Contents

Sanctions Against Tornado Cash

On August 8, 2022, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, a privacy mixer that operates on the Ethereum blockchain and has been used to launder more than $7 billion worth of virtual currency since its creation in 2019.

With more and more Web3 institutions or protocols actively or passively following OFAC’s regulatory policy to block addresses that have interacted with Tornado Cash. The community protested against brutal regulatory requirements by “doxxing” (some users withdrew a lot of money from Tornado Cash to the Ethereum addresses of well-known organizations or celebrities in small amounts, causing these accounts to be affected). As a result, this regulatory debacle has intensified and been mired in controversy.

Also, at the center of the controversy was Circle, another U.S. organization that issued and operated the USD stablecoin. Soon after OFAC announced the sanctions, Circle implemented its blacklisting feature and froze the USDC in the Tornado Cash protocol. At that time, ETH addresses in Tornado Cash could not be frozen due to its permissionless nature, but have been used by the community as an intermediary for “doxxing” to express dissatisfaction with the sanctions.

Although they are both crypto assets that run on permissionless public chain networks, USDC and ETH have clearly different components of decentralization.

Decentralized Stablecoins VS Centralized Stablecoins

The Importance of Stablecoins

USDC’s key role in cooperating with this sanction brings back the importance of concepts that fundamentalists have always followed but have been gradually neglected in recent years — censorship resistance, permissionless, and decentralization.

As the settlement layer of Web3 economy, stablecoin is more important than almost all other DeFi-based applications, as evidenced by:

- Widest user base: If users of centralized platforms are included, stablecoin has by far the largest number of stablecoin holders;

- Largest transaction volume: stablecoin has a very high turnover rate as a transaction intermediary, and is related to most of the transaction volume in the crypto world;

- Huge asset size: Stablecoin has a total market cap over $150 billion, second only to BTC and ETH.

So it’s no exaggeration to say that stablecoin is the most important infrastructure above the public chain layer in the web3 economy.

However, the market share, market cap, trading volume, and the number of users of centralized stablecoin have been expanding, as the landscape is dominated by centralized institutions such as Tether (USDT), Circle (USDC), and Binance & Paxo (BUSD) has always been solid since the birth of stablecoin. The decentralized stablecoins UST, which operates on Terra network with Luna as the underlying asset, its market cap even overshined the third largest stablecoin BUSD with over $17.5 billion in 2021 to 2022, but it quickly collapsed in May this year as a dazzling and short-lived meteor in the history of the stablecoin.

Various factors are hindering the expansion of decentralized stablecoins, but the most important and concise one is that decentralized stablecoins fail to give users a much better product experience than centralized stablecoins. Thus, “decentralization”, the main feature that enables BTC, blockchain, and Web3 emerge seems to be less pivotal in the stablecoin space. Thus, “decentralization”, the main feature that enables BTC, blockchain, and Web3 emerge seems to be less pivotal in the stablecoin space. Stable prices, ease of use and accessibility are rather more important.

It was always believed so, until the first sanctions that fell on the DeFi protocol in Tornado Cash in August 2022, the decentralized asset ETH got away with the sanction while the centralized USDC failed.

Growth Bottleneck of Decentralized Stablecoins

The sanctions against Tornado Cash were a major advertisement for the importance of decentralized stablecoins. The advertisement is not only targeted regular users, but also targets decentralized stablecoins projects that use centralized stablecoin as collateral, such as MakerDAO and its DAI, which is the largest decentralized stablecoins protocol with $6.8 billion in issue size.

Then will the sanction-induced centralization concerns pave the way for the “decentralization” of the stablecoin market and boost its market penetration?

Before thinking about this question, it is necessary to re-evaluate the origin of the bottleneck that is unable to break through the market share of decentralized stablecoins. The market cap and buzz of decentralized stablecoins are influenced by two factors:

- the actual demand for business or scenarios

- the narratives that engage excitement in the market.

The actual demand is intrinsic to its long-term development, while the narratives drive the short-term influx of users and funds, thereby drawing tractions, and pushing up public expectations and prices.

Bottleneck of Business and Scenario

The growth of UST’s market capitalization is a classic example of “demand-driven growth”:

Terra’s lending protocol Anchor offers a long-term interest rate 19-20% in stablecoins, significantly higher than Web3 and traditional risk-free yields over the same period, and the Anchor protocol only supports USTs as stablecoin deposits. This directly pushed up the demand for UST, enabling UST to grow into the third largest stablecoin within only one year, with a market cap size of $18.7 billion at its peak.

20% Interest rate also comes with side effects:

- Over-inflated UST size and excessive Terra Eco debt

- Excessive debt costs

- Extremely high yield that squeezes the space of Eco Terra’s other DeFi projects

In addition to Terra, other protocols that issue decentralized stablecoins have tried to create initial demand for their stablecoin.

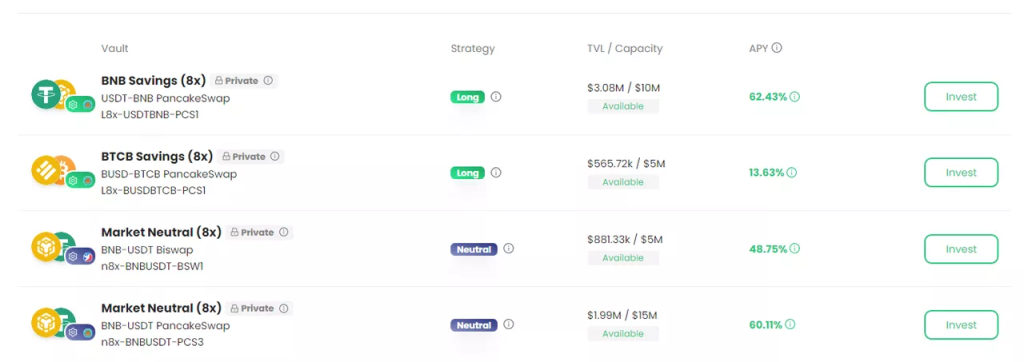

Take AUSD of the leveraged mining protocol Alpaca on BNBchain as an example. In the first half of this year, Alpaca launched its automated revenue product “Automated Vault”, a financial product based on leveraged mining strategies. Due to its high projected yield, the product is so popular that it is often sold out in seconds upon launch. Consequently, Alpaca set several conditions for purchasing the product, such as users providing liquidity on Ellipsis. finance (a Curve-like stablecoin trading platform on BNBchain) for AUSD to receive a purchase credit, attempting to create demand for AUSD via popular business.

But to date, AUSD only has a market cap of over $3 million.

That meant those efforts to drive stablecoin business growth by creating its own demand ultimately failed.

UST failed due to the runaway monetary policy. AUSD defeated due to the insufficient demand of its stablecoin and small scale of business. Terra and Alpaca are shaping demand for stablecoin because it is difficult for a new stablecoin to be adopted and get better liquidity. The public market is already saturated with players and users, where protocols tend to prefer established stablecoins, and the cost of stablecoin liquidity is already fully priced through protocols such as Curve. Therefore, the new stablecoin would have to get liquidity by providing subsidies, buying governance votes, or swapping benefits with other DeFi protocols at great expenses.

Bottleneck of Narratives

Decentralized stablecoins have encountered two sizeable narratives in recent years.

The first narrative was the wave of algorithmic stablecoin driven by Empty Set Dollar and Basis Cash in late 2020 to early 2021, while the second was the public chain stablecoin trend brought about by the dual token model of Terra + stablecoin.

Empty Set Dollar and Basis Cash attempted to achieve rapid market capitalization and network expansion through a completely uncollateralized approach with a Ponzi-colored inflationary design. At the time, this was quite an imaginative monetary experiment to balance the price of stablecoins only using inflationary/deflationary demand, and representative decentralized algorithmic stablecoin projects were called the “underground Federal Reserve”. “Only a stablecoin can outperform the BTC” therefore became a famous proverb in the wave of the algorithmic stablecoin. But the attempt has been proved to be a failure eventually. Because it was difficult to rely solely on expectations to stabilize the value of the currency at an early stage.

On the flip side, Terra succeeded, many public chains competed to issue their own stablecoin. Before the collapse of UST, Near, Secret, Tron among other projects announced the launch of their own public chain stablecoin with reference to Terra model, gaining a better short-term performance in market value.

However, Terra’s failure has brought questions to the self-hosted stablecoin model, making the second wave of stablecoins fall silently.

Like other Web3 projects, decentralized stablecoins grow and expand on business in the long term and compete with narratives in the short term. Decentralized stablecoins has previously hit a bottleneck, due to a lack of internal and external demand, as well as new narrative highlights in the short term.

But the market variability brought about by the sanctions may bring a new wave of growth for decentralized stablecoins.

New Spring for Decentralized Stablecoins

Spring Sower: Compliance

Public concerns about regulation became a reality, and centralized stablecoins are directly regulated.

The innovation and efficiency of the business in a permissionless environment and easy cross-border capital flows are making Web3 attractive. So it is unacceptable that the settlement layer is completely governed by a centralized stablecoin. And USDC issuer has frozen USDC funds in Ethereum wallet addresses held by sanctioned crypto mixer Tornado Cash, which has made the public clearly aware that decentralized stablecoins are not only business continuity, but more likely to become a rigid demand.

The regulation is not only driving decentralized stablecoins on a narrative level but may also directly lead to business demand expansion.

If such events occur again, or stablecoins such as USDT and BUSD are added to the sanctions list, user dissatisfaction with brutal regulation would activate demand for permissionless currencies ultimately.

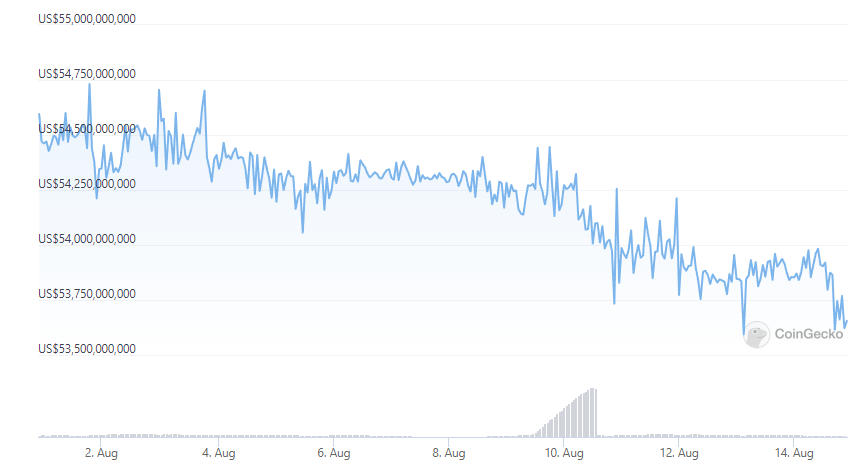

Statistically, the freezing of DeFi protocols and subscribers’ assets by USDC has undoubtedly reduced its credibility in Web3 commerce, enabling its market cap to shrink by around $700 million within a week.

However, the market share lost by USDC is not currently being absorbed by decentralized stablecoins. On the one hand, decentralized stablecoins as a whole have historically performed much less well in terms of stability and security than centralized stablecoins. On the other hand, decentralized stablecoins can be applied to a very small number of scenarios that can accommodate a narrow range and therefore require multiple rounds of exchange. Further, USDC is currently the largest decentralized stablecoin DAI’s largest collateral asset. Simply put, decentralized stablecoins cannot directly take over the lost positions of USDC in the home stretch.

Spring Sower: DeFi Protocol

Decentralized stablecoins has multiple internal drivers, in addition to the external force of regulation.

The wave of creating stablecoins on public blockchains from March to May 2022, was followed by a new trend of developing stablecoins in leading DeFi protocols. The most representative projects are GHO, issued by Aave protocol, and Curve’s stablecoin (unnamed, tentatively referred to as crvUSD below). There is nothing new about DeFi protocols self-host stablecoins, and lending protocols Abracadabra, Venus, Dforce have issued their stablecoin MIM, VAI, and USX, respectively.

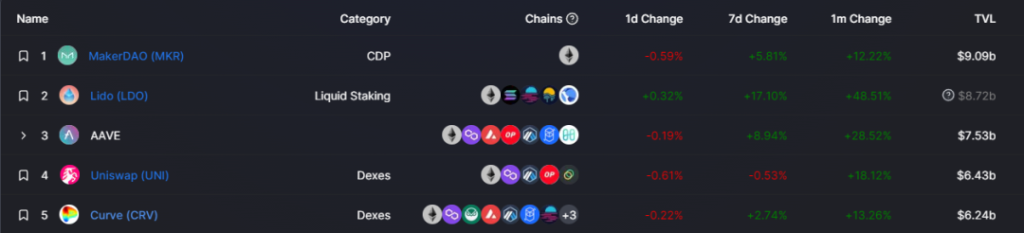

However, Aave and Curve are particularly notable on launching their decentralized stablecoins, as the two DeFi protocols are the absolute leading DeFi projects, with TVL ranking third and fifth respectively.

Aave and Curve shine with:

- Extremely strong governance

- Great multi-chain and L2 deployment

- Integration of external protocols

- Long development history, no serious security losses, good brand and ecological credit

These are the advantages that other DeFi projects relatively missing. What’s more, the self-hosted stablecoins of both projects operate with a clear business motive, rather than a stunt. For example, Curve’s stablecoin is likely to be minted with LPs in Curve’s core pool as collateral, which creates higher capital efficiency for LPs, helps to render market making more attractive, and gives Curve an opportunity to improve its own TVL through leverage.

In fact, the ultra-high TVL of MakerDAO and Uniswap is mostly coming from the following process plus leverage:

- Users mint DAI on MakerDA

- Exchange some USDC with DAI and market-making in DAI-USDC through liquidity management platform Arrakis to get G-UNI LP

- Take G-UNI LP as collateral to lend DAI again in MakerDAO

- Repeat the preceding steps

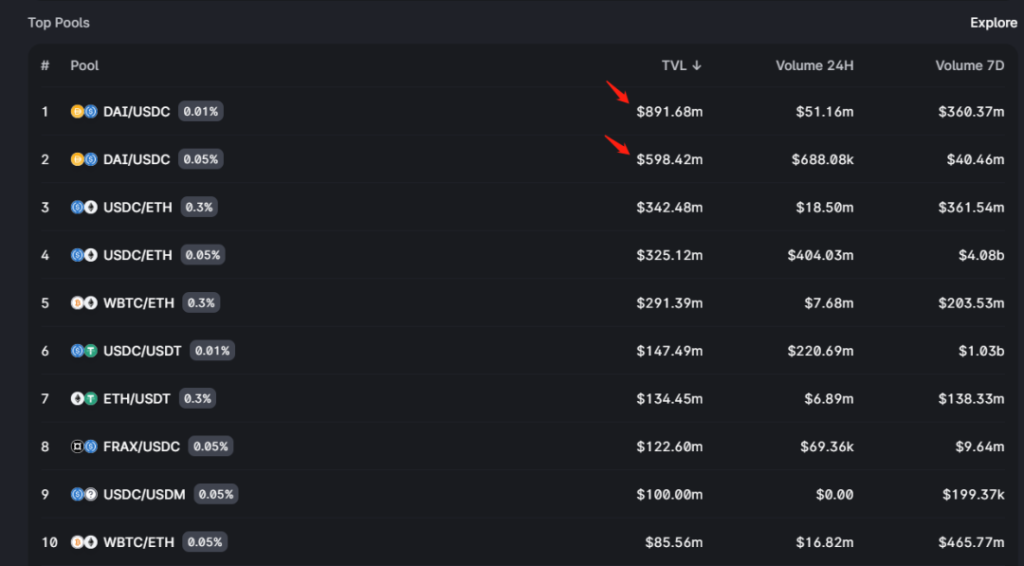

It is this process that has put Uniswap and MakerDAO firmly in the top five for TVL. Uni V3 data shows that DAI-USDC pair accounted for 32.6% of Uni V3 TVL.

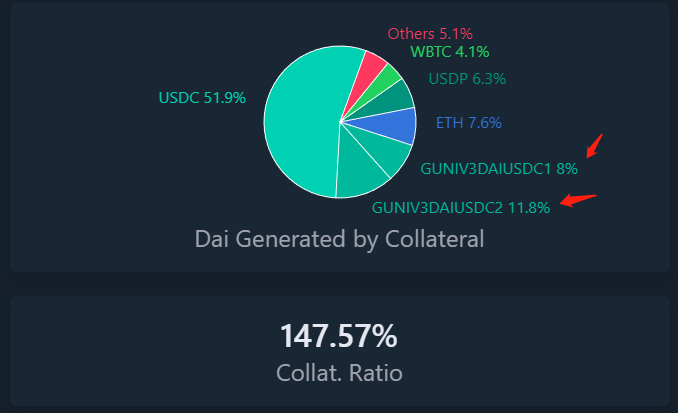

19.8% of MakerDAO’s DAI leveraged G-UNI as collateral.

If Curve launches its decentralized stablecoin, it is expected to replicate this process and raise capital efficiency + TVL.

Spring Sower: DeFi Ecosystem

While sanctions drive the narrative and business, and leading DeFi protocol self-hosts stablecoins, the integration of those projects that have the ability to build the DeFi ecosystem may provide another opportunity for decentralized stablecoins.

If the interaction between MakerDAO and Uniswap is only a business collaboration based on composability, the DeFi ecosystem puts the synergy between the businesses within the ecosystem at the heart of the design from the beginning.

The DeFi ecosystem is the vertical integration on the ecological chain, bringing together segments of the ecology that have business synergies upstream and downstream. This integration can be explored in two ways:

- The first way is to integrate multiple projects into a DeFi ecosystem or matrix through mergers, acquisitions and gaining the governance of collaborative projects. AC (Andre Cronje), a well-known DeFi developer and founder of Yearn Protocol, is an active practitioner of this approach. Since the inception of DeFi summer in 2020, AC has developed projects himself, sponsored the development, and participated deeply in the governance of the projects, thereby integrating public chains (Fantom), DEX (Solidly, Sushiswap), lending (Abracadabra, Cream), aggregator (Yearn), cross-chain bridge (Multichain) and other multi-track projects into a DeFi ecosystem.

However, AC was discouraged to announce his withdrawal before this approach succeeded, as it was hard to collaborate with multiple interests, users, and teams. Likewise, the acquisition of lending project Rari capital by the stablecoin protocol Fei Protocol was not considered a success.

- The other way is to build an ecosystem. Binance is the best practitioner of self-built ecosystems in the Cefi space. In the DeFi field, Frax is the representative project of self-built ecosystems. Frax’s business segments that are live or coming include decentralized stablecoins (FRAX), Swap (Fraxswap), lending (Fraxlend), and Staking (fraxETH). Currently, one of the most closely watched experiments is whether Frax can turn its segments into mutually accelerating flywheels to drive the long-term development of its decentralized stablecoins, based on Frax’s governance on Convex (Frax has become the largest single holder of CVX) and Curve, and its flexible cryptocurrency module AMO.

Concerns of Decentralized Stablecoins

Despite the discovery of various triggers for decentralized stablecoins, some pending issues are still worth noting:

- Centralized assets such as USDC act as the underlying assets of many decentralized stablecoins projects.

- 51.9% of issued DAI is from USDCs (USDCs in G-UNI LPs are not included). USDC was also used as the initial collateral in Frax, although the actual collateral is not just USDC, but mostly LPs in the Curve stablecoin pool. Therefore, unless Circle blacklists the Curve protocol, it cannot freeze Frax’s collateral assets. Will DeFi protocols like Curve be the next target of sanctions?

- Balance sheet expansion.

- If decentralized stablecoins protocols continue to adopt over-collateralization, their balance sheets are expanded with the size of collateral such as ETH as the ceiling. Since the introduction of MakerDAO D3M and Frax’s AMO V2, they can export DAI and FRAX directly through protocols such as Aave without the need for collateral. When a user lends DAI and FRAX from Aave, collateral is provided by the user, which improves the efficiency of capital expansion. But it is difficult to meet the monetary demand across Web3 commerce.

- Pitfalls of multi-chain security.

- Curve, Aave, and FRAX have deployed their product through multi-chain. While multi-chain operations benefit native stablecoin distribution on each chain, they also amplify the risk that security issues and NPLs on one chain may affect the entire system.

Closing Summary

The “disaster recovery value” of decentralized stablecoins as a Web3 settlement layer has been further revealed in the Tornado Cash event. Circle tried to exercise restraint when assisting OFAC in its sanctioning actions. Although USDC is justified in blacklisting Tornado Cash, when it goes after the next DeFi protocol, it may lose the trust of Web3 users altogether sooner than the protocol it sanctioned, and thus be forced out of the market.

Are decentralized stablecoins fully prepared to receive users and funds that have fled from centralized stablecoins by that time?

Apparently not yet… But that’s the beauty of uncertainty, which made us embrace more excitement, possibilities, and innovations.