Contents

Key Insight

Core investment logic

While Ethereum has traditionally dominated the liquidity staking arena, emerging markets on BNB Chain and ATOM are beginning to pique investor curiosity. The growth of pSTAKE Finance, especially after its partnership with BNB Chain, deserves particular attention. pSTAKE Finance takes diverse strategies on business development and ecosystem expansion, extending its liquidity staking services across multi-chains, including ATOM and BNB. This could be a bellwether for its future prospects and a potential magnet for investor interest.

Valuation

From a static valuation standpoint, pSTAKE Finance may seem overvalued, potentially due to the highly centralized nature of $PSTAKE token distribution, with over 75% held by a small number of addresses. Moreover, the circulating market cap of PSTAKE is relatively modest.

Main Risks

- Evolution of POS Chains Risk: pSTAKE Finance’s liquidity staking model heavily relies on ATOM and BNB. The significant uncertainty in the future comes from the development of other public blockchains. At present, the staking rates for BNB Chain and Cosmos are relatively high, offering limited growth potential from the staking ratio. Future expansion to other promising public blockchains with lower staking rates will be a true test of the strategic judgment of the founding team.

- Smart Contract Risk: The BNB liquidity staking market suffered a setback due to a smart contract issue with Ankr on December 2, 2022. If a similar event happens on a public blockchain where pSTAKE Finance operates, it could have severe repercussions for the project.

- Price War Risk: With the staking ratio of PoS public chains expected to rise, the industry might face a price war over the shrinking market. This competition could lead to reduced staking and unstaking fees, which would inevitably depress the overall value of the liquidity staking industry.

Business Analysis

User Base

At the core of pSTAKE Finance’s operations are holders of Proof-of-Stake (PoS) tokens. Aiming to provide a comprehensive staking service and ensuring a secure validation process, pSTAKE Finance employs a robust validator scoring system. This system selectively identifies validators that meet all the requisite criteria, delegating them with the responsibility of staking users’ PoS tokens.

- From the user perspective, pSTAKE Finance has facilitated staking services for four PoS tokens: ATOM, XPRT, ETH, and BNB. Preliminary roadmaps include plans to expand these services to SOL, AVAX, and other PoS tokens on the Cosmos Layer 1. Following the pivotal strategic partnership with Binance in 2022, pSTAKE Finance’s business operations have primarily focused on staking services for two tokens: ATOM and BNB.

- On the validator side, pSTAKE Finance has partnered with a select group of proficient validators to provide validating services for pBridge and the LSD-related business. Some of pSTAKE Finance’s validator partners include Figment, Chorus One, and CertiK.

Business Details and Multi-chain Strategy

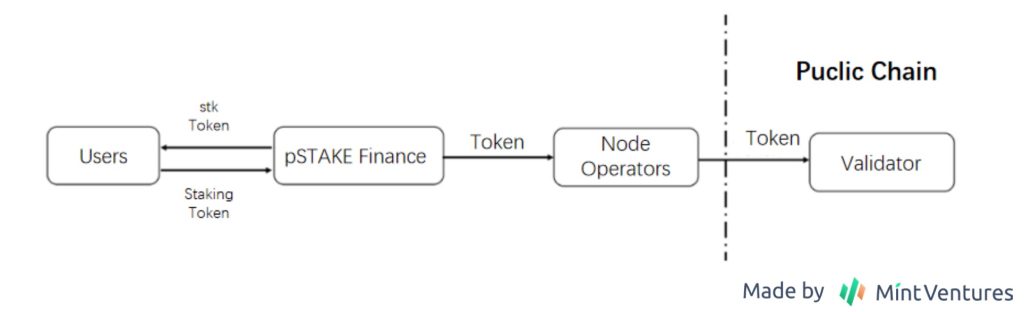

The liquidity staking business model can be simplified to the following diagram:

While the mechanism varies across PoS chains, the overarching business logic remains intact. Among the staking services provided for ATOM, ETH, and BNB, the BNB model stands out. It involves two chains: the BNB Beacon Chain, responsible for BNB governance and staking, and the BNB Smart Chain, an EVM-compatible chain capable of supporting a variety of Dapps. BNB also employs 42 designated validators.

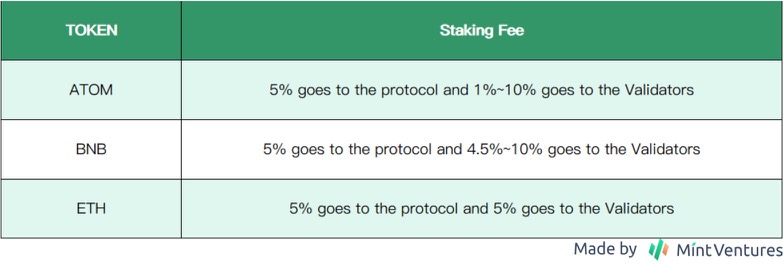

Similar to other liquidity staking protocols, pSTAKE Finance charges a fee for its services. For instance, with ATOM, 5% of the staking rewards accrued during the staking period are designated as a fee to pSTAKE Finance. For users seeking to unstake swiftly, a modest 0.5% charge is levied for the ‘Redeem Instantly’ feature.

Tokenomics Analysis

Token Supply and Distribution

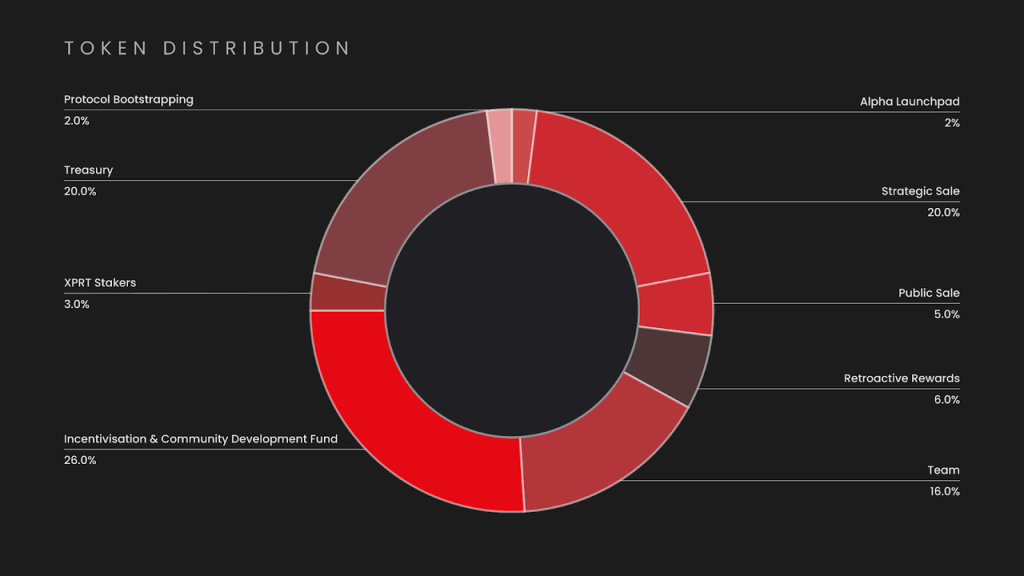

The total genesis supply of $PSTAKE is 500,000,000 (500M). The distribution breakdown is as follows:

- 2% was allocated to Alpha Launchpad for staked users in Alpha Finance and Alpha Finance team. It’s important to note that while Alpha Finance initially emerged as a lending protocol, it has since morphed into the Alpha Finance DAO, which offers an array of services including project incubation, venture capital, and more.

- 20% was allocated to a strategic round with a 6-month cliff, followed by 12-month equal monthly vesting.

- 5% was allocated to public sale on Coinlist with a 25% vesting at TGE, followed by a 6-month linear vesting schedule.

- 6% was set aside as a retroactive reward for stkATOM-ETH and stkXPRT-ETH LPs with a 6-month linear vesting schedule

- 16% was allocated to the pSTAKE Finance team, with 18 month cliff starting from TGE, followed by 18-month equal monthly-vesting.

- 26% was reserved for incentivisation and community development for a 24 month total vesting period with quarterly-vesting starting from TGE.

- 3% was allocated to XPRT stakers for a 12 month total vesting period with equal monthly-vesting starting from TGE.

- 20% was allocated to the treasury with alternate month equal vesting starting from TGE in a 24 month total vesting period.

- 2% was allocated to protocol bootstrapping and fully liquid on TGE

Based on these token distribution rules, about 55.2% of $PSTAKE is already in circulation and is expected to be fully vested by 2025. The average annual inflation rate for the next two years is approximately 35%, suggesting a high inflation rate.

Token Value Capture

Currently, $PSTAKE serves primarily as a governance token, providing holders with the ability to participate in project governance votes and to stake $PSTAKE for securing the network, but it does not offer direct revenue sharing.

The User Base of $PSTAKE

Two key factors may explain why investors currently value staking tokens for their governance functions:

- The ability to directly participate in governance and influence the project’s future trajectory. pSTAKE Finance mandates that investors or institutions holding a minimum of 250,000 PSTAKE tokens can initiate proposals within the community. This attribute may appeal more to investors with substantial capital resources and the capability to offer ecosystem support and business resources to the project. By initiating and voting on proposals, these major investors can influence various aspects of pSTAKE Finance, from fee structures and public chain deployment strategies to ecosystem incentives. Such influence could potentially enhance the value of PSTAKE over the medium to long term.

- Drawing a parallel with $UNI, value capture might potentially be realized through subsequent proposals. Nonetheless, like $UNI, $PSTAKE might not necessarily acquire value capture or profit-sharing features in the short term. Traditional equity markets often see shares issued by high-growth firms not yielding dividends for a certain period. For example, Amazon’s share price wasn’t negatively affected over the long term despite not offering dividends for a long time, as the company’s consistent high-growth phase necessitated substantial reinvestment. Similarly, $PSTAKE might not distribute cash flow dividends in the short term as it focuses on expanding its operations. Whether it chooses a multi-chain deployment strategy akin to Uniswap, or a synergistic development model of multiple business lines as with Frax Finance, the critical factor is that pSTAKE Finance can grow through these expansion efforts. As such, the absence of value capture capability at this stage might not be a primary concern for potential investors.