This Clip delves into the battle between the premier decentralized exchanges (DEXs) within zkSync, a rapidly expanding Layer2 ecosystem. The clip aims to address the ensuing questions:

- What makes the zkSync and its DEX ecosystem noteworthy for investors?

- How is the current landscape of DEX projects operating on zkSync?

- In the face of fierce competition, how do these rival projects measure up in terms of product quality and edge, and who is most likely to claim the vanguard?

Contents

What makes the zkSync and its DEX ecosystem noteworthy for investors?

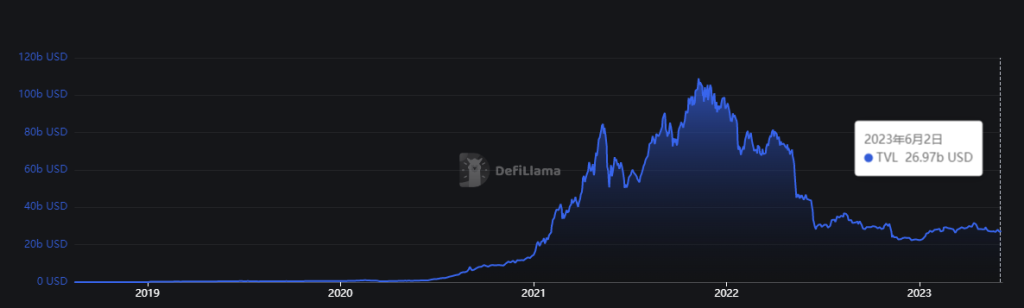

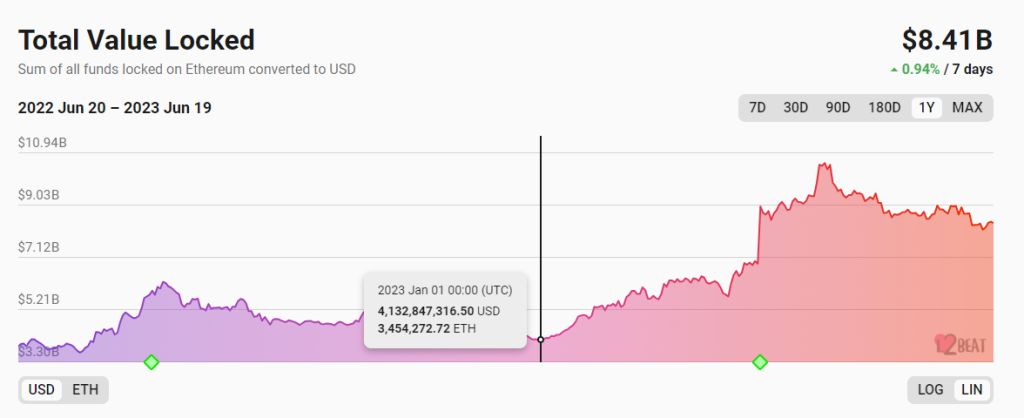

In 2023, the Layer 2 blockchain ecosystem, including zkSync, has seen significant growth in Total Value Locked (TVL), overtaking Ethereum in aggregate transactions per second (TPS), indicating increased activity.

The forthcoming Ethereum Cancun-Deneb upgrade could further drive Layer 2 adoption by reducing costs. Within this landscape, zkSync has emerged as a key player in ZK-Rollup projects, with TVL and active users consistently growing since its launch, making it the third largest Layer 2 and largest ZK-Rollup project by TVL.

On the Decentralized Exchanges (DEXs) front, zkSync is experiencing expansion in users, TVL, and developers.

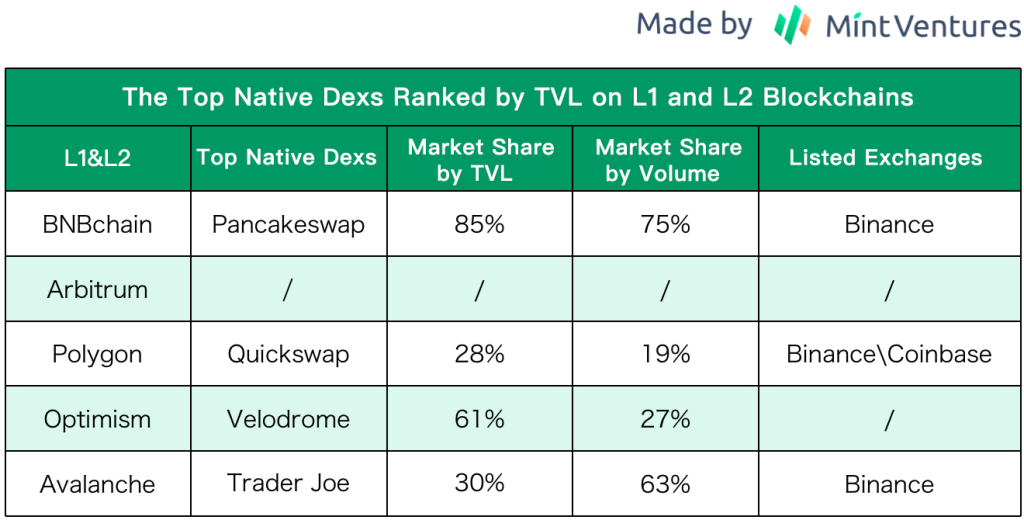

Though the market structure remains fluid, it’s predicted that zkSync, like other Layer 1 or 2 ecosystems, will house a single dominant DEX. This DEX will have competitive advantages including enhanced brand recognition, business advantages, and higher organic exposure. The challenge remains to identify the future leading native DEX on zkSync.

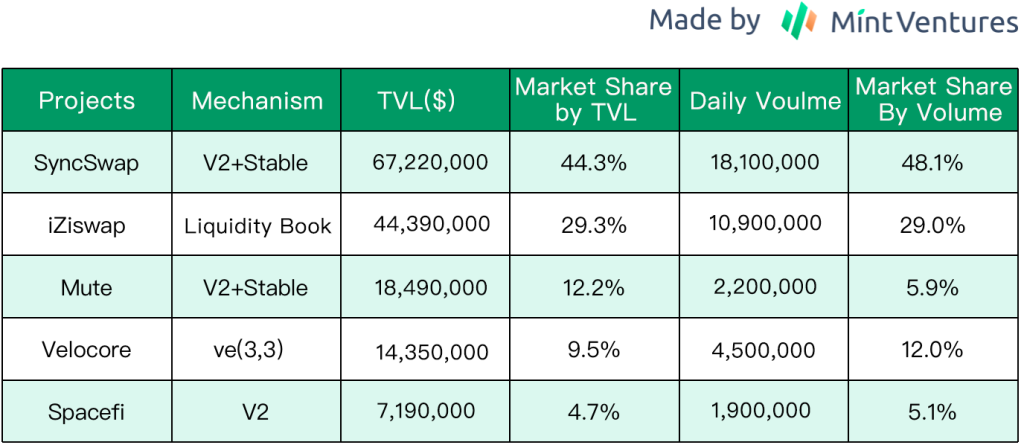

The zkSync ecosystem currently hosts a range of Decentralized Exchange (DEX) projects, with SyncSwap, Mute, and Velocore standing out due to their deployment of the V2 dynamic pool + stable pool model. The two frontrunners based on total value locked (TVL) and trading volume are SyncSwap and iZiswap, either of which is likely to secure the top DEX position in the future.

Syncswap vs iZiswap

Syncswap

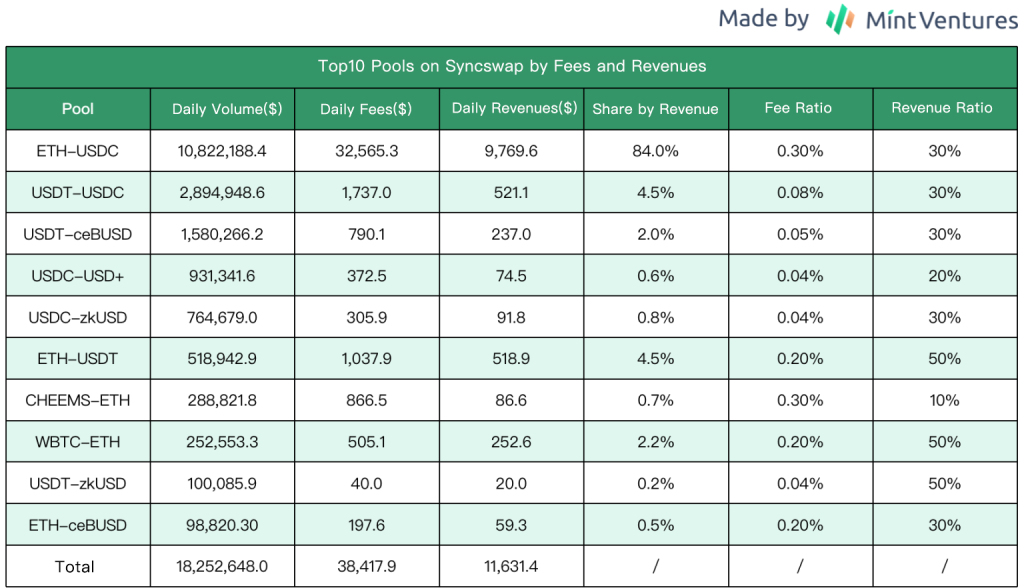

SyncSwap employs a popular multi-pool mechanism with a Classic Pool and a Stable Pool. Its so-called “Dynamic Fees” mechanism is not genuinely dynamic but highly customizable. It includes variable fees, directional fees, fee discounts, and fee delegates. SyncSwap’s monthly and weekly trading volumes have been robust, with a significant majority share of 60.8% attributed to the ETH-USDC pool.

SyncSwap’s total liquidity stands at $67.61 million, with the ETH-USDC Pool accounting for 84.5%. The protocol revenue is mainly sourced from ETH trading pairs, comprising 90.6% of the total. Despite not issuing tokens yet, SyncSwap has introduced details about its upcoming SYNC token, adopting some elements from Curve’s ve model.

However, SyncSwap’s team remains anonymous, and no information about any financing activities is available. Additionally, the project’s tokenomics are still partially undisclosed. Nonetheless, SyncSwap remains a promising player in the zkSync ecosystem and continues to demonstrate its capacity to generate positive returns.

iZiSwap

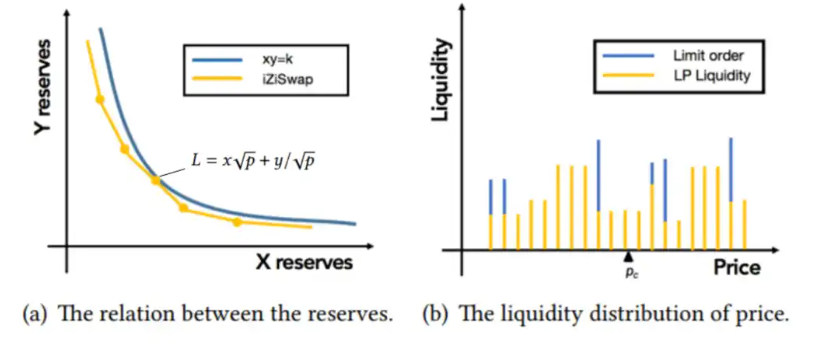

iZiSwap is a decentralized exchange product of iZUMi Finance, a DeFi protocol offering unique Liquidity as a Service (LaaS). The platform includes innovative services such as LiquidBox, an efficient liquidity reward service utilizing Uniswap V3’s concentrated liquidity mechanism, and iZUMi Bond, a financing solution similar to traditional convertible bonds. iZiSwap implements a Discretized Concentrated Liquidity (DL) mechanism in its Automated Market Maker (AMM) model, coined DL-AMM. The DL-AMM model distributes liquidity across various price points, each adhering to a constant sum formula, a deviation from the standard constant product formula commonly used in AMMs.

Two forms of liquidity exist on iZiSwap: LP (Liquidity Provider) liquidity and Limit Order liquidity. In a dual-token liquidity model, limit orders are reimagined as one-sided liquidity inputs. iZiSwap also offers a user-friendly trading interface known as iZiSwap Pro, providing a traditional trading experience within a decentralized setting.

iZUMi has also introduced LiquidBox, which offers three different liquidity allocation options: One-sided Mode, Fix Range Mode, and Dynamic Range Mode. All active LiquidBoxes currently opt for the dynamic model.

In terms of trading volume and user base, iZiSwap has accumulated significant trading volume and maintains a robust user base, which is still growing.

iZiSwap’s dashboard provides a comprehensive view of the fees and revenues associated with each pool. Here, I present a ranking of the top 10 pools based on weekly fees and revenues.

The native token of iZUMi is IZI, with a total supply of 2 billion tokens. The IZI token offers governance voting, staking rewards, and yield boosting opportunities for holders. iZiSwap represents a significant revenue stream within the iZUMi ecosystem, with its operations on the zkSync network serving as a key strategic component.

Conclusion

In the race for dominance in the zkSync-based DEX market, SyncSwap and iZiSwap have adopted different strategies, with SyncSwap adhering to a more traditional approach in product and system design, offering modest but effective innovations. On the other hand, iZiSwap has ventured into more distinctive product explorations, although the efficacy of these in driving user growth and asset accumulation remains to be seen. From a business metrics standpoint, SyncSwap currently enjoys a definitive advantage in terms of Total Value Locked (TVL) and trading volume. The anticipated token distribution and project airdrops have generated significant interest in SyncSwap, resulting in lower operating costs compared to iZiSwap, which still grapples with daily token incentive expenses.

However, a common hurdle that both contenders face is the limited number of zkSync’s native projects with substantial traction, given its relatively recent emergence as a layer2 solution. Consequently, the bulk of the liquidity and trading volume for both DEXs is still tied to ETH.

Looking forward, it is expected that an increasing number of native projects will make their debut on zkSync. The burning question remains, however, as to where these projects will choose to launch their initial liquidity – the commercially superior SyncSwap or the more mechanically innovative iZiSwap? This adds an intriguing layer to the existing competition. Adding to the mix, Uniswap announced in October 2022 its plan to launch V3 on zkSync, which could potentially disrupt the market at any moment, further amplifying the competitive pressure.

It is an exciting time for the industry, and we look forward to monitoring these developments closely.