April 13, 2023, marks a milestone in Ethereum’s history as the Shapella upgrade — featuring Shanghai is the upgrade to execution layer while Capella is the upgrade to consensus layer — successfully launched, now permitting the withdrawal of staked ETH. This move signals the long-anticipated completion of Ethereum’s Proof of Stake (PoS) transition. In light of these developments, we will delve into the potential changes in ETH staking yields, evaluate the competition within ETH Staking landscape, and scrutinize LSD-fi’s influence on the Ethereum staking ecosystem.

Contents

Reflecting on ETH Staking Journey

Before we begin, it’s important to briefly review the concept of ETH staking. Unlike the majority of PoS public chains currently active, Ethereum PoS does not support chain-native proxy delegation and it caps the maximum staking amount at 32 ETH per single node that can yield profits. This type of staking model has clear benefits — it minimizes the chances of a single entity influencing the Ethereum consensus through controlling a large node, thereby maintaining the Ethereum network’s decentralization to the fullest extent possible. However, due to the complexity of running a node can be daunting for average users, besides solo staking where users can participate in staking directly, alternative staking methods gradually developed in practice: staking pools, liquid staking, and cex staking. Here’s a brief overview of these four staking strategies:

- Solo staking refers to a method where stakers handle the entire staking process and subsequent maintenance themselves. Its main downside is the high requirements for computers, capital, knowledge, and network connectivity.

- Staking pools somewhat reduce the network and hardware needs for stakers. By paying a certain fee, stakers can engage professional staking service providers to stake their 32 ETH and earn rewards on their behalf. This method still allows stakers to retain control over the withdrawal private key, providing a relatively high degree of control over their funds. However, it does still demand a significant level of knowledge and capital from the stakers. This staking method is often dubbed “Staking as a Service.”

- Liquid staking takes the concept of Staking as a Service a step further. It uses a staking pool to collectively stake users’ ETH, allowing users to stake any amount they desire. Meanwhile, the staking pool issues the users a liquid staking derivative (LSD), a form of staking derivative token which we will refer to as LSD in the following text. LSD already has a wide array of use cases in DeFi, which we’ll discuss in detail later. Of course, it’s crucial to understand that, by nature, all staked funds in the liquid staking model belong to the staking pool’s contract, requiring users to place trust in the staking pool. In some classifications, this staking method is also known as “Pooled Staking.”

- Cex staking allows the centralized exchange (cex) to handle the entire staking process. Like liquid staking, it allows users to stake any amount they wish and typically issues staking vouchers to users (such as Coinbase’s cbETH or Binance’s bETH).

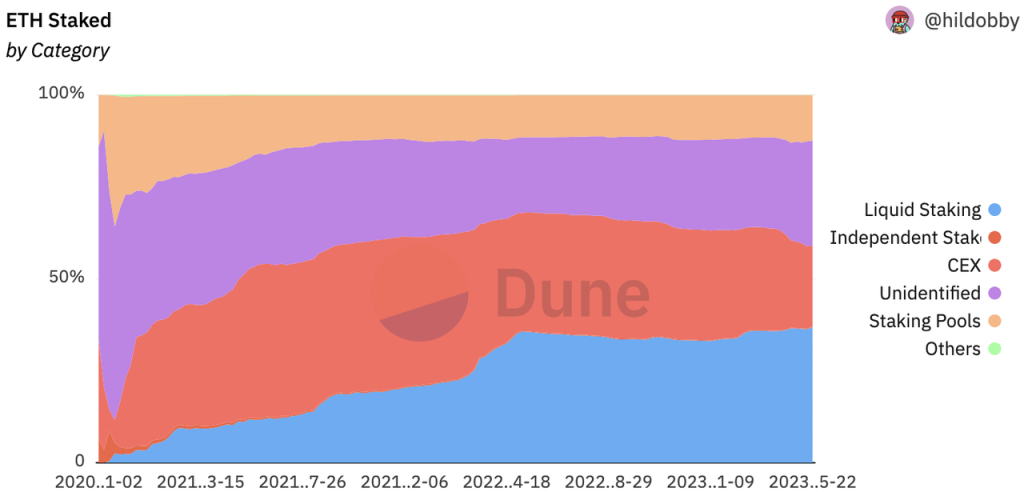

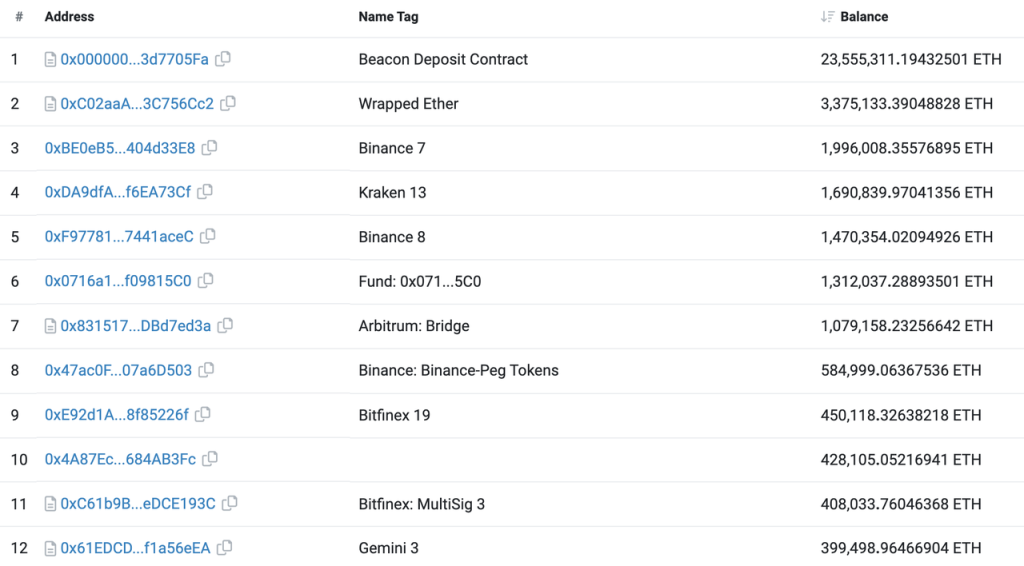

The following graph illustrates the historical shifts in the market share of staked ETH.

*Due to the complexities involved in collecting these data, it’s challenging to precisely quantify the portion of solo staking. Therefore, many graphs include an “Unidentified” category (as depicted in the image). According to recent analysis by Rated, solo stakers account for approximately 6.5% of the total staked ETH.

From the graph, it’s evident that, apart from the first two months after the Beacon chain launch, CEX staking rapidly took the lead until April 2022, largely due to the considerable amount of ETH naturally hosted by the CEXs. However, the Ethereum Foundation and community were less than thrilled with this development. Things began to change with institutions like Paradigm investing in Lido, leading to improved liquidity and composability for stETH. This facilitated the swift rise of Lido and subsequently stimulated the growth of the entire liquid staking category. To this day, liquid staking continues to maintain its lead within the sector.

After the successful launch of Shapella, there was a noticeable decline in the proportion of staked ETH on centralized exchanges (cex). Many users who previously staked their ETH on cex platforms started to shift towards liquid staking and solo staking (categorized as ‘Unidentified’).

Looking at the distribution of the staking market among specific entities, Lido currently holds a 31.8% share of the total staking market. The third to fifth positions are occupied by three centralized exchanges, with Rocket Pool, another liquid staking service provider, in the sixth spot. The seventh to tenth positions are held by staking pools.

Looking Ahead: ETH Staking Yields

The allure of staking rewards often drives the decision of average users to participate in staking. To fully grasp the future development of ETH staking, it’s essential to understand the composition of staking rewards and the trends ahead. After the Merge, staking ETH will yield rewards from both the consensus layer and execution layer, currently amounting to an Annual Percentage Rate (APR) of 5.4%.

Rewards from the consensus layer come from additional ETH issued by the Ethereum network. As the total staked amount increases, so do the rewards; however, the staking APR decreases as the total amount of staked ETH rises. Currently, the APR from consensus layer rewards is 3.4%. The market widely anticipates that the ETH staking ratio will reach 25-30% by the end of this year. At a 30% staking ratio, the consensus layer’s APR reward would drop to around 2.4%. This yield is considerably lower than most PoS chains, reflecting the Ethereum Foundation’s principle of minimizing $ETH issuance.

Rewards for the ETH staking execution layer are composed of 1) Priority fees, which are the portion of gas fees paid by users that are not burned, and 2) Miner Extractable Value (MEV). A key characteristic of these rewards is that they do not increase as the quantity of staked ETH increases. This portion is the main variable in ETH staking rewards, and it warrants further examination.

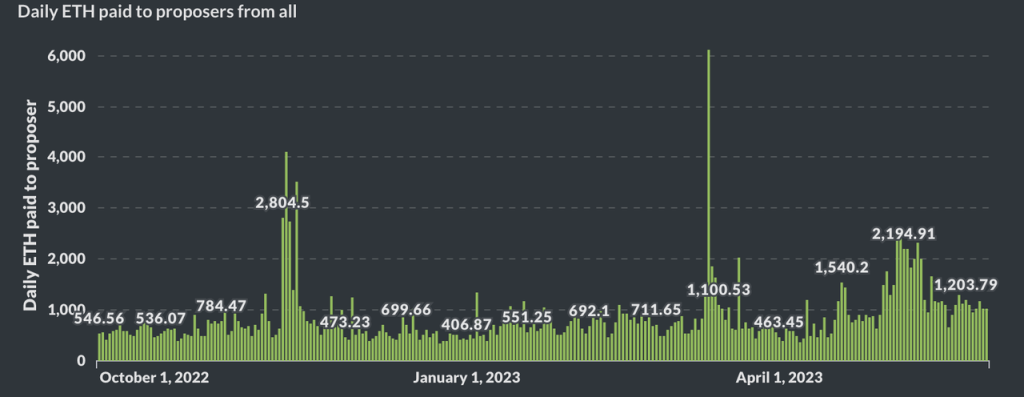

Flashbots has gathered data detailing the total revenue for proposers (also known as validators) since the Merge. Similarly, Lido has tracked its APRs for consensus layer and execution layer rewards since the Merge. Their trends align, and Lido has also compared the yields from the consensus layer and the execution layer. Let’s delve deeper into their analysis using Lido’s chart.

Following the Merge, the APR from the consensus layer has gradually declined as the total staked amount has increased. On the other hand, the execution layer’s APR has seen a significant variation, averaging around 1.5%. This fluctuation has led to the total staking APR reaching around 5%. During times of heightened on-chain activity (like the meme season in May), the execution layer’s APR can even exceed that of the consensus layer, pushing the yield from staking ETH close to 10%. Viewed as the “risk-free return” for the Ethereum network, staking rewards are highly attractive to ETH holders, as mentioned in our report “An Exploration of Risk-Free Rate in the Crypto World”.

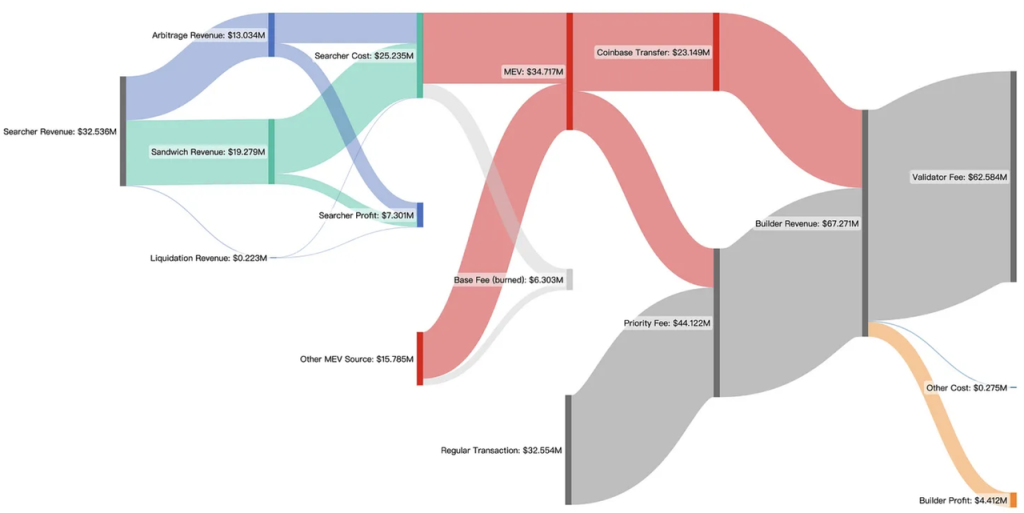

So, how will execution layer yields evolve in the future? To answer this, we must discern the proportion of priority fees and MEV contributing to the execution layer yields. Eigenphi, an MEV data service provider, offers a detailed analysis of the revenue data across various roles in the Ethereum execution layer ecosystem from January to February 2023:

The data reveals that over a span of two months, priority fees and MEV collectively formed the Ethereum staking earnings (Validator fee) of the execution layer at a ratio of roughly 55% to 45% (44.12 million to 34.72 million).

We now turn our attention to the future trends of priority fees and MEV.

As it pertains to priority fees, the market has witnessed a bullish-to-bearish transition since the implementation of EIP-1559. Clearly, priority fees are intrinsically linked to market activity. During the 2021 bull market, the daily priority fees could reach nearly $10 million, whereas during the bear market of 2022, the daily priority fees were around $800,000. Amidst the Meme Season in May this year, daily priority fees climbed to approximately $3 million. Looking ahead, priority fees will continue to ebb and flow with market volatility, and this portion of the revenue, settled in ETH, will remain susceptible to market conditions.

When it comes to MEV, things get more complex. Comprising elements like arbitrage, sandwich attacks, and liquidations, MEV cannot be fully traced on-chain. Currently, we don’t have access to the most recent data on MEV trends post-Merge. The Ethereum Foundation has generally held a negative view on MEV. A year ago, they introduced the Proposer-Builder Separation (PBS) plan with one of its objectives being the elimination of MEV’s impact on the rewards of smaller stakers. Recently, Justin Drake, a researcher at Ethereum Foundation, put forth the MEV burn plan, aimed at obliterating all MEVs within the next 3-5 years, serving as another driving force for ETH deflation.Although this plan is still in the proposal phase and involves balancing numerous interests, Ethereum has demonstrated its ability to “persuade” key stakeholders within its ecosystem to surrender their benefits for the realization of Ethereum’s roadmap, as evidenced by its successful transition from PoW to PoS.

Consequently, MEV, which presently accounts for approximately 20% of the total staking rewards, might likely be reduced or even eliminated in the medium to long term. This is due to its incongruity with the values upheld by the Ethereum Foundation.

Another crucial factor to consider is Layer 2 (L2). Driven by Ethereum’s roadmap centering around Rollups, an increasing number of transactions will shift from Ethereum L1 to L2. This shift will inevitably lower the MEV and priority fees on Ethereum mainnet. Currently, the MEV/priority fees on L2 are managed within L2 and have no relation to stakers on the Ethereum mainnet. Especially after the Cancun upgrade, which is expected to further decrease the costs on L2, it might catalyze a more robust development of L2. This, in turn, could potentially further reduce the total fees and MEV obtainable on L1.

In conclusion, taking into account the implications of MEV burn and the emergence of L2, when the proportion of staked ETH reaches 30%, the returns from ETH staking are likely to decrease to around 3% (including a 2.4% consensus layer reward and a 0.6% execution layer reward). This decline in yield will likely have a significant impact on user enthusiasm towards participating in staking.

Liquid Staking is Still Expected to Remain the Mainstream Form of Staking, and Its Centralization Might Even Increase Further

The activation of the Shapella upgrade has enabled the withdrawal functionality for ETH, providing liquidity for ETH staked through both solo staking and staking pool methods. This was a key advantage of Liquid Staking protocols, which gained traction rapidly in 2021 and 2022, primarily because they could offer liquidity to LSDs, thereby indirectly facilitating an exit from staking. Thus, the Shapella upgrade significantly reduces the advantages of Liquid Staking. Despite the relatively high barrier to entry for solo staking, the number of tools serving solo stakers is steadily increasing, gradually lowering the entry barriers. Moreover, solo staking maintains the legitimacy of Ethereum network decentralization, which has strong backing from the Ethereum Foundation.

Why do we still believe that liquid staking will maintain its dominant position in the staking race, and even possibly increase its concentration?

The main reason lies in its composability. LSDs have excellent composability, which means a higher possibility of achieving greater returns and superior capital efficiency. Stakers are naturally sensitive to returns and tend to choose staking methods that yield higher profits. Due to its high composability, LSDs effectively offer higher returns to stakers.

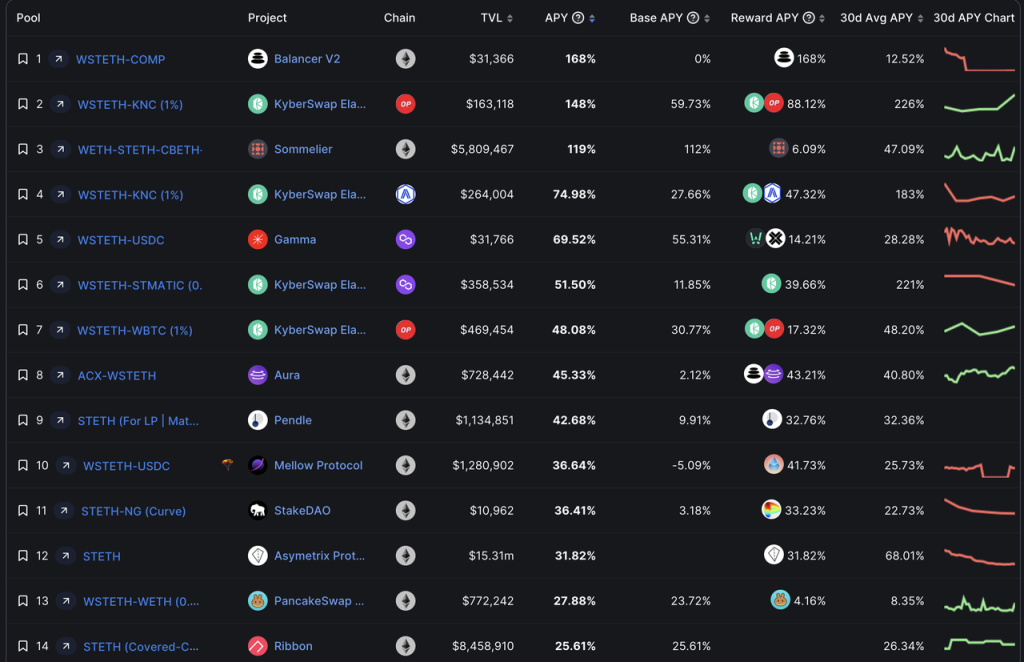

Let’s take Lido’s staked Ether (stETH) as an example. Currently, when the basic staking APR is 5.6%, LSDs such as stETH can quite easily achieve an APR of 10%.

As per recent data, liquidity providers of stETH can easily secure an APR in excess of 50%. Factoring in the capital utilization of paired assets, the total APR can still go beyond 25%. Additionally, stETH single-token staking can also achieve an APR above 25% on platforms like Asymetrix (a protocol for asymmetric yields distribution generated from staking) and Ribbon (an options protocol), although this might involve some risks. Coupled with stETH’s inherent 5.6% APR, users who stake via Lido can achieve a total yield reaching 30%.

stETH distinguishes itself through more than just high returns and stETH is also widely integrated within blue-chip DeFi protocols: Maker, Aave, and Compound all support stETH (or its wrapped version, wstETH) as collateral. These top-tier protocols accept wrapped stETH (wstETH) as collateral, offering similar collateral parameters to those of native ETH. With over $1.1 billion in liquidity for the stETH-ETH pool on Curve, stETH holders can readily access liquidity, whether through direct swaps or collateralized loans.

Such advantages are absent in solo staking and staking pools. Especially if, as mentioned earlier, the yield on ETH staking drops to just 3%, people might very well choose simpler and more profitable options. Considering the hardware, knowledge, time, and effort that solo stakers and staking pools expend for a 3% APR, alternatives that offer ease of use and higher returns – like stETH – could be more attractive.

Members of the Ethereum community value the concept of maintaining network decentralization, yet they must also weigh this against the opportunity cost of alternative investments. One sentiment might be, “Preserving Ethereum’s decentralization is vital and admirable, but I might still prefer the option that yields a 30% return.”

LSD and LSD-Fi

Following the Shapella upgrade, a burgeoning array of LSD-fi projects have surfaced in the market. Their common characteristic is attracting users’ LSD deposits for various financial applications. Many people believe that we’re about to experience an “LSD-fi summer,” indicating a surge of such projects.

Before delving deeper, it’s important to note that this article will not appraise the specific merits or drawbacks of individual LSD-fi projects. The reason being, LSD-fi, in my view, hasn’t established a unique business niche but rather has enabled LSD to serve as collateral for many operations. Essentially, these protocols are still handling stablecoins, yield aggregation, decentralized exchanges (DEXs), and interest rate services. Their success depends on their understanding and navigation of these markets. Among the LSD-fi projects that have launched so far, none seem to have ventured beyond basic yield farming games or forks. There may exist many high-quality LSD-fi projects that have not yet launched, and we look forward to seeing more innovations based on LSD in the future.

More crucially, this article seeks to explore the potential impact of LSD-fi on the staking industry at large.

LSD holders typically exhibit two attributes: they hold ETH on-chain and possess a degree of DeFi understanding, and they exhibit a keen sensitivity to ARP – a key reason why they choose to stake. These traits make them an ideal target audience for any DeFi entrepreneurs on the Ethereum network. Holding ETH on-chain allows them to engage in on-chain operations and potentially understand these businesses. Being sensitive to yield rates means that incentives can sway their behavior. Interestingly, even at this relatively mature stage of DeFi’s development, many ETH holders still choose to manage their ETH exclusively on centralized exchanges.

As the buzz around LSD-fi continues to grow, we can expect to see an increasing number of LSD projects making their debut, each armed with their own new tokens, and therefore, fresh marketing budgets. This trend has already been evident with projects such as unshETH, Agility, and Lybra, and it’s likely to continue playing out in the LSD-fi sector over the next 3-6 months. The likely result of this is that LSD will consistently offer APRs that far exceed those of on-chain ETH, potentially creating a self-reinforcing flywheel between LSD and LSD-fi: the more LSD-fi projects there are offering higher yields, the greater the incentive for ETH holders to convert their ETH into LSD. In turn, the increasing prevalence of LSD could encourage more DeFi protocols to target these users, offering them attractive yields to help get through the protocol’s initial growth phase.

Ultimately, it’s plausible that all DeFi protocols could broadly be classified as LSD-fi as they support LSD in some capacity. In fact, with the exception of a few stablecoin protocols, the vast majority of DeFi projects already have some sort of connection to LSD. Clearly, LSD has the potential to capture the beta of the LSD-fi ecosystem. Moreover, the surging popularity of LSD-fi is likely to further propel the market share of liquid staking.

Ethereum Foundation’s Perspective on Staking Matters

When it comes to matters related to staking, the Ethereum Foundation has demonstrated the following attitudes:

- They wish to discourage an excessive influx of ETH into staking. An overflow of ETH into staking would amplify the distribution of ETH rewards at the consensus layer, which is in direct contradiction to Ethereum’s long-standing principle of “minimal viable issuance”. On the other hand, it would reduce Ethereum’s ‘economic bandwidth’ (a concept proposed by Bankless), which refers to the circulating market value of Layer 1 serving as the fundamental foundation for all DApps operating on it.

- They maintain a skeptical view of MEV. For every ETH staker, MEV represents an occasional, low-probability, but significant reward. If left unregulated, this could inadvertently result in forced centralization (similar to the scenario observed in PoW mining pools for BTC and ETH), subsequently fostering new alliances over Ethereum’s consensus layer (such as MEV-boost). This could introduce unnecessary and potentially insecure complexity at the consensus layer. In the medium to long term, the Ethereum Foundation aims to eliminate MEV, transforming it from privilege held by a minority of validators into a shared reward for all ETH holders.

- They are wary of an overly dominant LSD that could potentially “supplant” ETH on the Ethereum mainnet. Such a development could introduce additional unnecessary security risks for ETH.

The guiding philosophy behind Ethereum’s approach is to uphold a decentralized consensus layer that does not compromise ETH’s role as the primary collateral asset within the Ethereum network. Furthermore, they aim to ensure that Ethereum’s consensus layer remains unaffected by the influence of protocols developed on top of Ethereum.

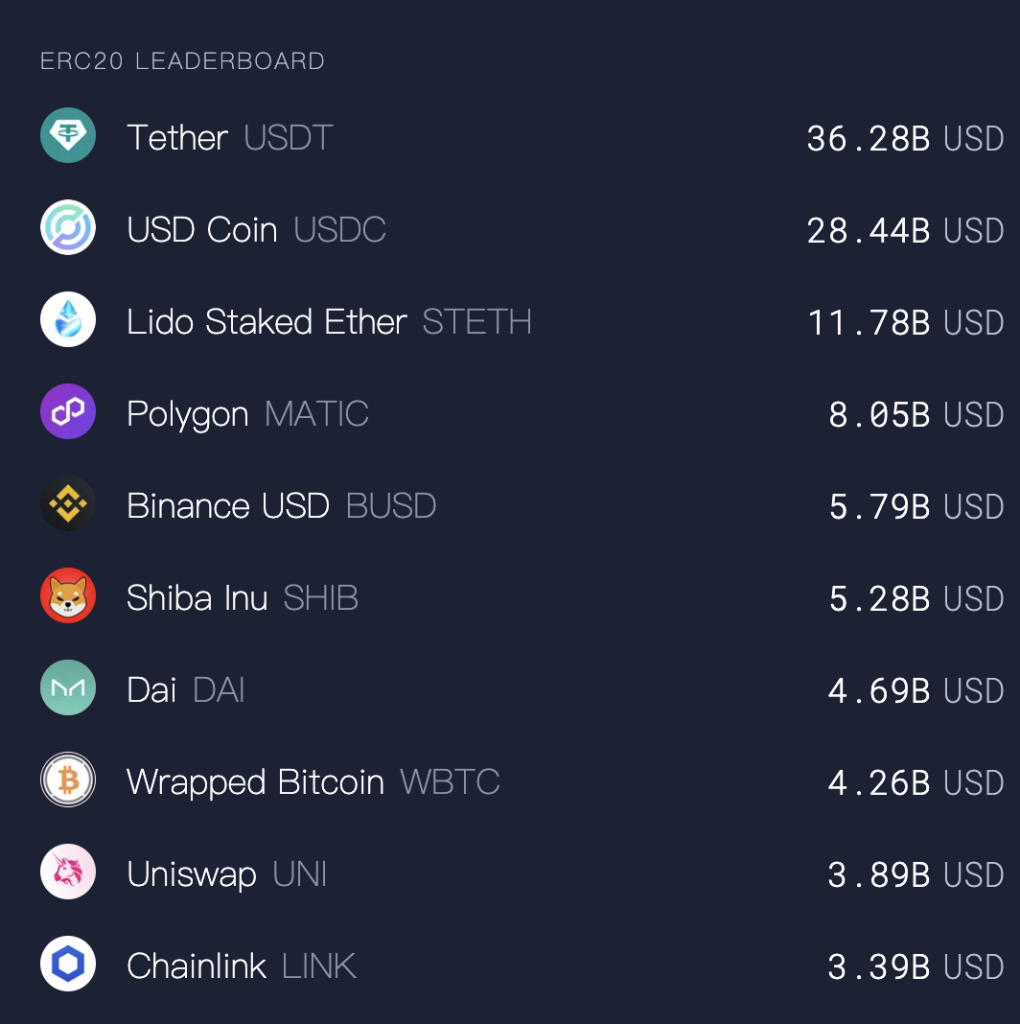

Currently, stETH is the largest non-native, non-stablecoin asset on the Ethereum network. While USDT and USDC rank higher than stETH and have a wide range of use cases,their value fundamentally depends on the creditworthiness of Tether and Circle respectively. If either of these were to falter, it could profoundly impact Ethereum, but it wouldn’t necessarily tarnish Ethereum’s credibility.

The uniqueness of stETH is that it has been integrated by almost all DeFi protocols as ETH-equivalent collateral. Let’s engage in a thought experiment: What if the Lido Finance contract were to be attacked, and all the Lido withdrawal private keys on the Beacon Chain came under hacker control? Would Ethereum be required to carry out a hard fork similar to the event of the DAO?

Nobody wants to see this scenario unfold, which explains why the Ethereum Foundation is actively supporting solo staking, why the Ethereum community debates limiting the size of Lido, and why Lido will prioritize decentralization in its future agenda. However, the emergence of a dominant liquid staking service provider is not the result of some malicious centralized organization’s deliberate actions but a natural outcome of market competition. Even if the Ethereum Foundation or the core community manages to control Lido’s size in some way, there would likely be the rise of another entity, a ‘Mido’ or ‘Nido,’ serving as the new Schelling point for staking.

There are two possible worlds in the future:

- The first one aligns with the Ethereum Foundation’s initial vision: a moderate proportion of staked ETH sufficient to ensure security, while the majority of ETH remains on the mainnet as collateral to sustain the operations of various DApps. The principal participants in staking would be Solo stakers.

- The second scenario reflects a more likely reality: due to the presence of one (or several) dominant LSDs, an increasing amount of ETH flows into liquid staking. This LSD (or these LSDs) becomes the collateral for various DApps. To a large extent, this LSD or these LSDs could “replace” ETH.

Given the current situation, the latter scenario seems to have a much higher likelihood of occurring.