Contents

Key Insights

Core Investment Logic

Broad prospects but undetermined competitive landscape: Although the metaverse has long been an investment hotspot, Metaverse projects in Web3 world with good operability, narrative innovation and exciting gameplay have not yet been developed.

Otherside Metaverse is likely to break the current stalemate of much cry and little wool, and become a popular Metaverse project that gets a premium in this already hot track.

Excellent innovation and narrative abilities: since the launch of BAYC, Yuga Labs has been leading the NFT market with continuous innovation, and its innovation ability is even more promising as more professional Internet and Hollywood executives will join it.

Yuga Labs, Improbable and Animoca Brands are the investors behind Otherside Metaverse, specializing in designing crypto narrative, focusing on building underlying infrastructure, and being the premier crypto gaming powerhouse with resources in the top crypto and gaming spaces, respectively.

ApeCoin DAO has a well-established governance structure, of which its first board members are well-known investors and entrepreneurs in the crypto space.

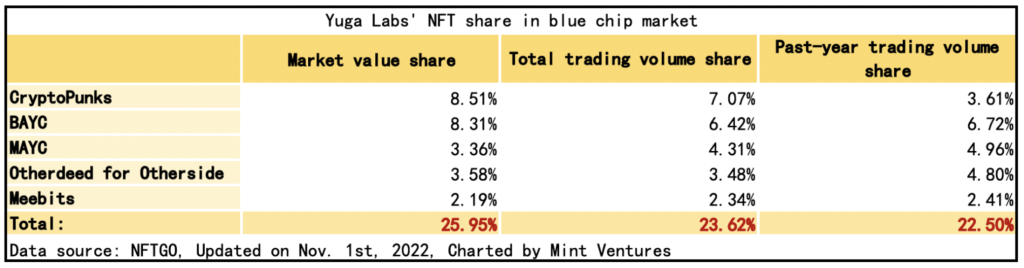

Strong IP moat: Yuga Labs NFT IP matrix occupies a blue chip market share of over 20%, and has been the undisputed leading crypto IP with an extremely strong consensus for more than a year since the launch of BAYC.

Yuga Labs has also partnered with infrastructure provider Improbable to create scenarios that accommodate thousands of people in real-time, demonstrating its extreme technical prowess.

Main Risks

$APE is mainly subject to the following four potential risks: IP and consensus risks, policy and legal risks, incomplete Tokenomics design, and less-than-expected Otherside development.

The most notable of these risks are the policy and legal risks, and incomplete Tokenomics design.

Regulation of NFT is still in its early days when policy and legal risks are a black swan that every crypto-project cannot avoid.

Therefore, the $APE ecosystem is designed to avoid the risks of the SEC.

The primary and secondary sale of Yuga Labs and Otherside’s NFT will not be accrued to the $APE ecosystem, giving no value capture to the token for the Ape ecosystem, with its main use as a circulating currency in the Otherside metaverse. And there is not enough value to support the price in the long run, although users may earn rewards through staking once the staking system is launched.

Although people from Yuga Labs and the ApeCoin Foundation are doing their best to avoid risks, there are many uncertainties at a time when crypto regulation is not yet well-designed.

In March 2022, Bloomberg reported that SEC was working on regulation in the NFT market, and in October 2022, sources said that SEC was conducting research on Yuga Labs.

See “Risks and Issues” in “Business Analysis” for additional details.

Valuation

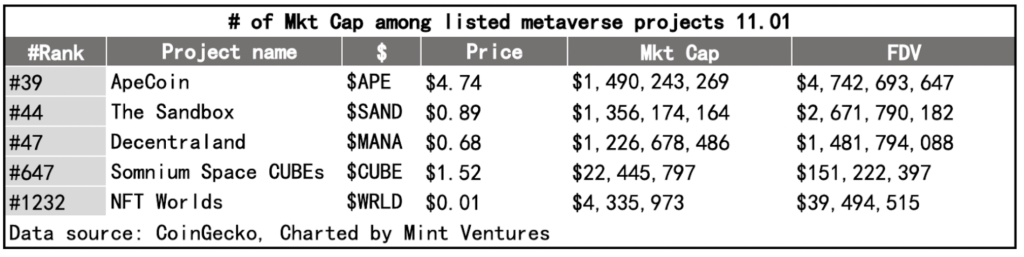

The $APE token corresponds to three businesses: IP of the Yuga Labs NFT matrix, Otherside Metaverse project and ApeCoin DAO.

However, $APE cannot directly capture the fees from Yuga Labs’ NFT primary and secondary market sales, and the project proposed by ApeCoin DAO has yet to generate large-scale revenue, so the parallel valuation focuses on comparing Otherside to its fellow metaverse targets.

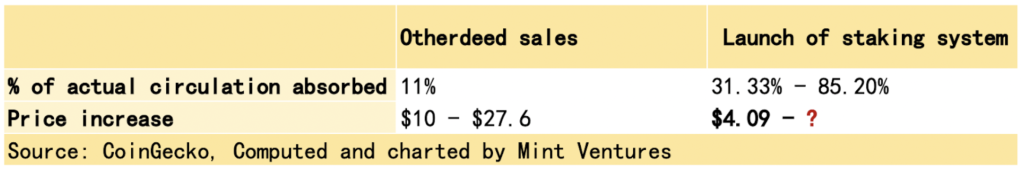

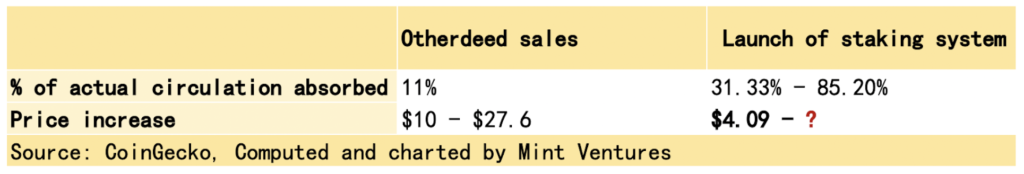

In addition to the parallel comparison, a rough extrapolation was made to past events that occurred when $APE flow fluctuated dramatically (i.e. Otherside land sales) to speculate the likely price fluctuations when the staking system is launched.

It should be noted that the IP business behind $APE, the Metaverse planning, and the community potential built on IP all demonstrate pioneering comprehensive business even in the Web3 sector, hence the difficulty of analyzing its valuation.

The following valuation analysis is more of an attempt to provide a possible perspective and should not be used as a direct investment rationale, so readers are urged to adopt it with caution.

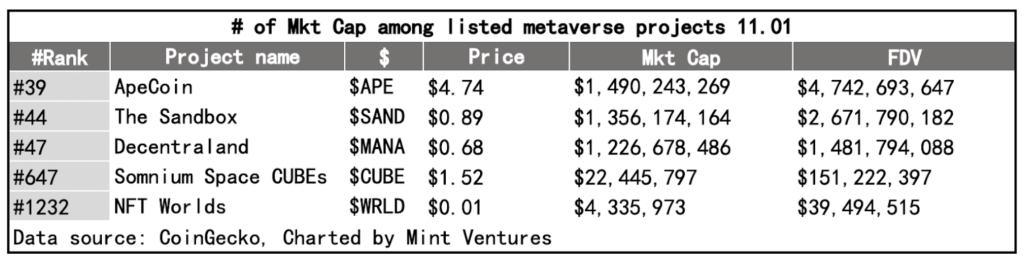

Side-by-side comparison of different Metaverse projects: the total market value of $APE is not too overestimated compared to those of other Metaverse projects by the volume of land transactions and total land value.

And while tokens of other projects are purely circulating currency in the Metaverse, the ecology behind $APE is not only characterized by Otherside, but also by Yuga Labs’ extremely strong narrative capabilities and the potential investment revenue from ApeCoin DAO. It’s reasonable for the FDV of $APE to command a higher premium than the rest of the Web3 metaverse projects if the development of Otherside continues to meet expectations.

Comparison of the two dramatic fluctuations in $APE liquidity: When the staking system was launched, there was a greater uptake of actual liquidity compared to Otherdeed land sales, which may have caused higher price fluctuations, based on estimates from the token model below.

However, it is still necessary to consider three important factors – macro, regulation and the nature of the event, and then judge with caution.

Specific data and analysis are detailed in “Token Model Analysis” in the “Business Analysis” section and “Valuation Analysis” in the “ Preliminary Value Assessment” section.

Project Information

Business Scope

The Ape ecosystem has three core components and one common token. Yuga Labs, Otherside, and ApeCoin DAO are three separate entities, but both Otherside and ApeCoin DAO use the IP of Yuga Labs.

$APE is a universal token in the Ape ecosystem, conceived and issued by Yuga Labs, and ultimately owned and operated by ApeCoin DAO.

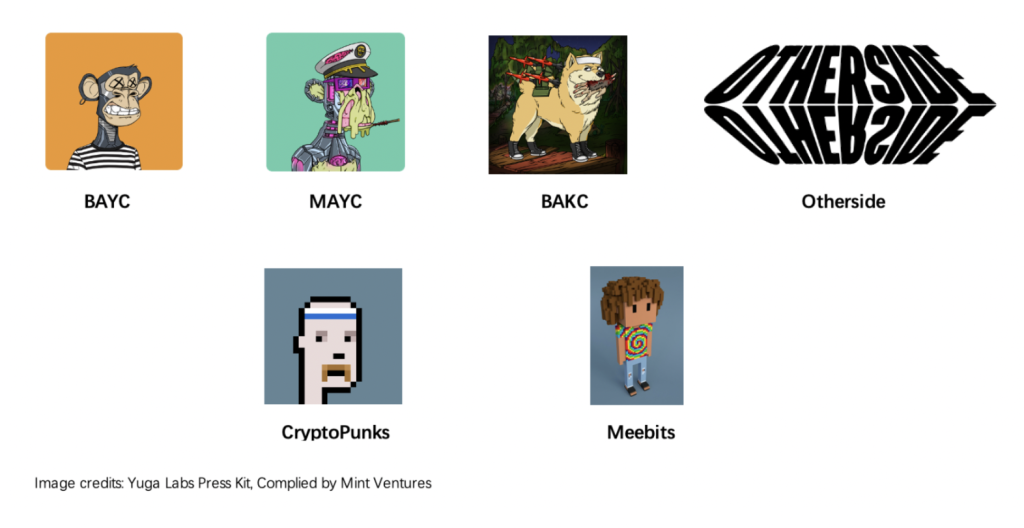

Yuga Labs owns four original NFT series (BAYC, MAYC, BAKC, Otherdeed for Otherside) and two acquired NFT series (CryptoPunks, Meebits).

This ecosystem that Yuga Labs builds will be enabled to the token ApeCoin ($APE) whereas ApeCoin DAO registered in the Virgin Islands is the manager behind $APE.

According to the official website, “Yuga Labs has conveyed all rights and privileges to this NFT and its underlying artwork to the APE Foundation. The ApeCoin DAO can decide how this intellectual property is used.”

Otherside, on the other hand, is a joint project between Yuga Labs, Metaverse infrastructure provider Improbable, and Web3 gaming giant Animoca Brands.

History and Roadmap

Although BAYC brought Yuga Labs from obscurity to fame, it started as an experiment by two Crypto Nerds who teamed up with another two computer-savvy friends they met in college.

Its founding members Gordon and Greg were introduced to each other by a friend early in life and got acquainted because they held completely opposing views on a book but discovered a common interest in gaming and crypto.

In 2017, they dove headfirst into the crypto world, with Greg buying cryptocurrencies as a Hodler and Gordon becoming a trader.

Both bought CryptoPunks in the early days, and participated in the orgy of multiplying Crypto Kitties. They said it was “just for fun” when talking about why they were involved in these projects.

Initially, Gordon envisioned that “an NFT is a digital canvas for holders to draw and become as creative as they want to be artistically.”

But this idea was rejected by a friend, who said, “this is the Internet, the first person who draws is expected to draw genitalia.”

After giving up the canvas idea, Gordon started to think about “what kind of community crypto players want to join”. He thought of his experience growing up in Miami, recalled his years in bars and clubs, and then found that a yacht club might be a good idea. With the combination of “Bored Ape” that comes from “Ape in”, Bored Ape Yacht Club was born.

BAYC opened for sale on April 23, 2021, but was not well received at first.

Discord opened a blind box pre-sale (where you buy NFT but can’t predict the corresponding image) with few users. Then the team did their best to promote it, but with little success. By the end of the week, only 400 BAYCs had been sold at 0.08 ETH.

It was not until April 30, 2021, when BAYC officially revealed that the situation was reversed. Almost overnight, 10,000 NFTs were sold out, and Twitter and Discord were flooded with BAYC avatars. Some KOLs in the NFT community bought tens or even hundreds of BAYCs. Pransky, the giant whale, even bought thousands of BAYCs. What’s more, the price on the secondary market also started to climb.

Initially, the founders saw MAYC as the end of their roadmap, and the unexpected popularity led them to rethink the development of BAYC, which eventually became the most prestigious and leading project in the NFT space. The project has experienced BAYC, MAYC, BAKC, acquisitions, the establishment of ApeCoin DAO and the start of the Otherside metaverse.

To date, Yuga Labs’ business ecosystem around PFP is one of the best crypto IP business cases in terms of creativity, impact, and deliverability.

Ape Milestones

2021.02:Yuga Labs was founded and registered in Delaware, USA. Inspired by Hashmask (an algorithmically randomly generated avatar NFT project in early 2021), Gordon and Greg wanted to do something interesting with the combination of art and blockchain technology, so they started contacting friends to write smart contracts, think of ideas, and meet artists to create projects.

2021.04.23:BAYC launched a week-long pre-sale with a minting price of 0.08E, where BAYC was offered without revealing the picture. The presale announcement in Discord was met with almost zero reaction. Most NFTs were using a curved offering at that time, when the earlier the NFT is minted, the lower the price of NFT. Yuga Labs felt that the curved offering was in fact hurting late entrants and was not conducive to the long-term growth of the community, so they adopted a flat pricing approach.

Such an offering received a lot of praise at the time.

2021.05.01:BAYC put its NFTs on sale and they were sold out overnight. NFT KOL Topshotfund and 3LAU purchased hundreds of BAYCs and the whale Pranksy snapped up about 1,000 BAYCs, making the secondary market continue to heat up.

2021.05.29:the first phase of Ape Merch (a peripheral sales market opened by Ape Eco for a limited time) began for physical peripheral goods, all of which were sold out in 6 minutes.

2021.06.18:BAKC (Bored Ape Kennel Club) was released and each BAYC holder received a matching puppy NFT airdrop. The founding team wanted their ideas to be more fun and add on value to the community, so the idea to make BAKC came about. Royalties generated from the first 6 weeks were donated to animal charities, and thereafter royalties from secondary market sales were set at 0.

A total of $1 million was raised.

2021.08.08:BAYC Riverboat opened in Decentraland (Web3 sandbox game project, to be detailed in the competition comparison), providing virtual event space.

2021.08.28:MAYC (Mutant Ape Yacht Club) was released with a total of 20,000 MAYCs, which are available in two ways: open casting (10,000) or based on potions dropped to BAYC holders (10,000). The initial intent in creating MAYC was to “scale the community of participants.” At the time, BAYC was already priced at 60 ETH (about $200,000), so the team hoped that the barrier would be lowered so that more new entrants might purchase newly-released MAYCs. The publicly minted MAYCs were offered in a Dutch auction, with minting prices ranging from 2.5 to 3 ETH. As a result, Yuga Labs had earned approximately $96 million in initial sales revenue within one hour.

BAYC holders only need to spend Gas to mint MAYC with the potions they get from airdrops.

2021.08.29:NBA star Curry purchased a BAYC avatar for about $180,000.

2021.09.09:Sotheby held the “Ape in ! ” auction, selling a collection of 101 BAYC and 101 BAKC, which were auctioned off for $24,393,000 and $1,835,000, respectively.

2021.09.13:An interactive scavenger hunt was launched where community members explored the club and beyond to solve a puzzle left behind by a monkey named Jimmy. Prizes for this hunt included 10 ETH, a BAYC, a BAKC, a synthetic MAYC venom and a special pair of gifts made by RTFKT.

2021.09.17: Christie’s held the “No Time Like the Present” auction in Hong Kong, which featured four BAYCs in suits. Bored Ape #1401 was sold for HK$5,000,000 (US$640,000). The community celebrated the success by modifying the clothes of their avatars to suits using dress-up technology.

2021.09.22: “Roadmap 2.0” was released, covering Ape Fest, handheld games, scavenger hunts, offline and online parties, Sandbox scenes, and BAYC Eco DAO initiatives.

2021.10.08:it announced that the first quarter of 2022 will see a compliant token with utility and governance features, intended to reward holders and expand the community’s reach. They have partnered with Fenwick, a leading organization in blockchain law, and Horizon Labs, a decentralized blockchain, to prepare for the token launch. Until 8 October 2021, Yuga Labs’ three NFT series generated a total of about $1 billion (then worth 300,000 ETH) in secondary market transactions on OpenSea.

2021.10.31-2021.11.06:Yuga Labs held the first Ape Fest, a week-long free event for its members. NFT holders were able to attend a Halloween boat party, concert, art gallery and raffle for limited edition merchandise, as well as a charity dinner. Thousands of people attended the offline events and donated nearly $200,000 at the charity dinner.

2021.12.17:Yuga Labs collaborated with Adidas. Adidas purchased Bored Ape #8774 and produced two derivative NFTs (Adidas Originals: Into the Metaverse), along with another buyer CryptoPunks.

2022.01.21:a BAYC x MAYC handicap contest was held for BAYC and MAYC holders, with the top 1000 from each series eligible for physical prizes.

2022.03.12:Yuga Labs acquired CryptoPunkss and Meetbits, and announced the granting of commercial use rights to NFT holders (in line with own series such as BAYC).

2022.03.16:Yuga Labs launched $APE as a cultural symbol and the token for a gaming ecosystem and the DAO.

2022.03.18:BAYC and MAYC Holders (or those also hold BAKC) are allowed to claim $APE on ApeCoin website.

2022.03.22:Yuga Labs announced a $450 million seed funding at a $4 billion valuation. The seed round was led by a16z and got Animoca, FTX, Moonpay, Sandbox, Tiger Global, Google Ventures and others involved.

2022.03.23:TIME Magazine supported subscription payments with $APE.

2022.03.24:ApeCoin DAO launched 5 DAO governance proposals, including a draft DAO governance, reward distribution in staking pools and more. The proposal sparked controversies in the aftermath, including questions about board members Yat Siu and Animoca Brands, and talking down the long-term ecology through token staking. The subsequent proposal passed in April defined more clearly the staking period, staking limit and output size.

2022.03.24:Yuga Labs announced the launch of the Metaverse project Otherside, which will use $APE to purchase land and subsequently set a price of 305 $APE. The 16,775,000 $APEs received by Yuga Labs will be locked for 1 year and would not be used for voting in ApeCoin DAO during that year. A total of 55,000 pieces of Otherdeed NFTs are available for KYCed users, and BAYC (10,000) and MAYC (19,425) holders may claim their Otherside NFTs on their own for the next 21 days.

2022.05.01:Otherside land was put up for sale with unprecedented fervor, when ETH Gas was once as high as 45,556 Gwei, resulting in a purchase cost of $305 APE (about $5,800 at the time) and an ETH Gas fee ranging from $4,000-$10,000 for the land purchaser. A total of 50,000 ETH were burned in this during the minting session. Yuga Labs said it would refund the Gas fee out of its own pocket and proposed to move the $APE to a new chain in the future. Later, the Foundation’s proposal to “keep $APE in the Ethereum” passed, rejecting the current proposal.

2022.06.21:BAYC announced that it would launch a co-branded NFT in collaboration with Rolling Stone magazine on June 22, accepting only $APE payments.

2022.07.06:Otherside Metaverse held its first load test in the first phase, only allowing users with Otherdeed NFT to participate.

2022.07.09:Otherside held the second load test in the first phase, which was only available to those holding Otherdeed NFT. The test has received good feedback from users and wide spontaneous spread on Twitter. According to Improbable’s CEO, up to 4,500 people were interacting and communicating with each other in the same scene.

2021.07.13:Robbie Ferguson, the co-founder of the well-known Ethereum L2 protocol Immutable X, tweeted that Immutable X will mint 100,000 NFTs for $APE holders for free Gas as part of its promotion for the expansion of the Metaverse project Otherside.

2022.07.23:ApeCoin Foundation partnered with Horizen Labs, a blockchain privacy and infrastructure building company, to build and manage the staking system for $APE, which will be available this fall.

2022.07.25:Yuga Labs was hit with a class action lawsuit organized by the Scott+Scott law firm, which may confirm whether NFT is a security in the United States.

2022.08.02:Some Gucci stores in the U.S. accepted $APE via BitPay as a payment method.

2022.08.05: Tag Heuer, the Swiss luxury watchmaker owned by LVMH, announced that it accepts payments using $APE via BitPay.

2022.09.22: AIP-98 was passed with the aim of bringing online an NFT trading marketplace for the Ape community with a 0.5% transaction fee rate paid in $ETH (with 0.25% going to the trading marketplace and 0.25% to the Ape Ecosystem Fund) and a 0.25% transaction fee rate paid in $APE (all going to the Ape Ecosystem Fund).

2022.09.23:Horizon Labs announced that the staking system is expected to open on Oct. 31th, possibly a week or so earlier or later.

The launch of the staking system was set to Dec. 7th or Nov. 14th, depending on the result of AIP-134.

2022.10.11:According to Bloomberg, Yuga Labs was under investigation by SEC, focusing on whether NFT is similar to stock and follows the appropriate disclosure rules. In addition, major Wall Street regulators were reviewing the distribution of ApeCoin ($APE). Bloomberg further stated that Yuga has not been accused of wrongdoing, and the investigation does not mean SEC will prosecute the company.

2022.10.28:AIP-134: Bug Bounty Program for AIP-21 was live on snapshot, aiming at holding a bug bounty before the launch of staking system.

The proposal will delay staking rewards by roughly 3 weeks. If this proposal passes, staking rewards would begin accruing on Dec 7th, rather than Nov 14th.

The voting ends on Nov 3rd.

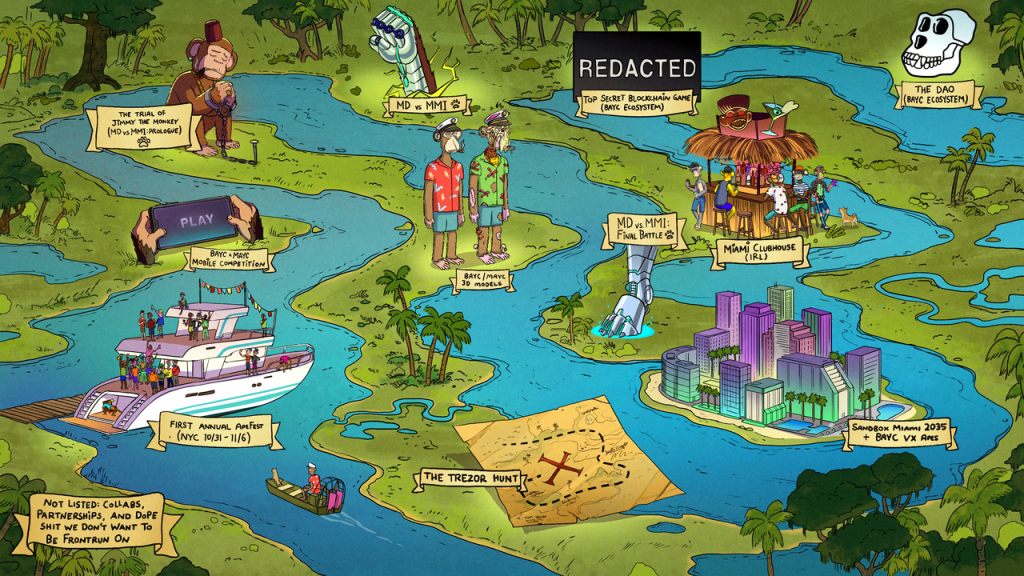

Ape Future Roadmap

Yuga Labs behind the Ape ecosystem is one of the strongest roadmap deliverables among the many projects in the NFT market.

In September 2021, BAYC Twitter released Roadmap 2.0 on its official account. Looking back at 2022, most of the expressed milestones have already been achieved, including Yacht Party, Meta-Universe Games, and the DAO.

Sandbox Miami 2035, a joint project between BAYC and Sandbox, has also been released for preview and has been found by the community to echo the Roadmap from a year ago.

Currently, the known future events released through official channels include the staking system jointly developed by ApeCoin Foundation and Horizon Labs, which is expected to be launched on November 14 or December 7th, depending on the voting result of AIP-134.

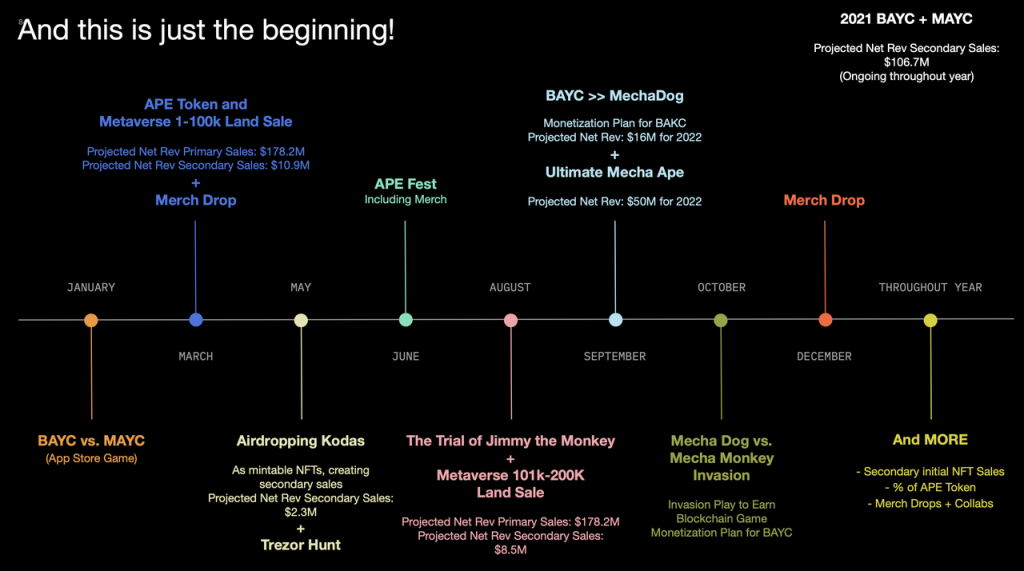

In addition, “Yuga Labs Pitchdeck” widely circulated in March 2022 predicts more major events in the rest of 2022.

- 08/2022: The Trial of Jimmy the Monkey + Metaverse 101k-200k Landsale (postponed)

- 09/2022: BAYC >> MerchaDog (Monetization Plan for BAKC) + Ultimate Mecha Ape (postponed)

- 10/2022: Mecha Dog vs. Mecha Monkey Invasion

- 11/2022: Merch Drop

Since these events did not happen and this Pitch Deck was not released through official channels, there may be changes and the document can only be used as a reference for follow-up plans.

However, co-founder Greg said in Discord of the Pitch Deck: “This is an old and outdated business plan, and neither Gordon nor I have ever seen it. Much of this planning has been changed, and more is about to be changed – we won’t do things that people expect”.

But until August of this year, the project was strictly following the roadmap of this plan.

Key Events Affecting Short-Term $APE Prices

In the short term, the staking system with an announced launch date, and the Otherside 101k-200k land sale mentioned in the plan with an indeterminate launch date are two key events that change the price of $APE.

Staking System (expected to be launched on November 14 or December 7th, depending on the voting result of AIP-134)

The staking system proposed in March 2022 was the subject of considerable controversy, either over the “staking incentive” itself or the fact that the uncapped staking was effectively against the interests of NFT holders. The latter controversy has been improved in subsequent community governance proposals while the former remains a widely questioned issue for $APE.

One of the most widely circulated comments from the crypto KOL Cobie says,

“When POS protocols issue rewards to stakers, they are buying chain security. It’s a worthwhile use of equity. When DeFi projects offer liquidity mining programs, they are buying growth and TVL. Depending on how the program is designed, it can also be a worthwhile use of equity. Spending equity for things that makes the protocol more sustainable, larger, or more secure seems worthwhile.” But these “staking” mechanisms (that do not do anything at all except pay users more coins for staking) are giving away equity for nothing except to reduce potential sellers’ liquidity.

“But these ‘staking’ mechanisms (that do not do anything at all except pay users more coins for staking) are giving away equity for nothing except to reduce potential sellers’ liquidity.

When POS protocols reward stakers, they are paying for the security of the chain, which is certainly a worthwhile investment.”

When Defi offers mining projects, they are subsidizing the reward growth and TVL, which can be considered a worthwhile expense if the projects are well designed. In these projects, staking awards will make the protocol more sustainable, gain growth, or be more secure. And the $APE staking mechanism (which does nothing but give more tokens to existing users) is only used to reduce liquidity for potential sellers.

Following changes to the staking cap, proposal AIP-22, which was introduced in April, was passed by the community despite the considerable controversy, clarifying when and how the $APE staking awards would be released.

Given the details stated by Horizen Labs in August, the protocol of the $APE staking will be expounded here.

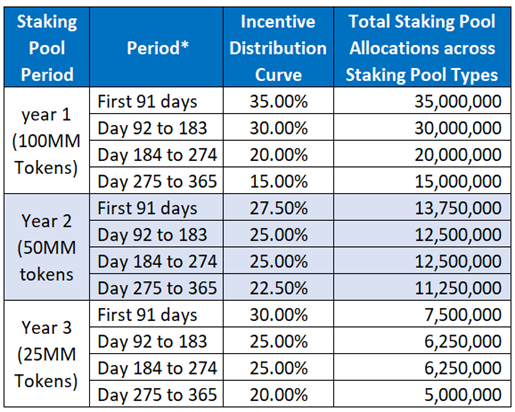

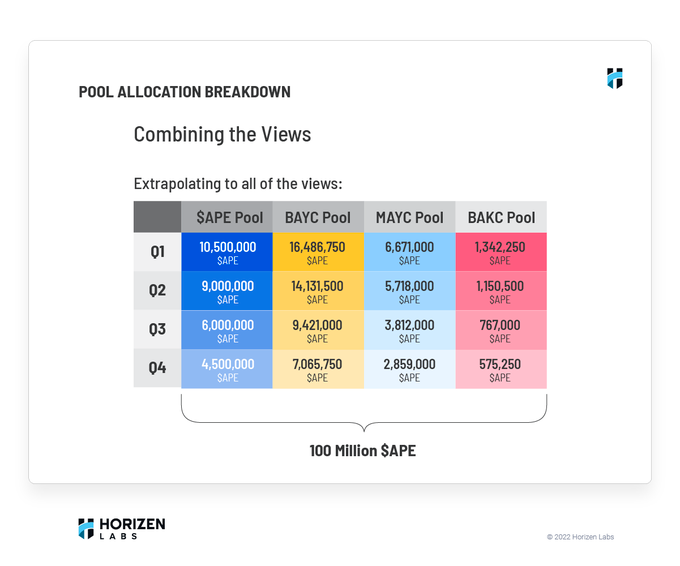

a) Staking reward release rate and reward pool allocation

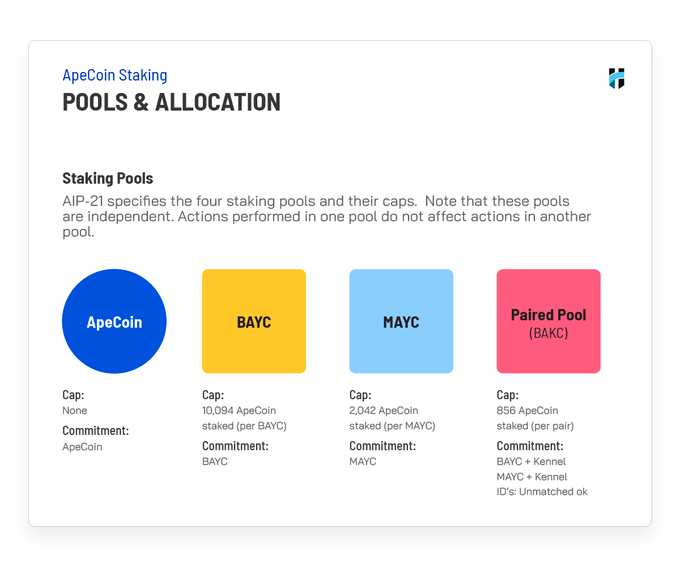

The staking system consists of 4 token pools – a pure $APE token pool, a token pool unlocked with BAYC, a token pool unlocked with MAYC, and a token pool unlocked with BAKC (this token pool needs BAKC to be paired with BAYC and MAYC to be unlocked). NFT is more of a functional key, which could not stake itself to generate income, but can unlock a staking pool with potentially higher yields.

A total of 175M $APE (17.5% of total tokens) will be released in three years.

On an annual/quarterly basis, tokens for staking rewards are released at a decreasing rate, with 100M $APE released in the first year, representing 10% of total circulation; 50M $APE released in the second year, representing 5% of total circulation; and 25M $APE released in the third year, representing 2.5% of total circulation. The quarterly allocation also follows a linear decreasing setup.

Rewards in the 4 token pools will be allocated on the NFT price in Q4 of the previous year.

The $APE pool will allocate a fixed 30% of the total pool for the year, whilst the remaining pools that require NFT unlocking will be subsequently price-floated, where the higher the price of NFT, the higher the allocation ratio of $APE.

Furthermore, the pools that require NFT unlocking are subject to a single-user staking deposit limit, while the pool that requires only $APE has no limit. The staking deposit limit is 10,094 $APE for a single BAYC, 20,402 $APE for a single MAYC, and 856 $APE for a BAKC if matched with a BAYC/MAYC. The NFT pool staking cap was established to ensure that NFT holders receive a higher potential return on their staking awards than regular $APE holders.

b) Staking rules and incentive calculation system

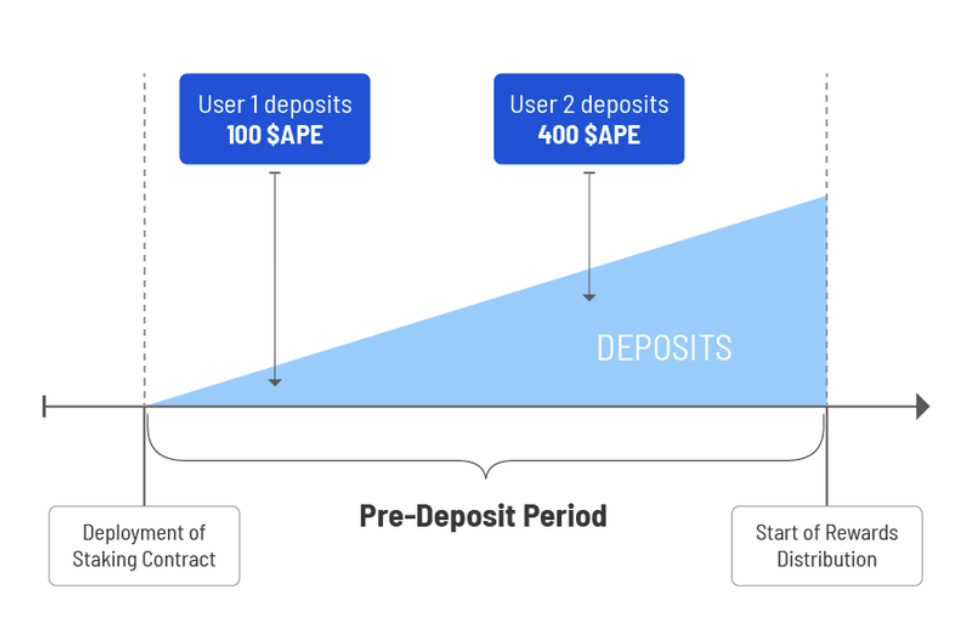

A “pre-staking period”, which is set before the staked earnings are formally calculated, during which the order of staking is not linked to subsequent earnings. Officially, this is to avoid Gas War on the chain and to allow enough time for users to prepare $APE for staking.

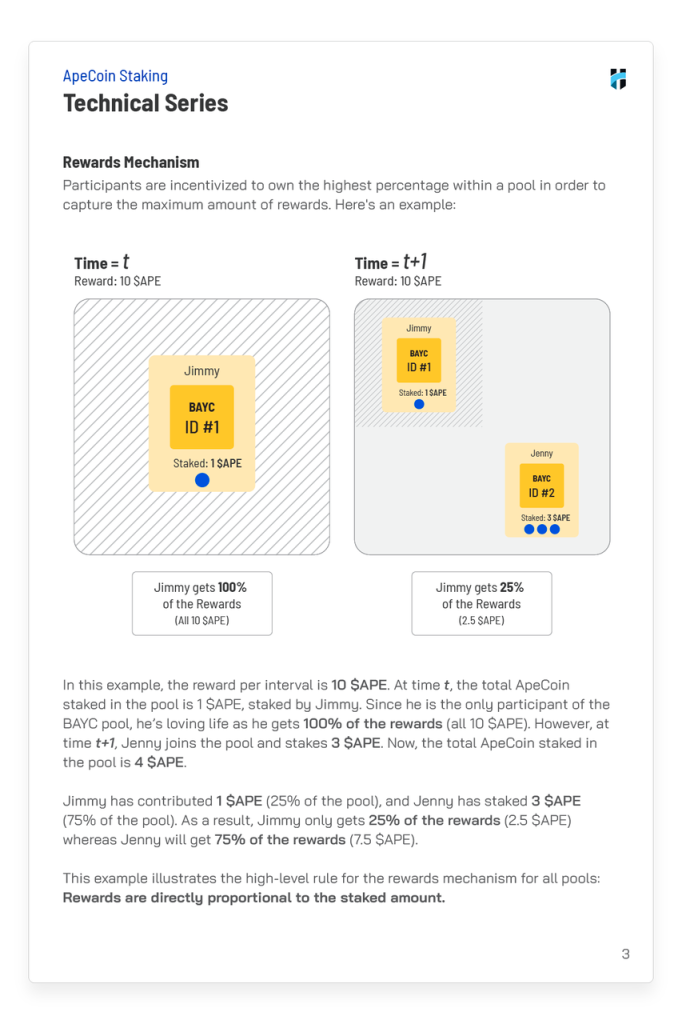

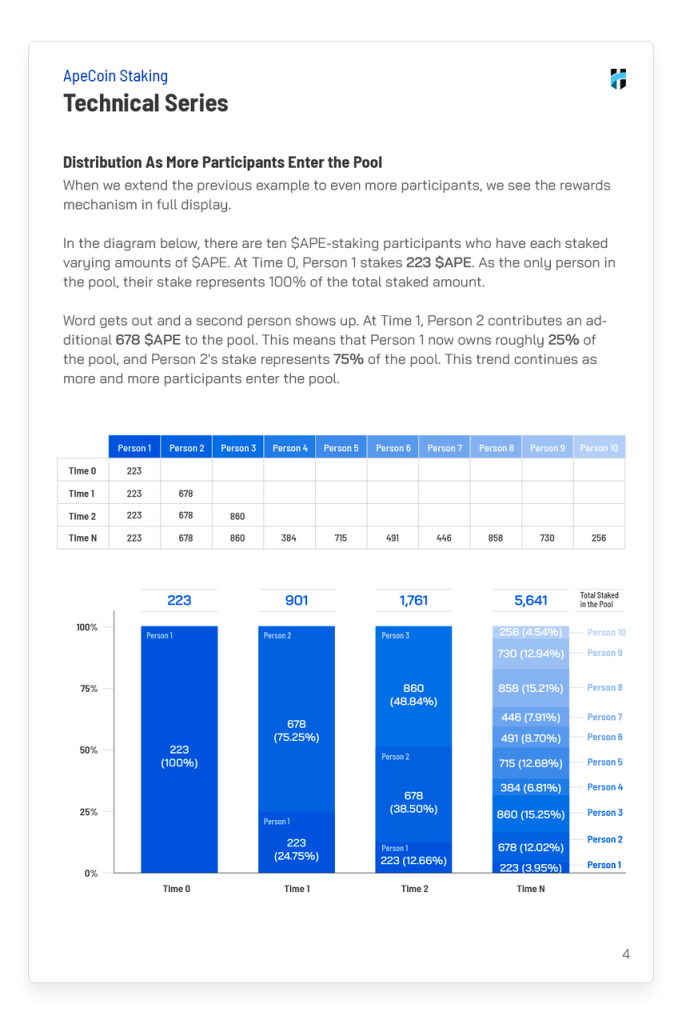

Staking rewards are distributed to users linearly over time and according to the weight of staking in the pool (specific time interval not yet determined). For example, at time t, if only User A stakes $1 APE, User A will receive the full reward for time t. If at t+1, User B stakes $3 APE, User A will receive 25% of the reward for that time period and User B will receive 75%.

And if more users participate in staking, the total reward at that time period is fixed, but those allocated to individuals are determined by their weight in the staking pool.

Since NFT is the key to the staking pool, the staking award should be withdrawn through NFT in advance, if NFT is to be resold.

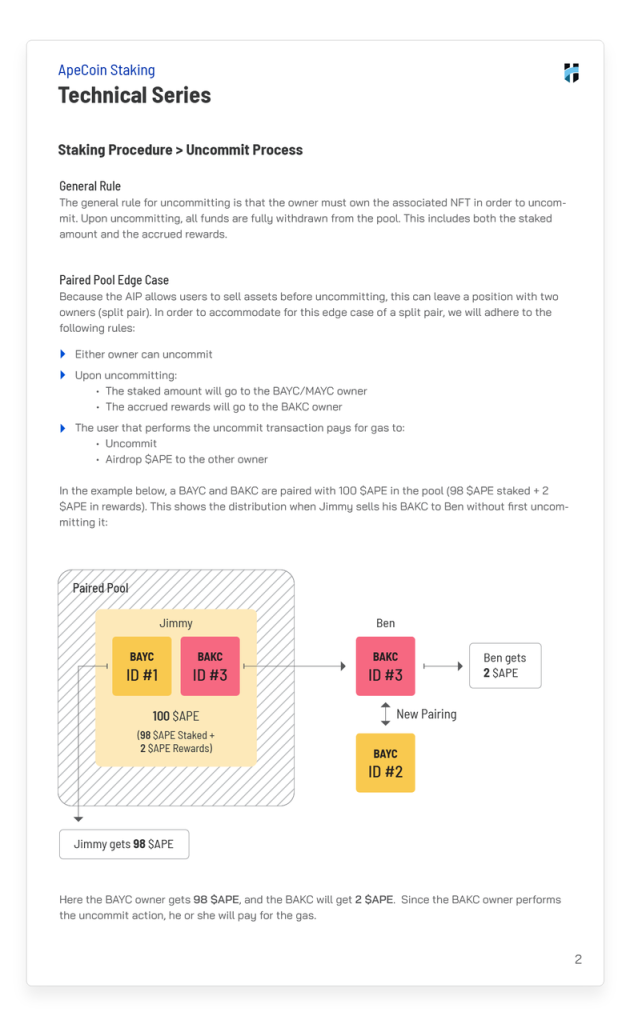

The case where the staked token has not been withdrawn but NFT has changed hands will be discussed in two scenarios: 1) In the BAYC/MAYC staking pool, once NFT is transferred to a new holder, the new holder will have the right to unlock the staking amount/staking reward immediately; 2) In the BAKC staking pool, if BAKC is transferred to a new holder but BAYC/MAYC are not, the new holder of BAKC will receive the staking award whereas the owners of BAYC/MAYC will receive the original staking amount once the holders of BAYC/MAYC release the staking.

The holder of the “key” to unlock staking pool is required to pay the Gas fee.

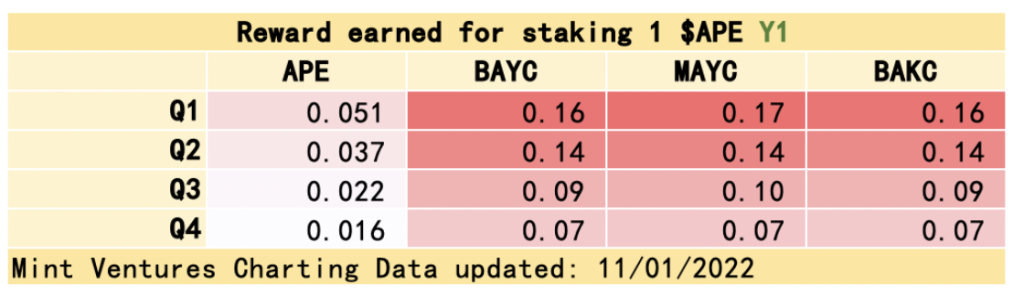

c) Expected rate of return on staking system

- Calculation under full staking assumption

Since the existing $APE liquidity as well as the number and staking limit of BAYC / MAYC / BAKC are known, the expected coin-based yield in the coming year after the staking system comes online could be estimated.

For reasons of rigor, what to be figured out is the extreme case where “$APE to be released is fully staked”, implying that the actual yield may be significantly higher than the calculated yield.

In addition, the yield of pure token staking pools may decrease due to the linear unlocking and release of locked $APE over the next year. The number of $APE in the pool will not continue to grow as it is assumed in the “full staking” that all NFT stakings have reached their limit. Hence, staking pools that require NFT unlocking will not experience a similar situation.

Assumptions:

- Holders of BAYC, MAYC and BAKC have deposited $APE into the respective NFT staking pools in a timely manner to be fully staked and reach the deposit limit.

- All remaining $APE will be placed in the $APE staking pool.

- $APE produced is “re-staked” quarterly into the $APE pool.

- There are 354 million $APEs in liquid (including eco-funds, investors) (based on the expected liquidity of $APEs when the staking system is launched on November 14th, if AIP-134 were rejected, otherwise the system will be launched on December 7th, which may slightly increase the circulating volume of $APE, thus slightly decrease the ROI)

Conclusions:

- If the circulating $APE is fully staked, the reward pool yield for holding NFTs will be 2-3 times greater than simply staking $APE.

2. For the three reward pools that unlocked with NFT, the annual yields are almost equal, and the yields in each pool are quite attractive.

3. As the cap varies for different NFTs, BAYC holders will get larger gains.

- Sensitivity Analysis of Staking Ratio and Yield under Non-Full Staking Assumption

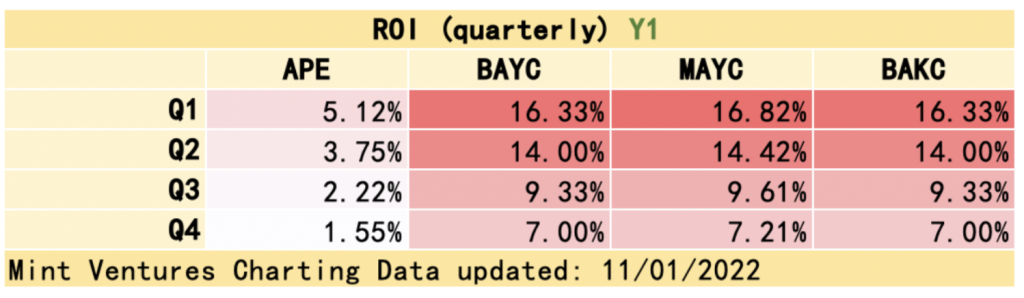

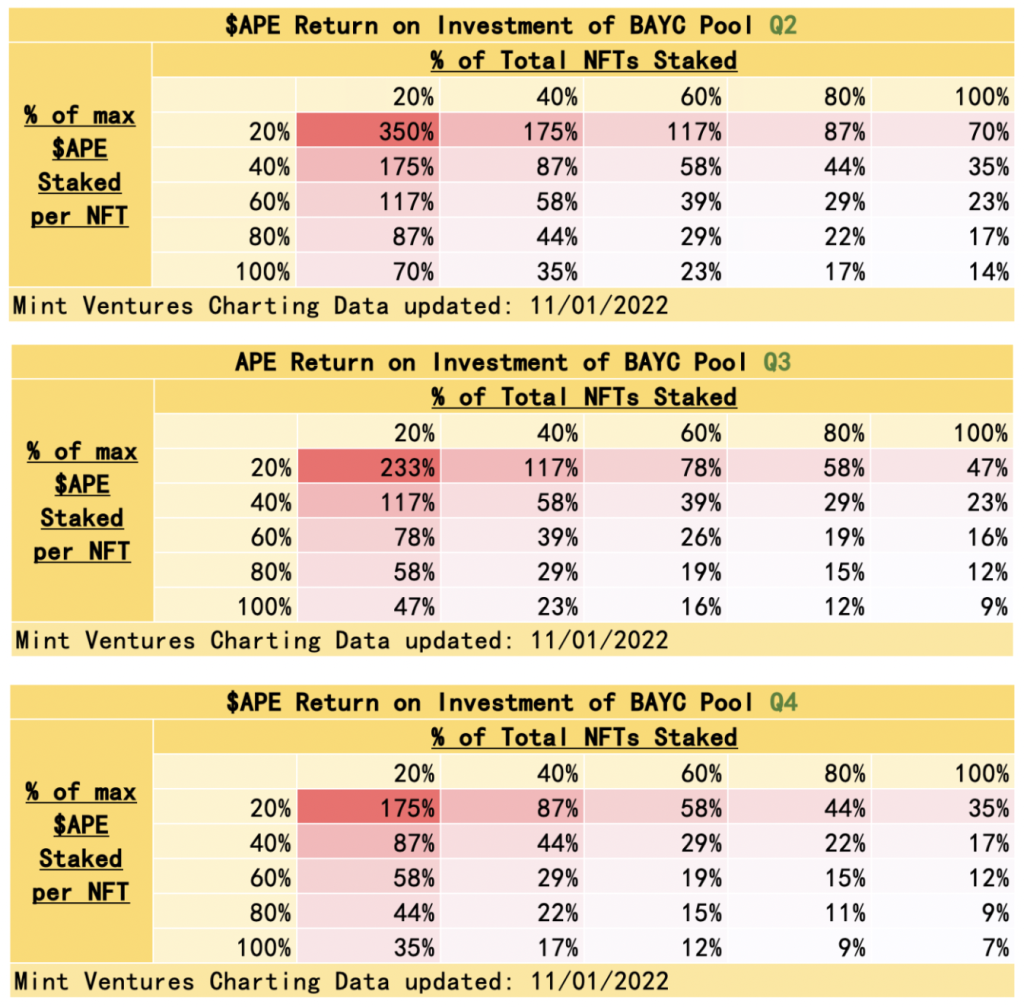

As already mentioned in Calculation I, the staking yields for the three pools are essentially flat. Using the BAYC staking pool as an example, a sensitivity analysis of the yields and staking ratios for the four quarters is calculated for the first year the staking is open as follows.

Sensitivity analysis of total revenue, yield and staking ratio in the first year: In the first year, the annual yield of the staking reaches 130% when 60% of the total NFTs are involved in staking and individual NFTs account for 60% of the staking cap (the larger the staking ratio, the smaller the yield).

As a result, the staking yield of the NFT pool is likely to be above 100%.

Sensitivity analysis of yields versus staking ratios for four quarters in the first year: the yield in one quarter will be 34% when 60% of the total NFTs are involved in staking and individual NFTs account for 60% of the staking ceiling (the larger the staking ratio, the smaller the yield).

As a result, the absolute return for the quarter is likely to be above 30%, corresponding to an APY of over 100%, which is quite impressive in $APE terms.

Therefore, the launch of the staking system may drive users to purchase $APE to participate in staking for rewards, provided that the $APE price bubble is not too high.

Otherdeed for Otherside Land Sale (time and form to be determined)

Previously, Otherside Metaverse land sale had a breathtaking wave of Ether Gas War, with Ether Gas reaching 45,556 Gwei at one point, costing land buyers $305 APE (about $5,800 at the time) in purchase fees and $4,000 – $10,000 in ETH Gas fees. Meanwhile, 50,000 ETH burned in the minting event.

| Otherside Sales | Unit price | Gas consumption | Sales details |

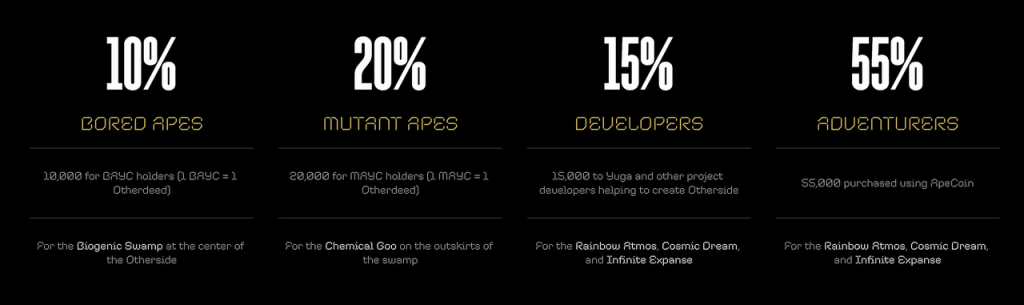

| 1 – 100k Land sale | 305 $APE (approximately $7,000 – $8,000) | $4,000 – $8,000 | 10,000 plots of land for BAYC holders 20,000 plots of land for MAYC holders 15,000 plots of land for developers who contribute to Otherside on an ongoing basis 55,000 plots of land in a public offering ($305 APE) |

100k – 200k Landsale (TBD) | To be announced | – – | The website says that the land will be fully “rewarded” to users who hold Otherdeed and contribute to the development of Otherside Metaverse. Given the program in the leaked Investment Deck, it is likely that only those who hold Otherdeed and participate in the Otherside test will receive purchase/collection rights. |

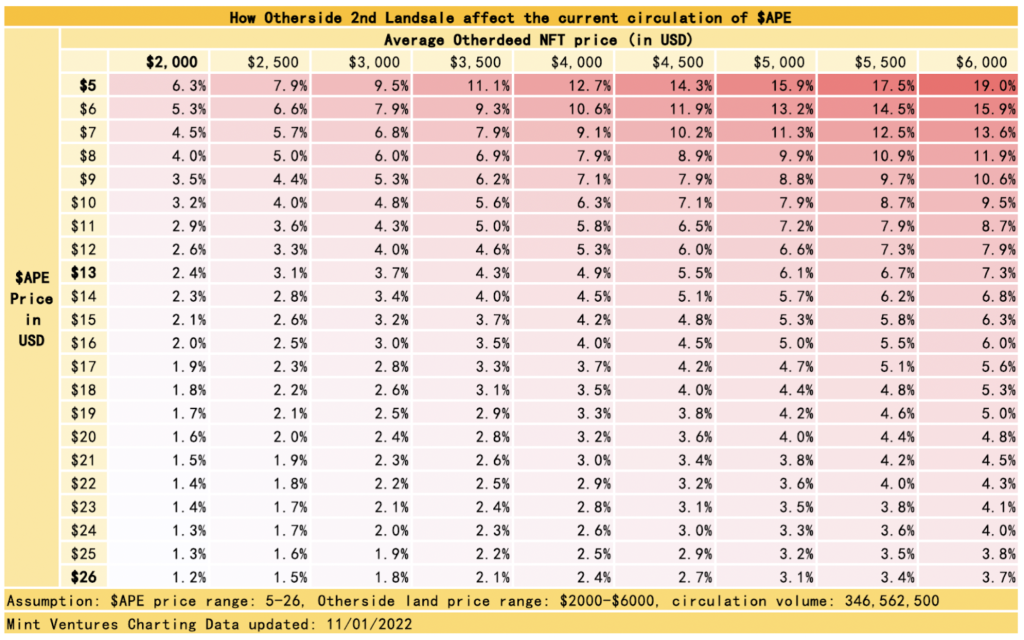

If a second land sale were to occur and available NFTs remained at 55,000 (an assumption based on the consistency of the projected revenues from the two land sales in the circulated roadmap), the impact of the “second sale on existing $APE circulation” could be analyzed.

a) Impact of the second land sale on the circulation of existing tokens (independent of the circulation analysis on the staking system)

Based on a nominal $APE liquidity of 346,562,500, if Yuga Labs were to conduct a second land sale, the corresponding amount of liquidity would be taken out of the market at the corresponding land/$APE price.

Business Details

Yuga Labs’ NFT matrix: BAYC, MAYC, BAKC, Otherdeed for Otherside, CryptoPunks, and Meebits

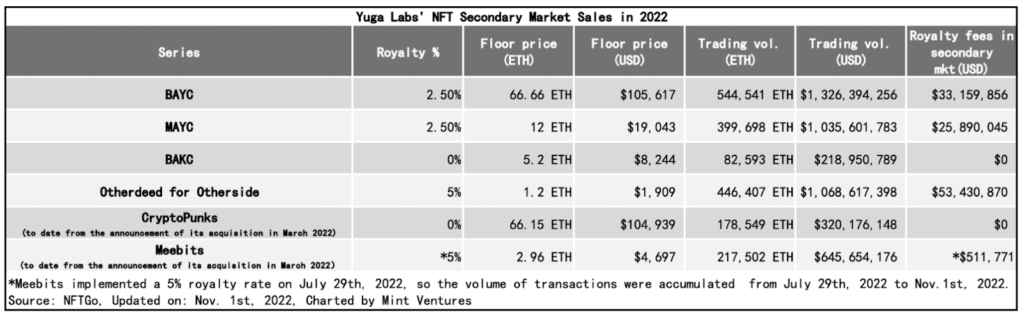

Secondary market sales of Yuga Labs NFTs in 2022 are as follows:

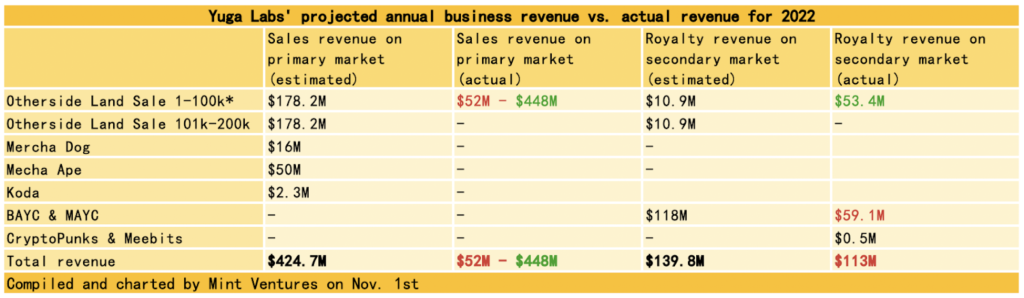

Based on the revenue estimates in the Yuga Labs Pitch Deck that was assumed to be leaked, full-year business revenue and actual revenue for 2022 are compared as follows (considering that land sales are settled in the volatile $APE asset, the fiat value of this revenue is volatile):

*Otherside 1-100k Landsale: 55,000 lots were actually sold at a unit price of $305 APE and the revenue was locked for one year. Therefore, the actual revenue is obtained by the formula: the fluctuation range of $APE/USD unit price after land sales (3.1-26.7) x sales revenue $APE.

*Red: the revenue falls short of expectations; Green: the revenue exceeds expectations

While Yuga Labs’ revenue for January through September 2022 was less than expected, the result was largely dependent on the recent dismal NFT market and the delayed launch of several NFT series.

In terms of market share alone, Yuga Labs’ NFTs remains firmly at the head of the blue-chip market, with a combined market share of over 20%.

Also, it acquired two blue chip projects. Meebits has just set royalties for 2 months, and CryptoPunks has not yet set royalties. As the contract of CryptoPunks was set zero-loyalty from the beginning, it’s unlikely to charge a loyalty fee in the future.

In August this year, the NFT trading platform X2Y2 added a custom royalty feature, making the royalty draw that was originally determined to belong to the creator/copyright holder optional (100%, 50% or 0% of the royalty rate).

In this way, the expected secondary market revenue for the NFT project parties will be significantly reduced if a large number of transactions occur on this platform.

X2Y2 witnesses it market share on the rise at the moment compared to that in the pre-custom royalty period.

But in the long run, the blue-chip NFT team, especially Yuga Labs, the unprecedented leader with over 20% of NFT market share, is the dominant one in the NFT market.

Once the NFT market has substantially harmed the project parties, they can make code updates to prohibit trading on NFT trading markets that do not respect royalties (NFT code upgrades are not unprecedented as CryptoPunks has had upgrades to versions V1 and V2).

Additionally, the NFT marketplace “X”, as adopted in the ApeCoin DAO proposal, charges only 0.25%-0.5% transaction fees and will allow the 0.25% of the earned handling fee to be returned to the community.

“X” is a community-voted, community-built, more community-taste-appropriate trading marketplace that has the potential to become the primary trading venue for NFTs in the Ape Ecosystem.

Otherside Metaverse

Compared to Sandbox, Decentraland and other Metaverse projects that have been officially launched with low user engagement and low playability, Otherside wants to create a Metaverse that is “fun, dynamic, and deeply narrative, while interacting with the user”.

Such a Metaverse has several core elements:

- Community: highly loyal, high engagement (BAYC series / CryptoPunkss / Meebits / $APE)

- Narrative: Otherside is a project with a core narrative, and strong storytelling painting style & storyline (the trailer indicates a Hollywood-style narrative)

- Infrastructure: a well-designed infrastructure that supports thousands of people interacting in the same scene at the same time (M², the interactive engine from Improbable)

- Engagement and sustained enthusiasm: integrating building and experience, collecting community feedback, and sustainably increasing enthusiasm (The Voyager’s Journey, a release and building event)

Otherside consists of galaxies and archipelagos.

The archipelagos have five sediment elements: Infinity Expanse, Cosmic Dream, Rainbow Atmons, Chemical Goo and Biogenic Swamp. Each plot of Otherdeed land is a unique blend of these elements while featuring rich resources and powerful artifacts.

The resource endowment of land is divided into four categories: Anima (research), Ore (metal), Shard (stone), and Root (wood), which have different rare properties and will be the raw material for the owner to transform the land.

And the artifact is a rare item scattered throughout parts of the land, part of which cannot be synthesized in any other form but will be the key to unlocking some secrets as the Otherside world is developing.

Among the 100,000 existing plots of Otherside land, 10,000 have Koda, which dramatically increases the rarity of the land and is a critical player in the Otherside metaverse.

Currently, the floor price of Otherside land with Koda is 8 – 10 times higher than the price of regular land.

Yuga Labs’ existing gameplay is only available to Otherdeed holders, but after the opening of the game, all NFT series, BAYC, MAYC, BAKC, CryptoPunkss and Meebits holders will have their own 3D figure models that correspond to NFT and match Otherside in all NFT series.

Other players create their exclusive models through ODK (Otherside Development Kit).

Obelisk & The Voyager’s Journey

To increase engagement in the Metaverse, Otherside Metaverse offers an “open, testing and teaching” approach, dividing the entire metaverse release into 11 phases with Obelisk, and rewarding contributions with potential ownership of the 100,000 lands that will be released.

Advantages of building and experiencing in parallel:

- Sustain the buzz over time: Expected rewards for participants and the “Obelisk” phase incentive stimulated thousands of people to participate in each test, resulting in a widespread social media buzz.

- Increase the engagement of landowners: Landowners are transformed from “beneficiaries doing nothing but passively gain the upside of the game ecosystem” to “active participants in experience and contribution”.

- Let players learn the newbie guide during the experience: In traditional games, the newbie guide is placed at the beginning and is lengthy. While Otherside divides the instructions with tasks in different phases, instructing players to walk, jump, talk, connect lands, disintegrate Koda, build digital assets and experience the narrative plot in the Metaverse. Combined with pre-launch and subsequent promotion on social media, it helps the game reach millions of potential users before its official launch.

The Voyager’s Journey is divided into the following 11 stages, each of which should be tested at least once to light up the Obelisk:

1.First Trip: Technical test prototype, mainly to test the platform’s multi-person loading capacity.

In the first test, 4,500 people entered the same scene at the same time to interact and converse. (participation in the game and watching the live broadcast can be counted as completion of the task)

2. The Codex: Players learn how to link land and more operations. Otherside Codex will be a manual for participants and developers to work together.

3. Koda Originals / The Decoupling: If the Otherside world were shaken, Koda history would be revealed, and then players could separate Koda and artifacts from the Otherdeed land they are in, and decide where they will eventually go.

4. The Growth: Otherside land begins to come to life and produce resources. But destructive creatures are also starting to appear, so players need to pay attention to the Codex guidelines.

5. The Agora: Players start using resources to make appliances and trade in-game resources and various assets.

6. The Dream: An arcade appears on the island of Biogenic Swamp, and players may gain rewards by adopting smart strategies on this trip.

7. The Choice: New plots of Otherside land are activated along with unidentified creatures (one can speculate that this is likely the time when the new land will open).

8. The Setting: Players utilize the resources produced by the land to create items and buildings and then enrich their land.

9. The Toolkit: An ODK (Otherside Development Kit) that allows players to have a more complete game experience.

10. The Aeronauts: Most plots of Otherside land are wrapped in mystery so that players can hunt for treasure and solve puzzles.

11. The Rift: An inter-dimensional rift cuts through the sky, allowing players to officially explore in the game, choosing initial stats and skills, completing the Obelisk task, and then starting an Otherside future.

Multiplayer Metaverse Infrastructure: Improbable & M² (M-Squrared)

Among the ideas and expectations of the Metaverse, “multiplayer real-time gameplay” is probably the most basic but the most easily ignored one.

In the Metaverse summary by Matthew Ball, it wasn’t until the mid-2010s that million-dollar consumer-grade devices could handle a game with 100 real players in a single match and could be equipped with affordable enough server-side hardware to sync that information in near-real time.

Breaking the technical barrier of “multiplayer real-time gameplay” is the basis for the popularity of multiplayer real-time games including Free Fire, PUBG, Fortnite, Call of Duty, Roblox, and Minecraft.

While the existing battle royale genre has been popular for five years, developers still need a few tricks to keep players from being spoiled by the limitations of the multiplayer real-time technique – most players do not really work together, but are scattered across a large map.

The server needs to keep track of what each player is doing, but the player device does not need to render, or track/process everyone’s movements.

In the gaming industry, lower-end devices allow up to 50 people into a single scenario for most games, while higher-end devices enable real-time player caps of 100 – 150 people per scenario.

In 2021, Fortnite hosted a concert that allowed 50 people to attend at once, but players could do less at the concert than in standard mode.

To enable a metaverse where thousands of people can enter the same scene at the same time, Improbable worked on developing an engine that would help game teams preempt problems of scale and complexity in the game world.

M² is the infrastructure of Otherside, built on Improbable’s Morpheus engine.

The timeline of Improbable is as follows:

| 2013 | The company was founded by Herman Narula and Robinson from Cambridge University and Peter Lipka, a graduate of Imperial College London. Its seed funding was raised from a $1 million family loan funded by founder Narula’s family, and $1.2 million from angel investors. |

| 2015 | The company raised $20 million in Series A funding from a16z, Horizon Ventures and Temasek. Since then, a16z partner Chris Dixon has become a director of the company |

| 2017 | the company received $512 million in Series B funding led by SoftBank and with the participation of a16z and Horizon Ventures. Between May 2016 and May 2017, Improbable’s revenue was £7.9 million, the majority of which resulted from a long-term contract with the US Army to provide war simulation games in 2016. |

| 2018 | the company received $100 million in investment from NetEase, valuing itself at more than $2 billion |

| 2019 | Improbable signed an £11.5 million contract with the UK Strategic Command and a £2.3 million contract with the British Army. That same year, the company was involved in a terms-of-service dispute with Unity Technologies, which blocked several SpatialOS games. Improbable partnered with Epic Games, a maker of the Unreal Engine, to create a $25 million assistance fund to help developers affected by the dispute, which has been resolved. |

| 2020 | Army Technology reported that Improbable has a global partnership with Microsoft in defense and national security, allowing Improbable’s synthetic environment platform to be deployed with Microsoft’s Azure Application Management Service to assist governments with operational planning, policy design, collective training, national resilience, and defense experimentation. |

| 2022. 01 | Narula highlighted the company’s shift to Metaverse applications, adding that it does not require additional investment to be profitable. |

| 2022. 04 | Improbable announced M², an independent entity designed to develop an interoperable Web3 Metaverse system based on the company’s Project Morpheus technology. M² aims to enable scalability and interoperability between Metaverses on the M² network, allowing game developers to create virtual assets, such as NFTs and other digital assets, and enabling users to transfer these digital assets between worlds. The M² metaverse will follow decentralized, blockchain-enabled Web3 governance principles, where the community can vote on network decisions. M² announced a $150 million funding round at launch, led by a16z and SoftBank Vision Fund, with participation from Digital Currency Group, Ethereal Ventures, CMT and several other crypto-native investors. Otherside Metaverse is the first project announced by M². |

Otherside will leverage M² to bring thousands of users into the same space at the same time to play and communicate together using any device.

To reach this goal, three major technical challenges need to be addressed:

- Multiplayer connectivity and rendering: How to get thousands of players to show up on the same screen, interact, and have nice visuals.

- Multiplayer Space Audio: How to get thousands of players talking to others at the same time and cheering together like they’re under the stage at a music festival, but without missing important conversations.

- Any Device Can Access: How to help everyone access Otherside Metaverse using their own devices.

The Morpheus engine, on which the M² platform is based, addresses:

- Real-time interaction + multi-dimensional rendering: To allow thousands of players to exchange interactive information with a normal bandwidth for only 100 players to interact. It features several functions, like real-time rendering of different images and actions, supporting thousands of players, and appearing in a customized avatar.

- Spatial Audio: To build audio engines designed to handle thousands of input audio streams and render spatial output streams. Spatialization supports distance attenuation, air absorption, masking, sound projection, and head muffling. It offers a realistic crowd audio solution protocol that produces a spatialized mix of thousands of live audio players.

- Live streaming platform for any device: Not all gamers have highly configured gaming laptops, so a live streaming platform is needed to reach a wide enough audience.

The M² platform consists of an integrated game streaming service that allows users who cannot play Otherside directly to watch the live stream through their browser, and any user to quickly access Otherside and connect with the community.

Next, the difficulty of developing the Morpheus engine for real-time interaction will be explained in brief. The more participants there are, the more data the engine needs to transfer per unit time.

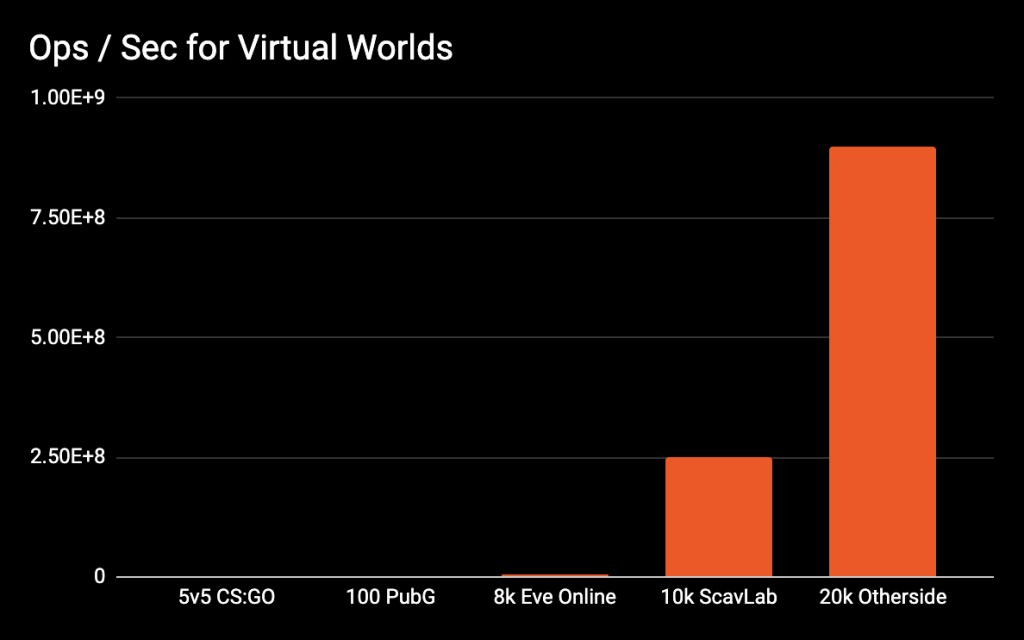

The transmission data are measured in ops/second, meaning how many interactions per unit time the participant has to transmit in the virtual world:

ops / second = number of participants x number of users each can see x refresh speed

For example, CS:GO has 10 players at the same time, each of whom can see all characters, and the server refreshes the user status 64 times per second, then

10 participants x 10 characters to be seen x 64 refresh rate = 6,400 ops / second

In PUBG, for example, a battle royale game with 100 players online at the same time and a refresh rate of 60 would require roughly 70,000 ops/second since only the players around need to be visible.

And for an Eve online game with 8,000 players and a refresh rate that is reduced from 1 hz to 0.1 hz when the number of players is high, 8000 participants x 8000 characters to be seen x 0.1 refresh rate = 6.4 million ops / second

Improbable conducted a test covering 4,000 online players at its ScavLab in 2021, and according to officials, it could reach a maximum capacity of 250 million per second.

The demo released by Improbable shows 20,000 users interacting in a scene at the same time, which would require a capacity of 1 billion ops/second if it were to become a reality.

In the past two Otherside load tests, Improbable has demonstrated excellent load capacity and operability with up to 4,500 people online in real time within the same scenario.

But it should be noted that while Improbable has demonstrated fairly good development capabilities in past collaborative projects/testing, Otherside is M²’s first Metaverse project and probably the largest one since Improbable transitioned to the Metaverse infrastructure sector (although the official website mentions its collaborations with several well-known, no game is specified).

To judge the game experience and quality, players still need to experience the game themselves.

Open, Exportable Metaverse Content Standard Protocols: the Future of an Interconnected Metaverse

Otherside Development Kit (ODK) is used in the Otherside Metaverse as the underlying layer for the creation of virtual assets in the game.

Specifically, ODK can be used to create interoperable contents:

- Characters: This will carry the user’s account, friends list and identity in Otherside.

- Locations: Players are allowed to travel through different worlds through the universal game system.

- Things: objects that can be interacted with, avatars, wearable devices, and various objects that can be carried in different locations.

These digital assets are carried by the user and traveled through different locations of Otherside, or exported from Otherside to other games.

Open Object Standards

Otherside is working with Improbable’s M² Network to create a set of open object standards, including the following dimensions:

- Metadata ontology – allow objects to be tagged with descriptors from the Otherside metadata ontology to implement common game behavior.

- 2D images – support common image formats like PNG and JPG, and other formats to be added later in response to user needs.

- 3D objects – support for 3D models (including meshes, materials, cameras, textures, animations, and everything needed to make a complete model) through the popular gITF format.

These objects can respond to in-engine lighting and physics.

- Generic Scripting System – support for attaching scripts to objects and worlds to define and extend their behaviors. (currently using Javascrip, and in large-scale testing)

Digital content built using these criteria will be supported in Otherside, any subsequent M² metaverse network, and any external project that adopts these criteria. It means that this open standard protocol will make it easier to introduce digital assets from other Metaverses, and allow digital assets from Otherside to circulate in subsequent M² metaverse network-based Metaverses.

ApeCoin DAO

Introduction

ApeCoin DAO is a decentralized community that aims to drive the Web3 Metaverse with community-driven construction. The Ape organization is composed of three parts, the Ape Foundation, the ApeCoin DAO and the Board.

ApeCoin DAO: ApeCoin DAO consists of $APE holders, and DAO members can participate in project proposals and decisions on ecosystem fund allocation, governance rules, projects, partners and more through the community governance process.

Ape Foundation: The Ape Foundation, which serves as the administrator of ApeCoin DAO, is not the ultimate decision maker but will do its best to facilitate the decentralization of community decisions.

It manages decisions related to ApeCoin DAO and is responsible for the day-to-day administration, bookkeeping, project management and other tasks to ensure that the DAO community’s ideas have the support they need to become a reality.

The goal of the APE Foundation is to steward the growth and development of the APE ecosystem in a fair and inclusive way.

It controls multi-signature wallets through an ecosystem fund, pays fees as directed by ApeCoin DAO, and provides the infrastructure for $APE holders so that they collaborate through an open and license-free governance process.

The Board: The Board is a special council of the Ape Foundation whose primary responsibility is to administer DAO proposals and serve the vision of the community.

The first board of directors consists of Yuga Labs’ investors and partners, such as Alexis Ohanian (co-founder of 776 / Reddit), Amy Wu (Head of Venture Capital and Games at FTX), Marria Bajwa (Head of Sound Ventures), Yat Siu (Co-founder and CEO of Animoca Brands), and Dean Steinbeck (CEO and Legal Counsel of Horizon Labs), Dean Steinbeck (Horizon Labs CEO and legal counsel). The first board serves a six-month term (now extended to nine months by community vote), and will be elected annually by community members.

It is clear that ApeCoin DAO boasts a complete organizational structure that fully demonstrates the separation of decision-making, execution, and supervision, and attracts a group of experienced crypto practitioners.

Governance Procedures

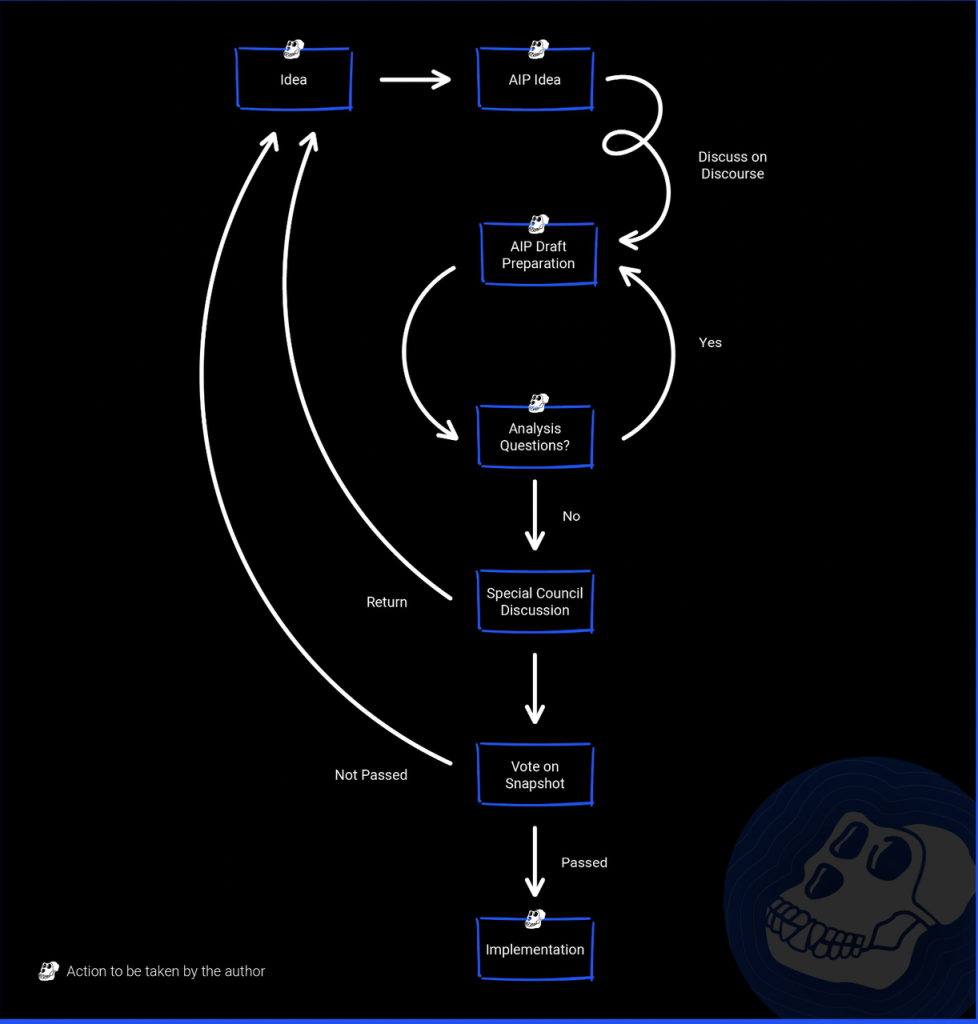

According to AIP-1 and AIP-2, the proposal and governance process for ApeCoin DAO are shown below:

Proposal Quality and Governance Effectiveness

Currently, ApeCoin DAO has 142 proposals, 32 of which went to snapshot, 10 have been rejected and 27 have been agreed to, including 12 that have been implemented.

There are 6 items involving Eco-Fund allocations:

| Proposal No. | Main purpose | Ecological fund allocation | Implementation costs |

| AIP-4 & AIP-5 | Staking system allocation and launch | 175M $APE | $300,000 – $500,000 |

| AIP-3 | Operating Expenses for the Ape Foundation: In this proposal, it is agreed that 6% of $APE in the Ecosystem Fund will be credited to a Coinbase wallet as an operating expense through December 31, 2022. | 28.2M $APE | – |

| API-9 | Sponsor Boring Security, an organization that maintains the security of the Ape ecosystem, tracks hacker addresses and reports dangerous behavior in a timely manner. | 6,969 $APE | |

| AIP-70 | Sponsor Bored Ape Gazette, a newsletter created by members of the Ape community to report on news related to the community. | – | $150,000 |

| AIP-36 | Guy Oseary, who serves as the ApeCoin DAO representative, has agreed to credit 1% of $APE in the Ecosystem Fund to a Coinbase wallet for his use as a branded partnership spend for the community through December 31, 2022. | 4.7M $APE | – |

| AIP-89 | Establish a proxy system and build a proxy voting tool that allows members to give their vote to their preferred proxy. | $150,000 in APE | |

| AIP-103 | To build a fun and addictive 3rd person shooter game based on Ape’s IP. | ~$1M in $APE | |

| AIP-91 | Ape Talent, a platform to connect talents/needs within the Ape community. | 23,000 $APE | |

| AIP-96 | Allocate funds to support projects built for ApeCoin through grants in ETH Global and Gitcoin sessions. | $200,000in $APE | |

| AIP-88 | Build a no-code NFT launching platform for Ape Ecosystem, letting creators launch NFT easily. NFT should be minted with $APE. | 25,500 $APE |

It has been 7 months since the ApeCoin DAO was established in March 2022.

But some of the biggest expenses of the Ecosystem Fund were incurred by internal proposals of the Foundation: stakings, operating expenses and Guy Oseary’s branding partnership on behalf of ApeCoin DAO.

Currently, except for API-103, which asked $1M in $APE and is proposed by the community. Most other accepted proposals that solely come from the community were asking for quite limited ecosystem fund allocation.

It indicates that the whole community has a more cautious attitude towards the allocation of funds, and the community is in its formative years, when fewer projects meets the expectation to be supported by the community.

Team Profile

Yuga Labs was registered in Delaware in February 2021 and has four founding members, two of whom have been publicly identified and two of whom remain anonymous.

As its projects have grown, it has hired executives from media, Internet giants and the consumable industry, and requested experts familiar with brand operations to assist its expansion.

Until August this year, Yuga Labs had 76 employees from Google, Oculus, Facebook, Twitter, 72andSunny, B-Reel, Acne, Apple, (the) Dune Game, Monolith Gaming, WB Gaming, Microsoft, Nike, Amex and many more.

The core team is as follows:

Four co-founders

- Gordon Goner: Founder of Yuga Labs, who entered the crypto space in 2017 as a trader. He decided to create an NFT project at the beginning of 2011, and formed a team with his friend Greg.

- Greg Solano: One of the founders, who entered the crypto space with his friend Gordon in 2017. He graduated from the University of Virginia, worked as an editor and book reviewer for several literary websites, and co-authored a World of Warcraft-related book with a game designer.

- NoSaSS: One of the founders and head of product at Yuga Labs, who remains anonymous.

- EmperorTomatoKetchup: Co-founder and technical lead of Yuga Lab, who remains anonymous.

Executives

- Guy Oseary: Partner and media industry giant. He is the founder of the agency Maverick, whose clients include the band U2 and Madonna. He also co-founded Sound Ventures with Ashton Kutcher. Guy Oseary joined the company in September 2021, and mainly works to develop new collaborations for BAYC as he is familiar with the way celebrity brands operate.

- Nicole Muniz (V Strange): CEO and Partner who has over 10 years of experience in consumer market operations and has been involved in the journey of many brands from seed stage to explosion. He has worked with brands such as Google, Facebook, Oscar, Nike, HBO, and Spotify.

- Jasmin Shoemaker (Soda): Chief Operating Officer who has 15 years of experience in technology strategy analysis and brand expansion, has worked on a startup incubator, has experienced Apple’s early expansion, and has executed operations strategy at Facebook.

- Patrick Ehrlund (Pez): He has 15 years of experience in creative branding and has worked for EA, Kanye West, Google, Square and HBO.Spencer Tucker: Head of Games who has 20 years of experience in the games industry, and has worked for Scopely and Gree Entertainment.

Financing

On March 22, 2022, Yuga Labs announced the closing of a $450 million seed funding round valued at $4 billion, led by a16z and with participation from Animoca, FTX, Moonpay, Sandbox, Tiger Global, Google Ventures and others.

It is worth mentioning that Animoca has a deep collaboration with Yuga Labs in the development of Otherside Metaverse, and Yat Siu, CEO of Animoca, is a board member of ApeCoin DAO.

Business Analysis

Industry Space and Potential

Yuga Labs is the top studio of the NFT IP area, and Otherside is one of the most promising Metaverse projects at the moment.

The NFT Industry

Firstly let’s look at the development of NFT industry. According to NFTGO, daily NFT volume on Ether had spiked since July 2021 but has been declining since April 2022, although it recently floats in the $200 – $300 million range. In November 2022, the market value of NFT totaled $22 billion. Since NFTGO primarily collects NFTs in the blue-chip stage, their actual turnover will be slightly larger than the statistics.

The number of Ether addresses held by NFT had been steadily climbing until November 2022, and has now reached 3.48 million.

To sum up, it is clear that BAYC was born on the eve of NFT explosion and reaped the double dividend of user growth and soaring asset prices.

Despite the slowing growth of NFT in a bear market, Yuga Labs’ blue chip assets still hold a solid 20%+ market share.

Most PFP projects are making quick money and lack the motivation to keep building the ecology after getting the sales revenue. They could not be compared to Yuga Labs which boasts both creativity and delivery ability. What’s more, Yuga Labs occupies a large capital reserve (consists of NFT revenue, Otherside land sales revenue, and allocated $APE) that other projects do not have, which is the core competency of its ecosystem that is likely to maintain its leading position in the new NFT development cycle..

The Metaverse Industry

Originally a science fiction concept, Metaverse has gradually been generalized into a virtual world where multiple people can interact with each other.

Here, it is divided into two parts: a more actionable Massively Multiplayer Online game (MMO) built by professionals(PGC), and a multiplayer sandbox game built by both professionals and normal players(PGC+UGC), where play and creation merge.

The former is represented by games such as Call of Duty and Free Fire, and has no rival projects with high completion and influence in the Web3 field, whilst the latter is represented by Roblox and Minecraft in Web2, and Sandbox, Decentraland and NFT World in Web3.

PGC-Created MMO

There is no full release to benchmark against Web3, but judging from NFT prices and community buzz, DigiDaigaku, created by the former Machine Zone team and the game company behind it, Limit Break, could be a strong rival to Yuga Labs’ NFT and Otherside.

DigiDaigaku and Yuga Labs are taking two very different approaches to the Metaverse: one starts with the actual use cases in the game, and its professional team focuses on playability to attract a large number of users; the other starts with the big landscape of the Metaverse, attracting users with NFT IP and land sales, and trying to build a worldview for UGC to better produce new content.

Gabriel Leydon, CEO of Limit Break, has said that he hopes to bring in one billion users to embrace NFT assets through the game.

Currently, 12 ETH is the floor price of free mint’s NFT DigiDaigaku, and the floor price of Spirits, which is airdropped to holders, already reaches 6 ETH.

Previously, Gabriel Leydon announced that the company had received a total of $200 million in funding from Paradigm, FTX and other top crypto institutions.

PGC + UGC Created Sandbox Game

Since the IPOs of Roblox and Unity, especially after Facebook changed its name to META in 2021, the Metaverse concept has swept the world, and related concept projects have become the darlings of the capital markets, creating strong growth drivers for various industries across AI, avatars, and games. This wave of narrative dividends benefits most sandbox games like Roblox. Sandbox and Decentraland are riding this wave to a soaring market value.

Sandbox, Decentraland and NFT World are projects that shine in the current Web3 Metaverse.

| Name | Introduction | Contrast |

| The Sandbox | A Metaverse platform based on Ethereum, founded in 2012 originally as a 2D sandbox game. It was acquired by Animoca Brands in 2018 when developing The Sandbox, a 3D sandbox blockchain game of the same name. The Web3 version of The Sandbox was officially launched on November 29, 2021. It has better operability than Decentraland and has come to occupy a higher market share than Decentraland. | Backed by Animoca, it comes from behind to snatch victory, with better gaming experience |

| Decentraland | A Metaverse platform built on Ether and Polygon that began opening in 2015 and was officially launched in 2017. It has a first-mover advantage due to its early launch. However, Decentraland has less content, which is of average quality and interactivity, is slower to load and is less playabe, so its market share is being eaten up by Sandbox and other competitors. | Encryption native, long history, less actionable |

| NFT World | A Minecraft server combined with blockchain with the goal of creating a powerful and flexible platform for Metaverse. It is built on top of Minecraft and will make game assets into NFTs. It has a total of 10,000 plots, each of which is a Metaverse to explore and build the game. On July 21, 2022, Minecraft announced a ban on all integration of Minecraft assets with the blockchain. Consequently, NFT Worlds’ NFT price immediately dropped by 80% and the token $WRLD depreciated by 70%. | It embeds the blockchain system on top of Web2, rendering the game more interesting and powerful, but with great policy risks |

Web3 Sandbox Game that Goes Begging after the Climax: What’s the Problem?

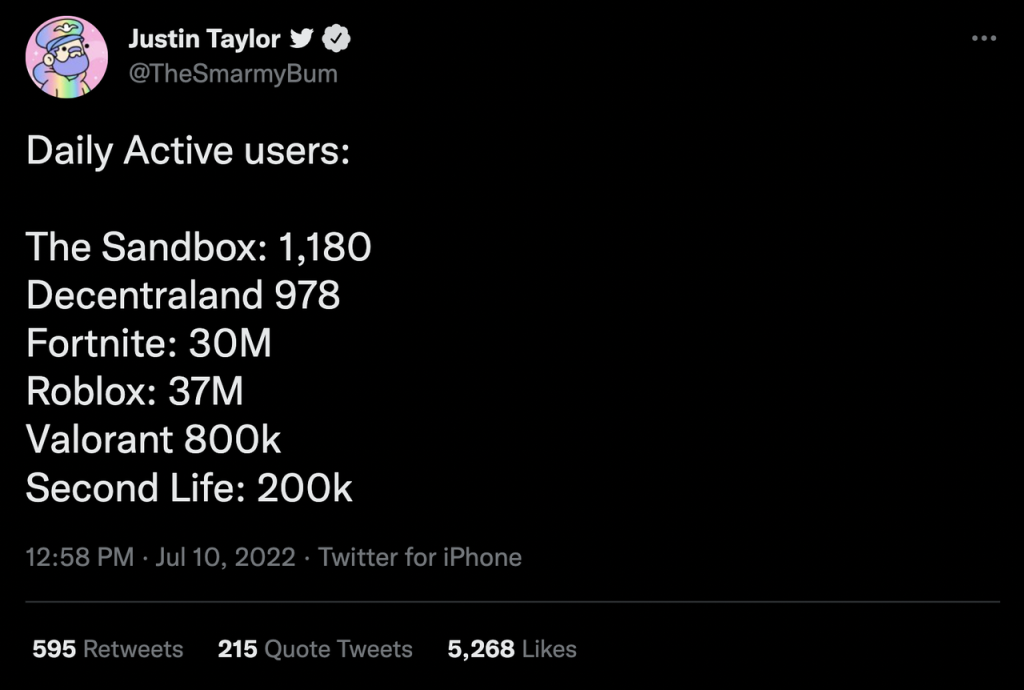

While the Web3 Metaverse concept remains hot and the head projects have a multi-billion dollar market cap, Web3 sandbox games are facing the rather dismal number of daily active users, as compared to a tweet by Justin Taylor, Twitter’s director of marketing. On July 10, 2022, Justin Taylor made a data comparison in his tweet:

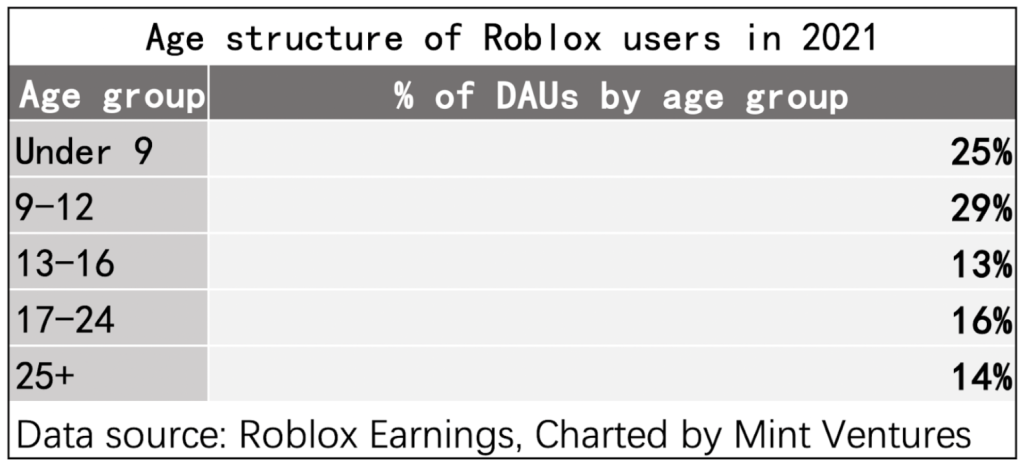

Why does Web2 Roblox have 37 million DAUs while its two sandbox games go unnoticed? It probably results from the age composition of Roblox users.

Data on the age structure of users published by Roblox in 2021 shows as follows:

It means that 70% of Roblox users are under 18 years old and 51% are under 13 years old. And there is a possibility of kids lying about their age in order to play more content considering Roblox’s content rating system, so users may be even younger. Despite its efforts to broaden the age range, it has had little success – 54.86% of users under 13 in 2020, 59.3% in 2019 and 57.76% in 2018.

This shows that Roblox is a pure UGC sandbox game with a clear demographic profile: children and teenagers who are still ignorant and like to explore the virtual world with their friends.

While pure sandbox games make a profile of kids who waste a lot of time on constructing and exploring the world, Crypto is profiled by crypto gamers who have been trained by X-to-Earn and subscribe to the “time is money” rule, forming a complete departure.

As a result, Sandbox and Decentraland in the bear market have only a few thousand users who return occasionally for parties or poker games, and a family of landowners who are not willing to see land prices fall with the heat.

Does the failure of Decentraland and Sandbox in acquiring crypto Players predict the failure of the rest of the Metaverse?

The answer may be found in the Web2 game. Fortnite, which was released in 2017 and still earned $5.8 billion in 2021, is a perfect case in point: originally inspired by sandbox games like Minecraft and Terraria, its creative team wanted to design a game that integrated sandbox and shooter elements.

In 2018, Fortnite was the first to test the “Save the world” gameplay and got a good response, but the game took the world by storm after the release of the “Battle Royal” mode.

Because its construction elements have strong sandbox properties, Fortnite eventually found a way to blend sandbox and gameplay: “Creative Mode”, which was introduced in 2019, allows each player to build their own private island and invite friends to play the unofficial game together.

The sandbox game, which is integrated with the core gameplay in a unified worldview, gives a rather impressive user activity. Data for July 2021 revealed that 458,565 players were online in real time under Fortnite Creative Mode, surpassing the 317,295 figure of Call of Duty – Warzone at that time.

Decentraland, on the other hand, has maintained a live online presence of just under 300 since July of this year, with most users playing Ice Poker’s derby games. In general, the high flexibility and composability of sandbox games are important components of the expected Metaverse.

But a pure sandbox is not interesting enough, nor can it make users addicted.

Otherside Metaverse itself already has a strong narrative style and characteristics. If it makes some innovations in its gameplay and blends the boundaries of PGC and UGC, it may become a pioneer of the Web3 Metaverse.

Competitive Landscape

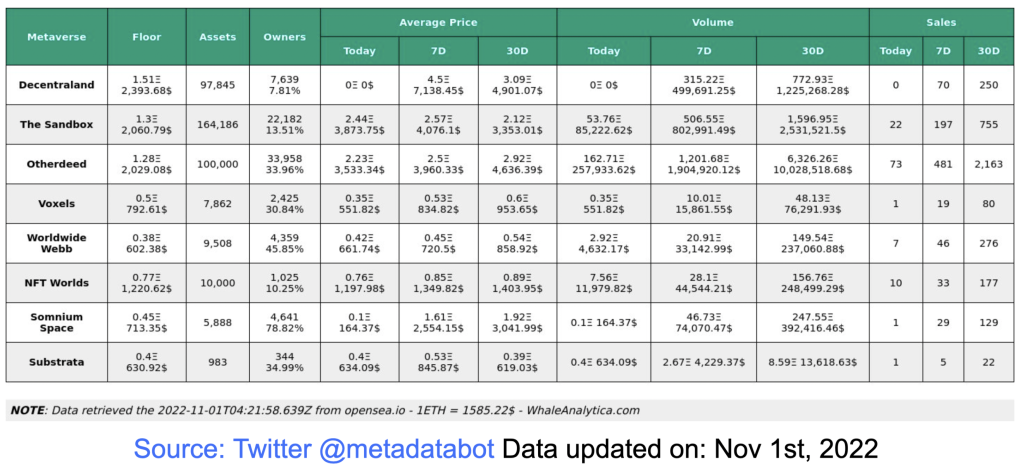

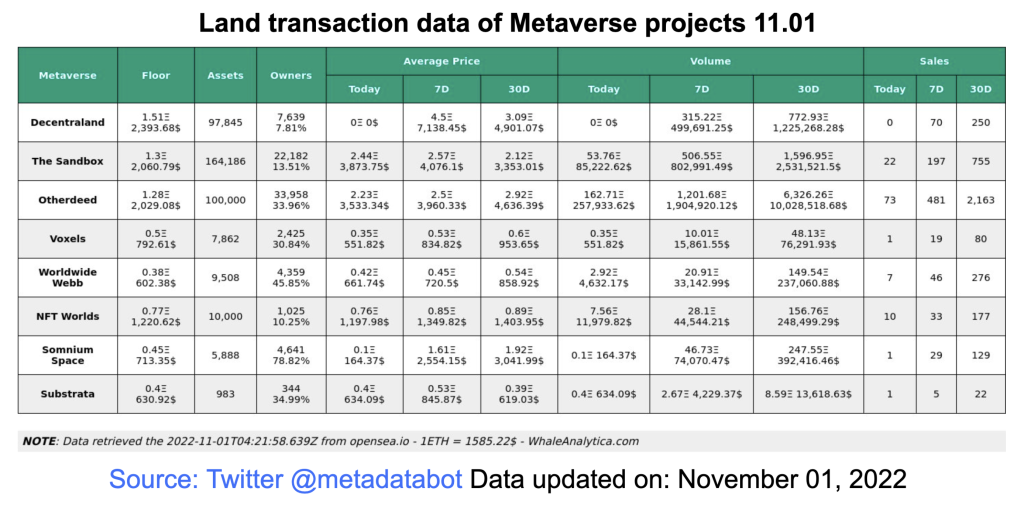

Beyond the number of real-time online users, land transaction data and market value are also core indicators that determine the hotness of a project.

Land transaction data of Metaverse projects 11.01

From the above transaction data, it can be seen:

- In terms of transaction volume, The Sandbox and Otherdeed are the only Web3 metaverse projects with high land liquidity and stable prices.

- In terms of floor price, Decentraland, The Sandbox and Otherdeed for the Otherside are not very different from each other, but the other projects are declining and can hardly compete with them.

- In terms of landholder concentration, Decentraland has a landholder concentration (holdings/total land=7.81%) well above average, suggesting that land is held by a small number of owners. As such, it is susceptible to price manipulation and is unable to build core communities covering a large population through land.

Otherdeed (33.96%) holders are more dispersed and have a healthier community structure than The Sandbox (13.51%).

Furthermore, Otherside Metaverse is expected to have higher market capitalization of circulation and total market capitalization than The Sandbox and Decentraland, while other Metaverse projects are almost silent compared to the three projects.

It is worth noting that $MANA has almost finished releasing and will therefore be under little selling pressure whereas $SAND and $APE have a large number of locked tokens to be released, which may cause drastic fluctuations in their market value.

And assets in the Metaverse itself can hardly become a competitive advantage in long term, since the digital assets in the Metaverse are exportable, and it is likely that there will be an interoperable and mutually trusted content standard protocol between different metaverse projects to simplify the export-import process of assets (refer to Otherside’s content standard protocol).

Considering Web3’s transparent data rules, highly autonomous account system and asset attributes, users will be smoothly migrated between projects.

Therefore, the community with the most interesting gameplay and the most core players will attract users directly from the old and less innovative projects.

Hence, it is believed that the IP matrix, the ability to iterate and upgrade innovative play, the ability to build narratives, and the content innovation by the community are the core competitive advantages of Web3 Metaverse projects, while the first-mover advantage of digital asset precipitation can be easily replaced.

Token Model Analysis

Basic Factsheet

Total number of tokens: Fixed at 1 billion, no additional tokens will be issued or burned.

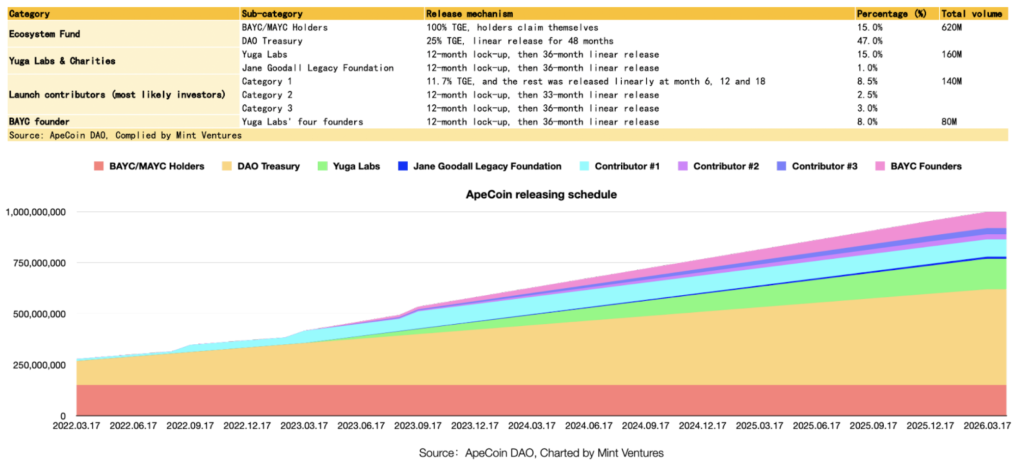

Allocation and release rate:

Token scenarios and value capture: The ApeCoin Foundation owns the rights to use all of Yuga Labs’ IPs (intellectual properties), including potential future ideas.

Uses of $APE in the ApeCoin ecosystem include:

- Governance: ApeCoin is the ecosystem’s governance token, allowing ApeCoin holders to participate in ApeCoin DAO.

- Unification of Spend: ApeCoin is the ecosystem’s utility token, giving all its participants a shared and open currency that can be used without centralized intermediaries.

- Access: ApeCoin provides access to certain parts of the ecosystem that are otherwise unavailable, such as exclusive games, merch, events, and services.

- Eco-integration: Third-party developers join the APE ecosystem simply by integrating $APE into their own services, games, and other projects.

For holders, the utility of $APE tokens so far are mainly focused on staking: Horizon Labs expects to release 100 million, 50 million, and 25 million $APEs over the next three years with a relatively high rate of return through the staking system that will be launched on November 14 or December 7, depending on the voting result of AIP-134.

(See Project History and Roadmap – Staking System for details)

The use cases for $APE itself are only governance and payments, neither of which is very powerful in creating demand and forming a token crunch. In the short term, the launch of the staking system will reduce the circulation of $APE on the market, which may change the supply-demand for the token, but in the long term, it means an increase in the total circulation of $APE. In case that the growth in new users does not catch up with the rate of $APE inflation, or token scenarios fail to expand, $APE prices will still face continued selling pressure, which will be explored in the next subsection.

Impact of the Staking System on Actual Liquidity

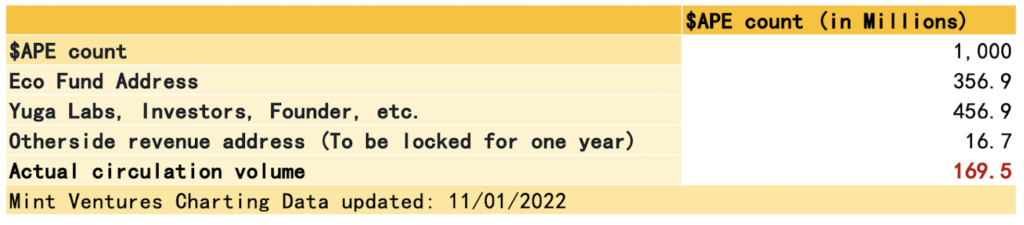

While the nominal liquidity ratio of $APE has reached 34.6%, the actual liquidity is much smaller as the temporary funds of investors and DAO treasury do not circulate in the market.

$APE is not released periodically as per the protocol under the smart contract, but 100 million $APEs were equally allocated to 200 addresses, and multiple transfers were made.

Based on the first 400 transactions of Etherscan, it is possible to count the token holdings of an address “not interacting with the exchange wallet”, which is considered an “Moral-Lock” and help infer the actual circulation of $APE in the market, as evidenced by the ecological fund addresses and subsequent transfers given by ApeCoin DAO on its website.

(“Moral-Lock” includes both tokens whose unlocking period has not yet expired and those that have been unlocked but not yet spent in the ApeCoin DAO Ecosystem Fund. Besides, ApeCoin DAO can use the Ecosystem Fund only if its proposal is approved by the community, and is governed by the APE Foundation. Therefore, the Ecosystem Fund is not freely circulated and does not count as “actual circulation”.)

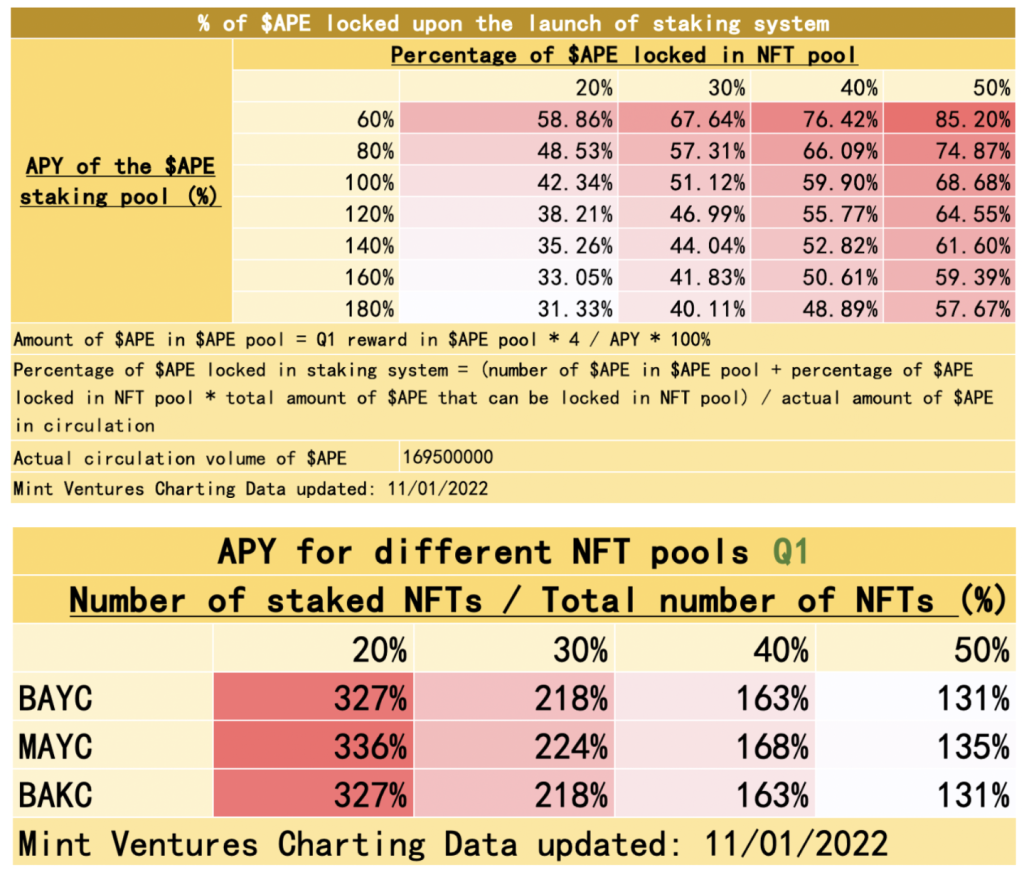

Sensitivity analysis of actual liquidity when the staking system is launched, Changes in actual liquidity at the launch can be calculated based on 2 factors, the % of $APE staked in NFT pools and APY of $APE pool:

When the staking system is introduced on November 14(might also be on December 7, if AIP-134 were passed), the approximate absorption of liquidity could range from 31.33% to 85.20%.

If the $APE staking pool has an APY of 180% denominated in $APE and the NFT pool is locked at 20% of the cap, it will absorb 31.33% of the actual liquidity, at which point the NFT pool will have an APY of 327 – 336%, a significant APY figure in bear market.

If the $APE staking pool has an APY of 60% denominated in $APE and the NFT pool is locked at 50%, it will absorb 85.20% of the actual liquidity, and the NFT pool will have an APY of 131% – 135%.

To conclude, the launch of the staking system will have a significant impact on actual circulation, so a simpler and more crude comparison can be made in the context of the last Otherdeed land sale.

$APE was priced at 4.75 on Nov. 1st. $APE soared before Otherdeed land sales, whereas the launch of staking system, which may impose a huge impact on current liquidity, has not priced in based on the current price change.

(Prices rose to 6.4 at the end of September when the specified timing of the launch was specified, but then fell to 4.1 on October 12 when Bloomberg reported that SEC was investigating Yuga Labs)

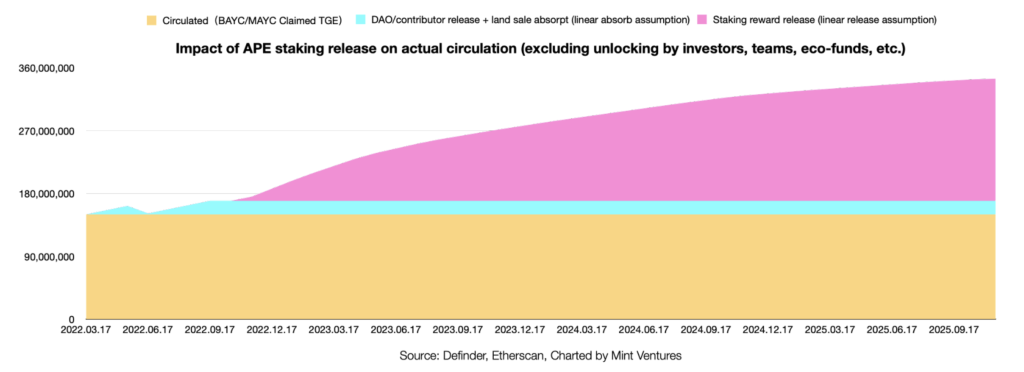

Impact of $APE circulation increase after the staking system is launched

A chart of actual circulation can be re-drawn based on the actual circulation and staking release (considering only the existing actual circulation and staking release, but excluding the unlock of investors and the team).

On April 17, 2023, actual liquidity is expected to increase by 35.4% over October 2022 figures as investors and teams unlock tokens in large numbers. If the investors and the team also sell their $APE immediately after unlocking, and Otherdeed $APE income is sold outright at the end of its lock-in period, the actual liquidity increases by 151.7% after one year and 196.6% after one and a half years even though the $APE sell-off by Ecofund is not taken in account.

It will be difficult to build a follow-on ecosystem to resist such sharp inflation, and the price of $APE may come under greater pressure in the medium to long term.

*Since the locked (but partially untransferred) and unlocked tokens are “morally locked” and not locked in a smart contract for regular release, uncertainties such as theft or sell-off by team accounts may have a significant and unpredictable impact on token prices.

Risks and Issues

IP and Consensus Risks

The core intrinsic value of both the NFT assets and the Otherside Metaverse comes from cultural IP and strong community consensus, both of which are unpredictably fragile when subjected to specific events, such as:

Founder Background: Two founders remain anonymous.

NFT copyright issues such as BAYC: If Yuga Labs has a dispute with the holder over copyright issues, it will greatly reduce the trust of the community and may cause a split.

and interpreting the meaning of BAYC image: In July this year, it was suggested that Yuga Labs was secretly run by Nazi supporters, which could deal a devastating blow to the entire ecology if it were to take over the mainstream.

Policy and Legal Risks

Token Legal Dispute: On July 21, 2022, Yuga Labs NFT and $APE investors announced a class action lawsuit filed with SEC, demanding that Yuga Labs return the losses from NFT and token price drops.

Since Yuga Labs is located in the U.S. and SEC strictly regulates token offerings, rulings in such lawsuits have an uncertain impact on the project development.

According to a Bloomberg release on October 12, 2022, SEC is reviewing whether NFTs issued by Yuga Labs is more similar to stock to determine whether it needs to follow the stock regulation and disclosure principles.

SEC has reportedly been investigating the NFT field since March 2022, and this review may be a part of that investigation.

NFT copyright and IP disputes: Yuga Labs’ granting of rights to commercialize NFT to the holder means that there could be potential legal issues if Yuga Labs were to commercialize the IP, as Disney has done.

Incomplete Tokenomics Design

Inadequate token usage and value capture: $APE tokens are mainly used for staking, payment, and governance, but seldom applied in real value capture and consumption scenarios. As a result, the bulk of revenue such as NFT transaction tax is not included in the value capture of tokens.

Fast inflation: The launch of the staking system coupled with the unlocking of investors and the team will bring sharp inflation in six months to a year.

Less-than-Expected Otherside Development Risk

Otherside is still in development: The development carries the risk of falling short of expectations, but the quality of Otherside gameplay can be observed in stages as players are involved in each stage of the testing throughout the process.

Preliminary Value Assessment

Five Core Issues

What Business Cycle is the Project In? Is It in Maturity or the Early to Mid Stage?

The IP-based PFP NFT business has reached maturity, while Otherside Metaverse is in the early days of development when its product is on its way to market, as is ApeCoin DAO.

Does the Project Have Solid Competitive Advantages? What are the Competitive Advantages?