that of Bob’s and Charlie’s.

- Eric, who opted not to partake in the Lybra ecosystem, still realizes his 5% stETH yield.

From the above example, several key insights emerge:

- Firstly, disregarding the Lybra fee for the moment, the formula to calculate the APR for eUSD for individual minters can be defined as: APR (eUSD) = (APR of stETH / Individual CR) * System CR. Under the assumption that the stETH APR and the System CR remain stable in the near term, the formula suggests that users can elevate their personal APR by diminishing their personal CR. However, it’s a double-edged sword: a lower CR corresponds to higher returns but concurrently increases the susceptibility to liquidation risks due to market volatility. In addition, current eUSD minters can earn esLBR incentives, based on the proportion of eUSD they’ve minted. This esLBR-generated APR is estimated to be around 20%, computed from the quantity of eUSD minted, and serves as a compelling carrot to encourage more users to mint eUSD.

- David, the individual who reaped the highest returns, actually never minted any eUSD himself. Nevertheless, the same return formula applies to him, albeit with a CR of 100%. The yield David garnered—calculated as (stETH APR * System CR)—serves as the theoretical maximum one can earn by simply holding eUSD. Interestingly, this is the APR promoted on Lybra Finance’s official website, presently standing at 8.54%. Unlike conventional stablecoin protocols, Lybra uniquely incentivizes users to minimize their eUSD minting and maximize their eUSD holdings to tap into this higher yield. For eUSD minters, it’s important to note that their personal CR can’t dip below the 150% threshold. As a consequence, their theoretical return ceiling is circumscribed by the formula: stETH APR * System CR / 150%.

- Lastly, a comparative look at Bob and Eric highlights that when an individual’s CR is in sync with the System CR, the Lybra fee and potential liquidation risks render eUSD minting less financially beneficial than simply maintaining a stETH position.

The advantages of Lybra’s design are indisputable: it provides a compelling use case for their stablecoin eUSD – interest-bearing. In today’s DeFi ecosystem, the dominant utility for decentralized stablecoins is primarily as “yield farming instruments,” overshadowing their foundational role as unit of account and mediums of exchange. Even MakerDAO, the first-mover in the decentralized stablecoin ecosystem with extensive network effects, has pivoted towards offering an interest-bearing variant, sDAI, which touts an APR of up to 8%. This strategic move is aimed at reversing the platform’s diminishing TVL and stablecoin circulation. Meanwhile, eUSD, which currently offers an annual yield ranging from 7.5% to 8%, successfully plays its role as a yield-farming instrument.

It’s not uncommon in the realm of over-collateralized stablecoins to redistribute profits generated from collateral assets. The underpinning logic is straightforward: over-collateralization is designed as a safety buffer to maintain the protocol’s integrity. Yet, it’s financially inefficient to have large sums of premium collateral sitting idle within the ecosystem. The resolution to this inefficiency rests in generating yields on these collateral assets. It’s a win-win scenario: Users not only acquire stablecoins but also receive additional yields, while the protocol can fairly extract a slice of the yield as revenue.

For instance, Alchemix Finance, a project backed by Andre Cronje, often referred to as the “godfather” of DeFi, upon its launch in early 2021, introduced alUSD, a stablecoin with a unique “automated loan repayment” feature. The fundamental mechanics behind this innovation involve deploying user-deposited stablecoins into Yearn Finance to earn yields. The accrued yield is applied to automatically pay the loans. Alchemix extracts a 10% share of these returns as protocol revenue. Their subsequent product, alETH, follows a similar paradigm. By leveraging the yield generated from the collateral, it not only automatically repay the loans but also satisfies the liquidity demands of yield-bearing assets holders, such as DAI or wstETH.

To illustrate the differentiated strategies among DeFi stablecoin protocols, let’s consider MakerDAO. MakerDAO deploys USDC held in its Peg Stability Module (PSM) to purchase a variety of Real World Assets (RWAs). The returns on these RWAs serve as a revenue pool for MakerDAO’s operational needs, get distributed to sDAI holders, and also function as liquidity provisions for its governance token, MKR—essentially facilitating a partial token buyback.

Contrastingly, Lybra Finance adopts a unique paradigm that diverges from both Alchemix and MakerDAO. Lybra capitalizes on the interest-bearing assets of the users and realigns the generated yield back to those assets. Skeptics argue that this setup is merely a redistribution of the original stETH yields, pointing out that depositing stETH in Lybra doesn’t generate any incremental yield but incurs a 1.5% protocol fee. This creates a negative-sum game amongst all eUSD minters. While these criticisms hold weight in the absence of other incentives, they overlook the dynamism of the contemporary DeFi landscape. Various yield farming prospects essentially sustain the stablecoin’s liquidity, usually through the governance tokens of the parent stablecoin protocol (although leading stablecoins like DAI sometimes also harvest additional yield via tokens from external projects). When protocol incentives are factored in, the Lybra ecosystem demonstrates resilience and operational viability, just like the current state of Lybra.

For users who are pure stablecoin holders—distinct from those who mint and then hold—the Lybra model makes their yield more “organic.” Returns are credited directly in the native stablecoin, eUSD, without mandatory lock-up periods or the complex management of a plethora of tokens. One simply needs to hold eUSD, and the returns accrue automatically, simplifying the entire yield-generation process.

Lybra’s design appears strategic in its aim to create a closed-loop ecosystem. By offering a high-interest stablecoin, the protocol first stimulates demand via its built-in mechanisms rather than relying solely on token incentives. Once demand is established, early-stage incentives for the supply side—primarily targeting stETH holders—help to sustain and expand the system.

Indeed, this design also brings a series of issues. For example, the rebase feature of eUSD makes it challenging to integrate into other DeFi protocols and is not convenient for cross-chain transactions, and significantly affects the composability of eUSD.

Moreover, to some extent, Lybra situates eUSD minters in a kind of “prisoner’s dilemma.”

As we mentioned above, individual APR = stETH APR / personal CR * system CR, and the stETH APR is an external parameter that cannot be adjusted, leaving users to focus on two primary strategies for increasing their returns: lowering their personal Collateral Ratio (CR) and/or elevating the system-wide CR.

In the previously cited example, Charlie achieved the system’s average yield by maintaining a collateral ratio (CR) of 200%—essentially mirroring the baseline returns of stETH, albeit without accounting for Lybra’s commission. Given that Lybra’s liquidation CR threshold is set at 150%, Charlie is exposed to a downside risk of a 25% depreciation in stETH value to sustain these baseline returns. Should the value of stETH fall beyond this 25% margin, Charlie risks liquidation and stands to lose his stETH holdings.

However, consider a scenario where the system-wide CR is elevated to 300%. In this case, Charlie could adjust his personal CR to align with the system average, thereby securing the stETH baseline return while extending his downside risk buffer to 50%. While both approaches yield the baseline stETH returns, the latter strategy provides Charlie with a considerably larger risk cushion, making it a more favorable option.

On a macroeconomic scale, if all minters collectively sustain a high collateral ratio (CR), the ecosystem achieves uniformity in returns, while simultaneously enhancing risk tolerance for all participants. However, at the micro-level, individual minters are incentivized to minimize their own CR to optimize personal returns. This dynamic sets the stage for a strategic game where minters collectively lower the system CR. The paradoxical outcome is a decrease in the collective risk-bearing capacity of the system, while the aggregate returns for participants remain static.

This interplay of incentives pales in comparison to a more immediate concern: the issue of eUSD trading at a premium. Under the architecture of Lybra V1, the protocol utilizes the daily stETH earnings generated by all collateral to buy eUSD on the secondary market. These purchases are then distributed amongst eUSD holders, thereby creating a constant buy-side pressure for eUSD. While Lybra’s mandatory redemption mechanism effectively tackles the scenario where eUSD drifts below $1, the protocol lacks the tools to correct an upward deviation. Consequently, eUSD has been observed to trade at a modest but persistent premium. Although the extent of this de-pegging is relatively minimal, the investment rationale weakens considerably when one considers the low risk-reward ratio of purchasing an asset projected to yield 7.5% annually at a 3% premium. From a structural standpoint, this dampens the allure and potential for broader adoption of eUSD.

Tokenomics

The governance token of Lybra Finance is LBR, with a total supply of 100 million and will be allocated as below:

- 60% of the tokens are allocated to the mining pool, forming the backbone of protocol incentives. This tranche will fuel rewards for eUSD minters, liquidity providers in the eUSD-USDC and those in the LBR-ETH liquidity pool.

- 8.5% of $LBR is allocated to the team with a 6-month cliff, then linearly vesting over the subsequent 2 years.

- 5% of $LBR are allocated to advisors with 0% at TGE and then 10% after a one-month cliff, followed by linear vesting over 1 year.

- 10% of $LBR are designated for ecosystem incentives, with 2% unlocked at TGE and the remaining portion linearly vested over two years.

- 10% of $LBR are retained in the protocol treasury with linearly vesting over 2 years after TGE.

- 5% of $LBR are allocated for the IDO, raising a total of 500,000 USD.

- 0.5% of $LBR is allocated as rewards for those who make it onto the IDO’s whitelist.

Based on current data from Coingecko, the circulating supply of Lybra Finance’s governance token, LBR, stands at approximately 11.78 million, making up 11.78% of the total supply.

The primary utility of LBR is encapsulated in its escrowed form, known as esLBR, which serves as the medium for distributing mining rewards within the protocol.

esLBR cannot be traded or transferred but can share in protocol earnings (i.e., a 1.5% annual deduction from the scale of eUSD). Users can redeem esLBR to LBR through a 30-days linear vesting or stake LBR for esLBR to receive multiple liquidity rewards and share in protocol earnings. Additionally, esLBR also has the function of participating in protocol governance.

As Lybra Finance prepares to launch its V2, substantial revisions are in the pipeline for its reward distribution framework. We will elaborate on details in subsequent coverage.

Lybra V2

Lybra V2 went live on the testnet, with detailed documentation available for public review. The smart contract audit is being conducted by Halborn and the new version is expected for a live release no earlier than the end of August.

Concerning the particulars of V2, Lybra Finance has provided an illustrative diagram to delineate the upgrades.

In summary, some of the key highlights include:

Firstly, Lybra V2 will issue a new stablecoin, peUSD, and will expand its support for more Liquid Staking Tokens (LSTs).

Broadly, the DeFi market offers two categories of LSTs. First are the ‘rebase’ types, such as stETH and sETH issued by Stakewise, which Lybra already supports seamlessly. The second category is what’s termed as ‘value-accumulating’ LSTs, which include rETH from Rocket Pool, cbETH from Coinbase, wBETH from Binance, swETH from Swell, and wstETH from Lido. Here, the quantity of tokens remains static. However, the underlying value—expressed as the exchange rate between the LST and ETH—steadily increases over time. Take rETH as an example: when you hold this asset, the number of rETH tokens in your portfolio doesn’t change. What does change is the amount of ETH you can swap each rETH for, effectively accruing value over time. This fundamental difference means that the Lybra protocol’s eUSD cannot accommodate the unique yield mechanics of value-accumulating LSTs.Recognizing this, Lybra has engineered a novel stablecoin—peUSD (pegged eUSD), which can be minted by ‘value-accumulating’ LSTs. The framework for peUSD closely mirrors that of eUSD in terms of price stability, liquidation mechanism, and fee structures. The key distinction is that peUSD is not an interest-bearing stablecoin. Holding peUSD does not automatically yield returns because the value accumulated by the collaterals still belongs to the users. However, if one opts to wrap eUSD into peUSD, the resulting peUSD will still inherit eUSD’s rebase-generated returns.

By issuing peUSD, the composability of Lybra can be significantly enhanced. On one side, peUSD offers enhanced stability, setting the stage for seamless integration with other DeFi protocols. On the other hand, the design of peUSD allows Lybra to bring ‘value-accumulating’ LSTs under its collateral list—a feat that was previously unattainable. This enables Lybra to achieve a comprehensive coverage of all LST categories. Moreover, under Lybra’s blueprint, eUSD reserves held in peUSD are earmarked to facilitate flash loan services which will amplify the yield for eUSD holders. However, the protocol’s two-tiered stablecoin approach isn’t without its challenges. The introduction of peUSD raises the cognitive threshold for users navigating between eUSD and peUSD—two related, yet fundamentally distinct, stablecoin mechanisms. This complexity may act as a friction point, potentially impeding user adoption. If utility and composability are channeled primarily through peUSD, then eUSD risks becoming a yield-generating asset with a sole focus on a 7.5% annual return. Any other financial maneuver, such as leveraging, would necessitate holding peUSD instead. The source of this yield, in such a case, would rely exclusively on LBR token incentives. While lucrative, such a model might call into question the sustainability of eUSD, framing it as a high-yield product primarily sustained by governance tokens—a situation that uncomfortably echoes the mechanics of a Ponzi scheme.

Lybra V2 is introducing significant changes to its reward structure, featuring two new bounty programs: Advanced Vesting Bounty and Dynamic Liquidity Provisioning (DLP) Bounty. These new mechanisms are inspired by Radiant’s V2, a lending project native to the Arbitrum network.

Under the revamped V2, the vesting period for esLBR tokens will be extended from 30 days to 90 days. However, users can still opt for early unlocking with a penalty ranging from 25% to 95%, depending on the remaining vesting period. The fees collected from this early unlocking process will contribute to the “Advanced Vesting Bounty.”

As for the DLP Bounty, to fully unlock their esLBR rewards, users must maintain a liquidity provision ratio of at least 5% in the LBR/ETH liquidity pool. Should users fall below this threshold, their esLBR rewards will be converted into a DLP Bounty.

Lybra V2 introduces an intriguing utility for esLBR obtained from both Advanced Vesting Bounty and DLP Bounty programs. These esLBR tokens can be acquired at a discounted rate using LBR or eUSD. LBR tokens will be permanently removed from circulation—essentially “burned”—while the eUSD will be funneled into a newly established Stability Fund, details of which are to follow.

The esLBR obtained from Advanced Vesting Bounty and DLP Bounty allows users to purchase with LBR/eUSD at a discounted price. LBR tokens will be permanently burned while the eUSD will be funneled into a newly established Stability Fund, details of which are to follow.

With the implementation of Advanced Vesting Bounty and DLP Bounty, Lybra V2 aims to closely align the acquisition of protocol incentives with the long-term development and health of the system. However, the high level of friction introduced by these new tokenomic adjustments might pose a challenge to the overall user engagement and mining activity.

Libra V2 brings forth a series of improvements focused on the price stability of eUSD. The existing interest-bearing mechanism utilizes stETH earnings to buy eUSD from the secondary market, thereby perpetually driving demand for the token. In V2, Lybra has introduced two additional methods to address the issue of eUSD trading at a premium:

- Firstly, the introduction of a “Premium Suppression Mechanism” marks a bold intervention in the market dynamics. Should the eUSD/USDC exchange rate breach the 1.005 threshold—indicating a premium of over 0.5%—the protocol will divert the daily stETH earnings into USDC instead of eUSD. This USDC will then be disbursed to eUSD holders. The objective is to reallocate the relentless purchasing pressure from eUSD to USDC, thereby mitigating the upward price drift of eUSD over the long haul.

- Secondly, Lybra rolls out a “Stability Fund.” This fund will be populated through the discounted purchase of esLBR tokens using eUSD. Acting as a reservoir of eUSD, the Stability Fund provides an additional layer of control to rein in eUSD’s price whenever it reaches an unsustainable premium. Through the Premium Suppression Mechanism and the eUSD deposited within the Stability Fund, the issue of eUSD trading at a premium should be adequately addressed. Combined with the rigid redemption mechanism that provides the floor price for eUSD, this may potentially maintain the price stability of eUSD.

Overall, Lybra V2 aims to resolve key operational issues: poor composability of eUSD, the inability to expand the product model to value-accumulating LST, and the difficulty in recovering eUSD from trading at a premium, all of which were exposed during the operation of V1. The update is highly targeted and also attempts to closely align the LBR token incentives with the long-term development of the protocol.

Two stablecoins designed with distinct mechanics could potentially hinder user adoption and engagement. Moreover, peUSD’s advantage in composability could inadvertently relegate eUSD to an awkward niche within the ecosystem.

Summary

Among the new LSDFi projects, despite its comparatively modest beginnings—complete with a lack of institutional backing, the lowest capital raise at $500,000, and ongoing narratives of FUD—Lybra has emerged as a standout performer in the LSDFi space. The protocol boasts the highest TVL and market cap among its peers, along with an expeditious business development trajectory. Notably, while its first version (V1) is already operational, its anticipated V2 is in advanced testnet stages. This is a witness to not only the Lybra team’s operational and business development ability but also the inherent product-market fit.

What sets Lybra apart in an increasingly crowded LSDFi market is its genuine innovation in the distribution of staking earnings. Unlike rivals that merely tinker around the edges of existing stablecoin architectures, Lybra offers stablecoins with a compelling APR of roughly 8%. This robust demand is further bolstered by a supply mechanism intelligently governed by token incentives, a scheme that has accelerated its growth. For stablecoin holders, the allure is clear: Lybra’s APR not only competes favorably but does so sustainably, unlike many protocols that solely rely on the native token incentives. It’s a crucial differentiator that could serve as the bedrock for its long-term competitive edge.

Yet, Lybra Finance faces a pivotal challenge: to transcend its current scope and leverage its $200 million market cap into more diversified use cases. While the stablecoin has already etched a compelling narrative in the competitive landscape of decentralized stablecoins, it lags behind its peers like FRAX, LUSD, alUSD, and MIM in terms of utility. If peUSD, Lybra’s innovative offering, fails to diversify these use-cases in subsequent updates would risk relegating Lybra to the status of a sophisticated yet fundamentally limited “mining game,” a complexity that would only intensify with the launch of V2.

Nevertheless, Lybra Finance has solidified its standing as a robust player in the LSDFi arena. While its current limitations may curtail immediate growth prospects, they also provide the framework for the project’s subsequent stages of evolution.