Contents

Key Insights

- Polygon boasts excellent ecosystem operations. Polygon ecosystem has 53,000 DAPPs, and it has partnered with conventional business giants like Meta, Starbucks, Disney, Mercedes-Benz, and Ernst & Young to reach more fields.

- The Polygon project holds a strategic vision. In February 2021, Polygon entered the field of Ethereum ecosystem aggregators and acquired multiple ZK Rollups to become the core of the Ethereum ecosystem. In July 2021, Polygon formed Polygon Studios and became the chain with the largest number of GameFi and one of the first chains to be launched on Opensea.

- Polygon’s current valuation is low. When compared horizontally with Solana, AVAX, and other public chains in terms of assets, user base, business activity, and developer, Polygon has a low valuation among all public chains; when compared vertically with Polygon’s indicators from 2021 to date, Polygon ranks in the median of its historical valuation.

Main Risks

- The Polygon may suffer a safety incident. Polygon’s side chain model has not inherited the security of the main chain of Ethereum, thus possible security risks for side chains and cross-chain bridges.

- ZK Rollup is progressing too slowly or losing market acceptance. Polygon’s current forward-looking ZK Rollup layout has become a core part of the Ethereum ecosystem, but the ZK Rollup is at its primitive stage and may be abandoned by the market due to its long development process.

Business of Polygon

Core Business

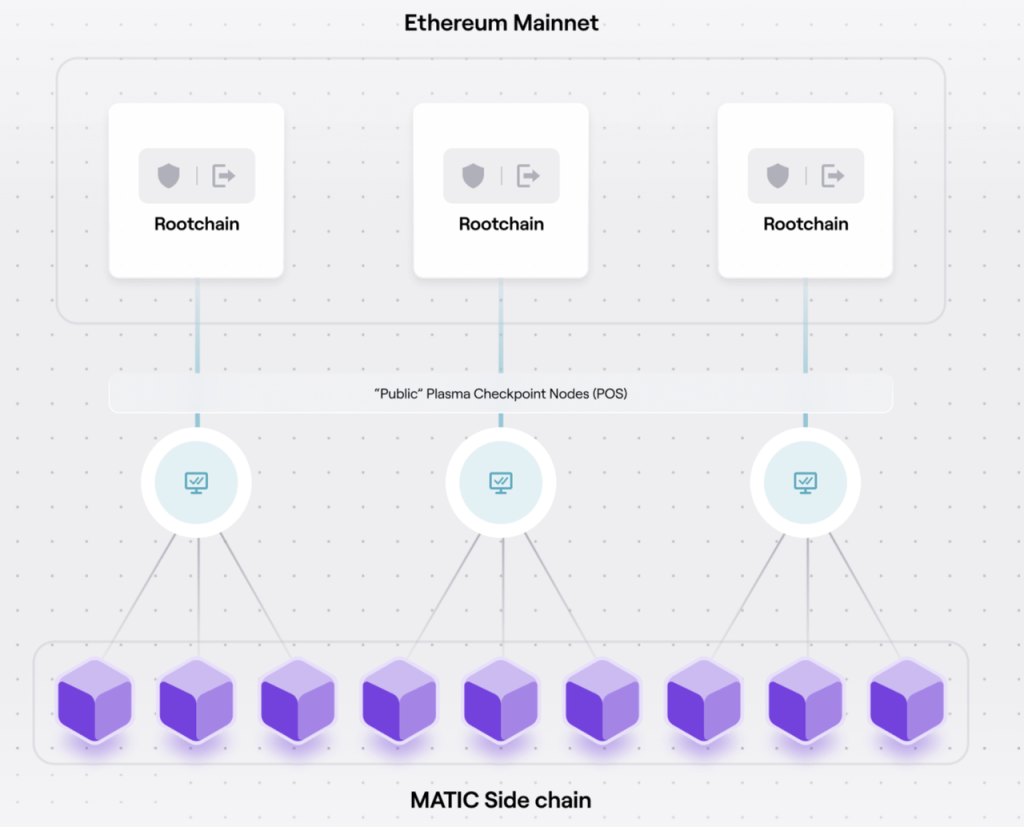

Polygon PoS: Polygon shares the pressure of the main Ethereum chain through its side chains and transfers information between its side chains and the main Ethernet chain to enable the scaling of Ethereum.

Such a model is more similar to the Ethereum ecosystem than new public chains such as Solana but less secure than various Rollups, so Polygon has positioned itself as a Layer2 aggregator and is vigorously developing ZK Rollup starting in February 2021.

Business of ZK Rollup

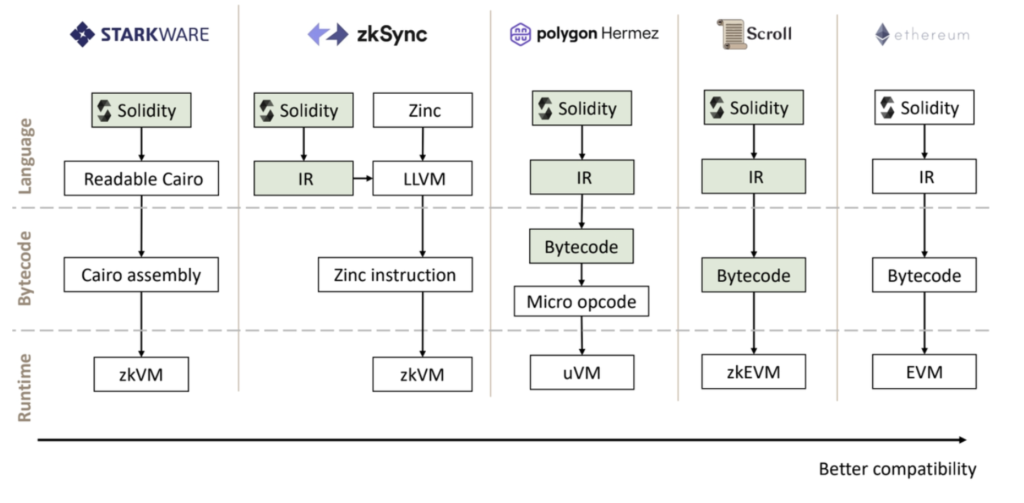

ZK Rollup is recognized as the most promising scaling solution, but because ZK Rollup is not EVM-compatible, the current ZK Rollup projects are still under exploration. Polygon keenly seized this industry trend, and then launched the following businesses through acquisitions and other means:

- Polygon Hermez(zkEVM)

- Polygon Miden

- Polygon Zero

Among them, Polygon Hermez (zkEVM) is a strong competitor in the ZKEVM field, Polygon Miden has quantum resistance, and Polygon Zero has the world’s fastest zero-knowledge provers.

Other Business

Polygon Avail: Data availability layer. It means that various Layer2 can archive various transaction records to Polygon Avail, and Polygon Avail submits the proof of “archival integrity” to the Ethereum main chain after processing the archived data, thus saving the cost of archiving on the Ethereum main chain.

Polygon Nightfall: Blockchain for corporate audit. Polygon has partnered with Ernst & Young on audits to launch an enterprise version of blockchain solutions. Polygon Nightfall scales through OP Rollup mode and adds a privacy layer based on zero-knowledge proofs.

Polygon Edge and Supernets: It can be used to develop various developer tools for Layer 2.

Polygon ID: It is a privacy-enabled decentralized identity.

Competitive Edge

How Should Polygon Stand Out When Plasma Technology has No Advantage?

Precise Strategic Vision of Polygon

Foresight in Ecosystem Strategy – Polygon Studios

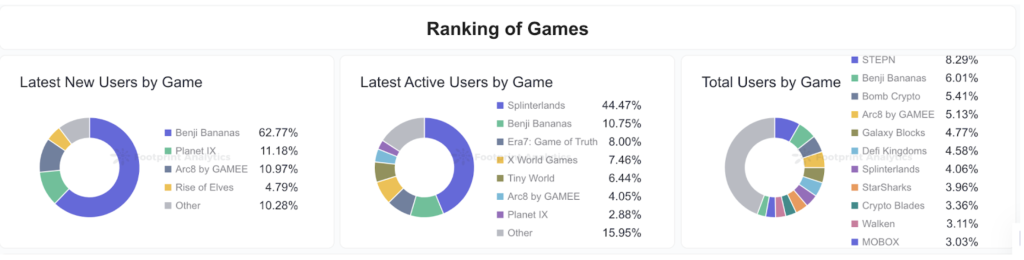

In 2021, Polygon responded quickly to the burgeoning GameFi and NFT business and established Polygon Studios in July to aggressively foster GameFi and NFT projects within the ecosystem.

NFT

Unlike Ethereum’s high-value asset ecosystem, Polygon focuses more on developing affordable NFTs. The low-unit-price NFT asset market may see rapid growth in bull markets, but the trading volume tends to shrink in bear markets.

Due to Polygon’s extreme importance placed on the NFT business, Polygon has become Opensea’s second-supported public chain after Ethereum. Subsequently, ETH and Polygon have taken almost all of the high- and low-priced markets for NFT respectively. Under the strong push of Polygon Studios, the trading volume of NFT on the Polygon chain once surpassed that of Ethereum, but the trading volume of Polygon’s NFT rapidly shrank in the bear market due to the much weaker viability of low-priced NFT.

GameFi

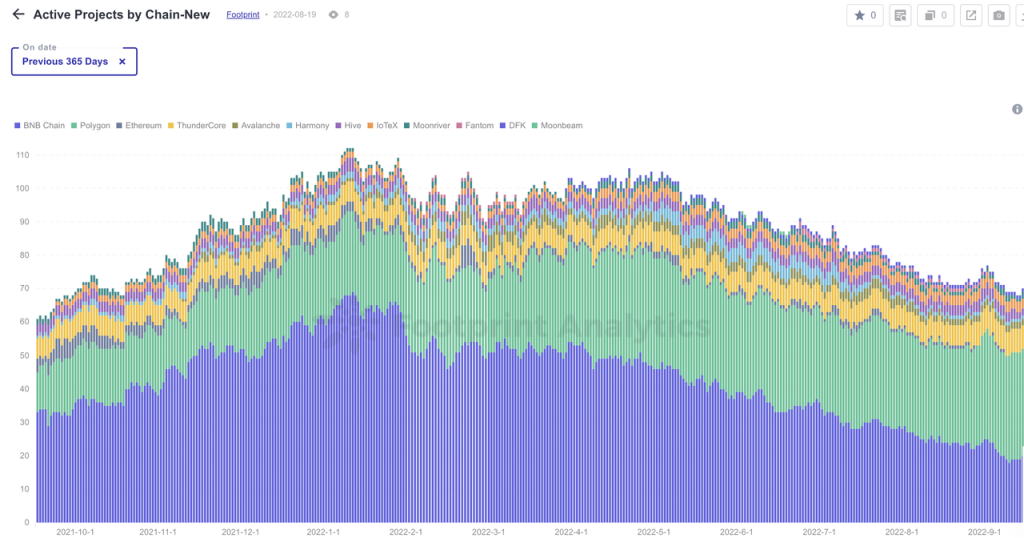

Polygon has a rich ecosystem of games and metaverse. Polygon and GameFi, which is active on BSC, have long been in the top two and an order of magnitude higher than other chains.

In addition to the well-known Sandbox and Decentraland, other new offerings of GameFi in the Polygon chain are also growing.

Arc8

In September 2021, GAMEE (GMEE), the gaming platform of blockchain gaming company Animoca Brands, announced a partnership with Polygon Studios. GAMEE is launching its GMEE token and blockchain action game app Arc8 on the Polygon chain. Arc8 is mobile gaming that allows players to earn revenue with games and is also a combination of E-Sports and cryptocurrency that allows players to crush their opponents and win GMEE tokens in Arc8’s E-Sports.

Planet IX

In September 2021, Planet IX was launched on Polygon. Planet IX is a tactical game of virtual land transactions running on the Polygon chain. It consists of virtual plots of PIX that are available for grabs. Players must compete and cooperate to gain as much of the land as possible. The game’s design is based on the Earth itself, and the goal of all Planet IX players is to collect as many PIX as possible. Players have to create and form contiguous lands (territories) as a way to earn rewards.

With the surge in GameFi on Polygon’s chain in September 2021, the number of active addresses on Polygon’s chain also surpassed Ethereum.

Benji Bananas

In March 2022, Benji Bananas, a mobile game of Animoca Brands, officially announced the launch of Play-to-Earn mode, which was later launched on Polygon. Benji Bananas now has over 30,000 active users, ranking first on Polygon and among the top of all GameFi.

Horizontal Strategy – From Plasma to Layer2 Aggregator

When Polygon was founded in 2017, it chose the then-mainstream Plasma solution. Yet with the evolution of the Rollup scaling solution in 2019 and the complete transformation of the Plasma Group in 2020, Polygon’s choice is no longer appealing among the many scaling solutions of Ethereum.

In February 2021, the Polygon team made the following judgment: Ethereum needs many scaling solutions and these solutions should be interoperable. Since then, Polygon has repositioned itself as an Ethereum Layer2 aggregator. In addition to the original Polygon Plasma and other solutions, Polygon has invested heavily in the layout of ZK Rollup, ZK, and OP hybrid Rollup solutions, and even provided developers with in-house underlying development tools of Layer2. Polygon has since grown incredibly rapidly in the Ethereum ecosystem, and in 2021, Polygon’s market cap grew more than a hundred-fold.

Among the most sought-after ZKEVM solutions currently, Polygon’s acquired Polygon Hermez is one of the leading projects with fast progress and sound compatibility.

Web 2.5 Leader — Strong Appeal to Conventional Business Giants

Due to Polygon’s unique positioning in the Ethereum ecosystem and Polygon’s ongoing efforts to advance partnerships with on-chain projects, Polygon is the most attractive ecosystem among the many public chains currently available to conventional business giants.

Options of Conventional Enterprises

From the perspective of conventional enterprises, if they put their business on the chain, the preferred choice must be the Ethereum ecosystem with the greatest influence on the chain. Yet, due to the limited capacity of Ethereum, it is difficult to meet the high-frequency requests from a large number of users at present. Polygon has an extremely cheap and high-speed, well-developed Ethereum side chain, and at the same time, it is positioned as a Layer2 aggregator and has a variety of Ethereum scaling solutions, making it the first choice for the blockchain business of many large enterprises.

Polygon has also shown great interest in Web2’s large user base, and the project team keeps expanding its partnerships with conventional companies.

Data Sovereignty and Transactions

Data has always been one of the core assets in business, and blockchain has natural advantages in data asset authentication and transaction.

In July 2022, Mercedes-Benz launched Acentrik, a data marketplace built on Polygon. Since then, Mercedes-Benz users and various partners can trade various data related to Mercedes-Benz cars and insurance in this marketplace, and the above transactions are paid with Gas fee using Matic tokens.

NFT and Brand Loyalty Program

In September 2022, Starbucks announced the launch of Starbucks Odyssey, an NFT-based loyalty program using blockchain technology provided by Polygon, which allows users to purchase digital assets in the form of NFTs for exclusive experiences and rewards. With stars awarded for spending, the program will expand digital communities and offer rewards, including digital Starbucks rewards and Starbucks-branded digital collectibles.

In addition, Meta and Reddit have both partnered with Polygon for an on-chain NFT issuance program.

As an example, Reddit, with 450 million users, has brought a large number of NFT users to Polygon since August 2022. As of November 2022, Reddit has brought 3 million NFT users to Polygon, and that number surpassed 5 million in December.

Convergence of CeFi and DeFi

As one of the Layer2 leaders with the widest variety of DeFi, Polygon has also become one of the best choices for CeFi to try out DeFi.

Beginning in May 2022, financial giants JPMorgan, DBS Bank, and SBI Digital Asset Holdings jointly tried DeFi on Uniswap and Aave DApp on the Polygon chain, with assets issued on the chain including Singapore Government Securities (SGS) bonds, Singapore Dollar (SGD), Japanese Government Bonds, and Japanese Yen (JPY). JPMorgan deployed and explored deposits and loans of the above assets on Aave, and subsequently deployed transactions of related assets on Uniswap and used Bloomberg feeds.

Summary

Meta with nearly 3 billion monthly active users, and JP Morgan with USD 3.2 trillion of assets under management… With Polygon’s in-depth collaboration with off-chain giants, Polygon is expected to see tremendous ecosystem growth at DeFi, NFT, and other dimensions.

Valuation

Overview of Polygon’s Competition Track

Looking at the main evaluation indicators of public chains, Polygon is generally among the top five and has good prospects for growth.

Public Chain Competition Indicators and Landscape

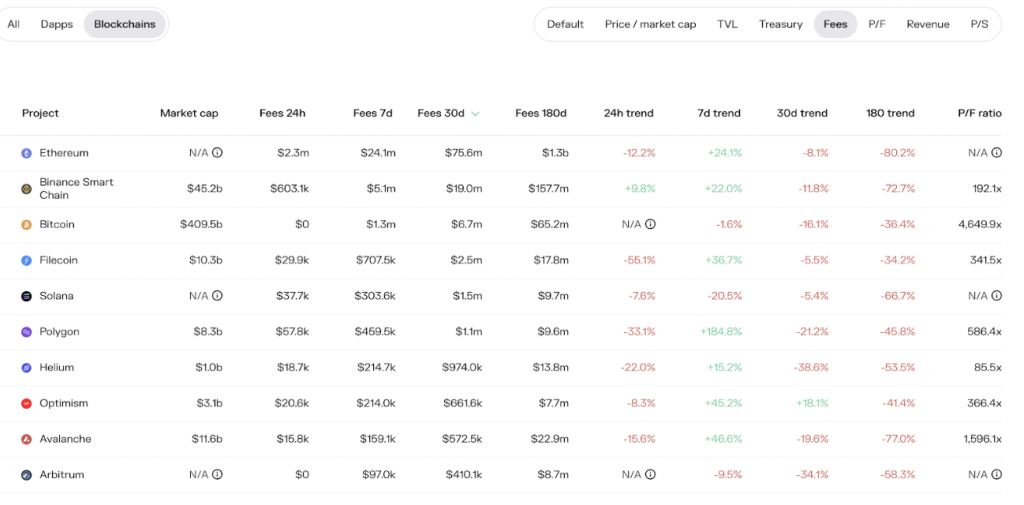

Crypto investors typically use TVL and the fees paid by users as the main indicators to measure how well a public chain is performing in the business.

Polygon ranks 5th among public chains in the TVL indicator and 4th among public chains in terms of fees paid by users, among the top overall.

Main Competitors of Polygon

In terms of TVL and public chain data, Polygon’s competitors include BNB Chain, Solana, Avalanche, Optimism, Arbitrum, Cosmos, and Polkadot.

- BNB Chain possesses the powerful traffic of BSC, but the ecosystem is relatively closed.

- Solana has maximized network performance, but frequent “downtime” and the collapse of its main industry backer, FTX, have left little room for optimism in the future.

- Arbitrum and Optimism enable the scaling of Ethereum, but their TPS and cost are not competitive compared to Polygon and are often questioned about centralization.

- Cosmos and Polkadot have realized a multi-chain ecosystem, but their development is slow and non-EVM has raised the threshold for users and developers.

- Avalanche has better performance and has also launched a subnet-based multi-chain ecosystem, but the ecosystem is developing a bit slowly.

Overall, Polygon has a stronger and more open ecosystem compared to new high-performance public chains and is also more competitive as a Layer2 aggregator within the Ethereum ecosystem. Generally speaking, Polygon has a competitive edge.

Valuation of Polygon

Polygon’s business is mainly divided into two parts, the Polygon PoS chain and a series of sub-projects of ZK Rollup.

Valuation of Polygon POS – Overall Moderate Level

We value Polygon PoS using a combination of horizontal comparative valuation and vertical comparative valuation.

Comparison of Horizontal Data

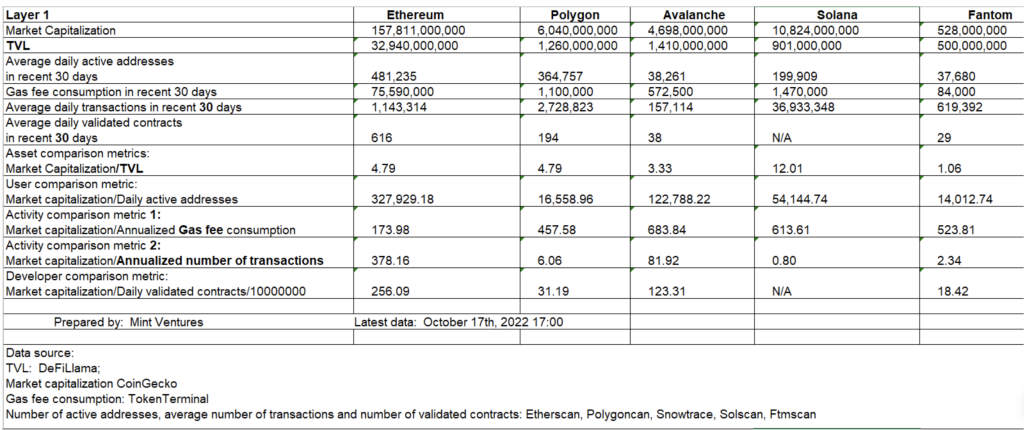

A public chain can be likened to an economy or a country, and the author selects indicators to measure public chains in four dimensions: assets, user base, business activity, and developers.

- Asset indicator: TVL

- User indicator: Number of on-chain active addresses

- Activity indicator: USD value of Gas consumed per day and total daily Tx

- Developer indicator: Number of validated contracts on the chain.

Setting Ethereum as the reference, we compare Polygon with Solana, AVAX, Fantom, and other new public chains horizontally, with the following results:

A horizontal data comparison of Polygon, Avalanche, Solana, and Fantom shows that Polygon is moderately valued in asset and developer indicators, and significantly underestimated in user and activity indicators. The overall valuation of Polygon is low.

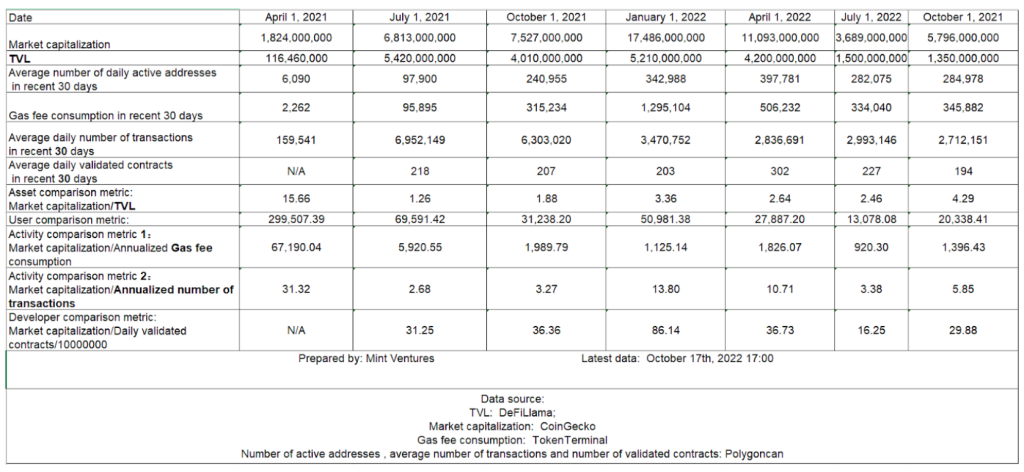

Comparison of Vertical Data

Vertical analysis of the Polygon at different moments and by the above indicators yields:

Polygon’s current valuation is generally at a historically moderate level.

Polygon’s user data, activity data, and developer data are performing relatively well while showing a trend of higher valuation when it comes to asset indicators.

To sum up, Polygon’s valuation is relatively low in the horizontal comparison with other public chain projects, and at the median in the vertical comparison with its historical valuation.

Valuation of subprojects launched by Polygon for ZK Rollup – These Subprojects are Valued High But are Not Factored Into the Market for Now

Since none of the ZKEVM projects has issued coins, we value them through data on the primary market:

Polygon spent USD 250 million and USD 400 million to acquire Polygon zkEVM and Polygon Zero, respectively, and when compared to the valuation of other ZK Rollups this year, the current market value of the above two projects should be more than USD 2 billion.

Final Conclusion

With 150 million user addresses, 53,000 Dapps, and a solid top-five TVL, Polygon is a public chain leader surviving bull and bear cycles.

Thanks to the growth of the “Web2.5” ecosystem, Polygon has connected with Web2 giants such as JPMorgan, which manages assets of USD 3.2 trillion, and Meta, which has nearly 3 billion monthly active users. As the cooperation deepens, Polygon is expected to see a large number of new users and businesses.

There are many growth drivers for Polygon’s ZKEVM. Leading ZKEVM projects are currently valued at roughly USD 2 billion or more, and Polygon Hermez, as one of the leading ones with superior compatibility and fast development progress, still has more room for growth.

Polygon’s 360,000 monthly active addresses substantially outperform similar new public chains, and the rest of its indicators also perform well, with an overall low valuation level.

Polygon currently has solid fundamentals, with many growth drivers, low valuations, and good overall investment value.