Constrained by the impossible triangle of blockchain, the emergence of new public chains is usually cyclical. The new public chains led by Solana in the previous cycle grew swiftly with their revolutionary low-fee, high-speed concept, but due to intrinsic flaws, they also ran the risk of being eventually surpassed by new public chains such as Aptos. Meanwhile, Ethereum has built a strong moat in the multi-chain future.

Recently, I was invited by 8BTC to participate in the roundtable “Web3 Builder, Forever Young”. One asked that top VCs including A16Z, Binance, and FTX are very optimistic about new public chains such as Aptos, and whether they can challenge the supremacy of Ethereum. Considering the topic is attractive to readers, I have sorted out my thoughts and written down this comprehensive review of Solana, Aptos, and the new public chains. And I will position Aptos in the market where Solana is at the moment.

The theory of blockchain consensus and communication technologies have been simplified in this article to make them easier for readers to understand.

The article is nothing more than my thoughts on a few particular topics related to the new public chains.

Contents

The Framework of Public Chains

In 2015, the birth of Ethereum ushered in a new era of smart contracts, which made public chains become necessary infrastructure for Web3.

In 2017, The growth of ICOs and the hype led by Crypto Kitties nearly brought the Ethereum network to a complete halt. Since then, people have come to realize that the blockchain is unable to handle massive transactions to meet the actual demand, and that scaling is unquestionably the best solution to meet the long-term current needs of Web3.

As there are a big number of influential applications and developers building on Ethereum, it is bound by the vast number of existing stakeholders and must evolve carefully. We will only focus on new public chains in this article, with an emphasis on those that lack early reputation and user accumulation but have less issues inherited from the past, and can adopt new high-performance solutions. Solana was previously the undisputed monarch of the new public chain, but investors now view Aptos as the “Solana Killer”.

High-Performance Public Chains: Will Aptos Replace Solana?

First, I believe that Aptos has a greater chance of challenging Solana’s position.

The high-performance new public chain track will exhibit a specific cyclical rule until Ether formally lands on sharding and reaches sufficient performance levels. Specifically, a new public chain grows swiftly in the early stage and then enters a negative cycle because of the vulnerabilities associated with aggressive offers for high speed and low fees. This time around, Solana’s story of high performance begins to lose its appeal, the moniker “downtime chain” gradually replaces the moniker “Ethereum killer,” and capital begins to search for a new leader in accordance with the cycling law.

The Rise and Decline of Solana – High TPS and Low Fees

The Storytelling of High TPS

Solana’s high TPS is predicated on its 10x blockchain size, low redundancy, and 1/30 of the block generation rate, as well as about 10x speed after parallel processing, achieving a theoretical TPS of over 3000x for ETH.

Blockchain Capacity

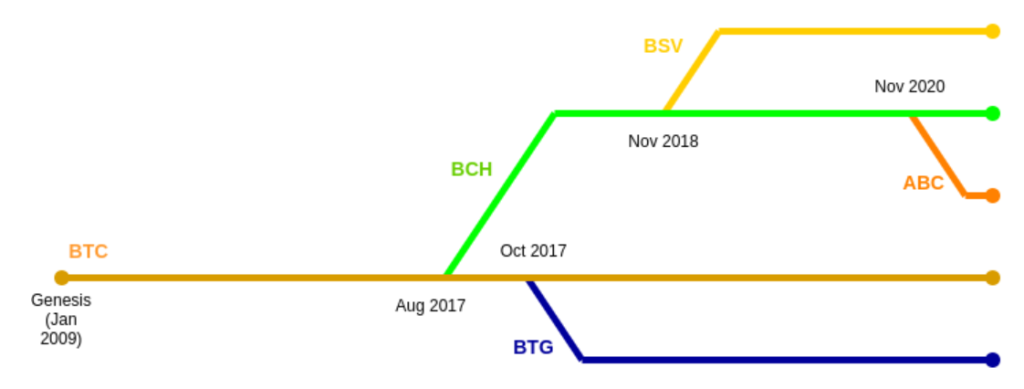

Specifically, Solana increases the block size from 1 MB to 10 MB, resulting in a tenfold performance boost, which is not a very wise choice. Although it can improve the processing capability of the network, there still exists some flaws—-a considerable loss in the number of full nodes that can store entire transactions in the blockchain, and big block size taking a long time in transmission process or possibly being subject to attacks. Some well-known fork attacks on Bitcoin, such as BCH and BSV, came from the heated discussion over blockchain size and Bitcoin insisted on small block size.

Despite the fact that Solana has avoided some risks by improving the transmission process, Solana’s big block size increases the threshold of full nodes and decreases the number of full nodes, which has a negative effect on decentralization and network security.

Improvement on Consensus Mechanism: Block Generation Rate and Low Redundancy

- Centralized Transaction Processing

In the centralized Web2 world, let’s take Alipay as an example, there is only Alipay’s server in the backend, and a transaction can be easily processed as follows:

1. The transaction is sent to Alipay.

2. Alipay approves whether the transaction gets processed.

3. There is no verification process because Alipay is believed to be not willing to commit evil.

The entire transaction processing time can be ignored, as transactions are only sent and processed once and without validation.

- Decentralized Transaction Processing

In terms of public chains, however, there is essentially no access permission for becoming a validator, and we cannot only rely on a validator to process transactions correctly. As a result, we need a huge number of validators, and the process of verification might be quite complex.

Let’s see how Ethereum network confirms a transaction:

1. Transaction requests can be broadcast to various nodes in the network in 6 seconds.

2. A single validator is selected to bundle transactions and propose a block.

3. The block is verified by other validators on the network.

Generally speaking, it increases the amount of transmission and validation and the average block time is about 12 seconds.

Due to the unreliability of a single node, there must be game mechanisms and rounds of validations among all nodes in order to maintain the accuracy of the ultimate output. This increases the block generation time and redundant calculations, which is also the reason why blockchains are facing a trilemma.

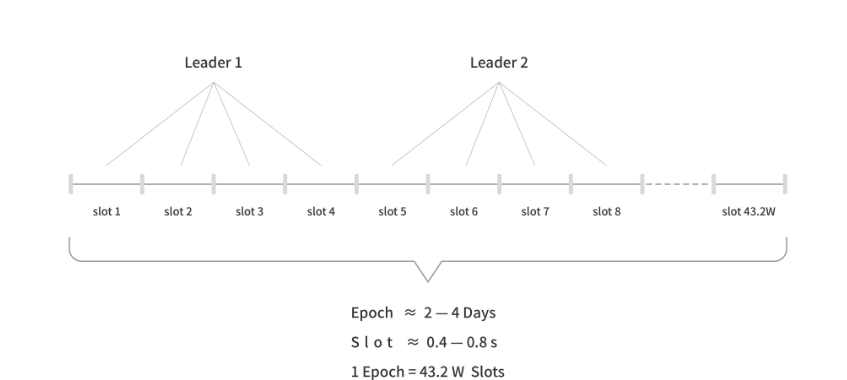

Solana enhances speed considerably at both transmission and blocks verification levels. Solana decreases Ethereum’s block-out time from 12 seconds to 0.4 seconds (maximum of 0.8 seconds), leading to a 30x scaling.

Let’s see how Solana network confirms a transaction:

1) Transaction flow: By disclosing the list of Leaders in charge of the Slot of each Epoch generated, Solana lowers the transmission redundancy because all transactions only need to be broadcast to the Leader and not to all nodes.

2) Transaction Validation: The Leader needs to split the block and send only fragments to each validator instead of the whole block.

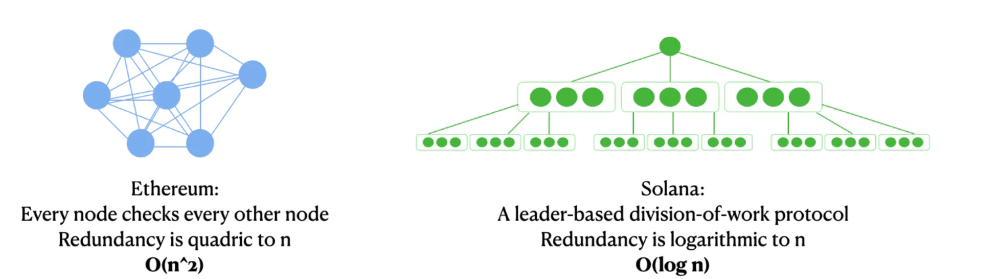

With the block generation mechanism, computation redundancy is reduced from n² to logn, which significantly improves TPS. Here is the analogy:

Let’s do some classic math problems first.

- If the total amount is N, any 2 of N need to swap ledgers, how many ledger swaps have occurred? The answer is n(n-1), or O(n²).

- Likewise, suppose that any one of N needs to exchange ledgers with a known “leader”, how many ledger swaps have occurred? The answer is 2(n-1) or O(n).

- If the total amount is N, known “leaders” swap parts of the ledger with everyone, how many ledger swaps have occurred? Obviously, the result is lower than N level, we can simply take it as O(logn).

The first example is just like Ethereum and the third one correspondings to Solana.

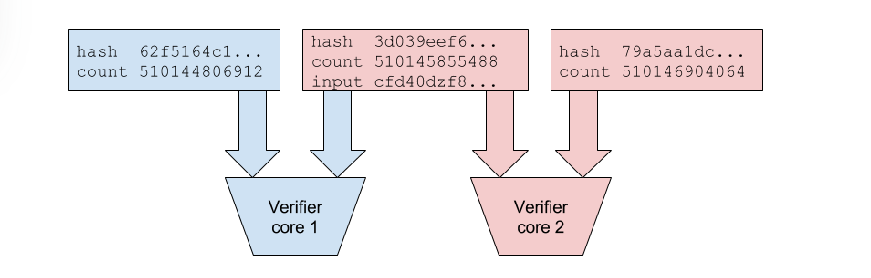

As shown in the figure below, Solana’s consensus mechanism will lower the redundancy of calculating to a much greater degree when generating a block. Besides, the block generation rate also gets promoted.

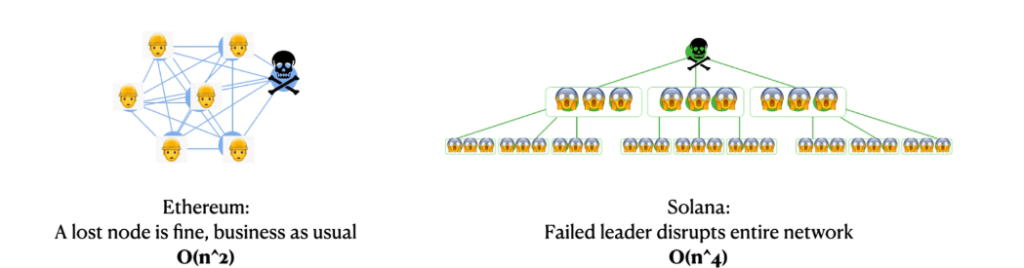

This design actually made it possible for Solana to run at high speed in the beginning. However, it is apparent that the transaction flow has some defects because Leader should be responsible for receiving transactions, checking transaction validity, packaging transactions, separating blocks, and supervising other validators to verify and recycling verification results.

When there are a large number of incorrect or invalid transactions, Leader is susceptible to crashing. The figure below makes it clear that if Leader fails, it becomes very difficult for the system to function smoothly, which results in frequent crashes of the blockchain network.

In addition, centralized issues such as pre-announced leaders being bribed and targeted attacks cannot be prevented, which has a negative effect on the blockchain.

Since the explosion of the Solana ecosystem in September 2021, repeated crashes have occurred, which obviously hindered its growing potential. In the next bull market, what people need is a new public chain that is not prone to frequent crashes or at least does not indicate a very high risk of crashes.

Parallel Computing

Besides the basic consensus mechanism improvements, Solana has also made smart contract parallel processing improvements.

In the early stage, Ethereum adopted EVM as the operating environment for smart contracts, featured serial computing, i.e. processing transactions in sequence, which is relatively inefficient. Although the Ethereum community has proposed to upgrade the EVM to EWASM, there is a long way to go.

Solana chose to adopt Sealevel to support parallel processing of smart contracts and the use of NVIDIA 4096-core GPUs for ultra-powerful parallel computing. This enables Solana to function admirably in most situations.

However, Solana also must deal with some special cases:

(1) Solana must accurately determine whether or not transactions can be parallelized, as wrong judgment may result in failures.

(2) If Solana deems that a transaction must be serial, it will execute serially more slowly than Ethereum.

In conclusion, the properties of 4096-core parallel computing make it incredibly efficient for parallel processing programs, but when dealing with transactions that cannot be processed in parallel, its efficiency will be lower than Ethereum, and the whole blockchain may even crash. Solana is featured with low redundancy, namely the “leader-assign-tasks” model, enabling it to run in a more effective way. In the case of a breakdown, however, Ethereum can get back on track easily due to its high redundancy, whereas Solana will be bogged down as it is of low redundancy. Overall, Solana has made some valuable innovations.It cut a figure due to its high TPS at first but it has to deal with frequent breakdowns and pay the price.

This is “fighting uncertainty with redundancy” in the blockchain space.

The Storytelling of Low Fees

The revenues and expenditures and “Printing Currency”

The low cost of Solana is the other major contributor to its popularity. In a nutshell, the low costs are a result of the system’s tokenization subsidy and the super-high processing power. We will explain the revenues and expenditures under this token issuance subsidy model in detail.

If we think about the business logic of public chains, it provides a business environment for various projects while collecting taxes from all users. To some degree, public chains would be much like countries, and their native tokens would be more like fiat currencies used to pay taxes.

We will explain the revenues and expenditures in a simple way on the basis of shared similarities in the majority of public chains. The taxes of these “countries” are the transaction fees paid by all users, while their financial expenditures are incentives for validators. If you go through the government’s financial report, you will most likely see this word: “balance of payments”.

Public chains must be break-even, just as sovereign states must. But if we review the income and expenditures of each public chain, we find that most of them spend more than they earn because the profit of public chains equals rewards for validators minus transaction fees income.

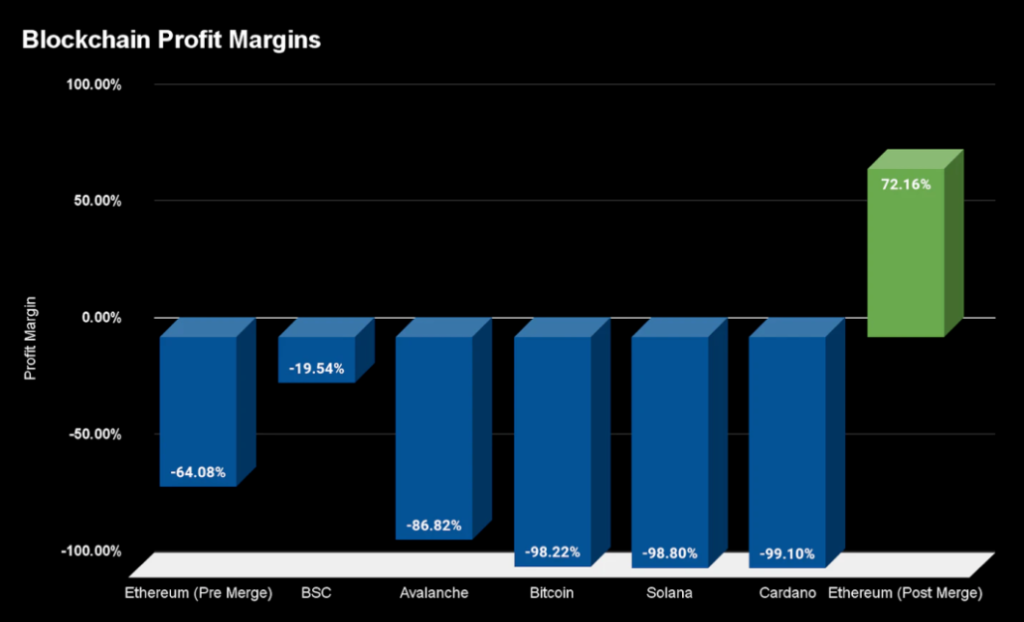

Bankless has analyzed profit margins of public chains:

When the income of a public chain is less than the expenditure that must be distributed to validators, the amount of these losses can only be covered by “printing money” or issuing tokens, which means “the loss of public chains = additional issued tokens”

Thus, the reward for validators often derives from general income and “money printing”, which means “transaction fees + additional issued tokens = validator compensation”.

In the case of Solana, if the reward for a validator is $100, Solana will pay $98.8 by printing money and users only pay $1.2. The proportion will fluctuate over time, but there is a long way for Solana to break even and achieve sustainable development.

“Printing Money” causes inflation of public chains

We try to analogize public chains to countries and public chain tokens to fiat currencies. Then for a public chain, the total value of the currency should correspond precisely to the full value of the commodity.

We can think as follows: A country has only apples as a commodity. In the first year, the country produces 100 kg of apples and issues a total of $100 of currency, then the market price of apples will be $1/kg. In the second year, the country develops rapidly, has 200 kg of apples, and issues an additional $100 in currency, then the price of apples can also be stabilized at $1/kg. And in the third year, the country’s development comes to a standstill, producing only 200 kg of apples. However, again issuing an additional $100 in currency, the price of apples will become $1.5/kg, i.e., serious inflation.

For Solana “countries” that issue “currencies” at a higher rate, the negative effects of issuing additional currencies will be almost offset by the rapid growth of the total value of commodities on the chain in the early years.

However, after Solana has reached an obvious development bottleneck when the total amount of money and the total value of goods begin to be out of balance, Solana either continues to print and issue more money to make up for the imbalance or reduces printing and increases “tax collection”. Both are intrinsically detrimental to blockchain’s progress. Some refer to this as the “cycle law of the new public chain”.

The market is expecting a public chain that can break even, or at least one that doesn’t make users feel unbalanced through the rapid growth of the early ecosystem in the next cycle. It looks like Solana could be replaced, and Aptos is expected to be that successor for now.

We may explore the Ethereum business model here as well. After the implementation of EIP1559 burning mechanism in 2021 and the lowering of operational costs due to the formal Merge in 2022, the corresponding formula has been as follows:

gas fee revenues + additional issuing – burned volume= expenditures to validators

If revenues – expenditures = profits, then for Ethereum:

profits = burned volume – additional issuing

After the Merge, the incremental volume decreases from 4.5 million to between 180-209 million per year, while the burned amount is determined by blockchain usage. When the price of Ethereum gas hits 15, it is not difficult to calculate that Ethereum is a blockchain beyond the break-even point. If it can be sustained for an extended period of time, it can accomplish long-term growth and survival.

Cases Analysis in The Perspective of Revenue and Expenditure

Revenue and expenditure may be an often-overlooked topic, yet even in the brand-new web3 era, revenues and expenditures remain fundamental to business logic.

In June 2022, events such as the increase in fees for the Immutable X (IMX) project on Starkware and DYDX’s independent construction of a blockchain hint at some of the effects of revenues and expenditures on the public chain landscape. We analyze the two projects above in this context through the lens of revenue and expenditure.

IMX

Firstly, We might analyze Immutable X’s revenues and expenditures.

As a ZK Rollup, Immutable X claims no gas fees for its projects by June 2022; therefore, zero revenue for its primary business.

In addition, being a ZK Rollup built on starkware, it needs to pack transaction records to Ethereum for verification and storage to ensure security, as well as pay corresponding fees to Ethereum, mostly gas fees. Additionally, IMX must pay starkware the usage fees.

Obviously, Immutable X’s revenues and expenditures do not balance. In June 2022, IMX began charging a 2% transaction fee to maintain the system’s income and expenditure balance.

DYDX and the Short-term Trend of Application Chains

Then let’s dive into the revenues and expenditures of DYDX.

For DYDX on Starkware, if it chooses Layer 2 of Ethereum, its revenues are equal to transaction fees, and its expenditures are the payments to Starkex, the Ethereum gas fees, and the cost of building the on-chain applications.

If DYDX builds its own blockchain on Cosmos, its income will be equal to transaction fees and the self-built chain gas fees, and its expenditures will be the cost of building the chain.

In other words, if DYDX chooses the self-built blockchain on Cosmos, it will save the expense of paying gas fees for Ethereum, increase the cost of building the blockchain, and increase the revenue generated by the self-built chain’s gas fees. Obviously, this will result in the loss of some traffic and Ethereum ecosystem users. Considering the present comparatively expensive gas fees of Ethereum and the low blockchain building cost of Cosmos, it might be prudent for DYDX to switch to Cosmos’s self-built blockchain.

Obviously, when Ethereum becomes less expensive and more efficient with the introduction of sharding, the self-built blockchain will no longer be a sensible solution from an application (chain) standpoint. And the application chain of DYDX and other projects will reach a tipping point.

Then, according to the logic and cycle law of high TPS and low cost, Solana’s development has reached a limit, and the successor of the leading new public chain will emerge. Regardless of the capital choice, the reacquisition of technology and the narrative of Move are viewed, it appears like Aptos maybe this successor.

Aptos is Expected to be the Next New Leading Public Chain

As of today, it seems that Aptos and Solana share many of the same investors. Some of Solana’s executives and the on-chain projects are tending to switch to Aptos, which is a greater opportunity for it to take over the position of Solana. In addition, the choice of high performance and the narratives of Move language make Aptos more competitive. Of course, whether Aptos can take over Solana’s position and how it develops really challenges the team.

On the first day of launch, Aptos team sparked some controversies in token allocation and community management, making me not too optimistic about the project team’s ability.

The High Performance

Diem-BFT V4 Consensus Mechanism

The core innovation of this consensus mechanism is as follows:

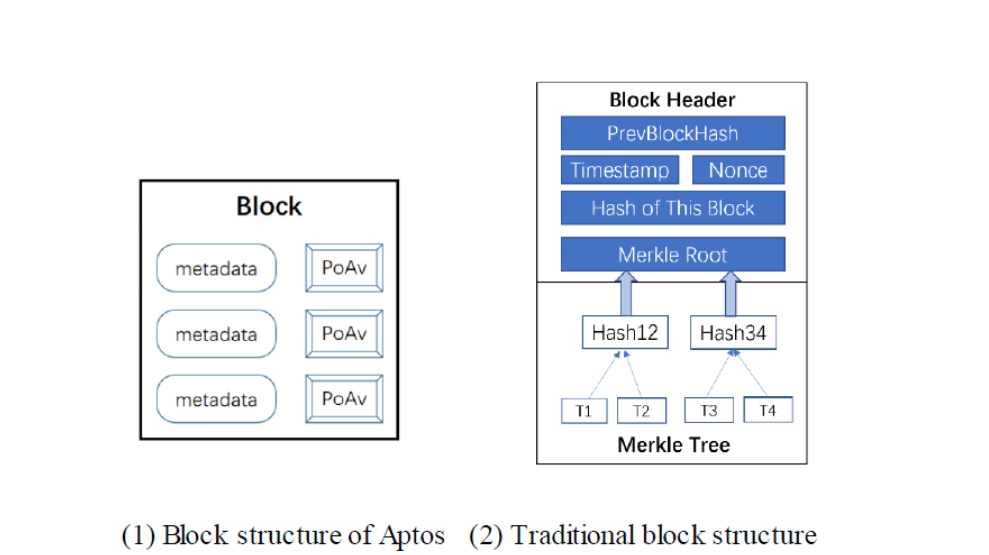

① First, the system compresses a huge number of transactions into a single “summary” record. (i.e. PoAv in the figure below)

② Second, the block contains only a “summary” instead of the whole transaction records.

Thus, the same-sized Aptos block can hold more transaction records, and a greater level of scaling is attained. There are, of course, a number of possible risks connected with this compression, such as the necessity for accurate separation of different batches of transaction records to prevent duplication or omission. Otherwise, errors in transaction processing may occur.

Since Aptos’ current published Tokenomics is rather vague, we will not delve into the persistence of its economic model.

Parallel Execution Engine

Aptos employs the optimistic assumption; transactions will be executed in parallel if considered uncorrelated by default. Aptos will accelerate significantly if the correlation between transactions is very low, and they may be executed in parallel, thanks to the parallel execution engine. Nonetheless, if the transactions are highly correlated, Aptos will have a slightly slower execution speed than ETH, but it will not lead to severe consequences relatively.

Aptos chose 16 threads of parallel execution in the end. The requirements for node hardware are high, and the number of nodes that fulfill the requirements will decrease, as can be seen from Aptos’s current node screening. Additionally, it will compromise the level of decentralization and security.

It should be said that, from a purely technical point of view of parallel execution, Aptos is more of another trade-off than an innovation. I have reservations about scenarios such as optimistic assumptions.

Move Language

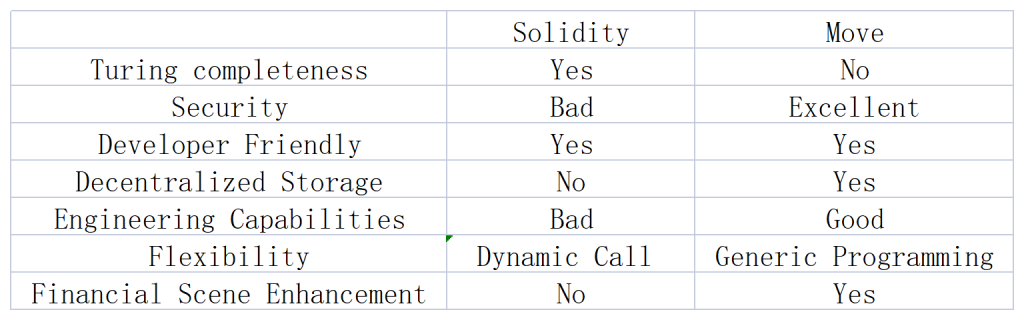

Move language is one of Aptos’ main narratives and does have a strong impact.

Move is a static programming language that emphasizes security. Move, for instance, does not enable Dynamic Dispatch, which means that all code must be easily comprehensible at a glance before execution. It is a more security-focused solution, which is very essential in the financial sector, whereas Solidity provides Dynamic Dispatch, which emphasizes adaptability.

Move should be adopted in numerous blockchain contexts. However, Solidity has its own benefits, such as adaptability and historical accumulation, which are sufficient to retain a substantial number of users.

New Public Blockchain VS. Ethereum

I am pessimistic about the Aptos hitting on Ethereum. Although Aptos and Ethereum have their tradeoffs in their performance of blockchain, Aptos can hardly be called the competitors of Ethereum in the same dimension as in the perspective of a multi-chain future:

Ethereum has already built a safe and large-scale multi-chain system (including Optimism, Arbritrum, Starkware, Zksync and other Rollups), and some of the Rollups have already developed to the new leading public blockchain. While as for Aptos, it is still a single chain without the composability of liquidity for the time being. A safe multi-chain system will be the invisible moat of Ethereum.

The Future of Multi-chain

Since blockchain inherently has an impossible triangle and there are more and more tracks on the blockchain (Defi, GameFi, NFT…), it is difficult for a single blockchain to meet the needs of multiple users. Thus the future will definitely be multi-chain.

The Risks of Cross Chain

High-performance new public chains and specific chains for each track grew by leaps and bounds in 2021. Meanwhile, people are also awaring of the problems of cross-chain risks and the non-composability of liquidity. One would frequently need to transfer assets across several blockchains if they purchase and use domain names on Aptos, play Stepn on Solana, and purchase the latest NFTs on Flow. And there is no safe cross-chain interoperation so far. Because of the frequent repeated hacker theft news, cross-chain bridges have been dubbed “hackers’ ATMs.”

It is well known that a consensus process confines the single blockchain and makes it secure. However, there isn’t a single consensus mechanism that can constrain both blockchains when they interoperate. Therefore, cross-chain bridge security vulnerabilities are unavoidable.

Thus, my prediction is that the future is the secure multi-chain era instead of the single chain without the composability of liquidity.

Security of Multi-Chain System

Ethereum is a shared security layer in the multi-chain age, with each having its Rollup to fulfill various user needs, making it an extremely secure multi-chain system.

Imagine that users can deposit assets to IMX for playing Illuvium, or they can transfer assets to Arbitrum by Ethereum to participate in Odyssey. All these asset transfer processes (Cross-Rollup) are secured by Ethereum, circumventing most of the problems in cross-chains.

The Powerful Multi-chain System of Ethereum

The TVLs of two significant OP Rollups on Ethereum, Optimism and Arbiturm, have exploded into the top 8. This indicates how competitive the multi-chain ecosystem of Ethereum is already. The cost of the Rollup projects interacting with Ethereum is expected to be greatly decreased in the Ethereum Shanghai upgrade that will take place the following year. It will prompt various Rollups to leap forward again and thus solidify the industry position of Ethereum as the shared security layer of the multi-chain system.

Additionally, ZK Rollup is also progressing quickly. In the long run, ZK has a higher ceiling than OP in multiple dimensions, such as security, transaction speed, and transaction fees. With the launch of Zksync main-net and the development of Polygon zkevm and Scroll, the ecosystem of ZK will also be expected to be the leading new public chain in the near future. Therefore, even though they may have ambitions for multi-chain development, single chains without the composability of liquidity, such as Aptos, find it difficult to have an impact on the robust Ethereum multi-chain system.