In the previous "Insights" (#MintClips) entitled "An Exploration of Risk-Free Rate in the Crypto World?", we delved into the concept of the Crypto Native risk-free rate and its application through POS yield. During this #MintClips, we aim to investigate the reasons behind the sluggish development of the on-chain bond market and potential future directions.

Contents

Reasons Behind the Underdevelopment of the Crypto Bond Market

Supply Side: The Unfavorable Cycle for Long-term, Low-risk Investors

In traditional finance, bond investors would have a lower risk appetite than stock investors. Bond investors aim to take a relatively lower risk to secure more stable returns.

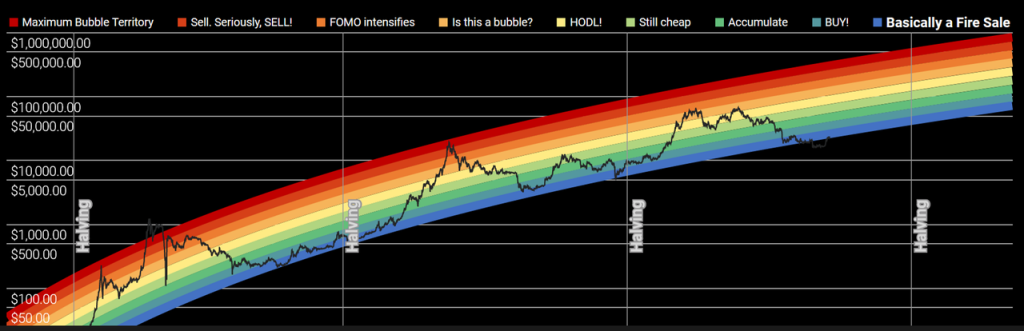

The crypto market is maturing with a total capitalization of over $1 trillion. However, the market has demonstrated extreme volatility under Bitcoin’s “4-year halving” and bursting crypto bubbles brought by a dramatic expansion of the industry. For instance, during a full market cycle, ten times or even more than hundreds of times upside potential can be achieved on Bitcoin but it comes with a serious downside of more than 80%. Other tokens may have more extreme movements. It results in around 90% of traders losing their money and exiting the market with such high volatility. That probably explains why we have seen perpetual contracts, one of the mark-to-market leverage, outperforming long-duration leverage.

Other low-risk investment opportunities available in the market also display strong cyclicality. For example, the funding rate of BTC perpetual contracts, which has the longest duration, the market’s returns are significantly higher under bullish markets. With such instability of investment returns, long-duration investors seeking “bond-alike” opportunities with lower risk may find it hard to navigate high-risk deals that are capable of bearing higher financing costs over the long term.

Demand Side: Explosive Growth in Institutions Adoption and DAO Treasury No-show

In the last bull market, institutional involvement and DAO Treasury were under the spotlight. And there were some entrepreneurs who were dedicated to becoming a market-maker tailored to DeFi. However, with Luna crash in May 2022 and the impact on Three Arrows Captial and FTX, a large number of institutional investors were affected, which influenced the utilization of existing institutional funds in the market and prompted regulatory bodies to place greater emphasis on monitoring the crypto industry. In addition, institutional massive adoption may be postponed due to the recent bankruptcies and closures of US crypto-friendly banks.

DAO Treasury management has been one of the topical issues in the industry. In 2021, Hasu analyzed the fund distribution within DAO Treasuries, which revealed that most of these assets consist of the project’s native token. Even for now, high-quality projects such as Lido and MakerDAO still rely heavily on their own tokens within their treasuries.

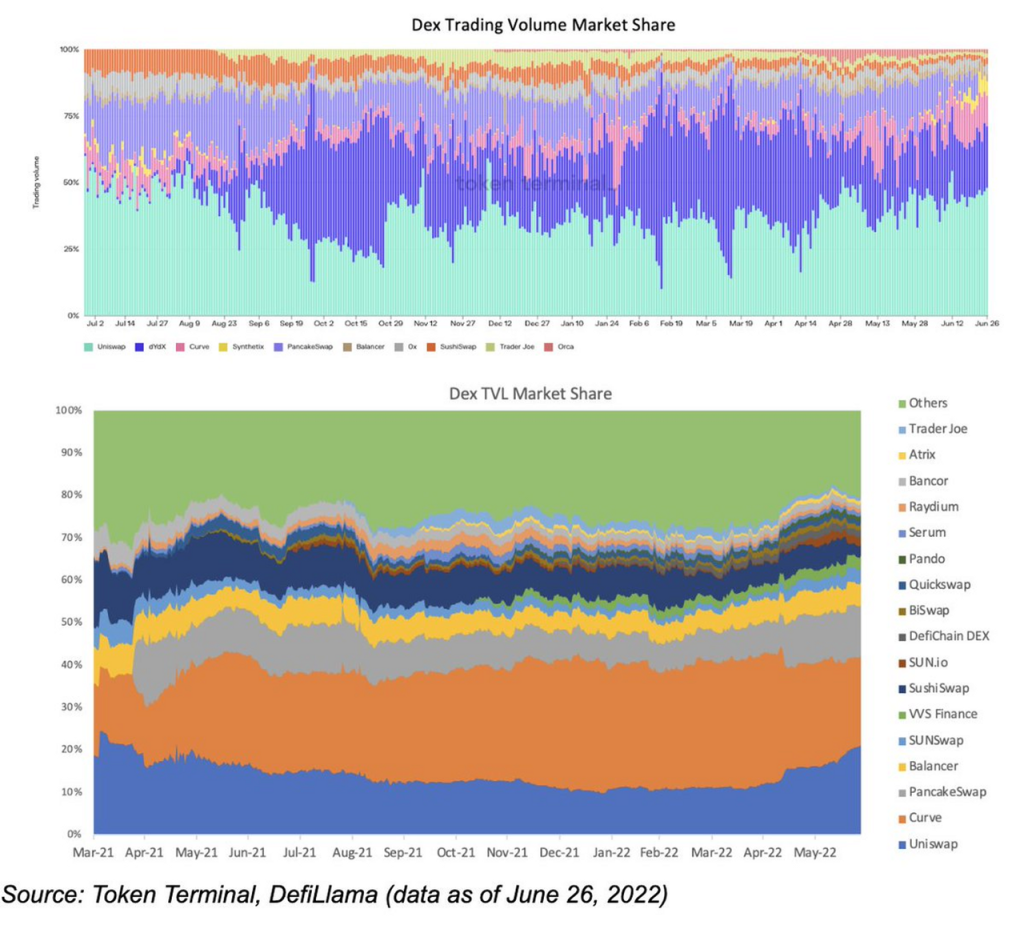

Even if we don’t consider the status quo and look forward to the future, it is foreseeable that some projects may struggle with accumulating sufficient other assets in their treasuries due to inherent attributes of the crypto industry. As an industry that is globally distributed and lacks uniform regulation, the crypto market has exhibited a particularly strong Matthew Effect, particularly in the more mature sectors of DeFi, such as decentralized exchanges (DEXs) and the lending sector. The presence of this phenomenon can be attributed to the fact that the crypto market is a global liquidity network that operates in a relatively under-regulated environment.

DeFi, being a form of finance, exhibits inherent financial attributes. Investors are looking for low costs, high returns and high security. Without the involvement of customer management, product differentiation would be the only winning recipe but code copy is much easier due to its open source. However, DeFi values liquidity and trading costs, and user liquidity can not be duplicated. Hence, early projects have a greater chance of dominance in the market due to their robust Matthew Effect.

In traditional markets, certain regulatory policies are aimed at preventing monopolies and promoting market multiple participation. For instance, regulatory bodies review mergers and acquisitions to prevent the consolidation of market power, which serves to curb the “Matthew Effect”. In contrast, the DeFi sector lacks regulatory oversight and customer service support, which creates an environment that is more conducive to the Matthew Effect.

Will many of these current DeFi projects still exist in the future? The answer may be no. We may even see many DeFi players, but they may come with small market shares. Only the top three DeFi projects may penetrate 95% of the market or even beyond.

Furthermore, the DAO Treasury of top-tier DeFi projects would hold a significant amount of assets, which may render the narrative that many DAOs have a large Treasury invalid. It is more likely that only a few top-tier DAOs in each sector will have sufficient funds to perform treasury management effectively.

In the long run, it is possible that the majority of the DeFi niche may experience an oligopoly situation with a market share of 90%, due to the liquidity and transaction cost advantages of the leading projects. For DAOs, the number of fund management scenarios may be limited consequently.

Token: The Possession of Equity and Debt

Equity

Token holders are able to participate in community voting and engage in project governance further. Additionally, token holders may be entitled to commission fees generated by the project as a result of the value capture attribute.

Debt

In the traditional world, companies that engage in equity financing during expansion are able to raise cash. In order to obtain a larger market share, companies may use these funds for marketing purposes such as advertising, tangible rewards, and discount incentives. Under such a scenario, the company has exchanged equity for cash.

In the cryptocurrency market, a portion of tokens is typically allocated as incentives to users who completed the quest. Typically, token incentives are settled at a specific time, such as every block, every day, or every week. Because user behaviors occur before the token incentives are distributed, each incentive represents a debt owed by the project to the user, similar to an “expected liability” in traditional accounting for sales rebates. For the founding team, debt expansion can be easily achieved by reserving more tokens as post-project operational “incentives”. Creating debt through reserved tokens as project incentives is advantageous over traditional debt financings methods such as loans or bonds, as tokens are not tied to a fiat currency and do not carry the same legal obligations. Token issuance is controlled by the project itself and is not subject to anticipated price requirements, only to the planned number of tokens, which is more user-friendly for the project. The emergence of tokens as a new value medium and financing method has significantly reduced the demand for traditional debt financing among projects.

The Future and Beyond

The aforementioned three reasons indicate that there is no fertile soil for the growth of the crypto bond market compared to the traditional bond market, whether it is from the strong cyclicality of the market itself or from the supply and demand sides of fixed-income products.

Then… what kind of bond market may be more suitable for the development of the cryptocurrency industry?

- From the perspective of the benchmark interest rate, the POS yield based on a public chain may be the best option. Because it is based on a larger ecosystem, with less volatility in business development compared to individual Dapp projects.

- From the perspective of the target audience, the bond market is more suitable for high-risk speculators and low-risk arbitrageurs. Currently, the crypto market lacks long-term investors, making it difficult to find a large number of stable and conservative investors.

- principle tokens (fixed-rate products that can be viewed as zero-coupon bonds)

- yield tokens (variable-rate products that allow users to speculate on future yield increases by buying yield tokens)

To satisfy the requirements of arbitrageurs and low-risk investors for yield, while also allowing high-risk investors to participate in the speculation of LSD yield rate.

- From the perspective of time horizon, the overall cycle of the crypto market is at a fast pace, therefore the maturity of bonds should also be shorter, such as bonds with a maturity of less than one year. Such a design not only benefits low-risk arbitrage traders but also benefits high-risk traders: short-term interest rate fluctuations will be more severe and frequent, providing more potential trading opportunities for short-term traders.