Contents

Key Insights

Investment Logic Mapping

FRAX Finance is an algorithmic stablecoin protocol that is partially backed by collateral. It is shifting from a single currency agreement to a stablecoin-centered DeFi matrix as its user bases and market cap have started to take shape.

The primary competitiveness of FRAX.Finance is a monetary mechanism with high capital efficiency and a flexible monetary policy via AMO modules. From a long-term perspective, the fusion between multiple business lines may become a moat for the project.

FRAX team has strong business instincts due to extensive serial entrepreneurship. The team is solid and reliable in making progress on the project constantly.

FRAX values the position of the ecosystem. At the early stage of launching, FRAX already attempted to gain the governance right of Curve in different ways. FRAX demonstrated clear advantages with its flexible monetary policy and high efficiency of capital, which made it become one of the prominent governance organizations in the Curve ecosphere.

Risk Assessment

FRAX has encountered some main challenges such as The regulatory policy of stablecoin, the ever-changing landscape of the ecosystem, as well as the dilemma during the credit expansion. Please see more information below in the “Risk Assessment” section.

Valuation

Financially speaking, FRAX. Finance has a higher price-performance ratio than MakerDAO. The investment risks may rise since the crypto market has been experiencing a slump with higher liquidity deflation expectations.

In addition to the project analysis for FRAX, the report also reveal the underlying competitive logic and advantages of stablecoins in Business Analysis in detail.

This article is for research and discussion purposes only, may contain biases and inaccuracies in facts, data, and opinions, and should not be used as advice for investment. We are also open to different opinions and look forward to having a discussion with you.

The Overview of FRAX

Project Scope

The core business of FRAX.Finance (later referred to as FRAX) is a stablecoin called FRAX, which is pegged 1:1 to USD. Compared with centralized stablecoin, FRAX has been recognized as open-source, permissionless, and algorithmic.

Essentially, FRAX is an algorithm-based monetary system.

FRAX vs. Other Decentralized Stablecoins:

- Decentralized stablecoins such as DAI and LUSD are overcollateralized, while FRAX is partially collateralized, which means less than 100% of the assets are collateralized.

- AMPL and UST employ a completely algorithmic mechanism, but FRAX leverages USDC-based hard currency assets as a degree of underwriting to retain the intrinsic value in some extreme cases.

Therefore, FRAX is also known as a “Fractional algorithmic stablecoin” or a “Hybrid stablecoin”.

There are two main objectives of the FRAX project.

- Improving the adoption and use cases massively on user bases (number of addresses), market penetration, and development of partnerships.

- Running and turning over the underlying assets and FRAX, and improving the revenue of the protocol by leveraging buyback and earnings of veFXS (pledged vouchers of FXS, similar to veCRV for CRV).

In addition to FRAX, FRAX.finance has also launched FPI (FRAX price index), a stablecoin based on the US CPI-U average. FPI aims to act as a USD-pegged stablecoin with an anti-inflationary function, hedging the inflation of USD and rising CPI, enabling users to hold a stable asset with the ability to maintain its value.

Who are FRAX’s clients?

- Stablecoin minter. In order to increase their capital efficiency, stablecoin minters want to swap other assets(e.g. USD) for stablecoins that function better in the cryptocurrency market. For example, long-term BTC and ETH holders seek to increase their stablecoin holdings without selling their assets, therefore they can use platforms such as MakerDao to mint DAI by collateralizing BTC and ETH. To maximize capital efficiency, a stablecoin with a higher LTV (Loan to Value) should be able to mint more stablecoins with the same collateral assets.

- Stablecoin holders and users. They have simple and explicit requirements that include a stablecoin with a high degree of stability, a low chance of unpegging, and a stablecoin with widespread adoption that does not need frequent replacement. If users have special requirements that only certain stablecoins can satisfy (for instance, a Farming platform that only accepts certain stablecoins), they will be able to tolerate temporarily-restricted use cases of the stablecoin as long as the coin’s value remains stable.

Furthermore, FRAX.Finance has developed its own DEX called FRAXswap, a governance system based on the veTOKEN and a number of functional modules including the “Algorithmic Market Controller (AMO)”. The team is also working on other products, like the privacy payments system and the lending platform FRAXLend. All of these modules and features are designed and operated in accordance with the overall stablecoin system and FRAX’s primary business goal.

Milestones and Roadmap

Milestones

| TimeLine | Events |

| June 2019 | The project was initiated by Sam Kazemian, co-founder of Everipedia, and Stephen Moore, an economist who was nominated by Trump to serve on the Federal Reserve Board. |

| November 2020 | FRAX.Finance’s Testnet went live. |

| December 2020 | FRAX.Finance’s official website went live and formed a partnership with Cover Protocol, a well-known insurance protocol at the time, to enable insurance mining on Cover Protocol. |

| December 2020 | FRAX launched its V2 roadmap with AMO (Algorithm Based Market Operations Controller) as its core feature. Following that, Curve AMO, Investor AMO, and Lending AMO went live one after the other, and the protocol began to make revenue via AMO. |

| January 2021 | The circulation of FRAX exceeded 100 million. |

| January 2021 | Curve announced the opening of a new asset pool: Metapool, which will allow anyone to deploy asset pools but support only three asset classes in the early stage – FRAX, Basiscash, and Mithcash. |

| February 2021 | The Curve community voted to approve an asset pool for FRAX-3Pool and FRAX.finance provided FXS as a liquidity bonus for the pool. |

| February 2021 | FXS was launched on Binance. |

| March 2021 | FRAX launched its V2 roadmap with AMO (Algorithm Based Market Operations Controller) as its core feature. Following that, Curve AMO, Investor AMO, and Lending AMO went live one after the other, and the protocol began to make revenue via AMO. |

| March 2021 | FRAX protocol went live on Avalanche and Polygon. |

| April 2021 | Sam Kazemian, the co-founder of FRAX, said that the Solana ecosystem will be introduced in the near future and that he hoped to expand to additional public chain ecosystems in the future with the aim of achieving $1 billion in trade volume. |

| April 2021 | FRAX is the first algorithmic stablecoin to be added to the Curve Gauge (the Gauge is used to accept Curve’s governance vote to select which asset pools are granted CRV per incentive round on Curve). On the Gauge weights page, Curve community members can vote for FRAX to boost the CRV incentive earned by the FRAX pool. |

| May 2021 | The veFXS system, which referenced Curve’s veTOKEN model, went live. Users can deposit and lock FXS for different governance and revenue share weights. The average staking period among early users was 3.5 years. |

| June 2021 | FRAX.Finance and OlympusDAO have joined forces to create create a dual incentive liquidity pool, OHM-FRAX, at Uniswap. OlympusDAO also accepted FRAX tokens as the underlying asset. |

| June 2021 | FRAX went live on Moonbeam. |

| June 2021 | TVL of Curve’s 3poo(FRAX pool) was over $100 million. |

| July 2021 | FRAX.Finance raised an undisclosed amount in strategic funding led by Dragonfly Capital. Additional investors in the round included Electric Capital, Compound founder Robot Ventures (Robert Leshner & Tarun Chitra), former Coinbase CTO Balaji Srinivasan, and Stani Kulechov, founder of Aave. |

| July 2021 | FRAX went live on Harmony. |

| August 2021 | FRAX upgraded its entire oracle mechanism to Chainlink Price Feeds. |

| August 2021 | FRAX.Finance raised an undisclosed amount from Crypto.com. |

| September 2021 | FRAX.Finance went live on Boba Network. |

| September 2021 | FRAX was added to the Aave V2 market as collateral. |

| September 2021 | FRAX.Finance partnered with GMX to deploy FRAX liquidity on Arbitrum. |

| September 2021 | Temple DAO selected FRAX as their predominant and first stablecoin to be used in their treasury. |

| December 2021 | FRAX.Finance partnered with Ondo Finance to launch the “FRAX-as-a-Service” product, making it possible for projects issuing tokens to increase the liquidity in their native tokens on decentralized exchanges by providing liquidity themselves. |

| February 2022 | FRAX went live on Evmos. |

| April 2022 | FRAX Finance and Terra proposed to develop 4Pool on Curve using USDC\USDT\FRAX\UST as the underlying stablecoin asset. |

| April 2022 | FRAX.finance launched FPI (FRAX price index), a stablecoin based on the US CPI-U average, and the governance token “FPIS” based on FPI, as well as FRAXswap, an AMM DEX introduces a time-equivalent weighted system. |

| May 2022 | FRAX.Finance founders proposed on the Curve Governance Forum to add FRAX.finance to Curve’s contract governance whitelist and to build a FRAX-USDC base pool. |

| June 2022 | Finance founders proposed spending $20 million from the protocol to buyback and burn its own FXS token via FRAXswap. |

Business Plan

According to the latest progress announced by FRAX.finance, The project is about to launch the following business lines:

- FRAX-based privacy payment

- FRAX Lending, a lending platform (under auditing)

- Add unstable assets to collaterals

- ETH-staking service, users can stake ETH and receive frxETH

- FRAX-based liquidity router (similar to the service provided by Tokemak)

- FRAX.Finance builds its own Layer2 network

Among the unpublished functions listed above, the lending business and private payment are under higher priority and may be launched sooner.

Overall, despite the fact that FRAX has not been live for a long time, the business project has quickly advanced. In addition, it has many business lines that have either gone live or are in the planning stages, and the expansion of external collaboration and commercial scenarios has been fruitful. Therefore, FRAX’s execution capability is demonstrated.

Business Landscape

Before we dive deep into the business landscape of FRAX.Finance, let’s quickly go over how FRAX works. Even though there are several stablecoin projects, their business models could be quite different.

Here are brief descriptions of a few typical stablecoin projects:

- MakerDAO is the pioneer of decentralized stablecoins. By depositing collateral assets within the Maker Protocol, users can generate DAI that pays interest (stabilization fee), which is the source of income for the protocol.

- Tether, the issuer of the centralized stablecoin USDT, has a business model in which users swap fiat currency (mainly USD) to USDT. Tether trade USD for other assets, such as treasury bills, money fund shares, commercial paper of big companies, etc. More than 85 percent of them are cash equivalents with good liquidity. Moreover, all the assets are interest-bearing and can bring consistent cash flow for Tether.

Tether Reserve Asset Breakdown (updated Mar.31, 2022) source: Tether

- Abracadabra is a lending platform and stablecoin protocol founded in 2021. It launched its stablecoin MIM that will charge a one-time 0.5% seigniorage + stabilization fee (interest) as the protocol’s main source of revenue.

- Launched last year, Fei Protocol is built on the PCV (Protocol Controlled Value) paradigm. With the assets that users deposit to mint the stablecoin FEI, it builds a diverse portfolio in the DeFi market and generates protocol income.

- The business model of Terra and UST are sophisticated because UST is an algorithmic stablecoin derived from the Terra blockchain network. The minting of UST won’t directly profit Terra, but the increase in stablecoin funding volume and the arrival of new users and developers can boost the overall valuation of Terra’s ecosystem and the demand for Luna tokens.

Therefore, I will probe into the business performance of FRAX from two points:

- the demand side (usage side)

- the revenue model and current state of the protocol

In the following section, the business data of FRAX. Finance, the minting/burning mechanism of FRAX, and the value capture of FXS will be introduced. For more information, see Business Analysis – Token Model.

Demand-side (user-side) of FRAX

Assessing the business model on the demand side of FRAX is actually an evaluation of the network status of the stablecoin. Stablecoin is one of the few fields in Web3 with strong competitive barriers, and the main source of such barriers is stablecoin’s strong network effect, which is represented in the larger user bases in the network, the higher the value of the network to individual users, and the more difficult it is for users to escape from that network; thus, it is more difficult for new projects to catch up.

The evaluation of FRAX includes four aspects: issue size, user volume, trading volume, adoption by top DeFi , and top CEX adoption.

Market Cap

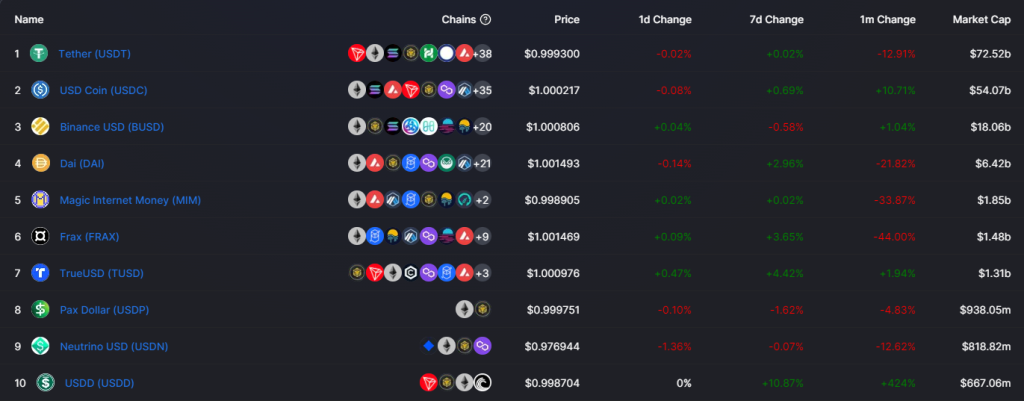

As of June 5, 2022, FRAX has a market cap of $1.48 billion, ranking 5th among all mainstream stablecoins (DeFillama’s stablecoin size number for MIM is inaccurate; MIM actually ranks sixth).

Top 10 stablecoins by market cap Source: DeFiLlama

FRAX ranks third among decentralized stablecoins after DAI and MIM, excluding the three centralized stablecoins USDT, USDC, and BUSD.

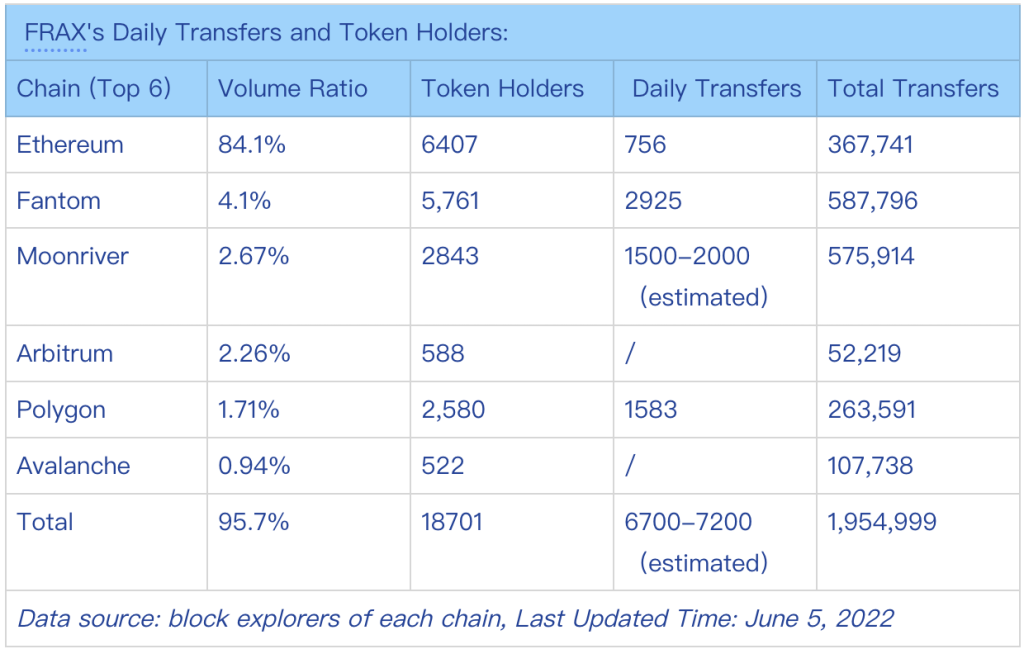

FRAX distribution on multiple chains Source: DeFiLlama

FRAX has been deployed on the majority of the mainstream public chains. As of June 5, 2022, 84.1% of FRAX was deployed on ETH, with Fantom following behind at 4.1%.

Taking a look at FRAX’s market cap history, it peaked at nearly $3 billion. Due to the UST crash in May 2022, which caused a huge market shock, people lost faith in FRAX. After FRAX quickly shrunk in size, its market cap dropped to less than $1.5 billion.

Data source: Coingecko

User Volume

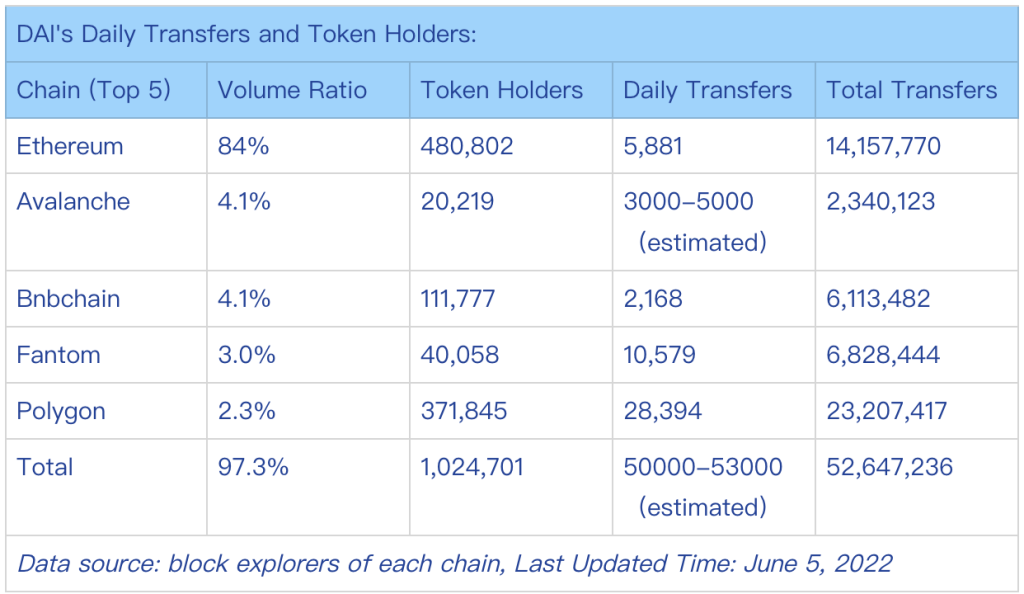

The following are the snapshot of the FRAX’s daily transfers and token holders:

In contrast, please see the other two decentralized stablecoins DAI and MIM below:

The size and activity of the FRAX user network are much less than those of DAI and MIM in terms of the number of holders, daily transfers, and total transfers. DAI has the largest and most active user network among stablecoins.

Trading Volume

Despite having a decent ranking in the market cap, FRAX ranks relatively low in trading volume. According to data from June 5, 2022, FRAX’s 24-hour trading volume on CEX and DEX was $9.6 million, ranking it 11th among all stablecoins and 5th among decentralized stablecoins.

Data source: CoinGecko

Curve, which accounts for 40% of FRAX’s total daily volume, is the most trade-active platform of FRAX, followed by Uniswap V3. Notably, Most of the trading volume is performed on DEX, with only a small proportion on CEX.

Data source: CoinGecko

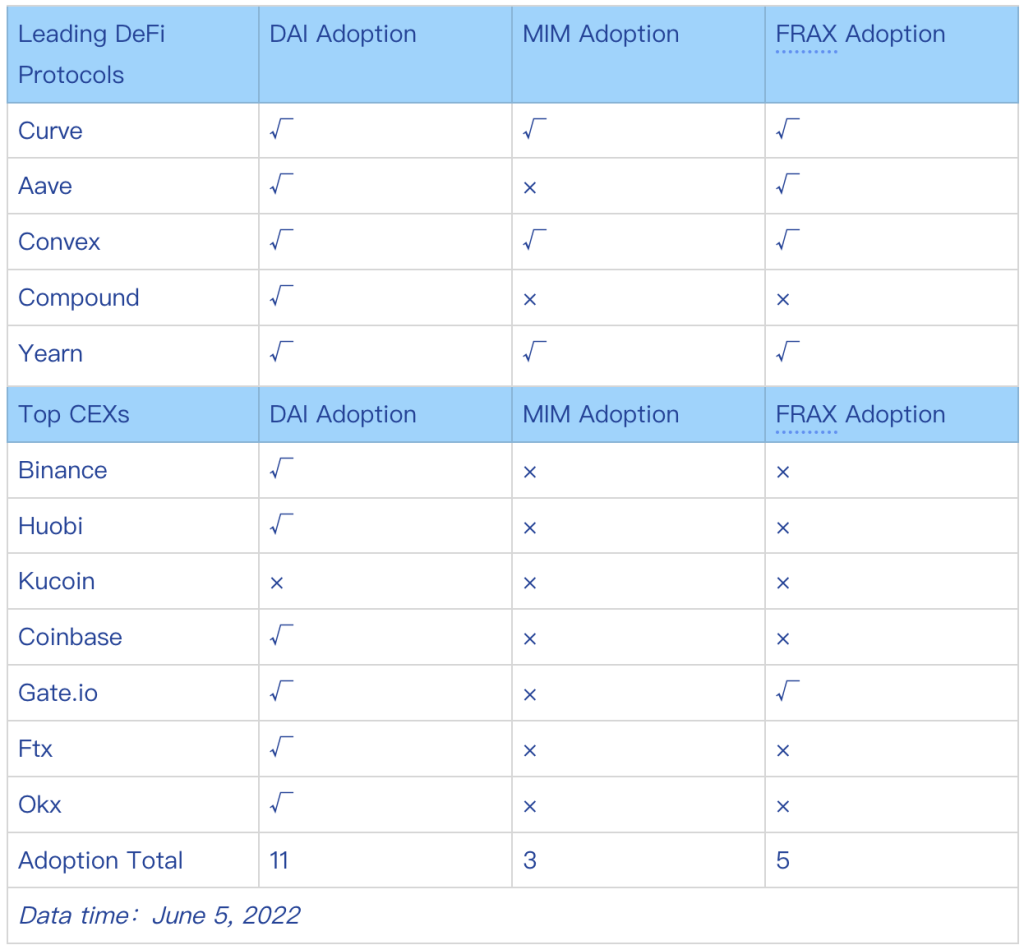

Adoption by Top DeFi Protocols and Exchanges

In this report, we describe a leading DeFi protocol as a DeFi project with solid TVL, growing popularity, wide userbase, and high composability as infrastructure, where TVL will be the most significant metric. The term “adoption” is DeFined as “an underlying asset that is added to DeFi protocol via community vote or by the protocol developers, however, permissionless creation of liquidity pools in DEX would not be considered as valid”adoption”.

According to TVL ranking on DeFillama.com, Curve, Aave, Convex, Compound, and Yearn can be identified as “top DeFi Protocols” here.

The top exchange refers to the CEX with a large trading volume and greater market depth. According to Coingecko’s ranking, the top 7 CEXs are shown below:

Data source: CoinGecko

The metric for “adoption” is whether the stablecoin is listed on the CEX.

We tracked the adoption of top3 decentralized stablecoins in the leading DeFi protocols and the top7 CEXs.

The table shows that DAI still has a distinct edge in adoption by leading DeFi protocol and CEXs, and surprisingly FRAX has a greater adoption than MIM.

As a relatively emerging decentralized stablecoin, FRAX’s user network is still far behind DAI and MIM. However, FRAX outshines MIM in the adoption of leading DeFi protocols and CEXs, mostly coming from FRAX’s diligence and resilience.

Revenue Model

As was said in the previous chapter, the revenue models of stablecoins are more diverse than we might think, even though there are small differences between them. The main sources of income for the FRAX.Finance is as follows:

- FRAX’s stablecoin minting\burning fees

- The “Algorithmic Market Operator” (AMO) module of the FRAX protocol

FRAX’s Minting and Burning Costs

When FRAX is minted and burned, users must pay fees for it.

The minting of FRAX requires staking the corresponding USDC and burning the corresponding FXS based on the current collateral ratio (CR). For example, if the current CR is 89.5%, users would need to collateralize 100*89.5% =89.5 USDC and burn $10.5 worth of FXS to mint 100 FRAX. Additionally, users must pay 0.2% of the minting fee.

The redemption procedure would be conducted reversely. The user who provides 100 FRAX can claim 89.5 USDC and a newly-minted FXS worth 10.5$ based on the current CR (collateral ratio) value of 89.5%. Again, users must provide 100 FRAX and pay 0.45% of the redemption fee, in addition to providing 100 FRAX.

Current CR values for FRAX source:FRAX.Finance

However, when the market price of FRAX is within a stable range ($1.0033 ≥ FRAX ≥ $0.9933), the FRAX protocol will be unavailable for minting and redeeming, and users will be able to transfer and trade FRAX to other assets on other DEXs.

FRAX prices are only available for minting and burning if it crosses a stable range. This also implies that the minting and burning of FRAX only bring in a sizable profit when its price crosses the range.

Income Generated by the “Algorithmic Market Operator” (AMO) Module

In comparison to the revenue produced by mint and burning, FRAX v2 launched the Algorithmic Market Operator (AMO), which provides a more consistent cash flow income.

AMO, Algorithmic Market Operations Controller, enables FRAX.finance to carry out a wide range of open market operations through AMO. Open market operations refer to the purchase and sale of the base currency in the open market and a key tool for implementing monetary policy by the central bank, achieving monetary policy goals by regulating market liquidity via conducting securities and foreign exchange transactions with authorized dealers. For example, if the central bank wants to reduce the amount of money in the market, it can do a “repo,” which means selling bonds to primary market institutions (like large commercial banks) to buy money. When the central bank wants to boost monetary liquidity, it can do a straight “reverse repo,” purchasing bonds with cash and transferring the cash to primary market institutions to inject money.

As stated in Project Scope section, FRAX is fundamentally a monetary system that includes the functions of a central bank, and the AMO is the specific mechanism via which the FRAX’s directors conduct their duties.

In fact, the function of minting and burning can be seen as an AMO, which is fully accessible and permissionless. The primary function of AMO is to balance the liquidity of the entire system. We’ll deep dive into more details about this mechanism in the section titled Token model Analysis.

The new AMO module developed in FRAX V2 serves three primary goals:

- Increase the flexibility of monetary policy, grant the protocol greater access, and boost the asset utilization to generate income. This is similar to Tether, which will invest its dollar holdings in treasury bills, currency ETFs, commercial paper, and even gold to generate investment income.

- FRAX prices can be better balanced through AMOs, and the supply and demand of FRAX can be regulated without activating the minting/burning mechanism. In the case of an insufficient collateral ratio for FRAX, the Curve module in AMO provides an efficient means of converting a large amount of FRAX on hand into USDC in Curve so that the USDC pledged in FRAX protocol can be increased. Also, FRAX can be provided to various lending platforms through the lending AMOs to directly mint FRAX, on the one hand, users can benefit from lending FRAX; on the other hand, users can use these lending platforms to borrow FRAX with their collaterals (such as ETH). This procedure is analogous to how MakerDAO users deposited collaterals to mint DAI. Major lending platforms serve as commercial banks under a central bank. By channeling FRAX to these commercial banks, lending AMOs are able to provide liquidity more easily, and users can acquire FRAX more conveniently (compared to minting FRAX with USDC and FXS).

Users can borrow FRAX by depositing collaterals at Aave and AMO’s lending modules provide a large percentage of FRAX. Source: AAVE

- AMO also allows FRAX to accumulate and manage assets that are vital to FRAX, such as deposit assets into Curve to provide liquidity via Convex for the accumulation of Convex’s governance token CVX. This will enable FRAX to acquire the governance right of Convex and Curve and to make steady progress.

There are now four primary active AMOs in FRAX, excluding the FRAX minting module, and they are as follows:

- The Collateral Investor AMO: Moving idle USDC collateral to select DeFi protocols that provide reliable yields, such as Aave, Compound, and Yearn Finance.

- Liquidity AMO: It deploys USDC and FRAX on multiple liquidity platforms and several blockchains, such as Uniswap V3, FRAXswap, and Curve, to assure sufficient liquidity of FRAX and stablecoins on blockchains, and to profit from FRAX’s transaction fees.

- Curve AMO: Curve is an AMM platform that assures stable liquidity for token swaps. FRAX has deployed its own FRAX3CRV Metapool and put FRAX and USDC in it to create sufficient liquidity and strengthen investors’ confidence while earning trading fees as income.

- Lending AMO: This controller mints FRAX into money markets such as Aave or Rari to allow anyone to borrow FRAX by paying interest instead of the base minting mechanism. The Lending AMO creates a new avenue to get FRAX into circulation by paying an interest rate set by the money market. The AMO can increase or decrease the interest rate on borrowing FRAX by minting more FRAX (lower rates) or removing FRAX and burning it (increase rates). Likewise, lending AMOs can accrue interest revenue from borrowers.

In fact, AMOs has mostly replaced the FRAX’s minting/burning mechanism. AMOs balance the inflation and deflation of FRAX and implement diverse monetary policies via Curve and other lending platforms.

According to the FRAX dashboard created by user @seba on Dune, the average daily revenue of FRAX’s treasury over the past week is $132,000.

Data Source:Dune; Last updated time: June.14, 2022

In terms of Protocol revenue, The average daily revenue outperforms most of DeFi protocols.

Daily revenue of major DeFi Protocols data source: Tokenterminal; last updated time: June.11, 2022

FRAX income from farming rewards, mostly CRV and CVX data source: Dune

However, the majority of FRAX’s protocol revenue is made up of CRV and CVX. CVX is the governance token of Convex, which is currently the largest holder of Curve’s governance token veCRV. FRAX would not sell its CRV or CVX holdings since they are essential to its ability to win the current Curve War and keep its place in the stablecoin ecosystem.

FRAX and Curve War

Curve War refers to the competition around Curve’s governance rights. In CRV under the attack of Uni V3: In-depth analysis of Curve business model, competition situation, and current valuation, we have done an in-depth analysis of Curve’s platform value: Curve is currently the largest liquidity pool of stable assets. With Curve’s governance rights, it is possible to determine the CRV incentive of each pool through voting on Curve’s Gauge, which controls the liquidity of the Curve platform. In addition, if one gets enough veCRV holdings (veCRV stands for vote-escrowed CRV, it is simply CRV locked for a period of time), one can also create Metapool (a pool that can interact with the base pool for liquidity) or even create a new Basepool (currently Basepool is only the 3pool consisting of USDT\USDC\DAI).

FRAX recognized the importance of the Curve War. It has been actively acquiring governance rights by receiving token rewards while providing liquidity in Convex and Curve. Furthermore, FRAX has higher flexibility of money supply than other stablecoin protocols due to AMO, earning token rewards through liquidity supply more efficiently.

In addition, FRAX will purchase votes on incentives platforms such as Votium to acquire more CRVs.

Here is a record of votes buying during Round 17-19 (10 days each) in Votium, in which FRAX spent $2-5 million per round to obtain votes.

Data Resource: llama.airforce

Bribery enables FRAX to acquire more governance rights and revenues, as well as expand its stablecoin pool. However, it also increases costs. Therefore, the daily income listed above is not the protocol’s net income; vote-buying costs and other costs need to be deducted. Some DeFi protocols have the same expenses such as leveraging yield farming to maintain liquidity or promote business metrics.

FRAX is very devoted to acquiring CRV and CVX. It is not only to ensure the liquidity of its own Metapool (FRAX-3pool) but also to establish a new Basepool based on FRAX that will achieve or even surpass the existing fundamental position of USDT/USDC/DAI Basepool.

Curve’s underlying liquidity determines the magnitude of Basepool. It is not only recognized by other assets but also benefits from the liquidity subsidies invested in other Curve projects. For example, FRAX provides liquidity subsidies to FRAX-3Pool, , which provides liquidity to the pool and subsidizes USDT\USDC\DAI without any cost.

A stablecoin dominates Curve war when it becomes a Basepool widely adopted by other pools. It could be the rationale that Terra and FRAX collaborated to form a new Basepool – 4pool (FRAX\UST\USDC\USDT) in April 2022. FRAX is clearly in a dilemma that being constantly rent-seeking by Curve war and having high liquidity costs. FRAX can only crack the code by being the core stablecoin asset of Basepool and obtaining benefits and gain through monopolizing the whole ecosystem. During the process, it is only possible to win the community vote in terms of the new FRAX Basepool if a large number of veCRVs have been held.

FRAX Founder, SAM’s proposal to build FRAX Basepool at Curve Governance Forum Source:Curve Governance Forum

Therefore, FRAX’s vote-buying cannot all be considered a one-time expense; essentially, it is a strategic investment (disguised acquisition of CRV) as well as a cost of maintaining the liquidity of its own stablecoin.

While the bear market continues, the cost of vote-buying decreases drastically along with the cost of liquidity accumulation.

Bribe votes’s price of each round in Votium, source: llama.airforce

As long as FRAX is still engaged in Curve War and Basepool has not yet gained a firm foothold, FRAX is likely to stay in a “high revenue, higher capital expenditures” situation with a negative net cash flow for an extended period of time. This is also similar to numerous instances that business growth is driven by issuing extra project tokens via yield farming and the inflationary value of the tokens exceeds the growth in business revenue.

Business Summary

Let’s wrap up the business model for FRAX. Finance.

FRAX operates as a monetary system with two primary business objectives:

- To expand the use cases of FRAX and generate its demand;

- To increase the turnover efficiency of the assets controlled by its protocol to generate revenue.

To achieve the first objective, FRAX must grow its user network and partner with more DeFi protocols, as well as satisfy the following requirements:

- Keep FRAX’s price stable. This means that the FRAX must not only have sufficient trading depth and decent collateralization mechanism but also proper monetary policies to accommodate expanding demand and manage associated risks.

- Assert dominance in DeFi ecosystem. FRAX protocol has stronger bargaining power in the financial and commercial ecosystem and becomes a monopoly within the larger system, instead of being rent-seeking by others. Given that the majority of DeFi’s rent-seeking actions are now centered on Curve and its derivative protocols, FRAX has been aiming to collect Curve’s governance tokens as many as possible.

In order to accomplish the goals, FRAX has been aggressively involved in Curve War, with the mid-term goal of building a FRAX-based basepool and shifting from being rent seeking to a beneficiary in Curve. Given the negative net cash flow, it will be difficult to reduce capital expenditures until this target is achieved.

In the long run, FRAX is not satisfied with generating revenue via asset turnover, they are also exploring business models such as lending and staking. However, Only when FRAX has the ability to build credit over time will the protocol’s assets volume, user volume, and business revenue rise. With the expansion of FRAX’s business scale and services, FRAX will gain users’ confidence and engagement, and the Lindy effect* will become increasingly powerful.

*Stablecoin fits the description of the Lindy effect extremely well. The Lindy effect describes something that does not naturally fade away, such as a technology or a concept; the longer it continues, the more vital it becomes.

The FRAX.Finance team began with a simple partial algorithmic stablecoin protocol and progressed to a more sophisticated and flexible monetary system, then actively participate in Curve War and diversify the business by leveraging the monetary system. Currently, the project has articulated motivations and objectives and has achieved initial success. However, with the “first-mover advantage” effect in stablecoins, FRAX’s subsequent attempts remain to be tested

Team and Funding

Founding Team & Core Members

Sam Kazemian, Founder

Sam Hamidi-Kazemian is a software programmer. Young Sam used to be a sports enthusiast and was on the varsity weightlifting team at UCLA while majoring in neurology and physics.

In December 2014, he co-founded Everipedia, a Wiki and blockchain-based web encyclopedia (and eventually one of the most renowned Dapps on EOS), with his schoolmate Theodor Forselius, who later served as CEO.

In 2019, he started building FRAX.finance, which had early backing from Trump’s senior economic advisor Stephen Moore, who preached FRAX multiple times as a co-founder in 2019 but abandoned FRAX afterward.

Travis Moore, Co-Founder

Travis Moore graduated from UCLA in 2011. He began with mathematics, then switched to physics and electrical engineering, and eventually chose three majors: 1. neuroscience; 2. molecular, cellular, and developmental biology; and 3. biochemistry.

After his graduation, he worked in a biological lab before joining the insurance company Anthem as a call rep, process specialist, and information analyst. During this time, he made his first money trading options and biotech in the middle of the night. In 2015, Sam Kazemian and Theodor Forselius, co-founders of Everipedia, approached Travis Moore (whose brother Justin Moore was a childhood friend of both and later joined Everipedia as a developer) and brought him on board as Everipedia’s CTO. Travis Moore became the co-founder and CTO of FRAX.

Jason Yu Huan, Co-Founder

Jason Huan earned a Bachelor of Technology in computer science from UCLA in 2021. In 2017, Jason Huan founded the blockchain community at UCLA and delivered the university’s first blockchain course as a teaching assistant. In 2018, Jason Huan interned at WhiteBlock as a developer and produced multiple review articles for the company on various blockchain platforms. Jason Huan joined FRAX in June 2020 and presently works as its Director of Development.

More Team Members

FRAX has not disclosed the total size of its team scale. According to the community, FRAX’s core development team consists of eight members at the present time.

Funding

In July and August of 2021, FRAX.Finance had closed two funding rounds. 12% of total tokens are backed by accredited private investors, however, the funding amount and valuation have not been announced.

The VCs that participate in FRAX.Finance’s funding is quite powerful, such as Parafi, Dragonfly, Mechanism, and Galaxy Digital, as well as notable project founders in the DeFi space, such as Stani kulechov of Aave, Robert Leshner of Compound, Kain Warwick of Synthetix, Eyal Herzog of Bancor, etc. In addition, there are investments with a CEX background, such as Crypto.com and Balaji Sriniva (Former Coinbase CTO and A16Z partner).

The extensive and diverse investor background facilitates FRAX’s expansion and industry collaboration significantly. Aave’s current lending asset is FRAX, and Bancor has lately enabled the staking of FXS.

Summary

FRAX’s core team has serial entrepreneurial experience (Everipedia received a $30 million investment from Galaxy digital and launched tokens), FRAX. Finance is their second try, and they work well together as schoolmates. Besides, the core team members acquired early wealth through the first project, and they are strongly motivated to succeed in their second endeavor.

Core team members are all American citizens and FRAX.Finance is presumably situated in the United States as well. The regulation of crypto in the United States has gradually improved over the past few years, particularly for stablecoins and DeFi, and FRAX’s team members may face increased regulatory pressure in the future.

The project is funded by diverse institutions, including top VC firms, CeFi and DeFi capitals, which is favorable to business development.

Business Analysis

Sizes and Market Shares of Stablecoins

According to data from Coingecko, the current market cap of stablecoins is $160 billion, with a daily trading volume of $566 billion.

data source: CoinGecko

Since the market capitalization of stablecoin has grown rapidly by the end of 2020, and reached a peak ($189 billion) in May, during which the total market capitalization grew by nearly 600%, before experiencing an unprecedented decline in May due to the collapse of UST and the short de-peg of USDT.

data source: DeFillama

Regarding the market share of stablecoins, we find that although the market capitalization of stablecoins as a whole has increased rapidly over the past two years, the change in market share has been highly uneven.

data source:DeFillama

- USDT market share continues to shrink and has decreased by nearly half.

- USDC market share increases steadily, and will likely surpass USDT’s market cap in one or two years based on current trends.

- BUSD is the stablecoin that grows fastest, with a nearly 10x growth in market share.

- The largest decentralized stablecoin, DAI, has experienced a flat share increase but a minor share overall.

- UST has undergone both exponential growth and abrupt downfall.

Despite the shock by UST and USDT, the entire stablecoin market has retraced its market cap much more slowly than the whole market cap of cryptocurrency did in bear markets. The stablecoin market, in general, has a history of rising quickly during bull markets and dropping gradually during bear markets.

The expansion of the stablecoin market has momentarily slowed down or perhaps shrunk after the Federal Reserve reduced its balance sheet and the cryptocurrency market entered a bear market. However, the increasing money supply continues to be a major factor in the growth of the world’s economies. And as Web3 gradually spreads, more users and money will inevitably be attracted to the crypto space. As the core layer of crypto’s liquidity, stablecoins will continue to develop in the future, and their growth rate will undoubtedly outstrip that of fiat currency.

Competitions Among Stablecoins

Before analyzing the competition among stablecoins, it is crucial to clarify the two questions:

- What exactly are stablecoin projects competing for?

- How do they maintain their long-term competitiveness?

The author’s thoughts are as follows.

What Exactly are Stablecoin Projects Competing for?

Stablecoin projects are competing for the settlement status of the liquidity layer, meaning that whoever becomes the top currency in the settlement will inevitably dominate the cryptocurrency market. When a stablecoin becomes the core settlement currency of liquidity and attains a natural monopoly, there will be an abundance of monetization modes, such as:

- Become a middleman between fiat and cryptocurrency, acquiring fiat currency without interest, then generate low-risk returns from fiat currency (centralized stablecoin model)

- Realize interest-free lending by offering stablecoins to mortgagors who seek to liquidate their assets (DAI model).

- Leverage the flexible policies and subsidies of stablecoins to build their own ecosystem, allowing tokens to be indirectly monetized and generating profits. (Terra and FRAX models)

Web3 economy keeps scaling with new projects, funds, and users. stablecoin projects are competing to become the settlement currency for these new blood. Stablecoin projects blow the horn and march into each other’s forts to grab market shares, leveraging various use cases as their battlefield. For example, BUSD has taken market share from USDT in the CEX space by waiving the maker’s trading fee.

How Do They Maintain Long-term Competitiveness?

It may vary. But stability mechanism is a foundation and cannot be recognized as a competitive advantage. The advantage will be driven by the market demand side.

The following are the benefits of centralized stablecoins:

USDT: First-generation stablecoin with a significant first-mover advantage and network effect

USDC: A compliant and secure stablecoin. When utilizing USDC, users are worry-free about the risk of acceptance, and they have smooth access to more compliant channels.

BUSD: Compliant and secure. Featured in the Binance ecosystem.

Compared to centralized stablecoins, decentralized stablecoins are relatively inferior in network size, accessibility, compliance, and user cases. But decentralized stablecoins are smart contract-based, permissionless and anti-regulatory, their magnitude cannot be neglected.

As discussed, stablecoins can turn into self-reinforcing and become a natural monopoly by their inherently powerful network. However, cryptocurrency is based on a decentralized structure. It may weaken the cryptocurrency economy If the whole currency settlement layer is entirely monopolized by centralized stablecoins.

Therefore, regardless of how convenient, stable, or powerful centralized stablecoins are, decentralized stablecoins will always have their value and can be viewed as a “Plan B for stablecoins” against centralized powers.

Decentralized stablecoins with decent market cap have the following advantages:

DAI: First mover advantage and strong network effect

MIM: Supporting interest-bearing assets as collateral with higher capital efficiency. Only a small proportion of centralized assets (such as USDC) in underlying assets.

FRAX: Abundant use cases in DeFi

UST (before the collapse): There were no centralized collaterals adopted. Initial use cases and business development empowered by its public chain ecosystem.

To sum up, stablecoins are claiming dominance of settlement currency, whereas decentralized stablecoins have only one important advantage over powerful decentralized stablecoins: they function as a “Plan B for stablecoins” against centralized power.

What is FRAX’s Core Competitiveness?

As a decentralized stablecoin, one of its core values is to compete with centralized stablecoins by giving a decentralized monetary settlement option. Compared to other decentralized stablecoins, FRAX adopted a fractional collateral + algorithm model. Sam (the founder) believes that FRAX has “greater capital efficiency” than DAI, meaning that users can mint stablecoins with fewer collaterals at a lower cost, or, more accurately, FRAX creates more money (credit) with fewer collaterals.

However, FRAX faces a big challenge in outperforming centralized stablecoin.

As a “Plan B” for centralized stablecoins: Currently, the proportion of decentralized assets is inadequate, with the decentralized ratio(a metric reflecting the degree of decentralization) of 23.08%.

data source:https://app.FRAX.finance/

DAI, the leading decentralized stablecoin, is encountering the same challenge. but its decentralization ratio is relatively higher than FRAX.

Collateral composition of DAI, data source: DAIstats

As previously noted, decentralized stablecoins are permissionless and independent. But it’s not comparable with centralized stablecoins in terms of the demand side.

Decentralized stablecoins lose most of their value if the majority of their underlying assets are centralized assets that can be frozen.

Some MakerDAO mentioned that MakerDAO may deposit the centralized assets into pools such as Compound or Aave, then centralized stablecoin issuers cannot freeze MakerDAO’s USDC collateral unless the entire pool is frozen. However, it would transfer the risk to other DeFi protocols with the chronic problems remaining. Moreover, no one can ensure that Aave or other protocols will not blacklist MakerDAO and FRAX from depositing USDC if some serious matters really happen.

It could be the reason that FRAX has been working on privacy payment. However, We would still need to monitor how they achieve the function.

The Core Competitiveness of FRAX Over Other Decentralized Stablecoins

FRAX is relatively competitive than other decentralized stablecoins due to its higher capital efficiency driven by partially collateralized mechanisms and flexible monetary policy.

What is “capital efficiency”? In a nutshell, higher capital efficiency indicates:

On the basis of the same collaterals/assets, a system with higher capital efficiency can generate more money (credit & debt). For example, if the pledged assets are worth $138, MakerDAO will release $100 DAI (credit/debt), however, $155 FRAX can be released with a collateralization rate of 89.5% via FRAX.

The capital efficiency of MakerDAO and FRAX is different due to disparate collateralization rates.

- other things being equal, a more capital-efficient monetary system will have a lower cost (interest) due to a larger money supply.

- The more type of collateral users could use, the more liquidity can be released and the more capital-efficient it becomes, which is why FRAX has proactively collaborated with many lending DeFi protocols.

Besides, the AMO module provides a highly flexible monetary policy to create and contract credit through loans, Curve, and other AMO modules, which greatly help FRAX in the Curve War.

But greater capital efficiency is not always preferable. UST is a non-collateralized (algorithmic) stablecoin. The creditworthiness of UST is backed by the circulating market value of Luna. Terra collateralized itself to issue UST without any collaterals (BTC has added afterward), showing exceptional capital efficiency.

However, Terra failed to manage its enormous debt, since the underlying assets and debt were highly coupled, Terra lost track in the crisis under the bear market, getting stuck in a death spiral.

Obviously, there is a limit to the improvement of capital efficiency. The greater the capital efficiency, the more credit expansion is possible, the higher the internal and external risks, and the more proper debt management is needed.

New Business Lines Launching

Additionally, there is potential growth driven by new business line launching such as wider adoption of FRAXswap, FRAXlend, FRAXstaking, and FRAX privacy payments. It would engage more userbases other than stablecoin use cases through brand new product value.

Tokenomics

Within the FRAX ecosystem, there are two primary types of tokens: the utility token FXS and the stablecoin FRAX. FRAX also launched the FRAX price index token (FPI) and its governance token FPIS in April 2022.

We will focus on FXS and FRAX only in tokenomics analysis.

FRAX’s Minting Mechanism and How it Connects with FXS

In the fractional algorithmic model, FRAX is partially secured by fiat currency and partially secured by the algorithm. The collateral ratio compares the value of collaterals to FRAX total circulation(Collateral Ratio).

The value of FXS tokens depends on the demand for FRAX on the market. Similar to Luna’s implicit collateral for UST, the market cap of circulating FXS should be higher than the non-collateralized value of the FRAX market value. FXS is also the implicit collateral for the non-collateralized portion of FRAX (otherwise both FXS and FRAX would decline simultaneously).

When FRAX is in the 100% collateral phase, 100% of the value that is put into the system to mint FRAX is collateral. When FRAX adopted a fractional algorithm, users need to deposit the required percentage of collateral and burn the equivalent rate of FXS to mint FRAX.

For example,

- If the market price of FRAX is above the target price of $1, then with a 98% collateral ratio, each FRAX minted requires $0.98 in collateral and burns $0.02 in FXS.

- If the market price of FRAX is below the target price of $1, each burned FRAX can redeem $0.98 of collateral and receive $0.02 of newly minted FXS, given a 98% collateral ratio.

The collateral ratio is determined based on FRAX pricing. If the price of FRAX hits above or below $1, the protocol’s collateral ratio refresh function can only be invoked once per hour and the collateral ratio can be changed by 0.25%.

- This function lowers the collateral ratio by one level when the price of FRAX is above $1.

- This function raises the collateral ratio by one level when the price of FRAX is below $1.

Both the refresh frequency and the adjustment magnitude can be modified through the governance of FXS.

The current collateral ratio of FRAX is 89.5%.

FXS Core Governance Token: FXS

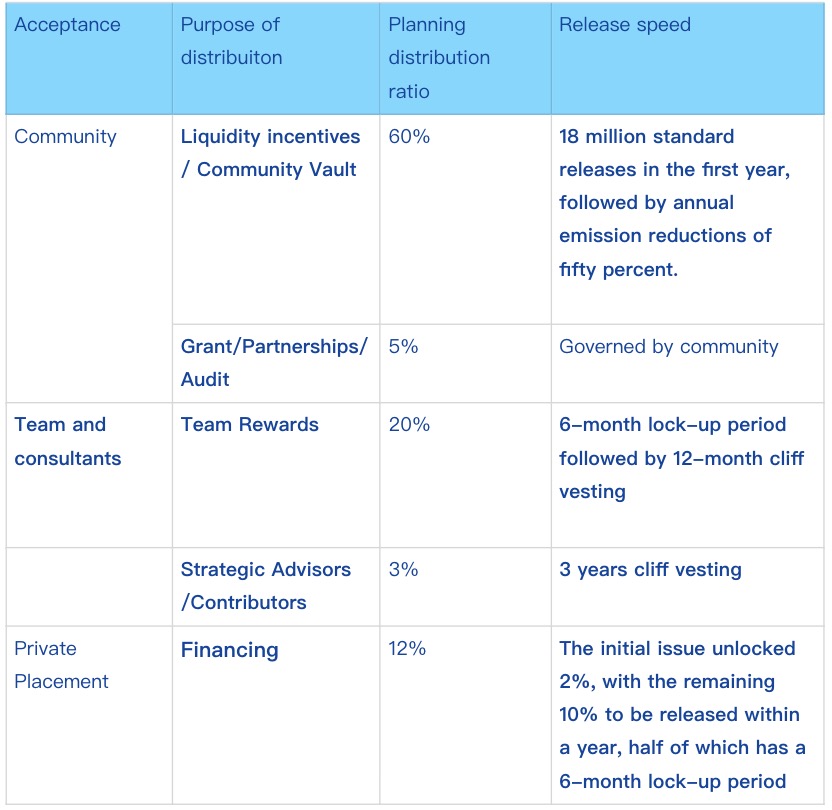

Token Volume, distribution, and circulation

The total initial supply of FXS is 100 million with the initial distribution scheme being as follows:

Token Usecases

FRAX adopts ve economy model derived from the Curve model. FXS, as the project’s primary governance token, can only capture the majority of the value of the FRAX.finance protocol if veFXS is obtained based on the volume and duration of the stake, as follows:

- Governance Rights: including exercising proposals and voting via veFXS, voting for the Gauge module of FRAX to determine the award ratio of FXS releases that are assigned to each FXS-related liquidity pool for each cycle, and the Gauge module serves as a liquidity guide based on FXS awards.

FRAX Gauge module’s FXS award allocation ratio, data source: https://app.FRAX.finance/gauge

- Revenue: part of the revenue generated by different AMOs of the FRAX protocol (tokens acquired that are related to liquidity governance, such as CRV and CVX, will go to the treasury, while the rest will be used primarily for profit distribution) will be used to buyback FXS through FRAXswap and be distributed to 100% of veFXS users.

- Minting: When the minting function of FRAX is activated, users are required to give collateral (USDC) and burn the equivalent rate of FXS, which will raise the credit of FRAX, promote deflation of FXS, and increase the intrinsic value of FXS.

FXS, being the system’s core governance token, still captures the vast majority of the value of the FRAX cryptocurrency protocol.

Risk Assessment

Regulatory Risks

With the rapid growth of the stablecoin market cap, there has been a heightened focus on regulations, mostly from America. In 2022, U.S. Treasury Secretary Yellen’s called for a stablecoin regulatory framework to be passed by the end of 2022. U.S. Senator Pat Toomey’s stated at the recent Consensus2022 conference that the U.S. could pass a new federal law on stablecoins by the end of the year. Recently, a legislative draft was leaked, which allows DAOs and protocols to launch stablecoins, and mandates stablecoins to have 100% reserves. FRAX’s fractional collateralized mechanism is obviously not invited to this party. Given that the primary members of the FRAX team are all U.S. citizens, FRAX will take the risk from U.S. regulators directly.

Changes in the Liquidity Ecosystem

FRAX is accumulating governance assets on the Convex and Curve in order to secure its dominance in the stablecoin ecosystem. If Curve’s position in the stablecoin ecosystem remains or is even more powerful in the future, It will benefit FRAX as well, since FRAX already has the first-mover advantage in the governance of the Curve ecosystem. But if the entire ecosystem of liquidity changes significantly in the future and a new dominant liquidity platform emerges, FRAX’s accumulated resources from Curve and Convex could be subject to severe write-downs. FRAX not only acquires Curve’s governance rights, it also devotes itself to emerging liquidity platforms such as Tokemak. The Future of FRAX will be impacted by the team’s anticipation.

Credit Expansion in Dilemma

Scaling is one of the pillars of the stablecoin network effect. USDC, USDT, BUSD, and other tokens all possess dependable user channels and demands. They could achieve credit expansion through external funds. Due to drawbacks in scales, user bases, channels, and usability, credit expansion is more challenging for decentralized stablecoins such as FRAX and DAI. Its still challenging whether FRAX can achieve credit expansion by relying on a new business line such as FRAXlend.

Primary Value Assessment

Core Issues

Which Stage is FRAX in?

FRAX’s current essential business: the stablecoin has achieved initial product-market fit, the stablecoin network has also taken shape, and protocol revenue is increasing. In addition, the token’s stability has undergone multiple rounds of market testing. Nevertheless, given that new business lines launching, the scope of FRAX will progressively grow from the stablecoin protocol to the DeFi protocol matrix. The project is therefore still in its early stages of development.

Does the Project Hold a Strong Competitive Edge?

Firstly, the project’s competitive edge originates primarily from the fractional collateralized algorithm design and great capital efficiency provided by the AMO module, which makes it more flexible and adaptable to any conditions. Secondly, FRAX has developed various business lines that could have powerful synergy. it could benefit both new business and stablecoin use cases. Lastly, the FRAX team possesses exceptional entrepreneurialism and creativity, sound judgment, and has amassed good industrial resources and a positive reputation in the DeFi ecosystem. However, the degree of consolidation and further progress still remains to be observed.

Is the Medium-term and Long-term Investment Logic Clear? Is it Consistent with the General Industry Trend?

In the long run, the market value of stablecoins will continue to rise. The Competition has switched from stability to user cases, demands, and position in the ecosystem. In general, The current FRAX model is aligned with the megatrend.

What are Key Variables Affecting the Execution of the Project?

The key variables are the demand generation and user base development, which can be assessed by the issue size, user growth, and partnerships with other leading DeFi protocols.

How Do They Manage and Govern the Project? Is DAO Going Well?

The project has enabled community governance based on veToken model, with relatively active community proposals and a significantly higher than average staking rate for FXS in the circulation of 59.36%.

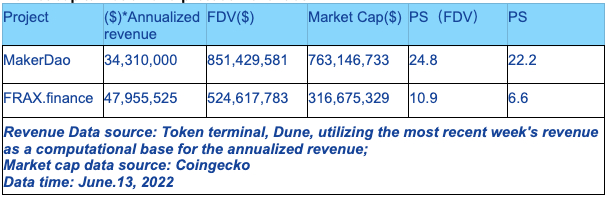

Valuation

FRAX will be assessed using a comparative method, with MakerDAO serving as the major rival. FRAX and MakerDAOo are comparable in the following areas:

- Both are decentralized stablecoin projects

- Both are central banks models, not commercial banks (borrow deposits from depositors, lend to borrowers, and collect interest spreads as income)

- Since MakerDAO has been under development for an extended period of time, its fundamentals and valuation are more solid and have more reference value.

Obviously, the two projects differ in numerous ways:

- The Revenue Model: MakerDAO generates revenue through stabilization fees, whereas FRAX earns revenue through the operation of protocol-controlled assets (there is also stable revenue from borrowing, but it accounts for a smaller percentage)

- Net cash flow: MakerDAO obtains net cash flow through stabilization fees, however, the amount of FRAX’s protocol revenue tied to liquidity governance rights must go into the treasury and will not be liquidated. Buyback dividends only account for 1/6 – 1/7 of revenue.

- User base: MakerDAO has a stronger user base, brand recognition, and high ecological position as Curve’s Basepool asset, which are implicit assets that cannot be reflected in financial terms. Although FRAX dominates Curve’s governance, there is a significant gap between DAI and FRAX in terms of user bases and brand recognition.

- Project Expenses: MakerDAO has up to $2-3 million per month in labor expenses (up more than 20 times from last year), while FRAX has larger expenses on governance bribes (vote buying) that may cost several million per month. However, It is not a fixed cost, and investment in governance assets included.

- The collateral ratio: FRAX employs an algorithmic and partially collateralized mechanism, but the collateral is stablecoin with superior liquidity and stability; MakerDao adopts over-collateralization, but the collateral contains a significant proportion of volatile assets.

After analyzing the similarities and differences between the two projects, the following table has a more detailed contrast in terms of earning multiples including market capitalization and protocol revenues:

From the perspective of earning multiples, FRAX has a significantly higher cost-to-performance ratio than MakerDAO especially comparing them horizontally. As stated previously, the mechanism and net cash flow of the two projects are dissimilar, with the exception of a few simple financial indicators, and MakerDAO has more implicit assets that cannot be reflected in the book. In addition, FRAX’s partially collateralized mechanism would need to be verified and validated by the market constantly, which may result in valuation adjustments.

The FRAX team, on the other hand, is more aggressive because they are preparing to launch many new business lines, which are not reflected in the financial reports.

Overall, Fininancilly speaking, FRAX. Finance has a higher price-performance ratio than MakerDAO. Nonetheless, the above comparison was limited to MakerDAO only. The answer to FRAX valuation level could be subjective if compares to the whole market.

Summary of Primary Value Assessment

FRAX.Finance is an algorithmic stablecoin protocol that is partially backed by collateral. It is shifting from a single monetary system to a stablecoin-centered DeFi matrix as its user base and market cap have started to take shape.

The main competitiveness of FRAX.finance comes from the monetary mechanism with higher capital efficiency and flexible monetary policy that is based on the AMO modules. From a long-term perspective, the fusion of the multi-business lines may become the moat of the project.

FRAX team has strong business instincts due to extensive serial entrepreneurship. The team is solid and reliable in making progress on the project constantly.

FRAX values the position of the ecosystem. At the early stage of launching, FRAX already attempted to gain the governance right of Curve in different ways. FRAX demonstrated clear advantages with its flexible monetary policy and high efficiency of capital, which made it become one of the prominent governance organizations in the Curve ecosphere.

From a valuation perspective, FRAX is already more attractive than MakerDAO.

References

Project Documentation: https://docs.FRAX.finance/

Dune business data: https://dune.com/seba/FRAX

Member information:https://everipedia.org/

Project business data: https://app.FRAX.finance/

DAI data: https://DAIstats.com/

Market capitalization: https://www.coingecko.com/

MakerDao monthly earnings report: https://forum.makerdao.com/t/financial-report-2022-04/15054

Revenue: https://tokenterminal.com/

Stable Coin Market Share: https://DeFillama.com/peggedassets/stablecoins

Address information: each blockchain browser