Contents

Key Insights

- BendDAO’s peer-to-pool lending protocol scores high on Product-Market Fit (PMF), delivering a great user experience in terms of funding efficiency, security, and simplicity of use. BendDAO precisely serves the blue-chip PFP market, the largest share in the NFT market. As the blue-chip NFT users are quite sensitive to capital efficiency, the simplicity and straightforwardness of the product saves users from setting parameters, greatly enhancing loan speed and lowering risks.

- The protocol becomes a great buy-the-dip place for NFT pro-traders. BendDAO provides professional NFT traders with immediate loans that allow them to trade with leverage when Yuga Labs dropped Otherdeeds. The liquidation mechanism has also made the BendDAO auction pool a perfect buy-the-dip place for NFT Flippers, further increasing its visibility in the blue-chip NFT community.

- The active participation of users in the governance and proactive product development work in tandem with each other to drive protocol forward. The BendDAO team is a true practitioner of DAO governance who has always encouraged the community to participate. BendDAO raised funds via an IFO approach (Initial Fair Offering) from the public without any private funds. The $BEND mining rewards allows users to participate in governance after obtaining veBEND by staking BEND. The tokenomics also opens up the channels for users to make suggestions for protocol development, while deepening the relationship between the protocol and users, enhancing customer loyalty.

- The competition in the NFT lending field becomes more intense, but BendDAO has been leading in most of the dimensions including the number of users, reputation and functionality. If the protocol continues to grow as the NFT market expands, BendDAO will have more momentum when the real NFT-Fi boom comes around.

- Although BendDAO is leading the NFT lending segment, we kindly remind readers and investors to watch the following risks: (1) the downturn of the Blue-chip PFP market, (2) the intensified competition landscape, (3) the limited customer base, (4) liquidation mechanism flaws, and (5) parameter risks. Users also need to be cautious about the stolen NFTs listed on BendDAO as the protocol doesn’t give users a warning.

Brief Introduction

BendDAO is a “peer-to-pool” NFT collateral lending protocol mainly serving the blue-chip NFT holders, whereby the borrower is able to quickly withdraw ETH in the protocol pool by staking blue-chip NFTs in the pool, and the depositor provides ETH to the pool to get ETH-denominated interest. Meanwhile, the borrower and the depositor get BEND mining rewards as they use the protocol. Currently, the NFTs allowed as collateral primarily include 8 blue-chip NFTs.

The protocol has been running for about 8 months since its launch in March 2022. Since then, its functions have been constantly developed and updated, whilst the BendDAO team continues to develop new features and functions according to the market needs. In addition to the lending business, BendDAO has a built-in trading marketplace to support new features such as “down payment” and “collateral listing”. Also, peer-to-peer lending function and Ape Staking Pair Listing function are under development. (As of this English report is published, the Ape Staking Pair Listing function has already been launched.)

As of the publication of this report, BendDAO’s main business is NFT lending where users can borrow ETH using Blue-chip NFTs as collateral. Additionally, BendDAO also has an NFT marketplace business that supports users to trade collateralized NFTs, lowering the opportunity costs while borrowing money, and to pay down payment to purchase NFTs. The main revenue stream is the interest rate spread income generated from lending business, and the rest revenue comes from the transaction fees (2% rate) and down payment fees (1% rate) from the NFT marketplace. As of November 6, 2022, the interest income approximated 2,065.11 ETH (of which 30% is allocated to veBEND holders), representing 98.95% of the total revenue.

The BendDAO business structure is shown below:

Highlights and Competitive Edges

High PMF Products Deliver an Excellent User Experience in Terms of Capital Efficiency, Security, and Simplicity

At present, blue-chip PFPs account for most of the NFT market, and BendDAO’s business accurately serves this largest share. The overall NFT market experienced a frenzy around PFPs from the second half of 2021 to the beginning of 2022. PFP sales account for most of NFT transactions on Ethereum. During this period, several blue-chip PFPs became the mainstream market. According to NFTGo.io, as of the beginning of November 2022, PFPs account for about 58% of the overall Ethereum NFT market. Despite the bear market, the 7-day trading volume of blue-chip NFTs usually accounts for 30% to 40%, and the trading volume of PFPs usually far exceed other NFT types, such as GameFi’s NFT assets, art collections or Metaverse assets. BendDAO only supports blue-chip NFT collections, focusing on serving the largest and the most active NFT segments in the market. Compared with lending protocols that serve all NFT assets at the same time, although BendDAO has given up on the non-blue-chip market, only supporting a few Blue-chip PFPs as collateral makes valuation easier and a fixed LTV reasonable, simplifying the borrowing process users.

Peer-to-pool protocols have outstanding advantages in the loan speed. The unit price of blue-chip PFP is relatively high, and the capital efficiency of holding NFTs is low. Although the traditional peer-to-peer protocols in the market can provide flexibility in pricing rare NFTs, the scarce and expensive blue-chip PFPs normally face low loan amounts and high interest rates. BendDAO’s peer-to-pool model allows some blue-chip PFP holders to immediately borrow ETH from the pool, which greatly improves the borrowing speed. The protocol valuation model ensures that the floor price will not be too low and has a certain degree of resistance to manipulation. The loan interest rate is somehow predictable along the APR-Utilization Rate curve.

Security is the focus of the team. Allen, one of the founders of BendDAO, and other members have repeatedly mentioned the importance of protocol security in public. The protocol code has also undergone a complete code audit, and every time a new function is launched, there is also a third-party audit to check the code security. In terms of product design, BendDAO emphasizes the security of the NFT assets. The NFT collaterals in the protocol will be turned into boundNFT which guarantees the security of users’ assets. The boundNFT retains the metadata and Token ID of the NFT, and has the characteristics of being non-transferable and non-approvable.

The simple and plain design brings a good user experience. BendDAO’s customer acquisition success lies in its simple product form. Products that reduce the difficulty of user cognition and operation can often win faster. BendDAO’s operation process is streamlined, and the product usage logic is easy to understand. The protocol is positioned in the blue-chip NFT market, and only supports 8 blue-chip NFT series, and the loan assets only support ETH. Users do not need to set a lot of parameters such as LTV, interest rates, or duration to get the loan. Compared with other lending protocols, BendDAO is simpler and easier to understand, which saves users the trouble of setting parameters. It is friendly to junior NFT players. Although the focus of business has weakened the flexibility, BendDAO can meet the most demand of the largest share of NFT users.BendDAO’s first-mover advantage has helped the product gain a lot of customers. BendDAO pioneered the “peer-to-pool” lending model. Among the many protocols classified as “peer-to-pool”, the more well-known ones are Drops and JPEG’d. Drops lending business was launched on the mainnet in May 2022, and JPEG’d in April 2022. Before the launch of BendDAO (March 2022), the NFT liquidity solutions available in the market were mostly peer-to-peer protocols, such as NFTfi, Pine Protocol, Arcade.xyz, but none of them really solved the pain point of loan speed. Users of the protocols often need to wait for a long time for matching. Blue-chip NFT holders may need to accept excessively high interest rates and low loan amounts. When BendDAO appeared on the market, blue-chip NFT users rushed to the protocol for its fast liquidity.

The Protocol Enriches the NFT Gameplay and Becomes a Tool for Professional NFT Traders

The simple lending protocol becomes a “leverage tool” for professional NFT traders, further enhancing BendDAO’s reputation in the blue-chip NFT community. From April to May 2022, Yuga Labs launched the Otherdeeds collection associated with its metaverse plan, and planned to airdrop Otherdeeds to BAYC and MAYC holders. The design of the BendDAO protects the rights of NFT holders to receive airdrops. Therefore, many blue-chip NFT users borrow funds through BendDAO against BAYCs and MAYCs and purchase more Ape NFTs to secure more Otherdeeds. After receiving the airdrop, they repay the loan and get back the NFT collateral. The Otherdeeds airdrop event of Yuga Labs had a positive effect on enhancing the influence of the BendDAO protocol in the Yuga Labs community, allowing many NFT users to make full use of the product. It marked many loyal users’ first acquaintance of BendDAO.

The auction market has become a great place for NFT flippers to buy blue-chip NFT dips. BendDAO’s liquidation mechanism makes it profitable for traders who are optimistic about the NFT market. Traders can find less expensive blue-chip NFTs in the auction market on BendDAO and then flip them for a profit. There are a group of people in the market who specialize in NFT flipping such as Twitter KOL @Franlinkisbored. Franklinisbored is the sixth largest BAYC holder (dynamically changing all the time) in the world, and as of November 6, 2022, he owned 61 Boring Ape NFTs. In addition, he has also become a well-known NFT Flipper by repeatedly buying low and selling high with BAYC and MAYC collections. We can see from the BendDAO auction records that Franklinisbored is extremely active on BendDAO, and has participated in bidding 49 times in history as of November 6, 2022. He is also the user with the highest cumulative loan amount on BendDAO, borrowing more than 15,000 ETH in total. There are also many other professional NFT players other than Franklinisbored who actively participate in bidding for relatively low-priced blue-chip NFTs. According to the auction records, as of November 6, 2022, we found that 42 different addresses actively participated in the auction (accumulative participation >= 5 auctions), of which 13 addresses have accumulated more than 10 auctions, as shown in the table below. The existence of BendDAO makes the circulation of expensive blue-chip NFTs more frequent, bringing different gameplay to the market.

Around November 15, 2022, due to a quick drop in the floor price, a large number of BAYC collaterals triggered liquidation. However, unlike previous times, the participation in the liquidation auction was more active, and the first bidder appeared much quicker than previous FUD time. After experiencing the previous crises, the market seems to build more confidence in the blue-chip NFTs’ value. BendDAO’s liquidation auction market allows the bid to start from the total debt of the loan, which usually is a discounted amount of the floor prices. The short-term floor price decline creates opportunities for NFT flippers to buy the dip from BendDAO and flip when the market recovers.

The Developer Team and DAO Governance Work Together to Promote Protocol Progress

BendDAO core team has always encouraged the community to participate in governance and is a practitioner of the decentralized DAO model. As can be observed on social media, core team members have been encouraging community members to participate in governance and brainstorm ideas for protocol development. Some of these efforts include opening periodic working meetings to the public and hosting a weekly Twitter Space to discuss protocol development and hot topics in the NFT market @The Big Bend Theory, and public encouragement of community members to participate in forum discussions, etc. On various occasions, the team showed an open attitude towards community opinions and suggestions. In addition, it is worth mentioning that before the mainnet launch of BendDAO, the team adopted the IFO (Initial Fair Offering) method to open financing to everyone, instead of raising funds from venture capitalists, and also airdropped tokens to the NFT community as an attempt to decentralize voting rights, and encourage the community to join BendDAO governance. The DAO governance helps the protocol to continuously improve and strengthen the binding relationship between users and the protocol. The lending business using the agreement will receive BEND token mining rewards. After locking the BEND tokens, users will get veBEND, and have rights to vote and to share the income of the agreement. The subtlety of the Voting Escrow model learned from Curve is that it gives protocol users governance rights and realizes real decentralized governance. It also enhances the user’s sense of belonging and loyalty to the product.

Essentially, BendDAO has been pushing the NFT industry towards a more decentralized community by encouraging more members and users to participate in building the product and providing suggestions. While it is improving the protocol’s ability to better serve the market, a good brand image has also been established, and the binding relationship between users and the protocol ent has been subtly enhanced.

Risks and Challenges

Although BendDAO is leading the NFT lending segment, we kindly remind readers and investors to watch the following risks:

(1) the downturn of the Blue-chip PFP market

(2) the fierce competition landscape

(3) the limited customer base

(4) liquidation mechanism flaws

(5) parameter risks.

Users also need to be cautious about the stolen NFTs listed on BendDAO as the protocol doesn’t give users a warning.

Valuation

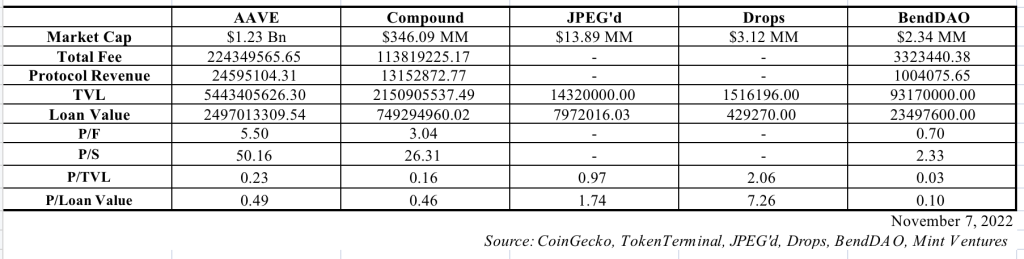

We value BendDAO by using Relative Valuation approach,and we compared with leading DeFi lending protocols including Aave, Compound, andNFT lending protocols including Drops, JPEG’d. We compare different players in the DeFi and NFT lending space with a variety of multiples, including P/F ratio (market cap/protocol fees), P/S ratio (market cap/protocol revenue), P/TVL ratio (market cap/total lockup value) and P/Loan Value ratio (market cap/loan amount). Due to insufficient data availability, JPEG’d and Drops are not compared on the total fee and protocol revenue dimensions.

Based on the above multipliers, BendDAO is in a lower valuation range, partly because the protocol is at an early stage of development, and the NFT-Fi sector has an overall low valuation level. In the future, chances are that more start-up projects, new users and TradFi capital flow into the NFT market, providing a strong unrevealed momentum for the market. Meanwhile, NFT has more application scenarios and has become the value carrier of more assets. Only if NFT assets continue to expand their category, impact and market value can NFT-Fi maintain long-term growth, and the protocol value of BendDAO be further discovered.