Contents

Key Insights

Core Investment Logic

- Crypto credit is in its early days. Credit lending is a large-scale business in traditional finance, but is only an insignificant segment of lending in the crypto sector. Going forward, infrastructural improvements will make it possible for credit lending to explode.

- Risk control is so effective that no nonperforming loans have occurred so far. TrueFi, a leading credit project, has yet to experience financial issues or nonperforming loans (NPL) since the wave of collapse that hit DeFi and CeFi in 2022.

- Governance and business models motivate TRU holders to actively participate in governance. Compared with Aave, a lending model whereby users may keep an eye on the closeout line in real-time after lending, credit lending is now a risk-front, reward-back model that requires more focus on risk management before lending. TrueFi aligns the risk and reward for TRU stakers by giving them incentives such as interest income, so they participate more proactively in project governance.

Valuation

TrueFi is more like traditional cyclical stocks in terms of investment strategy, as the downstream demand for credit lending pairs with strong cyclical financial activities such as arbitrage. Its business size may gradually shrink in a bear market, and then PS, PE, and other indicators will soar.

Main Risks

Overall, TrueFi Faces Five Risks:

- TrueFi faces competition with other credit lending projects.

- Credit DID is gradually maturing to break the monopoly of TrueFi’s risk management model.

- The tightening of regulatory measures for the crypto sector has led to a contraction in credit demand from downstream institutions.

- It is uncertain whether its NPL rate will remain zero, especially during the repayment wave in August this year.

- The risk management mechanism of NPL has not yet been tested.

Project Information

Business Scope

TrueFi (TRU) is a credit lending protocol that primarily provides uncollateralized stablecoin lending services to crypto-native transaction-based investment institutions, and will gradually explore issuing uncollateralized loans to companies and individuals. It has recently partnered with Woo Network to expand its non-stablecoin credit lending business.

Past Developments and Roadmap

In February 2018, TRU raised approximately $28 million in a Pre-Sale on CoinList.

Phase 1:

In November 2020, TrueFi V1 was launched, but only TUSD-based credit loans were supported, along with the issuance of TRU token.

Phase 2:

From November 2020 to February 2021, TrueFi V2 was deployed with

- “Liquid Exit”, making it convenient for deposit users to exit

- A staking model that updates from targeting individual loans to targeting all loans and allows users to earn TRU and interest gains via staking

- Governance on-chain

Phase 3:

From March 2021 to May 2021, TrueFi V3 was deployed with

- USDC Pool

- An improved credit model

- A new feature that allows trading of loan token (deposit credentials obtained by depositors after depositing stablecoins, similar to Aave’s aToken)

Phase 4:

From June 2021 to August 2021, TrueFi V4 was deployed with new features that

- Support any ERC-20 token

- Allow other lending protocols to provide liquidity to TrueFi’s loans

- Allow other protocols to become channelers of credit loans

- Launch the USDT pool

- Set up a secure asset fund for users (SAFU, a user safety asset fund that is used to prioritize the repayment of investors in the event of loan default) and inject 500W TRUs

Phase 5:

From September 2021 to the present, TrueFi V4 was deployed with new features that

- Are deployed on Layer-2 Optimism

- Support “protocol-to-protocol” lending, and now provide credit services for Perpetual Protocol

- Launch non-stablecoin lending products in partnership with Woo Network

- Improve the credit model; and

- Improve the stablecoin lending pool by adding a BUSD pool

Business Overview

Service Objects

TrueFi’s customers are divided into depositors and borrowers:

On the depositor side, anyone holding USDC/USDT/TUSD/BUSD can deposit stablecoins and add liquidity to them in a corresponding lending pool, thus earning income.

On the borrower side, there are two types of operations:

The first type of operation is TrueFi DAO Pools, a credit lending business supervised by TrueFi DAO. TrueFi positioned this business early on to serve crypto-native trading-based investment institutions, has since expanded it to include other protocols, and now plans to cover companies and individuals. Of the loans disbursed, the primary borrowers include: Trading-based investment institutions, exchanges, market makers, DeFi, high-net-worth individual investors, and asset management companies, of which crypto-native trading-based investment institutions and market makers have applied for the most loans.

The second type of operation is TrueFi Capital Markets, a lending project managed by third-party independent organizations, whose borrowers include TrueTrading and Cauris Finance, among other institutions.

Recently, TrueFi entered into a partnership with Woo Network, where the depositors are selected WOO DAOs and the borrowers are certain trading clients in Woo Network. This credited service for a specific group of customers will become one of TrueFi’s key business lines.

Business Classification

TrueFi now owns two business lines, TrueFi DAO Pools and TrueFi Capital Markets. TrueFi DAO Pools are focused on stablecoin credit lending, supporting TUSD, USDC, USDT and BUSD, risk-governed by TrueFi staker and TrueFi rating committee. TrueFi Capital Markets includes both stablecoin credit and non-stablecoin credit loans, with external managers responsible for its business-specific risk control. Stablecoin credit loans on TrueFi Capital Markets support TUSD, USDC, USDT and BUSD, while this business line has partnered with Woo Network to offer non-stablecoin credit lending to target customers.

Source: https://app.truefi.io/home

Business Details

TrueFi DAO Pools

TrueFi DAO Pools is a credit lending business managed directly by TrueFi, shown as follows:

Source: https://truefi.io/

On the depositor side, users choose from 4 stablecoin pools – BUSD, USDC, USDT and TUSD.

After depositing a stablecoin, investors receive tfToken representing principal and interest. At any point in time, the tfToken has a price, but it is an estimated value after the loan in the pool is repaid in full. If default for the underlying asset occurs at maturity, then investors holding the tfToken may suffer a loss.

Source: https://app.truefi.io/home

Each stablecoin pool consists of loans and unused funds. In the BUSD Pool, for example, there are 3 underlying loans as of August 4: 2 loans that are about to mature within 30 days, 1 loan that will mature in the next 1-2 months, and 2 loans that will mature in 2-3 months; 5.16% of the entire pool is unused.

Source: https://app.truefi.io/pools/0x1Ed460D149D48FA7d91703bf4890F97220C09437

However, users do not always have to deposit stablecoins, but may directly purchase tfToken when they choose “lend”, or directly purchase tfToken in the corresponding Uniswap pool at a price above the fair price due to low liquidity.

Source: https://app.truefi.io/lend

Source: https://info.uniswap.org/#/pools/0xd7c13ee6699833b6641d3c5a4d842a4548030a82

Users do not have to wait for the underlying loan to mature but may redeem assets at any point in time as long as there is sufficient liquidity in that stablecoin pool.

On the borrower side, business is sourced from a loan application initiated by the borrower.

An eligible borrower needs to fill in company information and loan information.

A user becomes an eligible borrower by first submitting an application that contains information about the applicant and the applicant company, completing KYC, and then getting involved in a review. However, the application is submitted, provided that the applicant has at least $10 million in debt-free net worth. After becoming a white-listed borrower, the user submits information on the amount, purpose, and term of the loan to initiate a loan application, similar to traditional bank lending. Once all of these steps are completed, the borrower is financed, and his credit facility will be placed into the appropriate stablecoin pool.

Source: https://truefi.io/institutions

Source: https://truefi.io/institutions

Source: https://truefi.io/institutions

Source: https://app.trusttoken.com/choose-account-type

To assess the credit profile of a borrower, TruFi has introduced the “TrueFi creditworthiness score” in Phase 3, which ranges from 0 to 255. The “TrueFi creditworthiness score” is linked to the borrower’s credit limit and interest rate, which assesses the following dimensions:

- Corporate background: compliance, legal and financial aspects

- Repayment history: only the repayment history in TrueFi, which will be expanded to include more data sources in the future

- Operational and transaction history: transaction data from crypto and traditional financial sectors

- AUM: size, asset type and trustee

- Credit indicators: leverage, liquidity and risk exposure, etc

Although this credit rating model integrates data from centralized exchanges and on-chain data, its scoring framework is currently more like a traditional bank lending model, except that it pools data from the crypto and traditional domains, while turning the borrowed funds into digital currency.

Currently, 33 companies (Amber Group, Alameda Research, etc.) and two large accounts (0x819, 0xB60) have become “eligible borrowers”.

Loan approval comprises two steps: TRU stakers Voting and Rating Committee Voting

TRU holders have the power to vote on each loan after staking. To be approved, a loan requires more than 15 million votes and at least 80% of those votes must be “YES”. After “TRU stakers Voting”, the Rating Committee makes the final decision on whether to issue the loan.

All loans originated through TrueFi DAO Pools are fixed-rate, fixed-term credit loans.

TrueFi Capital Markets

Source: https://app.truefi.io/home

TrueFi Capital Markets is also a credit lending business, but it is managed by third-party institutions that consist of two pools: Managed Portfolios and Lines of Credit. This is the main difference from TrueFi DAO Pools.

To apply for a Managed Portfolio, the “Manager” review must be performed, similar to the “Eligible Borrower” process for TrueFi DAO Pools, but it additionally includes the strategy and requirements of the portfolio to be created, and whether or not TRU incentives will be applied. The “Manager” review is ultimately determined by TrueFi DAO.

After the Manager meets the entry threshold and the portfolio requirements are considered appropriate, the Manager sets up a special loan product. As with TrueFi DAO Pools, borrowers for the special loan product need to complete both the “Eligible Borrower” and “Loan Application” reviews. The details of the “Loan Application” can be discussed with the Manager, but do not have to be the same as those in the TrueFi DAO Pools.

For investors, a Managed Portfolio is like a fixed-term product that is only redeemed at maturity, and the acquired portfolio token cannot be transferred to other addresses. In addition, each Managed Portfolio incurs two types of fees:

A: Protocol fee, which is variable within 5% depending on the borrower, and is transferred to TrueFi Protocol Treasury at maturity.

B: Portfolio fee, which is variable and agreed upon on a case-by-case basis, and will be transferred to the Manager’s wallet address when the product expires.

The “Manager” can also design the access threshold for investors, who are required to conduct KYC.

As illustrated in the following figure, “Manager” is “TrueTrading”, “Max Portfolio Size” is 100 million USDC, Investor must be a KYC user, Protocol Fee is 0.01%, Portfolio Fee is 0%, current “Total Portfolio Value” is USD 7.44 million, and expected APY is 9.58%.

Source: https://app.truefi.io/portfolios/mainnet/0x3eabf546fff0a41edaaf5b667333a84628571318

On July 14, TrueFi announced a partnership with Woo Network, whereby Woo DAO will provide WOO token to offer credit lending on such token to TrueFi’s institutional customers. This is TrueFi’s first Managed Portfolio of non-stablecoin, the interest on which will be fully injected into Woo DAO. These institution clients need to complete the KYC process with Woo Network, and WOO received will only be credited to the WOO X wallet and traded on WOO X.

Source: https://app.truefi.io/portfolios/mainnet/0xae86120411c450bc792e7465653f99e2fe47752c

Lines of Credit is borrower-initiated, but differs from Managed Portfolios in several ways: assets in this pool are only lent to a single borrower, the interest rate on which is no longer fixed but determined by a pricing formula related to capital utilization. After setting up Lines of Credit, the borrower pays a 0.5% Protocol Fee to TrueFi Protocol Treasury and may also pay a Portfolio Fee.

Source: https://docs.truefi.io/faq/truefi-capital-markets/automated-lines-of-credit

Multi-chain Deployment

On June 9, TrueFi announced its deployment on Optimism. The first product is Perpetual Protocol Portfolio, with a maximum size of $5.025 million and a current size of $1 million. Since then TrueFi has embarked on a multi-chain strategy.

Source: https://app.truefi.io/portfolios/optimism/0xa8c2f1571785007c9b5ff039957173e82a48768d

On balance, Ether remains the main business, contributing $308 million to the total $309 million TVL as of August 4.

Default Response Strategies

In the event of a default, TrueFi first asks SAFUs (5 million TRUs from the Crown) and TRU stakers to bear the default loss. If they could not cover the NPL, the depositor is required to bear the remaining loss. The full value of the loan is then written down, and a lawsuit is initiated against the defaulting debtor. If the lawsuit is successful in recovering the loan, the funds of the borrower, stakers, and SAFU will be restored.

On June 7, 2022, TrueFi Foundation, registered in the British Virgin Islands, was established to exercise rights such as recourse in the event of default on behalf of TrueFi DAO.

Business Data

Total Credit Loan Issuance

As of August 4, TrueFi had issued a total of $1.68 billion in loans, of which $1.41 billion matured and $270 million was in survivorship.

Source: https://dune.com/tt_tyler/tru-staking-burns

Matured Loans

Of the loans originated by TrueFi, 122 loans were due, totaling $1.41 billion, with an average individual size of $10.984 million, an average interest rate of 10.5% and an average maturity of 68 days:

Source: https://app.truefi.io/loans

The top 5 borrowers borrowed a total of $1.01 billion in loans, accounting for 71.6% of the total.

Stock of Credit Loans

Currently, 14 loans worth $260 million are within the duration, with an average individual value of $18.81 million and an average maturity of 126 days, of which 8 loans worth $130 million will mature during the remainder of August (see Competitive Advantages and Moat – Risk Assessment Model for more details on the risk of loans); 1 will mature in September, valued at $10 million; and 4 will mature in October, valued at $120 million.

Source: https://dune.com/tt_tyler/truefi-loan-stats

TVL & Utilization Ratio

TVL hovers around $320 million, and ATH has fallen by 73% to $1.22 billion. The utilization ratio has recently remained above 90% and now stands at 94%.

Source: https://dune.com/tt_tyler/tru-staking-burns

Total Revenue to NPL Ratio

To date, TrueFi has earned $29.85 million in interest income for its investors and has performed well with zero NPL ratio. TVL and revenue numbers could decline significantly going forward as arbitrage opportunities diminish rapidly and loans mature in a concentrated manner in August.

Team

Overall Situation

According to LinkedIn data, TrueFi has 78 employees, mainly comprising engineers, BD, IT, finance and legal staff, who are part of TrustToken.

Source: https://www.linkedin.com/company/trusttoken/people/

Founder

Source: https://www.linkedin.com/in/rafaelcosman/

Rafael Cosman is the founder and CEO of TrueFi, who graduated from Stanford University. Prior to founding TrueFi focusing on the engineering business, he worked at Palantir Technologies, Google, and as a partner at Lightspeed Ventures. He also has experience in finance, engineering and investment. Notably, TUSD is another TrustToken project, the ownership of which was transferred to an Asian consortium in partnership with TRON in December 2020.

Core Members

Members of the key business lines are well-experienced and professionally trained.

Head of BD: Ryan Rodenbaugh, who has worked as an investment analyst or advisor at various investment firms including VM Capital and BlueRun Ventures, and became the Head of BD at TrustToken in 2018.

CIO: Bill Wolf, formerly a partner at traditional financial head offices such as Goldman Sachs, HSBC and Credit Suisse, and joined TrustToken as an advisor in 2018.

CPO: Ryan Christensen, formerly a product manager and partner at Yahoo, Zynga, AppNexus, etc.

Financing

TrustToken is the subject company behind past funding profiles of TrueFi, one of TrustToken’s business lines.

- In June 2018, TrueFi’s parent company TrustToken received a total of $20 million in funding from a16z crypto, BlockTower Capital, Danhua Capital, Jump Capital, ZhenFund, Distributed Global and GGV Capital to develop the TrustToken Platform that enables asset tokenization and expand its legal, partner, product and engineering departments

- In August 2018, TrustToken raised $8 million through ColinList

Put together, 26.75% of TRU tokens were sold through the two funding rounds.

- In August 2021, TrustToken secured a total of $12.5 million in financing from a16z, Blocktower and Alameda Research to scale TrueFi’s business

Business Analysis

Industry Space

Classification

Infrastructure updates across regulation, credit rating and pricing theory make credit lending an important tool for enterprises to obtain financing, in addition to providing convenience for residents’ daily consumption. Credit lending has thus become a crucial business branch in traditional finance.

Almost all lending in the crypto space is now collateralized lending, so efforts have been made in collateral rate, interest rate pricing, and collateral by different projects to raise capital utilization. In terms of capital utilization, uncollateralized lending is definitely the best.

Market Size

Market makers and quantitative trading institutions are the main clients of credit facilities, who lend primarily for arbitrage, execution of market neutral strategies, and market making. Especially during the bull market phase, low-risk arbitrage opportunities abound.

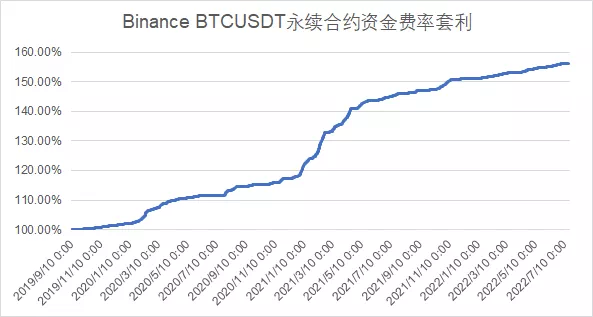

Taking the Funding Rate Arbitrage under a perpetual contract as an example, there will be plenty of arbitrage opportunities in bull BTC markets. According to Binance data, a BTCUSDT perpetual contract once offered an annualized yield of more than 15% without leveraging in the last 3 years.

Source: https://www.binance.com/zh-CN/futures/funding-history/quarterly/1

From 2020 to August 2022, the daily open interest in BTC futures averaged around $10 billion, and a BTC perpetual contract was subject to an annual funding fee above $1.5 billion.

Beyond that, both traditional market makers and market-making demand in DEX liquidity pools has been gradually replaced by credit lending.

The market cap of the top 5 futures will not stay at $800 billion for the next five years. Since the annualized return is inversely proportional to the market value of a currency, perpetual contract funding rates are potentially rich in arbitrage and market making, compared to TrueFi and Maple Finance with a combined peak TVL of less than $3 billion.

Token Model Analysis

Token Amount and Distribution

A total of 1.45 billion TRUs were issued in November 2020, and part of them were burned by TrustToken in February 2021, leaving 1.44 billion. Of which:

- 39% are incentives for TRU Staking, Lending, Sushiswap TRU-WETH Liquidity Providing, etc

- 26.75% are pre-sales

- 18.5% are assigned to the team

- 11.25% are assigned to the Company or the Foundation

- 4.5% go to future team members

Source: https://blog.trusttoken.com/truefis-tru-token-economics-7facea6651c0

Now 1.94 million TRUs are given as incentives to Lending and Sushiswap TRU-WETH Liquidity Providing per week. This translates to an annualized rate above 10%.

Source: https://app.truefi.io/farm

By the beginning of 2023, only about 350 million tokens for incentives and less than 200,000 tokens for future team members will remain to be released, and all tokens will be released by 2025. Until they are released, tokens in circulation have an annual inflation rate of about 20%.

In order to ensure the future stability of the project, 5 million tokens scheduled to be released to the company in 2021 have been put into SAFU as insurance funds.

Token Value Capture

TRU tokens only capture their values by staking. Users receive three incomes after staking and holding TRUs:

- 10% interest income. TRU Stakers share 10% of the interest on loans in TrueFi DAO Pools

- Protocol fee

- TRU incentive

Source: https://dune.com/tt_tyler/tru-staking-burns

125,000 TRUs are allocated to stTRU holders per day as a reward, with an annualized yield of about 19.92%. About 29.71% of TRUs in circulation now are in staking status.

Source: https://app.truefi.io/stake

A total of $3.04 million worth of interest income and protocol fees was assigned to TRU Stakers.

In addition to TRU incentives and interest expense awards, staking TRUs can gain governance authority, such as making adjustments to the incentive project.

Source: https://app.truefi.io/stake

Core Demanders

Investors who have been bullish on credit lending and TrueFi for a long time have a need for layout in this bear market. As for credit lending currently in its early days, TrueFi is the only underlying asset with robust inherent risk control and large scale. As the multi-chain strategy and targeted credit lending projects catalyze on-chain arbitrage, TrueFi is likely to witness fast-growing business. So at this stage, both “staking after lending/liquidity providing” or “directly staking” are good options.

Holding larger amounts of TRUs helps borrowers increase the likelihood that their loans will be approved. Because each loan requires no less than 15 million votes and 80% approval in a single vote, borrowers have an incentive to participate in governing TRUs. At the current price of $0.093/TRU, obtaining 15 million votes would cost about $1.4 million. At an annualized rate of return of 15% on the perpetual funding rate arbitrage and an average borrowing cost of 11%, then borrowing no less than $35 million would fully cover the cost of 15 million TRUs.

3.2.4 Conclusion

Token releases in the future will revolve around how to incentivize users. As of July 2022, few non-incentive tokens remained to be released and will be released mainly according to the incentive mechanism, whereby incentives for lending and liquidity staking will make the deposit side attractive for a period of time.

Matching the risk-reward of TRU stakers by allocating interest income gives them a greater incentive to review each credit loan. TRU stakers take on not only pre-lending risk incurred by voting on their own which borrowers to back, but also post-lending risk as they are the first to suffer if they experience an NPL. While tokenomics only provides a staking incentive but does not distribute profits, TrueFi’s modest profit share renders TRU holders more willing to participate in staking and voting, avoiding a win in a breeze by staking alone.

Newly-released tokens will account for 20% of the total tokens in circulation at the beginning of the year in the next two years. Hence, TRU prices are under considerable pressure going forward, due to little demand for credit facilities in a bear market where arbitrage opportunities are scarce

In short, TrueFi’s token mechanism aligns the rights, responsibilities and benefits of the relevant stakeholders, in particular, allowing stakers to both assume the risk of debt default and be assigned the corresponding benefits. In this way, stakers pay more attention to the approval of each credit and actively participate in the voting. However, problems persist:

- Token release is in such a short cycle that tokens will be allocated to the company and its core team members within this year, which will not provide enough incentive for them

- The loan vote required a narrow margin, hence a possibility of borrower manipulation as borrowers can buy TRU they need with a small amount of capital

Competition Landscape

Market Landscape & Competitors

Current Competitors

Maple Finance, Goldfinch, Clearpool and Atlantis Loans also involve credit lending. In terms of business model and volume, Maple Finance is the main competitor with TrueFi.

In the long run, credit lending is largely associated with size, risk control and risk pricing.

TrueFi and Maple Finance differ little in total token issuance, but Maple Finance has grown to over $500 million in TVL, higher than TrueFi’s $320 million, indicating a disparity in their ability to attract deposits. As both have regular users on the deposit side and anyone can lend assets, the ability of the project owner to develop customers by marketing serves as an important factor in determining the size of credit loans placed in the pro-cycle. In this regard, Maple Finance has an edge over TrueFi:

First, Maple Finance becomes more active on social media by launching more Twitter Space and other activities, which helps to promote the project and attract more deposits. After the CeFi collapse in June, Maple Finance promoted its product positioning and responded to community questions in a timely manner through Twitter Space, various podcasts/interviews, and other shows. This may help its token price quickly rebound to pre-collapse levels. In addition, Maple Finance has posted a total of 2,895 tweets since 2019 whereas TrueFi has posted 4,180 tweets since 2017. Statistically, Maple Finance’s annual average tweet count is about 25% higher than TrueFi’s.

Second, Maple Finance yielded more than TrueFi, possibly by tapping into riskier clients and then attracting more deposits in a bull market. Maple Finance went live in May 2021, later than TrueFi, but it originated $1.533 billion in credit loans, and earned investors $33.88 million in interest, with a nominal yield of 2.21%, while TrueFi originated $1.67 billion in credit loans, earning investors about $28 million and a nominal yield of 1.67%. The yield gap suggests that Maple Finance developed higher-risk depositors and borrowers. Also, the gap may result from high yields, as Maple had a total deposit size of close to $700 million after the collapse.

Source: https://dune.com/scottincrypto/Maple-Deposits

Maple Finance collapse: In May this year, the UST collapse triggered a chain reaction of CeFi, making some investment institutions, including Maple Finance, default on their debts. On June 21, Maple Finance posted that there might be problems with its depositors’ withdrawals, and updated news on June 22 that its Orthogonal USDC pool, managed by one of its clients, had a $10 million outstanding loan to Babel Finance.

Source: https://maple.finance/news/updates-on-celsius/

Risk control capabilities are categorized into pre-lending risk control, lending risk control and post-lending risk control. In the traditional financial sector, fraudulent lending generally consists of three cases:

- Fraudulent lending using other people’s identity information

- Using real personal information, but falsifying credit data such as asset certificates and income certificates

- Falsifying the use of funds

Technology has advanced to the point where the first case can be circumvented to some extent by leveraging real biometric information, such as fingerprint and facial recognition, by in-person loan processing, and by providing a valid ID. The traditional financial industry already has more options to deal with this issue.

To avoid the second case, users are required to submit asset certificates with official endorsement, income certificates, credit reports, while credit officers conduct regular site visits and other measures for risk screening.

Risk management measures for the first and second cases are pre-lending risk control.

To circumvent the third case, the use of funds should be specified. Within the commercial system, the payment can be changed to a credit loan after the user has placed an order.

Risk management measures for the third case are classified as in-lending risk control.

Once a credit default occurs, traditional financial institutions will recover funds through the collection, legal proceedings, and selling asset packages to NPL disposal agencies. Since the ultimate penalty mechanism is targeted at the individual and the company, this model ensures that the traditional financial system keeps the default rate of credit loans at a low level, and cpvers potential defaults by a higher level of interest rates.

Risk management measures for default disposal are part of post-loan risk control.

Crypto credit lending is not yet able to complete the complete loop of “pre-credit – credit – post-credit” purely on the chain, so the default can only be handled off-chain. Credit demanders are often crypto-native investment institutions who are not subject to regulatory constraints, nor do they specify the use of capital and leverage ratio. And it is more difficult to clarify the “off-balance sheet financing” and its true use. Therefore, lending institutions should not only have the power of recourse off the chain, but also should be familiar with analysis and information collection on the chain.

TrueFi has not collapsed so far, while Maple Finance has an outstanding loan to Babel Finance. Maple Finance’s credit assessment system has yet to be improved and will determine the final fate of the project.

Risk pricing is related to spreads. This collapse at least suggests that the current spreads may not be sufficient to cover the potential risk, and Maple Finance needs to further revise the pricing model.

Potential Competitors

Credit DID may be a potential competitor. In his work “Decentralized Society: Finding Web3’s Soul“, Vitalik mentions soulbound tokens (SBT), saying that if a credit assessment system connecting crypto and the real economy is established through SBT, then this project is likely to be another S&P Global Ratings, Zhima Credit, or FICO Score, and it will be easier to entre the credit lending space, thereby threatening TrueFi’s long-term envisioning.

However, TrueFi’s credit evaluation system includes on-chain data to evolve into a more comprehensive scheme. As on-chain data becomes richer, TrueFi may not lose the competition with DID represented by SBT.

Competitive Advantages and Moat

TrueFi Owns Two Core Strengths:

Risk management measures

Gaining insights from risk control in the traditional financial system, both TrueFi DAO Pools and TrueFi Capital Markets are equipped with a two-tier evaluation structure that evaluates the borrower first and then the individual loan. Pre-approval of credit loans is based only on the data and information available upon approval and cannot incorporate tail risks after lending, so pre-lending/lending/post-lending risk management measures are crucial. Since TrueFi’s risk management model and parameters are unknown, there was a problem with TrueFi’s pre-lending risk control in the case of a loan to Three Arrows Capital in May. However, this credit facility, which was supposed to mature in August this year, was repaid early in June, indicating TrueFi’s great post-loan risk management capabilities. Also, borrower selection and loan terms have helped TrueFi maintain a zero NPL ratio, and its risk control may be tested this August when the loans it originated collectively expire. Of the total outstanding loans, Alameda Research has $35.04 million, or about 13%, to repay, Amber Group has about $65.86 million, or about a quarter, and Wintermute has about $92 million, or about 35%. Additionally, Bastion Trading and Folkvang are the debtors, but they have not been exposed to the risk of bankruptcy or default for the time being, hence a low probability of overdue payment.

Business scalability

TrueFi Capital Market leverages the customer capture capabilities and strategies of other projects and institutions while exporting TrueFi’s risk control capabilities. This business employs two strengths:

- TrueFi’s control over large risks

- The need to tap into enough quality borrowers to maintain a healthy business after the Manager is established

As crypto moves into well-integrated members of society, the founding team’s resources in traditional finance and several executives’ experience in the leading finance sector are likely to be imported into TrueFi.

Risks

Competition with other credit loan projects. Clearpool in the same segmented sector has been running solidly so far and may survive to grow in this bear market. Projects in a credit lending sector may operate on different business models, such as Goldfinch, which takes deposits on the chain and lends to merchants off-chain to enter the credit market for small and medium-sized institutions by honing its own risk control model.

Credit DID is maturing into a technical cornerstone for credit lending, breaking the exclusivity of current risk control models. While TrueFi has exclusive risk control tools, if DID is more mature and incorporates more data dimensions, it has the potential to enter credit lending, thus building a new risk control paradigm superior to TrueFi’s.

Tighter regulatory measures on crypto sector lead to shrinking downstream demand. The collapse of UST has triggered the attention of regulators in major economies. As a result, stablecoin-related areas may be more tightly regulated, as well as crypto fund investment behavior and balance sheet, which may compress the space of credit loans.

Preliminary Value Assessment

Core Issues

Market Space

Even if the total market capitalization of digital currencies stays at the current level, there is an annualized capacity of around $100 billion for arbitrage of the top 5 non-stablecoins under perpetual contracts, excluding the market-making demand from centralized exchanges and AMMs. If the “digital gold” narrative of bitcoin is eventually realized to a certain extent, and functional public chains such as Ethereum further mature, market demand for arbitrage and market making will further expand. Consequently, the demand for credit from trading investment institutions and custodians will also grow.

Cyclicality of Downstream Demand

Credit demand is a pro-cyclical demand, and crypto lending is mainly used in financial activities such as market making and arbitrage. Arbitrage is a lagging demand, so its demand for credit lending may explode slowly, but TrueFi may be a strong-cyclical underlying project.

With the last of the credit loans in current existence applied for in June, it is foreseeable that TrueFi’s business will become increasingly dismal until the bear market comes out of the bottoming cycle.

Source: https://app.truefi.io/stake

Replace TrueFi Credit Assessment Model When SBT Matures

Web3 will not completely replace Web2 and Web1, so the current demand for “off-chain data-oriented, with on-chain data as accessory” will not wane. As TrueFi is gradually increasing the dimensions of on-chain data, SBT, a class of DID, will not replace it immediately. Also, SBT will face limitations in application scenarios, because traditional assets will not all be on the chain soon, and a pure on-chain DID may fail to address a default risk without off-chain assistance. On the flip side, TrueFi has already built the TrueFi Foundation for default risk litigation, which may be more advantageous if its risk control tools based on both physical and on-chain data are used well.

Valuation

The long cycle of TrueFi’s business makes it likely that traditional valuation metrics such as PS and PE will spike in the coming period as the business becomes languished. At the same time, TrueFi has not experienced a full bull/bear cycle and therefore does not have sufficient historical time dimensions for reference.

An investment in TrueFi may have to be judged vaguely by the broad cycle and the pick-up in business volume. The following indicators will help in the judgment:

- Demand foresight metrics: Indicators that can represent market heat such as perpetual contract funding rates, term spreads, and Gas Fee

- Size metrics: TVL and Total Loans Outstanding

- Risk control metrics: NPL ratio

- Profit metrics: Fees paid to stkTRU

- Liquidity metrics: TRU staking rate

If these indicators, especially demand and size metrics, start to improve, the intrinsic value of the project increases.

Summary of Preliminary Value Assessment

Even from the downstream demand for arbitrage and market making, credit lending is one of the very promising businesses in DeFi. When other infrastructures such as DID get more sophisticated, credit lending will expand to richer application scenarios and greater demand size.

Whether evaluated by size metrics like TVL and loans originated, or the fact that it safely survived the CeFi/DeFi collapse this time around, TrueFi has become a competitive credit lending project, thanks to its risk management measures and scalability of its business going forward.

TrueFi team is composed of highly seasoned practitioners in the traditional financial sector so that it applies its risk management knowledge into this project. This experience and capability will help TrueFi deal with high-impact risk events in the present absence of infrastructure such as credit DIDs and other on-chain risk management measures. The recent partnership with Woo Network also illustrates that TureFi is not hidebound by its business scope, but rather innovates products to meet new customer needs with controlled risk.

TrueFi’s highly cyclical downstream demand leads to a valuation more similar to that of traditional cyclical stocks, as PE, PS and other indicators deteriorate in a bear market. If demand and business scale indicators show signs of improvement whereas risk control indicators do not edge downward, TrueFi may have more investment value.

References

Project Mechanism

TureFi: https://truefi.io/https://truefi.io/

Project Data

Dune:

https://dune.com/tt_tyler/tru-staking-burns

https://dune.com/queries/636881/1186840https://dune.com/queries/636881/1186840

LinkedIn:

https://www.linkedin.com/company/trusttoken/people/

Uniswap:

https://info.uniswap.org/#/pools/0xd7c13ee6699833b6641d3c5a4d842a4548030a82

Other References

Binance:

https://www.binance.com/zh-CN/futures/funding-history/quarterly/1

Cryptoquant:

Dune:

https://dune.com/scottincrypto/Maple-Deposits

The Block: