This research focuses on the decentralized stablecoin industry. The US regulation on crypto assets is on the way, with centralized stablecoins being the primary object of it. Decentralized stablecoin projects, whose growth pace has been far slower than centralized stablecoins in recent years, may benefit from this.

Before 2020, developers have explored blockchain business applications broadly, with new dApps startups emerging in the Game-Fi, gambling, data, and social sectors. Given that the user base is relatively small and the product life cycle is very short, it hasn’t been able to spark a rise in commercial solutions.

Until the DeFi summer in 2020, Compound, Uniswap, and Yearn Finance are emblematic of the explosion of applications. 2020 was defined as the first year for both decentralized finance and blockchain business. As a result, the crypto world has experienced exponential growth in active users, capital volume and entrepreneurs with emerging demands.

We believe there are multiple reasons why crypto blossomed first in the financial field:

- The financial industry is very mature in digitalization and online business and has the technical possibility of ‘blockchainization’.

- Finance is an essential service, with large user bases, promising business prospects, and strong sustainabilities, which is an excellent direction for entrepreneurship.

- Finance is one of the fields with the most gatekeepers and regulations compared with other industries. The inherent traits of blockchain financial services of no permission, free combination and freedom to cross borders bring it much more rapid innovation than traditional finance. And the improvement of user experience is also exponential, which will inevitably attract a large number of users, entrepreneurs and capital to pile into the space.

“We think it’s better to consider the crypto world as a parallel monetary system that is vital not so much as a decentralized internet, but as developing a financial system without traditional banks,” says Ryan Sean Adams, the founder of Bankless.

Therefore, there are three core sectors for finance-focused crypto business: ecosystem (public chains), financial services (lending, trading, derivatives service), and cryptocurrency (stablecoins).

The two primary narratives of financial services (DeFi) and ecosystems (new public chains) have benefited from the entire market hypes in 2021, with only the cryptocurrency market remaining tepid after the algorithmic stablecoin boom receded earlier in the year.

So perhaps it’s time for us to refocus on it.

Contents

The Value of Decentralized Stablecoins

In 2008, Satoshi Nakamoto released the Bitcoin whitepaper –Bitcoin: A Peer-to-Peer Electronic Cash System. Over the following 13 years, the value of Bitcoin has grown 10,000-fold as a niche asset, making it one of the highest gains of the decade. However, limited by its network capacity and volatility, Bitcoin has not been widely adopted as a payment method but is more akin to a value of reserve like gold, which we don’t use to buy or price commodities in our daily lives.

But for now, USDT, USDC, and DAI, are emblematic of stablecoins, that have truly achieved the vision of a “peer-to-peer electronic cash system”, serving as the crypto gateway. Most people must exchange their fiat for stablecoins before they trade crypto assets or use DeFi protocol.

The Market: Huge and booming

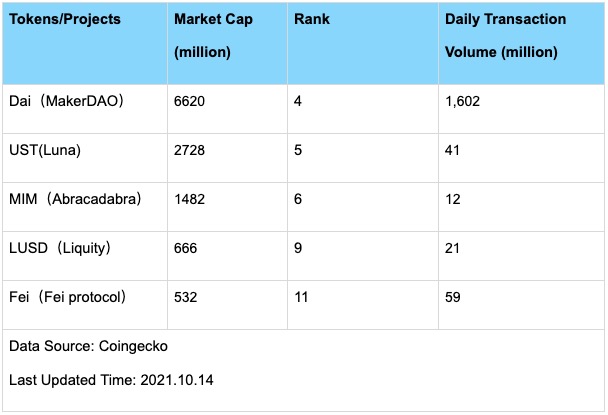

According to Coingecko, the stablecoin’s overall market cap was $132.6 billion (as of Oct.14, 2021), with a daily trading volume of $69.6 billion. In addition, 5 of the top 10 stablecoins in terms of issue scale are decentralized stablecoins, as follows:

Data Sources: CoinGecko

DAI, TerraUSD, Liquity USD, MIM, Neutrino USD and Fei are decentralized stablecoins. Although they are still far from USDT, USDC and BUSD in terms of market cap and trading volume, their potential should not be underestimated.

Opportunity: The Rivals Are Facing The Regulation

2021 is a year of tremendous growth for crypto commercialization, at the same time, the first year facing potential regulations.

The heads of financial instituions, regulations and industry groups in the United States have repeatedly called for the inclusion of crypto assets and DeFi into the regulation to clarify their responsibility and scope. And as the primary medium for most of the funds to crypto, centralized stablecoins will be the main object of regulation. We have listed some global discussions as follows:

| Time | Regulation Details |

| 2021.6.1 | The Securities and Exchange Commission (SEC) of Thailand has announced that any DeFi-related activity may soon require a license from the financial regulators. Meanwhile, the SEC will have stricter regulations for DeFi protocols that issue tokens. |

| 2021.6.8 | Dan M. Berkovitzzai, the commissioner of the U.S. Commodity Futures Trading Commission (CFTC), addressed the challenges of regulation in the face of decentralized finance in a public speech and laid out why DeFi should be regulated. |

| 2021.7.8 | In a letter to SEC Chairman Gary Gensler, U.S. Senator Elizabeth Warren complained that cryptocurrency platforms lacked the fundamental safeguards of traditional exchanges. To address these dangers, the SEC must fully use its jurisdiction and Congress must tighten regulations to fill regulatory gaps. |

| 2021.7.19 | U.S. Treasury Secretary Yellen convened a meeting of the President’s Working Group on Financial Markets (PWG), which discussed issues such as the rapid growth of stablecoins, the potential use of stablecoins as a method of payment and their target users, as well as any risks they may pose to the financial system and national security. Yellen also stressed the urgency of taking action to establish an effective regulatory environment for the United States. |

| 2021.8.3 | In his speech on “Cryptocurrencies and National Security,” SEC Chairman Gary Gensler compared DeFi and the crypto economy to the Wild West. He suggested that Congress should give the SEC the supervision authority to better regulate cryptocurrency transactions, lendings and their related platforms, including peer-to-peer decentralized financial (DeFi) websites where lenders and borrowers trade cryptocurrencies without traditional banks. |

| 2021.8.5 | A letter from SEC Chairman Gary Gensler in response to Senator Elizabeth Warren states: It doesn’t matter whether it’s a stock token, a stable value token backed by securities or any other virtual product that provides a synthetic exposure to underlying securities. These products are subject to securities laws and must work within our securities regime. |

| 2021.8.6 | The U.S. SEC issued the first DeFi fine, requiring the DeFi Money Market (DMM) project to pay a $125,000 fine and return $12.8 million to the government. |

| 2021.8.19 | In an interview with the Wall Street Journal, Gary Gensler said DeFi projects could be regulated by the SEC. |

| 2021.9.8 | Coinbase posted that it received a lawsuit warning from the U.S. SEC last Wednesday regarding its lending business, Coinbase Lend. On Sept. 20, Coinbase said it was canceling the launch of the USDC-based lending service. |

| 2021.9.10 | The European Securities and Markets Authority (ESMA) released a report on financial trends and risks, which mentioned that the use of stablecoins and increased interest in crypto assets by institutional investors is blurring the boundaries between the centralized traditional financial system and DeFi. Thus it increases the risk of potential DeFi risk to the real economy. The report also states that the EU’s upcoming regulatory framework for the Market for Crypto Assets ( MiCA ), which will apply to 27 states, includes restrictions on stablecoins. |

| 2021.9.12 | The Treasury Department held a meeting with financial industry practitioners to address a variety of stablecoin-related concerns, which Bloomberg suggests may be in preparation for regulation policies. The Treasury Department and other federal agencies are nearing a decision on whether to launch an examination by the Financial Stability Oversight Council. U.S. officials are discussing launching a formal review into whether Tether and other stablecoins threaten financial stability. FSOC has the power to deem companies or activities a systemic threat to the financial system — a label that typically sets off tough rules and aggressive monitoring by regulators. |

| 2021.9.14 | In a Senate Banking Committee hearing, SEC Chairman Gary Gensler said regulators are drafting the rules for the cryptocurrency market. He further stated that cryptocurrency lending and staking platforms that custody user funds may need to be subject to U.S. securities laws regulation. And he added that stablecoins are probably also going to be securities. |

| 2021.9.22 | In the live interview with the Washington Post, SEC Chairman Gary Gensler made it clear that he doesn’t like stablecoins. He said, “these stablecoins are almost like chips in a casino, so we will take action and work with Congress to help regulate stablecoins. The SEC has strong authority to regulate cryptocurrencies and will use that power.” |

| 2021.9.23 | Fed Chairman Powell says reports on Central Bank Digital Currency (CBDC), stablecoins, and cryptocurrencies will be available soon. |

| 2021.9.24 | The U.S. House of Representatives included a cryptocurrency provision in this year’s annual defense budget bill that would require the SEC and the U.S. Commodity Futures Trading Commission (CFTC) to clarify the scope of regulation of the cryptocurrency market. The House has passed the defense package, which is now awaiting Senate approval. |

There has been a heightened focus from regulatory authorities since August 2021,especially the discussions around stablecoins has increased significantly. U.S. Treasury, the Federal Reserve, SEC, and all the major U.S. regulators has been targeting stablecoins.

As per a report published by New York Times on stablecoin regulations, they believe that U.S. regulators will initiate the regulations of stablecoins in the following ways:

- Define stablecoins as system risks

- Classify stablecoins as securities

- Define stablecoins as currency funds

- Impose bank-level regulations on stablecoins

The report also said that standards and plans for stablecoin regulation are already in the progress.

Centralized stablecoins most likely will be the first regulated in the DeFi sector due to their clear legal subjects and synergies with traditional finance on asset custody and access, making it less difficult to regulate.

On the other hand, when centralized stablecoins are brought into the regulatory framework, it is more likely to get the opportunity for decentralized stablecoins that have been lagging behind them. It enables more users and protocols to adopt them actively.

In the long run, national regulators are unlikely to give up on regulating decentralized stablecoins. But since decentralized projects are much more challenging to regulate, it takes more time to make regulation rules on decentralized stablecoins, which leaves the time and room for it to catch up with the development of centralized stablecoins.

The Network Effect: First Mover Advantage

The network effect means that, all users will be able to benefit more from more scalable network with its user base grows. This network’s overall worth increases with both the quantity and size of its users, which increases the likelihood that new users will choose to join it first.

Although social media and telephone networks are frequently used as examples when discussing network effects, the currency is actually the most historical case.

The power of the network effect is quite evident in the stablecoin market.

USDT has been criticized for its asset transparency, compliance, market manipulation, and other issues and even had a brief crisis of de-peg. But as the first widely used stablecoin, it has always maintained its leading position in the industry because of its strong network effect.

MakerDAO’s DAI, a first-generation decentralized stablecoin, is currently far ahead of the game, despite having suffered a bad debt event in March 2020 and facing challenges from a large number of next-generation decentralized stablecoin products.

With a network effect as the first mover advantage, market-leading decentralized stablecoin projects can maintain their leading position at a much lower cost, a core advantage that most fields lack.

The enormous market space, the market opportunities that rivals would forgo because of regulation obstacles, and the competitive advantages brought about by powerful network effects are all distinctive qualities that the decentralized stablecoin track possesses.

But it’s not easy to capture these values, and the competition in the stablecoin track is far more brutal than in other tracks, so which projects are worthy of attention?

Stablecoins Project Highlights

There are more than 50 stablecoin projects in the market, most of which are based on algorithms or over-collateralization mechanism stabilization mechanisms. We have picked 5 of them for analysis and comparison, the rationale of the selection is following as below:

Top 20 Market Capitalization

The network effects determine that projects that already have a decent scale are more advantageous.

Deployed on Ethereum

Ether is currently the most well-developed business ecosystem, and stablecoins deployed on Ethereum can be better explored in the crypto business. In addition, successful stablecoin projects on Ethereum are more likely to achieve cross-chain competition. It is difficult for stablecoins deployed on other new public chains to cross into Ethereum to capture the market.

The Stabilization Mechanism Verified by the Market

Stability is an essential condition for business. Stablecoin projects that cannot maintain stability in practice may have short-term speculative value but do not have long-term use value.

Massive Adoption by DeFi Protocols

It proves that those stablecoins are widely recognized by other communities.

Listings on Leading Centralized Exchanges

It states the level of recognition by centralized crypto exchanges.

As a result, we have selected the following five decentralized stablecoin projects for comparison.

we hope to answer the following questions from the comparison:

- The current operation of each project.

- The stability mechanism and history of stability.

- Innovations on product and mechanism.

- Market prospects in the near future.

Decentralized Stablecoin Track Overview

Industry Size, Growth Rate, and Potential

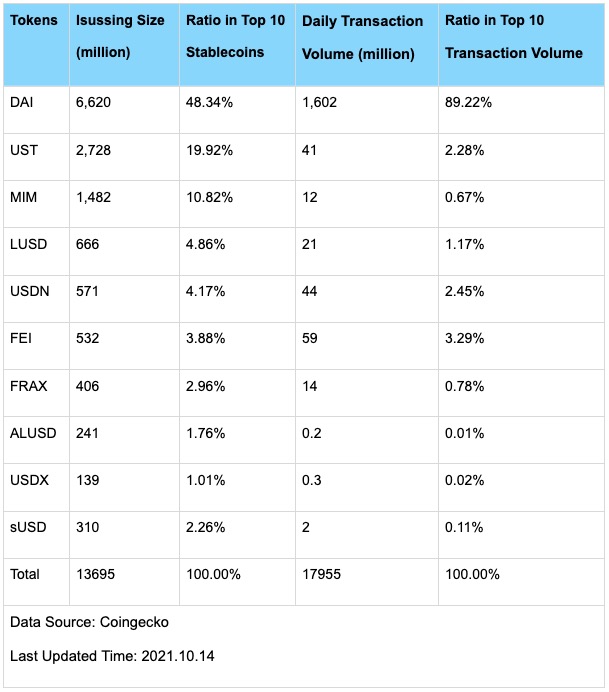

According to Coingecko, the total issue volume of the top 10 decentralized stablecoins in terms of market capitalization size is currently $13.695 billion, as follows:

DAI still occupies the absolute leading position in the market of decentralized stablecoins, especially its trading volume, which accounts for nearly 90% of the top 10.

The above top 10 decentralized stablecoins have accounted for more than 90% of the entire decentralized stablecoin market in terms of total market capitalization and trading volume. Nevertheless, the market cap size of decentralized stablecoins only accounts for about 10% of the whole stablecoin market, and their daily trading volume is only about 2%, as follows:

Data Source: Coingecko (2021.10.14)

On the one hand, this shows that centralized stablecoins still have absolute dominance, especially USDT, which accounts for 87.5% of the trading volume. But on the other hand, it also shows that decentralized stablecoins have tremendous room for growth, especially when centralized stablecoins face regulation constraints.

The size of the decentralized stablecoin market has grown by around 10 times year over year in terms of growth rate. The total amount of decentralized stablecoins has increased from roughly $700 million last year to more than $7.7 billion, according to data from Debank.

And Debank’s data does not include UST on Terra and some other small and new decentralized stablecoins. Thus the total decentralized stablecoin market is growing at a much higher rate than 10x.

Growth trend of decentralized stablecoin market cap; Data Source: DeBank

The largest of these decentralized stablecoins, DAI, has seen an annualized year-over-year increase in market capitalization of around 900%. It is important to note that the current market cap of DAI has surpassed the May 2021 market high and keeps setting new records, suggesting that the growth in decentralized stablecoin market size may not entirely depend on the bull market cycle.

Decentralized Stablecoin Categories

In terms of product, we can categorize the mainstream stablecoins as follows:

Source: Mint Ventures Research – Terra: The Rise of the Stablecoins

Based on the minted mechanism, we can classify decentralized stablecoins into overcollateralized decentralized stablecoins and algorithmic stablecoins. Even though overcollateralized stablecoins emerged earlier and have developed for years, algorithmic stablecoins still have seen a lot of significant instances this year. UST, Frax, and Fei, all of which have undergone short-term de-peg, consistently maintain prices at or near $1 most of the time.

But in terms of the issue size, overcollateralized stablecoins still account for the larger market cap. DAI, in particular, accounts for half of the market cap and leads in trading volume.

Fundamental Analysis of Leading Stablecoins

In this chapter, we will make an overall analysis of decentralized stablecoins from diverse perspectives.

The success of stablecoins is determined by two factors:

- the stability mechanism and price volatility of stablecoins;

- use cases, usage scenarios, popularity, user base and activity of stablecoins.

The first metric is the foundation of success. Before testing its stability, stablecoins will not be adopted as vehicle currency or settlement measures by users or platforms, which will gradually lead to the failure of the project. Nevertheless, decentralized stablecoins attract much attention because of their token speculation.

The second factor is a measurement of the business adoption of stablecoins. Stablecoin projects are only valuable if they have built up the user base and business network. When it gets to the critical point, the growth of the payment network will be in a continuous self-reinforcement loop. We may not know the exact critical point for each project, but it is evident that if a project is unqualified in all metrics, it will be far away from the critical point and more likely to fail.

We will also pay attention to the tokenomics, value capture of utility tokens and the valuation of these projects.

Last but not the least, we will have a brief analysis of the regulatory risk associated with these projects.

Dai by MakerDAO

Introduction

DAI is issued and managed by MakerDAO which was formed in 2014 and has a long history. The MakerDAO protocol is one of the top decentralized applications on Ethereum and the first DeFi application to achieve mass adoption.The primary service offered by MakerDAO is the minting of decentralized stablecoin: Dai. MakerDAO’s mechanism aims to enable users to deposit accepted crypto assets as collateral to generate (borrow) Dai, while charging customers stability fees (interest on borrowed tokens) for the Dai they borrow.

Stability Mechanism

Dai’s Stability Mechanism

DAI aims to maintain 1:1 pegged to the US Dollar. The stability of Dai comes from two factors:

a. Over-collateralisation

All accepted collateral assets can be leveraged to generate Dai in the Maker Protocol through Vaults created by users. Every Dai is borrowed and endorsed by over collateralized assets and the value of the collateral is always more than the amount of the Dai loan.

b. Controlling Dai Supply and Demand with Stability Fees and Savings Rate

The Stability Fee, is effectively a loan interest rate when users deposit crypto assets to mint DAI. Under the given conditions, increasing the stability fee pushes up the cost of borrowing DAI, reducing demand for minting DAI, thus a large amount of Dai will be returned and the liquidity will enter a deflation cycle; the inverse will be true when the market demand grows. The Dai Savings Rate(DSR)is an interest rate that is applied to deposits of DAI. Under the given conditions, if the DSR increases, it will boost the demand for Dai, and users will mint more Dai to deposit and if the DSR decreases, it will stifle the demand for Dai.

The current DSR is 0.01%, source: https://oasis.app/

c. PSM Module

PSM is the abbreviation for Peg Stability Module, which allows users to swap a given collateral type directly for DAI at a 1:1 ratio, where “given collateral type” refers to stablecoins such as USDC. USDC created through a PSM is owned by the Maker Protocol, rather than being owned by a user swapping it directly for Dai, which increases the loan of Dai. This module will accumulate numbers of centralized stablecoins with high liquidity for Maker Protocol, ensuring the stability of the DAI and reducing the overall leverage of the Maker system. However, given its superhuman abilities, the USDC issuer is also able to freeze Maker’s USDC addresses.

Note: Keeper (Keeper) is an external agent in MakerDAO responsible for the stability of DAI and system liquidation via arbitrage.

Overall, the over-collateralization mechanism prevents the volatility of Dai in extreme market conditions. Then, it regulates supply and demand using two macro interest rate instruments—the stablecoin and DS, as well as the presence of the PSM module. The robust stability of DAI pegged to USD is maintained by these combined mechanisms.

Stability Level

Dai is the pioneer of decentralized stablecoins, and its stability is growing year by year. In 2019 and the first half of 2020, it frequently depegged from the USD. Dai has experienced many daily drops of 5%, with values fluctuating between $0.93 and $1.06, however in just one day, the price of Dai rebounded to $1. The stability of DAI has substantially improved over the past year, and the price of DAI is seldom depegged from the USD.

With the growth of trading volume, Dai’s stability has improved considerably in the recent year; Data source: Coingecko

Dai’s growing stability could be explained by the recent marked increases in major business metrics including market cap, active users, trading volume, and user scenario.

Business Data

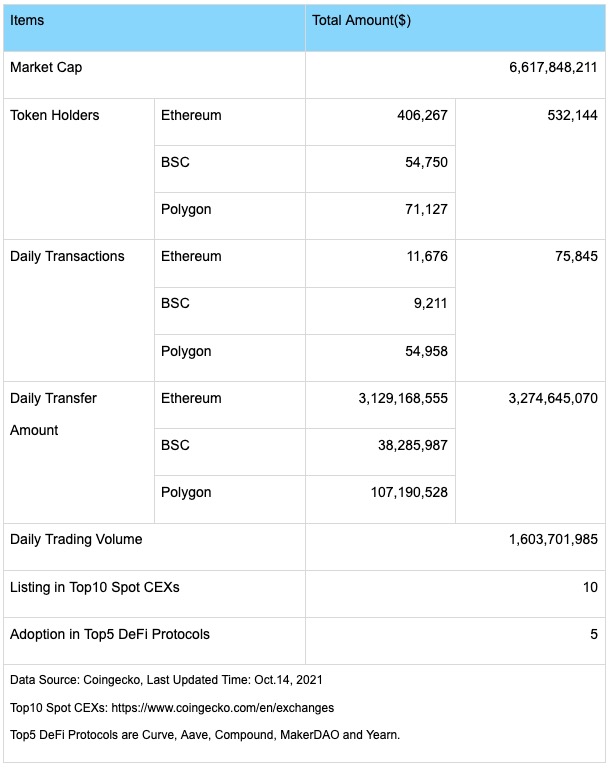

The major business data of Dai are summarized in the following table:

MakerDAO is also actively looking into new business opportunities.

MakerDAO continues to add new assets(recently Matic) as collateral and has begun to add Uniswap LP tokens as collateral assets. The collateral assets in the module have rapidly increased in value since August and now have a locked value of more than $100 million.

The total value of LP token as collateral in MakerDAO; Data Source: Dune Analytics

MakerDAO, on the other hand, strengthened its partnership with Real world assets (RWA) and built a special community group for this, with its primary partner being Centrifuge. The total value of the RWA pool is over $8.6 million.

The total value of RWA pool in MakerDAO; Data Source: Dune Analytics

In addition to the launch of new collateral and Real world assets, Rune Christensen, the founder of MakerDAO, recently made a proposal that DAI will become “Clean Money” as an important environmental + financial solution in the future, which draw a greater blueprint for MakerDAO, and the takeaways are as follows:

- Environmental protection models the fate of humans. Due to the global political and economic system’s emphasis on short-term objectives, it is impossible to prioritize long-term issues such as environmental conservation over short-term economic objectives and the monopolies’ interests.

- By leveraging clean energy infrastructure and green investment projects (such as solar farms and recharging stations) as new collateral to support funding these projects as the underlying assets of DAI, MakerDAO will aim to address climate change. The resilience and flexibility of DeFi will make funding more effective.

- To increase the DAI’s security, and profitability and to show its support for environmental protection, MakerDAO will also buy bonds from leading ESG (Environmental, Social, and Governance) corporations in developed nations as DAI’s underlying assets.

- By reforming the original tokenomics, MakerDAO has introduced a new and advanced tokenomics called “Sagittarius Engine” to improve the efficiency of the system and governance, thus significantly innovating the value of MKR.

Tokenomics

Token Total Supply and Circulation

MKR is the governance token of the Maker Protocol, with a total supply of 1,000,000 and fully diluted. Dai is the stablecoin of Maker Protocol.

Note: the total number of MKR can fluctuate if the new tokenomics “Sagittarius Engine” is implemented.

Value Capture

The utility of MKR is as follows:

- As a governance token, MKR is used by its holders to vote on a number of different things such as changing the risk parameters of the Maker Protocol, adding new collaterals, adjusting DSR, choosing the set of oracles and so on.

- All Maker Protocol revenue will be sent to the Maker Buffer. Once the Maker Buffer reaches a specific size of surplus(the precise amount is decided by the governance of MKR holders), some of the surpluses will be sent to the surplus auction to buyback and burn MKR in order to increase the intrinsic value of MKR.

It should be noted that if the Maker system has a bad debt and the funds in the Maker Buffer are not sufficient to pay it off, additional MKRs will be issued to be auctioned off and Dai from the sale will be used to cover the bad debt of the system, hence MKR holders are obliged to govern the protocol prudently.

According to the monthly report provided by MakerDAO, the Maker Protocol’s workforce expenses have increased dramatically from $594,400 in May to over $2 million in August and September, and it should be deducted from the net revenue of the Maker Protocol, thus is the actual net cash flow of the MKRs.

MakerDAO’s balance sheet (2021.9) shows a sharp increase in costs; source: MakerDAO Forum

MakerDAO’s receipts and disbursements; source: MakerDAO Forum

Regulatory Risk

Since its early establishment and its investors are mainly VCs, MakerDAO Since its early founding with institutional investors, MakerDAO has not held a public token launch. MakerDAO is highly governed by the community with a small share held by the team. And in July of this year, Rune Christensen, the founder of MakerDAO, stated that he will dissolve the MakerDAO Foundation in the following months and hand over operation rights to the community. All these indicate that MakerDAO faces less regulatory pressure in the near future. However, according to the September report of MakerDAO, it has a considerable quantity of centralized stablecoins(mainly USDC) on its balance sheet, accounting for approximately 59% of total assets. In response to this possible risk, MakerDAO has implemented some active measures, including the “DeFi Shields” strategy by depositing USDC in pools like Compound and Aave to isolate risks and gradually replacing USDC with ESG bonds of developed and financial-protection nations to avoid regulatory risks from the US.

Summary

In terms of detailed analysis of business metrics, MakerDAO maintains its position as the leading decentralized stablecoin with a sizeable user base, frequent transactions and high volume. Adding LP tokens as collateral and the active exploration of real-world assets are also quite promising and are expected to be the second curve of MakerDAO. There are also two challenges for MakerDAO, one of which is the transformation has resulted in a quick increase in expenses as well as a decrease in net profit, although the concept of “clean money” is attractive. Besides, the ratio of centralized stablecoins is high on the balance sheet, the “DeFi shield” strategy will trigger the external risks, and the process of shifting to the ESG bonds cloud take a long time.

UST by Terra Protocol

Introduction

Founded in January 2018, Terra is an algorithm-based stablecoin protocol with the goal of delivering a stablecoin system that is widely adopted.

Terra serves as the stablecoin within this system. In contrast to MakerDAO and Liquity, which focus largely on minting stablecoins pegged to the US dollar, Terra aspires to provide a wider variety of currency combinations to meet the demands of stablecoins in different regions and scenarios. Terra Protocol offers stablecoins that are pegged to several fiats including USD, KRW, Mongolian Tugrik, Thai Baht and IMF Special Drawing Rights (SDR), however, UST is by far the most widely adopted stablecoins in terms of circulation.

Beyond the diversity of the available pegged fiats, Terra differs from Maker in that it is not constrained by being only a minting or lending protocol. Terra desires to build a financial system based on the underlying monetary system, hence Terra Protocol is evolving into a DeFi-focused public chain ecosystem.

Stability Mechanism

Terra is a non-collateralized or algorithmic stablecoin. The advantage of algorithmic stablecoin is that non-collateralization provides it with greater capital efficiency, but the problem is that customers have less faith in its stability than in over-collateralized stablecoins, and the price is more likely to depeg.

Terra’s Stability Mechanism

Terra’s stability mechanism is derived from its smart contract that promises to swap stablecoins with Luna at a fixed rate, which Luna’s market cap becomes an “implicit guarantee” for all stablecoins in the protocol.

A user can mint 1 UST by burning $1 of LUNA or can swap it for $1 worth of LUNA in the protocol, details are as below:

- When UST price below $1, then arbitrageurs can buy UST on the market at a discount, and swap it for $1 worth of LUNA. Then arbitrageurs quickly sell Luna in the market, which reduces UST’s circulation until the price of the UST goes to $1 and there is no room for arbitrage.

- When UST price above $1, arbitrageurs can burn $1 of LUNA to mint 1 UST and sell UST on the open market for a profit. This arbitrage will be open until the supply of UST in circulation matches demand and the price of UST goes back to $1.

Therefore, the stability of Terra is ensured by arbitrageurs and the smooth mechanism of Luna-UST swapping.

Stability Performance

The overall stability of UST is qualified and it experienced the worst de-pegging in May when the crypto market collapsed with the lowest price once going close to $0.9.

UST price chart in the past year, source: CoinGecko

The UST stability mechanism is mostly to blame for its de-pegging at the end of May. Unlike MakerDAO’s users, who must deposit tokens such as ETH to mint the stablecoin Dai, Terra’s users don’t have to deposit Luna for UST. It seems that Terra’s users bear no liquidation risk if the price of collateral slumped, but the risk was transferred to the whole Terra Protocol.

Arbitrageurs who maintain the stability of UST are willing to buy UST below $1 because they believe that 1 UST is enough to swap for $1 of Luna and that they can quickly sell it on the secondary market for a profit. Under extreme conditions, if the market cap of Luna crashes and is less than the total market cap of Terra stablecoins, theoretically the sell-off of Luna was not enough to reinstate the stablecoin peg. Arbitrageurs selling Luna on the open market to make a profit is the final step leading to the collapse and even death spiral of Luna, followed by the insolvency of Terra Protocol.

Properly speaking, Luna is not a collateral asset to mint stablecoins, but an “implicit guarantee” to maintain the price of stablecoin, which is an important incentive for arbitrageurs.

If Luna’s market value climbs to a peak and there is strong demand for DeFi protocols, the minting of stablecoins will boom. However, when experiencing a sharp bull-to-bear-market transition, Luna’s price slumps and its market value crashes in a short time. As a result, the “implicit guarantee”, Terra Protocol will be in a debt crisis because the value of secured assets is not enough to pay off the debt, which is an obligation for the system.

In fact, in late May of this year, Terra’s stablecoin went through a temporary crisis as the crypto market crashed.

The de-peg of UST in May 19 and May 24; Source: CoinGecko

Terra’s team has been aware of the mechanism’s flaw, in addition to the arbitrage stabilization mechanism, Terra has introduced miners to jointly bear the system risk by adopting PoS as the consensus mechanism of the mainnet, in order to improve the system’s robustness when facing bull-bear market transitions.

Business Data

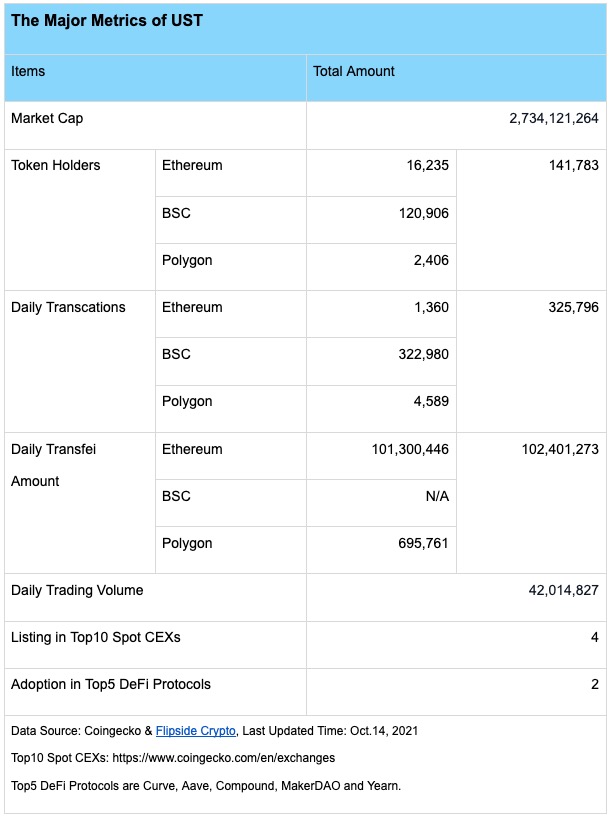

The statistic is based on UST:

We found that the circulation and activity of UST are mainly on Terra’s ecosystem because numerous DeFi applications on Terra’s mainnet help build the initial user scenarios of UST and improve user retention. Terra thinks that stablecoin is the most essential product in DeFi, it has implemented a “stablecoin-first” strategy in the ecosystem, designed a public chain based on stablecoins, and developed and integrated a large number of DeFi applications to build scenarios and boost demand for its stablecoin.

Tokenomics

The Terra Protocol has 2 different tokens: Luna is the governance token, and Terra is the stablecoin with Luna as the underlying asset.

The Terra blockchain is a proof-of-stake blockchain, powered by the Cosmos SDK and secured by a system of verification called the Tendermint consensus. Validators can produce a block every 6 seconds and users can delegate Luna to the validators.

Token Supply, Allocation, and Circulation

Luna planned supply is 1,000,000,000, but the total supply of LUNA stands at 995,415,000 and the circulating supply is 400 million. Token allocation is as follows:

| Allocation | Purpose | Ratio | Releasing Rules |

| Terraforms Labs | Incentive for the team and contributors | 30% | unknown |

| Terra Alliance | Incentive for business partners helping build usage scenario of Terra | 20% | unknown |

| Stability Reserves | To manage the stability of Terra | 20% | unknown |

| Genesis liquidity | To provide early liquidity for Luna | 4% | in circulation |

| Investors in private sale and seed round | To raise funds for Terra | 26% | in circulation |

As up to 70% of the overall token supply is subject to an unclear cliff time. We should notice that Terra Finder has relatively limited functions and is unable to verify Luna address ranks and position ratios, which lack transparency.

Value Capture

There is three utility for Luna’s holders in Terra:

- Governance Token: create and vote on proposals with parameter rules changes regarding the Terra protocol.

- Staking rewards: by delegating Luna to the validators, users receive rewards taken directly from transaction fees, tax fees, and seigniorage.

- Seigniorage Assets: To mint new stablecoins in Terra, it is necessary to swap Luna for stablecoins, and the process is known as Seigniorage. All Luna burned from Seigniorage will go to Community Pool. However, after the Columbus-5 mainnet is deployed on Terra Protocol, the system will burn all Luna from Community Pool.

When swapping Terra for Luna by using its official wallet Terra Station’s built-in Terra Swap, the fees it generates will be used to buyback Luna as validators’ rewards.

Luna is vital to the Terra Protocol in two aspects:

- Luna is the underlying asset of the POS mechanism, which is similar to the hashrate of the POW mechanism, and provides fundamental security for Terra’s network via staking.

- Luna can absorb demand fluctuations for stablecoins minted on Terra to maintain price pegs. More details are explained in the Stability Mechanism.

For Terra Protocol, the higher the market capitalization of Luna, the greater the liquidity of its stablecoins, and the more secure the system is and the less probability of stablecoin de-pegging. Conversely, if the market capitalization of Luna is too low, system security cannot be guaranteed, and there is even a chance that the overall market capitalization of Luna will fall below that of stablecoins in the Terra Protocol, triggering the stablecoin de-pegging.

Terra will spare no effort in building more utilities for Luna to increase its inherent value.

In conclusion, Luna’s value can be captured by:

- maintaining the security of the protocol and becoming the fundamental collateral during the Seigniorage process.

- accumulating most of the economic value generated when the system is running

Luna’s value capture of the Terra protocol is better than the role that ETH plays in Ethereum.

Terra stablecoin and governance token Luna are interdependent and work together to keep the entire system running.

Terra stablecoin is the core product of the system, as well as the effective means of business expansion and the source of revenue while Luna is the beneficiary of the system and the guarantee of system security.

All these make sense that Terra has built its own public chain with PoS mechanism, making Luna not just an equity token of the DeFi Protocol, but giving it the potential to capture the value of the broader public chain ecosystem, allowing holders and miners to voluntarily bear the short-term volatility of the stablecoin.

Regulatory Risk

South Korea has one of the largest proportions of its population that invests in cryptocurrencies and has a favorable attitude towards crypto assets, with pragmatic regulators making big progress in compliance this year. It has not yet leaked any regulatory policies towards public chains like Terra or stablecoins like UST. Terra Protocol is highly centralized because it is governed by the core team and institutions, and it is vulnerable to changes in regulatory policies.

Summary

Due to the “stablecoin-first” design in Terra public chain and the overall plans for DeFi projects, UST has rapidly climbed to the 5th on the stablecoin ranks in less than 6 months. However, lack of transparency, the market cap of the governance token growing faster than the stablecoin, and centralization in governance will bring both opportunities and risks to Terra Protocol.

Further reading: A Overview of Terra: How Does it Become A Rising Star

MIM by Abracadabra

Introduction

Abracadabra.money is a lending platform where users can deposit collaterals to borrow a USD pegged stablecoin (Magic Internet Money – MIM). Abracadabra’s core mechanism is similar to MakerDAO but the major difference is that Abracadabra uses interest-bearing tokens as collateral to mint MIM and it takes aggressive measures in cross-chain deployment and combination with other projects.

Abracadabra has deployed services on Ethereum, Avalanche, Fantom and Arbitrum, and BSC is in the works, though not yet officially deployed.

One of the features of Abracadabra is that it allows users to continue leveraging this position by depositing collateral to withdraw more MIMs by doing a flash loan (all interactions with the smart contract are done within one block). In Abracadabra’s case, the process is like a loop of providing collateral ➡ borrowing MIM ➡ swap MIM to USDT ➡ providing collateral, which actually leverages a long position of collateral assets.

To better explain this, let’s use the example of a user that wants to leverage his yvWETH position:

Step 1 – Bob selects yvWETH (an interest bearing token) as desired leverage. yvWETH is the interest bearing token of ETH and is proof of depositing ETH in Yearn, due to interest accrual, it will be able to be redeemed for more ETH over time.

Step 2 – Bob deposits yvWETH in Abracadabra to withdraw MIMs and swap MIM to ETH.

Step 3 – Bob deposit ETH in Yearn to generate yvWETH

Step 4 – These yvWETH tokens are deposited back into the Abracadababra to collateralize the user’s position.

This process is a loop and can be done within one block by doing a flash loan, which will save the gas fees and enhance the user experience.

leverage on Abracadabra.money

Stability Mechanism

MIM’s Stability Mechanism

In terms of stability mechanism, MIM and DAI are largely identical but with minor differences. MIM is secured by over-collateralization and seigniorage (similarly to DAI’s stability fee). Over-collateralization ensures that MIM is backed by enough collateral assets, and seigniorage is used to control the cost of MIM, which maintain the balance of MIM’s supply and demand.

Unlike Dai’s stability fee, Abracadabra don’t have a deposit module for stablecoins and it will charge 0.5% one-time seigniorage when minting MIM. If a user pay off the borrowed MIM in a month, the actual APY of one-time seigniorage (loan interest) is 6%.

Without a specific stability mechanism, the stability of MIM is primarily dependent on consensus. If users have confidence in MIM’s stability, whether it is above or below $1, they will deposit collateral to mint MIM and sell it out for arbitrage.

To maintain users’ confidence and consensus, Abracadabra builds a MIM3POOL on Curve where users can deposit their stables (MIM, USDT, DAI and USDC) to continue to give SPELL tokens as incentives for the liquidity providers.

If users provide liquidity for MIM+3CRV pool (deployed on Ethereum), there will be a high yielding by harvesting CRV token rewards with an APY of 13.43%, plus the SPELL token incentives with an APY of 11.82%, which attract many users and its TVL reached $647 million.

The Rewards APY of MIM+3CRV, Last Updated Time: 10/14/2021; Source: Curve

In addition, Abracadabra create a MIM+2CRV Factory Pool on Curve( deployed on Arbitrum). LPs can yield an additional 38% SPELL token reward and maker fee rebates

MIM+2CRV Factory Pool on Curve (Arbitrum); Source: Curve

Abracadabra offers extra rewards for LPs on Curve (Arbitrum)

MIM does not have much innovation in the stablecoin’s mechanism, but it spares no effort in the market depth.

Stability Performance

Since MIM was issued not a long time, in its 3-month running, there hasn’t been a volatile de-peg yet with the price ranging from $0.98 to $1.01.

Business Data

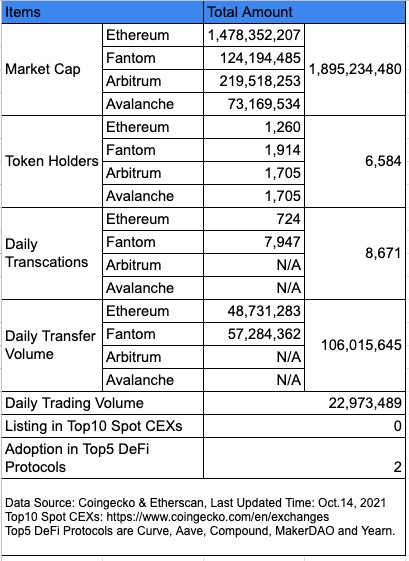

The major business data of MIM are as follows:

Through the above data, we find that there are several MIM has the following :

- The number of token holders is less and most tokens are held by whale address.

- The transaction frequency is low, but the value per transaction is high.

- The majority of TVL are in Ethereum, however, users on Fantom and Arbitrum are more active.

When combined with the data on Curve’s MIM, it becomes apparent that Curve is currently the most popular destination for MIM, with approximately 45% of MIM on Ethereum and 38% of MIM on Arbitrum trading on Curve.

Abracadabra has deeper integration with leading DeFi protocols in product mechanism and asset portfolio, as reflected by adding Yearn’s interest-bearing tokens as collateral, Sushi’s Kashi lending engine, direct integration of cross-chain bridge Anyswap, and adding Convex’s interest-bearing tokens as collateral which is

a market maker and staking platform for Curve.

Besides, it also supports assets like the ALUSD of Alchemix, a future-yield-backed synthetic asset protocol, and the FTM of Fantom.

Adding interest-bearing tokens, utility tokens of other DeFi protocols and new public chains as collateral might, on the one hand, attract the target audience to Abracadabra and support the rapid growth of its company. On the other hand, it also magnifies the risks, particularly the risk of smart contract, where the massive integration of other DeFi protocols not only increases the complexity of the DeFi composability but also strengthen the security correlation between Abracadabra internal system and external DeFi protocols.

It is important to note that Abracadabra is firmly backed by projects of AC such as Fantom and Curve where Yearn holds a sizable amount of veCRVs and has a strong say in the distribution of liquidity incentives for CRVs.

Tokenomics

Token Supply, Allocation and Circulation

Apart from MIM, Abracadabra has 2 main tokens:

SPELL: the protocol’s token which is used for incentivization.

sSPELL: obtained by staking SPELL tokens and used for fee-sharing and governance

When users single-side stake the SPELL tokens they receive sSPELL tokens which represent the share of the SPELL fee pool vote on governance proposals with a mechanism similar to the SUSHI/xSUSHI one.

The total supply of SPELL is 210,000,000,000 and the allocation is as follows:

- 45% (94.5B SPELL): MIM3POOL rewards on Curve

- 30% (63.0B SPELL): Team allocation (4 Year Vesting Schedule)

- 18% (37.8B SPELL): ETH-SPELL rewards on Sushiswap

- 7% (14.7B SPELL): Initial DEX Offering

The speed of allocation is as follows:

- 45% of the total supply will be used to incentivize MIM-3LP3CRV stakers. A 10 Year halving model will be followed, which will cut in half the rewards distributed every year

- 18% of the total supply will be used to incentivize ETH-SPELL SLP stakers. 75% will be distributed in the first year and 25% for the second year.

- 7% of the total supply has been distributed via an IDO, half on Uniswap v3 and half on Sushiswap.

- 30% of the total supply is allocated to the team members which is vested as follows:

This indicates that SPELL will have high inflationary pressure in its first year, with the circulation reaching approximately 40% in the first year and gradually declining thereafter.

Value Capture

According to the official doc from Abracadabra, the cash flow are mainly come from:

- interest and borrow fee

- 0.5% one-time seigniorage

- 10% of the liquidation fee

Part of the protocol revenue will be used to buy back SPELL tokens and distributed to sSPELL users. According to the official documentation, 75% of the protocol revenue will be used to buyback SPELL tokens, while 25% will be used to build up a treasury.

Regulatory Risk

Due to the fact that MIM’s collateral mostly consists of several kinds of DeFi interest-bearing tokens, as opposed to MakerDAO, which has a big proportion of centralized assets, Abracadabra’s balance sheet is less affected by regulation. And it is still in the early stage from the perspective of popularity, trading volume and userbase, it is unlikely to be confronted with the regulation in the short term.

Summary

Abracadabra’s core mechanism is similar to MakerDAO, but is more aggressive than MakerDAO, especially in multi-chain deployment, collateral types and protocol integrations, which bring growth opportunity but also increase the risk of smart contract composability and external failure. Although the minting volume of MIM is high the amount of token holders are small and scattered on different chains. We can draw the conclusion that it has not been adopted largely yet as a payment network.

LUSD-Liquity

Introduction

Liquity is a decentralized cryptocurrency protocol that allows to borrow LUSD, a stablecoin pegged to USD, by depositing ETH as collateral. Liquity project started in 2019. The white paper was released in May 2020, and the project went live on Ethereum on April 15 this year. After its launch, it quickly attracted over 1 million Ethereum funds due to the system’s subtle design, and at its peak, the deposit amount exceeded $4 billion, with no major security or mechanism issues exposed till now.

Stability Mechanism

Stability Mechanism of LUSD

The core of LUSD’s stability mechanism is that the system allows users to mint or loan LUSD by pledging ETH at a price of 1USD or repay or redeem LUSD at a price of 1USD to recover ETH.

Repayment means that users with LUSD outstanding can return LUSD to the system and then receive their collateral ETH back; Redemption means that any user can swap LUSD for ETH from the user with the lowest collateral rate at any time for the price of 1 USD. Under this mechanism:

When the price of LUSD in the market is above $1:

Users can mint new LUSD and sell them to the market for a profit, but they are not required to (the cost of LUSD minting is only 1USD). There are various restrictions, including the 200 LUSD in liquidation costs that were set aside for the new position and the minting and redemption costs (which are controlled by an algorithm and range from 0.5% to 5%; the mechanism is detailed below). The minting of LUSD is always valued at 1 LUSD = 1 USD (in ETH), but as the minimum collateralization rate at the time of minting is capped at 110%, any user can benefit by starting a new position to buy LUSD and immediately selling it to the market when the LUSD price is over 1.1. This could be considered the upper limit of price control reserved by the system.

When the price of LUSD in the market is below $1:

Users who owe money to the system will be encouraged to purchase LUSD from the market (since their LUSD minting cost is 1 USD). The system establishes a price floor through “redemptions” in some extreme instances, such as when the market is extremely illiquid and the borrower is unable to purchase LUSD from the market. Any user may purchase LUSD on the market at any moment for less than 1 USD and redeem 1 USD worth of ETH from the system.

This mechanism is what Robert Lauko, the founder of Liquity, calls a “hard peg”: the price of LUSD is kept between [ 1 – redemption rate, 1.1 ] USD by allowing the entire market to engage in open arbitrage. The LUSD price stability mechanism is well-illustrated in the following chart:

Source: On price stability of Liquity, Soft versus hard pegs

Stability Performance

Except for the initially somewhat higher price, LUSD has performed consistently well since its formal launch. The subsequent price has consistently ranged between $0.98 and $1.03, hovering around $1 most of the time. Even after the price of ETH crashed in late May, the fall in prices for LUSD was brief and of a modest scale, indicating comparatively decent stability.

Data Source: Coingecko

Business Data

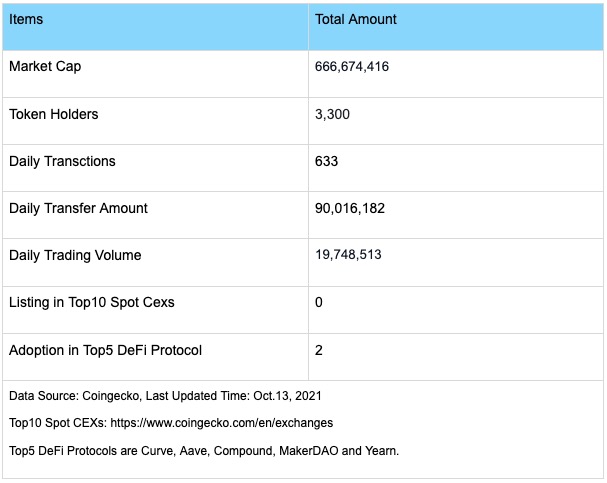

The major business data of LUSD are as follows:

We found that the number of holders and the daily transactions of LUSD are tiny at the moment, despite a large number of issue, reflecting the small user base and low activity of the project.

However, only a very little portion of the LUSD is actually used for trading, liquidity, or value storage; the majority of the them are staked in the system’s stability pool.

Tokenomics

Token Supply and Circulation

The total supply of LQTY is 100,000,000 and was issued with the launch of Liquity’s mainnet on April 5, 2021. As of July 8, 2021, there are 6.31 million LQTYs in circulation (data source: Dune Analytics) with a market cap of 33.5 million.

- 35.3% LQTY is allocated to the community, of which 32,000,000 LQTY is allocated to the LQTY reward pool. These tokens are used to incentivize deposits to the Stability Pool, with a cumulative distribution following the function: 32,000,000 (1-0.5 ^ year). That is, 16 million are distributed in the first year and 8 million in the second year; 1,333,333 LQTY are allocated to the LPs of the LUSD-ETH Uniswap pool and distributed within 6 weeks after the protocol goes live; and 2,000,000 LQTY are set aside for the Community Reserve Fund.

- 23.7% LQTY is allocated to current (and future) employees and consultants of Liquity AG with a one-year lock-up period, after which 1/4 of LQTY is unlocked and then 1/36 of them each month.

- 33.9% LQTY is allocated to the investors, of which 33,902,679 LQTY is allocated to the early investors with a one-year lock-up period.

- 6.1% LQTY is for Liquity AG fund with a one-year lock-up period.

- 1% LQTY is allocated to the service providers with a one-year lock-up period.

The circulation volume in the 36 months after launch is shown in the following chart:

Source: https://medium.com/Liquity/Liquity-launch-details-4537c5ffa9ea

We can see that after the launch for 12 months, the LQTY vesting will peak in April 2022, when the total volume of circulation will reach 75 million.

Value Capture

First, it is important to note that Liquity is different from many other lending and over-collateralized stablecoin protocols:

1. LQTY does not have a governance function;

2. There is no interest after users collateralize ETH to lend LUSD.

Therefore, the only utility of LQTY is to capture the minting and redemption fees of the protocol.

Again, minting refers to the process of users collateralizing ETH to obtain LUSD; redemption refers to the fact that any user can redeem ETH with LUSD from the user with the lowest current collateralization rate at any time at the price of 1 USD. The fees incurred in both processes are the minting and redemption fee, which are dynamic.

In particular, the amount and the duration of redemptions affect the minting and redemption rates. In simple terms, when the system is idle, the minting and redemption costs decrease (to a minimum of 0.5%), and they rise as redemption amounts rise. Because redemptions are essentially a type of user arbitrage, there is relatively little demand for them during regular times and only occasionally when the price of LUSD is less than 1 USD.

This means that when Liquity’s system is running smoothly, there is less minting by users; and when the price of LUSD is pegged and there is no room for arbitrage, LQTY holders will earn less.

As a result, LQTY benefits more from the liquidity scaling caused by market cycle transitions and captures little system revenue when it remains stable.

Regulatory Risk

The Liquity protocol is subject to very little human intervention with parameters that are either fixed or controlled by the algorithm. This also means that even if it is entirely out of human control, it can keep running relatively well on its own without requiring extensive governance work to advance (except for commercial and marketing work such as token utilization expansion). According to this viewpoint, the protocol is less likely to face regulation intervention and is more resistant to censorship.

Summary

Liquity has an excellent mechanism design, and the token’s historical stability has been largely verified. Its governance-free and less human intervention mechanism also enhances its ability to resist regulation. Its main problem is that it currently has a small user base, low trading activity, and few supported CEX and large DeFi projects, which make it not in a self-reinforcing cycle. LQTY has a lower intrinsic value than other tokens with the same volume grade since the project’s cash flow is mainly derived from token minting and redemption fees, and there is no predictable income that can be earned over the long term.

Fei By Fei Protocol

Introduction

Fei Protocol is an algorithmic decentralized stablecoin protocol deployed on Ethereum and released its white paper and project description in January 2021. It began the Genesis launch on March 31, raising 639,000 Ethereum in 3 days, minting 1.3 billion stablecoins Fei and breaking previous fundraising records in DeFi space. The investment of Fei Protocol includes A16Z, Coinbase Ventures Framework Ventures, ParaFi Capital, and Jump Capital, among others.

Fei Protocol offers a totally new approach to dealing with the low capital efficiency and scaling issues of traditional overcollateralized decentralized stablecoins, the high volatility of algorithmic stablecoins, and the withdrawal of liquidity from traditional lending protocols.

The main differences:

- Adopt the PCV (Protocol controlled value) model: Unlike MakerDAO and Liquity, where users can get back their collaterals once they repay the loan, they cannot get back them in Fei protocols. The collaterals are used to mint Fei in the protocol and will be used mainly for ‘peg adjustment’ – one of the core stability mechanisms of Fei – which will be discussed in detail in the chapter on Stablecoins Mechanism. In addition, the protocol will also use PCV assets for other long-term benefits to the protocol by governance.

- Adopt a ‘direct incentive’ mechanism: When the price of Fei falls below the peg price threshold ($1), users will be rewarded for buying Fei, while they will incur more losses by selling Fei. So the mechanism is called as the ‘burn mechanism’.

- The project has governance tokens, but follows the governance minimization principle, and the stability of the system and the increase or decrease of the currency is mainly based on the algorithm.

However, as the project went live, many of the above initial mechanisms were modified through community governance proposals. For example, the ‘burn mechanism’ in the ‘direct incentive’ was canceled soon after it went live due to community dissatisfaction. Then the entire ‘direct incentive’ mechanism was abandoned in the FIP-4 proposal in June this year, and they added a new method of redeeming ETH with FEI.

Stability Mechanism

There are some basic concepts we need to know before we go deep into the stabilization mechanism of the Fei protocol:

- The ETH (and other supported assets) deposited to Fei Protocol will become PCV (Protocol Control Asset). Most of the PCV will be used to support the market in Uniswap for FEI, thus ensuring the liquidity of FEI.

- The process of swapping ETH to FEI is based on a Bonding Curve.

Now we go deep into the stablecoin mechanism.

a. Stability Mechanism of Fei

The stability mechanism of the Fei Protocol consists of two main components as follows:

- PCV-based ‘peg adjustment’ mechanism: when the FEI price is above $1, PCV maintains the status quo and balances the FEI price mainly through user arbitrage. Through the protocol, users can mint FEI with ETH and later sell them at Uniswap to do the arbitrage. However, when the FEI price is below $1, PCV will remove the liquidity from Uniswap and then swap a portion of ETH to FEI to bring the price back up to $1. After that, PCV funds will add liquidity to the pool at $1 for FEI. The extra FEI will be burnt to reduce the amount of FEI in circulation.

- ETH redemption mechanism: Less than a month after the protocol officially went live, the redemption mechanism for FEI went live, allowing users to redeem Ethereum at a ratio of 1FEI: $0.95$ETH. Then in August this year, the redemption ratio was adjusted to 1FEI: 0.99$ETH, which realized the guaranteed price of ETH to FEI.

b. Stability Performance

Although Fei Protocol was one of the highest-funded protocols, its performance was a major disappointment. After its project officially launched and completed its stablecoin distribution, Fei’s price remained below $1 for a month. Until early May it was back near $1$. However, with the crypto market crash in late May, the PCV value of Fei Protocol dropped rapidly, causing the short-term de-peg of Fei again. Fortunately, the scope of this de-peg was smaller, with the lowest short-term drop to $0.93$; then, it returned to the peg price after May 24. Since then, the market cap of Fei has remained around $1$.

The Price Performance of Fei;Data Source: Coingecko

Fei has experienced two de-peg for different reasons.

The first de-peg occurred soon after the project launch and was caused by the imbalance between supply and demand. The main reason for the de-peg was that the project launched in the bull market, and the users got a full passion for participating in the minting of a large amount of Fei to get the governance token Tribe at the project launch (cause the oversupply). As a brand new stablecoin, Fei had no usage scenario at the beginning of the launch (insufficient demand). Therefore, this severe imbalance between supply and demand in the early stage directly led to the de-peg of Fei, and then formed a serious panic, leading to further panic selling by Fei holders. It took nearly a month for this serious stampede to recover.

The second de-peg was caused by concerns about the lack of protocol PCV assets. It occurred during the crypto market crash in May when PCV assets were mainly ETH. The rapid plunge in ETH in May led to a big drop in the value of the assets (PCV) in the system, triggering concerns about the intrinsic value of Fei. It caused another de-peg of Fei. While this time, the de-peg was shorter in duration and returned to the peg price quickly.

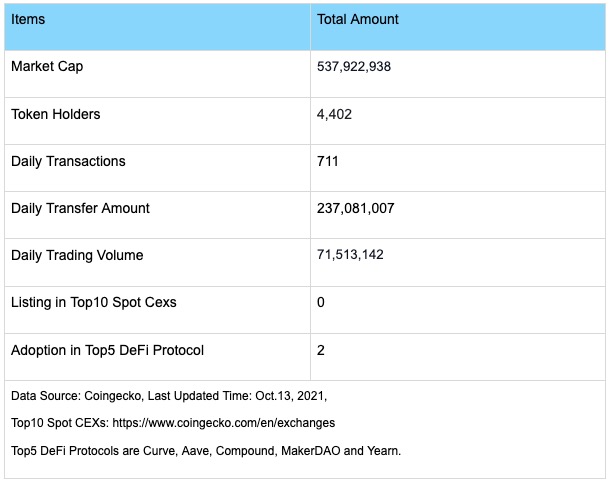

Business Data

We can see from the data that the number of Fei users and transactions is still deficient, and so is the user and payment activity.

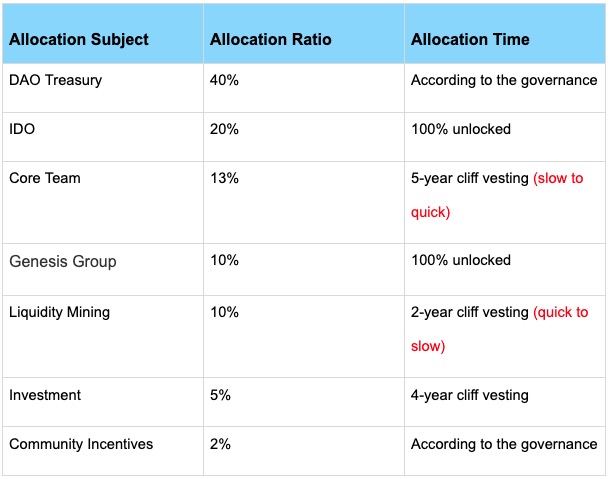

Tokenomics

Tribe is the governance token of the Fei Protocol.

Token Supply, Allocation and Circulation

The total supply of Tribe is 1 billion, with the allocation is as follows:

Value Capture

Fei protocol is a project that has undergone significant changes. Although it has only been officially launched for six months, its core mechanics and token designs have already undergone many changes.

According to its white paper, the main role of Tribe is for governance proposals, which are mainly related to the following two categories:

- Annotate new tokens for minting Fei, and adjust the price function of the Bond Curve used for minting.

- Authority to employ and allocate PCV funds

In short, Tribe’s role is to: 1. determine what assets and algorithms are used to mint Fei; 2. have access to the assets controlled by the protocol and determine how to use these funds. Like Liquidity, Fei protocol also pursues ‘light governance’. Hence, as the core governance token of the protocol, Tribe has a relatively small scope of governance on the protocol. Its more significant role is the right to call the liquidity of the vast assets within the protocol.

For example, the community has allocated the protocol’s PCV assets to multiple DeFi platforms through proposals, including depositing ETH into Compound, Aave and pledging at Lido, and also purchasing a portion of the DPI index assets (DeFi index-based assets issued by Defi pulse in partnership with Set Protocol).

And in August of this year, Fei protocol founder Joey proposed the idea of Fei V2. On October 7th, Joey further explained the details of V2, whose core points include:

- Enhanced the peg: Fei is guaranteed to be able to redeem counterparts at a 1:1 ratio, thereby achieving a strong peg and a stable consensus for Fei.

- Enhance the value-added and risk management flexibility of PCV assets: The Smart Pools feature of Balancer V2 will be used to further improve the capital gain efficiency of existing PCV assets, automatically and dynamically adjust the asset allocation ratio, and governs the various parameters of the Smart Pools through Tribe.

- Tribe’s value and liability are further profoundly tied to the protocol: when the ratio of the value of PCV assets and Fei minted is above a certain target value, it means that PCV’s funds are well managed and value-added, from which a portion of it will be withdrawn to repurchase and burn Tribe, as well as put into the DAO reserve pool and the liquidity incentive pool. And if the value of PCV plummets, causing the ratio of the value of PCV and Fei in circulation to fall below the target value, then Fei will be able to mint Tribe to sell for $1:$1$ to ensure its peg. In this case, the Tribe is equivalent to becoming the system’s cashing reserve in disguise.

Under this mechanism, the Fei protocol essentially becomes a liquidity protocol. The PCV liquidity it controls can be used as a bargaining chip with other liquidity-hungry DeFi protocols for greater benefits.

However, the code of the V2 mechanism is still under audit, and more details of the mechanism are still to be observed and analyzed after its launch. And it is expected to launch in November.

Regulatory Risk

Fei protocol currently faces less regulation pressure, mainly because of its small business volume and few stablecoin use case scenarios at the moment; thus, it has a low probability of being included in the regulatory landscape.

Summary

Despite many innovations, Fei protocol is retained mainly in the PCV module. Its stability mechanism has returned to the DAI-like PSM module and Liquity’s promissory model. V2 upgrade is expected to solve the problem of the weak presence of Tribe, but the practice of its specific mechanism remains to be observed after V2 goes live in November. Regarding business performance, the number of users and transactions of Fei as a stablecoin is tiny, and the project is still far from entering a positive cycle.

Summary

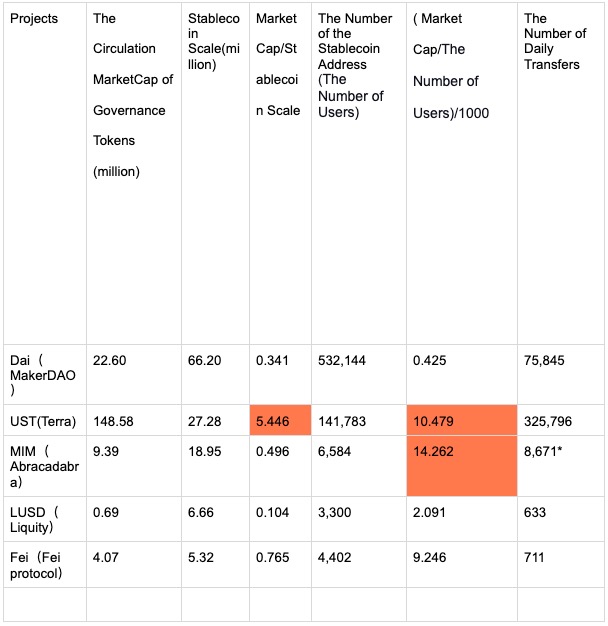

In this article, we focus on the market business volume share of decentralized stablecoins and the stability mechanism, business data and token model of 5 projects in the top 10 decentralized stablecoins. Next, we compare the circulation market cap of governance tokens (value-capturing assets of the protocol) with the project’s stablecoin business data to see the connection between project valuation and the actual business of the stablecoin.

MakerDAO and Abracadabra share relatively similar revenue and token value capture methods. In contrast, other projects hold significantly different value capture and token models for their governance tokens, so we cannot directly compare each project with traditional transversal valuation metrics such as P/S, P/E, etc. Only by comparing the market cap of a project’s governance token (which can be interpreted as the market’s assessment of the governance token’s control over the project and the corresponding cash flow) with the core data of its stablecoin business, such as the market cap/stablecoin size ratio and market cap/address number ratio listed in the article, can we learn some facts about the projects.

The Present

Among these five decentralized stablecoin projects, only DAI and UST own a large user volume and number of transfers, and DAI dominates in terms of issuance and trading volume. The other three projects are in the early stages of user growth as well as their user activity, especially LUSD and Fei.

Regarding Luna, it is a little different in that it has overstepped from a stablecoin protocol to a stablecoin-based DeFi public chain and therefore also enjoys a higher market valuation. And with its public chain GAS supporting payments in UST, its stablecoin on-chain metrics also appear to be very high.

The Future

MakerDAO is firmly rooted in the decentralized stablecoin segment and is actively expanding its integration with real-world assets, as well as trying to address higher dimensional human issues – environmental protection and green finance – through the transparency of DeFi, and the flexibility of economic incentives. MakerDAO has a clear strategy with a promising second growth curve. But the penetration into the real world and the grand narrative opens up a higher valuation space for DAI on the one hand but also allows MakerDAO’s operating costs to surge on the other. Leading decentralized stablecoin, it also faces severe regulatory risks.

The Terra protocol, supported by UST, has a clearly defined future strategy. They try to create an initial financial scenario for the stablecoin with a self-built DeFi matrix, and use the core of Tendermint to open up interoperability with other public chains and expand stablecoins such as UST to more chains such as Solana. However, Terra is more centralized than MakerDAO and may be more vulnerable to regulation.

Through its aggressive cross-chain strategy, high composability, and fast synergies with multiple projects, Abracadabra is fast increasing its issuance, but it also gets some early use cases. However, it cannot be compared to the two top projects in the sector in terms of user volume and fundamental business statistics (such as the number of transfers). Whether a more extensive group will adopt MIM as a stablecoin instead of just a mining asset under a nested mechanism is still debatable.

The core issue of Liquity and Fei protocol is the use case of their stablecoins. Regarding the user number and transfer activity of stablecoins, it is difficult to call these two projects a success even though they have been developing for most of the year. There is no clear breakthrough idea to deal with the problems mentioned above.

Despite the pressure of regulation, MakerDAO has a promising prospect with its clear strategy and comprehensive plans. And as for the Terra protocol, it sorts out the road of differentiated stablecoin exploration and broadens its impact by expanding its influence in the field of ecology with the scenario. The next thing to consider is how smoothly its cross-chain business will develop. While MIM, LUSD and FEI, are still stuck in the user growth problem, it is crucial to focus on whether they can find an effective user expansion strategy to overcome the network effect of the leading stablecoin.

Besides these five projects, the tough but immense market of decentralized stablecoins still has numerous competitors emerging. With regulatory uncertainty, the battle is far from over.

Reference

Tokens and Projects Data:

On Chain Data: