Contents

Key Insights

Core Investment Logic

What Terra is doing is the most anticipated narrative in the crypto world right now – breaking down barriers between crypto adoptions and traditional business. If the experiment is a success, Terra has high expectations for its ability to continue taking resources from other crypto industries while also fostering ecological development in the future.

Terra has achieved a certain degree of success which comes from a series of aligned and sequential actions, with the team taking great care to develop their strong points. This achievement is the result of insights into the industry and excellent strategic planning. The advantages of Terra are as follows:

To build its own public blockchain and integrate with Tendermint Core, which will provide the project with higher scalability, full independence and a robust macro-policy toolbox for public blockchains, ensuring the interoperability of Terra with other external ecosystems and the development space of stablecoins.

Stablecoin + DeFi combo strategy. The DeFi ecosystem offers the initial use cases for stablecoins to help stablecoins get off the ground quickly, increase their market capitalization and trading volume, and become a tier one stablecoin.

Rich commercial resources. The project’s founder is a well-known business leader in the Korean Internet industry. He established Terra Alliance, which is an industry alliance made up of a large number of top Korean Internet organizations, allowing Terra’s ecosystem to provide customers with easier access to DeFi products than other crypto-native projects.

Regulatory policy and crypto adoption. Terra is located in South Korea, which has a very large amount of cryptocurrency investor and a relatively practical regulatory environment, allowing Terra’s exploration to crack the sandbox and boost adoption.

Main Risks

The key risks of the project include a high degree of centralization, unpredictability in regulatory policies, bottlenecks in product growth, a lack of transparency in the project information, and the potential for a debt crisis under extreme market volatility, all of which require investors’ close attention.

The Overview of Terra

Project Scope

Terra Protocol is an algorithmic stablecoin protocol that aims to provide a price-stable and widely-adopted stablecoin system.

Terra serves as the stablecoin within this system. In contrast to MakerDAO and Liquity, which focus largely on minting stablecoins pegged to the US dollar, Terra aspires to provide a wider variety of currency combinations to meet the demands of stablecoins in different regions and scenarios. Terra Protocol offers stablecoins that are pegged to several fiats including USD, KRW, Mongolian Tugrik, Thai Baht and IMF Special Drawing Rights (SDR), however, UST is by far the most widely adopted stablecoins in terms of circulation.

Beyond the diversity of the available pegged fiats, Terra differs from Maker in that it is not constrained by being only a minting or lending protocol. Terra desires to build a financial system based on the underlying monetary system, hence Terra Protocol is evolving into a DeFi-focused public blockchain ecosystem.

Terra’s founding team and principal market are located in South Korea, which is known as the most crypto-crazy country in the world.

Milestones and Roadmap

Terra was founded in January 2018. According to the whitepaper, Terra is designed as a decentralized stable currency to complement both existing fiat and cryptocurrencies, driving wide adoption of cryptocurrencies.

Milestones

- In January 2018, Terra was founded.

- In August 2018, Terra has raised $32 million which is led by Binance Labs, Okex, Huobi Capital and Dunamu & Partners (the investment firm of Upbit operator Dunamu) with the investment arms of Polychain Capital, FBG Capital, Hashed, 1kx, Kenetic Capital, Arrington XRP.

- In June 2019, Terra’s Payments dApp CHAI went live. The company reached 500,000 users by October 2019 and launched a physical card in July 2020. As of August 2021, Chai had a total number of 2,466,000 users according to the official statement.

- In April 2020, Solana partnered with Terra to bring stablecoins to the Solana ecosystem and strengthened cooperation with Terra by leveraging the strengths of both parties.

- In September 2020, there were 2 million accounts on Terra.

- In December 2020, Terra launched Mirror Protocol, a synthetic asset protocol.

- In January 2021, Terraform Labs raised $25 million in a new round from Galaxy Digital, Coinbase Ventures, Pantera Capital and Coinbase Ventures. The new funding will be used to build infrastructures such as Mirror and Anchor.

- In March 2021, Anchor Protocol launched its V1 after closing a total of $20 million fundraising led by Arrington XRP Capital, Hashed, Galaxy Digital, Pantera Capita, Naval Ravikant(founder of AngelList), Delphi Digital, Dragonfly Capital, Alameda Research.

- In July 2021, Terra launched a $150 million ecosystem fund, supported by Arrington Capital, BlockTower Capital, Delphi Digital, Galaxy Digital, Hashed, Pantera Capital, ParaFi Capital, QuantStamp and many others. The goal of the fund is to sponsor dApps inside the Terra ecosystem and to propel Terra towards its next adoption phase augmenting an accessible DeFi supersystem targeting mainstream adoption.

Terra team is now focusing on developing Columbus-5, the newest version of the Terra mainnet. Columbus-5 is Terra’s boldest and most significant mainnet upgrade including some key changes regarding Treasury allocation and burn module.

Difference between Columbus-4 and Columbus-5

Business Landscape

As mentioned in Project Scope, Terra can be viewed as a public blockchain platform centered on the stablecoin protocol. When evaluating its business performance, we must consider two aspects:

- the growth of the stablecoin industry;

- the activities on the public blockchain and the ecosystem.

Terra’s Stablecoins

Despite the fact that Terra Protocol offers stablecoins that are pegged to several fiats, UST, which is pegged to USD, is the most widely adopted stablecoins by far, so the data analysis is based on UST.

Market Cap

As of August 4, 2021, UST had a market cap of $2.05 billion, ranking it 5th among all stablecoins.

The other two primary stablecoins on Terra are SDT, a stablecoin pegged to the SDR(Special Drawing Rights of International Monetary Fund), and KRT, a stablecoin pegged to the Korean won. The volume of SDT minting has reached 712 million ($1.01 billion), whereas the volume of KRT minting is 43.8 billion KRW ($38 million).

Trading Volume

Compared to its market capitalization, UST’s trading volume ranking is much lower, with UST and Wrapped UST ranked 10th in total trading volume.

According to the market share, the biggest exchange on UST trading volume is Kucoin, which has more active international users. On August 2, 24-hour UST volume on Kucoin accounted for 33.8% of total volume, followed closely by Curve, a protocol focused on swap of stablecoins and wrapped tokens, and Terraswap, the official DEX of Terra, ranking in third place. In terms of trading pairs, UST-USDT on Kucoin and Curve are the largest two, followed by UST-MIR, which is a synthetic asset of Terra. UST-LUNA, Terra’s utility token, also has a large volume and it is mainly traded on Kucoin.

Generally speaking, swaps between stablecoins dominate the UST trading volume and Kucoin is the most popular CEX for Terra users.

Transfers

The average amount of daily transfers on the Terra blockchain for UST in the last 180 days is approximately 220,000. Recently the number has been over 300,000 which doubled from the bottom in the middle of June.

Note: We only counted transfers for UST on Terra mainnet.

Data Source: Flipside Crypto

As far as the metric is concerned, UST is doing fairly well, nearly catching up to the amount of activity occurring on BSC for BUSD, which has recently been over 400,000 transfers per day.

Data Source: https://bscscan.com/

At the same time, the average number of daily transfers on Ethereum for USDT is approximately 110,000.

Data Source: https://etherscan.io/

TRC20 based USDT is the dominating stablecoin as a trading medium with daily transfers is approximately 550,000.

Data Source: https://tronscan.org/

Velocity

Velocity is a macroscopic indicator derived from the velocity of M2 Money Stock, which refers to the turnover rate of a unit of currency exchanged in the real economy. Specifically, it is the number of times one dollar is spent to gauge consumer activities per unit of time which excludes investment activities. A higher velocity figure indicates more vigorous economic activities.

Velocity of M2 Money Stock, retrieved from Federal Reserve Bank

And in the case of Terra blockchain, the velocity refers simply to the turnover of Terra’s stablecoins and not to specific consumer activities. We found that the velocity of UST has been on the downward track after peaking in mid-to-late February this year.

Data Source: https://terra.flipsidecrypto.com/

We also found an interesting fact that the velocity of KRT, Terra’s stablecoins pegged to KRW, is relatively smooth, with the number consistently hanging around 9.

Data Source: https://terra.flipsidecrypto.com/

UST and KRT are two of the top three stablecoins issued by the Terra protocol, and based on the movement and comparison of their velocity, application scenarios of the two stablecoins are quite different.

- The primary use case for UST is in DeFi, namely for trading and lending. In February, as the whole crypto market soared, the velocity of UST reached a peak. And then when UST’s minting volume grew rapidly, the velocity began to decline. Moreover, Anchor, a saving protocol launched in March, took many UST deposits from holders, which increased the saving rate of UST and contributed to the further decline of the velocity.

Data Source:Coingecko Since the end of February in 2021, the minting volume of UST has increased while its velocity has decreased.

- KRT, pegged to the Korean Won, has few DeFi application cases and is not supported by Anchor and Mirror on Terra ecosystem. The velocity of KRT remains generally stable, reflected by the fact that KRT is free from the crypto cycle and is mostly utilized for local payments such as e-commerce or offline shopping via Chai, a mobile payment app on Terra, therefore its velocity remains relatively stable.

Summary

Since the official deployment started last year, Terra’s stablecoins have quickly risen to the top 5 in terms of market cap and circulation, and UST’s average daily transfers are also very high in terms of on-chain activity. However, UST is still far behind both the decentralized stablecoin Dai and the centralized stablecoins such as USDT, USDC, and BUSD in terms of trading volume.

It is astonishing that Terra, a relatively new stablecoin protocol, has made many achievements in only three years. The development of the ecosystem, which provides a suitable demand for UST, is the reason why Terra’s stablecoins were able to make a cold start in a short time and get through the close siege, becoming one of the top stablecoins.

Then let’s dive into the analysis of Terra’s ecosystem.

Terra’s Ecosystem

Business Data

The Terra blockchain is a proof-of-stake blockchain powered by Tendermint consensus with producing a block every 6 seconds. The active validator set is made up of the top 130 validators and the rank is determined by their stake or the total amount of Luna bonded to them.

Due to the adoption of Tendermint and PoS consensus mechanism, Terra’s subsequent stablecoins would have better access to COMOS and other PoS ecosystems, hence increasing Terra’s market penetration.

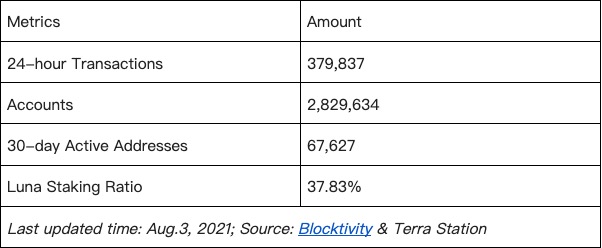

According to the disclosed information, the major metrics of Terra are as follows:

Ecosystem-building Strategy

Terra has chosen a very different competitive strategy from the majority of public blockchains in ecosystem building.

- A: The inner driver of a public blockchain is different

Ethereum, BSC, and Solana all portray themselves as open and decentralized platforms. Although a stablecoin protocol is vital for public blockchains, it is merely part of the DeFi ecosystem, let alone the whole blockchain ecosystem. It indicates that the Ethereum ecosystem and other blockchain ecosystems are open and free to explore including not only DeFi protocols but also games, social applications, DAO, privacy protocols and so on. Whether the public blockchain can survive the competition depends on its capacity to triumph in the free market.

Terra is first and foremost a stablecoin protocol and then a public blockchain ecosystem, and the applications on Terra ecosystem all share a very clear vision——to grow demand for Terra’s stablecoins, broaden its usage scenarios, and foster mass adoption around the world.

Terra’s competitive strategy is focused on the growth of stablecoins, whereas other rivals concentrate on the bilateral market of developers and users. Due to the built-in network effect of money, when Terra gained mass adoption, its ever-growing stablecoin network will feed the public blockchain ecosystem built on the Terra protocol.

This competitive strategy helped Terra form a distinctive ecosystem with all DeFi applications in the early stage because DeFi was the most effective product in boosting demand for stablecoins.

If applications are the driver for most public blockchains and stablecoins are the driver for Terra ecosystem.

- B: The target audience is different

The target audience of most public blockchains are crypto natives or crypto investors, a small (though rapidly growing) but adventurous group who embrace the ideals of decentralization (although this spiritual trait faded with the user base growing) and have a high level of financial independence and cognition.

Terra, on the other hand, is more focused on growing its user base beyond the crypto world, aiming to lure non-crypto users into the ecosystem or integrating blockchain services into people’s daily life as an alternate solution to traditional banking. In a January 2021, interview with Bloomberg, Mike Novogratz, Galaxy Digital CEO, said “What’s great about Terra is they are one of the first sandbox experiments that are getting outside the sandbox”, right after Terraform Labs has raised $25 million round led by Galaxy Digital, Coinbase, and other famous institutions.

In order to bring more non-crypto users into the crypto world, Terra team developed and operated the first applications in the ecosystem, which can be divided into two main categories:

- a: Savings protocol and yielding applications for attracting users and money

By offering higher deposit interest rates than traditional financial institutions, these applications primarily aim to draw consumers with financial needs into the crypto ecosystem.

The typical one is Anchor, which went live on Terra in March 2021, with the selling pitch of providing a 20% deposit APY for stablecoins. Perhaps 20% APY is not that attractive to crypto users who have experienced the DeFi Summer, it’s a big attraction to non-crypto users who can only earn low or even negative interest rates.

The interface of Anchor: Anchor’s Dashboard

Under normal conditions, Anchor provides a stable interest rate for depositors, but the earn rate can be adjusted by community governance and the current APY is 19.46%. Compared to most DeFi protocols with a dynamic rate, Anchor’s fixed interest rate is an effective and direct measure to attract new deposits because it is in accordance with the habits of non-crypto users. This brings back memories of a few years ago when P2P products with 10% APYs were extremely popular among Chinese dama.

In a bull market, the valuation of various projects is inflated and full of bubbles and the price of their tokens also float high, coupling with strong demand for speculation and arbitrage, as well as increasing demand for borrowing stablecoins, many DeFi protocols can score a double-digit or triple-digit APY for a long time. However, in a bear market, the price of tokens will slump, the earnings will decrease, and so does the demand for investment and arbitrage diminishes, followed by the interest rate declines.

The average 30-day interest rate has fallen back into single digit across major platforms; Data Source: https://defirate.com/

So how does Anchor maintain the interest rates being around 20% for a long time?

There are two main reasons:

1. Anchor only accepts assets with native staking revenue as collateral, such as Luna, Terra’s core token, and stETH, which has recently been supported (through a partnership with staking provider Lido). Thus, Anchor can receive additional staking revenue from the collateral token to subsidize depositors.

2. After its launch, Anchor introduced a 4-year lending mining system. The system will boost the lending mining rewards to stimulate borrowing behavior when the actual yield (borrowing rate + staking revenue) is less than the target interest rate. It effectively lowers the borrowing rate through token rewards, which in turn improves the utilization of deposit funds. Eventually, it raises the borrowing rate to the targeted savings range (e.g. 19.46% at the moment) to satisfy depositors’ income needs.

You might be curious about how Anchor will maintain its 20% APY despite the expansion of its savings fund, a steady decline in the staking yields on collaterals (a drop in the inflation of the POS), and the exhaustion of its ANC token incentives?

I believe that 20% cannot be a long-term APY, but it is an “early-bird reward” provided by Terra ecosystem, which aims to attract users from the traditional world through high yields quickly. It is just like the early P2P products to gain customers through a variety of coupons to give them high financial yields, and as for Anchor, the “coupon” is its token ANC.

At some point, Anchor’s interest rate will return to the standard for the industry, and possibly by then, it will have achieved its goal of acquiring customers during the cold start phase.

In addition to Anchor, Terra is also preparing country-specific Anchor-like products, such as Tiiik, a savings app that also has 20% interest rates (with priority for users in Australia), and Saturn Money, a fixed-interest product positioned as a consumer-grade app (supporting deposits in GBP and EUR). It also shows Terra’s ambition to reach out to more users in different regions.

- b. Investment platforms and payment tools: retaining users and funds

After attracting users and money through high-yield savings products, Terra ecosystem is also trying to build two types of applications to maximize the retention of users’ money: consumer payment and investment.

These are the two categories of high-frequency scenarios typically used with funds in the traditional world. After users transfer their funds to Terra’s savings platform are much less likely to leave if they find that it can meet basic financial management, investment, and most of their daily consumption needs. Thus, Terra would have accomplished the ultimate goal of introducing traditional users to Terra’s ecosystem.

- c. Consumer Payment Applications

Daily payment is the most high-frequency scenario for currency, and the earliest application Terra laid out is the payment application – Chai.

Chai went live in June 2019, gained 500,000 user registrations in October of the same year, and has achieved 2.47 million accounts, according to the official announcement.

According to data from Chaiscan, Chai’s DAU is about 85,000-90,000, WAU is about 210,000, and daily spending is 1.75 billion KRW ($1.52 million). Regarding compliance, Chai has a fiat currency payment gateway regulated by the Korean government and can connect to about 15 major banks.

Users can earn discounts or points back for consumption through the Chai app or Chai debit card at partner merchants.

Chai charges around 0.5% fees for merchants, much lower than the 2-3% charged by other credit bureaus in Korea.

Both of Terra’s founders are Internet business natives and have accumulated substantial business resources. The payment alliance Terra Alliance built by them includes many Korean and Asian e-commerce leaders, including Interpark Ticket, Korea’s largest ticketing site; bugs, a listed Korean music media company; Ground X, a blockchain company of Korean social giant Kakao; Sinsang Market, Korea’s mainstream B2B fashion wholesale platform; Yanolja, Korea’s No. 1 hotel booking app platform; TMON, Korea’s second largest e-commerce site; Pomelo, a Thai e-commerce platform led by JD.com, and Carousell, one of Singapore’s largest e-commerce platforms, among others.

In addition to Chai, other payment applications in the Terra ecosystem include Kash, MemePay, PayWithTerra, BuzLink and more.

- d.Financial Investment Applications

The investment platform is another important scenario for user funds and is particularly important for the retained funds of high net worth users. Compared to payment applications, which are more of a “defensive” application configuration to meet users’ essential needs, Terra’s decentralized investment platform is more like an ace, with the advantage of the rich financial portfolio derived from the openness and combinability of DeFi.

One of the most representative is Mirror, a decentralized trading platform on Terra.

Mirror Protocol is a decentralized synthetic asset protocol that was incubated by Terra and can freely mint and trade all types of synthetic assets with Terra’s stablecoins as the primary collateral at a 150% collateral rate. Synthetic assets, also known as Mirror Assets (mAssets) in the Mirror platform, aim to simulate and track the price of any assets, from stocks to cryptocurrencies. It offers a wide range of assets for investors to pick from.

All mAssets on Mirror are paired with UST and can only be traded through UST, which provides a direct trading usage scenario for UST.

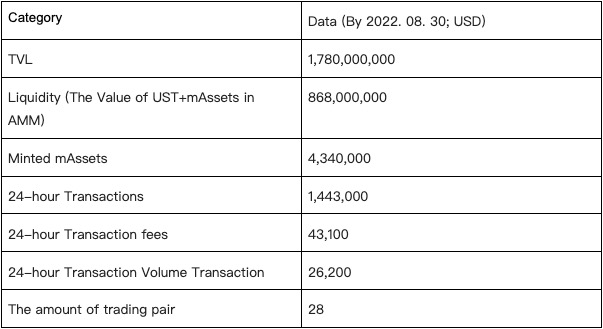

Data Source: https://terra.mirror.finance/trade

In theory, the price of the synthetic assets is a “mathematical function” based on the change in the parameters of the underlying assets with no actual value support. It gives no custody of the underlying assets (for example, the synthetic assets of the Tesla stock would have been Tesla stock) and is synthesized directly on the blockchain.

Thus, synthetic asset smart contracts can be all-encompassing and add leverage, boasting greater flexibility than traditional assets. There is tremendous scope to tap into the underlying assets they can cover, including stock indices, stocks, interest rates, foreign exchange, commodities and commodity indices, and even alternative derivatives based on credit, housing, inflation, weather, etc. It has tremendous room for exploration.

Theoretically, it allows Mirror to meet the full range of investment needs of investors within the Terra ecosystem.

We should notice that unlike Synthetix’s synthetic assets, which use oracle quotes for direct trading, Mirror’s synthetic assets are traded through the AMM mechanism. On the one hand, it creates a vast liquidity requirement for UST and causes problems such as high slippage when the amount of a single transaction is large, affecting the user experience.

In addition, Mirror is currently enabling its liquidity mining. This mechanism brings additional revenue to what is otherwise a zero-sum game market, which has helped Mirror’s initial rapid uptake. The MIR tokens’ value capture and this model’s sustainability, however, remain to be seen.

Mirror and Anchor account for nearly 98% of TVL in Terra’s top 5 applications. Unlike Anchor, which creates Terra’s stablecoin demands through high-interest fixed-income deposits, Mirror is producing huge stablecoin demands for Terra through liquidity mining of mAsset.

Data Source: https://terra.smartstake.io/tvl

To give people more investing options beyond Mirror, Terra is also incubating other investment products. For instance, Do Kwon, co-founder of Terraform Labs, stated at the end of March this year that he was developing an algorithmic ETF product based on Terra’s ecosystem, Nebulas. In addition, among other things, there is the Vega trading platform for derivatives.

Terra Ecosystem Landscape by Terra Community

Summary

Unlike the unrestrained growth of most public blockchain ecologies, fostering applications within the Terra ecosystem has a clear purpose: to enhance the use scenario of Terra’s stablecoins as the first goal. They want to build financial service applications to attract users to the space and retain user funds.

A self-reinforcing cycle will occur once the stablecoin’s online and offline network effects have taken shape, supporting the ecological evolution.

Of course, the aforementioned plan has a visible window of opportunity. It is uncertain whether the approach will be successful if Terra’s stablecoins do not develop scaled use cases as anticipated prior to the expiration of user incentives for a number of main apps.

Founding Team

Terra’s core team is attached to Terraform Labs, just like Block.one is to EOS. Terra protocol was founded and is mostly driven by Terraform Labs.

Founders

Terra was founded by Daniel Hyunsung Shin and Do Kwon

Daniel Hyunsung Shin

Daniel Shin is the co-founder of Terra. He has been frequently featured in early news reports as the founder. Graduating from Wharton School of Business, Daniel is a well-known entrepreneur in the Korean e-commerce industry, and the founder and chairman of TMON, a Korean e-commerce platform. TMON was Founded in 2010, focusing on a group-buying model. According to news reports, it has approximately 9 million users as of 2020, making it the second largest e-commerce platform in Korea.

However, starting in 2020, Do Kwon took over as the team’s external spokesperson as Daniel Shin gradually stayed out of Terra’s external publicizing and reporting.

Daniel’s biography on Linkedin shows that he worked at Terra from January 2018 (when Terra was officially founded) to January 2020, coinciding with the time he stayed out of Terra’s external publicity. On the other hand, he remains the founder and CEO of Chai, the core payment app of the Terra ecosystem. In addition to Chai and TMON, he is a co-founder of The Encore Company, an international marketing consultancy in Korea, and a co-founder and board member of Fast Track Asia, a venture capital firm.

Although he no longer holds a position at the company, Daniel Shin should not have withdrawn from Terra’s management and associated resources. He may be unable to focus on his multiple roles and has handed over the team leader role to younger co-founder Do Kwon.

Daniel Hyunsung Shin’s biography; Source: Linkedin

Do Kwon

Do Kwon, Terra’s CEO and co-founder, graduated from Stanford University with a degree in computer science and was named to the “Forbes 30 Under 30” in 2019. He previously founded the messaging app Anyfi in January 2016 but exited in October 2017. Since 2020, Do Kwon has been the company’s main spokesperson, frequently appearing in media and community AMAs.

The Team

Terraform Labs, the company behind Terra Protocol, is based in Seoul, South Korea, with employees of more than 50 people, which is a sizable workforce in the cryptocurrency industry.

Regarding staff distribution, most of Terra’s employees work in Korea, but there are also a number of employees in the United States. The highest positions are for developers, followed by BD, finance and marketing. The employees’ specialties concentrate on computing, mathematics and finance.

Data Source: Linkedin

The program is seeing growth, as seen by the team’s employment growth of 24% over the previous year.

Summary

In an online interview in May 2020, Terra’s CEO Do Kwon shared his views on Stablecoin: “Stablecoin is a very vertical branch in cryptocurrency, and different stablecoins solve different problems and application scenarios. Terra’s stablecoins can swap on the chain, and their initial point is still based on users’ usage, such as payment and finance. In contrast to Libra, there is some intersection and overlap between Libra’s vision and Terra’s. Libra’s global cross-border payments are based on Facebook’s massive user ecosystem. In contrast, Terra’s user advantage stems from its merchant background, where the team’s experience is more from retailers than social apps, who have a greater understanding of this space.”

Terra’s team is mainly from an internet business background, unlike other DeFi and public blockchain teams that are all crypto natives. So far, the team has also made full use of this advantage, using their industry resources to keep embedding Terra ecosystem into large internet products through payment applications.

Business Analysis

Size and Market Share of the Stablecoins

Terra’s business is an integrated financial service built around its stablecoin. The value derived by Terra and the token Luna is largely based on its stablecoin market, even though the financial services created on Terra are also an important component of its ecosystem. This article will primarily provide a brief introduction to the stablecoin market.

Compared to native crypto assets like BTC and ETH, stablecoins are relatively young, being here for about 7 years. Stablecoins are cryptocurrencies whose value is usually pegged to other assets, whether a government-issued currency, a precious metal, or a purchasing power (for example, Ampl is pegged to the purchasing power of $1 in 2019).

For the time being, stablecoins are mostly used in foreign exchange, lending, and cryptocurrency trading. CoinGecko’s Q1 2021 report states that stablecoins are being used more as a medium of exchange than a store of value, which is supported by the fact that they circulate hundreds of times more quickly than BTC and ETH.

Data Source: CoinGecko-2021-Q1-Report

In addition, many countries do not support direct transactions between fiat and cryptocurrencies due to regulations, and stablecoins have become a transit point connecting the traditional and crypto worlds. For those who want to avoid market volatility, they are the top option for exchange.

Although stablecoins have long served as a medium of exchange and a foreign exchange substitute, and the market has been steadily growing, their actual boom just started in June and July of 2020.

The big bang for stablecoins happened in the first quarter of this year, when the total market cap of the top 5 stablecoins grew by nearly 120%, according to CoinGecko’s report. The full size of the stablecoin market has now reached $115 billion, which is about 10 times the level of the same period last year.

Data Source: CoinGecko-2021-Q1-Report

We believe that the reasons for the dramatic expansion of the stablecoin market originate from the following aspects:

- The global epidemic has accelerated currency issuance, and governments worldwide are expanding their balance sheets in response to economic stagnation.

- The rapid development of various DeFi applications and the rise of liquidity mining brings high yields, which draw a significant quantity of non-crypto money to the market.

- Crypto markets are bailing out of the slumps, with the total size of cryptocurrencies, represented by Bitcoin, reaching new highs, fuelling huge demand for stablecoin trading

- The year of institutionalization in the crypto world has arrived with the further improvement of compliant and secure custodians and the on-ramp and off-ramp of fiat.

With the above analysis, we find that the remarkable growth of stablecoins in the recent year is primarily due to the recovery and boom of two markets that are currently inaccessible or inconvenient for fiat currencies to reach directly.

1. Crypto Trading

2. DeFi

It is these two markets that are supporting the huge demand for stablecoins.

And after the crypto market collapsed in June 2021 and started to experience volatility at lower levels, the growth of the stablecoin market also began to slow down significantly as the demands for both crypto trading and DeFi decreased as the market fell down.

Therefore, predicting the expansion trend of the stablecoin market will require watching the market cycles, and more important is whether DeFi’s services continue to drive up additional demand for liquidity.

Although the market is currently in a chilly mood after a big pullback, the crypto business represented by DeFi is just beginning to take off in the long run. We believe that while the traditional world of financial services is relatively mature, DeFi still has considerable growth potential. That potential is not just in the form of the inflow of traditional money into the crypto.

DeFi’s vitality comes from the transparent, trustless, composable, highly liquid, anonymous, and global qualities offered by the underlying architecture of blockchain. Perhaps never before in the economic history of human society has there been such a pure and global free market.

In such a market environment and the sandbox of the crypto world, DeFi has very little resistance to innovation and is the best testing ground for the concept of “agile development”. Entrepreneurs can quickly raise funds and build and experiment with rich DeFi products in a short period, while the weak die out quickly and the excellent ones stand out with 10 times the efficiency of innovation in the traditional world.

This speed of innovation from a thoroughly free market is the source of DeFi’s vitality. As long as that source remains in place, we see no need to worry about innovation drying up for DeFi and blockchain commerce.

And as long as technological and business innovation around user needs continues, the traditional funds will not cease investing in the crypto space, and the market expansion for stablecoins will continue. The current total stablecoin size of $115 billion is far from the end.

Tokenomics Analysis

There are two main types of tokens within the Terra ecosystem: the core utility token, Luna, and the stablecoins issued with Luna as the underlying asset, both of which are analyzed in this section.

It is necessary to briefly explain the consensus mechanism of Terra Protocol before formally analyzing the mechanics of Luna and Terra stablecoins.

The Terra blockchain is a proof-of-stake blockchain, powered by the Cosmos SDK and secured by a system of verification called the Tendermint consensus. Validators can produce a block every 6 seconds and users can delegate Luna to the validators.

Luna: The Utility Token

Supply, Allocation and Circulation

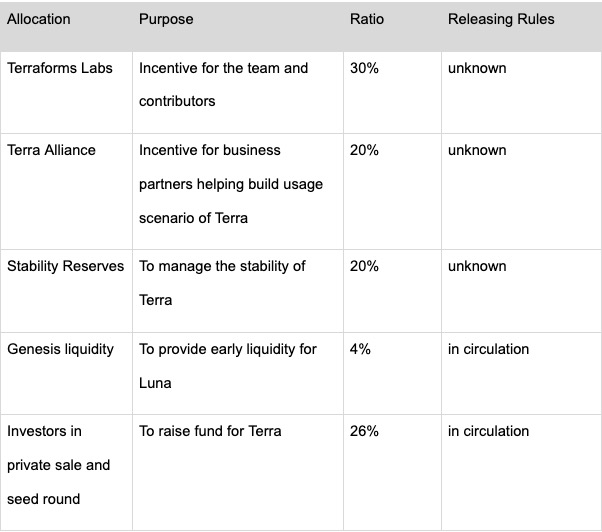

Luna planned supply is 1,000,000,000, but the total supply of LUNA stands at 995,415,000 and the circulating supply is 400 million. Token allocation is follows:

We found that up to 70% of the total token volume has no definite unlock time. In addition, Terra Finder has limited functionality and cannot verify Luna address ranks and position ratios. It further reduces the project tokens’ transparency, which investors should be wary of. After all, depending on the project’s moral self-discipline is less trustworthy than using clear, transparent standards and data disclosure.

Tokenomics

There is three utility for Luna’s holders in Terra:

- Governance Token: create and vote on proposals with parameter rules changes regarding the Terra protocol.

- Staking Rewards: by delegating Luna to the validators, users receive rewards taken directly from transaction fees, tax fees and seigniorage.

- Seigniorage Assets: To mint new stablecoins in Terra, it is necessary to swap Luna for stablecoins, and the process is known as Seigniorage. All Luna burned from Seigniorage will go to Community Pool. However, after the Columbus-5 mainnet is deployed on Terra Protocol, the system will burn all Luna from Community Pool.

When swapping Terra for Luna by using its official wallet Terra Station’s built-in Terra Swap, the fees it generates will be used to buy back Luna as validators’ rewards.

Luna is vital to the Terra Protocol in two aspects:

- Luna is the underlying asset of the POS mechanism, which is similar to the hashrate of the POW mechanism, and provides fundamental security for Terra’s network via staking.

- Luna can absorb demand fluctuations for stablecoins minted on Terra to maintain price pegs. More details are explained in the Stability Mechanism.

For Terra Protocol, the higher the market capitalization of Luna, the greater the liquidity of its stablecoins, and the more secure the system is and the less probability of stablecoin de-pegging. Conversely, if the market capitalization of Luna is too low, system security cannot be guaranteed, and there is even a chance that the overall market capitalization of Luna will fall below that of stablecoins in the Terra Protocol, triggering the stablecoin de-pegging.

Terra will spare no effort in building more utilities for Luna to increase its inherent value.

In conclusion, Luna’s value can be captured by:

- maintaining the security of the protocol and becoming the fundamental collateral during the Seigniorage process.

- accumulating most of the economic value generated when the system is running

Luna’s value capture of the Terra protocol is better than the role that ETH plays in Ethereum.

Terra: A Package Stablecoins

Terra is a general term for various types of stablecoins in the Terra protocol. According to Terra Station, the protocol has now supported the minting of as many as 17 types of stablecoins.

In essence, Terra is an unsecured stablecoin or an algorithmic stablecoin. The advantage of an algorithmic stablecoin is that the unsecured mechanism brings it higher capital efficiency, and the disadvantage is that users have less confidence in its stability than those fully secured stablecoins. They are more likely to see the token price being depegged.

Terra’s Stability Mechanism

Terra’s stability mechanism is derived from its smart contract that promises to swap stablecoins with Luna at a fixed rate, which Luna’s market cap becomes an “implicit guarantee” for all stablecoins in the protocol.

A user can mint 1 UST by burning $1 of LUNA or can swap it for $1 worth of LUNA in the protocol, details are as below:

- When UST is trading below $1, then arbitrageurs can buy UST on the market at a discount, and swap it for $1 worth of LUNA. Then arbitrageurs quickly sell Luna in the market, which reduces UST’s circulation until the price of the UST goes to $1 and there is no room for arbitrage.

- When UST is trading above $1, arbitrageurs can burn $1 of LUNA to mint 1 UST and sell UST on the open market for a profit. This arbitrage will be open until the supply of UST in circulation matches demand and the price of UST goes back to $1.

Therefore, the stability of Terra is ensured by arbitrageurs and the smooth mechanism of Luna-UST swapping.

The Risks of The Mechanism

Unlike MakerDAO’s users, who must deposit tokens such as ETH to mint the stablecoin Dai, Terra’s users don’t have to deposit Luna for UST. It seems that Terra’s users bear no liquidation risk if the price of collateral slumped, but the risk was transferred to the whole Terra Protocol.

Arbitrageurs who maintain the stability of UST are willing to buy UST below $1 because they believe that 1 UST is enough to swap for $1 of Luna and that they can quickly sell it on the secondary market for a profit.

Under extreme conditions, if the market cap of Luna crashes and is less than the total market cap of Terra’s stablecoins, theoretically the sell-off of Luna was not enough to reinstate the stablecoin peg. Arbitrageurs selling Luna on the open market to make a profit is the final step leading to the collapse and even death spiral of Luna, followed by the insolvency of Terra Protocol.

Properly speaking, Luna is not a collateral asset to mint stablecoins, but an “implicit guarantee” to maintain the price of stablecoin, which is an important incentive for arbitrageurs.

If Luna’s market value climbs to a peak and there is strong demand for DeFi protocols, the minting of stablecoins will boom. However, when experiencing a sharp bull-to-bear-market transition, Luna’s price slumps and its market value crashes in a short time. As a result, the “implicit guarantee”, Terra Protocol will be in a debt crisis because the value of secured assets is not enough to pay off the debt, which is an obligation for the system.

In fact, in late May of this year, Terra’s stablecoin went through a temporary crisis as the crypto market crashed.

Before May 19, the pegging mechanism of UST had been working well without any major price de-pegging deviations. However, during the market collapse from May 19 to May 25, UST experienced a negative premium of about 10% for the second time, and lasted for 2-3 days.

The reason behind this is that Luna’s market cap experienced a severe slump, with the market cap dropping by up to 73% in a few days. It is important to note that on May 19, UST was significantly de-pegged for the first time. The market had already sold off a lot due to panic. 1UST dropped as low as $0.89 that day, despite Luna’s market cap not reaching the issued stablecoin’s net worth. After the market had stabilized, UST rapidly made a comeback and was pegged at about $1. However, in the more severe collapse on May 24, Luna’s market cap went below that of UST for the first time, leading to a second, more severe de-pegging of UST. The price didn’t start to peg again until Luna’s total market value rose back over UST stablecoin.

Luna’s market cap fell to a low near $1.647 billion, already below UST’s total market cap of $2 billion at the time; Data Source: CoinGecko

The Solution to the Systematic Risks

After two severe de-pegging of the UST, why has the Terra system not collapsed entirely, and so has the Luna market value not gone into a complete death spiral?

This is primarily due to Terra transferring volatility risk for the stablecoin. That is to say, the short-term volatility and risk of Terra’s stablecoin are forcibly passed on to Luna’s miners.

There are two kinds of Luna’s miners. One is the validators who directly build POS nodes and are responsible for several functions of the Terra network:

- Responsible for generating the block in the system

- Responsible for quoting stablecoins and Luna, playing the role of blockchain oracle, rewarded if the quoted price is within the exact range, and forfeited the pledged Luna if it is wrong

The other one is Luna holders, who cannot build nodes by themselves. They delegate Luna as well as the voting rights to node validators and get various rewards distributed by the validators, so we also call them the delegators.

The delegator’s act of delegating their Luna to the node is called Staking. However, the delegator must go through a 21-days waiting period if they want to withdraw their Luna, during which there are no earnings or voting rights for their Luna. The process is irrevocable, which requires caution for the delegator.

This long waiting period prevents those Luna stakers from withdrawing their Luna when short-term risks occur, which means that in the face of an extreme market collapse or even systematic insolvency. Luna delegators and nodes cannot withdraw their Luna in time to sell out and stop their losses. All they can do is to continue their responsibilities for generating blocks and operating the oracle mechanism, then patiently wait and expect things to get better.

This is what we mentioned: the short-term risks of Terra’s stablecoins are passed on to Luna miners, and the miners bear the losses from volatility.

Under this mechanism, miners who bear the risk of short-term market volatility also need a higher medium and long-term financial compensation. So as a stablecoin protocol, Terra rewards miners not only with seigniorage, but also with stablecoin transaction fees, network gas fees, Terraswap’s transaction fee rewards, token airdrops for new projects within the Terra ecosystem, etc. Otherwise, the miners will gradually leave, and the system’s security will decline further.

Finally, it is important to note that in addition to the miners, people who sold USTs at a low price during the panic are also defusing systemic risks.

Their cut-loss action plays a twofold role:

1. they take on the system’s bad debt with their losses, essentially helping the system to restructure its debt;

2. their dump causes the UST to be depegged, and when the arbitrage space is large enough, some bold arbitrageurs will enter the market to buy the UST for Luna and start arbitrage. It causes deflation of UST, which is directly helpful in stabilizing the price of UST.

Of course, if Terra hadn’t survived the collapse, that would be another story.

The Summary of Tokenomics

Terra’s stablecoins and Terra’s utility token Luna are interdependent and work together to keep the whole system running.

Terra’s stablecoins are the core product of the system and are also the grip of systematic business expansion and the primary source of profit. As for Luna, it is the beneficiary of the system on the one hand and the system’s security assurance on the other.

The above logic holds mainly from the fact that Terra has built a POS public blockchain of its own, which makes Luna no longer a simple DeFi product equity token, but has the opportunity to capture the value of the broader public blockchain ecosystem. It enables the holders and miners willing to take on the short-term volatility of the stablecoin.

The Competition Landscape

Basic Market Landscape & Competitors

Terra’s core product is stablecoin, and the Terra protocol can also be seen as a product combo built around stablecoin. As a result, the stablecoin’s business state essentially mirrors the combo’s general situation.

Specific data is offered in the 2.3.1 section of this article regarding UST, the primary product of Terra’s stablecoins. There is no further description for that; therefore, let’s concentrate on analyzing the growth of other stablecoins instead.

There are a lot of stablecoins available and the market is currently over $115 billion, so we have attempted to categorize them based on their mechanisms.

In the current stablecoin market, centralized stablecoins still dominate and grow much faster than decentralized stablecoins.

Market Size Growth Curve For Centralized And Decentralized Stablecoins; Data Source: Nansen

The influence of centralized stablecoins has even permeated the decentralized space, with roughly 60% of Dai’s collateral being USDC, according to data previously released by Maker in June.

This also reflects the unavoidable collateral quality dilemma of the over-collateralized decentralized stablecoin DAI, from which the significance of algorithmic stablecoin is born.

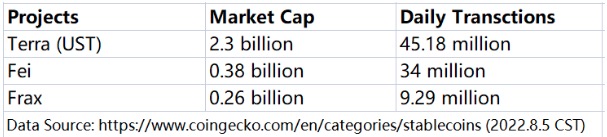

In the algorithmic stablecoin space, the only projects that can be pegged most of the time are Terra, Frax and Fei.

Fei and Frax have far lower market caps than UST. And in terms of use cases, Terra’s stablecoins scenario is also significantly superior to Fei and Frax thanks to its growth of Terra eco-applications.

In terms of algorithmic stablecoins, Terra’s stablecoins, represented by UST, now lead the field, although its true rivals are still centralized stablecoins with compliance advantages and substantial resource backing. Because of this, the crypto field maintains high expectations for algorithmic stablecoins.

The Competitive Advantage and Defensibility

Terra’s success at this stage comes from a series of highly coordinated sequential project initiatives, with the team paying close attention to “building on strengths and avoiding weaknesses”, with deep industry insight and excellent strategic planning behind the success.

Specifically, it concentrates its resources on building an ecosystem around the stablecoin in the early stage and lets the ecosystem serve the stablecoin. A self-reinforcing cycle will occur once the stablecoin’s online and offline network effects have taken shape, supporting the ecological evolution.

This avoids the “Ethereum killer problem” faced by most public blockchains, i.e. How can you recreate a more powerful ecosystem than Ethereum? It also won’t get stuck in cash burning, or to be more precise, it avoids the inefficiency and imprecision of application incentives.

So far, Terra’s main competitive advantages as a public blockchain ecosystem built around a stablecoin protocol are as follows:

- The Use of Independent POS Public Blockchain With Cosmos’ Tendermint Core: It brings multiple benefits to the project-

1. greater scalability: As a cryptocurrency protocol dedicated to providing services for legitimate businesses, Ethernet currently cannot meet the demands for low-cost and high-frequency transactions;

2. Complete platform independence: This enables Terra to propose adjustments to a variety of crucial parameters, such as the gas fee, mint tax, transaction tax, etc., in response to changing circumstances. Terra also has a more robust “public blockchain macro tool set” to respond to market developments. Additionally, the system can withstand stronger external shocks and handle bull and bear cycles thanks to the coupling of the product, public blockchain, and mining mechanism.

3. Development based on Tendermint core: This ensures the interoperability of Terra with other external ecologies in the future and enhances the circulation boundary and imagination of its stablecoin in the crypto world.

- Stablecoin + DeFi Combo Strategy: The initial use cases for stablecoins are offered by the DeFi ecosystem in order to help stablecoins get off to a quick get off the ground quickly, increase their market capitalization and trading volume, and soon ranking in the first tier of stablecoins; and then drive its DeFi ecosystem to keep developing through the penetration of stablecoin products into more fields. With the stablecoin+DeFi combo strategy, Terra has fairly solid fundamentals.

- Rich Business Resources: Terra’s early founders were well-known Korean Internet entrepreneurs, and the industry alliance he later launched, Terra Alliance, also attracted a sizable number of top Korean Internet companies, which allows Terra Eco to provide users with more convenient and extensive access to DeFi products than other native crypto projects, as well as attract a sizable number of web2 users to Terra’s matrix.

- The regulatory policy and crypto vibeTerra is located in South Korea, which has a very high population of cryptocurrency investors and a somewhat pragmatic regulatory environment, allowing Terra’s exploration to go out of the sandbox and fully practice the popularization of crypto products.

The most anticipated narrative in cryptocurrency today is what Terra is doing: eliminating the barrier between crypto applications and the traditional business world. If the experiment is successful, Terra is expected to expand its ecosystem and further realize the siphonic effect on various materials used in the crypto business.

Previously Compound, Aave and Maker benefited from this business model and enjoyed valuation gains, but none of them explored it as thoroughly as Terra did.

Risks

Despite the fact that Terra protocol has only been around for a short while, it has already made major strides, and its market cap has increased significantly. However, the project’s rapid growth comes with many concerns.

Centralization

Terra is a more centralized project as compared to other DeFi and public blockchain projects. Many different ways show this. For instance, the token allocation is set up to provide the team and its partners a relatively high percentage of tokens, and some tokens are also theoretically under their control (such the stability reserve), giving it a disproportionately high share of power over the project.

I’m sure nobody would argue with the statement that the Terra team and its alliances of interest have complete control over all proposals.

In addition to the token allocation, the team’s background and the commercial resources it backed and utilized at its founding, such as a sizable number of Internet businesses, payment methods, etc., are highly centralized and bring some obvious benefits, making it easier to break the barriers between blockchain products and the legitimate business world.

However, this highly centralized team and how resources are integrated will become quite vulnerable in the face of the inevitable ongoing tightening of DeFi regulations in major global markets.

The issue with centralization extends beyond overly concentrated power and regulatory vulnerability to the worry that team-driven industrial support may prevent ecosystem innovation. In contrast to CeFi, founded in a free market economy, DeFi’s primary competencies are its capacity for innovation and its rapid rate of evolution. It remains to be seen if Terraform Labs, the company that created it and is currently in charge of many of the projects being established and run, will deter truly innovative developers from entering Terra ecosystem because of regarding it as an ecosystem with a robust planned economy.

The Regulations

As previously indicated, some significant economies, including the US and China, emphasize and even promote policies against crypto businesses, especially DeFi. Other nations have begun to frequently step in to regulate the transnational cryptocurrency companies represented by Binance. In addition to the fragility of its centralized organization, Terra is subject to regulation due to the sensitivity of its industry, which may lead to heavy-handed regulation by different governments.

Stablecoins, savings products, and synthetic assets, all of which are part of Terra’s portfolio, are currently the subject of regulatory attention in a number of nations. The recent ceasing support for Stock Tokens on Binance and front-end blocking of Mirror and Synthetix’s equity-based synthetic assets on Uniswap reveal a gradual strengthening of regulatory deterrence.

In fact, Terra has already received alerts from regulators in other countries. This March, the Bank of Thailand announced that it would consider any activity involving THT is deemed illegal, as “the creation, issuance, usage or circulation of any material or token a for money is a violation of Section 9 of the Currency Act 1958.” The Bank of Thailand said it had noticed a new algorithmic stablecoin version of the Thai baht (terraTHB) circulating on the Terra blockchain, so they warned the public not to use THT stablecoins because they lack any legal guarantee or protection. And this will also have an adverse effect on the general public’s confidence in the stability of the country’s monetary system.

The Growth

Terra’s on-chain metrics have started to substantially decline as the cryptocurrency market cools, and so has user growth. More significantly, Chai, its stablecoin payment platform, has suffered a little decline in weekly active users from its high in May and has not experienced major growth in users for three consecutive months. While it is obvious that the crypto cycle has an impact on Terra’s DeFi business statistics, the stalling user growth of Chai, a daily-life payment app, is a more worrying development that will undermine Terra’s claim that it is a “wall-breaker in the crypto and legitimate industries.”

Weekly Active Users of Chai; Data Source: https://www.chaiscan.com/

Information Transparency

The transparency of information about Terra is another concern, which is firstly reflected in the lack of transparency in the team’s and partner Terra Alliance’s token unlocking plan (see 3.2 section of this article: Tokenomics Analysis). Of the project’s total 1 billion tokens, about 70% are under the direct and indirect control of the team and partners, but I did not find the relevant token unlocking time plan in either the official documents or the white paper.

In addition, Terra Finder cannot verify token address ranks and position ratios, and no official addresses of important contracts have been published in the documentation, making it difficult for investors to monitor the circulation of tokens.

Severe Market Shocks And Negative Feedback Loops Caused By Prolonged Bear Market

As discussed in the Business Analysis section on the risks of the Terra’s stablecoins mechanism, the system is still exposed to the risk of “over-issuance of stablecoins in a bull market, and the system’s debt crisis due to the Luna crash when the cycle reverses”. If the 5.19-5.25 collapse is more severe and lasts longer, will the volatility of the Terra system exceed the tolerance limit of the POS miners, leading to a negative feedback loop of “miners leaving the system to stop the loss, further weakening the risk resistance of the Terra system”?

Primary Value Assessment

Five Core Issues

Which Stage is Terra in? Is It Fully Developed or Still in its Early to Mid Stages?

The project is in the early stage of operation, and its core product, stablecoin, already has concrete use cases within the ecosystem, and PMF (Product market fit) has been verified. How this stablecoin takes off in the real world of commerce remains to be seen.

Does the Project Hold a Strong Competitive Edge? Where Does this Competitive Edge Originate?

The independent POS mainchain framework with Tendermint core, the stablecoin + DeFi combo strategy, the industrial resources it backs, and the favorable development environment of the country it is located in are the project’s main competitive advantages.

Is the Medium-term and Long-term Investment Logic Clear? Is it Consistent With the General Industry Trend?

The project’s medium and long-term investment logic is to break the barrier between legitimate businesses and the crypto industry and promote the services of the industry to support stablecoin use cases. The business logic is straightforward and in line with the long-term trend. However, its development will inevitably face problems such as regulations and the speed of integration between crypto applications and real scenarios, which remain to be seen.

What are the Key Variables Affecting the Execution of the Project? Are These Measurable and Quantifiable?

The project’s two primary business variables are as follows:

- how fast its crypto ecosystem and stablecoin penetrate the mainstream of legitimate commerce, which affects whether the project’s most crucial business logic can function and continue to be a sustainable development;

- how successfully its stablecoin and DeFi ecosystem work, and whether it is gaining users and projects at a faster rate than other main chain ecologies. The size of the stablecoin, the trading volume, and the number of essential eco-applications and commercial data may all be used to observe and quantify these points.

How Do They Manage and Govern the Project? Is DAO Going Well?

The project has established a relatively systematic governance framework. Its governance forum owns active users, frequently updated proposals, and a high voting share. Initially, we found that the development status of its DAO is positive. However, the project’s token ownership is currently fairly centralized; therefore, this needs to be taken into account.

Valuation

We acknowledge that comparing the valuation of a public blockchain project to that of a dApp or a DeFi project is far more challenging.

For DeFi projects, we can compare projects based on price-to-sales (PS), or price-to-earnings (PE), because they are more like companies, creating the cash flow.

The public blockchain ecosystem is more like a Republic; although it is rudimentary, we may use GDP to gauge a nation’s overall strength. However, no data tool is available to calculate the total output value (total income) of all dApps on each public blockchain. The only thing we can use for a visual comparison is the number of active addresses on the chain or the number of transactions. And because the mechanism and transaction costs of various public blockchains vary, the result of such a comparison is even more primitive.

We believe that the speed of innovation within their ecosystem determines the value of public blockchains in the short term, as this ecosystem will likely offer more innovations that satisfy users in the future. Unexpected outcomes from the combination of innovation will also increase the prosperity of this ecosystem. However, it is not easy to measure the quality of innovation, or we lack statistical support from most public blockchains in this regard.

We believe it is more reasonable to use a side-by-side comparison of Terra’s historical data when making a value assessment of Terra. The metric used in the assessment can be the circulating market cap of Luna tokens / TVL of Terra ecosystem. The TVL on the chain is similar to the AUM of this financial institution if we consider Terra as a decentralized financial complex.

However, we could not locate any TVL data for Terra that was long enough to allow for longitudinal comparison.

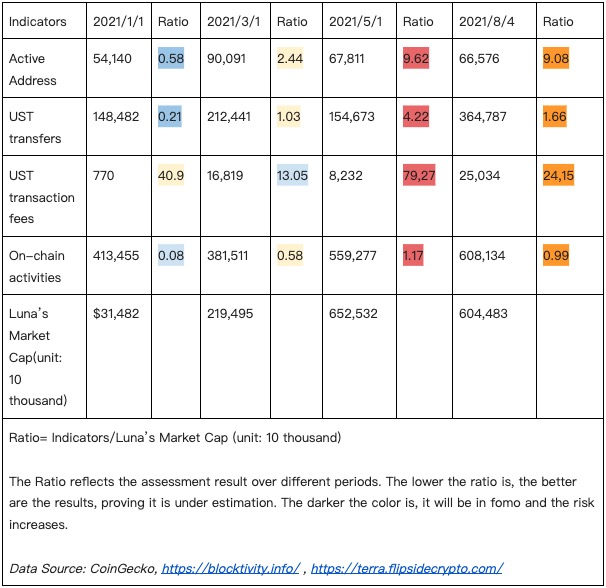

The data we can find for Terra public blockchains with a more extended history are as follows:

Since Terra’s present valuation level is at the high end of the overall 2021 valuation and is second only to the high end of early May 2021, it suggests that Terra’s valuation has recently increased too fast.

However, it’s worth noting that the above metrics may not be a complete and accurate reflection of the actual fundamentals of Terra at the time, and the above valuation comparison can only be used as an essential reference.

Summary of Primary Value Assessment

Terra focuses on the stablecoin track and has a strong team with superior industry insight and strategic level. Due to its own public blockchain with PoS mechanism, stablecoin + DeFi combo strategy, and abundant commercial resources, Terra has a distinct competitive advantage. Investors must carefully consider the project’s centralization issues, regulatory difficulties, growth limitations, and lack of information transparency. We have just conducted a preliminary analysis of Terra’s indicators and circulating market cap, which is now at a high level for the year in terms of data, as the valuation of public blockchain projects is challenging and there is a dearth of previous data.

Reference

Project Market Cap:

Business Data:

https://terra.flipsidecrypto.com/

Terra Station

Project Infomation:

Forum: https://agora.terra.money/

Document: https://docs.terra.money/

Medium:https://medium.com/terra-money

Reports and Research:

全面解析合成资产机制设计、应用类别与发展趋势

HashKey 曹一新:解读 DeFi 合成资产特点与发展路径

一览韩国区块链生态现状:交易所、头部企业与银行等

我们与王纯及 Terra、Klaytn 等项目资深从业者聊了聊韩国加密货币市场生态

一文读懂进军 DeFi、主打商业落地的算法稳定币 Terra