Contents

NFT Overview in 2022

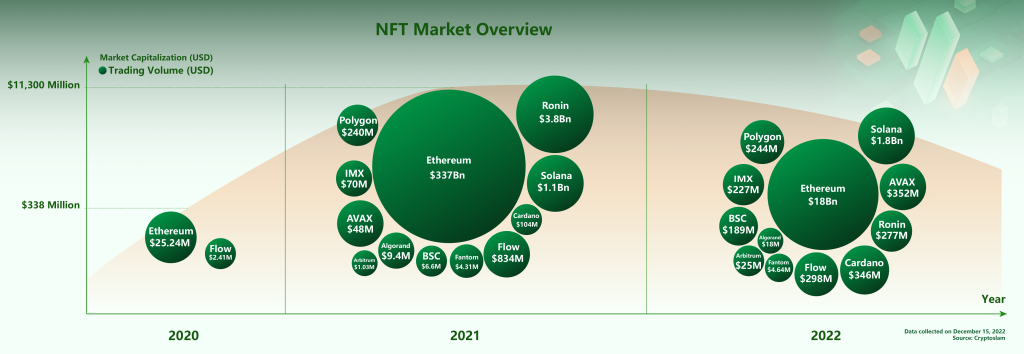

2020-2022 NFT Market Overview by Public Chain’s Market Cap

Since 2020, NFT has experienced a “Sea Change” in the past 2 years with all the ups and downs in the crypto market. The concept “NFT” has turned into a type of financial asset to the public. From the perspective of trading volume over the past 2 years, we have the following observations:

The Entire NFT Market Hit Dramatic Growth in 2021, But Dropped Sharply During the Bear Market in 2022

The PFP mania on Ethereum ushered in the NFT fashion for the crypto world in 2021, but this year the trading volume on Ethereum surprisingly shrank by approximately 95%.

NFT Categories Scatter Around Different Public Chains

NFT concept was introduced very early on but didn’t become a topic until the NBA Top Shot sale and Axie Infinity on Ethereum in 2020. In 2021, NFT assets become popular on many public chains with continuous momentum on Ethereum. Profile Pictures (PFP) collections with artistic elements and cultural meaning became viral, composing a major part of NFT transactions. Meanwhile, public chains such as Immutable X, Binance Smart Chain, Solana, and Polygon have a stack of GameFi and SocialFi projects bringing active NFT trades, too.

From the Perspective of Public Chains

- Ethereum and Solana are no-brainers the king and queen in the NFT space. Both chains led the NFT trading volume in 2022, weighing heavily on PFP assets. Due to the occasional outages of Solana, users complained a lot about projects in its ecosystem, impacting the NFT transactions on Solana to a certain extent.

- The OG NFT chain, Flow, hit the plateau in the race. NBA Top Shot NFTs were introduced in 2020 and have attracted Web2 users to adopt NFT. Being one of the pioneers of the market, Flow didn’t last long in its position due to the unscalable NFT ecosystem, a sharp contrast against that on Ethereum and Polygon. The NFT transaction on Flow dropped from over $800 million to around $300 million.

- Polygon is in the spotlight for NFT projects. With its low gas costs, high stability, and EVM compatibility, Polygon became the first go-to place for many Web2 brands and franchises. Household names on Polygon include Starbucks Odyssey, Donald Trump Digital Trading Card, and Reddit Avatar. The high-profile decentralized social protocol, Lens Protocol, is also built on the eco-friendly Polygon network.

In retrospect, the booming of the NFT industry relies heavily on content. Art, inspiration, and creation are some rare resources, becoming the vital pillar of the current NFT market. The market embraced the NFT fashion with real money and high valuation on certain NFT projects. The value of IP, stories, culture, and art is materialized through JPEGs, carrying the market’s rosy expectation on the future development of the NFT ecosystem. Many NFT projects seem to follow similar roadmaps of issuing NFTs before delivering utilities or selling users’ expectations. Some projects that don’t follow issue NFTs based on the original IP or web3 projects such as GameFi. A few projects even don’t sell any stories but the JPEGs themselves.

Surprisingly, all aforementioned categories saw successful NFT projects, which implies no fixed rules in this field create huge possibilities. After the NFT mania around blue-chip PFPs, the market would become more rational when looking at NFTs as an asset. The transformation of NFT’s intrinsic value would be the key to disrupting the whole industry. The utility proposition will be brought up again, provoking the thought that the meaning of having “Non-Fungible” tokens in the crypto world is not merely having an emotional connection to some cute JPEGs. Building solid connections through sophisticated utilities with NFT holders would become a strategic focus for NFT projects, recalibrating NFT itself as more of a medium. PFPs are recognized as discretionary consumer goods, some even luxuries. Only a few PFP projects have included utility design in their roadmaps. The NFTs with more utilities would have better liquidity and stronger fundamentals in all aspects. That could be one of the reasons why those well-established NFTs still shine in the bear market.

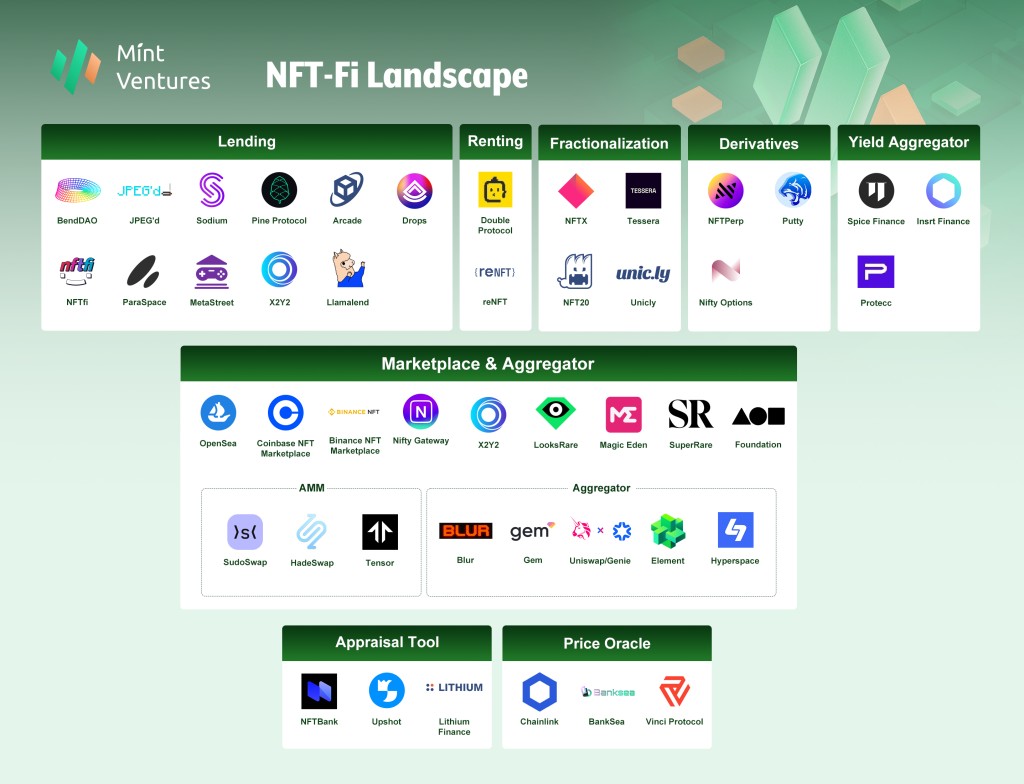

NFT-Fi Landscape in 2022

NFTFi- Landscape

Compared to the NFT-Fi landscape in 2021, there have been interesting, nuanced and dynamic changes in the NFT industry. Some highly-anticipated segments failed to meet expectations, while others gained traction despite the bear market. Some players left the battleground while more are joining the NFT-Fi protocol league.

The NFT Marketplace (Including Aggregators) Remains the Most Competitive in the Race. The Players Tend to Master User Intent

Marketplaces and aggregators continued their exploration, attempting to provide NFT traders with better features in terms of transaction fees, token rewards, creator royalties rule, multi-chain deployment, and the refreshing frequency on sweeping interface. Even the legacy of DeFi protocols, Automatic Market Making (AMM) mechanism was introduced into the NFT space, aiming at providing more NFT liquidity. We see there are a lot more marketplaces and aggregators for users to adopt, but it seems the user base and the market growth didn’t follow, leaving those NFT-Fi Players, especially aggregators constantly struggling to grow. Gem (@gemxyz) and Genie (@geniexyz, now moved to Uniswap) seem to have relatively poor performance overall.

Despite all the attempts and efforts made by other players, OpenSea (@opensea) still kept its supremacy in the marketplaces even with complaints and controversies. However, Blur (@blur_io), launched in October 2022, is a rising star with its intuitive user experience, and intensive airdrops, gaining popularity among NFT pro traders in a short period of time. According to the Dune Dashboard created by Sea Launch, Ethereum NFT trading volume on Blur caught up quickly and even surpassed that of OpenSea close to year-end.

NFT Lending Protocols Gained Momentum Despite the Bear Market

In 2022 H1, Yuga Labs (@yugalabs) launched airdrops for MAYC and BAYC holders, promoting the adoption of lending protocols. Notably BendDAO (@BendDAO), as a leverage tool to get more airdrops. In December 2022, Ape Staking started and many lending protocols introduced their side business, such as pair listing or staking features, to achieve decent user growth. When compared to fractionalization, futures and options, or yield aggregators, NFT lending has seen the most startup teams and new products, as the lending business has been proven profitable and the life cycle is turning to the fastest-growing stage.

The Highly-anticipated NFT Fractionalization was Performing Mediocre

Making NFT more fungible is the key to unlocking NFT liquidity, where fractionalization stepped in as a universal answer. However, those fractionalization protocols didn’t really add liquidity to the market. The early player Niftex stopped operation. Fractional.art rebranded into Tessera (@tessera) with business renovation. NFT pioneers tap into fractionalization for liquidity, but it seems there is still a long way to go.

NFT-Fi Yield Aggregators are Almost Ready to Fight

If we think of NFT lending, futures, options, and fractionalization protocols built directly on top of NFTs as “layer 1” in NFT-Fi field, yield aggregators sit at “layer 2” that are built upon layer 1 protocols, dedicated to maximizing the yield of users’ FT and NFT assets. In 2022, teams behind Spice Finance (@spice_finance), Insrt Finance (@insrtfinance), Protecc (@Proteccxyz) and other protocols have been building up products even when the layer 1 protocols are still nascent. Yet, yield aggregators highly rely on the base layer protocols that they build upon. High adaptability, high composability and smart strategies are essential to a well-designed product. Other than that, identifying market opportunities and having consecutive product updates are vital for the teams as well. Furthermore, from the perspective of the TVL, if NFT-Fi yield aggregators take the same share as DeFi aggregators in the entire DeFi market, which is less than 5%, then the NFT aggregators may need to consider how to break the market ceiling given the current market prospects.