This Clip shines a spotlight on MakerDAO, a leading force in the Real-World Assets (RWA) sphere and a blue-chip project in the DeFi sector that has recently been the subject of substantial attention. Delving into the internal and external factors contributing to the rise of $MKR price, we offer a comprehensive assessment of the strengths, challenges, and concealed long-term risks that evaluate MakerDAO’s business landscape.

The insights and opinions presented in this article reflect the author’s views as of the publication date and may contain factual inaccuracies or biases. This content is intended for discussion purposes only, and feedback from fellow investment researchers is welcomed and encouraged.

Contents

The Revival of $MKR Price: A Result of Multiple Resonating Factors

In the recent dynamics of the crypto market, established DeFi projects like Compound and MakerDAO have shown clear signs of price recovery, with these two experiencing the most significant gains. While Compound’s surge can be partly attributed to its founder Robert Leshner’s renewed involvement in the RWA field, this event has had limited impact on Compound’s underlying fundamentals. Thus, $COMP price increase can be more aptly described as a “flash in the pan,” offering limited value for serious analysis.

Contrarily, the rise of MKR is driven by a complex combination of both internal and external factors. These include a turning point in the underlying business fundamentals and the gradual maturation of the long-term vision laid out in the Endgame plan.

The resurgence in the price of $MKR can be attributed to several factors:

1. MakerDAO’s monthly expenses have witnessed a substantial decrease, dropping from the previous levels of $5 to $6 million down to approximately $2 million in June.

Source: MakerBurn

2. By shifting collateral from non-interest-bearing stablecoins to treasury bonds or stablecoin financial products,MakerDAO has markedly improved its anticipated revenue, reflected in a decrease in the PE ratio. According to data from MakerBurn, MakerDAO’s forecasted annual revenue from RWA alone reaches an impressive sum of nearly $71 million.

3. The founder of MakerDAO, Rune’s actions of selling LDO and other tokens in the secondary market, along with the continued buyback of $MKR over several months, have significantly bolstered market confidence.

4. Through governance decisions, the threshold for buyback funds from the System Surplus pool has been reduced from $250 million to $50 million. The current available funds in the System Surplus stand at $70.25 million, with around $20 million allocated for token buyback. However, MakerDAO’s buyback mechanism has shifted from “buyback and burn” to “buyback and market-making.” Therefore, the actual amount for $MKR buyback is $10 million, while the remaining $10 million in DAI will be used to provide liquidity for $MKR on Uniswap v2, existing in the form of LP (Liquidity Provider) tokens within the treasury assets.

Since last year, when Rune Christensen, the founder of Maker, introduced the Endgame Plan for MakerDAO, the grand vision laid out in his narrative has not only bolstered investor confidence but also spurred a fresh wave of buy-ins, driven by the alignment of improved business performance and the rebound of $MKR price.

The ultimate goal of MakerDAO’s Endgame Plan is to realize its vision of a “Unbiased Stablecoin.” This ambition entails optimizing the governance structure and funding promising SubDAOs to drive forward this transformative agenda.

Moreover, the narrative surrounding RWA seems to have recently caught the market’s attention. Though only a few projects have launched tokens that specifically revolve around this emerging sector, the discussion and hype around RWA have noticeably heated up, attracting positive views and interest from numerous investment institutions.

The recent increase in $MKR price is the result of a combination of both internal and external factors, with the internal ones serving as the primary catalyst. Regarding the promotion from the narrative around RWA, I tend to believe that it is MakerDAO’s practical implementation and favorable interim results in the RWA business that have driven the development of the crypto market’s RWA narrative, rather than the other way around.

The Nature of MakerDAO’s Business

How should we view the long-term impact of these factors on MakerDAO? Can these positive elements propel Maker to a new level, achieving its grand vision of creating a “World Fair Stablecoin”?

This is a complex issue, and understanding it requires an examination of the underlying logic of MakerDAO’s business.

MakerDAO’s core business remains consistent, positioning itself alongside stablecoin giants like USDT, USDC, and BUSD. The principal goal revolves around deriving “seigniorage” from the issuance and management of its own stablecoin.

The term “seigniorage” can be defined as profit made by a project via issuing currency. Different stablecoin projects employ various methods to acquire this seigniorage revenue. For example, Liquity, another decentralized stablecoin protocol, charges users a 0.5% fee when minting its stablecoin LUSD. Meanwhile, Tether charges a 0.1% fee or $1000 when depositing or withdrawing USD.

Furthermore, Tether actively manages the US dollars deposited by users, strategically investing in highly liquid assets such as treasury bonds, reverse repurchase agreements, or money market funds. This approach seeks to earn financial income on the asset side of its balance sheet.

One of DAI’s former primary sources of income was the Stability Fee, a borrowing interest paid by users who minted DAI through collateralization. However, MakerDAO later adopted a strategy more akin to Tether, transitioning collateral like USDC within its PSM (Peg Stability Module) to yield-generating assets such as treasury bonds, or depositing USDC in Coinbase to earn rewards.

However, the crux of the stablecoin protocol hinges on broadening the demand for stablecoins. A high level of newly-minted token must be sustained to acquire adequate collateralized assets, enabling the realization of financial revenue through the judicious management of these available resources.

Moreover, the difference between DAI, USDT, and USDC lies in its decentralization. The unique value that sets DAI apart is its “enhanced resistance to censorship and reduced exposure to regulatory scrutiny” compared to USDT and USDC. However, the substantial replacement of DAI’s collateral with RWA that can be regulated by centralized authorities essentially erodes this distinction, blurring the lines between DAI, USDC, and USDT.

Despite this, DAI’s position as the largest decentralized stablecoin remains unchallenged. Boasting a market capitalization of $4.3 billion, it stands significantly ahead of competitors like Frax (with a market cap of $1 billion) and LUSD ($290 million market cap).

DAI’s Competitive Advantages

Despite recent operational attempts to RWA on the asset side, Maker’s overall management of DAI in the past few years has appeared lackluster. Nevertheless, DAI firmly retains its position as the leading decentralized stablecoin, with two main competitive advantages underpinning its success.

1. The Legitimacy of Being the Pioneer: DAI enjoys the distinction and reputation of being the “first decentralized stablecoin.” This positioning has allowed DAI to integrate with, and be adopted by, many leading DeFi protocols and centralized exchanges, substantially reducing the expense of liquidity providing, business development and public relation. A case in point is Curve, where DAI is included in the 3pool, the oldest stablecoin liquidity basepool. By being Curve’s default stablecoin, Maker, as the issuer of DAI, benefits from this liquidity without any costs. Additionally, DAI profits from indirect subsidies offered by other liquidity bribers who want to pair their token with the 3pool.

2. The Power of Network Effects: People always gravitate towards the stablecoin with the largest network size, the most extensive user base and applications, and one that they are most familiar with. Among decentralized stablecoins, DAI’s network effect remains far beyond its competitors.

However, DAI’s main rivals are not merely Frax and LUSD (who are also grappling with challenges), but rather the heavyweights such as USDT and USDC. When users and projects are selecting stablecoins, they often compare them with DAI. In this context, DAI is at a clear disadvantage in terms of network effect.

The Real Challenges Unveiled

While MakerDAO has experienced a cluster of short-term favorable factors, we remain pessimistic about its future development. After discussing Maker’s core business of stablecoin issuance and operation, along with the competitive advantages that DAI currently possesses, let’s face the real issues they are confronting.

Challenge 1: Shrinking Scale and Stagnation in Adoption

DAI’s market cap has plummeted by almost 56% from its previous peak, and there is no sign of a halt in this decline. In stark contrast, USDT has reached a new market cap, even in the bear market.

DAI’s previous growth spurt was driven by the DeFi summer. However, where will the momentum for its next cycle come from? It seems challenging to pinpoint a robust use case for DAI in the near term.

MakerDAO’s team has been actively exploring and strategizing to expand DAI’s use cases and adoption. Under the Endgame design, one approach entails integrating renewable energy projects as underlying assets for DAI, branding it as “clean money.” In theory, this alignment with environmental causes would make DAI a mainstream choice, creating political barriers for regulators aiming to seize or penalize DAI-backed clean-energy projects. However, this vision that the “green” quotient of the collateral could bolster DAI’s popularity appears overly optimistic. While people may vocally support environmental protection, practical actions often diverge. Users are likely to gravitate towards widely-accepted stablecoins like USDT or USDC, regardless of the environmental narrative. Promoting a decentralized stablecoin in Web3, a space that deeply values decentralization, is already a complex task. Can we realistically expect real-world users to prefer DAI merely for its “environmental protection” badge?

A central pillar of Endgame Plan revolves around the incubation of community-driven subDAOs. These sub-projects not only bear the responsibility of streamlining governance and coordination—tasks previously centralized within MakerDAO—but also transform centralized governance into a segmented and project-based structure. Additionally, subDAOs are empowered to launch distinct commercial endeavors, thereby uncovering new revenue streams and creating new use cases for DAI. Yet, this ambitious pivot presents Maker with another significant challenge.

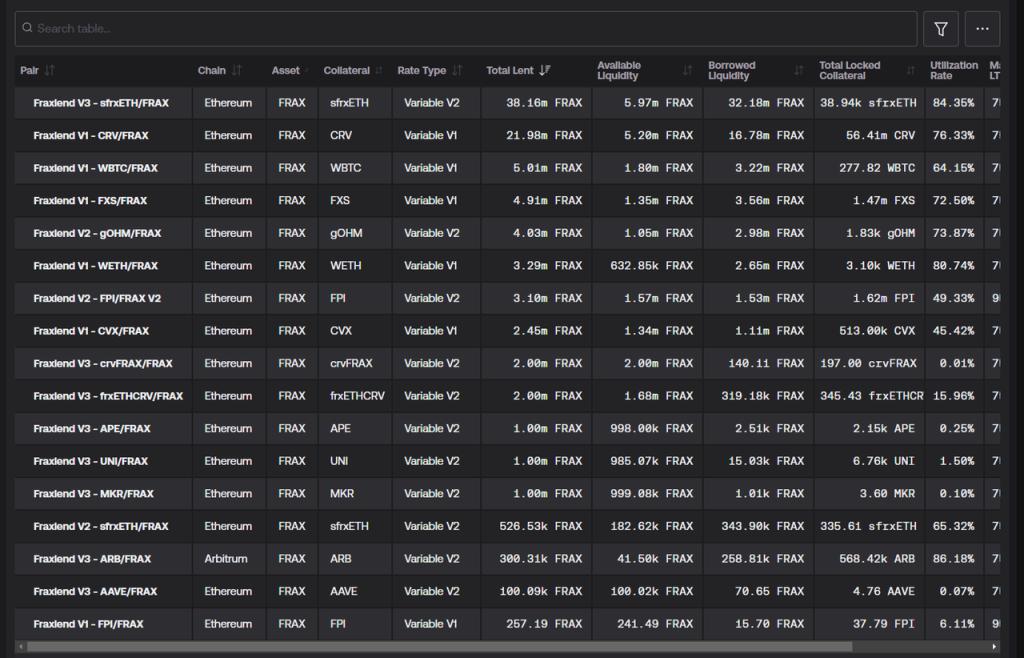

Challenge 2: Balancing Entrepreneurial Success and Support for MKR and DAI in the subDAO Program

In the future, subDAOs incubated by Maker will deploy their native tokens to enhance DAI liquidity mining, thereby expanding DAI’s use case. Meanwhile, MakerDAO will facilitate subDAO business projects by offering DAI loans at negligible or zero interest, helping them in navigating through their early stages. Beyond mere financial backing at preferential rates, subDAOs inherit MakerDAO’s reputable branding and its robust community. Such an endorsement and the infusion of early adopters are important for DeFi projects during their initial launch. The subDAO approach seems more pragmatic than merely pinning hopes on eco-friendly initiatives to expand DAI’s adoption. The DeFi sector already showcases analogous strategies: for instance, Frax introduced Fraxlend, a platform where Frax can be borrowed against various collaterals, carving out new utilities for Frax.

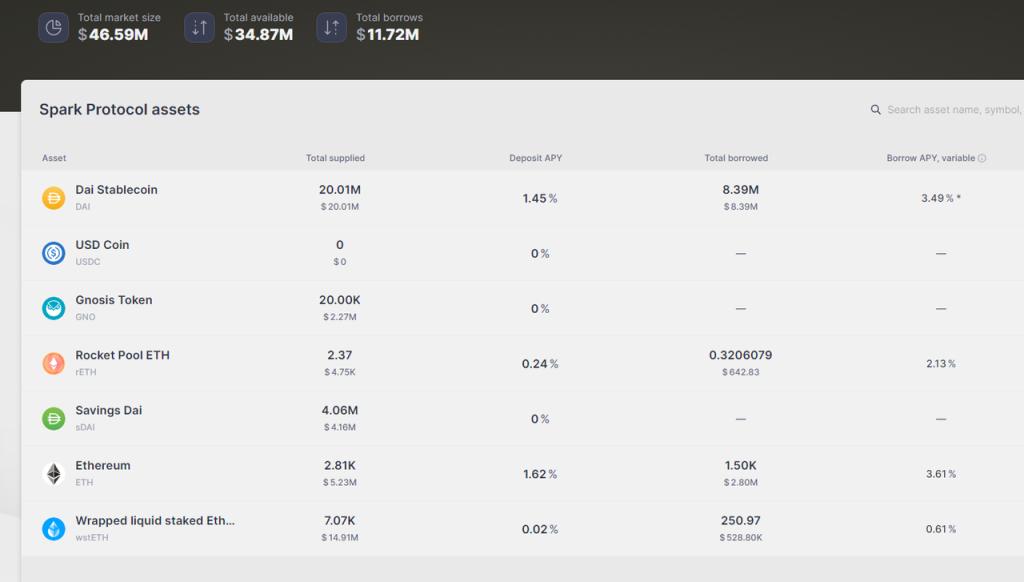

The problem lies in the fact that in the DeFi landscape, most of the “low-hanging fruits” have already been picked by entrepreneurs. As a result, developing a subDAO project that aligns with market demands is not a straightforward task. Adding to the complexity, these subDAOs are expected to simultaneously add value to both DAI and MKR. This means they must allocate additional tokens as incentives to DAI, ETHD (wrapped LST token envisioned in Endgame, serving as collateral for DAI), and MKR. Undertaking such a “tribute mission” while aiming to meet user demands and outperform competitors is undeniably challenging. For instance, Spark, a lending protocol incubated by MakerDao, has only managed to secure an actual TVL of slightly over 20 million, after deducting the 20 million DAI directly minted by MakerDao.

Other Concerns

Beyond the challenges previously described, MakerDao confronts additional underlying concerns.

Firstly, MakerDAO’s stablecoin reserves for purchasing RWA are running low, which poses challenges for further allocations to US Treasuries.”

According to statistics from Makerburn, the market cap of stablecoins in PSM currently amounts to roughly $912 million (comprising USDC and GUSD). Of this, $500 million in GUSD is already benefiting from a 2% APR offered by Gemini. Although this rate is significantly lower than other RWAs, due to a range of intricate factors—such as MakerDao’s PSM representing a whopping 89% of the total GUSD circulation and the potential for significant price depreciation if there’s an enforced liquidation to convert into USD—this portion of funds is anticipated to remain largely unchanged in the short term.

Consequently, the flexible funds that Maker can deploy for the acquisition of yield-generating assets amount to only $412 million in USDC within the PSM. The only conceivable alternative is to swap the $500 million USDC that earns an annualized 2.6% yield at Coinbase for US Treasuries. This means, at best, Maker can commit roughly $900 million to US Treasuries. However, in practice, to accommodate potential PSM redemptions, Maker must maintain liquidity. If there were significant DAI redemptions for USDC, Maker would be compelled to offload US Treasury holdings to meet this obligation, which could expose it to high slippages and price volatilities, incurring potential losses. Furthermore, if the market cap of DAI continues to decrease, the investable asset size of Maker will be further constrained.

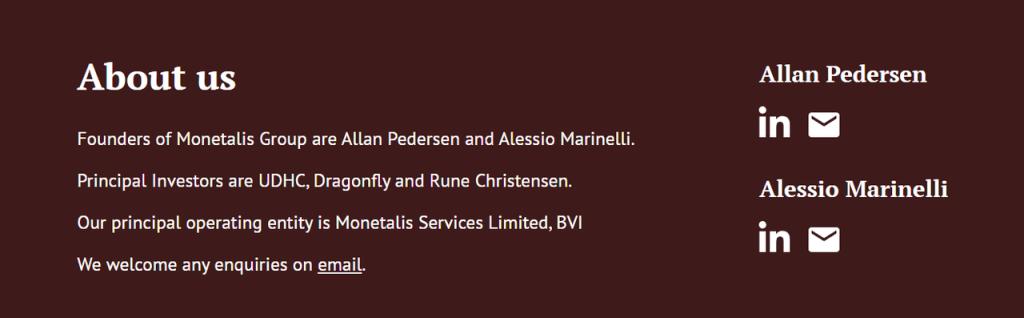

Secondly, concerns arise over whether MakerDAO can sustainably manage its costs. As outlined by Endgame Plan, it aims to decentralize governance and authority from “Maker Central” to various subDAOs. However, this involves the creation of intricate roles, organizations, and arbitration departments within the subDAO, leading to what can be described as a “governance maze.” Those interested can read the full version of Endgame V3 for a thorough understanding. In addition, the integration of the RWA business has fostered a convergence between DeFi and traditional offline financial entities, leading to a surge in high-paying outsourced positions. Compounding this is the serious issue of centralized governance. This was particularly evident in October 2022 during the vote on the Endgame plan. Remarkably, 70% of the affirmative votes came from groups associated with Rune, Maker’s founder. This conduit for interest within MakerDAO has become the elephant in the room. For instance, the largest RWA investment vault was managed by a relatively small entity called Monetalis Clydesdale. Controlling $1.25 billion of Maker’s assets for US treasury allocations and connections with other financial institutions, they charge $1.9 million annually in service fees. Notably, at that time, Maker was their sole client, and adding to the intrigue, Rune Christensen, Maker’s founder, holds significant equity in this enterprise.

Similarly, Maker pays Block Analitica, a risk management service provider, a service fee of nearly $5 million per year. What’s paradoxical is that Block Analitica not only offers risk management services but also evaluates them. This dual role blurs the lines between player and referee, turning Maker’s risk control into a lucrative monopoly. The lingering question is how the substantial benefits derived from Maker’s treasury will be distributed between Block Analitica and the group monopolizing $MKR governance. Given such incidents, coupled with the ambitious blueprint of Endgame — a plan that has even drawn criticism from a16z — may contribute to growing concern about potential further drainages from the treasury. However, as the organization becomes more decentralized and responsibilities are devolved, the tactics employed by interest groups to siphon off funds might become increasingly covert and circuitous.

Moreover, DAI’s stability fee ratio has recently seen an increase from just above 1% to over 3%. This uptick further diminishes users’ inclination to borrow and lend through MakerDAO, a development that may hinder maintaining the scale of DAI.

In conclusion, from the unveiling of Endgame plan to large-scale acquisitions of treasury bonds and RWAs, along with the founder’s conspicuous secondary market buyback and a proposal to considerably lower the threshold for withdrawing buyback funds from the treasury, a combination of aggressive maneuvers has provided a tangible short-term boost to $MKR price. However, these actions have also introduced several hidden risks:

- Insufficient Treasury Reserves: The inadequate safeguarding of surplus reserves may undermine the ability to handle bad debt risks, diminishing overall stability.

- Increased Exposure to RWA: A more aggressive stance on RWA has escalated the risk of assets being controlled by centralized institutions, thereby DAI’s vulnerability is further magnified.

- Complexity and Division in Endgame Plan: The grand and intricate Endgame blueprint has caused fragmentation within the community. Additionally, Rune Christensen’s Endgame roadmap, released in May, introduced concepts such as “AI governance,” the launch of “new branded” stablecoins and governance tokens (while retaining DAI and MKR), and the development of MakerDAO’s own blockchain.

Endgame is Not The Endgame

Beyond the typical praises and questions from other governors in the Endgame Roadmap post published by Rune Christensen on the MakerDAO Forum, the remarks from these two users have garnered attention:

“All the money and energy that once was there were squandered and used for funding useless people/garbage. All the money and research should have gone into researching how to make DAI/MKR autonomous! Remove all people. Remove governance. That’s it.”

“What makes us think that a global pre-planned endgame plan will provide a greater outcome than, say, fixing problems as they come and iterative improvements ? Apart from the blockchain part of the endgame, the “what” is pretty descriptive but there is very little on the “why”.

These comments went unanswered.

For blockchain-native Web3 projects, the focus should be on leveraging the efficiency gained through transparency and trustlessness. Instead of building new barriers and creating more obscurity, they shouldn’t be seeking personal gains behind these walls and amidst the fog.

Endgame should not be seen as the final destination for DeFi. Rather, it represents the unique challenges and obfuscations within MakerDAO itself.

Reference and Acknowledgments

I’d like to thank @ryanciz233 from @DigiFTTech for providing a lot of important information about MakerDAO. His research on Maker’s RWA operation will also be released soon.

- MakerDAO Becoming ‘a Company Run by Politics’?

- Endgame Resources

- A16z Doesn’t Support Plan to Break Up DeFi Giant MakerDAO

- MakerDAO collateral data: https://makerburn.com/

- MakerDAO expense statistics: https://expenses.makerdao.network/

- DAI’s data: https://daistats.com/#/