2022 has been unprecedented and has brought significant challenges to the Web3 world.

Mint Ventures bids farewell to 2022 with reviews and outlooks to draw an end to a year of research and learning. We are here to recap feats and clashes, achievements and failures, trying to visualize the present and the future.

Our researchers and investment managers aim to answer the following three questions to wrap up the year. We are thrilled to share their insights and takeaways with everyone since we are all committed to bringing Web3 inclusion to society.

- In the past year, what industry events have impressed you the most?

- What trends or investment opportunities do you believe are worth watching in the next year or two or during the next bull market cycle?

- On top of your observations, is there anything else you want to share?

Disclaimer: The Next Cycle Outlook: WEB3 in 2022 and Beyond is for informational purposes only and should not be relied upon as a basis for investment decisions, nor is it offered or intended to be used as legal, investment, financial, or other advice.

Contents

|Alex Xu: Still Bullish on DeFi for the Next Cycle

In my opinion, the regulatory action against Tornado Cash (“Tornado”), the rise and practice of a large number of DAO organizations, and the collapse of the Luna ecosystem are three milestones in 2022.

- Regulatory action against Tornado Cash.

Tornado is the largest coin mixer on Ethereum, being widely adopted by hackers and other users with a need to cut off money tracking. The US Treasury Department’s Office of Foreign Assets Control (OFAC) placed it on a sanctions list in early August this year, banning its use by US citizens, and Tornado’s developer, Alexey Pertsev, was arrested by Dutch authorities. Later on, many agencies began to follow OFAC’s sanction actions. Circle, the second largest stablecoin issuer, quickly froze the USDCs within the Tornado protocol and froze the USDCs within highly associated addresses. Then, Github offloaded the Tornado codebase. Other organizations, including some decentralized project, also blocked or blacklisted addresses that actively interacted with Tornado. For example, Uniswap blocked 253 crypto addresses associated with stolen funds or sanctions. Aave blocked numerous addresses that had interacted with Tornado for transfers. And third-party node operators, Infura and Alchemy have terminated services to Tornado as well .

Regulators have taken actions against DeFi unprecedentedly, although there were constant concerns before, the difficulty and cost of sanctioning DeFi is much higher than that of centralized institutions and individuals, considering that DeFi is deployed on Ethereum and inherits the security and decentralization of Ethereum, and the users all have anonymous addresses. But the Tornado incident revealed the harsh reality that: Although DeFi operates based on trusted code and a decentralized network, the individuals and other institutions that interacted with them, still subject to regulations and other credit systems. Regulators are still capable of enforcing relevant laws powerfully than expected.

This event has made the entire crypto community re-evaluate itself by following:

- Security of the business model: Is it safe to use a large number of assets issued by centralized institutions? Rune Christensen, the co-founder of MakerDAO, stated that DAI aims to be de-anchored from the US dollar and that the protocol will insist on decentralization to limit potential censorship attacks. But USDC is still the primary collateral for DAI.

- The rightness of business ethics: Should DeFi, which is managed by the community, cooperate with the regulatory action? The key values of DeFi’s are permisionless, transparent, free, and anonymous, when one DeFi protocol helps regulators beat other DeFi protocols and users, how does it explain that to its own communities and convince them that it will not be tamed by regulators, and do something that may harm the interests of the community?

- Other than that, How should Ethereum community respond if regulators crack down on Ethereum’s node service providers? In the Ethereum community’s vote in response to this situation, one option is to view such censorship as an attack on Ethereum and then conduct a broad consensus to destroy the pledged interests of nodes that cooperate with the regulation; the other is to tolerate censorship. Vitalik Buterin clearly stated his position: considering the behavior of controlling nodes to cooperate with the censorship as an attack on Ethereum and penalizing these verifiers.

The event has shed new light on the value of “decentralization”, which once seemed less important in the bull market when new high-performance public chains were riding high in the face of Ethereum’s high gas fees. After the Tornado incident, and the attack on the BNB Chain cross-chain bridge (where the main network stopped working and the node blacklisted the offending address), it is necessary to re-evaluate the value of the protocol and the network’s “decentralization” and resistance to censorship.

- The rise of a large number of DAOs.

DAOs as a form of organization and collaboration are not something new in 2022, as numerous crypto projects have already been governed as DAOs, featuring discussions in community forums, ballot initiation, product upgrades, and allocation of funds.

But ConstitutionDAO was the one that got the entire crypto community to value and actively engage in DAO in late 2021. With a mission to bid on the official first edition of the printed US Constitution that Sotheby’s auctioned off in mid-November, ConstitutionDAO successfully crowdfunded over 10,000 pieces of ETH, worth USD 43 million at the time, through fundraising platform Juicebox in just a few days. At the time, cryptocurrency trading platforms Gemini, Coinbase, a16z, and other well-known organizations rushed to promote this. Although the ConstitutionDAO failed the bid eventually, it showed the powerful capabilities and possibilities of DAOs, and more importantly, the huge popularity of the ConstitutionDAO, has enabled the successful launch of its donation voucher token People on first-tier trading platforms such as Binance in December, a project token that originated from the concept of “democracy” and became the last successful MEME token in 2021 and the first in 2022, creating significant wealth in a market that was already waning at the moment.

The great influence and wealth effect of ConstitutionDAO, successfully engaged crypto users at a broader level in DAO, thus enabling a big explosion in the number of DAO organizations in the crypto world. DAO became the most discussed topic in the media and SPACE at that time, and the financing of DAO organizations and DAO tools soon heated up in the first half of 2022. I also joined quite a few DAO communities at the time to find answers to the following questions:

What is the featured scenario of the DAO organization over other mainstream organizations, what is its strength and weakness on problem-solving?

What is the main value that blockchain and crypto business offers to DAOs?

How to assess the performance of a DAO organization?

For now, the DAO is waning, especially for event-driven DAOs with a single mission (such as the one that bid for a quota on the Blue Origin moon landing after the constitutional auction), but many DAOs set on long-term, comprehensive goals are still running, and their lean improvement efforts continue. I seem to be a little closer to the answers to two of the questions I was initially looking for:

Greater flexibility is one of the advantage of a DAO in the crypto world over a corporate system. Flexibility represents organizational flexibility, inclusiveness, and democracy, backed by transparent systems, open access and cooperation, and a collaborative spirit across geographies\ethnicities\and civilizations. With a clear goal and a strong rallying mission, it is easy for people to achieve rapid gathering and active action in DAO.

Blockchain and cryptocurrencies provide a low-barrier tool for DAO transparency and serve as a natural filter for the audience (Web3 users, naturally, have a favorable view of DAO organization and values)

Of course, these answers and thoughts are still far from the conclusion, because now DAOs are still evolving.

If we look back at the development of DAO, we can see that what led to its first wave of prosperity was not some breakthroughs in organizational behavior or management, but rather that the speculative boom and wealth effect attracted enough attention, hot cash and talent inflow for the concept, which became the sustenance for the practice of DAO organizations. This once again proves the role of speculative bubbles in driving important technological advances and social practices.

- The rapid collapse of the Luna ecosystem.

Terra is not a conventional Ponzi scheme and its never the main controversy. Instead, the main point of disagreement is the public chain development model of Terra.

“Supporters argue that: Terra’s high-interest deposits are similar to customer acquisition and retention subsidies in the Internet field. Despite the huge losses in the early stage, the money currently subsidized will be recouped from the long-term ecosystem prosperity in terms of the total life cycle of users; Opponents believe that it is difficult to form a steady state in the development model of Terra, i.e., subsidies + public chain tokens & stable coin linkage, which will die in the negative spiral of a certain Luna price plunge in the end. ”

Let’s revisit Terra’s vulnerabilities, business model, and potential risks:

Vulnerabilities:

“The vulnerability of the Terra ecosystem lies in the lack of economic scalability of its eco-token, Luna, and the stability of UST is inferior to decentralized stablecoins like DAI. ”

Business model:

“And to drive the narrative and build stronger economic scalability, Terra has built a self-reinforcing business model based on its two-wheel model of stablecoin + public chain, in the following order:

- First, creating and subsidizing its DeFi scenario within the public chain such as Anchor, to create the demand for stablecoins.

- The demand drives the scale of UST minting and users engagement.

- Improving the key indicators of the ecosystem, such as TVL, number of addresses, transfer activity, and number of projects participating in the ecosystem.

- Enhanced indicators of the ecosystem made Luna’s narrative more compelling.

- Enabling collaboration with more leading projects by its strong consensus and fundamentals.

- The strong narrative and consensus have increased Luna’s trading breadth (number of investors and regions) and depth, and have gradually pushed up prices.

- The actual controller has obtained funds by cashing out or burning Luna.

- Continuing to subsidize [Step 1] with the cash-out funds to drive the above cycle.

In this cycle, the primary expense and revenue are [Step 1] and [Step 7] respectively. As long as the revenue from [Step 7] is sufficient to support [Step 1], the cycle can be sustained, helping Terra move toward with its main business objectives:

- Driving the mass adoption of its stablecoin UST, replacing centralized stablecoins such as USDT and USDC.

- Boosting the prosperity of the Terra and making WEB3 economy accessible for open finance and other applications.

Potential risks:

The main challenge in maintaining Terra’s business cycle is that narrative-building process for steps 3-6 may go off. For example, Luna token price may be overly costly to maintain, resulting in insufficient revenue and funding for [Step 7] to subsidize [Step 1].

Possible factors may include:

- The collapse of crypto asset prices. The narrative value and valuation of projects across the field are impacted, and Terra ecosystem cannot survive as well.

- Unforseen events within the project (such as Abracadabra affected by scandals). The events may cause the Luna token price drop and iquidity lacking, which may triggers a potential under-collateralization of the UST, leading to a death spiral that the team can do nothing about.

- Regulatory shock. Regulation may limit Terra’s access to more financial resources to keep the project running and manage crisis. Sometimes regulation itself can be a contingency as well.

- The above business cycle failes to attract enough developers and users to the Terra ecosystem, the market’ view Terra narrative negative, or the current valuation framework of the public chain change significantly.

If you are a Luna investor or UST holder, you should be very alert to the above situations.

According to Terra’s crush, it turned out some of above theories has veen validated. For example, negative spiral caused by the Luna crash was under the gradual penetration of the bear market, with most crypto assets experiencing a precipitous drop. But some important possibilities have been overlooked, such as the main driver of taking down the whole Terra ecosystem. It seems the negative narrative due to the ecosystem failing to catch up with its token price, is not the fundamental reason but rather some intentional attacks. When the mechanism has its vulnerabilites, this impact can be far worse in practice than it was designed to be, as attackers will try to leverage the vulnerability in every possible way to benefit from a massive crash.

But Terra’s early success also proves one thing: To beat Ethereum in the face of the public chain’s powerful network effect, do not follow the same strategy that led to Ethereum’s success.

Still bullish on DeFi for the next cycle

I still remain bullish on DeFi in the next cycle and have been actively searching for quality DeFi projects in the bear market, both for undervalued newbies and veterans. The rationale is quite simple: Finance is the basis of industrial development, and the market value and profits of the financial industry have benefited from the dividends of economic development in the development of major economies. And in the business of the Internet of Value, the demand and frequency of value being used for capitalization, liquidity, transactions, and efficiency will be several times greater than the information Internet, in which DeFi’s role in setting the foundation would only be more pronounced.

Of course, the development of DeFi also faces potential risks, such as broadened regulation as mentioned earlier, which may slow down the development of many models and directions that could otherwise be explored. This entails a more rigorous evaluation of our investment in DeFi projects.

In the selection of specific DeFi projects, in addition to the leading projects with robust competitive advantages, I also like those projects that actively engage in Web3-native innovation, value business synergy and composability, and still remain diligent despite the market. FRAX is one of such projects. In addition to its earliest stablecoin business (including the USD stablecoin FRAX and the inflation-anchored currency FPI), it has launched Lending, Staking and DEX, and the community is discussing wrapped BTC business. The most important feature of these businesses is that they are well combined and synergistic with each other and have positive externalities with each other. In addition, Frax was one of the first projects to recognize the governance value of Curve and has a strong governance base in the Curve community.

But it’s worrisome that the FRAX team is a real-name entity in the US, which is under the heightened focus of US regulatory authorities.

Some other thoughts for 2022:

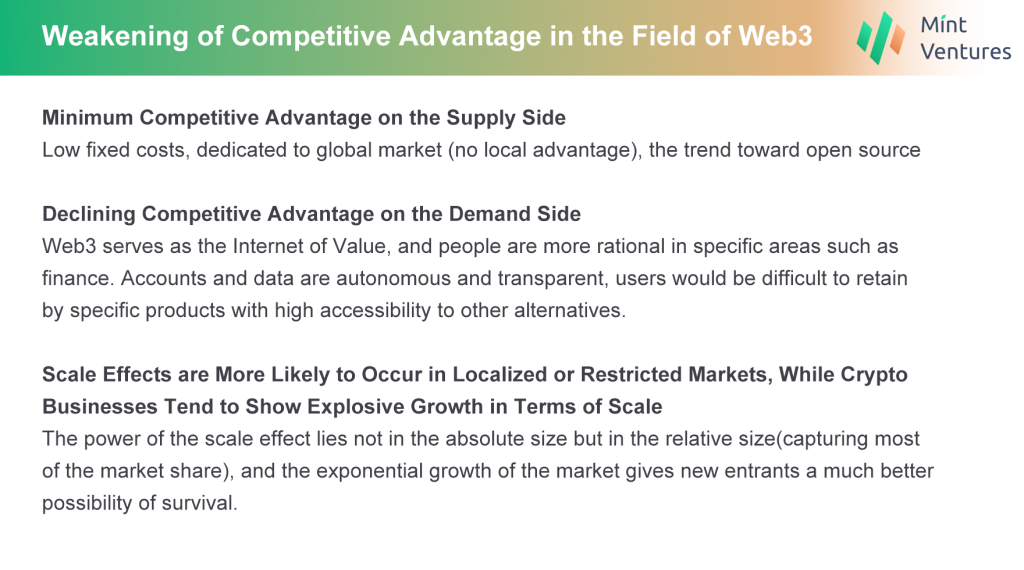

- Waning barriers to competition: Main challenge of Web3 investment

We often view and evaluate investments from the perspective of “barriers to competition,” but this standard faces many challenges when applied in the Web3 investment, such as:

When there are no explicit barriers to competition in an industry, it can be a nightmare for investors and entrepreneurs alike. It is more difficult to build a monopoly in Web3 than in the Internet era, which may imply that it is very hard to invest in absolute “long term” and “barriers” here, and it is more essential to see who can find the innovation at the edge earlier and who can achieve the ultimate efficiency (in a market that lacks barriers, efficiency is the key to survival).

- Economic Model ≠ Business Mode

StepN’s story tells us that Economic Model ≠ Business Mode. Only a Ponzi scheme would bring an economic model to market as a product, otherwise, the role of an economic model should be to coordinate and lubricate the relationship between multiple parties in the business model. Token economists attempt to use a set of economic models to solve the problems of “product growth” (the actual purpose of X to earn), public fundraising, and corporate governance, is this a difficult move worth trying? Or is it a complete delusion? It remains to be seen. But in any case, our interest in “what problem is this project trying to solve” should come before “what is its economic model”.

- The value created by Web3 is greater freedom and lower cost of trust

What is the intrinsic value of Web3? This is a question that all the entrepreneurs and investors in Web3 should think about continuously. In my opinion, a free market with unprecedented size and boundaries has been created by permissionlessness and globalization. and the open-source code and verifiability of data provide a lower cost of trust for this unprecedented free market, enabling a prosperous world to emerge.

Therefore, projects that do not leverage Web3’s core strengths of “freedom” and “trust”will face greater difficulties in business, such as projects that put real assets on-chain based on the original credit system ( law and government asset identification). Projects that have native Web3 assets and business flows that can all be put on-chain are naturally advantageous and will be worth more of our time to dive.

|Colin Li: Public Sentiments, Fundamentals, and Innovations

There are 3 big events that impressed me the most in 2022.

- The craze of public sentiment.

There was a slogan that went viral on social media “dropping out of the school to all in Web3.0” back in th March 2022. The slogan later evolved into different versions, such as “resigning to all in Web3.0”, “divorcing to all in Web3.0” and so on. Some DAOs, Influencers, and reputable institutions also participated in this hot discussion. There were numerous Twitter Spaces with quite a lot of audiences held during that period. Though I read similar phenomena that have occurred in books about financial bubbles, the replication in real life still shocked me.

This craziness has provoked me with some thoughts. Firstly, the longer the bubble lasts, the more investors believe in an everlasting bull market. Secondly, compared with traditional financial bubbles, Crypto bubbles are much easier to attract outsiders. For example, students choose to drop out of school, which is not a universal phenomenon in other bubbles. Lastly, “all in” is technically practical as long as investors strategically pick the right timing.

- The magnitude of project fundamentals from the great collapse of Luna.

At the end of March 2022, some investors estimated that LFG (eco fund of Terra, providing subsidy to Anchor protocol) will run out of reserves in 2 months. I didn’t anticipate Terra would collapse so fast and even some well-established institutions also suffered from that.

At the beginning of Terra, there is no right or wrong about its “Ponzi marketing” strategy. But after the price of Luna skyrocketed in one year, the ecosystem of Terra was still imbalanced. The flywheel of “Luna-Anchor” didn’t enrich Terra into a more diversified system, which could be the fundamental reason for the Lunar crush.

The UST depeg caused the Luna panic, as the liquidity of the on-chain UST pool was no longer sufficient to support large trading volumes. I perceive the UST depeg as a sniper attack. Strategic investors are able to both find the flaws of projects and detect the time to pull the trigger and make more investor panic due to the transparency of on-chain activities. We may need to stay sharp about the risks of different projects when dancing with those experts in the same ecosystem, to survive potential attacks.

- The Innovation of Sudoswap AMM.

NFT is booming and developing in the last 2 years. Some players such as The SandBox、BAYC、Axie Infinity and StepN emerged and performed very well. But we may need to realize that NFT is still in the early stage.

For example, only very few PFP projects differentiated themselves in the market and followed their roadmaps in time, and most of the projects are fading away. The NFT AMM of Sudoswap acknowledged NFTs with weak non-fungibility as fungible assets. I am inclined to their approach from a trading perspective, but in the long run, NFT will not end up there. Personally, I’m expecting an NFT world with more fungibilities. The rights, forms, and content of NFTs still have broad room for innovation.

On top of all observations that I had in 2022, Here are 5 aspects to watch in 2023:

- Decentralized stablecoins

Stablecoins have experienced three market cycles. Especially in the third cycle, we witnessed innovations in underlying assets, pegging regimes, etc. After the purge of the bear market this year, only fiat-backed stablecoins like USDC and overcollateralized stablecoins like Dai survived. Decentralized stablecoins are not only a non-sovereign currency, but also have the potential to be used in daily life. With a more and more turbulent world, we may need decentralized stablecoin beyond USDC and Dai. Thus, given the solid demand out there, decentralized stablecoins will still play a role in the game, and we may be able to see projects with greater innovations in underlying assets, pegging regimes, value-added abilities, and marketing efforts, accelerating the circulation of stablecoins.

- Uncollateralized lending

The introduction of soul-bounded token by Vitalik officially means blockchain technology could be widely adopted by many industries and massive populations. Soul-bounded token could have a profound impact when users deeply interact with on-chain activities, , and a pluralistic impact on daily life based on economic actions on-chain. For instance, it would be inconvenient for us if we lost our own Wechat or Twitter accounts. Once the on-chain activities and on-chain identities could be represented by SBT, the financial attributes of crypto will combine with it. In my opinion, uncollateralized lending is the most promising one among all financial businesses. Currently, uncollateralized lending mainly focuses on institutional borrowers, it could be tough for individuals to embrace the service of uncollateralized lending. In the next bull market, it could be possible that uncollateralized lending will be open to individual investors, and its scale and growth rate are beyond imagination.

- The securitization due to the innovation of NFT

Non-fungible assets nurtured the traditional financial industry in the 1970s. At that time, mortgages became the underlying asset of ABS, and related derivatives also boomed. Thus, with the development of NFT, related securitization opportunities will emerge. PFP-based NFT lending may just become some fleeting moments for NFT-Fi.

- Decentralized storage

One of the cornerstones of a decentralized society is decentralized storage, which is a way to disintermediate data. We have seen more and more NFT projects choose to store data on decentralized storage networks, the demand will grow especially with the development of the entire industry. However, traditional industries are not able to see the value of decentralized storage. I would reckon that some game-changing moments are needed to disrupt the existing business line for them.

- WEB3 market penetration with enhanced regulations

Web3 could be overwhelming for new beginners. “How to lower the entry barrier” is the key to improving the adoption of Web3 projects. Wallets and other players attempt to solve the problem, but till now, only very few projects could achieve usability, playability, intuitive product design, and sustainability at the same time. Any projects that could digest these elements very well will be the next super DApp undoubtedly. I am more inclined to think the next go-to DApp may emerge in the NFT sector.

| Scarlett Wu: It’s Easier for Content / Killer Apps to Become Aggregators, Rather Than Platforms to Incubate Great Content

There are three cases that impress me the most in the past year:

- Yuga Labs’ redefining seed round in March.

When talking about Seed Round, most will refer to “raising a little amount of money at a pretty low valuation”, while Yuga Labs is just the reverse. In March 2022, they announced a $450M seed round at a $4B valuation. What’s more insane about this deal is the financial status of the 1-year-old company. Through a leaked pitch deck, Yuga Labs achieved $137M in 2021 with a 90%+ profit margin.

However, this transaction may also be the apex of the speculative excess engendered by traditional investment funds, exhibiting FOMO in the realm of cryptocurrency during this period. BAYC, which was purchased for hundreds of thousands of dollars at that time, is currently trading at a floor price of less than $90k.

Despite the bursting of bubbles, the ApeCoin DAO gradually established an active community. It has 2-4 proposals per week for voting, with a few meritorious ones, and successfully transmuted the board of directors from investors to community members through a more judicious proposal, review, voting, and execution process, serving as an exemplar for most NFT projects aspiring to become one.

- StepN’s going viral in Q1-Q2, while GMT ends up with a sharp decline after the hype.

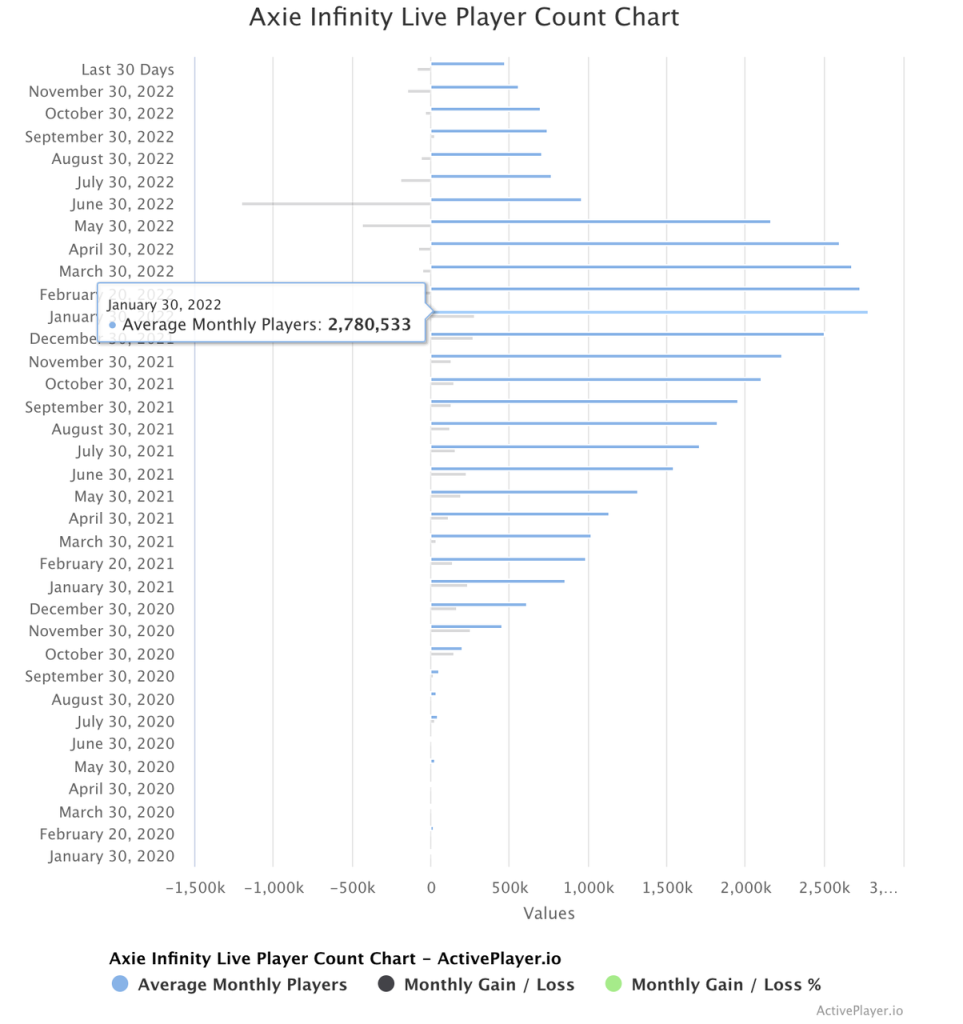

How large can X-to-Earn’s dual-token model inflate? StepN in April-May of this year gave us the answer. As not everyone can sit in front of a computer and play a game all day, but everyone carries a phone while walking, the experience StepN provides is more accessible than Axie, the pioneer of the dual-token model + X-to-Earn.

Excellence in insights into segmented markets outstands StepN from other imitators of Axie. Although the game’s popularity cannot compare to Axie in terms of duration, StepN reached a peak user base of 2.3 million MAU and had a peak monthly revenue of over 100 million US dollars, according to Forbes’ report in May.

Despite StepN’s viral spread and intuitive product experience with a highly refined token consumption mechanism, the weakness of the dual-token model is still evident when user growth is sluggish. For VCs investing in this project, the price of GMT can currently still generate a considerable return (nearly 100 times), but it is uncertain what range the price of GMT will enter when VCs’ tokens unlock. For project who use X-to-Earn to dream of VC financing, there are three issues that must be confronted:

- Is it possible to surpass StepN in terms of 1)TAM(Total Addressale Market) 2)Refinement of product details and 3)Governance ability of the economic system?

- If not, it may only be possible for VC to write a check at a shorter vesting schedule, in the hope of an earlier exit – but an immediate departure after the hype may also damage VC’s brand, and the primary market is an industry where the brand is more important than money.

- If not, it may only be possible for VC to write a check at a shorter vesting schedule, in the hope of an earlier exit – but an immediate departure after the hype may also damage VC’s brand, and the primary market is an industry where the brand is more important than money.

- What will the product leave after users chasing hype gradually flow away? And what’s the influx of potential earning expectations?

- How will the hype affect the product? Will it provide a better experience after the hype ends than before the flood of users?

- How will the hype affect the product? Will it provide a better experience after the hype ends than before the flood of users?

- Additionally, from Axie to StepN, and from StepN’s Solana to the BSC and then ETH, it’s obvious that the life cycle of Ponzi is getting shorter and shorter as users lose faith that the symphony will play forever. How can Ponzi be ensured not collapse within a few weeks by increasing the potential market size, improving mechanisms, and enhancing the governance power of the economic system?

- The birth of Limit Break, a signal of successful serial entrepreneurs in Web2 games entering the Web3 industry, with its 200M fundraising.

Gabriel Leydon is the former CEO of Machine Zone, who has experienced the arcade era of Atari, seized the opportunity of mobile gaming and Free-to-Play, and released many successful games. For the entire industry, the entry of such a “serial successful entrepreneur” into Web3 gaming is an encouragement. Entering Web3 should not be a secondary choice of “there is a lot of hot money in the industry and it is difficult to get financing elsewhere”, but rather an active choice of “seizing the opportunity and taking bold action”.

The release of DigiDaigaku under Limit Break and the subsequent trend of its series of NFTs illustrate the extent to which an adept marketer and gamifier can do with the gamification of NFTs. Gabriel Leydon’s podcast guest appearance in 2021 was my annual best at the time, and his clear vision and richly argued outlook left me convinced. The progress of the project since September of this year also leaves me highly anticipating its potential to transform the mechanisms and promotional models of Web3 gaming.

Trends and opportunities in the next bull market:

This may be a bit of a cliche – especially when everyone has abandoned focusing on consumer projects in favor of infrastructure – but I still believe the best opportunity lies in a Killer App. New users may not be able to spot the difference between Ethereum, Polygon, Solana, and Aptos; they care about what app is appealing and what app their friends are using.

Blockchain infra, wallet, or various small, modular components may have certain technical barriers, but they are not real barriers compared to “having millions of highly sticky active users”. The prerequisite for Steam becoming a gaming platform was the need to download Valve’s “Half-Life” on it – content brings traffic, not traffic brings content. Currently, most gaming platforms are hoping that attention brings content, and the source of attention is the expectation of airdrops on cobrand events for likes, comments, and retweets – such attention has low value and weak barriers.

As a result, I still believe that it is easier to move from content to platform/infrastructure, rather than from infrastructure/platform to content, especially in a landscape dominated by giants. The popularity of StepN at the beginning of the year, which even caused Solana to crash, is a prime example. Most users may have never encountered Solana or even Web3 before, but that did not prevent them from having a blast (and potentially losing money) while playing StepN.

One more thing

In my opinion, the importance of Tokenomics is currently being overemphasized in the market while Product Market Fit is being neglected.

The consequence of PMF (Product Market Fit, or the alignment of a product with market demand) being greatly overlooked is that the Tokenomics flywheel has generated false demand. As the three considerations for X-to-Earn projects mentioned earlier, the essence is contemplating how to prolong the period of ecological prosperity and enhance revenue during that period of prosperity, thus increasing the revenue of investors. False demand can be driven by Ponzi schemes, but once the bubble bursts and no new users enter the market, the prosperity period will only become shorter.

Tokenomics is also important in ensuring long-term prosperity and facilitating growth. However, it should be integrated with the mechanisms and goals of the product itself. Many projects on the market make the same mistake by only understanding the potential for growth through the dual-token model and neglecting the problems the product is intended to solve, as well as the timing, user base, and corresponding economic model that should support growth demands. In reality, genuine demand can also be enhanced through Tokenomics because the demand itself can generate income (without the expectation of investment returns), and Tokenomics greatly promotes the flywheel for early users to acquire assets through high securities.

In recent times, I have been re-evaluating the history of internet companies that emerged around 2000. The Silicon Valley of those days bears a striking resemblance to the current crypto scene in terms of bubble-inflated valuations: top VC firms invested in a couple of companies such as Amazon and eBay that went public, and subsequent startups received good valuation support – even if they didn’t necessarily find their product market fit, a great story could potentially convince a publicly traded company to acquire them, and the latter’s innovative concept stock price would then reach new heights.

In the days when PayPal was not yet widespread, it was a story of “needing to mail a check to purchase second hand dolls online” that supported the valuation of eBay, which was worth billions of dollars. Within this absurdity, the bubble burst, but a new generation of internet giants emerged, with Amazon leading the pack as the most valuable giant among them, worth nearly a trillion dollars.

In comparing the stock price changes of eBay and Amazon, we can see something interesting: how a product that finds its own positioning and always stays innovative will gradually emerge after going through cycles.

In 1998, when eBay went public, its market value was $700 million. At the peak of the internet bubble in 2000, its market value reached a high of $14.4 billion. When the bubble burst in 2001, it returned to a low of $3.2 billion. (Think of BTC and ETH’s dramatic ups and downs…)

In 1997, when Amazon went public, its market value was $400 million. At the peak of the internet bubble in 2000, its market value reached a high of $36 billion. When the bubble burst in 2001, it returned to a low of $2.1 billion. (More ups and downs than most altcoins…)

However, the subsequent trajectories of the two companies differed significantly:

eBay reached $33 billion in value in 2004, peaked at $54.9 billion in the internet bubble of 2021, and has since returned to $23 billion.

Amazon, on the other hand, has been on a roll, from $2.1 billion in value in 2001 to a peak of almost $20 trillion in the 2021 bubble, and even with recent setbacks, is still valued at nearly $10 trillion.

For investors holding stocks that saw such a range of depreciation in value in 2001, it may have been difficult to envision their future. For crypto believers, the current crypto market is reminiscent of the chaotic scene of the collapse of the .com bubble in 2001. Will the token in hand be the next Amazon, eBay, or one of the countless anonymous companies silently shut down in the winter? This is a question we must continue to ask ourselves.

|Snapp Ye: zkEVM is the Most Noteworthy Trend in the Next Cycle

OP and ZK system’s layout and competition for the L2 market have amazed me this year. Let’s briefly review the highlight moments of the L2 market in 2022, starting with the zk system’s intense competition to take over the market.

1. Polygon triggered the L2 War.

In July 2022, Polygon was the first to announce the implementation of ZKEVM equivalence. Within a month, the Polygon token price soared from $0.34 to $0.95. Polygon’s surge caused unprecedented Layer2 fever.

However, Polygon’s announcement turned out to be a stunt. Polygon made the ZKEVM code live on July 21, 2022, but its tokens had a rapid drop afterward given the inability of the relevant program. Many speculators who were familiar with ZKEVM successfully shorted it on the night of July 20 and made a good profit from it.

Polygon has not launched its public testnet until October 11, 2022. The real progress has been far slower than it claimed.

2. zkSync’s catch-up.

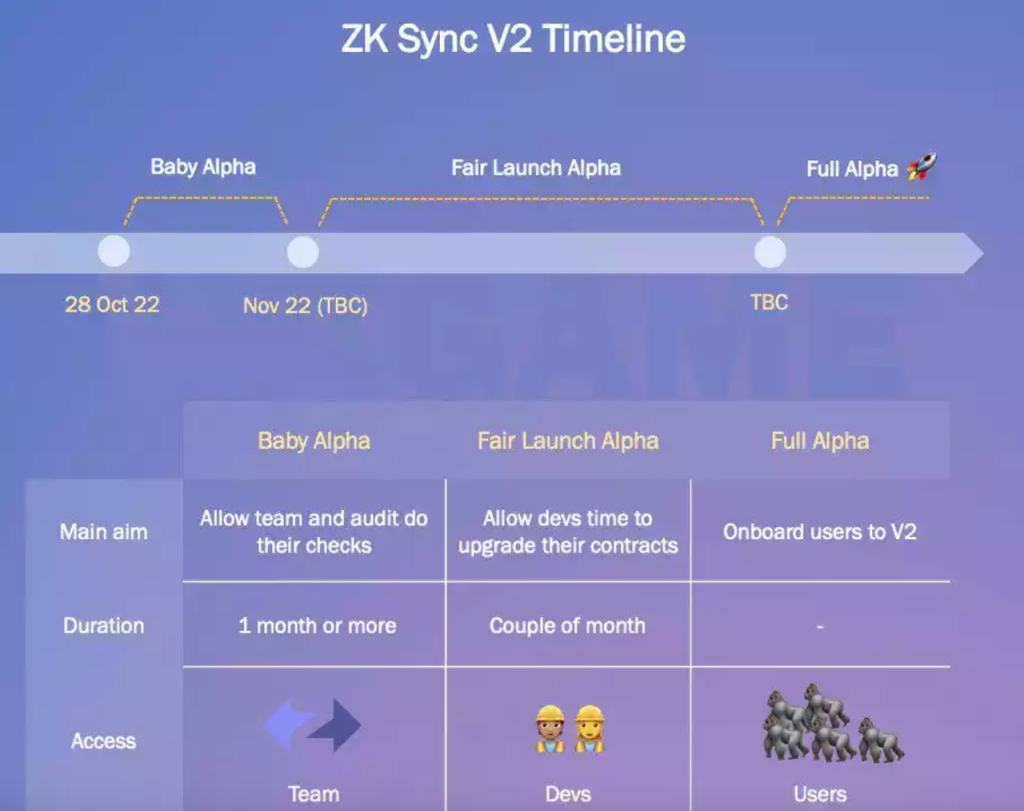

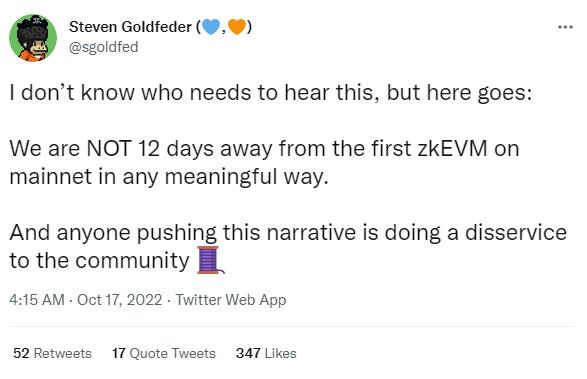

As one of the leading ZK Rollups, zkSync responded quickly. zkSync officially released the 100-day ZKEVM mainnet countdown in July 2022 and is expected to officially launch the ZKEVM mainnet on October 28.

zKEVM has gained high anticipation in the upcoming October. However, on October 28, zkSync went live with a “Baby-Alpha” version of the mainnet, which has only been recognized as an internal test version due to the fact that it was not accessible to the public and could not be deployed by developers. Later on, zkSync released several plans to upgrade the mainnet, which is expected to be online in 2023.

On November 16, 2022, with the bloat of zkEVM, zkSync developer Matter Labs closed a $200 million Series C round of funding.

3. Scroll stepped in.

On July 19, 2022, Scroll announced the launch of the Pre-Alpha version beta network and opened the application for internal testing. Due to the overlaps in announcement times for the three projects, posts about three major ZK Rollups that achieved ZKEVM equivalence at the same time flooded the social channels. However, the internal test version of Scroll has met expectations, the current test network quotas are being developed in an orderly manner and the ecological construction is steadily progressing, showing the high work integrity of the Scroll team.

Besides, Scroll’s vision in decentralized parallel proofs (commonly known as mining), and its strategy in data availability schemes (rejection of the zkPorter model, etc.), is representing the core value of Web3 Native.

Then let’s dive into the OP system’s actions:

1. Optimism’s ambition

In October 2022, when the zkSync’s mainnet launching created the hypes of ZKEVM. Optimism also announced the OP Stack with its profound vision.

In Optimism’s vision, Optimism, which inherits the security of Ethereum, can serve as the underlying layer for a large number of application chains with all-around cross-chain interoperability, which is also known as Cosmos on Ethereum.

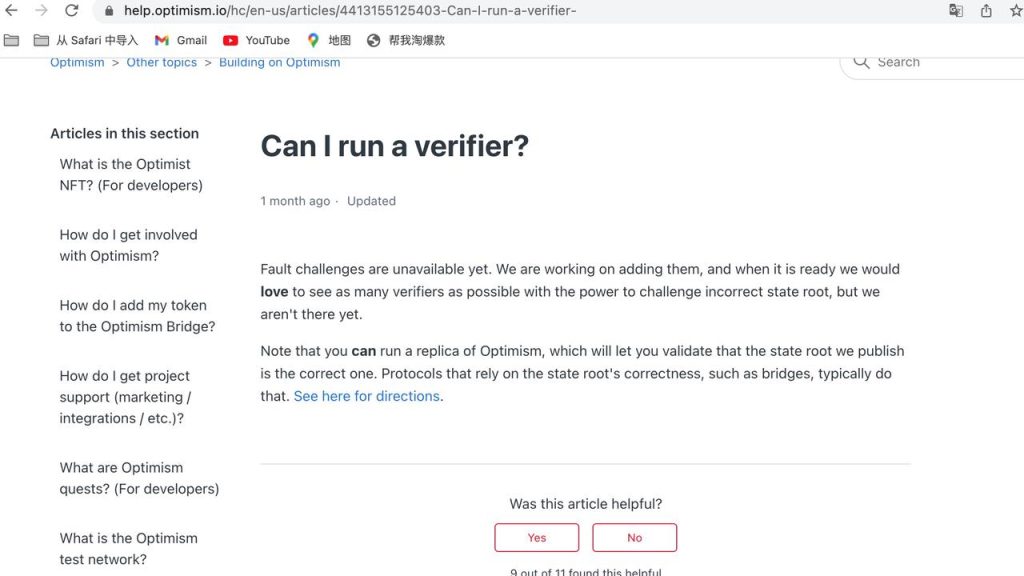

It has also been called into question because Optimism’s fraud proofing has been in the works since its November 2021 upgrade.

2. Arbitrum’s hit back

In July 2022, the CEO of the Arbitrum team overtly questioned the inability of Polygon ZKEVM. In October 2022, Arbitrum CEO stated that the reckless promotion of ZKEVM now is jeopardizing the entire community.

Here are some walkthroughs about why Layer 2 is noteworthy:

- Layer 2 has a promising market prospect.

The processing capacity of Ethereum is extremely limited, and a large number of Layer 2s are needed to execute specific transactions to achieve capacity expansion and thus land in the real world on a large scale. On the other hand, with the drastic increase of on-chain application scenarios, the demand of on-chain applications for execution layer is also more diversified, and massive Layer2s with different features interacting through the main chain of Ethereum would be the trend of blockchain in the future.

- Layer 2 shows upside potential in the next 1-2 years.

For example, the Layer 2 project’s coin offering could be one of the opportunities. Other than Polygon and Optimism, the rest of the major players in the OP and ZK systems are likely to issue coins in the next 1-2 years.

Starkware

In July 2022, Starkware officially announced the issuance of the token Starknet and elaborated that the token would become a gas fee payment token. On November 16, the token contract was officially deployed on the ethereum mainnet, but it is not available for trading or any other usage yet.

zkSync

In November 2022, the team articulated that 2/3 of the tokens will be allocated to the community after the coin offering (Note: Starknet is 1/2 allocated to the community). zkSync ought to launch its token in the next 2 years given that zkPorter and other projects must ensure security through token staking and zkSync is dedicated to making the mainet live in the next two years.

Scroll

Scroll specializes in zero-knowledge proof mining. Since the current ZK Rollup is operated through packaged (Sequecer) – proof (Prover), and zero-knowledge proof generation is much slower than transaction packaging, Scroll has conceived a complete decentralized parallel proof model, aiming to use Scroll tokens as mining rewards to encourage miners to use higher quality hardware to participate in proof generations.

The main Scroll network is also anticipated to be released in the next 2 years. Scroll tokens are essential when the main network is live, given the mining mechanism design. On top of that, Scroll tokens are capable of capturing certain values from their ecosystem.

ZK would be the next big thing to invest in the near future.

ZK Rollup is the best theoretically

Since Ethereum can only process about 15 transactions per second, it is far below the current demand. The basic logic of off-chain scaling of Ethereum is to let Layer2 process multiple transactions and then hand them over to the main chain of Ethereum for verification and archiving. Previous off-chain scaling solutions disabled transactions to be compressed and then verified by the Ethereum main chain, while zero-knowledge proofs can compress dozens of transactions into verifiable proofs of only one transaction size, thus enabling blockchain performance to be greatly improved. Therefore, ZK Rollup becomes the theoretically best scaling solution for Ether.

Why “ZK in the long term”?

First, the process of computation and proof is almost completely freversed for the same math problem, which means that the proof will be a complete refactoring of the computation. Secondly, for Ethereum, some early computational processes are not welcoming zero-knowledge proofs, which represents that replicating the Ethereum Virtual Machine (EVM) is still a long way to go.

Other thoughts:

- About Layer 2

- In general, the concept of “OP in the short term, ZK in the long term” has taken root, and ZK Rollup has made progress, leading the “Layer 2 Summer”. ZK Rollup players are encountering fierce competition, especially on launching time, while OP (especially Arbitrum) is inclined to be more conservative about the timing, to earn more time and space for solid developments.

- The future is multi-chain, and it is likely that Cross-Rollup interactions with Ethereum as a shared security layer, so each distinctive ZK Rollup has more opportunities for development.

- Layer 2 Investment Opportunities

- ZK mining

As ZK Rollup proves to be far slower than transaction packing, and the more compatible Ether is, the slower the proof will be, then future-proof speed enhancement through hardware will be the long-term direction. Given that Scroll and other leading projects have announced zero-knowledge proof mining, the original mining industry’s layout opportunities are equally prominent.

- ZK Token Investment

The business model of ZK Rollup is to collect gas fees from users to support project maintenance and to cover verification fees and commit fees for Layer 1.

Taking the zkSync block number 90415 as an example, zkSync charges users a total of $9.92 in gas fees and spends a total of $19.91 in verification fees and $42.20 in commit fees to Ether, at which point zkSync is clearly in a serious break-even situation. This imbalance often requires the entire business model to be lubricated by the token issuance model.

In the era of non-coin offerings, zkSync often requires 50 dollars to subsidize the production of one single block. But in coin-offerings model, projects get to pay zkSync tokens for miners as a subsidy. zkSync token holders are expected to share in the dividends of the zkSync ecosystem with zkSync cost decline, break-even achievement, and market share improvement. This is much similar to a traditional corporate option incentive.

Bitcoin has disruptively achieved principal-less and financing-less business development precisely through such an economic model. Current IPFS storage costs are much higher than storage centers, but decentralized storage is still gaining traction because of the Filecoin token subsidy provided.

Overall, tokens can be a great financial innovation that puts less-established and high-cost projects in the spotlight. Therefore the ZK Rollup project parties are more than happy to lubricate the business model through tokens, and these tokens may bring us some sound investment opportunities.

|Fei Fei: Being Enthusiastic and Persistent Will Help You to Move Forward

As a newcomer who just transformed from Web2 to Web3 this year, here are some takeaways based on my own journey:

- Is now a good time to join Web3?

Web2 has reached a bottleneck after twenty years of consecutive and prolific developments.

At the beginning of this year, I kept asking myself what industry has at least ten years of upswing and where the next generation of Internet opportunities are. The universal answer is Web3 after repeated brainstorming.

What is the current state of Web3? Let’s take a look at the breakup of NetEase and Blizzard in November this year. The game’s suspension has articulated the strong demand for “account/equipment ownership”.

The opportunity begins to shine given the solid demand out there. Web3 project development and user demand are mutually reinforcing. For instance, Defi improves the efficiency of traditional finance, and NFT adds creativity to brand marketing. Web3 is burgeoning with evolving user intent, replicating the early golden age of the Internet.

In addition, given the crush of Luna and FTX, there is a greater emphasis on regulations, and negative sentiments are spreading. But, the policy-maker has swayed overtly by embracing co-existence instead of having intense and negative enforcement.

In the case of Hong Kong, at the Web3 conference in October, the Hong Kong Financial Secretary officially released the “Policy Statement on Virtual Asset Development in Hong Kong”. Hong Kong will accelerate the improvement of the licensing system for virtual asset service providers in the future, will conduct public consultation on the appropriate level of virtual assets that can be traded by retail investors, and is open to the introduction of virtual asset exchange traded funds (ETFs) in Hong Kong. Major cities in China are also revisiting, exploring, and experimenting with metaverse, digital collections, and other Web3-related deliverables after the cryptocurrency ban policy.

To sum up, it is quite a good time to join Web3. In the sluggish bear market, we can sow the seeds and harvest in the booming bull market.

- How to find opportunities in Web3?

In fact, the opportunities in Web3 are basically the mapping of Web2. There are tons of options in Web3. You get to pick to do investments or projects, you can start your own business or simply join a team. you can serve in developer roles or community operations, and you can choose which sector you are devoted to, such as GameFi, NFT, and DeFi. Analyzing your own background, expertise, interests, and objectives is the key to finding the right passion here.

Here is my takeaway from my own journey: always take more initiative.

You could sit back and wait for headhunters to call you for a job in Web2. People who take action and are proactive, can onboard themselves quickly, even if they are newbies to Web3.

For example, if you tend to join a project, reach out to them by finding their website and sending them an email. If you want to meet some thought leaders, start by following their social channels and interacting with them, leveraging your own expertise and insights.

- As a newcomer to Web3, how to improve yourself?

It doesn’t matter which direction you pick or what your previous background is, being enthusiastic and persistent will help you to move forward. You are able to navigate your inner drivers to achieve constant growth and learning.

It is recommended that you keep up with social channels all the time to keep track of all dynamics. From my own experience, I am managing my own content channel “Web3 100 days” to record our progressive cognition of Web3 and bring deliverables to people that may have the same interests.

Additionally, Try to place yourself in an organization such as DAO or even in other forms. The key to surrounding yourself with like-minded people is making you feel most secure, inspired, and confident.

| Jessica Shen: Expecting NFT Market to Bring Us More Surprises in the Future

The crypto events that enlightened me in 2022 encompass the collapse of Luna, the mania around StepN, and the massive migration of talents from big tech companies into Web3.

The collapse of the Luna empire had far-reaching consequences for the industry, and the cryptocurrency world is still reeling from the fallout. Although I was not one of the most severely impacted nor a beneficiary of the Luna crash, this incident allowed me to see the evil and the magic of cryptocurrency, and it also gave me a deeper understanding and awareness of the shackles of the industry. Contrary to many investors, Luna’s debacle has strengthened my confidence in the industry.

The cryptocurrency world is like Pandora’s box. “These violent delights have violent ends”, a friend gave me this piece of advice when I just got in touch with cryptocurrency. During the few days when the Luna incident happened, I had been closely following the market changes and progress of Terra Foundations’ responses, by listening to people’s insights on the impact of the incident on Twitter Spaces and various podcasts. Yet, even though almost everyone hoped Terra Foundation would find a turnaround, Luna, the cryptocurrency that was so renowned and a highly-anticipated stablecoin project among investors and KOLs on social media, was eventually crushed. The stablecoin and the overall ecosystem of Terra fell from heaven to hell in just a few days. Inevitably, bad news continued to come from afar. For a long period of time since then, aftershocks have affected many institutional investors including Three Arrows Capital. It was an incident that negatively affected almost all participants, including well-known investment institutions and individuals. I was deeply shocked by the speed of the crash and the intensity of its impact. My friends’ words become a prophecy. People who once made a lot of money in the bull market seem to be swimming naked now.

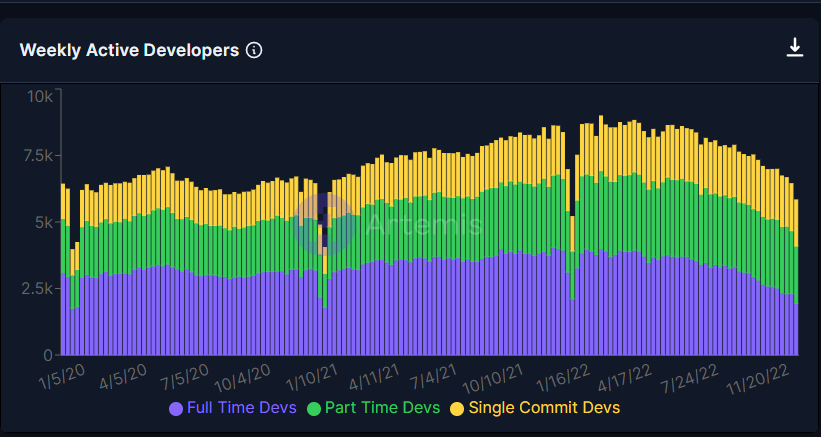

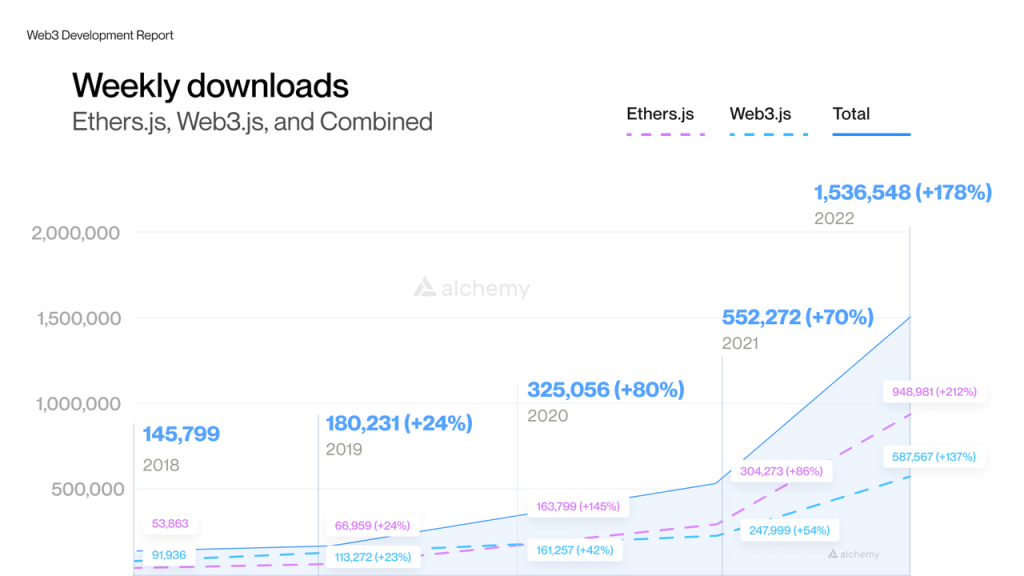

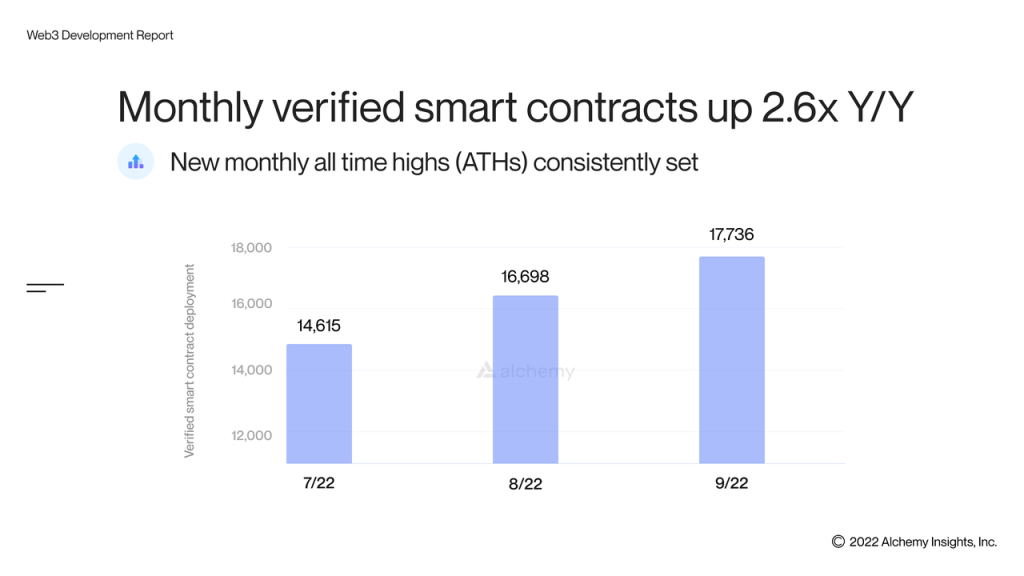

2022 is also the year when talents migrate from technology companies to Web3 in large numbers. According to GoKuStats, the number of weekly active developers in 2022 dropped a lot during the bear market, but on Ethereum, where the development volume is the most concentrated, the trend of developer migration is still obvious. According to the 2022Q3 web3 developer report on Ethereum released by Alchemy in November 2022, the weekly downloads of two important web3 libraries Ethers.js and Web3.js. times more. The number of smart contract deployments in September 2022 reached all-time-high of 17,376. It is quite clear that developers are still actively developing and deploying despite the bear market. During my work at Mint Ventures in 2022, I also talked to a lot of developers and product managers from traditional Internet companies, who have become web3 entrepreneurs.

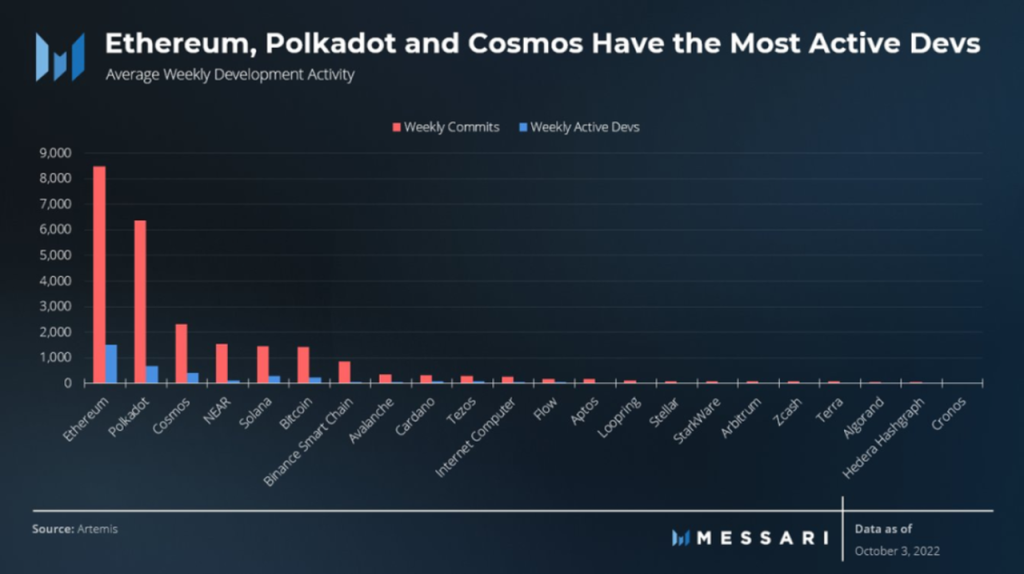

According to a Messari report in early October 2022, the number of commits submitted by active developers on Ethereum is about 8,000 per week. The data shows that the development activity of web3 is a drop in the bucket compared with that of web2, which further proves that the potential of developers has not yet been fully unlocked in the blockchain field, and the development of the crypto world is still on the eve of an explosion. What is certain is that web3 will continue to penetrate into more areas of people’s daily, and blockchain is an unstoppable wave.

The launch of StepN definitely is worth the headline of the year. Being the most popular project in the first half of the year, StepN, brought a large number of people who knew nothing about cryptocurrencies and web3 into this space. Although the project was controversial in terms of team management, regulatory policies, and tokenomics, my takeaway from the StepN mania is that crypto space is expecting more participants to join, and if there is no product with intuitive user experiences or profit-generating mechanism as a window, the learning curve for people out of the crypto space is steep, from private keys to asset security, from all the abbreviations to the tokenomics. What’s even worse is the uncertainty of regulations from many countries, and the frequent scandals that have led to a lack of public confidence. Having said that, I am still optimistic about the expansion of the cryptocurrency market with regulation harmonization, technological advancement, and more security resolutions.

Some trends and segments that I will pay attention to in the future are:

- Infrastructure around asset security will still be the focus of industry development;

- NFTs will continue to be an important medium bridging people to Web3.

Let’s talk about the Infrastructure around Asset Security first.

There are many hackers in the bear market. In 2022, we have seen too many hack attack incidents. As more and more traditional capital has ties with cryptocurrency, the degree of regulation is only on the way going more stringent. National-level review of on-chain assets and web3 projects, and regulatory escalation in KYC and AML are all paving the way for more funds and users participating in cryptocurrency activities. At the same time, in 2022, incidents of illegal misappropriation of user funds by multiple centralized exchanges were exposed, and the idea of centralized custody once again lost the trust among web3 users. For users and funds who are accustomed to the centralized trust mechanism model in the real world, asset security will be the top priority when participating in “the decentralized society” on chain. It is the same for native assets and TradFi capital. However, due to the nature of decentralization and weak supervision, infrastructure in all forms around asset security protection will be the rigid demand in the cryptocurrency industry.

In the field of infrastructure, crypto wallets, as an important channel and source to acquire traffic, has the role of “gatekeeper”. There are various types of wallets. Since the birth of Bitcoin, the meaning of wallets has also extended from simple asset management, transfer, and bookkeeping to asset management, on-chain applications, social identity, etc. In the form of wallets, there are hardware wallets and software wallets. By custody setup, there are self-custody wallets, co-custody (multi-signature) wallets and centralized third-party custody wallets. By signature mechanisms, there are single signature wallets, multi-signature wallets, and single private key wallets, MPC segmentation wallets and others. But at present, various web3 wallet products have trade-offs in terms of security, functionality, user experience, gas fee, and recoverability. In 2022, under the dual effects of frequent hack attacks and improved user experience requirements, more MPC wallets and smart contract wallet solutions emerged on the market, providing solutions without private keys but with high security. Yet, many are still in the product development phase.

According to the Grand View Research report, the global crypto wallet market was worth US$6.97 billion in 2021 and is expected to reach US$48.27 billion by 2030. In the future, web3 wallets will no doubt develop in a safer and more user-friendly direction as the trend we see right now.

NFT is an important medium bridging people to Web3.

In 2022, the NFT market continued the fashion that started in the second half of 2021, and a number of PFP projects quickly became blue chips, strengthening the market consensus on NFT. However, as the bear market came around, the value of PFP assets were under tests by the market. We will not discuss whether there is a “bubble” in social value and identity as the dispute may not end any time soon, but it is a consensus that the NFT industry will develop towards a more practical and pivot to utility proposition even more. I expect the NFT industry to talk more about the real meaning of “Non-Fungibility”. Technological progress and product iteration will also bring about a higher TPS and lower gas-fee environment, making NFTs become more popular in various fields.

For example, fan/community management tools are an important scenario where NFT is needed. Take the e-sports industry as an example. If the time and money paid by fans to their favorite team can be recorded in the form of POAP or NFT, and then used as a channel for the feedback or rewards from the team, the community would love to support even more capital to their idols and the team would love to see that as well.

Looking at the current model of web2 Internet moguls, most of the value is captured by giant platforms rather than the content creators, which is what web3 is trying to disrupt. It will be a huge paradigm shift in terms of the fan economy, and it will also be popular with e-sports teams and fans, once that NFT model comes into place.

In addition, we have seen traditional businesses and Internet companies making various explorations in the NFT field, and NFT has gradually become a tool for user management, a channel for connecting users. The NFT issued by the brand naturally and subtly elevates the traditional relationship between buyers and sellers, brands and members through users’ wallets. For example, Starbucks has launched a new membership system based on the NFT platform – Starbucks Odyssey. In addition to providing members with free drinks, discounts and other benefits, Starbucks plans to bring users a new web3 experience, adding more fun features to the membership system, and The NFT owned by the user acts as a “proof” to bring more special experiences to its members. I deem it as a “paradigm upgrade” of the membership system. In traditional marketing strategies, there is no technical difficulty in improving mobile app features, but on the one hand, it is difficult to make users feel fresh with discounts and benefits. The NFT platform makes the overall membership experience refurbished. Gen Z, the main consumers soon, are also more willing to embrace new things. On the other hand, the NFT platform (or the web3 membership system adopted by other brands) can enable Starbucks to provide more web3 experiences, such as GameFi, NFT badge transactions, etc. You can see Starbucks and any other web2 franchises are drawing a larger territory into web3 around their original product areas. Once the web3 experience reaches customers, it will enhance user loyalty and renovate the user experience, and at the same time bring members fresh expectations of the brand. Let alone NFTs will bring new revenue streams for brands.

Another example of the great migration of web2 users to the web3 field is the NFTization of avatars on major social media platforms. Social media platforms such as Line and Reddit launched NFT avatars this year, which created a type of fashion around the globe. Former Redpoint investor Tomaz Tunguz once published an article The Most Successful Web3 Launch in 2022. He mentioned that the number of Reddit NFT avatar users is twice that of OpenSea and 10 times that of Axie Infinity users. This level of user education should have cost a lot of money, but it was easily and naturally realized on Reddit, and the creators activity was high.

While we are waiting for a phenomenal web3 project, a large number of web2 users are also constantly accepting the changes in their lives brought about by the worldwide web3 trend. The strong culture and art essence in those small pictures is the unique weapon of NFT. After the utility around NFT is gradually unlocked and tapped, it will make the bridge connecting the web3 world even wider.

Final Thoughts:

Since the second half of 2022, NFT Boom has become another big new narrative in the industry after DeFi Summer. The expectation of NFT-Fi summer has often become a viral topic. However, this “warm spot” has not really heated up yet. While thinking about the reasons behind it, I also reminded myself to be wary of path-dependence traps.

NFT-Fi Summer may not necessarily come. Let alone bringing a huge increase in users and funds to the cryptocurrency industry like DeFi Summer. It is not entirely impossible that NFT-Fi will be replaced by a new narrative despite so much anticipation. There are many differences between NFT and FT in essence, and it is difficult to compare DeFi and NFT-Fi in many senses. The neutral statement is that the rise and fall of the NFT industry directly determine the survival of NFT-Fi. The pessimistic statement is that if the pillars of the NFT industry collapse, the defects of the NFT-Fi market capacity ceiling will become more obvious.

The current market value and transaction volume among all public chains show that NFT transaction is still concentrated on the blue-chip PFPs on Ethereum. Even when there are Avatar NFT projects such as Reddit that have brought large amounts of Web2 users to the space, and “Art + Tokenomics” social experiments such as Art Gobblers, all kinds of GameFi that have issued tons of NFT assets, and fanatical sports fans trading NFT cards, blue-chip PFPs still dominate the NFT trading volume leaderboard. At present, only NFT marketplaces (including aggregators) and lending protocols have seen some mature products. The rest of the NFT-Fi segments such as functionalization, futures, and options, AMM DEX products only have a small number of users or are not even on the Mainnet yet. From the perspective of the mainstream NFT-Fi protocol ecosystem, the current popular NFT-Fi products are still built around the existing blue-chip PFP assets. The risk of high concentration is that the collapse of blue-chip PFP will immediately affect the survival of downstream NFT-Fi protocols.

This year we have also seen more NFT-Fi yield aggregators and market-maker products under development. These are the products of the development of the industry to a certain stage, but due to the high concentration of the target market, the competition of the blue-chip PFP market is going to be more fierce, and the market capacity ceiling seems to limit future business development. It is difficult for us to predict the future NFT market, but what is clear is that in the absence of innovation of NFT-Fi or without the emergence of high-quality NFT assets like blue-chip PFPs, a large number of NFTs are likely to be short-lived, and so are the NFT-Fi protocols built to serve that market.

Foresight is very crucial in investment. Although the future of NFT-Fi seems vague, and the road ahead is not clear, it is certain that NFT itself carries more content value, creativity, art. The stronger cultural and artistic attributes are able to establish a link between users and the cold and obscure world of blockchain codes more easily. NFT users pay more “emotional costs” in a subtle way and can feel crypto in a less abstract way than FTs and therefore have stronger loyalty to the jpeg-linked tokens in their wallets. Overall, I still expect the NFT market to bring us more surprises in the future.

| Lawrence Lee: The Beta from the Cycle Makes People Believe They are the One Who Created Alphas

- 2022 is all about “Crash”.

The series of meltdowns delivered shocks and ramifications over the entire year of 2022. Starting from Luna collapse, then 3AC, Celsius, Voyager, Blockfi, and now FTX, those well-established companies fell apart like dominoes. Recently, Grayscale stated that it did not provide proof of Bitcoin reserves for “security concerns”, which is more like some kind of echo of the circle: everything begins with it, will it end with it? The narrative that “Wall Street institutions enter the market to bring about the eternal bull market of Crypto” was once clamorous, but as more and more unbelievable amateur operations of institutions are disclosed, no one mentions it anymore.

Ultimately, the rationale behind their snap collapse is some very basic and simple ethics that they were not following:

Borrowing new and repaying old is not a sustainable business model.

Do not abuse leverage beyond your ability.

Do not misappropriate other people’s funds.

DoKwon, ZhuSu, and SBF are all intelligent, diligent, and ambitious people. otherwise, it would be difficult for them to quickly accumulate a lot of wealth, reputation, and status within one market cycle. But they all committed simple, naive, and irreparable mistakes and fell apart quickly. Although their mistakes are different, their failures can be attributed to the same reason: The Beta from the cycle makes people believe that they are the ones who created Alphas.

- Introducing a large number of users is still the main obstacle to the entire web3 world in the next cycle.

In this cycle, Axie Infinity and StepN have been able to support the immersion of over 1 million people for more than 20 minutes a day, and we have seen the dawn of web3 making great strides into people’s daily lives.

Therefore, I would pay attention to the infrastructure that supports millions of users’ daily life on-chain, including centralized exchanges, public chains, Layer 2, financial infrastructure (FT&NFT exchanges, liquidity protocol, stablecoins, oracles), and storage. leaders and pioneers already took place after this round of bull and bear, and many businesses have presented strong first-mover advantages and network effects. In conclusion, we can always focus on the secondary market opportunities of the above-mentioned projects.

- The application that enables more users into the web3 world is noteworthy as well.

Looking back at the past, we have seen the applications that have triggered large-scale interactions on-chain, whether it was CryptoKittes in 2017, Fomo 3D in 2018, Gambling DApp that was active on multiple chains in 2019, Axie Infinity in 2021 and StepN in 2022. The combination of investment/speculation and addiction is consistent:

- Investment/speculation is one of the fundamental needs of human nature, especially for the web3 industry, which is still in its early stage. This will still be the core driver for any DApp to attract users.

- Addiction is essential for these applications. It enables user acquisition consecutively, and it is also the main cause of why non-productivity applications can attract users. The non-productivity web2 applications commonly used in our daily life are highly addictive.

In the next 1-2 years, This trend may continue, so I will keep my eyes on the application of the pan-entertainment sector with a certain degree of addiction, and focus on looking for those that can make a good combination with investment/speculation. They should preferably deliver an exquisite multiplayer game mechanism and clear value.

| BOBO: Continuously pursue deep game content and experiences

At the end of 2021, I was immersed in the metaverse craze and eagerly anticipated how interesting the crypto world would be in 2022. I was looking for answers for the following questions throughout 2022.

- What would be the impact of liquidity tightening on the crypto world?

- Will these metaverse projects continue to be popular without deep content?

- How far can the combination of crude games and complex mining models go?

Apparently, the answers can be found in 2022. I am here to review three major events from 2022 with everyone below:

- WETH’s “insolvency”

At the end of November, exacerbated fears and uncertainty triggered by the great FTX and SBF collapse. WBTC also had a brief decoupling (WBTC is maintained and operated by the centralized institution BitGo). Then an alleged joke regarding the insolvency of WETH was trending.

WETH and ETH are always swapped in a ratio of 1:1 through coding, completely decentralized, and theoretically there is no possibility of decoupling, no so-called fund maintenance, and Developers and KOLs began to engage in mischief, insisting that this was a legit event, and Justin Sun also claimed to raise 2 billions to save “WETH Foundation” which doesn’t even exist. Other influencers also added their statements to increase uncertainties around the false rumors. Some mainstream media also took this prank as legit news. All these movements made users quickly swapped WETH back to ETH for safety concern.

In my opinion, the spreading of FUD has become less costly following the demise of Terra and FTX. While early rumors of collapse did rescue many individuals, it also caused crypto communities to become skittish at the slightest sign of trouble, and media/KOLs ought to have higher standards for the discernment of such information.

Secondly, the scale of user base is increasing with the strong educational and informational demand. Users may only need to understand how to use the product properly in most situations, But in emerging crypto world, comprehension of the product’s operating system can provide users with a significant informational advantage and enable them to seize trading opportunities for themselves.

- Decentraland’s daily active users being less than 1000.

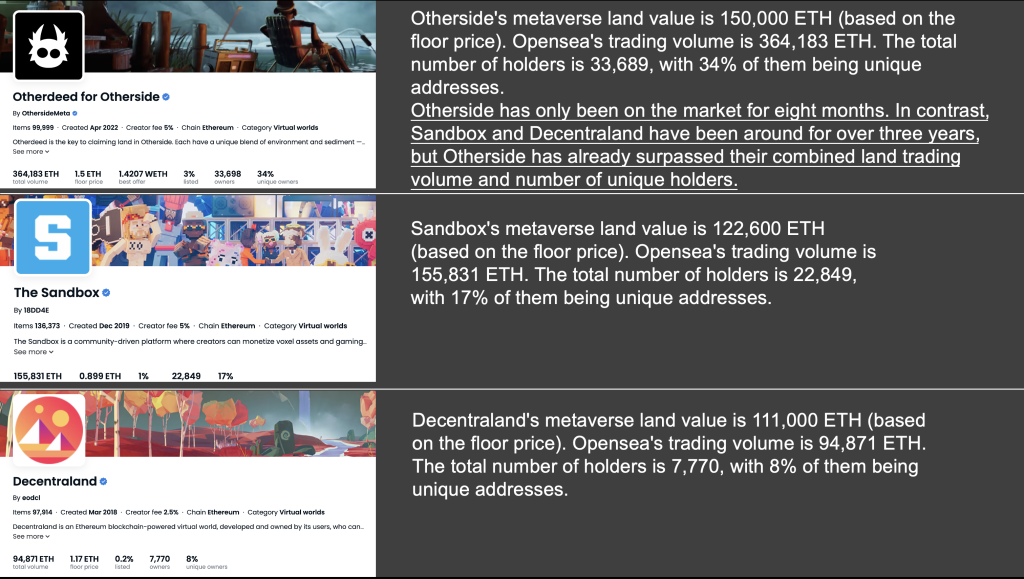

In October of this year, Decentraland’s daily active user count had fallen below 1000. Upon retrospect, its clear that the land NFTs of the three universe projects Otherside, Sandbox, and Decentraland have diverged significantly in terms of both trading volume and market value.

In the metaverse race, the barriers to competion that were empowered by first-mover advantages have ceased to be a central source of competitive advantage. The ability to generate high-quality content within the metaverse has become the primary source of competitiveness.

Both Sandbox and Decentraland rely heavily on the design of various mini-games, as well as partnerships with third-party IPs (particularly those from outside the industry) and curatorial events to cultivate their content ecosystems. Their competitive edge lies in their ability to secure business development deals. The Sandbox, in particular, have a more comprehensive game design.

In addition to formally announcing its acquisition of 10ktf in November, Yuga Labs boasts a highly active community ecosystem, with popular content ecosystems including Mutant Cartel, Mutant Hounds, and Applied Primate Experiment. Initially, these projects will maintain a degree of independence from one another and feature a robust narrative. However, they are connected to one another through subtle clues, and upon the revelation of their interconnectedness, there is a sense of epiphany. The entire content ecosystem is structured around the BAYC brand, exhibiting a strong sense of unity, as if one were watching a series of cinematic, game-like experiences. Its primary source of competitiveness lies in the project’s own research and development capabilities and the creativity of its community members.

In comparison, I am more inclined to Yuga Labs’ solution for the content ecosystem because, in addition to having a strong development team, it fully mobilizes the potential of the community. However, the SEC’s regulation of the Yuga Labs ecosystem is still a potential risk. And excessive anticipation may also make products deliverables hard to live up to the expectations.

- GameFi project’s significant decline in trading volume.

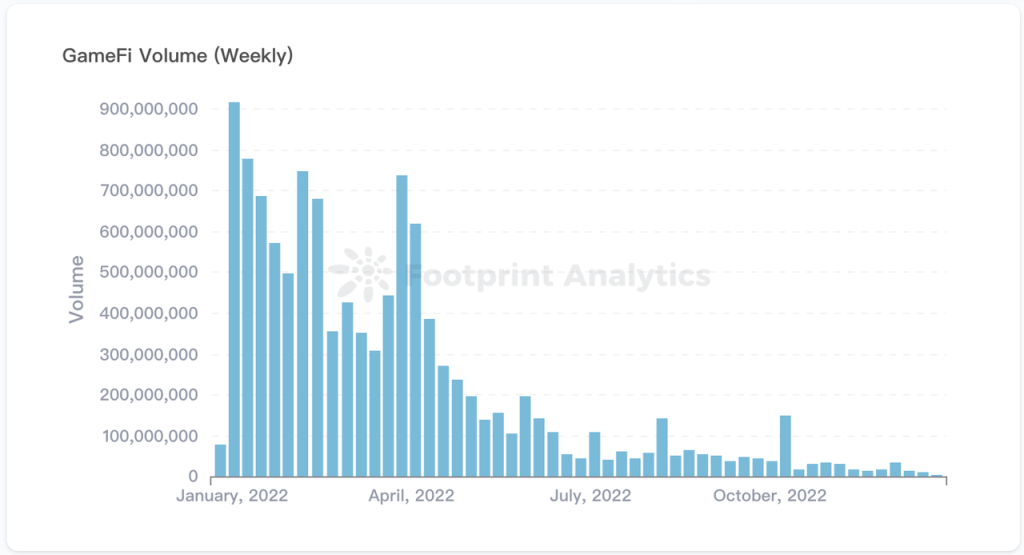

The total trading volume of the GameFi project has seen a gradual decrease since January 2022.

Apart from the unexpectedly strong performance of Starshark in the early year and Stepn’s foray into the X-To-Earn pathway, other projects have failed to meet expectations. The launch of the Crypto Unicorn game was particularly disappointing, dashing the remaining enthusiasm of GameFi players.

The intricacies of economic models have become unable to replicate the former hype cycle: as existing users become familiar with the lifecycle and patterns of Ponzi games, they are more inclined to engage in speculation based on the supply and demand of tokens, causing the price of tokens to experience short-term fluctuations. This, coupled with a decrease in users willing to hold assets long-term, ultimately leads to a shortened lifecycle for the project.

As Web3 games continue to mature, the importance of “fun” in these games will become increasingly prominent. The majority of chain games are not entertaining, making it difficult for investors and early adopters to convert and retain as real users. Users will inevitably ask themselves, “if I’m seeking something fun, why not just play a corresponding traditional game?”

Over the past year, we have seen many traditional game companies enter the Web3 industry. I am anticipating the first content-centric Web3 game to officially launch and generate buzz among non-industry players, rather than one-off self-congratulatory news such as “Axie Infinity’s daily revenue surpasses that of Honor of Kings.”

Therefore, the enhancement of content and experience is the trend for the future development of Web3 games and metaverse projects, and building a strong community based on this is an essential path for maintaining success for the project.

In the next cycle, we expect that Web3 games will continue to thrive and make progress in multiple dimensions:

On the production side: more professional practitioners, higher quality content, but also facing more challenges

In the primary market, more and more professionals from traditional gaming industries have begun to join or create Web3 gaming teams, most of whom have had successful experiences in building products in the traditional gaming industry and can introduce more advanced gaming development technologies to the Web3 industry.

Beacon, a small dungeon-exploration themed game, has proved that an interesting small game can also run on Web3. We see that there are also real users in Web3 who are willing to spend the money to buy 3A games to experience the fun of the game and own the rights to the props. Of course, Beacon’s success is not solely due to its content, but users also have great expectations for its subsequent NFTs and tokens. However, its outstanding performance is sure to attract the attention of many game teams to Web3 games.

In comparison to traditional games, Web3 game teams face numerous challenges beyond simply crafting enjoyable content: they must also grapple with the cyclical nature of the Web3 industry, possess a clear understanding of the operations of the entire Web3 market and community, and differentiate between traditional game users and Web3 users.

Web3 game teams must carefully consider their choice of Layer 1 for their project, the method of asset issuance (whether through Freemint or paid minting, and which groups to prioritize), and their subsequent marketing plans, all while aligning with the user base they aim to attract. They should strive to attain a strong initial user base at the time of asset issuance and gradually filter out game asset holders who are not genuine players.

At the same time, the Web3 PFP ecosystem has nurtured a user base with a strong community culture. If Web3 game projects can offer sincere products and maintain an open and encouraging attitude towards community UGC content, we may see the emergence of highly vital and high-quality UGC content game products.

On the consumption side, there will be an increase in the number of users and an improvement in the professionalism of users.

At present, the number of real players in GameFi products is insufficient, and it is common for the number of holders of game tokens to exceed the number of players. Traditional game players and many game industry professionals are currently adopting a wait-and-see attitude towards Web3 technologies such as NFTs.

However, with the improvement of the Web3 gaming experience, the number of real players is expected to significantly increase. In the future, we will see more mainstream game platforms and game manufacturers adopt Web3 technology, see game teams seamlessly integrate Web3 technology into game construction, and use other names more easily accepted by the mainstream to refer to Token, NFT and other Web3 technology terms.

Different players have different preferences for game types, and a detailed assessment of Web3 users should be made before developing games.

Industry pattern: Fine-grained according to development costs:

- Low-cost games (e.g., single game with a cost of 5M or below)

These games have low quality graphics but prioritizing gameplay. Teams often delve into the community to build a loyal player base, mainly generating revenue from game tickets or the sale of props, with high requirements for team streamlining, low cost, execution ability and marketing ability. This type of game is expected to be the first to burst out, as they need to accumulate a few thousand core players to build a community, and can then recover costs and continue to generate business income. Among them, projects that can better combine Web3 with games will stand out.

- Medium-cost games (e.g., single game with a cost of 5-20M)

These games have higher requirements for graphics and gameplay immersion, and can spend some resources on promoting to traditional users in overseas markets. They mainly generate revenue from the sale and collection of functional props, character decorations and other showy items. This type of game has received the most financing in recent years, and I am more optimistic about the products that can continue to be exposed in both the Web3 game market and the traditional game market.

- High-cost games (e.g., single game with a cost of 20M or above)

These games require a longer development cycle and a larger development team, as well as the entry of top practitioners in the traditional game industry into Web3 construction. The industry may still need time to explore business models and await the delivery of the first high-cost game.

The advantages of integrating Web3 technology and gaming include: